2021 in Review

It’s been a long year for everyone, and in crypto is has felt like four years. The year can be defined in clear era’s:2 - The froth (May - mid Jul)

3 - NFT adoption and reignited interest (mid Jul - Nov)

4 - Correction and stabilisation (Nov - now)

One thing to note in general, when zooming out on the year, is that despite the market volatility we are overall in an uptrend. Call this a ‘supercycle’, bull/bear market, institutional interest or however else you wish to interpret it. I have a simpler and more concise way of looking at the current crypto industry. It is referred to as Amara’s Law:

We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.Reviewing the crypto market since it’s inception, it becomes quite clear that the overestimation off the technology occurred in 2017 with the ICO era being the peak of this overestimation. In the 5 years since then, the industry has continued to grow. Innovations have been incessant, but 2021 is the year that it can be said that crypto went - and stayed - mainstream. Many people expressed doubts about the targets which were laid out last year. Indeed, although being correct in the positive outlook, we might have been a bit too positive. However, as you know we preach that the ‘market can’t be timed’, and that ‘time in the market’ is better. This logic when applied to the predictions adds some nuance. See the below graphic from a journal published in February.

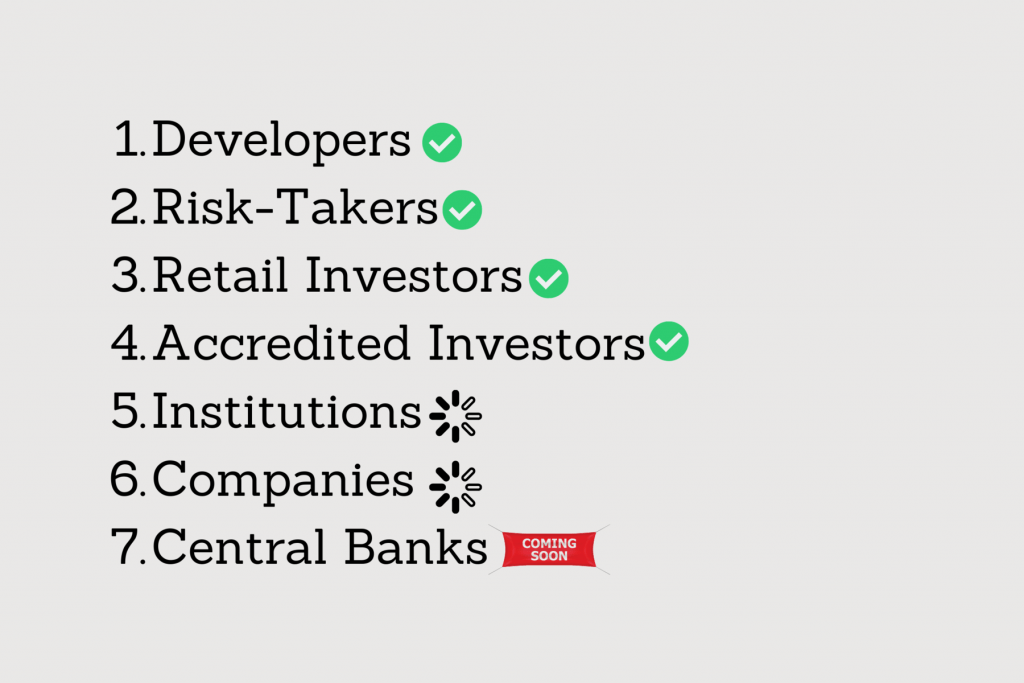

Observe, what has happened this year, and will only continue to accelerate. Institutions (all the banks offering crypto service), companies (Tesla, Grayscale) world renowned investors (Dalio, Musk) made crypto being in someones' portfolio expected. El Salvador has already made bitcoin legal tender, and we believe it is a matter of time until other countries follow suit. Adoption happens slowly at first and then rapidly.

Regardless, it is imperative to be directionally correct in the ‘macro’ sense, which we have been. Holding, staking to passively increase holdings in a risk free manner, and taking calculated shots at preferable entry points (IDO’s, post market crashes, NFTs), takes care of the risks incurred from volatility. This strategy also serves to help preserve mental focus - you’re not checking the price every 5 minutes, you don’t have to constantly keep up with market developments. And most importantly it allows for the correct amount of exposure, to the high risk/high reward class of crypto. Indeed, this article will highlight how some assets we covered over the past year have fared.

Before we start reviewing the content from 2021, we ask you the reader to keep two principles in mind:

Miyamoto Musashi - You must understand that there is more than one path to the top of the mountain.

The Pareto principle - For many outcomes, roughly 80% of consequences come from 20% of causes (the "vital few").

Why are these key? Because, trust me my friend, we are still early and there are always more opportunities, just as there are many paths to the mountain. And you only have to reach the mountain once to ‘attain enlightenment’. Once you have reached the top once, it becomes infinitely easier to find another successful path.

It is important to keep these principles in mind as we review the articles, although we strive to cover only the best projects, and if we don’t like a project covered it is always clearly stated. Below we will lay out some of the sectors that we covered, to simply illustrate how abundant opportunities in the space were in 2021 - and will continue to be in 2022. This will not be the case forever, but for the first six months of this year, we are certain there will be more opportunities.

Let’s dive into the year gone past, from the start. The first piece of content published in 2021 was looking at the year ahead, and covered BTC, ETH, DOT, FTT,SNX, RUNE and SRM - whilst laying out projections $135,000, $6,000, $100, $120, $60, $50, $20, respectively.

The portfolio assets performed well this year, and for long time members some of the portfolio assets delivered a successful path to the mountain. But one of the questions we get a lot from new members is regarding how to structure their portfolio. The below shows how someone who followed up on the projects covered this year, would have found a successful path. This strategy can be followed in 2022 - if current portfolio allocations have appreciated too much - another path will reveal itself.

One of the most read and also most valuable pieces of content we published this year was ‘low risk, high reward’. The article outlined how the usage of some key protocols in DeFi would lead to the user being able to claim token airdrops. A year down the line, people who interacted with the protocols outlined received two airdrops both worth at least more than 1,000 USD (DYDX and LOOK$) and in some case upwards of 10k USD.

Solana was a core focus of our content this year with it becoming a portfolio participant throughout the year - one characterised by Layer 1 networks. Indeed the trifecta of SOL, AVAX and LUNA dominated the narrative.

SOL started off as a capitalisation on hype as we saw a very similar narrative to BSC arise because, to be frank, we weren’t certain the TVL capital would stick beyond hype. We entered on a dip ($10) and patiently held while monitoring the growth of the ecosystem - which did not disappoint. Ultimately this turned into an incredible return throughout the year and led to a 25X from trough to peak.

AVAX and it’s ecosystem was covered in depth for which all the items covered have performed admirably. We were a bit late to the party with LUNA, but with the growth the crypto industry has experienced, it is inevitable a gem will fall through the net.

The Binance Smart Chain, although not much discussed saw significant usage this year, something that we lightly touched upon - as we preferred backing Solana in the Layer 1 race at that point in time. Our decision was rewarded with the market’s evolution throughout the year.

Along with Layer 1 networks, Layer 2 solutions have received a lot of attention due to the potential solutions they offer.

In terms of general shifts, we covered which blue chip protocols we expected to see continue their growth and which ones we expected to lose their market position here, something which for the majority came to fruition.

The DOT ecosystem is slowly becoming operational, and the parachain auction winners were predicted correctly in a series of in-depth articles. The tokens received as rewards for loaning DOT are already significant, and will only continue growing in 2022, as more parachains become operational, and their tokens are distributed to Crowdloan participants.

The projects that have won the first batches will lay down the essential infrastructure required for the introduction of DApps, bridging, and interoperability to the ecosystem. This in itself will open up the opportunity to invest in all kinds of products, as well as open up a whole new ecosystem for other economies and chains to connect to.

Lastly the crypto and gaming sector received a lot of attention in the second half of 2021. The first three journals covered, Axie Infinity, Illuvium and Mines of Dalarnia, all had tokens which have performed admirably since the articles were written. Timeless and Aurory, the two other projects covered in the series are still in development, and we eagerly anticipate playing the games when they are released!

Lastly, let’s cover the limited amount of articles we published regarding NFTs. As stated multiple times, NFTs are a topic that has to be handled with caution. Supply in most NFT collections is only 10,000, and they are extremely illiquid as well. For this we take extreme care regarding the collections that we cover. Our first article covering NFTs covered CryptoPunks when they were still at a price of 2.6ETH, and Hashmasks. In turn the second article which covered NFTs highlighted the Bored Ape Yacht Club, when Apes were priced at around 2ETH. Later in the year we had our first ever NFT giveaway, giving away a Super Shadowy Coder from GenesysGo, minted for 2.5SOL, on the aftermarket for around 7 SOL when announced and currently 135SOL.

Conclusion

Of course for the long time member, there will be some questions. What about OXY and SNX. Well as we mentioned above, not every path leads to the top of the mountain. When protocols are researched, projections are based on the protocol delivering on their roadmap within a certain timeline. For both OXY and SNX - they simply didn’t deliver on their roadmap and promise. For OXY we were alert enough to be aware of this, and as initially stated our position in OXY was exited. Regarding SNX, the lack of execution on their vision, our conviction to sticking to our price targets, combined with a better opportunity appearing (SHDW) led to us exiting the position. If there is one lesson to take from the above, it is that profit should always be taken at certain points. The infamous ‘$90 RAY’ meme is proof that the profit taking approach is the best, and sticking to your predefined conditions regarding a protocols development is key. Stick to your initial plan.The above 20 articles, illustrate the Pareto principle - we published over 100 journals throughout the year, but the above were the significant ones. Indeed a lot of them offered ‘paths to the mountaintop’, it was up to the reader to ascend the path with their own actions. Do not kick yourself, no one is perfect, and you will have missed - and will continue to miss - paths, author included (note authors lack of both punks and apes). However, the signal to noise ratio is strong from above - and as outlined you only need one to ascend to the mountaintop.