So, what’s going on this week?

ETH is becoming deflationary, technicals are getting better and multiple upgrades are on the way!

TLDR

- Ethereum is a better version of Wall Street 2.0.

- Buying ETH is similar to buying Manhattan Real Estate (hear us out).

- Ether is becoming deflationary.

- Two Upgrades have taken place that drastically improved Ethereum, three more incoming in 2023.

- The technicals are pointing towards a $2,000 ETH price in the next few weeks - as first stop.

- Share this report with your family and friends.

Disclaimer: This is not financial nor investment advice. You are fully and solely responsible for any capital-related decisions you make.

Before we start, let’s settle a popular semantics mistake:

- Network: Ethereum

- Asset: ETH or Ether

How Ethereum is Reinventing Wall Street

You may be wondering, what the f*** are you talking about Cryptonary? Well, give us a few minutes of your precious time before you get back to scrolling on Instagram (just kidding, we love you all).

- Ethereum has built a network, called a base layer, on top of which you can build applications. Those applications are built using smart contracts and you can build anything from an exchange to a lending platform and more. If you’re building an app, you must pay a fee and if you want to use it, you must also pay a fee.

- Wall Street is a chosen piece of land where many financial institutions reside offering you multitudes of services such as exchanging, lending, borrowing and more. In order to build, you must pay a fee (either purchasing land or renting land/offices) and if you then want to use the service you pay a fee to the provider.

Now let’s talk about what Ethereum does better than Wall Street:

- Corruption is minimised due to blockchains’ transparency and rules set in code.

- The landlord takes a fee from both builders and users.

- Anyone can be the landlord and earn the fees via staking.

- You can build more than just financial applications, however this is what it is popular for.

- Inclusion regardless of your ethnicity, income level or political views.

Ethereum Revamps | Network Upgrades

Past Upgrades

We’re going to quickly bring you up to speed on the two most recent and important upgrades Ethereum had:- **EIP1559 (**5 August 2021): ****Prior to this upgrade, ETH had no fundamental reason to go up due to its poor economic design. This EIP (Ethereum Improvement Proposal), created a burning mechanism for ETH that was directly proportional to usage. The more Ethereum gets used, the more ETH gets burnt. With enough usage the burn can outweigh the yearly inflation making ETH deflationary. As you know, the scarcer something is, the more valuable it becomes.

- Proof-of-Stake (15 September 2022): Unless you’ve been living under a rock, you probably have heard of Ethereum’s historic move from Proof-of-Work to Proof-of-Stake. This upgrade achieved three things for the network: made Ethereum “Green” (important for many institutional investors), reduced the ETH supply by taming yearly inflation by -89% and turned ETH into a productive asset with yield (again, something institutions love). For more details, read this.

Upcoming Upgrades

- Shanghai Upgrade (March 2023): This upgrade will allow Ethereum PoS stakers to finally be able to withdraw their stake should they want to. There is the theory that 16M ETH may get dumped but what people fail to see is that these depositors will be subject to an exit queue. Additionally, they’ve staked their ETH at an average price of $2,290 so they’re not winners here looking to lock in gains. The truth is, if this upgrade happens as planned it will mainly be seen as proof of a functional system.

- EIP4844 (Fall 2023): Imagine a chain “Secure like Ethereum, Cheap like Solana”, this is what EIP4844 offers to do for Layer-2s (read here for more details).

- EIP4337 (2023): This proposal aims to drastically improve Ethereum wallets in order to onboard the next wave of users. Imagine if you could create a wallet through your email without the seed phrase hassle, be socially recoverable by people you trust in case you lost access and delegate your gas fee payments? Yes, that’s what EIP4337 brings: Ethereum for the masses.

The Ether Supply Crisis

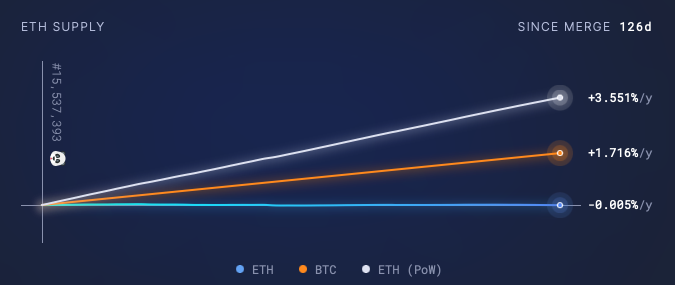

As stated above, both the move to PoS and EIP1559 contributed to lower Ether’s supply, the question is: by how much?Take a look at this chart

Source: Ultrasound.Money

- White Line: What ETH’s yearly supply growth rate would’ve looked like if it still ran on Proof-of-Work.

- Orange Line: BTC’s yearly supply growth rate since Ethereum flipped to PoS.

- Blue Line: ETH’s actual yearly supply growth rate - which is negative.

The ETH Supply Lock | Staking

You can consider all staked ETH as locked as they cannot be withdrawn until the Shanghai Upgrade is performed later in the quarter.13.38% of the total supply (16M+ ETH) is locked in the staking contract.Today, this metric is intriguing as it reduces the supply on the market (positive for bulls). But once withdrawals are open it will be critical to keep up with it to see if there are any significant outflows.

Per the simple laws of supply and demand, the lower the supply the higher the price should go. That is of course, if there is demand. So let’s find out 👇🏼

The State of ETH

Price Action

When it comes to Technical Analysis (art of chart reading), key levels matter a LOT. They are derived from previous moments in time where market participants either bought or sold in mass. For most assets, an ATH acts as a very important key level.

If you were to ask us - on the way down - if we believe the 2017/18 high of $1,420 would hold as support for price, our answer would have been a resounding yes.

Unfortunately, external powers came into play with the liquidation of Three Arrows Capital, FTX, Celsius, BlockFi and Terra and they made technicals irrelavant in the short-term. This led towards a break of a historic key level: $1,420.

Last week, we finally saw it be reclaimed and hopefully this time it holds as support (likely, given Bitcoin’s improved state add link).

On the above basis, we believe ETH may see a bullish rally in the upcoming weeks leading it towards $2,000 as a first stop.

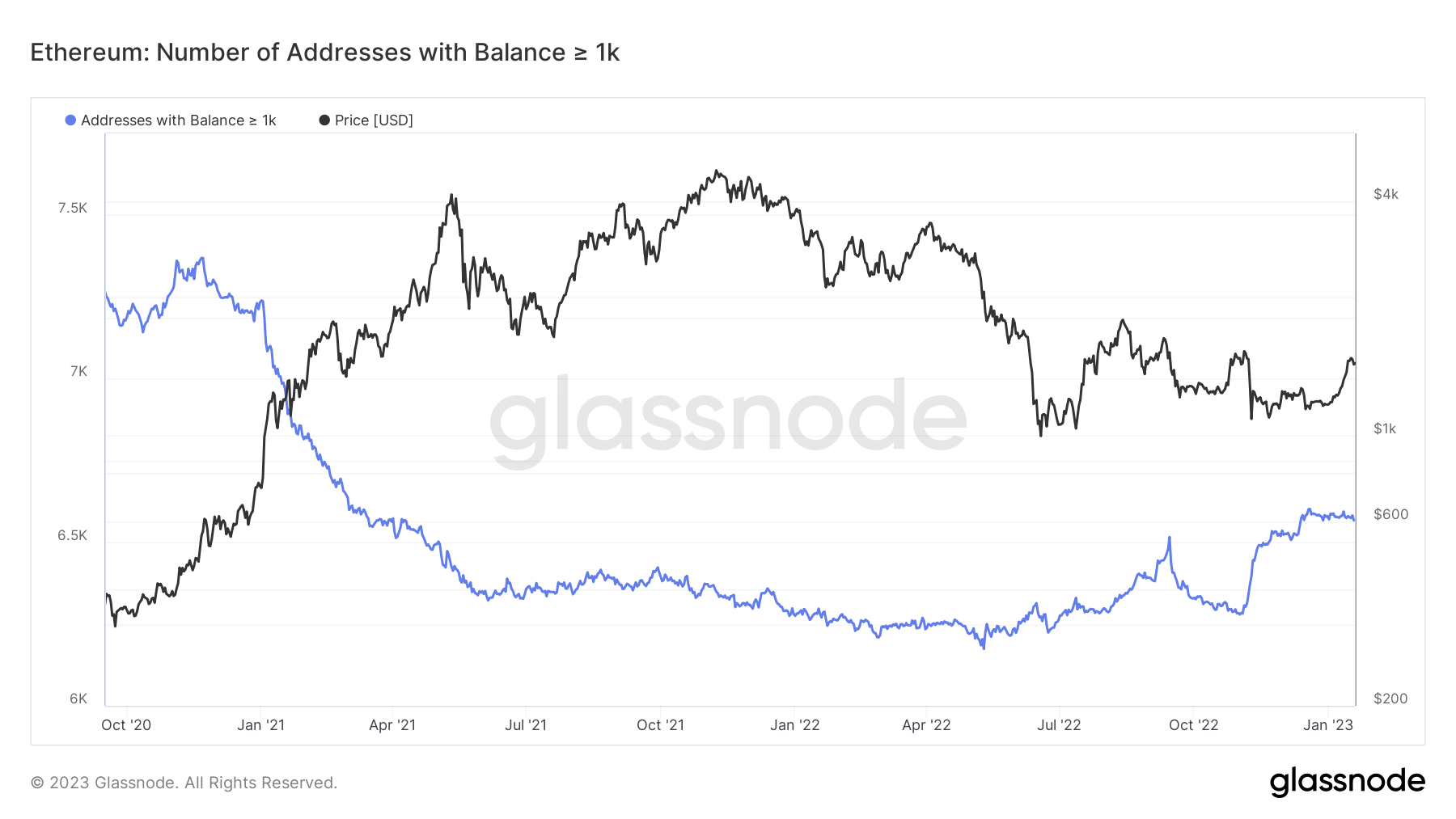

Smart Money

Addresses owning over 1,000 ETH have been steadily increasing since the summer and the pace recently accelerated. The 10,000 ETH+ whales have also increased towards a new ATH - although subtle till now.

Another development is the fast withdrawal of ETH from exchanges. In on-chain analytics, this is viewed as a bullish indicator as it means ETH has been purchased and withdrawn into cold storage. AND it reduces the available supply for buying.

Of course, in the case of base layers like Ethereum this is different because ETH can be traded in decentralised finance. Majority of people (~90%) still use CEXs though so the point still holds.

Ethereum Ecosystem

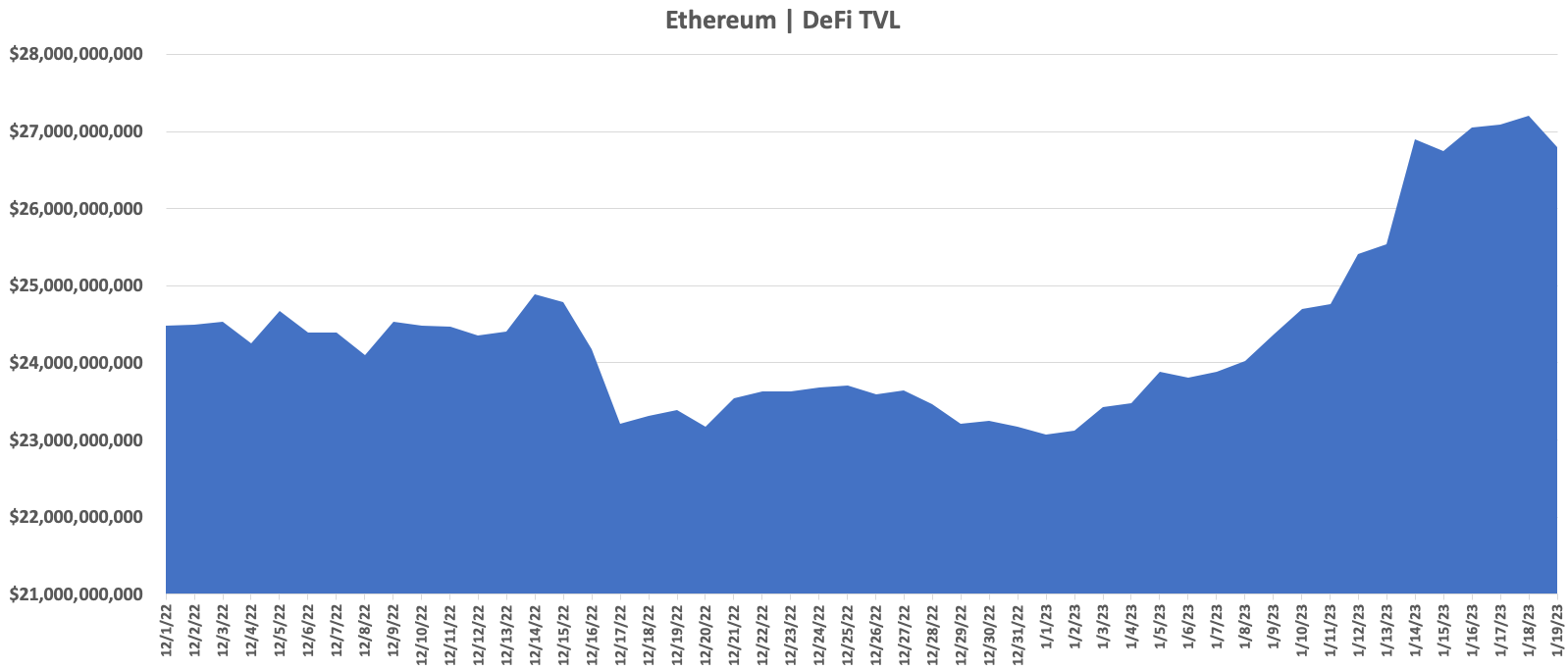

Decentralised Finance

Ethereum’s DeFi TVL finally saw a $3.7B uptick from the start of this year. This metric is still far off its ATH of $110B but this is a start. We expect this TVL uptrend to continue, especially after the FTX collapse and people flocking to DeFi.

Cryptonary, how do you know people are flocking to DeFi? Let’s look at the daily users count of Ethereum, before and after FTX’s collapse.

- 1 November 2022: 360,091

- 19 January 2022: 403,309

Layer-2s

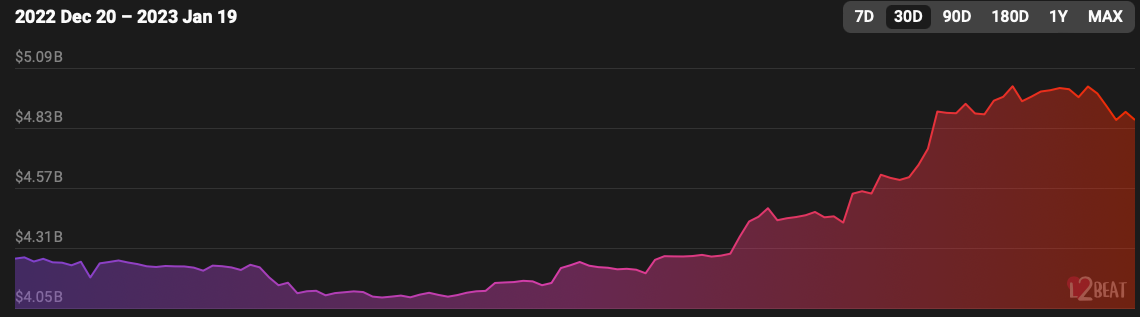

[caption id="attachment_260321" align="aligncenter" width="1140"] Layer-2 TVL | Source: L2Beat[/caption]

Layer-2 TVL | Source: L2Beat[/caption]

Layer-2s are where the next hype is, you can think of them as another BNB Chain or another Solana.

The TVL has grown by 19% since the start of the year - going from $4.11B to $4.89B.

However, do keep in mind that 3 of the major 4 L2s do not have tokens yet (do yourself a favour and participate in their airdrops) which plays a massive role in adoption. Additionally, the L2 experience drastically improves once EIP4844 is implemented.

L2 TVL can easily surpass the $10B mark once all L2s have a tradeable token. Why? A token price increase is the best type of marketing a project can get - think of Solana.

NFTs

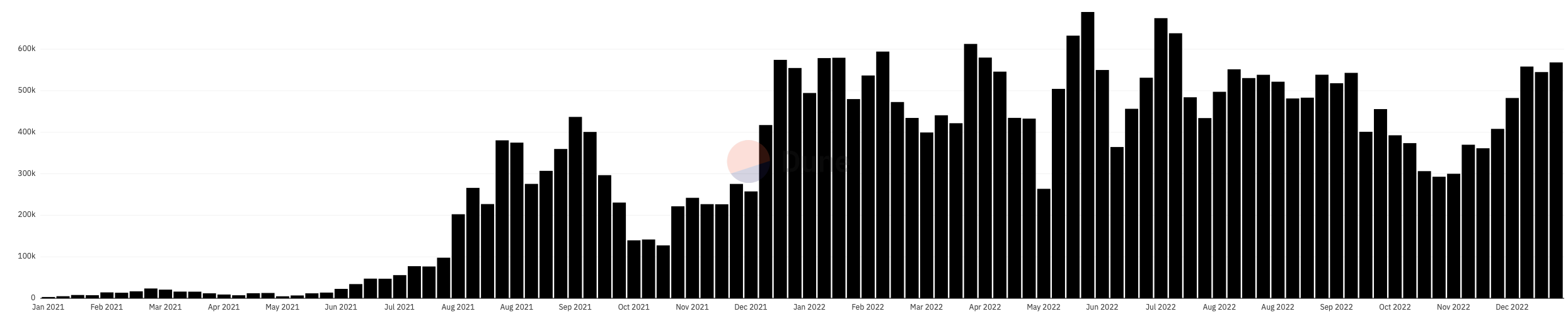

[caption id="attachment_260320" align="aligncenter" width="2488"] Total NFT Marketplace Trades by hildobby[/caption]

Total NFT Marketplace Trades by hildobby[/caption]

The NFT market has once again picked up after a low of 292,884 trades in mid-November. This number has now increased by 95% to 568,201 trades over the past week.

Ethereum earned many users throughout the NFT bubble of 2021 and given the market’s trend (in addition to this data), then NFTs may get their own little rally soon as well.

Ether’s Risks

Permanent Risks

- Centralisation. This is by far the most popular argument against ETH after it shifted to PoS. This stems from the fact that individual staking is tough and most people prefer simple liquid staking solutions such as Lido. Due to that reason, Lido gained 30% market share amongst Ethereum vaidators and if it were to reach 50%, it becomes a security concern. Luckily, Lido is led by a DAO and not a single individual and voting is done through the LDO token. In theory, LDO becomes more valuable because of that. So… buy LDO? (Not Financial Advice).

Non-Permanent Risks

- ETH being deemed a security is a looming risk over Ethereum. While there have been indications that the SEC will not consider it as such and further proof that it fails the infamous Howey Test after shifting to PoS, nothing has been confirmed.

- Fees are the enemy and this is what has caused many to migrate to other chains - despite Ethereum being more secure. Users care about their user experience above all and if Ethereum doesn’t manage to do that in time, it risks losing significant market share. You can say Ethereum was lucky Solana had mechanical faults and Terra failed, as its dominance would’ve further shrunk.

Cryptonary’s Take | Conclusion

- Fundamentals: Ether’s economic model has drastically improved and the UX is getting better. This will lead towards both institutional investments and mainstream adoption. Which is positive for long-term investors like us.

- Technicals: The charts tell us that a relief rally is underway which will lead price towards $2,000 as a first step - given that $1,420 holds as support. Whales are in agreement of that thesis but not too strongly yet. If you want to know more about our Yearly Predictions for ETH and other assets we believe outperform it, read this.

- Ecosystem: We are seeing increased traction in L1 & L2 DeFi, as well as the NFT market - all of which helps Ethereum gain further users and buyers. Heightened activity increases the fees paid on the network, which makes owning ETH and staking it that much more attractive (to capture the fees). More demand, less supply… you know the drill.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms