Why you should be worried about central bank digital currencies (CBDCs)

Central bank digital currencies (CBDCs) have become a hot item worldwide. China has already launched one. The Federal Reserve Bank of San Francisco has reportedly hired developers to work on a CBDC, intensifying discussions about the potential launch of a digital dollar. And, the UK has hired a Head of CBDC and is testing a digital pound.

This article explores why so many nations are exploring CBDCs and what these developments could mean for you.

Spoiler: they’re not good.

Let’s dive in…

TLDR:

- Governments argue that CBDCs are convenient.

- However, concerns have been raised about increased surveillance and government power.

- The launch of a CBDC in Nigeria hasn’t been beneficial for its citizens, to say the least.

- CBDCs do not necessarily pose a direct danger to crypto, but their wider implications are certainly no good for society.

- Crypto is the real alternative that protects individual freedoms and financial privacy.

First up, what is a CBDC?

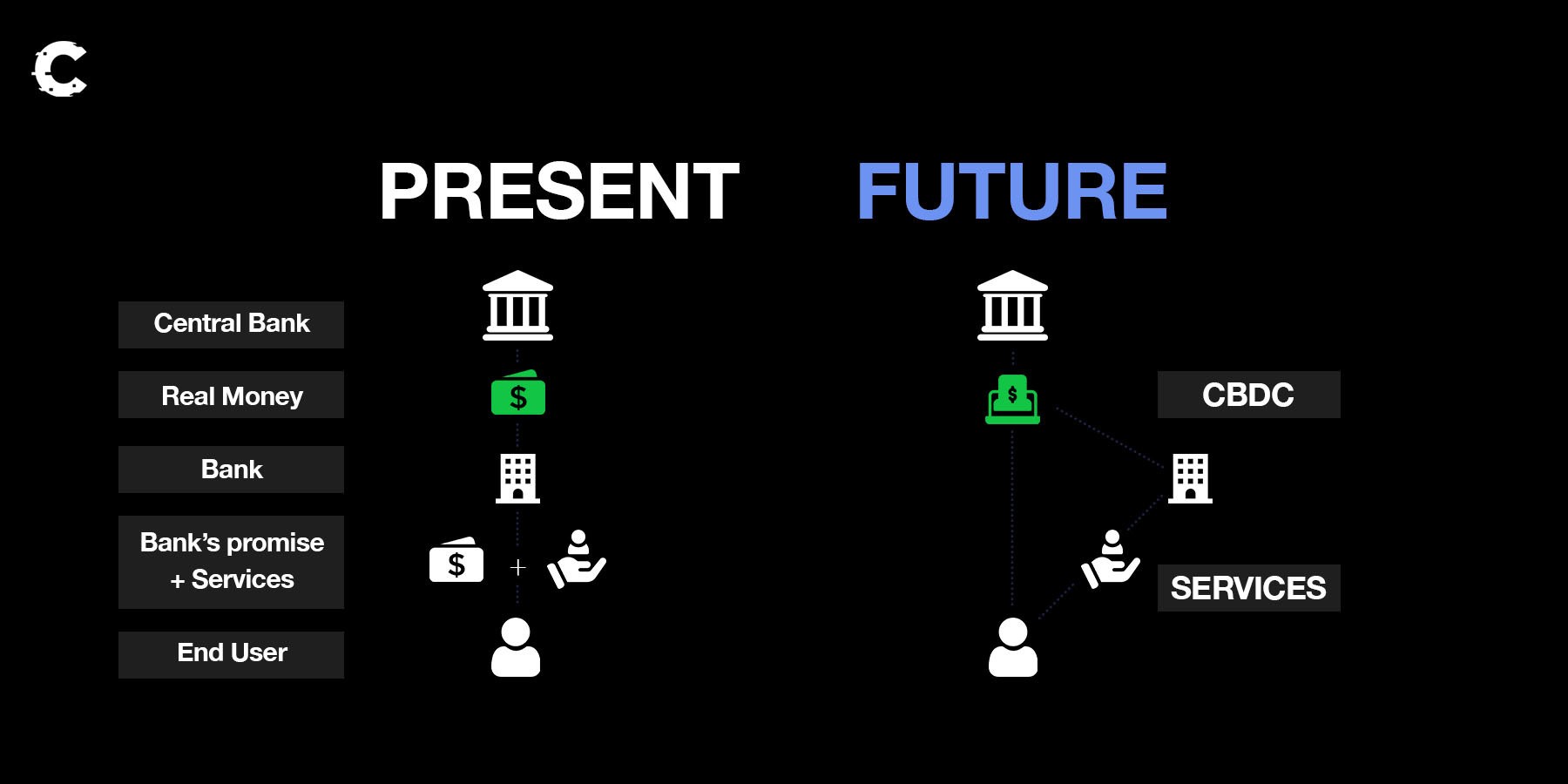

CBDCs are a form of digital money issued by central banks, the same institutions that issue physical cash.We can already make digital payments however in our current system, these are not backed by the central bank, unlike physical coins. In other words, a bank owes a customer the money deposited in that customer's account and is responsible for transferring it. However, in the case of a CBDC, the money would be a liability of the central bank as it’s directly issued by a central bank instead of being issued by a bank.

Governments argue that CBDCs are a natural and logical innovation for developing digital cash, and there are indeed theoretical benefits to using a CBDC for convenience.

However, there are concerns that CBDCs could, depending on their design and implementation, enable increased monitoring and provide central banks with excessive power over individuals.

We couldn’t agree with the concerns more. They include:

- Freezing or seizing assets: CBDCs could make it easier and faster for governments to freeze or seize resources, potentially leading to the exclusion of certain individuals from society.

- Negative interest rates: People may lose money due to negative interest rates. As individuals cannot hoard real cash, it's much easier to drive interest rates well below zero. Otherwise, the zero rate on notes stashed under the mattress seems attractive. While proponents argue that this could stimulate spending, it also risks financial insecurity for citizens.

- Programmable spending: CBDCs could limit or prohibit certain purchases, such as alcohol for individuals with alcohol-related offenses.

Governments move ahead despite concerns

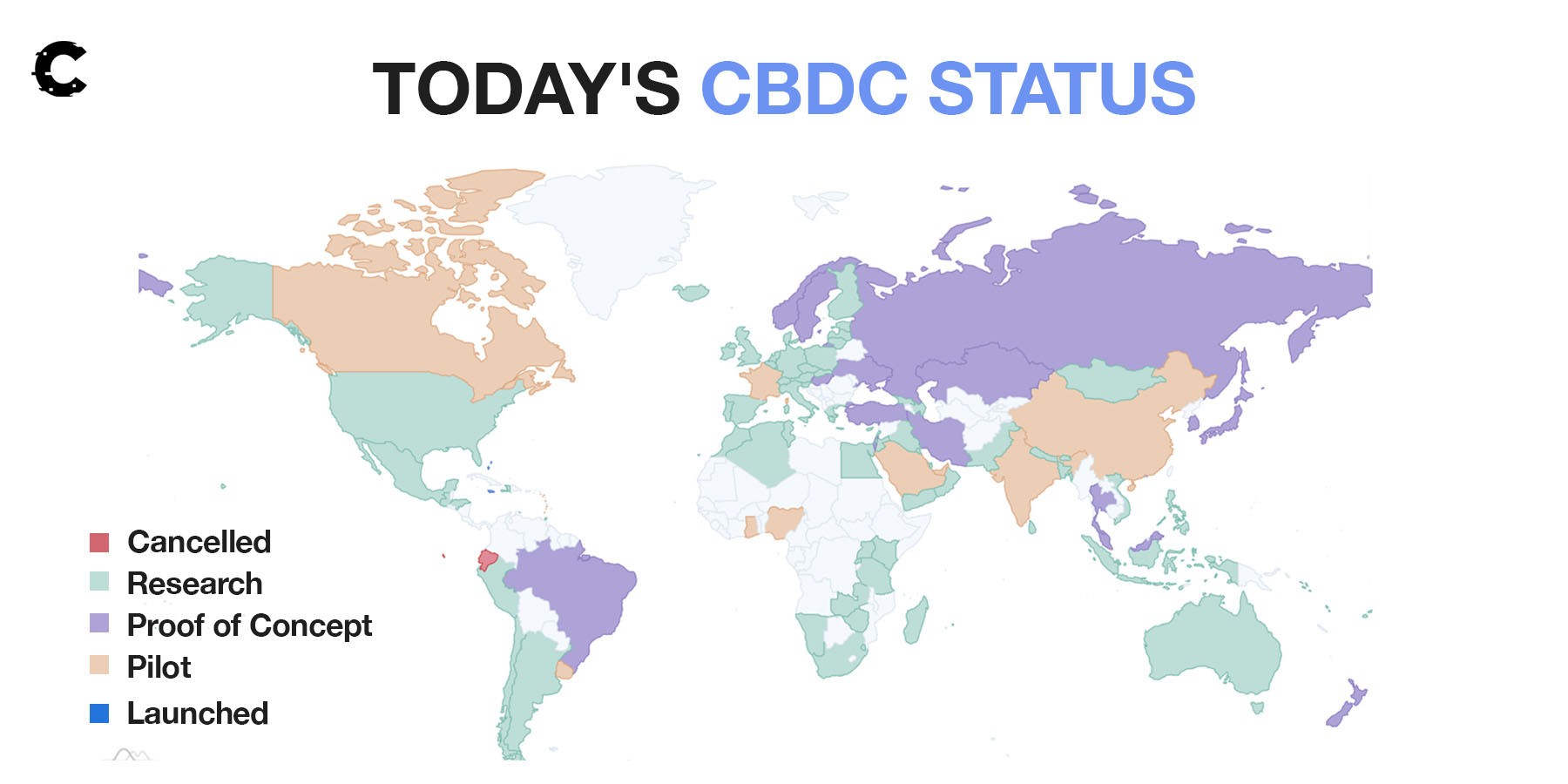

More than 100 countries, which collectively make up 95% of global GDP, are currently exploring the development of CBDCs, despite these potential issues.Of these countries, 57% are in the research or development stage, 16% are testing, and 10% have already launched CBDC projects. China, India, Nigeria, and Jamaica are among the launchers, while the US and Europe are still exploring the idea.

China is known for its authoritarian government and the use of technology to gain power over its citizens. It was the first country to introduce a CBDC.

Political and monetary experts are now concerned that the digital yuan (e-CNY) could make it easy for Beijing to stop payments or freeze holdings, taking authoritarian retaliation to an entirely new level.

The potential adoption of a digital dollar in the US has also raised concerns about the risk of importing the same type of authoritarianism that prevails in China into Western nations. To address these concerns, Congressman Tom Emmer (R-MN) proposed legislation that would prohibit the Federal Reserve from issuing CBDCs directly to individuals. However, most Western countries still view the introduction of a CBDC as inevitable. The United Kingdom and the European Union are already in serious talks about the launch of a digital pound and euro.

Can we trust our governments?

Listen, CBDCs are not inherently harmful. The key factor lies in their development. However, once implemented, their standards become challenging to reverse.The European Union claims that a digital euro will not replace physical cash and will come with strong privacy protections. The crucial question is whether such a government will keep such promises.

The case of Nigeria underscores the dangers of putting too much faith in CBDCs. Despite being designed to promote financial inclusion, the E-Naira has struggled to gain popularity, with less than 0.5% acceptance since its inception in 2021. As a result, the government has limited the use of cash, forcing citizens to use digital currency instead.

While you may currently trust your government, it's essential to exercise caution when considering giving central banks and governments so much power.

This occurred in Canada, a democratic western country, where bank accounts were frozen for protesters in February of 2022 because they protested against the Covid health restrictions. Even if you do not agree with these protestors, this indicates that even in the freedom-loving West, money can be used as a tool of control.

Crypto is the true alternative

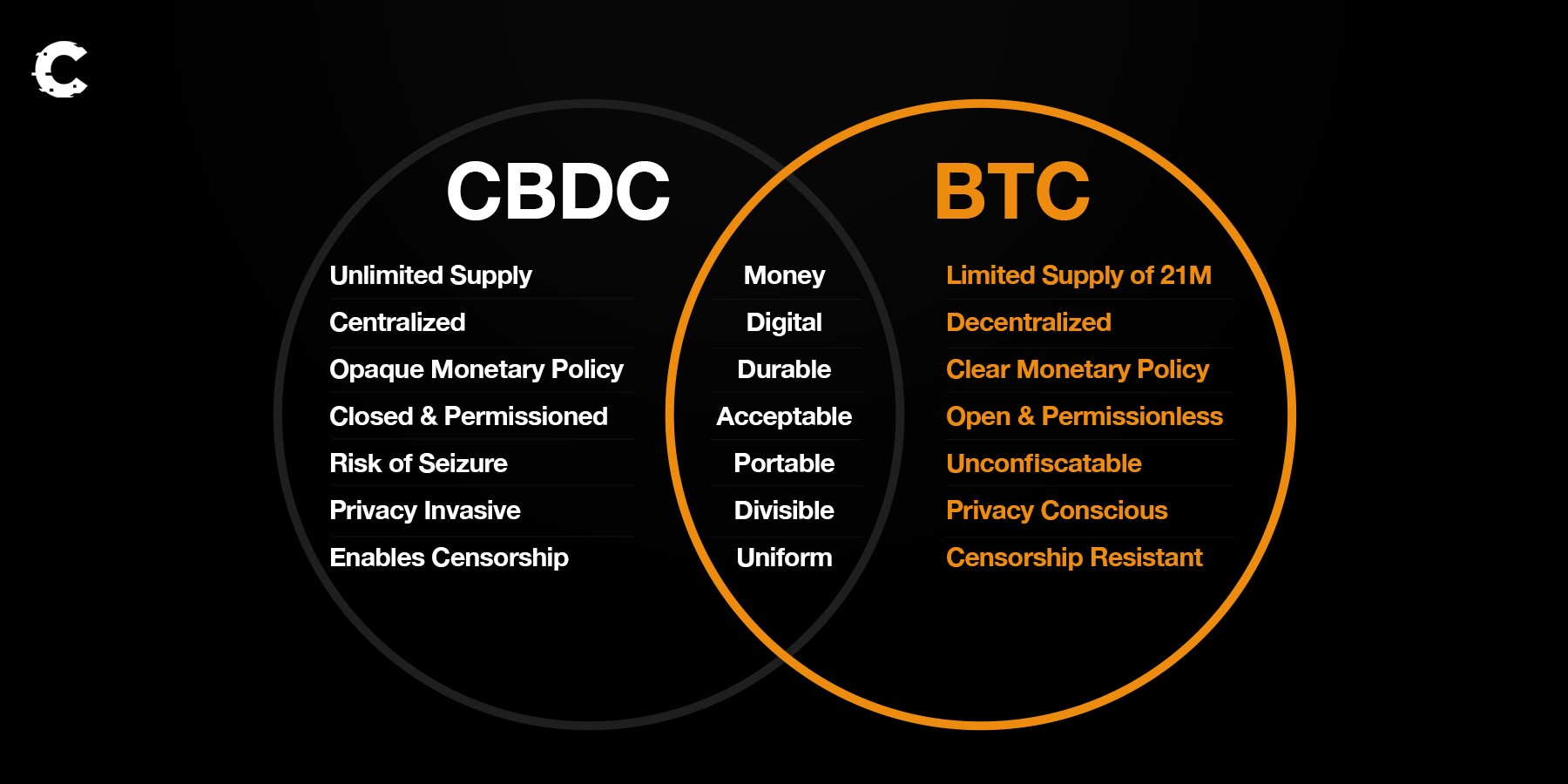

Given the risks associated with CBDCs, cryptocurrency is not only a viable alternative, but it’s also the only oneBitcoin was created to provide a decentralized, digital currency that operates independently of governments and central authorities. Unlike CBDCs, which could increase government power and surveillance, cryptocurrency is designed to protect individual freedoms and financial privacy.

It is important to recognize the fundamental differences between CBDCs and cryptocurrencies… and work to safeguard the latter to protect ourselves from the risks associated with their up-and-coming, mutant little siblings.

Cryptonary’s Take

The appeal of CBDCs for countries like China is obvious; a central bank's digital currency allows for the monitoring of all transactions. However, as Western governments also look to adopt this powerful technology, it's important to remain cautious and avoid placing too much trust in them.This is precisely why cryptocurrency was created: to eliminate the need for such trust. The situation in Nigeria, where the government has restricted cash access to force its CBDC on citizens, highlights the need to continue working towards a decentralized financial system. Cryptocurrency will further separate money and state, while a CBDC appears to bring them much more tightly together.

Action points

- If you’re a citizen of a country that’s working on a CBDC and have concerns, it’s worth reaching out to politicians to express them. Also, research the way your country plans to implement a CBDC.

- If you’re concerned about cash limits or other threats to your country's financial system, consider storing some of your money in foreign currencies or crypto in a hardware wallet.

- Keep up with your nation's CBDC developments. Every country has different goals, and some CBDC designs may be beneficial while others may harm citizens’ financial freedom.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms