VCs typically get better deals than the rest of us. In most cases, they’ll have scored multiples before the token hits an exchange.

But occasionally, there are instances when VCs invest in projects that already have a token.

And if the timing is right, you can invest in a project at about the same time as VCs.

This timing levels the playing field and enables you to score the kind of multiples you only read about in the news.

So, what are the hottest projects that VCs are investing in right now?

Here are the top 3 picks for you👇

Macro overview 🚁

Let's start by examining the broader landscape of the private market.

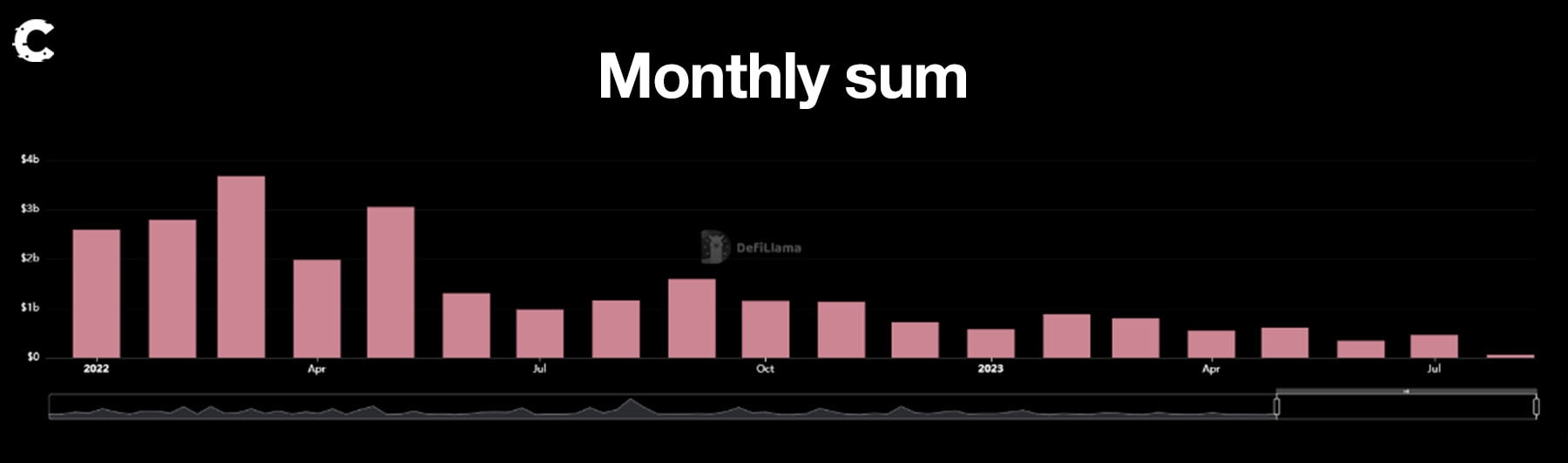

In July, crypto projects secured funding through 76 rounds, marking a 14% decrease from the preceding month, June 2023, which saw 88 projects receive funding.

However, the total funding surged from $343 million to $460 million.

VCs are becoming more selective, with a heightened focus on specific projects.

Infrastructure projects across various crypto sectors accounted for 32% of total funding in July.

Despite a favourable market, private investors remain cautious, evident in the absence of a significant funding surge.

Nevertheless, we've identified some opportunities for you.

Here are the top 3 projects VCs loved ❤️

Venture capital isn't here for charity; they're after big returns. So, they are cold and calculating in their research, analysis, and due diligence. And they only back projects that have great odds of delivering exponential multiples.

And that's what happens in seed rounds, private rounds and all the other rounds available exclusively to institutional investors and high-worth individuals.

But sometimes, VCs spot "retail" mass-market opportunities that are just too good to pass up. So, they step off the exclusive pedestal of private rounds to invest in projects that already have tokens in the market.

Enter our spotlight: These three projects are already open to everyday investors, yet, VCs are still betting heavily on them.

Conic Finance 🗂️

Ticker: CNC

Key Players: Curve founder, Michael Egorov

Amount invested: $1,000,000

You've probably heard of Curve - it processes billions of dollars in DeFi transactions by facilitating easy swaps between stablecoins like USDC and USDT.

Conic Finance is built on Curve and offers automated yield farming across Curve liquidity pools.

It's like an automatic money manager for yield farming. Imagine you have money in a high-interest bank account that automatically moves your funds between accounts for the best interest rate.

Similarly, Conic automatically moves your funds between Curve pools to maximise yields from fees and rewards.

Instead of manually managing your funds across Curve pools to chase returns, Conic does this automatically.

Recently, Conic Finance faced a major setback. In a July 23rd post-mortem, the team reported losing $4.1M in two separate attacks on its pools.

As a result, its TVL tumbled - once hacked, protocols tend to lose reputation.

Yet, Curve founder Michael Egorov invested $1 million post-hack in $CNC tokens, signalling potential recovery.

We'll closely monitor Conic's journey as a recovering project.

Radiant Capital ⛓️

Ticker: RDNT

Key Players: Binance Labs

Amount invested: $10,000,000

Have you heard of Radiant Capital? It's a DeFI project bringing multi-chain lending to the crypto world.

Here's the deal - if you want to lend or borrow crypto, you must use separate platforms on each blockchain, like Compound on Ethereum or Venus on BNB Chain.

Radiant wants to change that by building one unified lending market across multiple chains.

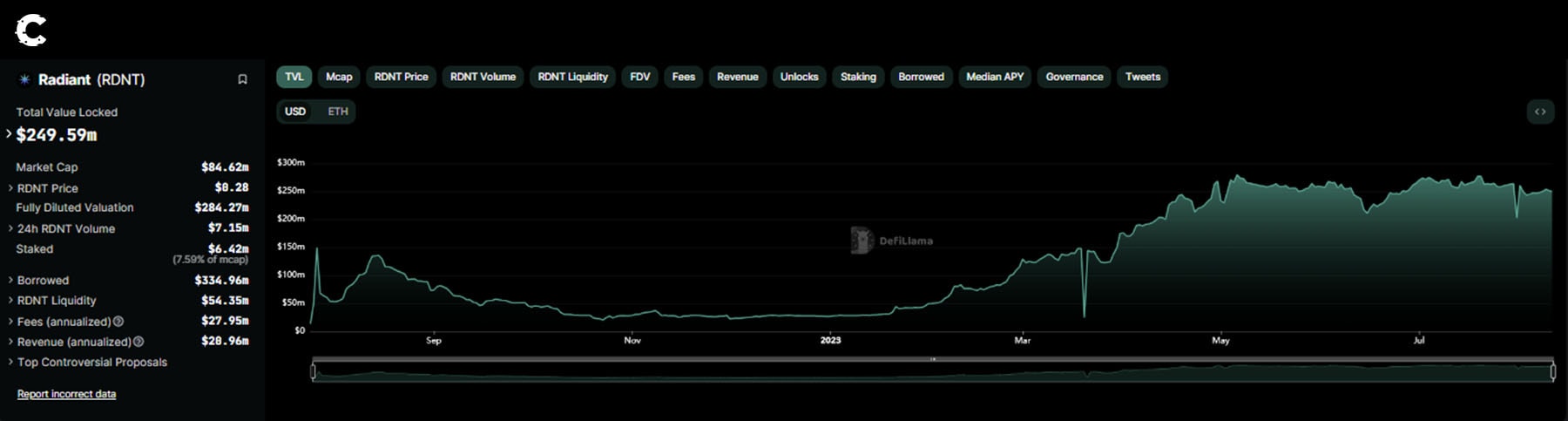

So far, it has been pretty successful, with its Total Value Locked (TVL) skyrocketing to almost $250M this year.

Radiant Capital is currently live on Arbitrum and BNB Chain. Being on BNB Chain explains the Binance Labs investment, as Radiant is now a top 10 BNB protocol.

The investment likely recognises Radiant's potential, especially as they expand chains.

But it also locks Radiant into the BNB ecosystem, not just money for Binance.

While the concept is innovative, real-world usage will determine whether Radiant can attract long-term sticky liquidity. Partnerships help, but differentiation from competing protocols is key.

In terms of the RDNT price outlook, here are some of the key factors we're watching:

In a healthy (and normal market), RDNT would've been headed for the downside after flipping that channel into resistance. However, there's a twist.

We're trading on uncertain grounds.

Assets can explode, range, or take a dive like which is why we're also acknowledging another possibility...

RDNT can pull a 180 and break past the channel again. Why? Because of Bitcoin's recent and expected performance during the next weeks.

That will put us on track for $0.4236 instead.

Now, this remains just a theory. The trend has changed after RDNT lost the channel as support, and the probable outcome is down. In the case that things take on a bullish turn, then you now know what to expect.

UnsETH 🫗

Ticker: USH

Key Players: Soma Capital, MH Ventures, and ICONIQ Capital

Amount invested: $3,300,000

You know that the S&P 500 index lumps the top US stocks together into one bundle.

Now, imagine that, but for liquid-staked ETH tokens - that's UnshETH in a nutshell!

USH combines all the major liquid staking tokens, like Lido's stETH, Rocket Pool's rETH, etc., into a single index token representing pooled exposure to ETH staking rewards.

It's a neat way to tap into juicy yields from staking your ETH without locking up your coins or picking a specific protocol.

Just buy the index and boom - instant diversification across liquid staking on Ethereum.

Given the hype around liquid staking tokens recently, it's no surprise venture capitalists are jumping on the bandwagon.

Soma Capital, MH Ventures, and ICONIQ Capital have all invested in UnshETH.

They likely believe the governance token of the project USH is undervalued in the rising liquid staking market.

Let’s delve into the technical side to better understand investor sentiment and potential market dynamics.

Following a recent move-up, USH faces resistance at $0.094 - $0.12, aiming for support at $0.0420.

Cryptonary’s take 🧠

In the realm of captivating crypto projects, Radiant Capital and UnsETH have emerged as intriguing candidates that command a closer look.

Radiant Capital has triggered our interest with a distinct shift on the RDNT chart, signalling an alluring opportunity worth exploring. Additionally, Cross-Chain lending has caught our attention, holding significant potential, particularly in addressing liquidity fragmentation.

Shifting focus to UnsETH, its alignment with the liquid staking narrative, is an exciting proposition. Although the current state of its chart may not be optimal, a potential retracement to $0.0420 could mark a strategic entry point reminiscent of past buyer activity.

On Conic Finance, the challenge of recovering from a notable TVL loss tempers our enthusiasm. However, the strategic investment by the founder of Curve adds a layer of interest. This calculated move indicates a deliberate approach, suggesting the potential for a rewarding outcome as uncertainties clear.

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms