With hackers funnelling stolen funds through Thor, the protocol shutting down, and prices crashing down, it's been general mayhem for all involved.

And understandably, it's left many THOR holders feeling frustrated and concerned.

But put down the pitchforks for a second - let's chat about what really happened.

So, what does the recent development mean for THORSwap, THORChain, and your portfolio going forward?

Let’s find out.

TLDR

- THORSwap halted operations after revelations it facilitated hacker money laundering. This crushed the trading price as swap volume evaporated.

- THORSwap claims no direct regulatory orders but likely acted preemptively per legal advice. Questions remain on communication and readiness.

- THORChain is less affected due to decentralization. But reputation and node support may suffer. Users can still access via other fronts.

- Open questions around further regulatory crackdowns, especially on cross-chain protocols. But too early to predict wider industry impacts confidently.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Why is THOR down -40%?

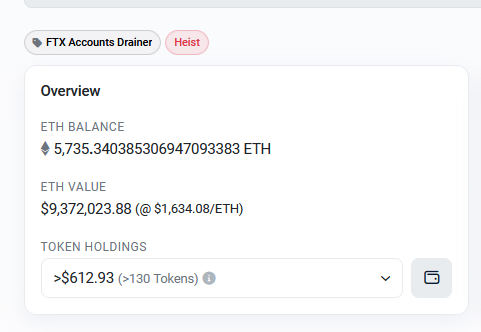

So here's the deal - it was brought to light that there were some pretty shady transactions going through THORSwap. We're talking stolen funds, money from hacks, the whole nine yards. Of course, this isn't that uncommon in crypto, but these addresses were literally labelled as belonging to hackers and thieves.

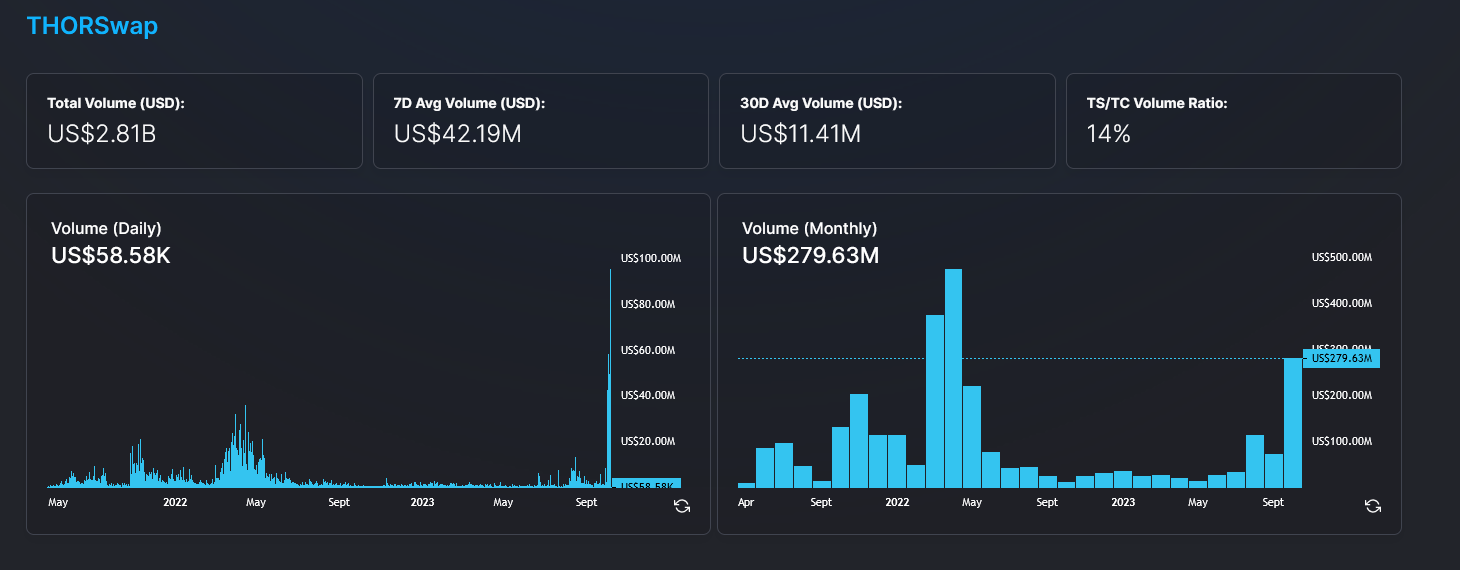

Anyway, the volume on THORSwap suddenly spikes at the same time, which looks sketchy as heck. We're talking almost 3 times higher than the previous month. So THORSwap does some song and dance about infrastructure issues but eventually has to go into maintenance mode to figure out what's up.

This kills the THOR price - we're talking a 40% dump overnight. And for good reason - THOR relies on swap volume for its value, so no volume equals no value. THORSwap didn't give anyone a heads-up either, so THOR holders got totally blindsided. It's not a good look for THORSwap right now.

How is THORChain (RUNE) affected?

THORChain itself should not be impacted to the same degree as THORSwap. As a decentralised blockchain, censoring transactions would contradict its principles. However, its major investor, Nine Realms Capital, may face legal pressures to stop operating a node. Despite ample funding, negative publicity could still hamper THORChain long-term.

Users can still access THORChain through platforms like THORWallet or Asgardex. Though THORSwap facilitates 75% of swaps via THORChain, viable alternatives exist. Shifting volume to these other front-ends can minimise disruption. The underlying technology seems resilient, but reputational damage may linger.

Quite similar to the issues that arose with TornadoCash. They built the platform, but they have little to no control over how people use it.

What is likely to happen next?

THORSwap will most likely restart after implementing a blacklist for known criminal wallets. This can be automated based on publicly available resources. Volumes should begin flowing through THORSwap again. The technology works, and other than this issue, the longevity of the protocol should be unaffected

Here’s what remains to be answered

Alright, let's recap what's still unclear and could affect things going forward.

Were they told to shut down?

THORSwap's shutdown came out of nowhere, so naturally, users are wondering - were regulators involved behind the scenes? Looks like THORSwap talked to lawyers and advisors who likely suggested full access restrictions to limit legal risks. They say they haven't gotten direct orders to shut down, so seems like a preemptive move on their part. Makes sense for a centralised exchange, even if it sucks for decentralisation ideals.

Is THORSwap (THOR) dead?

Is THORSwap toast for good? Doubtful. They probably wanted to get ahead of regulators cracking down directly. Most people agree that stopping blatant criminal activity is common sense, not true censorship. And THORSwap can tweak their systems to filter out the sketchiness. Once they're back running clean, THOR price could recover with that nice volume.

Will Nine Realms stop providing liquidity on THORChain?

As for THORChain, its key backer, Nine Realms Capital, might get nervous about legal issues and stop operating a node. That could be a blow, but THORChain is bigger than any one node. This situation is still developing, so fingers crossed the network stays resilient.

Will this trigger a crackdown on cross-chain comms?

The biggest open question is whether this triggers a broader regulatory crackdown on cross-chain protocols. The hackers have already moved to other platforms like Threshold. So, regulators may see a pattern. If they take a hardline Tornado Cash-style approach, it could mean bad news for the whole sector.

However, they will face the same issue as trying to clamp down elsewhere in crypto.

Shut one protocol down, someone forks it, and two more are launched to fill the vacuum the previous one left. That’s if they can even shut it down - most of the time, they can’t.

Cryptonary’s take

After assessing the situation, we don’t think there is a cause for concern. Unfortunately, the exploiters used THORChain as their initial method of funnelling funds. But it’s not THORSwap’s fault by any means.

What makes this even more of a “black swan” is that the hackers literally do not care where they siphon funds. It’s not like they went, “THORChain is the only place we can do this”.

Here’s the proof.

For us, this whole debacle shows that THORChain and THORSwap were working as intended. The criminals decided their infrastructure was the most cost-effective way of moving large volumes of assets between chains -- that's a win on the one hand.

On the other hand, there is the fallout from intended consequences -- and on that, it's much harder to predict which way the pendulum will swing.

This is a developing story, and we will be sure to provide you with updates and contextual analysis as it unfolds. Stay tuned!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms