Every time a new blockchain came out, Ethereum haters around the world swore the end was near for the king. Solana, BNB Chain, and Cardano were all set to slay the mighty number one.

To be fair, this was not without merit.

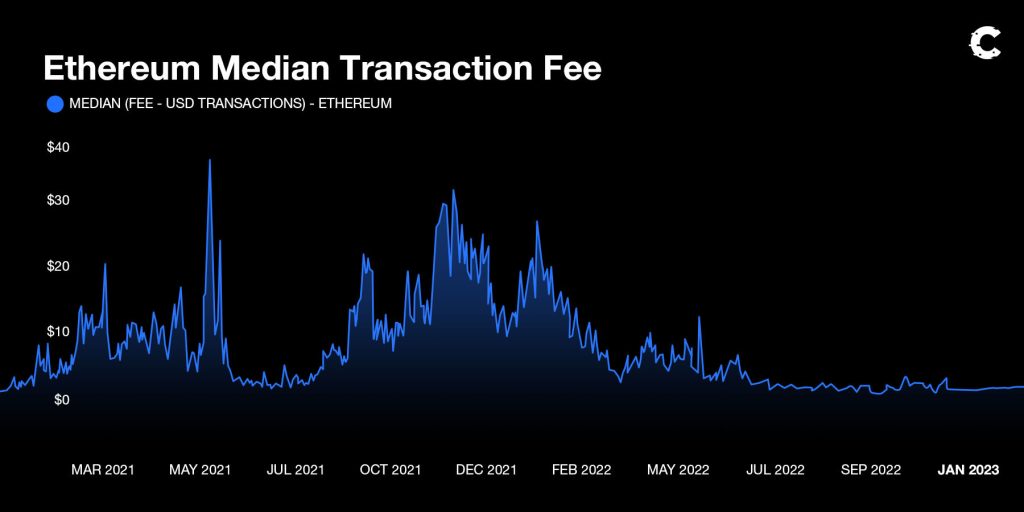

Who could forget ETH’s insane gas fees and slow transactions? We all had that one friend who just couldn’t stop minting NFTs that cost more than the NFTs themselves!

With powerhouse competitors popping up, things started to look grim for our favourite blockchain. It lost over 45% of its market share, and Solana became the number one chain for NFTs, outperforming ETH by over 10X.

Alas, two years have passed, and it seems the narrative has started to shift.

What if we told you 2023 was Ethereum's turn to do the hunting? That's right.

It's no longer the Ethereum Killers. It’s Ethereum, the Killer.

Let's dive in to find out what this means and where the opportunities can be found!

TLDR

- Ethereum's folly was its lack of scalability. Its slow speed and high transaction fees caused the chain to lose over 45% of its market share through 2021 and 2022!

- Layer 2s stepped up and fixed half the problem, but it’s an upgrade coming in 2023 that will change the game completely.

- If the upgrade is a success, it could spell the end for Solana, Binance Smart Chain, Cardano and more.

Who was a threat to the king?

While networks like Binance Smart Chain and Solana didn't offer the same level of security, many users were willing to sacrifice that security for faster and cheaper transactions.With NFTs blowing up and everyone wanting in, it simply wasn't realistic to expect crypto newbies to choose the expensive chain. Why pay a $40 gas fee on Ethereum when Solana costs $0.01?

Then, with Binance being the dominant exchange, users were inclined to use Binance Smart Chain for their first DeFi endeavours.

This all resulted in Ethereum’s market dominance dropping from 95% at the start of 2021 to around 50% at the beginning of 2022.

Yikes!

Hold tight your Majesty, reinforcements are coming

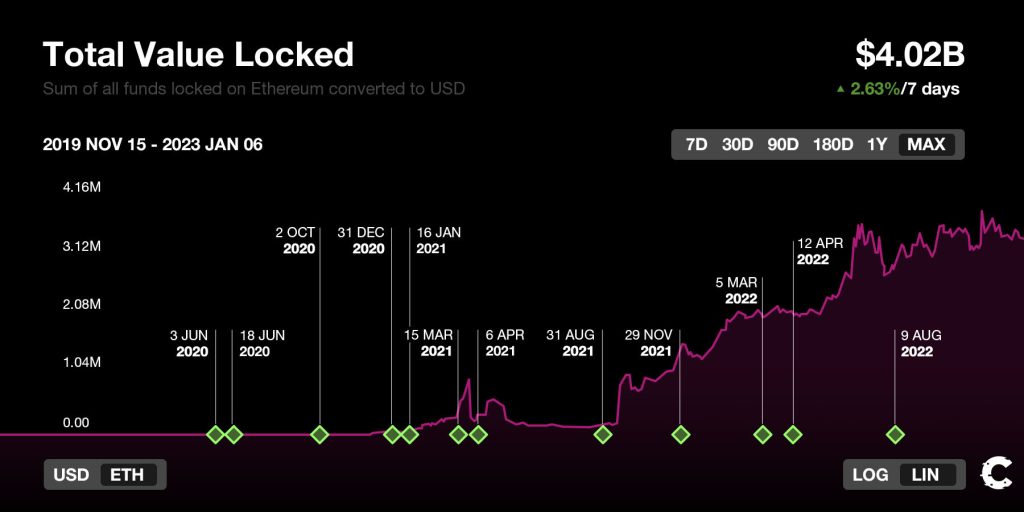

The scalability issues actually opened up big opportunities for builders in the space. When a problem needs solving, you can be sure a crypto geek will be there to do just that.In 2022, we saw the rise of multiple Layer 2 projects: apps built on chains to improve a blockchain's efficiency. These projects helped speed up the network and make it more affordable.

Two leaders that paved the way here were Arbitrum and Optimism. Both added tremendous value, which is reflected in the total value locked in Ethereum.

Is this enough? Not quite

There is still one big glaring issue facing the Ethereum blockchain, and if the king is to hold his throne, it must be addressed.Layer 2s made Ethereum faster and more affordable, but at what cost? Security.

Now, we’re not saying Ethereum isn’t secure, but there is a greater risk due to Layer 2s. The big thing Ethereum has always had over Solana and co is its long-standing reputation for security and reliability.

Ethereum can’t let Layer 2s get in the way of that.

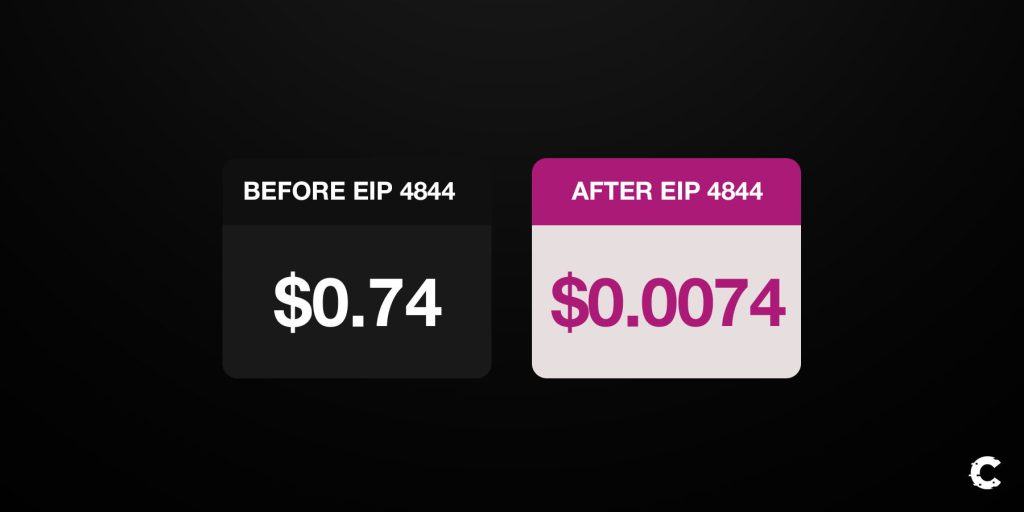

Meet EIP-4844: Secure like Ethereum, cheap like Solana

Ethereum's Layer 2 networks already offer cheaper fees and faster speeds than the main chain, but the EIP-4844 upgrade scheduled for 2023 will take things to the next level.What is that next level? How about 20X cheaper with full security maintained?

How does it work? Well, it's quite complicated. Let us try to explain through an analogy:

Picture a crowded downtown London. There are vans, cabs, and buses everywhere. You’ve got places to go, but traffic is moving too slowly! Those silly red buses are clogging up the street.

Imagine the city built a new type of road specifically for buses. They’d no longer waste time and slow down your commute, but people will still be able to move around the city easily. EIP-4844 is like that but for Ethereum.

How will Ethereum maintain its security?

Ethereum's Layer 2 networks are working towards offering the same level of security as the main chain.Right now, users still need to trust centralised operators. As we’ve seen in 2022, centralised anything is not the way to go.

The key to maintaining security is to decentralise the process of validating transactions. This is called ‘decentralising the sequencers’ and will hopefully take place alongside EIP-4844! No timeframe yet, but it’s not far away.

Cryptonary’s Take

Let's do a short awareness check.Ethereum is about to become as cheap and fast as Solana while maintaining its unparalleled security.

The massive drop in Layer-2 transaction fees will drive more money to Optimism and Arbitrum. Capital will flow from other Layer 1s back onto the Ethereum chain, and this capital will then seep into the Layer 2s built on top.

This is why you do not step to the king!

Ethereum rockets. Ethereum Layer 2s to the moon!

Now we’re not discounting the other Layer 1s, but it's no longer a question of ‘will Ethereum win?’ It's a question of ‘will there be anything left for anyone else?’

Action Steps

- Focus on projects launching on Ethereum Layer 2s, that's where most of the action will be in 2023. Here are some we’ve got our eye on.

- Arbitrum is the best place for projects to build and is attracting the most users. ZkSync is also a strong contender. Get involved in both of their likely airdrops. Here's how to become eligible.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms