3 DeFi Plays Printing Massive Passive Income (Part 2)

Last week, we broke down Part 1 of our yield + airdrop income strategy. Now it's time for Part 2, and it's even more rewarding. From hidden gems to high-yield plays, here are the three most exciting opportunities we're farming right now. Let's dive in...

In this report:

- LPing KHYPE and uETH on ProjectX

- Stablecoin yield on Lighter

- Lending USDe on HypurrFi

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

ProjectX: LPing KHYPE and uETH with Concentrated Liquidity

Project X uses a concentrated-liquidity model similar to Uniswap v3. You supply KHYPE and uETH into a single pool and choose a price range where your liquidity is active. While price trades inside your range, you earn a share of trading fees and incentives. If price exits your range, your position stops earning and tends to convert toward one asset.Why this pair. KHYPE and uETH form a correlated asset pair. Correlation should reduce extreme impermanent loss compared to unrelated tokens, but it does not eliminate it. Your range choice and how actively you manage it will drive results.

Step-by-Step: Add Liquidity to KHYPE/uETH

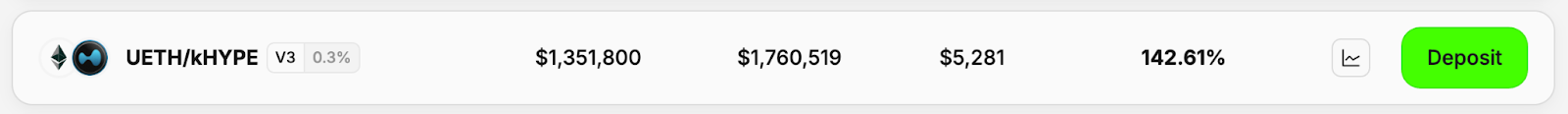

1. Prepare funds: Swap to KHYPE and uETH in your connected wallet. Keep some gas (HYPE) for approvals and transactions.2. Open the pool: Select the KHYPE/uETH V3 0.3% fee tier pool. Review TVL, 24h volume, and the Estimated APR.

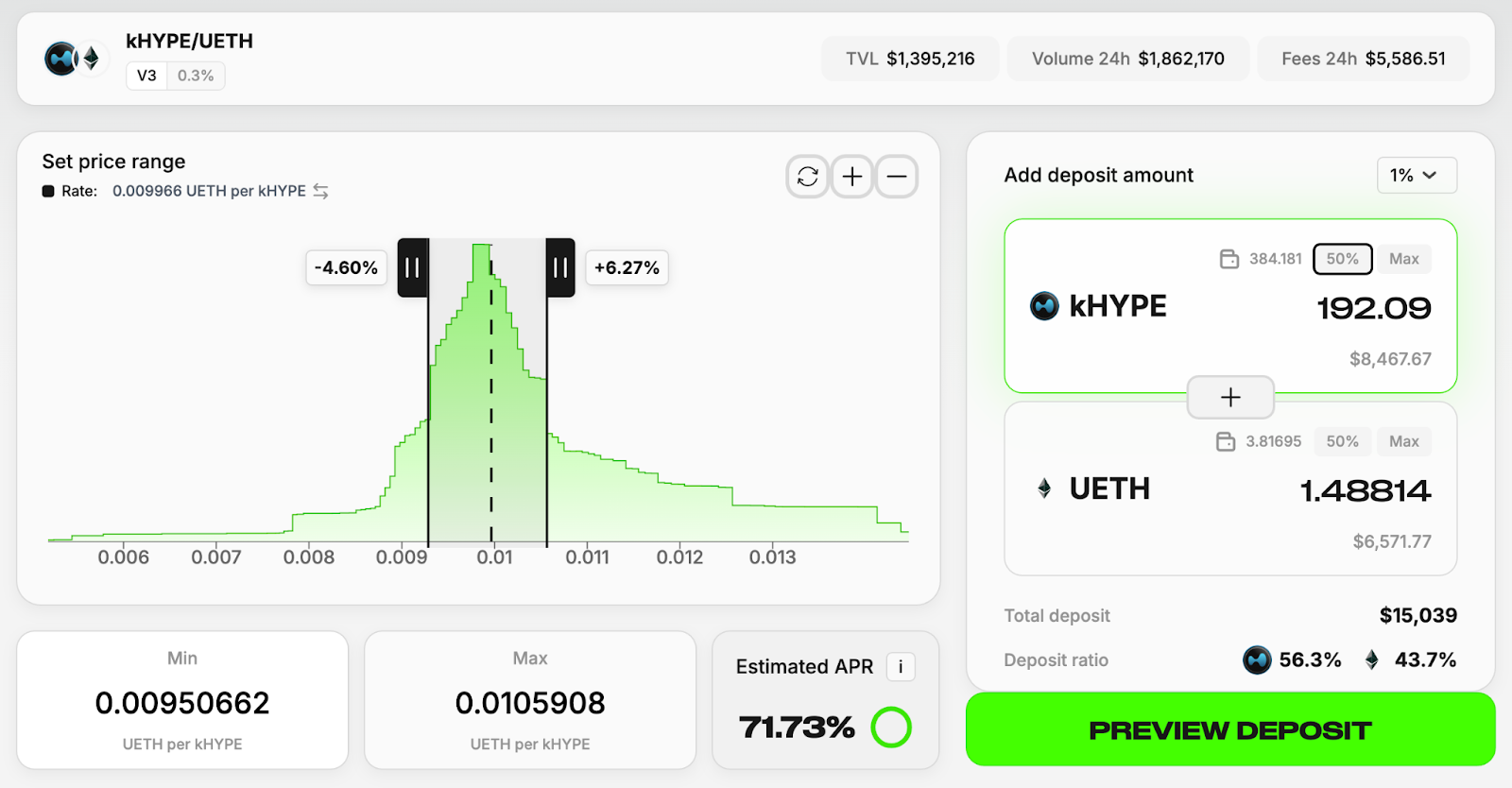

3. Choose a price range: Set your active liquidity band.

- Narrow range: higher fee capture, higher risk of going out of range.

- Wider range: lower fee capture, lower maintenance.

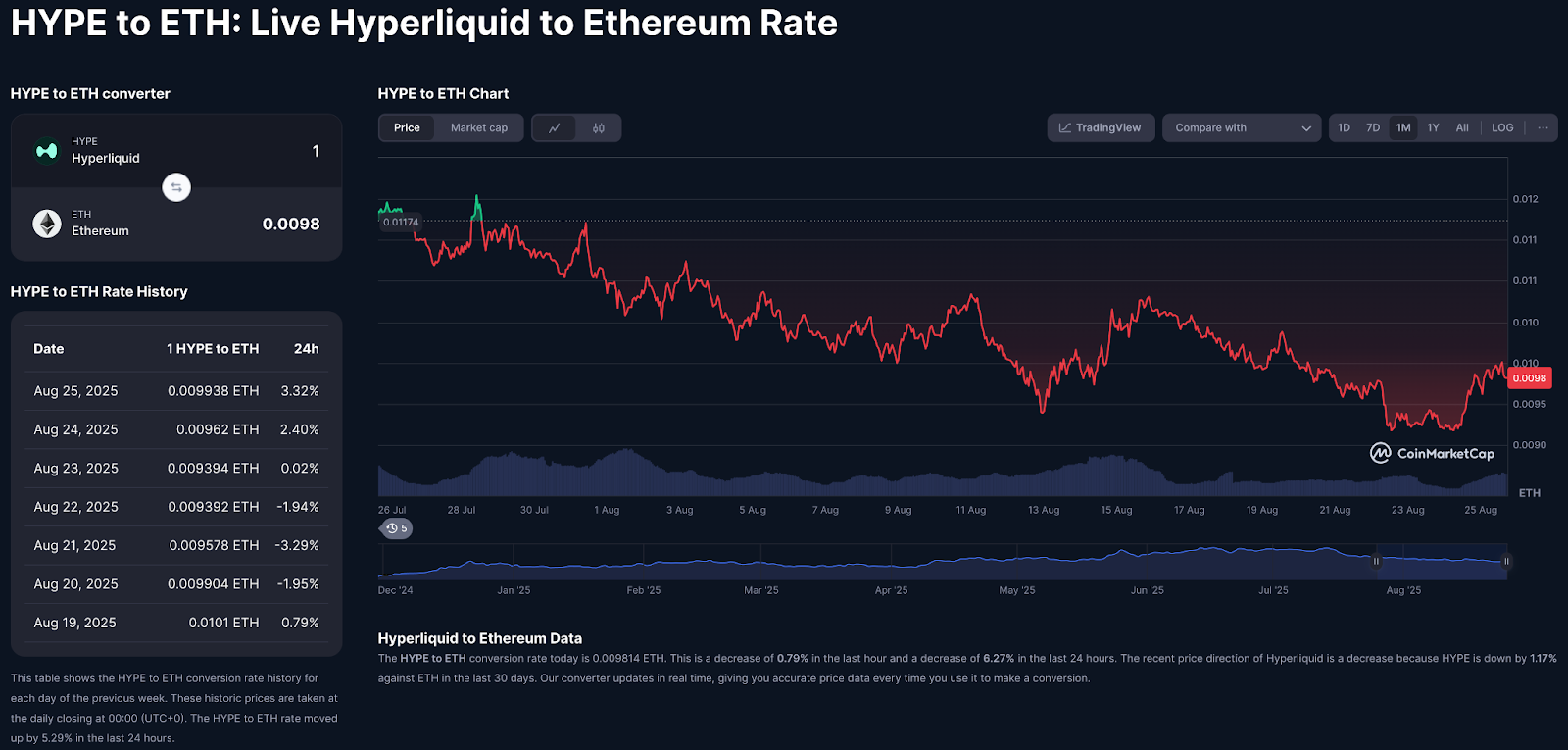

Use the historical HYPE/ETH chart to inform your decision. A short-term view helps capture current volatility, while a longer-term chart (1M or 1Y) shows broader price ranges and helps set safer, more resilient bands.

4. Set amounts: Enter KHYPE and uETH deposits. The user interface will calculate the ratio needed for your chosen range.

5. Approve and supply: Confirm approvals and supply. A position NFT records your range and liquidity.

6. Monitor and manage: If price moves outside your range, fees stop accruing. Withdraw and reposition or widen ranges as needed.

7. Exit: Remove liquidity to reclaim KHYPE and uETH in whatever ratio the market dictates.

Fees and Costs

- Pool fee tier: 0.3% from traders, distributed to LPs in range.

- Gas: approvals, adds, claims, removals.

- Rebalancing costs: frequent repositioning can erode returns.

Airdrop Angle

Neither Project X nor Kinetiq currently have a token, but both use points systems to track user activity:- Project X: awards points and ranks to LPs and traders.

- Kinetiq: issues kPoints and ranks users into leagues for staking and liquidity activities.

In addition, some LPs rely on Unit assets on Hyperliquid EVM (e.g., uETH, uSOL) to participate. While Unit itself does not yet have a token, consistent usage of Unit assets on EVM could help qualify for a future airdrop.

This creates a triple upside scenario:

- Earn LP fees from KHYPE/uETH.

- Accumulate Project X points and Kinetiq kPoints.

- Potentially positioned for a Unit or Hyperliquid airdrop simply by using Unit assets within the EVM.

Risk Rating: ★★★☆☆ (3/5 — Moderate Risk)

Dual-asset exposure plus active range management raises risk relative to stablecoin pools. Correlation helps, but impermanent loss and out-of-range risk remain significant.You can watch our full breakdown of ProjectX HERE.

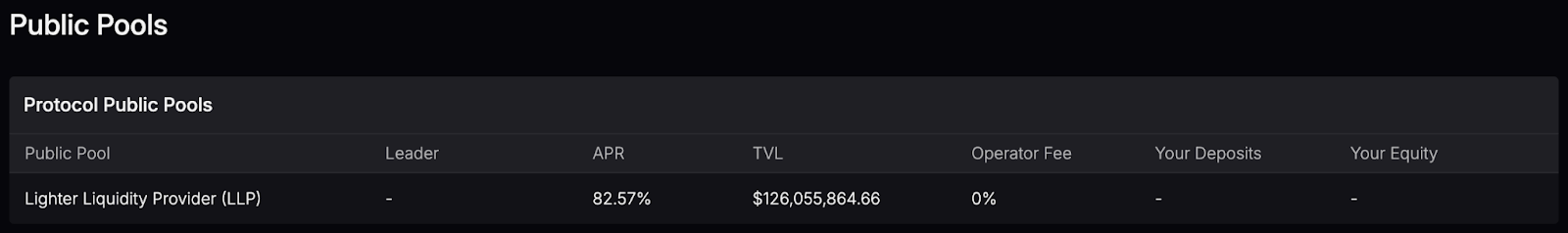

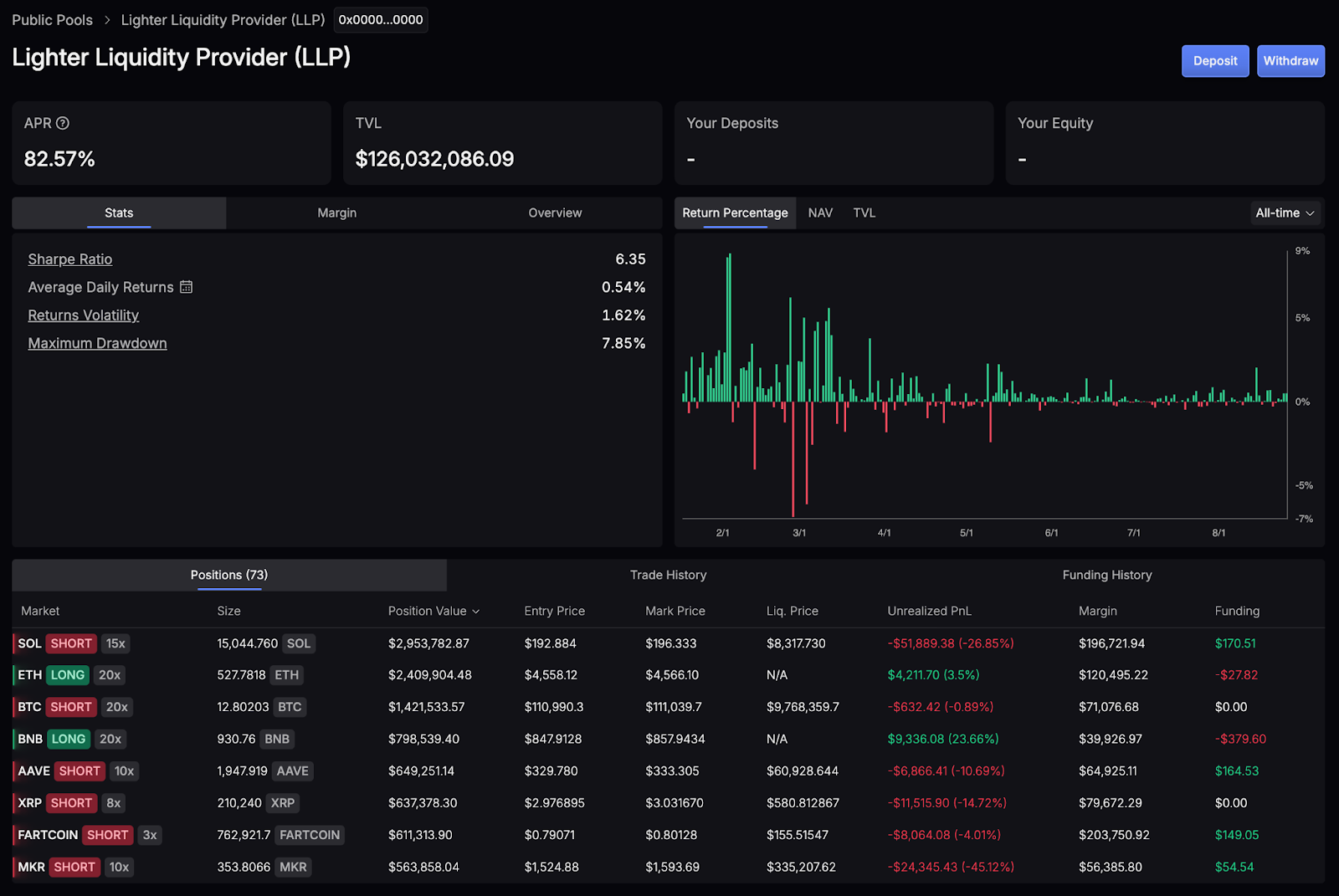

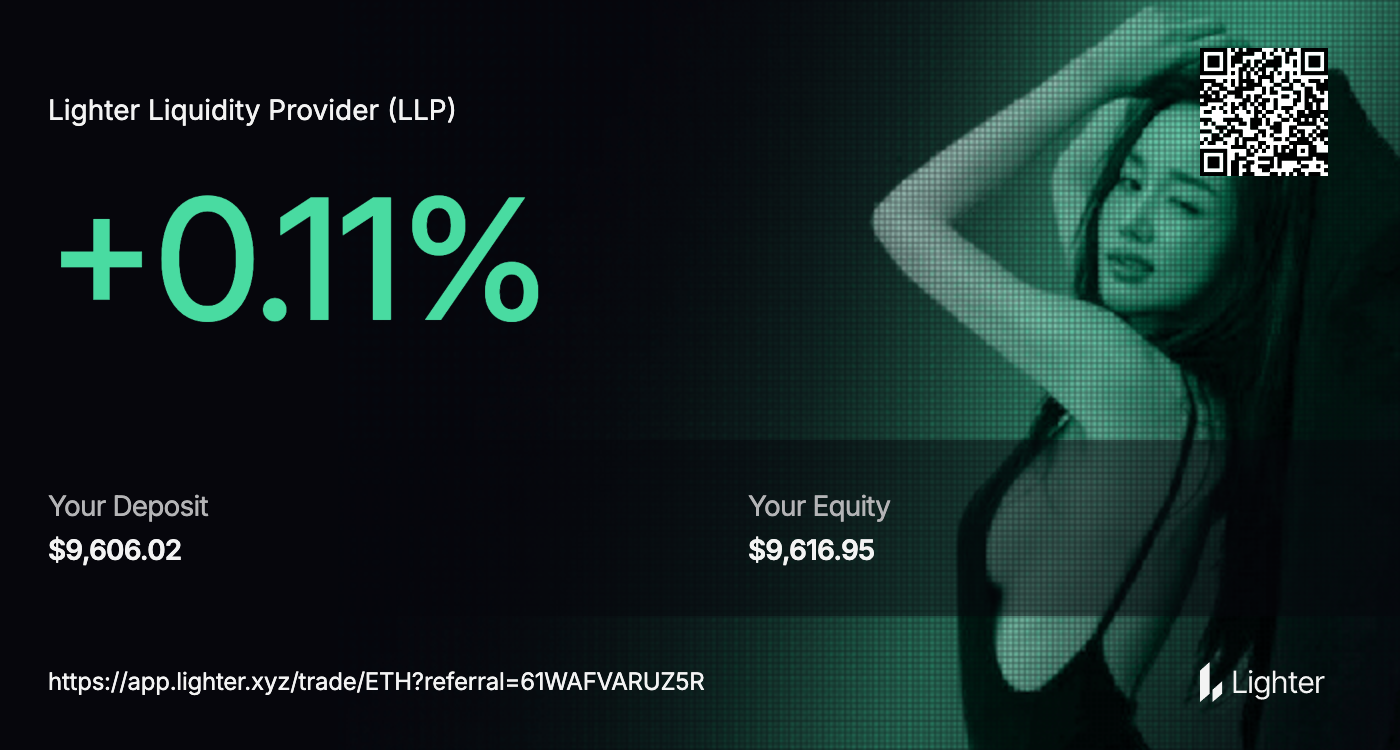

Lighter: Liquidity Provision for Perpetual Futures

Lighter is a perpetual futures DEX that allows users to provide liquidity into its Lighter Liquidity Provider (LLP) pool. By depositing stablecoins such as USDC, liquidity providers take the other side of trader PnL and earn from trading fees, funding payments, and insurance mechanics.The LLP resembles Hyperliquid's insurance fund or Paradex's LP vaults, but operates inside Lighter's zk-rollup environment, offering transparent, verifiable settlement. Recent APRs have been very attractive (in the 60–80%+ range), though returns vary with trader performance and market conditions.

Note: Lighter is currently in private beta and invite-only. If you need access, you can request an invite link directly from our Discord community.

Step-by-Step: Providing Liquidity on Lighter

1. Fund your Lighter Account:- From the wallet panel, hit Deposit.

- Choose Connected wallet (MetaMask / WalletConnect) or External account (CEX/Solana/etc.).

- Pick the network (e.g., Arbitrum One) and deposit USDC (min ≈ 5 USDC).

- You'll see the balance in your account equity once funds arrive.

Then click Lighter Liquidity Provider (LLP).

Review APR, TVL, Sharpe, returns volatility, max drawdown, and the positions/funding history that drive PnL.

3. Deposit from your account into the LLP: Enter the USDC amount and Click Deposit.

Deposits are subject to points-gated caps:

- 0–299 pts → up to 25% of balance

- 300–1,499 pts → 50%

- 1,500–9,999 pts → 75%

- 10,000+ pts → 100%

- The dashboard shows APR and daily returns.

- Some days may be negative when traders win, but over time, fee flows and funding usually favor LPs.

5. Withdraw: You can withdraw your deposit at any time, subject to execution impact and liquidity conditions.

Airdrop and Points Angle

Unlike trading on Lighter, LLP deposits do not currently earn points. Rewards are strictly yield-based.That said, the LLP is central to protocol stability, and there's speculation that depositors could be retroactively recognised in a future token event — but this is not guaranteed.

For readers interested in the trading side of Lighter (which does earn points), we've prepared a separate walkthrough video that demonstrates how to open and manage positions.

Risk Rating: ★★★½☆ (3.5/5 — Above Average Risk)

Providing liquidity to LLP has a similar risk profile to Hyperliquid or Paradex LP vaults:- Trader PnL exposure: LPs win when traders lose, and vice versa.

- Return volatility: APRs are attractive but fluctuate with trading activity.

- Liquidation backstop: LLP helps cover liquidation shortfalls, but this is rare under normal market conditions.

- Correlation risk: Sharp moves can briefly benefit traders, denting LP returns.

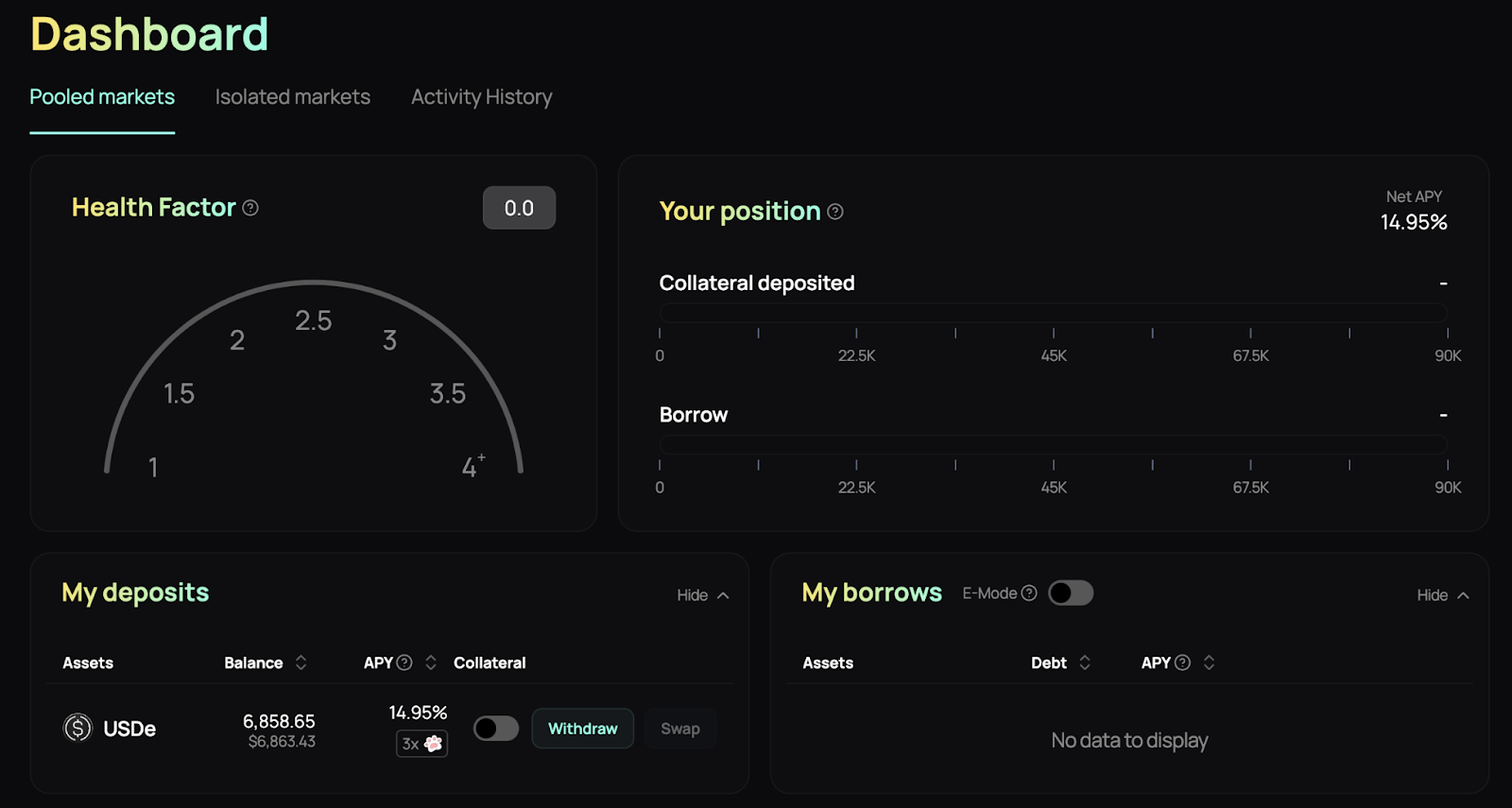

HypurrFi: Lending USDe for Safe Yield and Points

HypurrFi is a lending protocol on Hyperliquid EVM, built as an Aave-style money market with both pooled and isolated markets. For our purposes, the most attractive opportunity is supplying USDe, Ethena's synthetic dollar. This earns lending APY while also stacking Ethena points and HypurrFi points, making it a core play for both passive income and airdrop positioning.Step-by-Step: Supplying USDe on HypurrFi

1. Swap into USDe: Acquire USDe before depositing. We recommend using an aggregator for the best execution: 2. Navigate to HypurrFi → Pooled Markets: From the sidebar, click Markets → Pooled Markets to access the lending dashboard.3. Deposit USDe

- Click Deposit from your wallet balance.

- Approve USDe.

- Confirm the deposit.

- Your position will appear under Dashboard → Pooled Markets.

4. Track Returns:

- Net APY is visible in the dashboard (historically around 14–16%).

- Your USDe balance increases automatically over time — there's nothing to claim, as interest compounds directly into your supplied position.

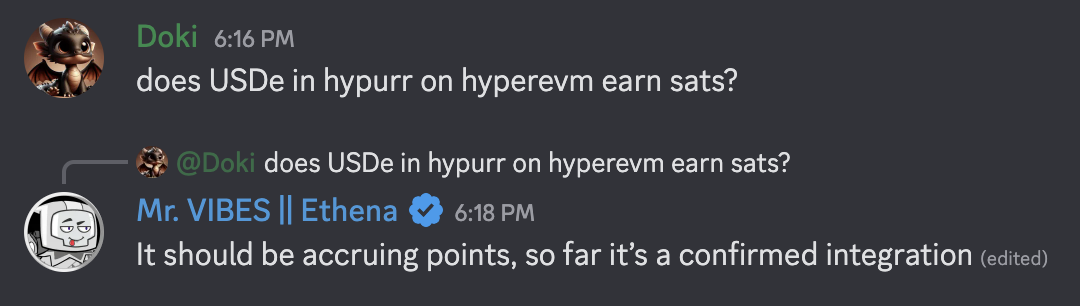

Airdrop Angle

Supplying USDe on HypurrFi compounds 2 additional benefits:

- Ethena Points & Airdrop from lending USDe.

- HypurrFi Points & Airdrop from using the platform.

Risk Rating: ★☆☆☆☆ (1/5 — Low Risk)

HypurrFi inherits the proven Aave model and has relatively straightforward lending mechanics. Key risks include:- USDe stability risk – reliance on Ethena's delta-hedging mechanism.

- Smart contract risk – as with all DeFi protocols.

- Liquidity risk – possible delays on withdrawal if utilization spikes.

Note: This strategy would also work on Felix or Hyperlend if you prefer using those platforms. They are also running point incentives.

Cryptonary's take

As we said last week, yield farming is a constant balance between risk and reward. Protocol design, incentive structures, and market volatility all play a role in how sustainable those returns really are. In this report, we're spotlighting 3 more protocols worth allocating to, earning passive income while positioning for future airdrops. As always, manage your risk, and diversify the strategies you deploy across multiple platforms.Happy farming!

Cryptonary, OUT!