So, what’s going on this week?

Multiple indicators are flashing bullish signs, layer-2s continue to gain traction (especially Arbitrum) and smart money is on a buying spree!

TLDR

- ~3M ETH burned thanks to EIP1559: Bullish

- ETH Price Structure: Bullish

- Whales Buying en masse: Bullish

- ~$500M added to Layer-2s

- Arbitrum users at ATH awaiting the airdrop

- NFT volumes at new highs thanks to the BLUR airdrop

- Share this report with your family and friends.

Disclaimer: This is not financial nor investment advice. You are fully and solely responsible for any capital-related decisions you make.

The State of ETH

Supply Change

Since August 2021, EIP1559 has been around and close to 3 million ETH have been burned up. The move to Proof-of-Stake also helped lower the supply a lot. If Ethereum was still working on Proof-of-Work, the supply would have grown by 1.78 million ETH. Instead, it dropped by 25,000 ETH.

Price Action

Last week, we saw a significant decline of 14.5% in just a few days, causing many to doubt Ethereum (ETH) and its performance, leading to second-guessing the trend. Fortunately, if you are a Cryptonary follower, you would have been relieved to know that the price was about to reverse and push higher again.

This was tweeted right at the lows 👇🏼

Run it back turbo 💨

— Cryptonary (@cryptonary) February 10, 2023

ETH has set a new record high, and market structure remains bullish. Our first target in this bear market rally is for it to reach $2,200.

Futures’ Market Health

Traders remain in disbelief of this rally, convinced that this rally is non-sustainable. We can see this through the decreasing open interest on this latest move up.

We won’t bore you with definitions but this means that many traders have been caught on the wrong side of the market in the last 24-48 hours leading them to close their short positions. Disbelief acts as fuel to the market, in order to close a short, a trader effectively places a buy order of equal size to do so. This is known as a “short-squeeze”.

TLDR: Bullish.

Smart Money

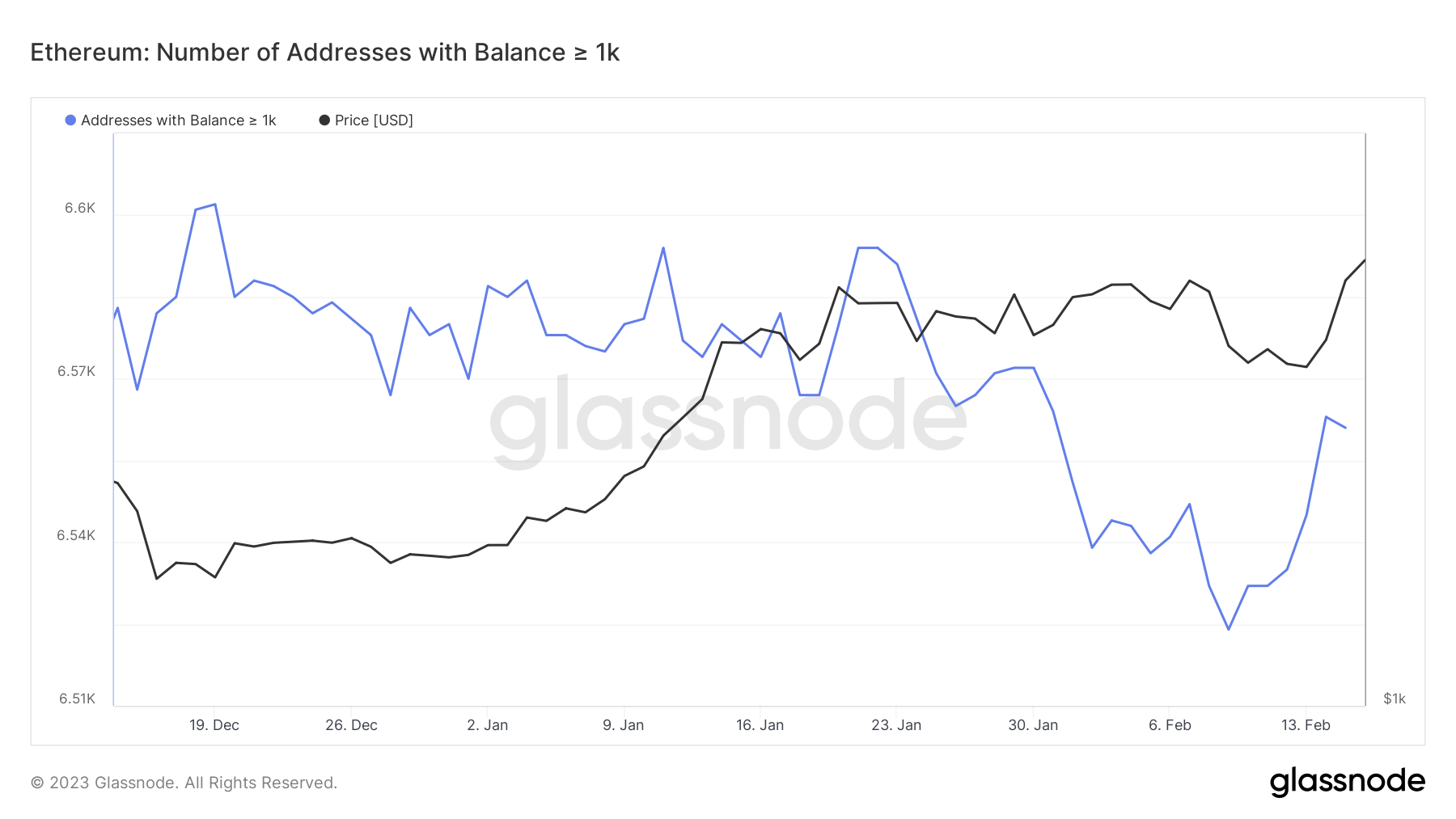

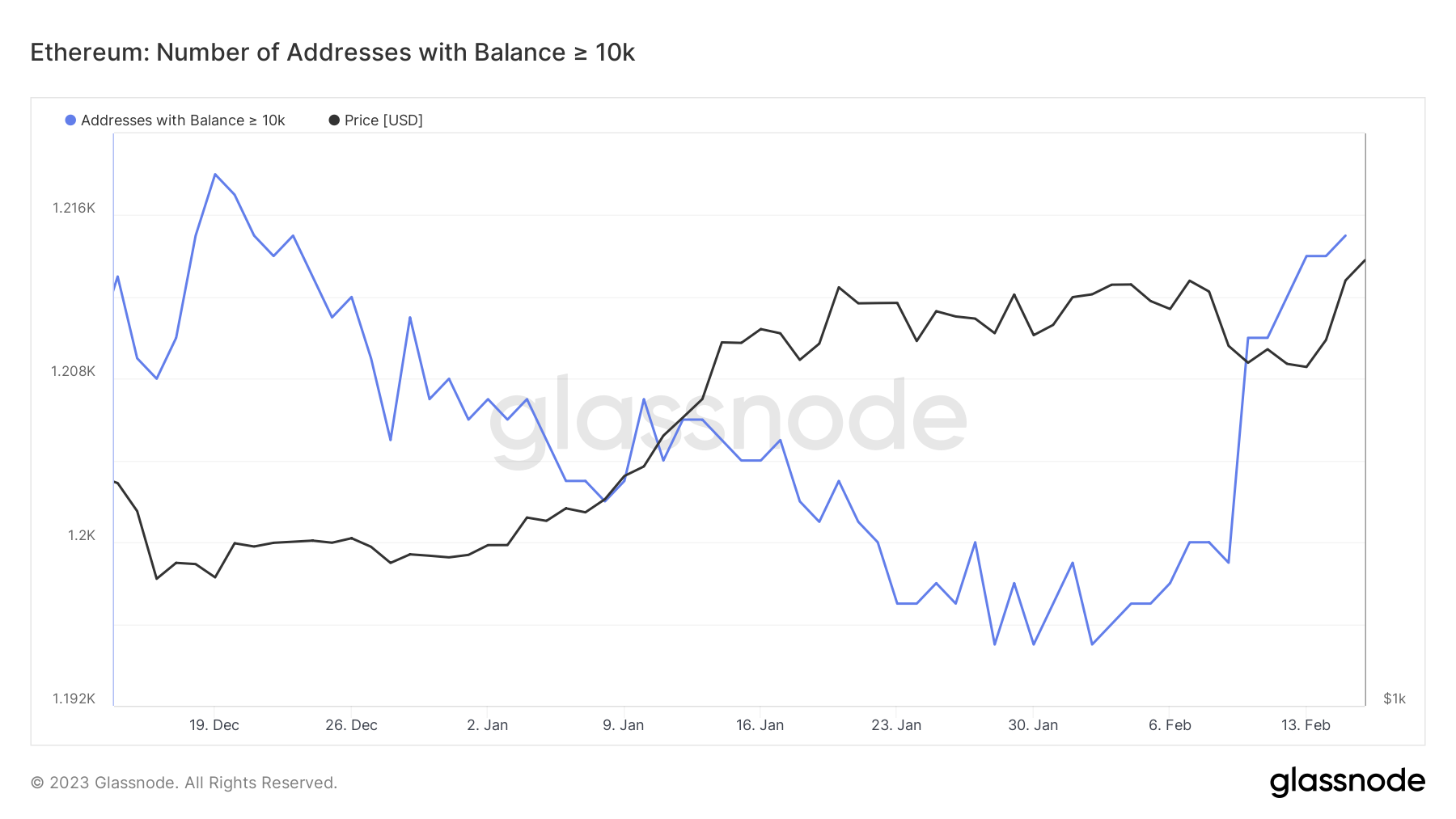

ETH whales have been on a buying spree over the past six days. Both addresses with 1,000 ETH and 10,000 ETH have seen a sharp increase.1,000 ETH Wallet Count

10,000 ETH Wallet Count

Ask yourself a simple question: If the whales are buying, do you want to be selling?

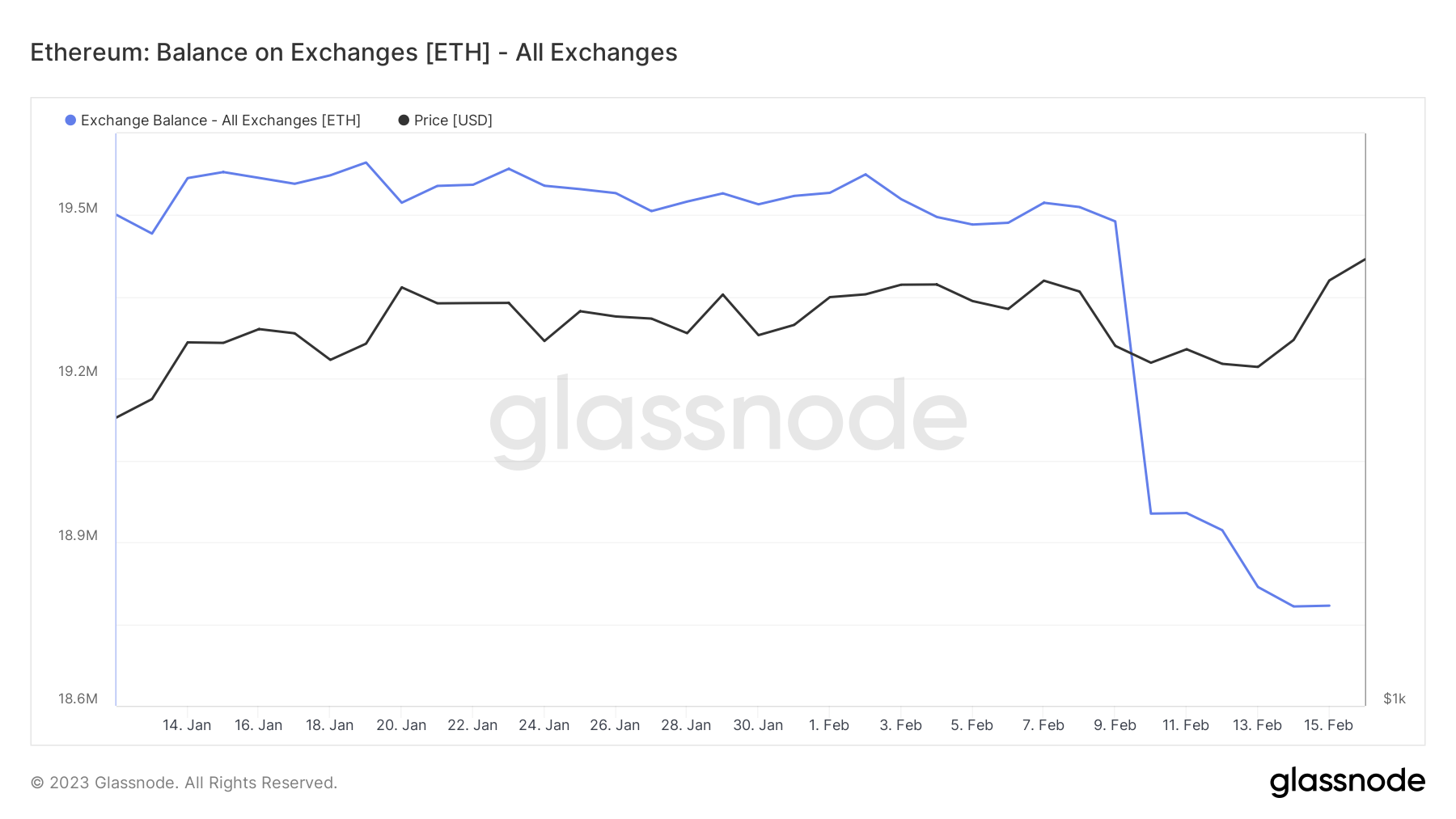

Exchanges Balance

The blue line in this graph shows a big fall in the last few days. That's because $1.2 billion (705,000 ETH) has been taken away from places like Binance and Coinbase. When there's less of something and more people want it, the price goes up. We all know how supply and demand works.

Ethereum Ecosystem

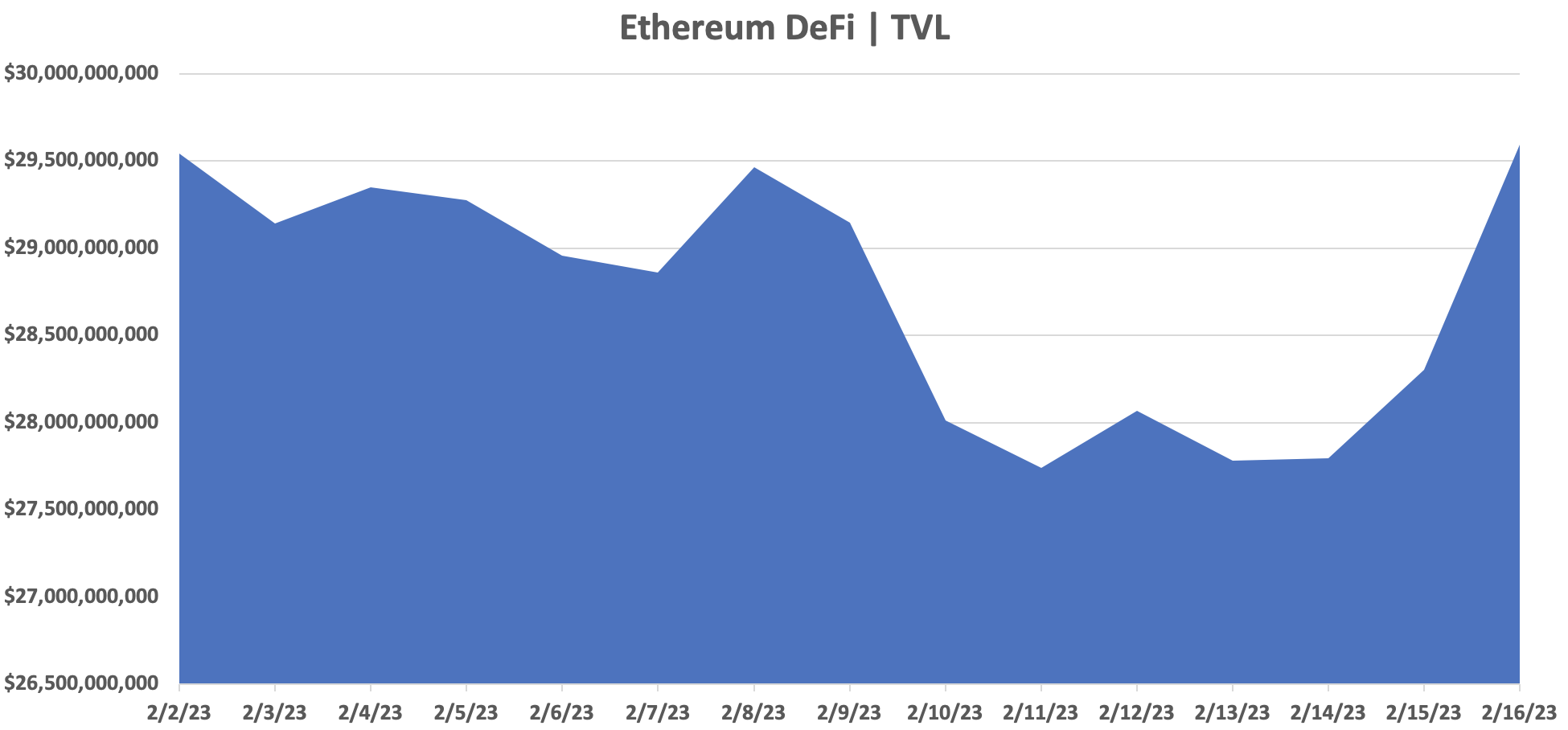

Decentralised Finance | DeFi

DeFi has remained relatively flat (+0.16%) since the last digest. However, we have seen some interesting capital injections across a few DeFi companies:

- Lido Finance (+$380M): Whales have been buying, so an increased amount of ETH staked via Lido is to be expected.

- MakerDAO (+$210M): MakerDAO is the issuer of the decentralized stablecoin DAI. This increase is understandable, given the recent adversarial move from the SEC against the centralized stablecoin BUSD.

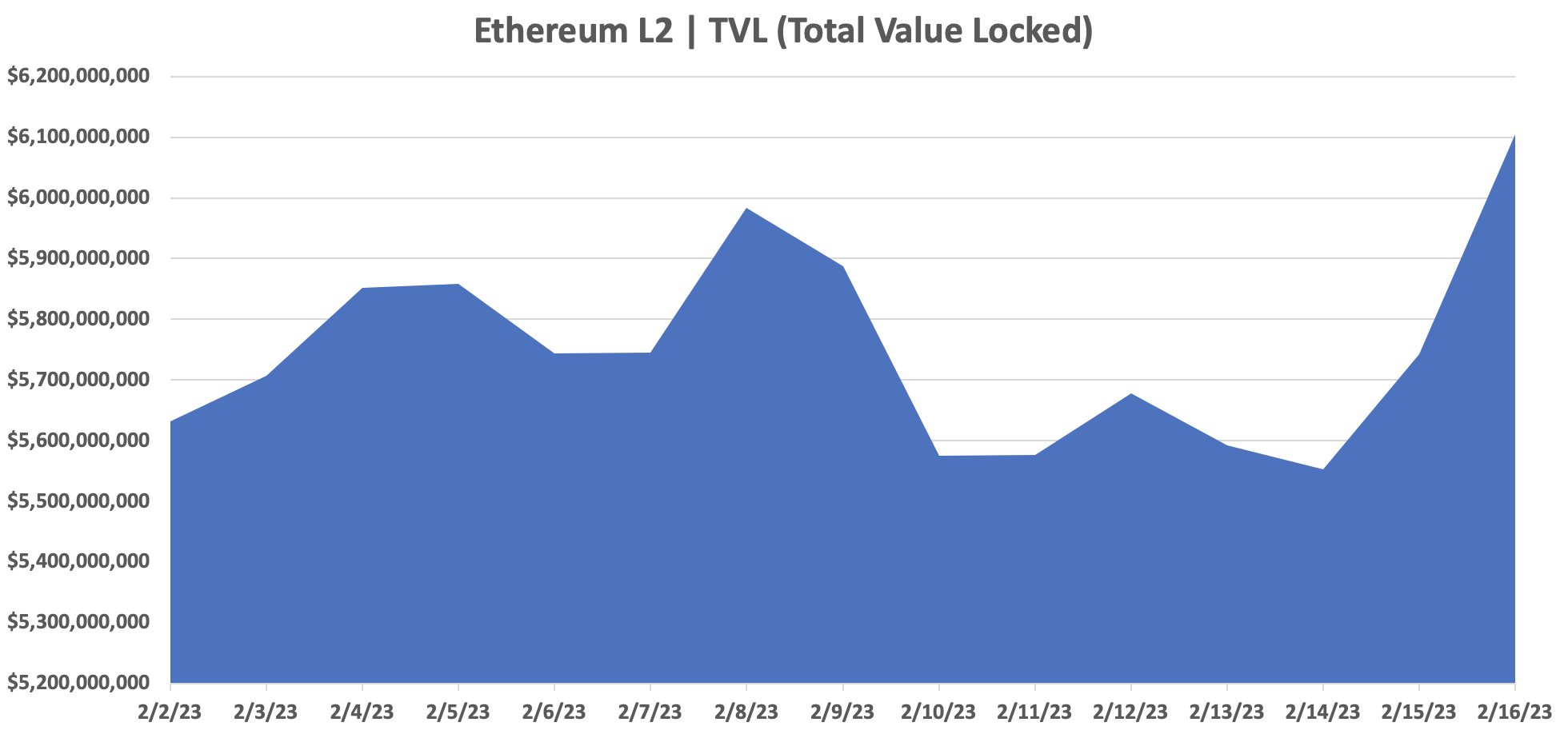

Layer-2s

Layer-2s have seen a decent injection of capital in the past two weeks, with $473M added (+8.4%).

The most interesting fundamental development is that Arbitrum has reached an all-time high (ATH) in active users, as shown in the chart below 👇🏼

Arbitrum Daily Active Users | Source: TokenTerminal

There are two main reasons for the current activity:

- Many protocols are being built, so there is a lot to explore and experiment with.

- People are expecting an ARBI airdrop soon and are farming it.

ZKSync recently announced their "ZKSync Era" mainnet, the final stage before launching the mainnet. This is likely to attract more users to ZKSync, similar to the current surge in Arbitrum's user base.

The wait is over.

All aboard zkSync Era∎ Mainnet!Today, Ethereum's first zkEVM is:

• Opening mainnet to builders 🥳 • Adopting a brand new name 🎈 • Open-sourcing its entire codebase 🎆https://t.co/PoZeliPU8t

1/8

— zkSync ∎ (@zksync) February 16, 2023

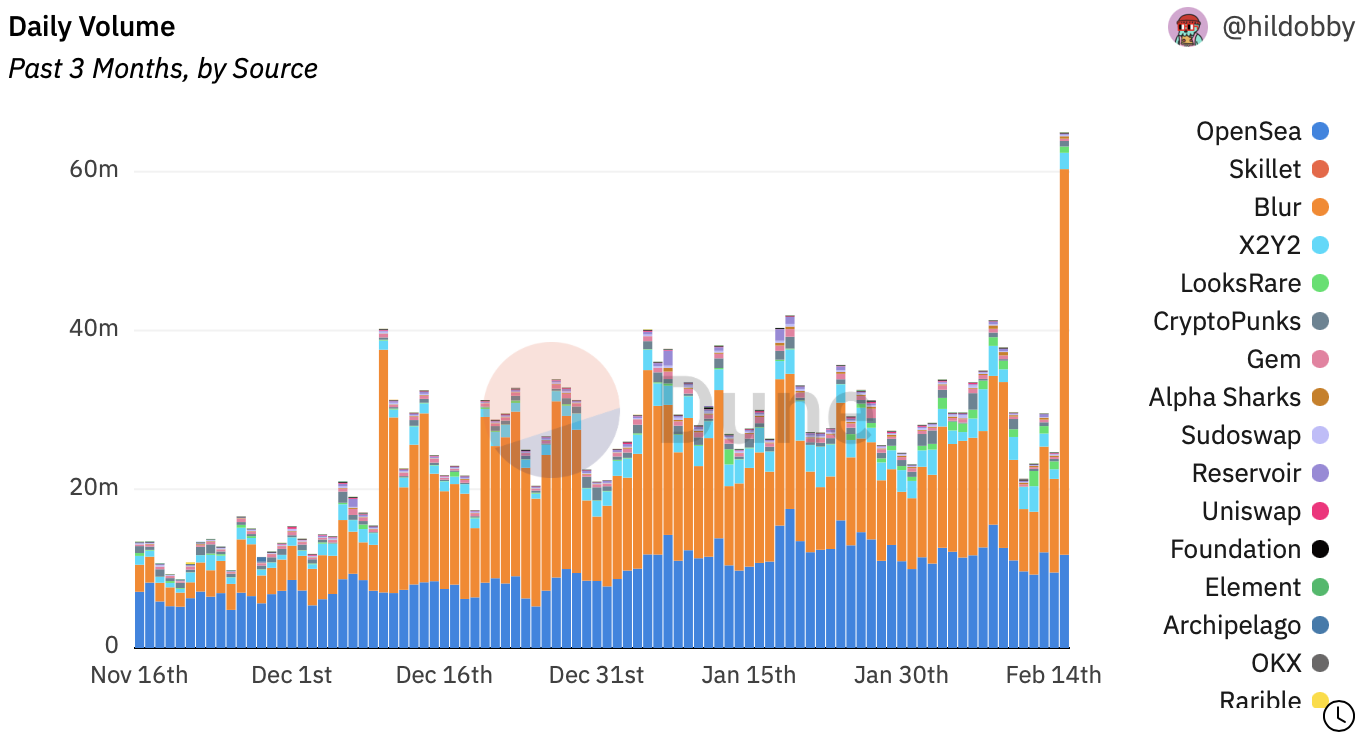

NFTs

We have seen an exceptional increase in daily volumes in the last day. This can be attributed to Blur airdropping their token to users. In reality, NFT airdrops are often sold to purchase additional NFTs, which contributes to these volume spikes.

On another note, OpenSea has a limited time frame to drop their token before they risk losing market share permanently.

Cryptonary’s Take | Conclusion

Whales are accumulating, supply is drying up on exchanges, the price structure is bullish, and usage in the ecosystem is increasing. All signs point to ETH reaching $2,200 soon, and that's just the beginning.Stay tuned for future targets 🎯

As always, thank you for reading 🙏🏼

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms