Introduction

Here at Cryptonary, we wanted to summarise the experiences of this year, so have identified the infographics that best visually represent the highs and lows of the cryptocurrency and blockchain market over 2020.

In this piece, we explore the impact of Covid-19 on the global economy, the ‘offstream’ rise (which is our new word for community growth, preceding mainstream growth) in use-cases of concepts such as De-Fi, stablecoins, CBDCs, Bitcoin’s near ATH’s, Ethereum’s 2.0 launch and historic advancements in regulatory clarity.

We’ve also attached some links to valuable sources for further reading.

If you want to recap the articles that got us here, we recently created our own hall of fame, a Top-25 of the most impactful news stories we have written this year. It was originally supposed to be a top-10, but we genuinely couldn’t narrow it down!

On this piece, here’s our 10 trending sectors over 2020 and their impact on our market:

1. Economic Impact of Covid-19

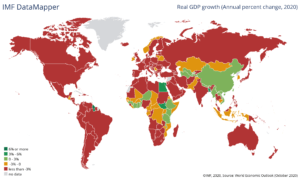

The impact of the Covid-19 pandemic has had major implications for the health of the world’s economy. All major governments have declared recessions (two negative GDP quarters) and have implemented historic quantitative easing measures to save their economies.

China is a clear outlier in this trend after their rapid recovery from the effects of Covid-19, posting a 4.9% gain on GDP in Q3 and overall 2020 gains of 1.9%.

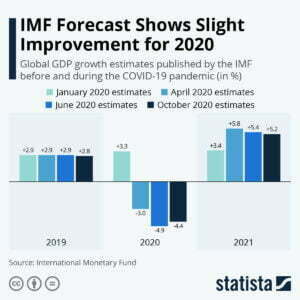

Despite the dire outlook, the International Monetary Fund (IMF) have noted a slight upturn in GDP figures for Q4 of 2020, but still report -4.4% for the year, the greatest fall since records began in 1980.

Encouraged by the developments in vaccination and wide-scale testing, the IMF foresees an optimistic recovery in 2021 with a 3.4% upturn predicted for Q1 and 5.2% across 2021 - which would be a ten-year high (see above link).

It’s important to note that GDP is not the only metric of a healthy economy. As you’ll see in the next section, the economic initiatives forced through this year are historic and will have long-lasting implications for an economic turn-in fortune.

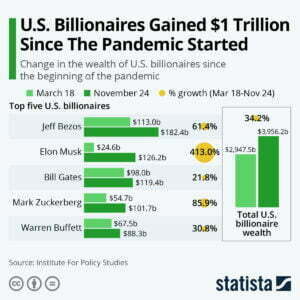

In complete contrast to this year's recession, the fortunes of billionaires have soared by 34.2% since the start of the pandemic with Elon Musk experiencing a staggering personal net-worth growth of 413%. I guess capitalism works even when it doesn’t...

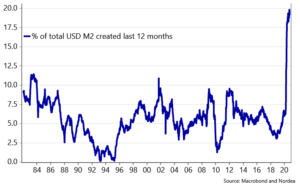

2. Fed Prints Trillions

Following the outbreak of Covid-19 and the subsequent halt in global production, unprecedented amounts of capital were injected into the global economy in a desperate effort to stimulate a revival. In total, the US Federal Reserve have printed an astounding 20% of all dollars throughout history this year, an approach paralleled by the Bank of England and European Central Bank.It has been well documented that the current economic model was designed for production in the industrial age. The recession of 2008 was the landmark event that highlighted the urgent need for a full-scale restructuring of the economic system to suit the 21st century paradigm of hyper-connected efficiency.

The economic fallout from Covid-19 and impact of historic quantitative easing measures will further drive inflation in the world’s reserve currency (USD) and other major fiat currencies over the next 2-3 years.

This pressure will only serve as further justification for the adoption of digital assets and blockchain technology in our global economy following what has now been two economic recessions in a dozen years.

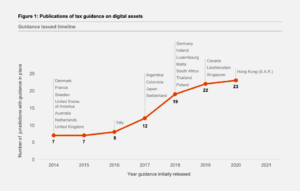

3. Calls for Regulatory Clarity

In 2014, regulatory authorities from the USA, UK and Sweden were the first to issue public tax guidance surrounding digital assets. In the following years, the speed of publications on the topic increased as other nations stamped their official stance on the cryptocurrency market, ensuring citizens were provided with sufficient information for their investments.In 2020, the number of global authorities that have published guidance on digital asset taxation has risen to 23.

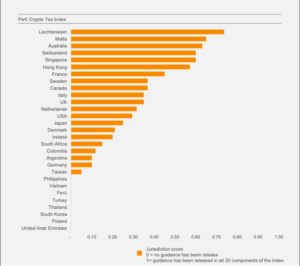

In the spirit of quality over quantity, this next chart details the level of comprehension within each authorities publication by assessing the inclusion of specific information from twenty areas of cryptocurrency asset taxation. Following this determination of clarity, a relevant score was provided to match the nation.

It is clear to note that nations such as the US and UK who performed reasonably well in the above chart, have faltered in the quality of their insights into cryptocurrency taxation in the below chart.

Nations such as Liechtenstein and Singapore have scored consistently throughout, showcasing their depth of education on the market and willingness to adopt the technology.

The PWC annual report highlighted areas such as capital gains, mining income and VAT tax as areas that were discussed heavily within official publications with 62%, 52% and 48% inclusions respectively.

On the opposite side, newer topics within cryptocurrency such as De-Fi, NFT’s and VAT tax on staking income were not reported as discussed at all.

Digital assets undoubtably pose unique challenges for policymakers and regulatory authorities because of their decentralised, anonymous, anti-establishment origins.

However, across 2020 many industry leaders including Jeremy Allaire of Circle, Dan Schulman of PayPal and Brad Garlinghouse of Ripple have emerged as spearheads in the quest to encourage regulators that all crypto’s aren’t equal and that much of the market can unify with the existing system to create symbiotic growth.

Going into 2021, we expect to see publications released from governing bodies which have a higher intelligence and visionary outlook in outlining a clear framework on the identity and legal entity of digital assets.

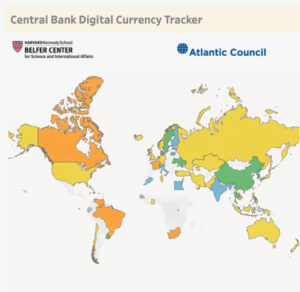

4. Development of Central Bank Digital Currencies (CBDCs)

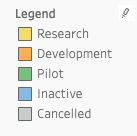

Central Bank Digital Currencies (CBDCs) have become a prominent discussion point in 2020, spearheaded by China’s successes in pilot testing.This map was created by the Belfer Center’s Economic Diplomacy Initiative, in collaboration with the Atlantic Council’s Global Business and Economics Program. It visually analyses the progress of different nations in the development of a CBDC.

Currently, 1 in 5 nations have announced their intentions to launch a digital currency in the near future, whilst 80% are reportedly in the research stage.

2020 was the first year that a major nation took substantial action in the form of pilot testing a digital currency on its citizens - China in April. Alongside them, pioneer nations including Uruguay, The Bahamas, Sweden, Ukraine, South Korea and Thailand have also implemented their own digital currency initiatives.

Members of the European Central Bank were cautious in their discussion last month, suggesting a decision wouldn’t be made until mid-2021 on the prospect of a Eurozone digital euro, as well as predicted four-five year window until any launch date. This report published in October drawing out scenarios and future requirements stands as their most extensive work to date in the field.

The Digital Dollar Foundation, a non-profit private entity has outlined the best proposition to date for a US digital currency through their insightful report, the Digital Dollar Project (DDP).

They succinctly evaluate: “We can expect that alongside the myriad of opportunities unlocked by a U.S. CBDC, an equally complex set of questions regarding foundational and nuanced design elements will be unearthed.”

The Foundation has no ties with the Federal Reserve, who are still in the research phase of any concept.

Following the launch of Facebook’s dollar-pegged stablecoin, expected in early January 2021, major nations will likely be sprung into action amid fears that their economic sovereignty is under threat.

The trend shows that more expert committees, boards and research groups will be formed globally to educate and advise on the development of CBDCs throughout 2021.For further reading on the research, development and testing of CDBCs for each nation, see CoinMarketCaps extensive guide published last month.

5. Rise of Stablecoins

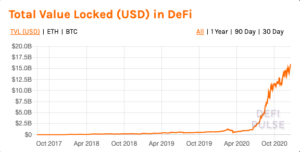

In a year of financial instability, stablecoins use-case as a store of value became apparent. As a result, their value soared from $6 billion at the beginning of this year, to $26 billion at the time of writing.Despite emerging competition, Tether (USDT) still controls the monopoly share of the market at around 78% with Circle’s USDC taking second with around 12.5%.

The parabolic rise of stablecoins was supported by the emergence of decentralised finance (De-Fi), which in many cases required users to use stablecoins as a method of deposit.

CTO of Bitfinex, (who hold ties to Tether) Paolo Ardoino stated: "I think collateral for derivatives is one of the main drivers. DeFi follows with I would say around 1.5B of allocation (USDT) and then we're seeing miners getting used to selling bitcoin for tethers rather than dollars.

6. Rise of De-Fi projects

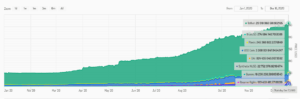

Decentralised finance (De-Fi) was the talk of the summer in the cryptocurrency community, however, like all overnight successes, it had actually been working in the background for many few years.In early 2018, projects such as Kyber Network (KNC) and 0x (ZRX) gained traction, showcasing the limitless versatility of cryptocurrencies across multiple sectors.

Traders became intrigued by the decentralised ability to borrow, lend and invest with nothing more than an internet connection and crypto wallet.

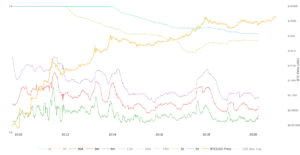

The chart below from Coin Metrics visualises the market capitalisation of De-Fi in 2018 which rose to over $5 billion in value, largely due to KNC and ZRX.

The parabolic surge of De-Fi’s market cap in mid-2020 to over $15 billion was supported by the emergence and hysteria of projects such as Sushi, Uniswap and Aave.

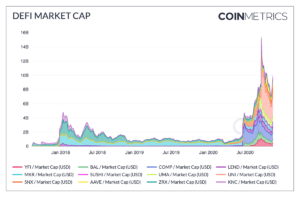

The chart below shows the growth of dollar value of ETH locked in DeFi protocols all time. Starting this year at $675 million, value grew slowly across the summer, crossing the $1 billion mark on the 31st May.

The launch of decentralised exchange Uniswap and their airdrop token allocation, resulted in a booming trade volume on the platform and a ripple effect across the market. As most DeFi projects are built upon Ethereum, the anticipated launch of 2.0 (which we’ll discuss next) further contributed to the market reaching new heights in the latter half of 2020.

Total value stands at $16.11 billion at the time of writing.

DeFi is here to stay and will flourish alongside the developments of the Ethereum network throughout 2021. 'Initial DeFi Offerings' are something to watch out for next year, an offering which allocates tokens to community members with a stake in the project.

7. Ethereum 2.0

After 5 years in development, 2020 marked the launch of the genesis block on Ethereum 2.0.Currently in Phase 0 known as Beacon Chain, ETH 2.0 will use this platform as a testbed to develop innovations in preparation for their eventual adoption of a Proof-of-Stake and sharding model.

The network will still work in parallel with the Proof-of-Work model over the coming years until a full transition can be made.

The Ethereum team summarise as follows:

“Imagine Ethereum is a spaceship that isn’t quite ready for an interstellar voyage. With the Beacon Chain and the shard chains the community has built a new engine and a hardened hull. When it’s time, the current ship will dock with this new system so it can become one ship, ready to put in some serious lightyears and take on the universe.”

Ethereum 2.0 will be a landmark development for the network in securing its legacy as a faster, more scalable and environmentally sustainable smart-contracts platform.

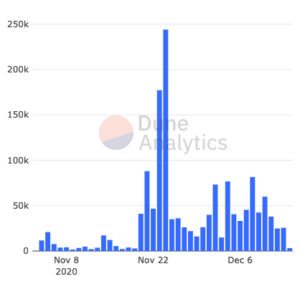

Over 1.525 million ETH worth over $1 billion has now been staked in the Eth2 deposit contract, almost three times the original requirement. This graph below shows the anticipation of investors in late-November to stake their ETH into ETH2 to ensure launch was confirmed.

8. Bitcoin ATH’s

Bitcoin achieved a historic price all-time high this week, breaking the illustrious $20,000 mark of late-2017, pushing the leading cryptocurrency into uncharted, speculative territory. Quite simply, Bitcoin’s is in price discovery - from here it could go anywhere.At the time of writing, price has topped $23,500.

This bullish market has been driven by the introduction of colossal capital from institutional investors such as Grayscale, a firm which provides cryptocurrency trusts to accredited investors. Grayscale now hold with 2.5% of the supply of BTC within their trust fund.

The below chart visualises the age of Bitcoin held in wallets over time in oscillation ‘HODL waves’. On the bottom, different timescales such as 30 days, 3 months, 6 months indicate the amount of time BTC has remained untouched in investors' wallets. These smaller time frames represent demand for the asset, whilst the longer-term time frames such as 24 months, 3 years and 5 years act as supply levels.

Movement of BTC from wallets to exchanges over the past decade has correlated with the emergence of bullish cycles. The summer of 2011, twice in 2013 and late 2017 all saw parabolic demand for Bitcoin and consequent rises in withdrawals from wallets 30d, 3m and 6m.

As we enter late-2020 and the beginning of a new bullish cycle, demand for BTC is intensifying. A smart strategy now is to analyse previous chart data, to inform future decisions. Bitcoin broke previous all-time-highs of around $1150 in February 2017, but it wasn’t until July 2017 that the demand for BTC skyrocketed as seen in the trajectory of 30d, 3m and 6m.

A new all-time high for Bitcoin has just been registered, signified by an uptick in 30d and 3m wallet activity. This shows us that the data for this bullish cycle is just emerging.

To conclude, it may take a few months for us to witness parabolic activity on these timeframes and therefore the true beginning of Bitcoin’s historic demand and price growth in this bullish cycle.