Logistics, manpower, and definitely superior technology.

And speaking of superior tech in the DeFi lending wars, we found two challengers bringing huge guns to a knife fight.

We aren’t kidding – these new entrants threaten Aave and Compound’s position.

In fact, in the last six months, they’ve grown their combined TVL close to $2B and may soon be stealing market share from the incumbents.

Who are these challengers, and what do they do better than Aave and Compound?

Let’s find out.

TLDR 📃

- Aave and Compound dominate DeFi lending, with a combined TVL of $10.02B, but face challenges.

- Despite challenges, Aave and Compound remain dominant in DeFi due to first-mover advantage and scalability.

- Radiant Capital and Morpho Labs are riding on newer technology to challenge Aave and Compound.

- Radiant Capital's token ($RDNT) faces downward pressure due to Bitcoin's influence, needing to break resistance at $0.25 - $0.2375 for potential upside.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

The DeFi lending leaders 👑

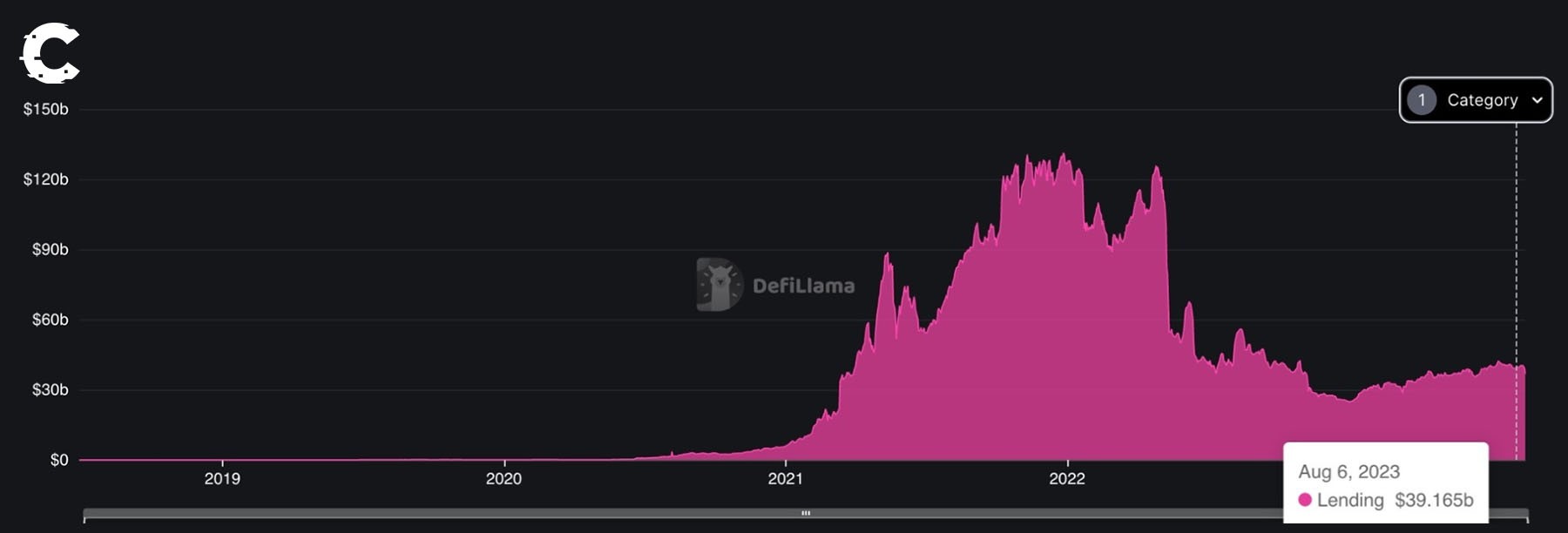

The traditional lending system, over time, has posed several challenges to its users, such as low financial inclusivity plus slow and cumbersome processes. Solving the traditional lending challenges has made DeFi lending a land of new possibilities and opportunities for investors and financial enthusiasts.The DeFi lending sector currently sits at $13B TVL, signalling the huge interest in the space. This interest is facilitated by how the sector increases capital efficiency by allowing users to enjoy additional benefits beyond buying low and selling high.

Spearheading the DeFi lending competition are Aave and Compound.

Both projects currently dominate the DeFi lending space with a combined TVL of $10.02B, which accounts for 76.9% of the Total Locked Value of the DeFi Lending space.

While Compound uses computer calculations to determine how much interest borrowers pay and lenders earn, Aave uses a liquidity pool model to pool users’ deposits. Aave dynamically determines interest rates based on the supply and demand of assets.

Aave is the clear leader here. It has a TVL of $7B, but Compound is no pushover. However, Aave’s market-leading position is powered by superior technology, and that’s why the new challengers also pose a threat.

The DeFi lending challengers 🥷

While Aave and Compound have succeeded significantly, they still have some challenges. Now, two protocols are circling with intent, waiting for an opportunity to dive in and steal the spotlight.A 20x potential in Radiant Capital 🔆

Radiant Capital is one of the key challengers in the DeFi lending space. It aims to solve the challenge of fragmented liquidity across multiple lending protocols – problems Aave and Compound have failed to tackle.

Since its launch in July 2022, Radiant Capital has seen a continuous rise in its TVL, reaching heights as high as $764M in TVL from a $58M low. This proves the in-flow of liquidity into the ecosystem.

Currently, Radiant capital sits on $584M TVL and a Mcap of $72M. While that looks small, our back-of-the-napkin calculation says there’s a 20x upside here.

Radiant Capital can become a household name in the DeFi lending space due to its distinct approach to how users manage borrowing and lending. But aside from Radiant Capital, another lending protocol stands out in innovation.

Playing smarter with Morpho Labs 🧚♀️

The Morpho protocol overshadows both compound and Aave because of its suite of smart contracts. Smart contracts are the building blocks of DeFi protocols, and Morpho has built some innovative contracts to improve the capital efficiency of existing lending protocols. Its smart contracts connect to existing liquidity pools while maintaining the underlying liquidity and liquidation guarantees.

Morpho Labs has evolved with a TVL close to $1B, yet it remains a tokenless project. So, how do you get a slice of the pie?

Well, you won’t have to wait for too long. Morpho Labs looks very enticing to investors who seek profit through airdrops.

Morpho Labs has raised $18M in funds from venture capitalists A16z and Variant Fund to conceptualise this airdrop opportunity. Now, we can’t wait to see how it all unfolds.

In the meantime, what does the chart say about $RDNT, the radiant capital’s token? 👇

Price analysis 📊

Bitcoin's recent endeavours left many assets in a rough spot, and RDNT wasn’t left out.

We saw a loss of support a few days ago, and the asset is currently retesting as resistance. Unfortunately, the structure turned bearish when RDNT dropped under the grey region between $0.25 - $0.2375.

This now hints at further downside; our nearest support level is $0.1935. We don't think RDNT has a reason to descend to that level unless Bitcoin takes another dive.

Nonetheless, some downside isn't off the table, and we'll need its price to break past the $0.25 - $0.2375 region if we were to see more upside from here.

Cryptonary’s take 🧠

The DeFi lending sector, in the previous bull run, grew to about $130B TVL and currently sits at $13B. The difference shows the probable upside movement for this sector in DeFi, and on a conservative note, there’s almost a 1,000% upside from the current TVL to the previous peak.Though lending tokens don’t seem to be doing well due to emissions, a revamp in token economics will see a different story, which is the case of $RDNT

With the tokenless nature of Morpho Labs, the best move is to continue using the protocol so you can qualify for future forms of incentivisation whenever the team decides to launch a token.

Nonetheless, we think Aave and Compound will continue to be market leaders because of their first-mover advantage in the short-to-medium terms. However, if they stay static on the innovation front, it is only a matter of time before the contenders capitalise on their weaknesses to take over the market.

Overall, the DeFi lending sector will keep growing, and we will be here to profit from the products and the tokens.

As always, thanks for reading.🙏

Cryptonary out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms