They're like those kids at school who shot from nobodies to prom king and queen overnight. How did they pull it off?

You might think they cooked up an idea so unique it would blow Einstein's mind, or maybe they had a team of coders who could out-code anyone at Google. Nope, neither.

Their secret? They've got some serious financial muscle behind them. We're talking about Venture Capitalists, or as the cool kids call them, "VCs".

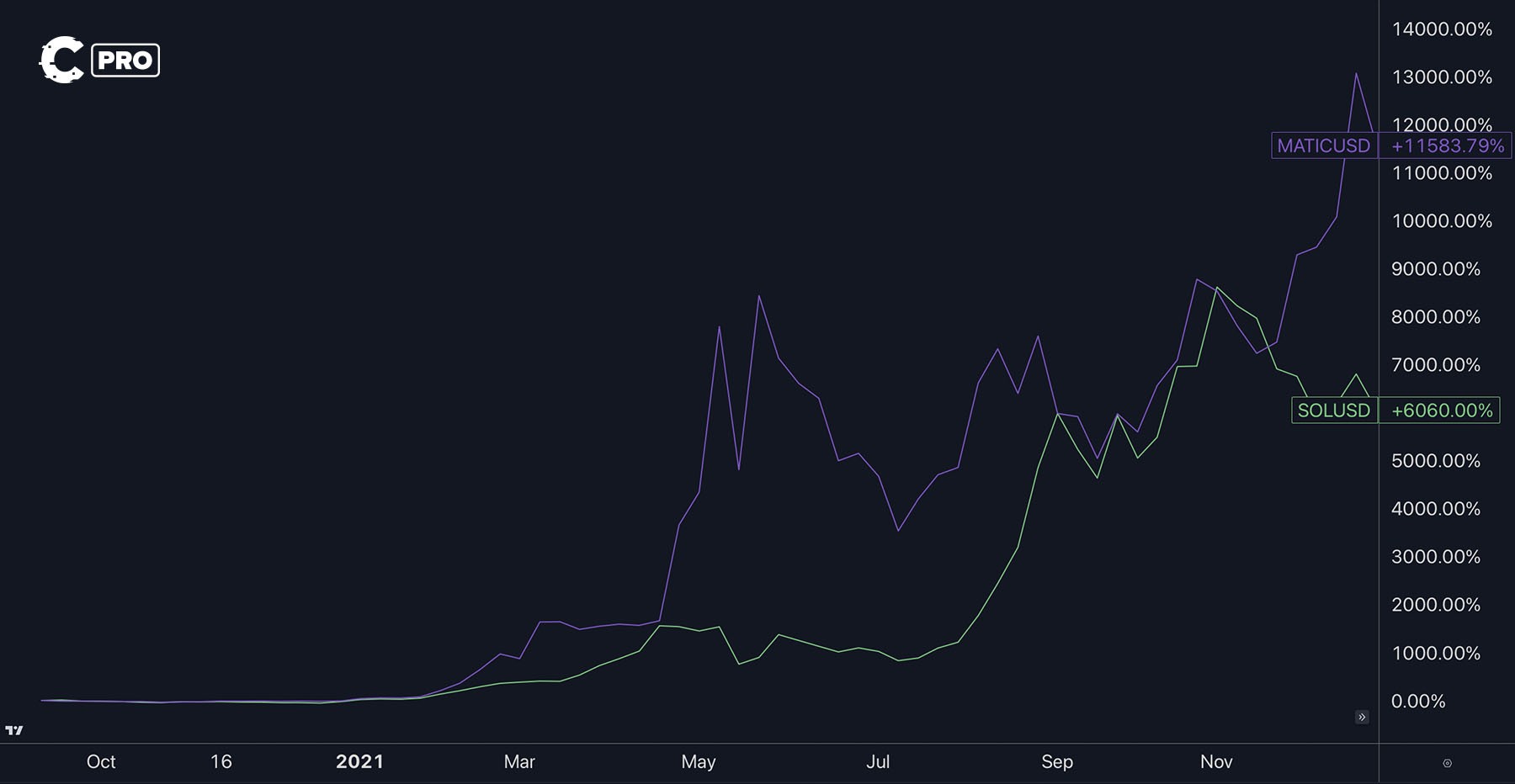

Polygon (MATIC) was backed by none other than a16z and Coinbase Venture. And not to be outdone, Solana (SOL) also got a slice of the a16z pie, with a side helping from Polychain Capital.

But these big-shot VCs aren't just throwing money at them. They're giving them hands-on help with development, and they're also masters at getting the word out there.

In fact, a16z has such a rockstar reputation that as soon as they get involved in an investment round, all the other investors are falling over themselves to get in on the action.

So, where are they investing now? Where are the next SOLs and MATICs?

TLDR 📃

- SOL and MATIC? They didn't just happen; they were turbo-boosted by the mighty Venture Capitalists (VCs) like a16z and Coinbase Ventures.

- VCs right now? They're splashing the cash across the crypto scene, but they're particularly jazzed about infrastructure – we're talking cross-chain communication, wallets, staking services, and decentralized data storage.

- Sectors to stalk? Eyes on the Base Layers and Infrastructure. They're the VCs' darlings, and market trends are saying, "Yup, makes sense."

- The new kids on the block? Check out Scroll and BeraChain for Base Layers, LayerZero and Eigenlayer for Infrastructure. These are the projects with VC swagger. Oh, and keep your tabs open for Metaverse and Web3. Some noteworthy bets are being placed there too.

- Market shivers? VCs couldn't care less. They're playing the long game and throwing their dollars at sectors with juicy long-term potential in crypto.

- Next crypto superstar? Keep a keen eye on these projects. When they roll out their tokens, you might just spot the next SOL or MATIC in the making.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

Following the money 💵

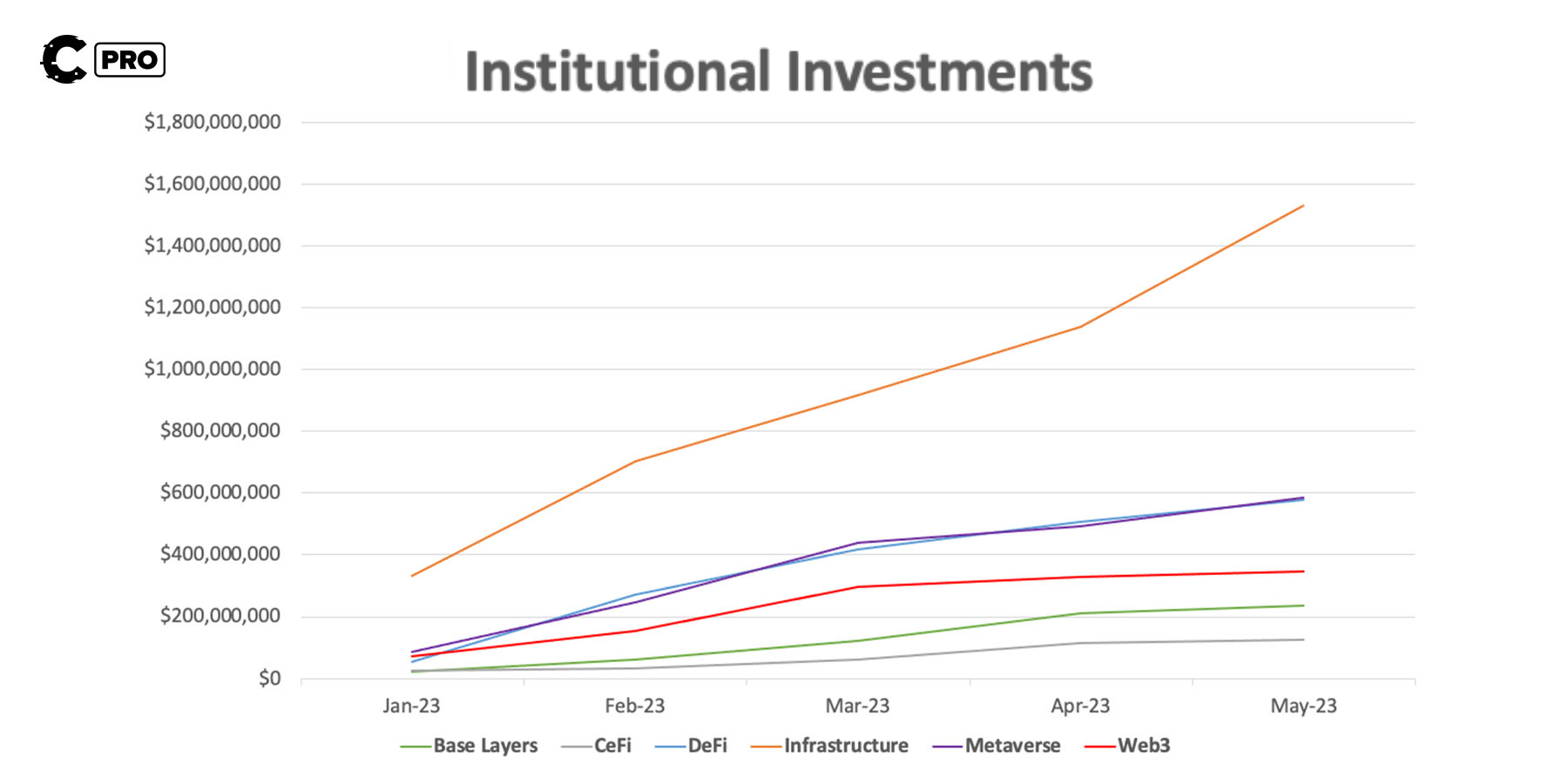

Alright, let's cut to the chase. We've been digging deep into where institutional (VC) investments are pouring their funds in the crypto world, and boy, they're spreading their bets wide.

We're talking about the underappreciated, yet money-making, platforms for cross-chain communication, wallets, staking services, and decentralised data storage.

Sure, they're also injecting funds into the metaverse, DeFi, Web3, and CeFi, but let's zero in on what really matters 👇🏼

[caption id="attachment_274715" align="alignnone" width="1800"] What you really need to keep your eye on is the average check size per sector (last row). A larger number means VCs are betting big on that sector and are likely to pump in more resources, like marketing.[/caption]

What you really need to keep your eye on is the average check size per sector (last row). A larger number means VCs are betting big on that sector and are likely to pump in more resources, like marketing.[/caption]

So, with the full scenario laid out, we see that Base Layers and Infrastructure are the sectors to watch. This fits perfectly with our expectations of market trends and growth trajectories (read our detailed multi-year investment thesis for a peek at which sectors are set to soar when).

The VCs to follow 💳

There are hundreds, if not thousands of VCs, but it doesn’t mean they’re all skilled. Here, we've rounded up the big hitters - the ones whose returns would make your jaw drop.

So, when these names pop up in conversation, take note - they're not just playing the game; they're dominating it.

The Base Layers to watch ⛓️

Base Layers? Yes, these refer to any L0 (like Polkadot), L1 (like Solana) or L2 (like Arbitrum).The biggest upcoming two with VC backing?

Note: these projects do not have tokens yet, but they all will soon, and you’ll want to be ready, aware and decisive when that time comes.

Scroll 📜

VC investment: $50,000,000VCs involved: Polychain Capital, Sequoia China, Bain Capital Crypto, Moore Capital Management, Variant Fund, Newman Capital, IOSG Ventures and Qiming Venture Partners.

So, what's Scroll's mission? It's all about supercharging Ethereum's scalability with a layer 2 solution. The result? Users can enjoy speedy, budget-friendly transactions, all while keeping Ethereum's high-security standards intact.

Scroll isn't your run-of-the-mill scaling solution, though. It boasts a unique setup known as zkEVM, reminiscent of the zkSync Era. But here's where it stands out: unlike other solutions such as Arbitrum or Optimism, Scroll packs a more advanced form of rollup. It's based on zero-knowledge (ZK) proofs, giving it a serious security boost.

Another ace up Scroll's sleeve is its dedication to developing an EVM that mimics the Ethereum Virtual Machine to a T - a feat neither ZkSync nor Polygon can claim.

Keep up with their latest updates here.

BeraChain 🐻

VC investment: $42,000,000VCs involved: Polychain Capital, Hack VC, dao5, Tribe Capital, Shima Capital, CitizenX and Robot Ventures.

It's set on creating the best space for DeFi projects to kick off. The twist? BeraChain ditches the traditional proof of stake model for an innovative "Proof of Liquidity" approach. This allows users to stake big names like ETH and BTC without using a native token.

Better yet, users can stake assets and simultaneously use them for on-chain activities. This clever mechanism ramps up capital efficiency, making your assets work smarter.

Keep tabs on BeraChain's progress here.

The infrastructure plays 🪜

LayerZero

VC investment: $120,000,000VCs involved: a16z, Circle Ventures, Sequoia Capital and Samsung Next and OpenSea Ventures.

Their mission? To create a platform that makes transferring funds between blockchains as easy as pie and fosters seamless communication across different blockchains.

We've been fans of their potential for quite a while now, even featuring them on a podcast - give it a listen here.

Keep up with their latest developments here.

Eigenlayer

VC investment: $50,000,000VCs involved: Electric Capital, Polychain Capital, Hack VC, Finality Capital Partners, and Coinbase Ventures.

Their solution? They're all about maximizing users' returns on staked ETH. How? By letting users lend their ETH to beef up the security of other networks and infrastructure, offering them an extra yield. This not only puts more money in users' pockets but also makes it easier for new networks to find stakers ready to contribute to their security.

Stay on top of their latest updates here.

Other notable investments 💰

CCP | Metaverse 🎮

VC investment: $40,000,000VCs involved: a16z, Makers Fund, Bitkraft, Kingsway Capital, Nexon, and Hashed.

This project is crafting a triple-A game that goes all-in on blockchain technology.

Ever wished for true ownership of your epic in-game loot? This project is here to grant your wish. Expect secure data storage and real ownership of your digital treasures.

Remember the creators of Eve Online, the mammoth game with 9 million users? They're the brains behind this venture too! And this game is not just any game — it's a new addition to the Eve universe. Imagine the potential player rush!

Stay up-to-date with their progress here.

Towns | Web3 🏚️

VC investment: $25,000,000VCs involved: a16z

Towns aims to establish a decentralised social platform. Imagine a space where you can chat freely without relying on a central company for data storage. It's like having your own digital town square, where the rules are yours to set, and your data remains yours alone.

Keep track of their latest developments here.

Cryptonary’s take 🧠

Even with the market hitting the brakes recently, VCs are still splashing the cash big time. They're all about playing the long game, speculating on which sectors will hit the jackpot and going all-in on those. Right now, their money is on base layers and infrastructure solutions.Want some inside scoop? We placed our bets on layer-2s (like ARB) and liquid staking derivatives (like LDO) as the standout performers in the next bull run. Trust us, Cryptonary can dish out more insider tips than any VC out there.

Bear in mind VCs are privy to private investment rounds that we ordinary people can't join. But don't fret. These projects will soon have tokens up for grabs, and when they do, they're likely to shine bright on the performance charts (just a prediction, not financial advice!).

Action points 📝

- Dive deeper into how the crypto market's set to evolve. Check out our multi-year thesis here for a detailed look.

- Want a bird's eye view of all the VC crypto investments? DeFillama's got you covered with an up-to-date dashboard here.

- For a more real-time insider perspective, why not follow the smartest investors' moves? Our Smart Money Series takes you one step closer to the action, showcasing on-chain activities of top-performing wallets (they’re smarter than the VCs 👀).

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms