So, what’s going on this week?

DeFi is heating up again, OpenSea is getting serious competition and Ethereum's final vision will be shipped in 2025!

TLDR

- The Final Version of Ethereum is on track for 2025 Delivery

- Ethereum’s DeFi has attracted $2.3B+ recently (75% of which into six protocols only)

- Optimism (L2) Fundamentals looking worse than ever

- Blur, OpenSea’s competitor, is dropping a token on Valentine’s Day

- The charts are still bullish and indicating $2,000+ soon

- Share this report with your family and friends.

Disclaimer: This is not financial nor investment advice. You are fully and solely responsible for any capital-related decisions you make.

Before we get started, here is a clip of Vitalik explaining how crypto is changing the world.

Ethereum’s Roadmap

Ethereum’s roadmap is almost complete, once there (est. 2025), the chain will go into its maturity phase. Here is an overview:- The Merge (shipped 15/09/22): The goal was to safely migrate Ethereum from Proof-of-Work to a Proof-of-Stake consensus algoritm.

- The Surge (on the way): This step increases Ethereum’s scalability, targeting 100,000 transactions per second on Layer-2s. The main upgrade allowing that to happen is called ‘proto danksharding’ (EIP-4844) which will also reduce the fees by 100x making L2s as cheap as Solana.

- The Scourge (on the way): This part of the roadmap is more technical but what you need to know is that it improves decentralisation even further. It does so by assigning the responsibilities of proposing and implementing new blocks to two separate parts of the network (i.e. fixes MEV).

- The Verge (on the way): This stage’s goal is to adopt Zero-Knowledge Proofs in the transactions verification process. That change will make TXs simpler and quicker to verify by any computer.

- The Purge (on the way): This is closely intertwined with the previous step as ZK technology can help reduce the overall size of the blockchain. Ethereum already exceeds 1TB in size and is expected to reach up to 8TB in only a few years. This makes at-home nodes practically impossible to run, leaving a centralisation risk as only large parties would be able to run nodes.

- The Splurge (on the way): Fix everything else - smaller fixes.

Privacy on Ethereum

One of the unaddressed problems with blockchains today is how public they are. Blockchains are anonymous but not private. This means if your address is found by someone, they have access to your entire financial history. This is a big problem for worldwide adoption.Vitalik released a blog post last week, explaining ‘Stealth Addresses’ whereby this privacy issue is resolved. The basic idea is that stealth addresses allow for the creation of one-time use addresses for receiving funds, making it difficult for outside parties to track the movements.

This does present its own set of challenges as of today, the solution likely comes with ZK technology - in ‘The Verge’ part of the roadmap.

The State of ETH

Price Action

Charts tell us stories, here’s what this one is telling us:

Last week, despite being relatively quiet, there was a silent war between buyers and sellers but buyers ended up winning. They forced sellers to walk back any ground they conquered.

Price has also set a subtle new local high, indicating that the change in market structure from bearish to bullish is complete. This suggests that our target of $2,200 is up next.

The one condition we have to remain bullish is $1,420 holding as support.

While we believe both $2,200 and $3,475 get tapped over the coming weeks, do note that the Risk:Reward has changed and is no longer as favourable for new buys as it was a few weeks ago.

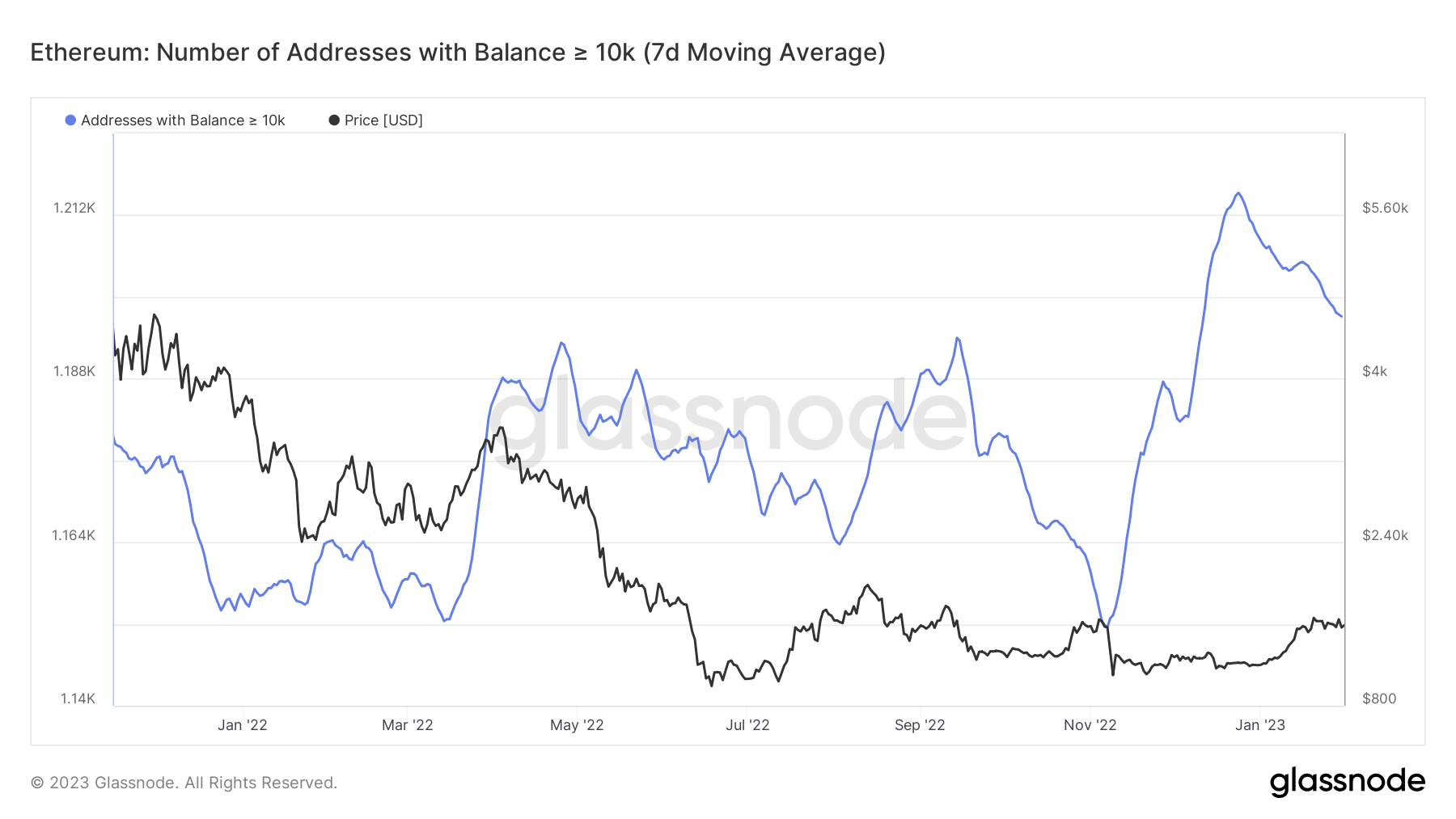

Smart Money

The number of ETH whales with 10,000+ ETH in their wallets has seen a sharp rise since November to historic highs. In the past weeks however, we’ve been seeing a sustained fall from 1,215 to 1,197 whales. The number remains low and unworrying but we must monitor this stat as a severe fall can indicate a local top.

The number of 1,000+ ETH whales has sustained at the same level since last two weeks - meaning they are holding their newly acquired ETH (positive for bulls)

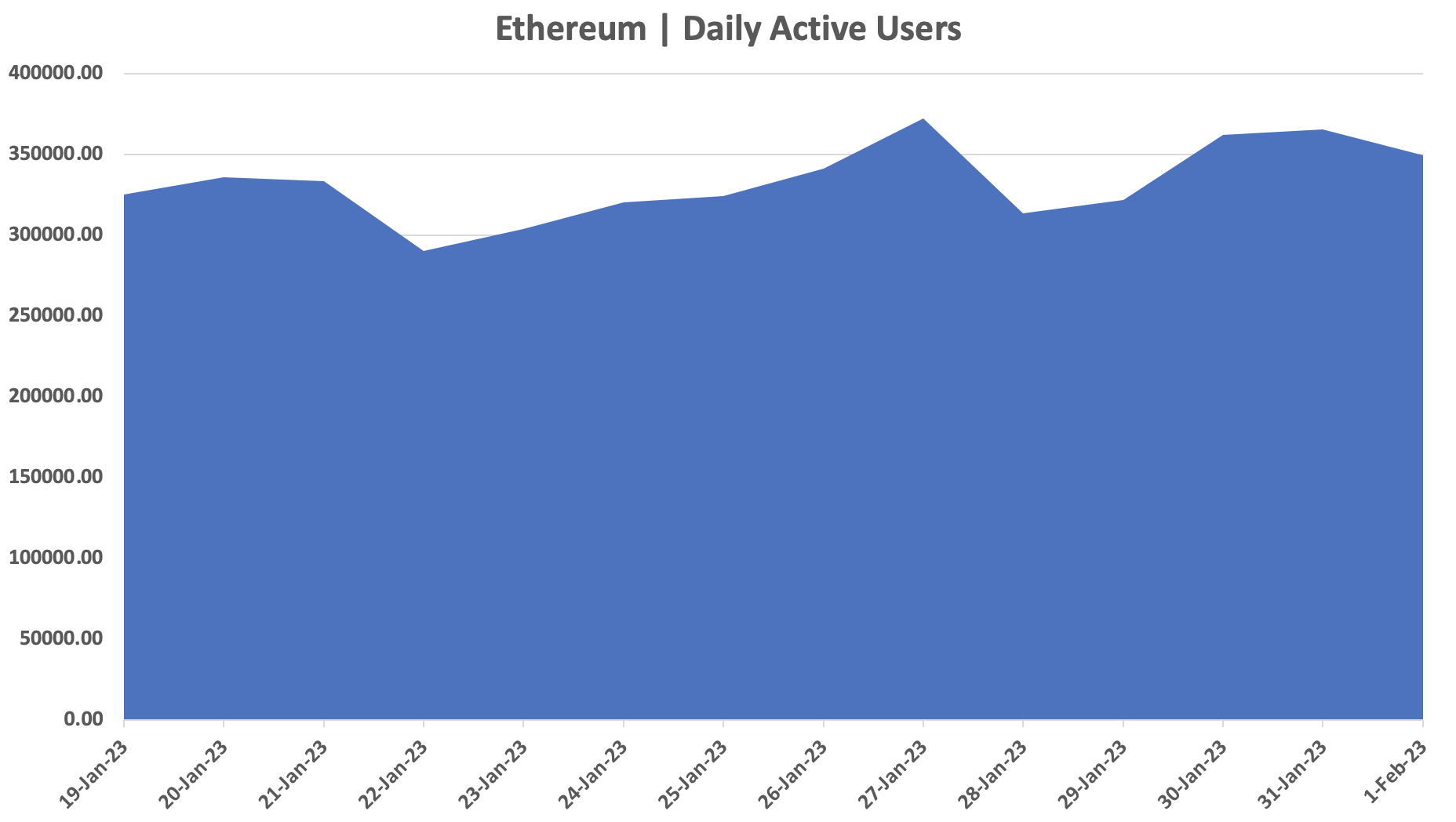

Ethereum Users

In the past two weeks, the number of users has increased by +7.4% jumping up from 325,000 to 350,000.

Ethereum Ecosystem

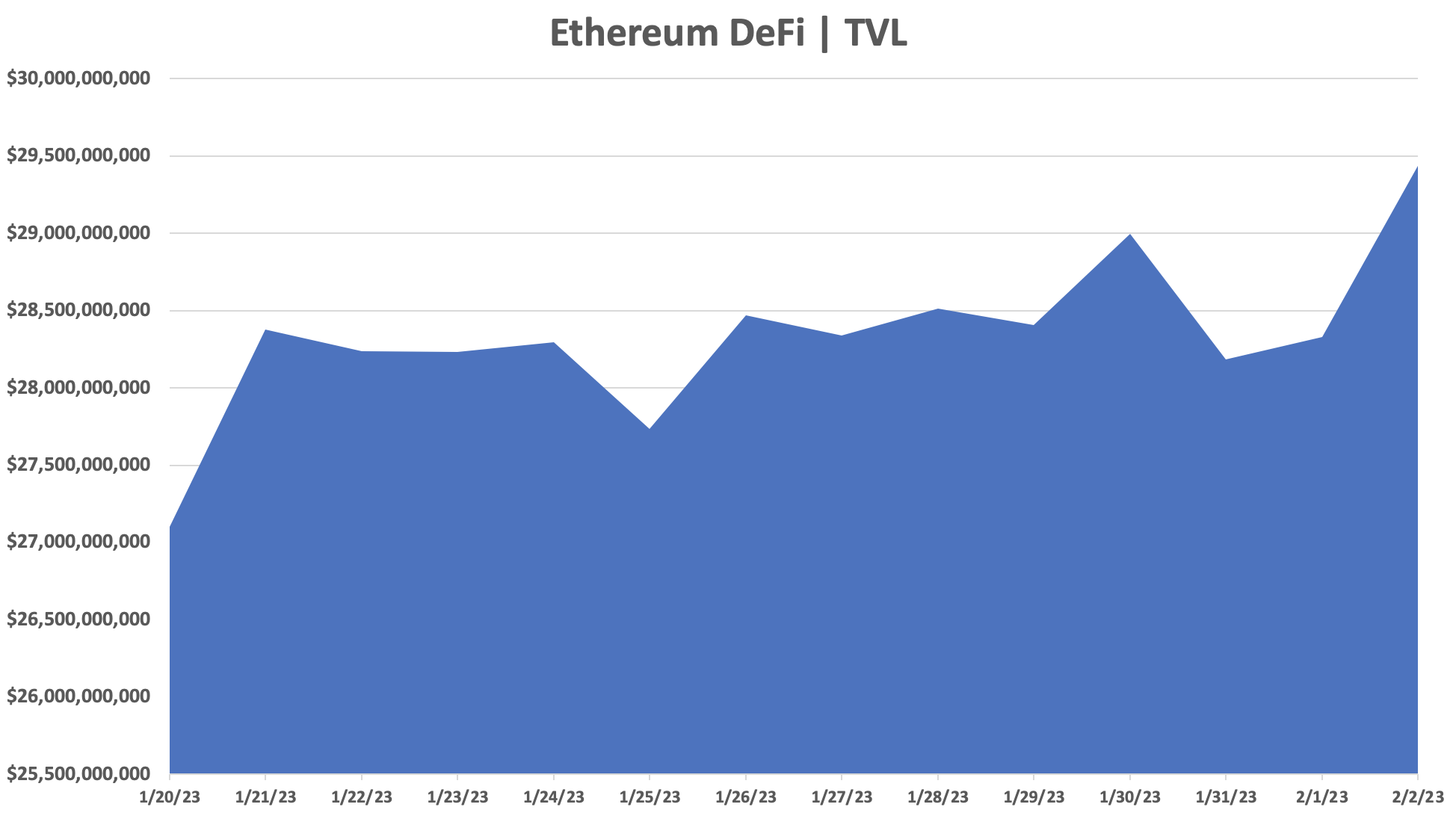

Decentralised Finance | DeFi

Ethereum’s DeFi TVL has grown by +8.6% over the past two weeks by adding $2.3B+ to the ecosystem.

While a logical explanation would be that ETH’s price has gone up and so has the TVL given that a lot of it is denominated in ETH, this time that isn’t the case. Why? Because the price of ETH is barely up 2% in the past two weeks.

Almost 75% of that added TVL came into six protocols only (amongst thousands):

- Curve Finance (+$570M): Decentralised exchange built for low-slippage stablecoin trading.

- Aave (+$310M): Decentralised lending and borrowing protocol.

- Convex Finance (+$280M): DeFi protocol helping you boost Curve yields.

- Uniswap (+$220M): Primary and largest Ethereum DEX.

- Compound Finance (+$210M): Decentralised lending and borrowing protocol.

- Liquity (+$110M): Decentralised borrowing platform allowing you to take 0% interest loans on your ETH.

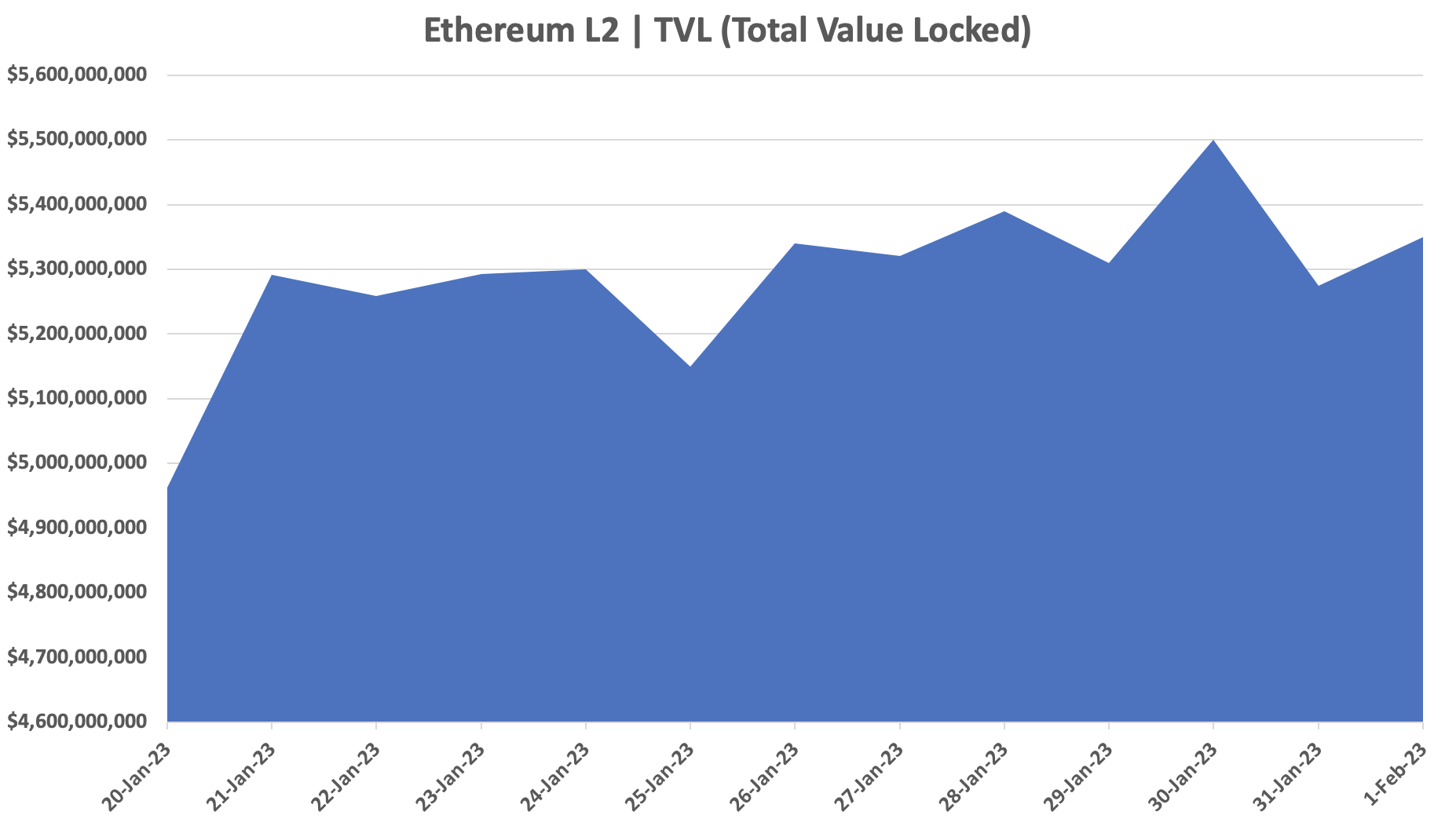

Layer-2s

The L2 TVL continues to rise with $740M+ added since the last update. What is most interesting in this part of Ethereum however is the sharp decrease in Optimism usage as soon as ‘Optimism Quests’ ended 👇🏼

[caption id="attachment_261405" align="aligncenter" width="2212"] OP Price & Optimism Daily Active Users | Source: TokenTerminal[/caption]

OP Price & Optimism Daily Active Users | Source: TokenTerminal[/caption]

What we notice here is a severe divergence between price and active users. OP’s price continues to trend up even though the number of daily active users has severely fallen.

Euphoria is a hell of a drug and as they say: “the market can remain irrational for longer than you can remain solvent”. Nonetheless, what we do know is that prices catch up with fundamentals and unless Optimism users increase by a large margin, price will soon be following it on its path to the downside.

NFTs

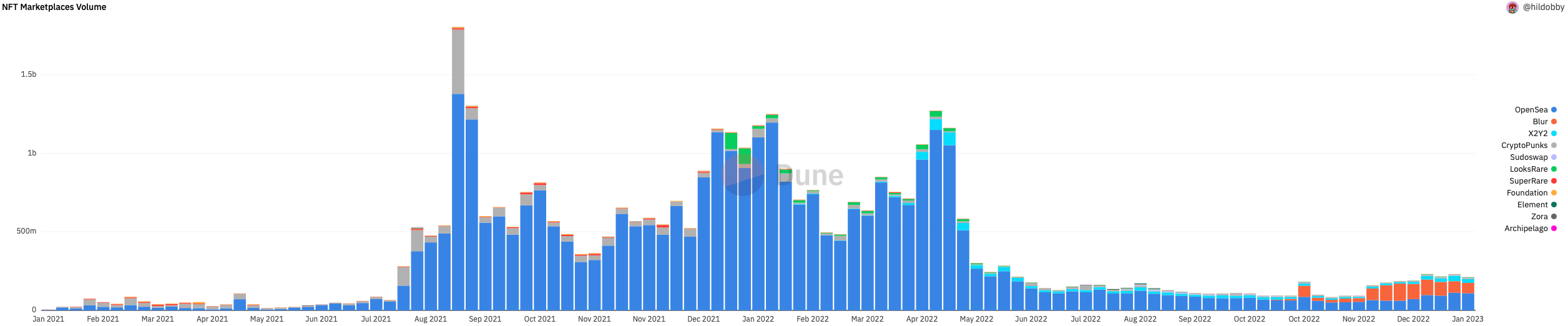

The volumes and number of transactions across Ethereum NFTs hasn’t seen drastic changes since last week.One metric stands out however: marketplace market share.

NFT MarketPlace Volumes by hildobby

Up until October 2022, the main NFT marketplace competitor has been OpenSea, having almost 100% market share. Recently however, a new one is taking a good amount of market share: Blur.

Neither Blur nor OpenSea have a token but Blur have announced the launch of theirs on Feb 14. This can lead OpenSea to finally drop theirs to avoid a vampire attack.

Token launches heavily depend on the economic model adopted. Historically though, NFT marketplace token airdrops began with a large rise and continued with a sustained downfall in price - take a look at $LOOKS below 👇🏼

Cryptonary’s Take | Conclusion

Based off the increasing number of users, capital and favourable charts we believe ETH is set to tackle $2,000+ soon. With that said, we must also mention that the Risk:Reward ratio for short/medium-term traders is no longer 'as' favourable if you’re looking to buy here.The only other notable point is that OP has gotten ahead of itself and seems on the verge of falling based on poor fundamentals.

Vitalik thanks you for reading 🙏🏼

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms