3 DeFi Plays Printing Massive Passive Income Right Now

DeFi yield farming remains one of the most effective ways to put idle assets to work. By staking stablecoins or providing liquidity across correlated asset pairs, participants can tap into yields that far outpace anything found in traditional finance. Here, we’ve identified three asymmetric opportunities to earn passive income with DeFi. Let’s dive in...

Yield farming is constantly evolving. Protocol design, collateral health, incentive mechanics, and market volatility all shape how sustainable a given strategy really is. The challenge for today's farmer is to align personal risk tolerance with the realities of protocol mechanics, and to know what's actually happening under the hood.

In this article, we'll explore several strategies across both stablecoin pools and leveraged loops, examining how they work, what yields they offer, and what risks you should be aware of.

Let's GOOO!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Hylo: Farming Stablecoin Yields with hyUSD

Hylo is a Solana-native protocol built around its over-collateralized stablecoin, hyUSD. Depositing hyUSD into the Stability Pool lets users earn 10%–25% APY, compounded automatically. The protocol generates this yield by harvesting staking rewards (from assets like mSOL or jitoSOL), minting new hyUSD, and distributing it into the pool each epoch.

Why use Hylo? Staked hyUSD is composable and passively accrues yield, requiring no manual reinvestment or complex workflows. Here is how to set this up...

Step-by-Step: How to Farm with hyUSD

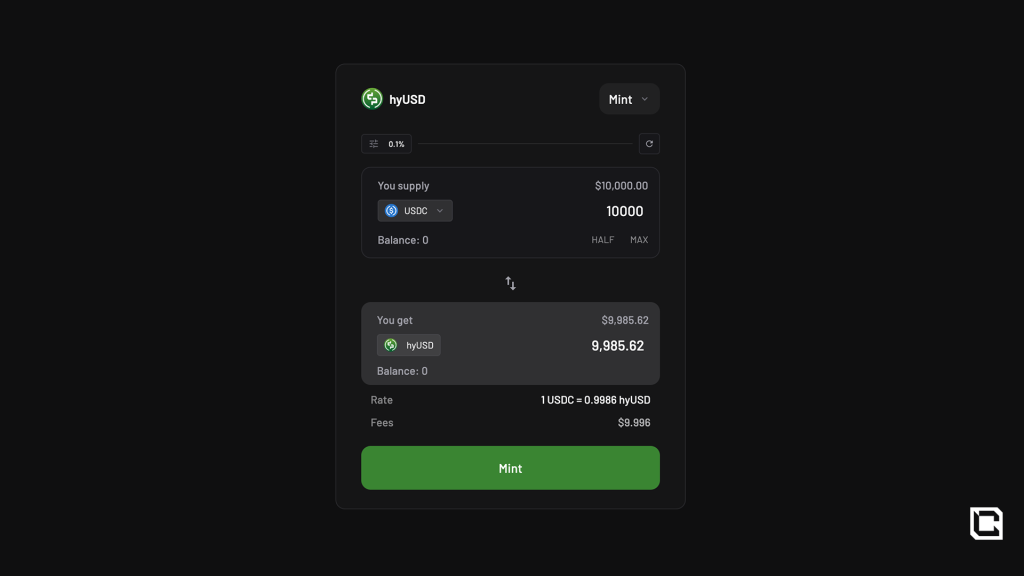

1. Acquire hyUSD: Go to the Hylo website and click the Stablecoin tab and Mint hyUSD using supported collateral, or purchase it from secondary markets.

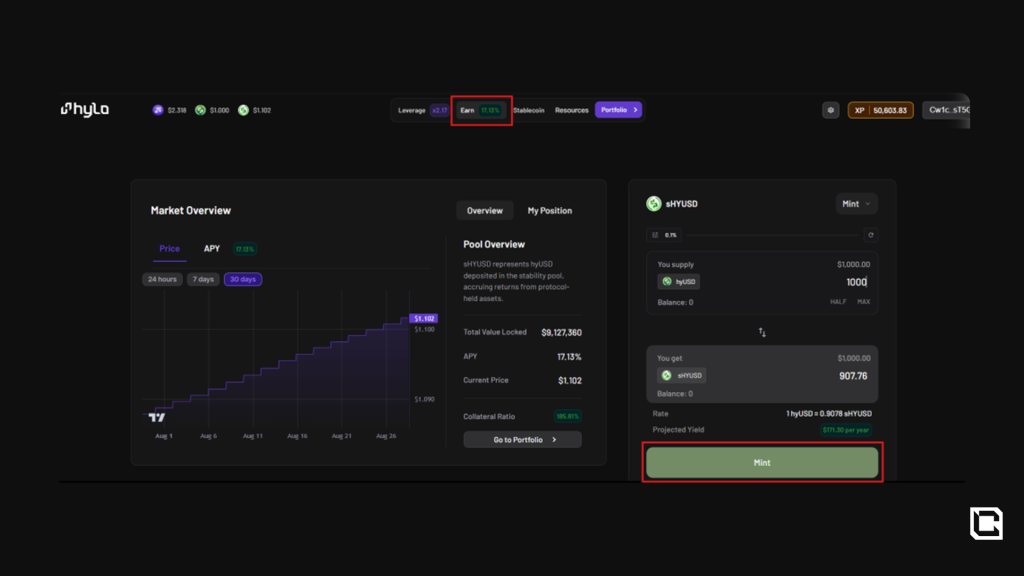

2. Deposit into the Stability Pool: Click the Earn tab and add hyUSD to the Stability Pool. You'll receive Staked hyUSD, your yield-bearing position.

3. Auto-Compounding Kicks In: Every epoch, new hyUSD is minted from collateral yields and distributed into the pool, increasing the value of Staked hyUSD automatically over time.

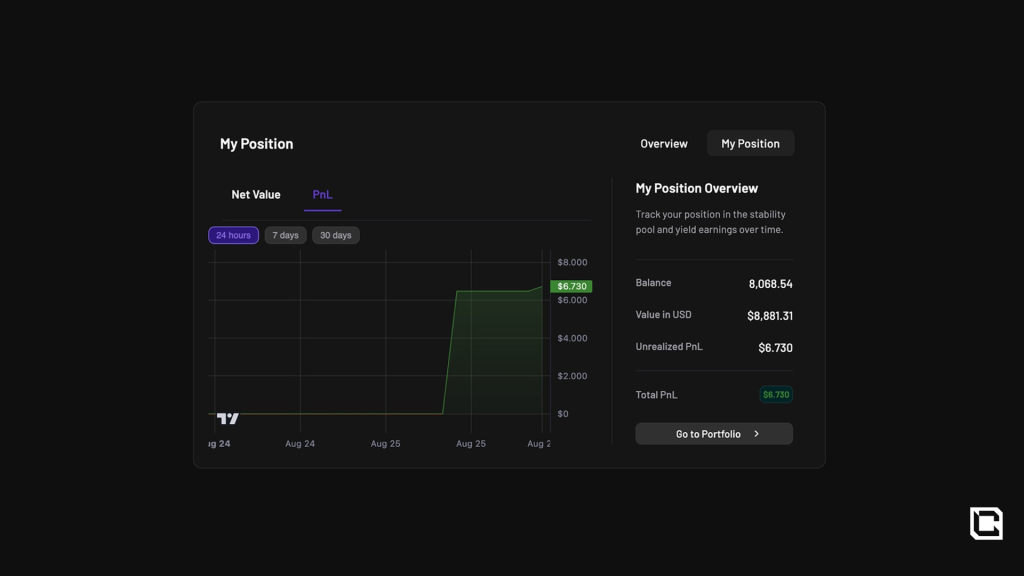

4. Monitor Yields: Typical yields are around 15%, spiking to 30% in optimal conditions. These rates fluctuate with protocol and market performance.

5. Understand the Risks: In times of stress, the protocol may convert Staked hyUSD into xSOL to preserve the system's collateral ratio. Hylo has developed a Risk Dashboard to monitor this.

6. Account for Exit Fees: When you redeem sHYUSD back into hyUSD, a 0.1% exit fee applies. While small, this fee can add up if you're frequently entering and exiting positions. For long-term farmers, the compounding yield generally outweighs the fee, but it should be factored into net returns.

Bonus: Airdrop Angle

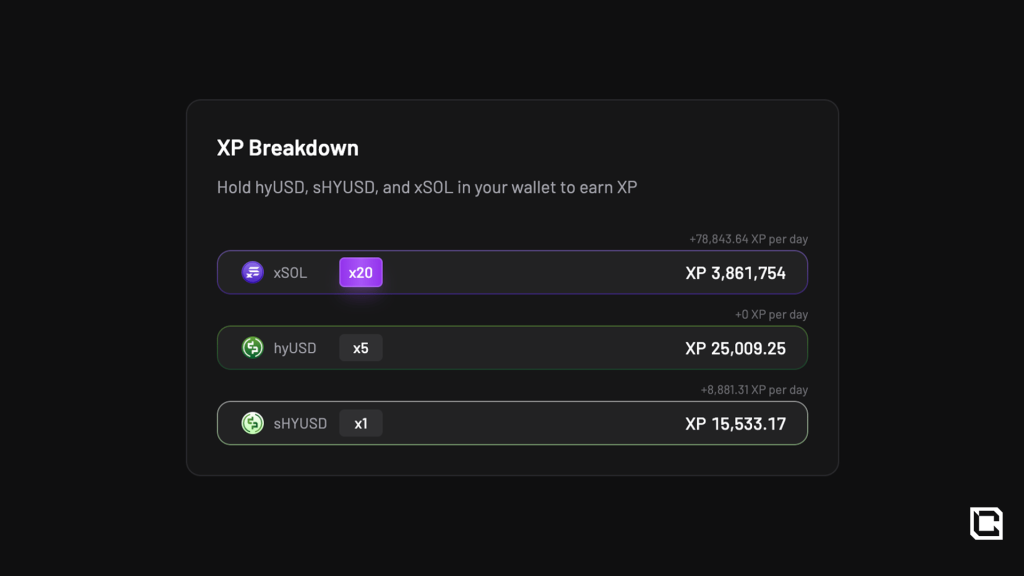

What is extra here is that Hylo doesn't have its own governance token yet. However, it runs an XP points system for holders of hyUSD, sHYUSD, and xSOL, with xSOL offering the largest multiplier. XP may factor into a potential future token airdrop, offering an extra layer of upside while farming yield.

Risk Rating: ★★★☆☆ (3/5 — Medium-High Risk)

While Hylo offers strong stablecoin yields, exposure to collateral volatility and forced conversion risk means this strategy rates as medium-high risk. Any yield farmer should size allocations accordingly and be ready for possible drawdowns in extreme scenarios. But overall, we like this opportunity...You can watch our full breakdown of Hylo here:

OnRe: Institutional Yield with ONyc Loops on Loopscale

OnRe is a yield protocol that tokenises access to reinsurance premiums and collateral yield through its dollar-linked asset, ONyc. Unlike typical DeFi stablecoins, ONyc is backed by real-world reinsurance income and collateral strategies (e.g. sUSDe yield).ONyc is not a rebasing token. Instead, it appreciates in USDC terms as the underlying pool performs, and profits are realised upon redemption. Yield comes from three streams:

- Reinsurance premiums (institutional-grade, non-crypto native income).

- Collateral yield (stablecoin yields like sUSDe).

- Compounding effects as premiums are earned and NAV increases.

OnRe has added credibility through integrations with Kamino and institutional backers. For farmers, however, Loopscale is especially attractive: yields are higher, and because Loopscale does not yet have a token, users could capture airdrop upside in addition to yield and OnRe points. Here is how we are going to farm passive income here...

Step-by-Step: Farming ONyc/USDC on Loopscale

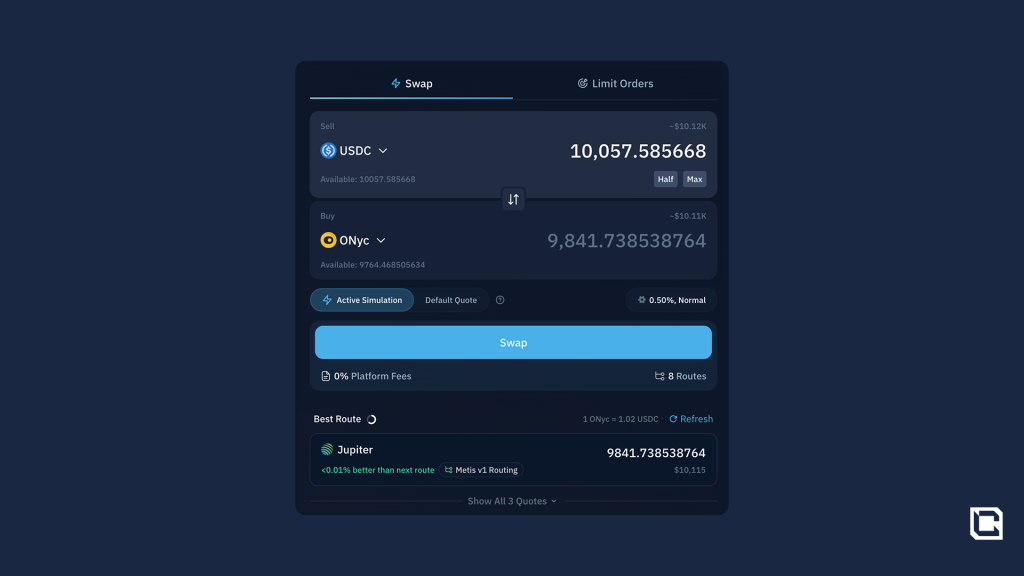

1. Acquire ONyc: Swap USDC for ONyc via Kamino or supported routes. ONyc typically trades slightly above peg ($1.02), reflecting its yield-bearing nature.

2. Go to Loopscale website and connect your wallet. Then...

- Go to the Loop tab.

- Select Stablecoin-Pegged loops.

- Choose the ONyc/USDC pair (currently one of the featured loops).

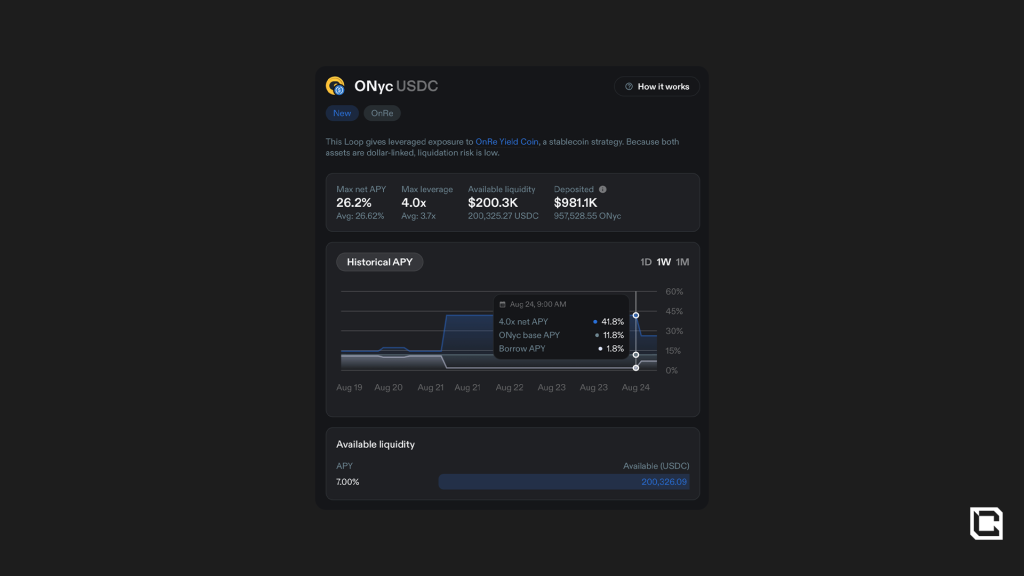

3. Select Leverage

- Max leverage: 4.0x.

- Safer users may choose 2–3.5x leverage.

- Leave fixed rate at 1 Day.

- The strategy works because ONyc's lending APY is consistently higher than borrowing costs, creating a positive spread.

4. Deposit & Confirm: Deposit ONyc, approve, and start your loop.

5. Track Rewards: Avg APY: 26–29% (boosted via Loopscale).

- Rewards accrue daily, but ONyc's appreciation in USDC terms is only realised when redeemed or swapped.

- Watch your liquidation price in the dashboard. Higher leverage reduces margin for error.

- Rising borrowing costs could turn the yield negative.

When you close the loop, you receive ONyc + a small portion of USDC. Because ONyc appreciates in USDC terms, the gain is embedded in the ONyc balance you withdraw, not in rebased balances.

- To fully realise profits in stables, swap ONyc → USDC on a DEX such as Jupiter.

Some additional Fees you might incur

- Swap spread: 0.5% when converting USDC ↔ ONyc.

- Loopscale fees: Minor protocol charges for opening/closing loops.

- Borrowing costs: Paid on leveraged USDC, but consistently lower than ONyc's APY.

- Exit costs: Closing involves fees, price impact, slippage, and execution impact. Final conversion back to USDC requires an additional swap.

Bonus: Airdrop Angle

- OnRe: No token yet — instead, farmers earn OnRe Points, which are likely tied to future incentives.

- Loopscale: Also tokenless, meaning users could gain double airdrop exposure by looping here instead of Kamino.

Risk Rating: ★★☆☆☆ (2/5 — Moderate Risk)

While ONyc and USDC are dollar-linked and impermanent loss is negligible, risks include:- NAV volatility if reinsurance premiums underperform.

- Leverage risk, especially near max borrow.

- Protocol risk across OnRe and Loopscale.

- Subsidy risk — yields may decline once external incentives taper.

You can watch your video guide on Loopscale here:

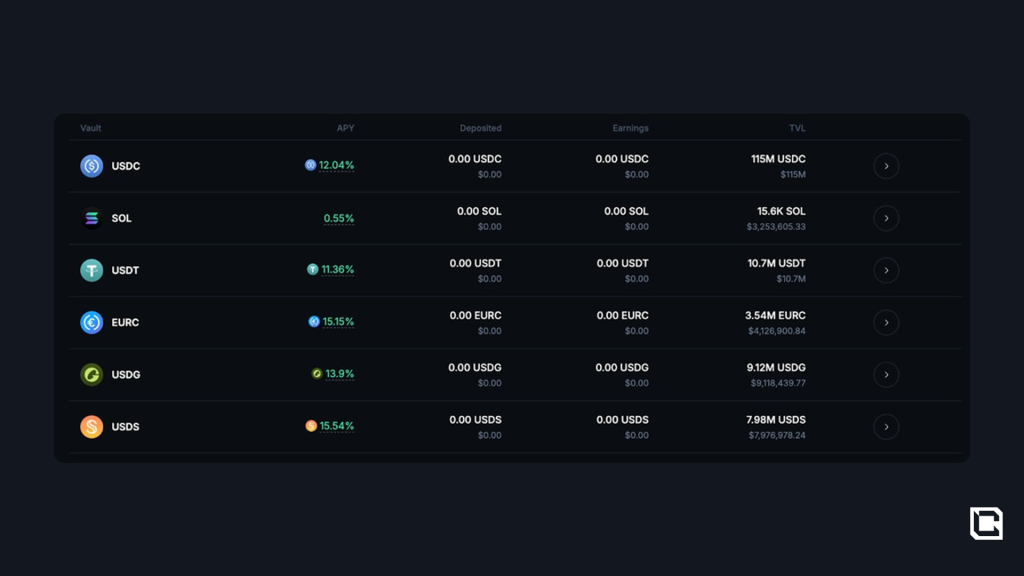

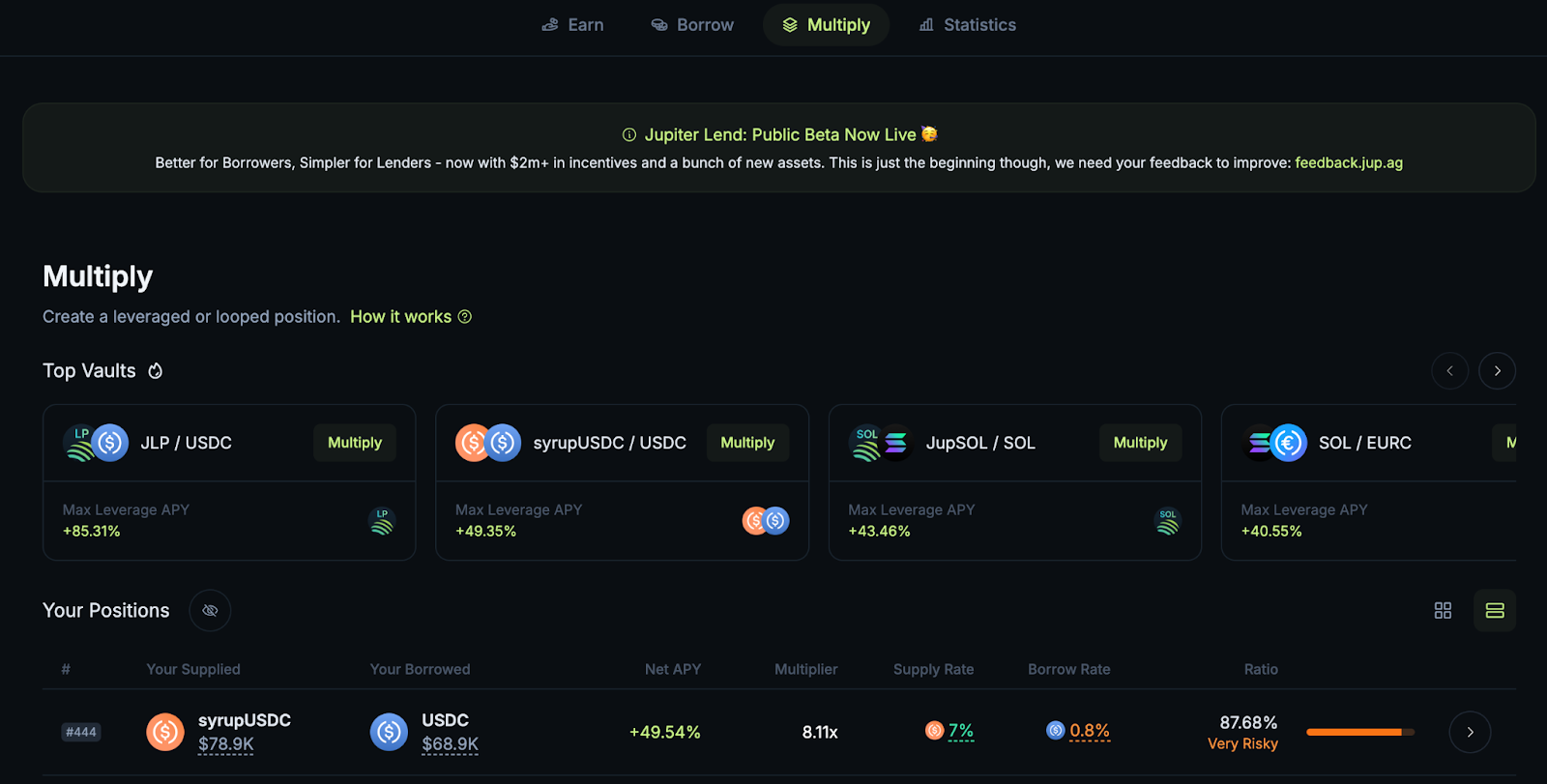

Jupiter Lend: Leveraged Stablecoin Yields with SyrupUSDC

Jupiter has launched its own lending and borrowing platform, designed to compete with Kamino by offering simplified mechanics, boosted incentives, and a strong UI. In its beta phase, the protocol is distributing over $2M in rewards to bootstrap adoption. These incentives won't last forever, making the current environment an attractive time to participate.

Among the available markets, SyrupUSDC stands out as the most attractive stablecoin option. Over 50% APY while looping!

Why SyrupUSDC?

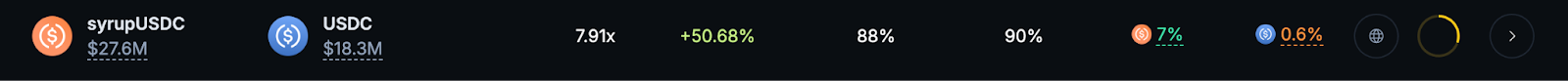

SyrupUSDC is a yield-bearing wrapper of USDC created by Maple Finance. It accrues 7% APY automatically from institutional lending pools, and because the token steadily appreciates against USDC (currently 1.12), it provides a strong base for leverage loops. This appreciation means liquidation risk comes from Syrup falling, not rising, which historically has been rare.Step-by-Step: Using SyrupUSDC on Jupiter Lend

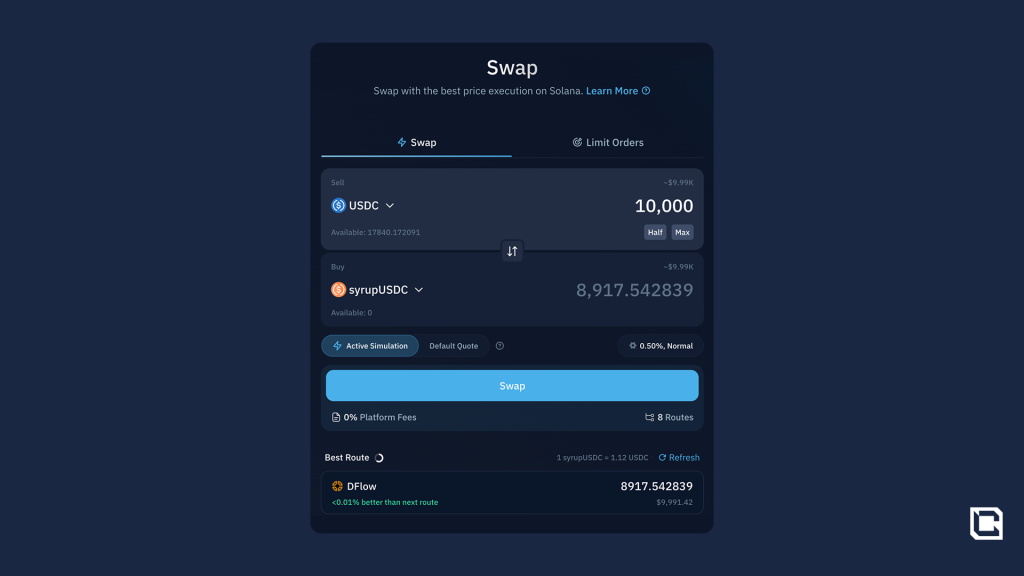

1. Acquire SyrupUSDC: Swap USDC → SyrupUSDC on Kamino or Jupiter.

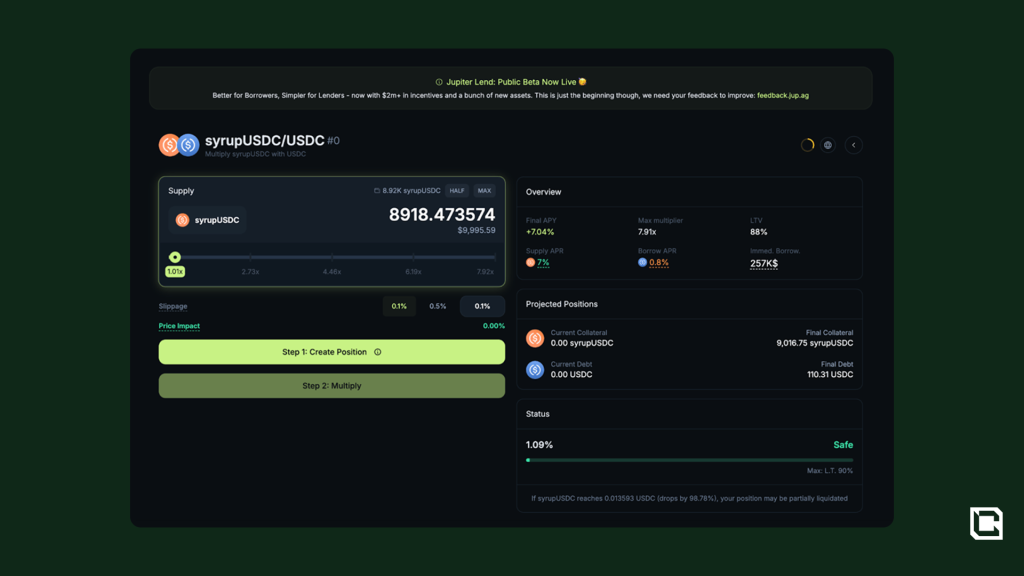

2. Create the Initial Position: Navigate to Lend → Multiply → SyrupUSDC. Then, select your initial deposit amount. This sets up your base loop.

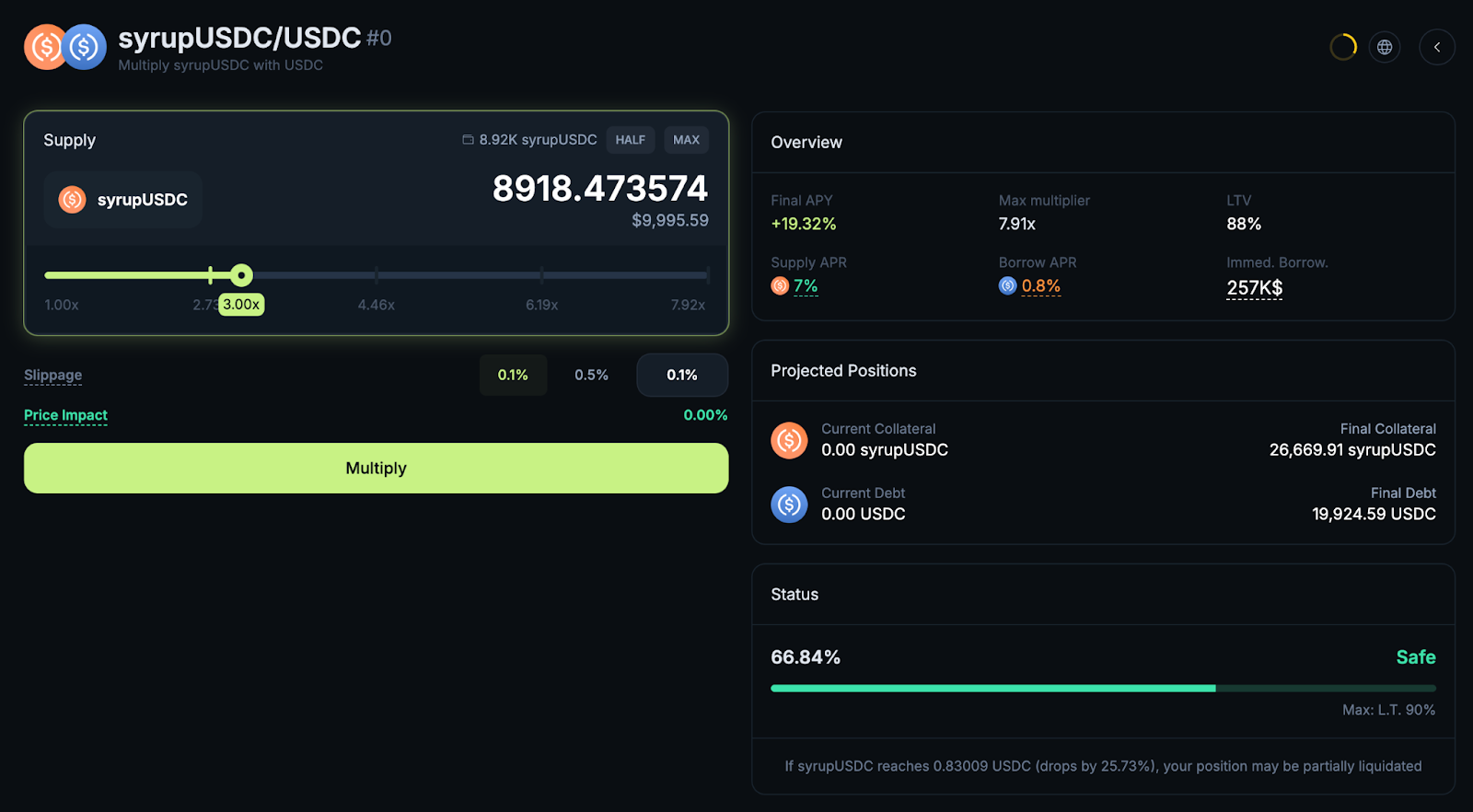

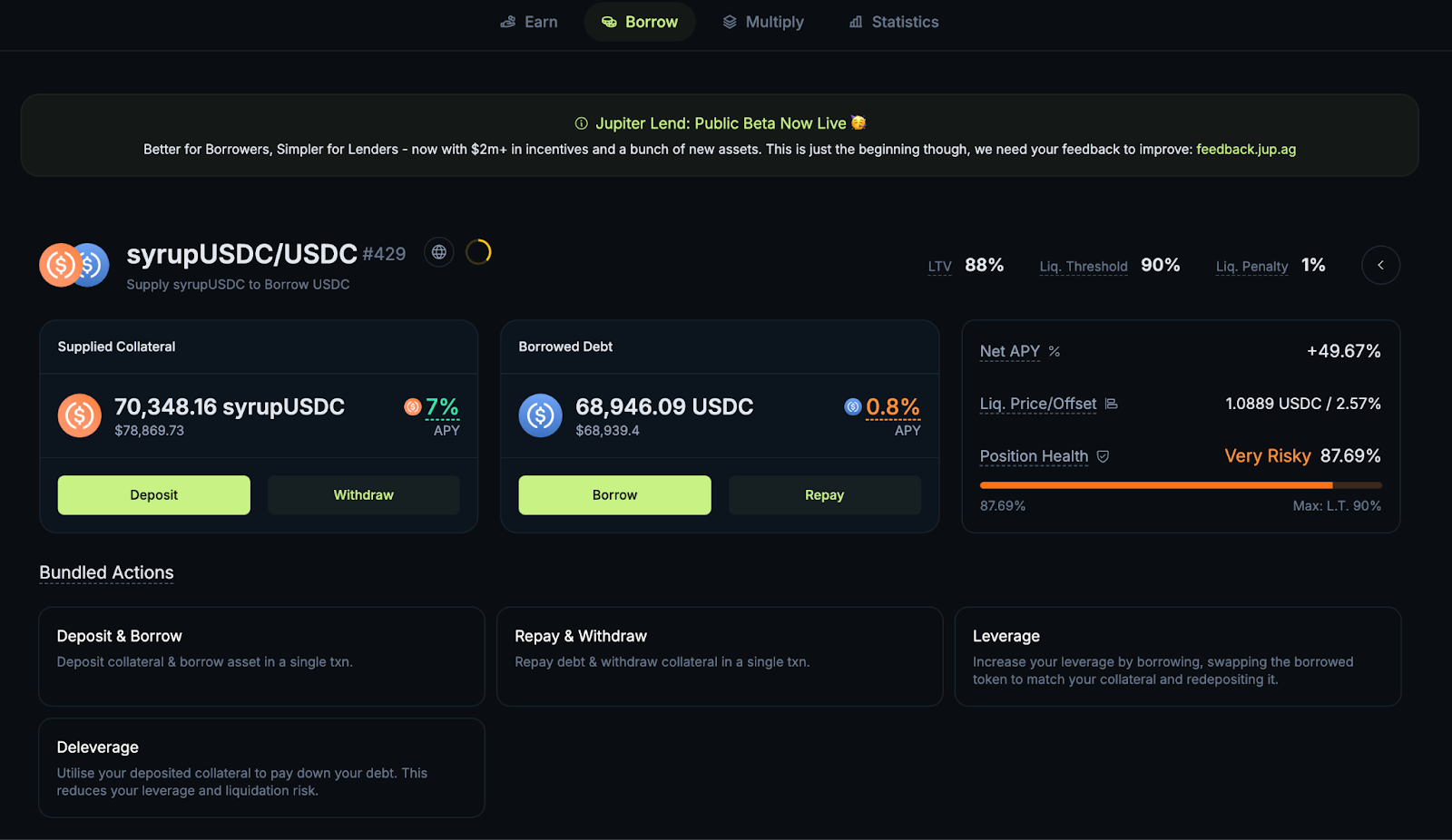

3. Multiply (Looping for Higher Yield): Once the base position is created, use the Multiply slider to scale leverage. At 3x, the position is considered safe, with APYs around 19%. At 7.9x max leverage, APYs can approach 50%+, but even a 2–3% price deviation in SyrupUSDC could trigger liquidation.

4. Monitor Position Health: Under the Multiply tab, the dashboard tracks your position in real time:

- Total Supplied vs. Total Borrowed

- Supply and Borrow Rates

- Net APY after looping

- Loan-to-Value (LTV), liquidation threshold (90%), and current ratio

This makes the trade-off between yield and risk completely transparent. For example, an 87% ratio is flagged "Very Risky," indicating that only a small price move could cause liquidation.

5. Manage or Exit:

-

- Deleverage (Borrow tab) : Uses collateral to repay debt, lowering your LTV and making the position safer.

-

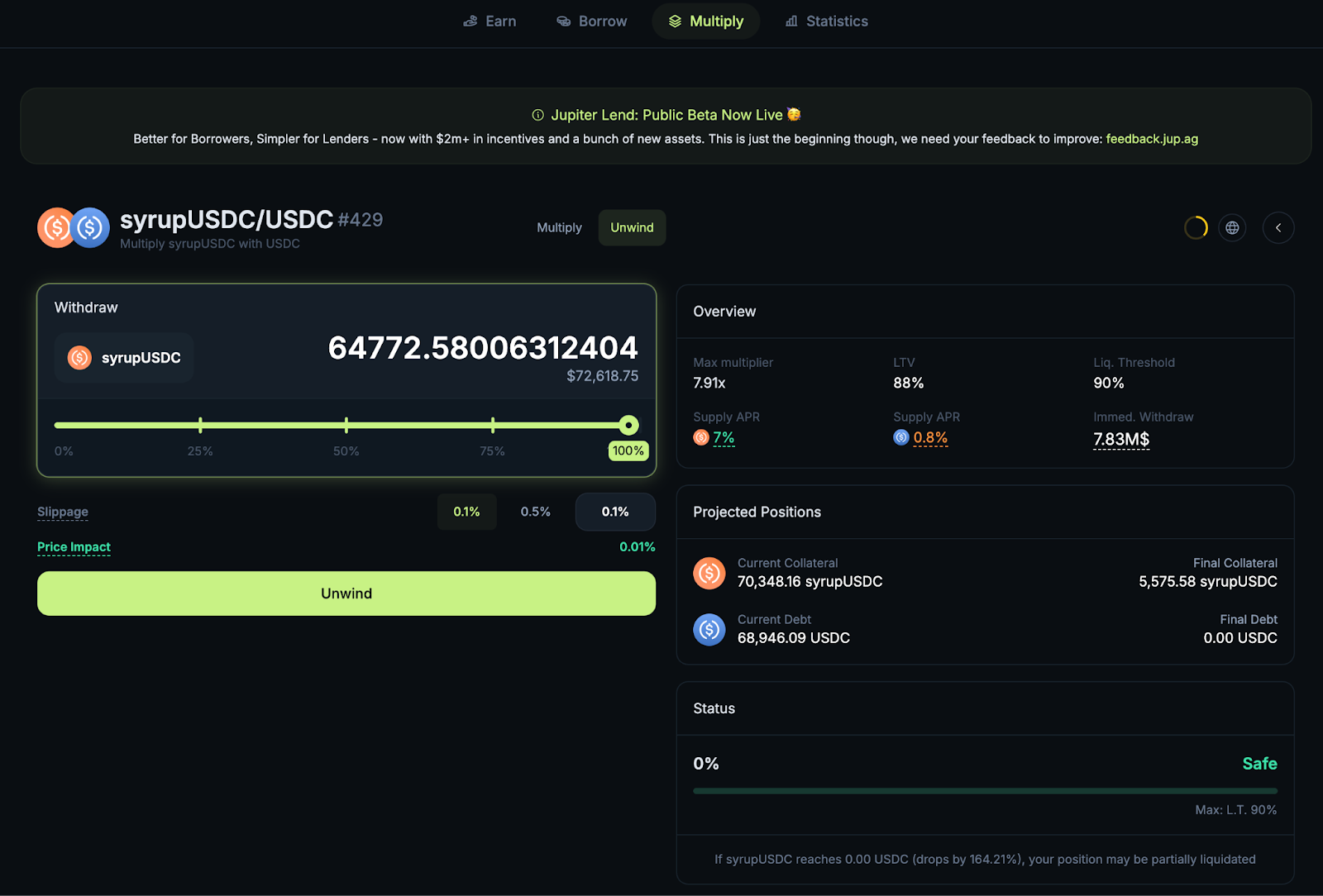

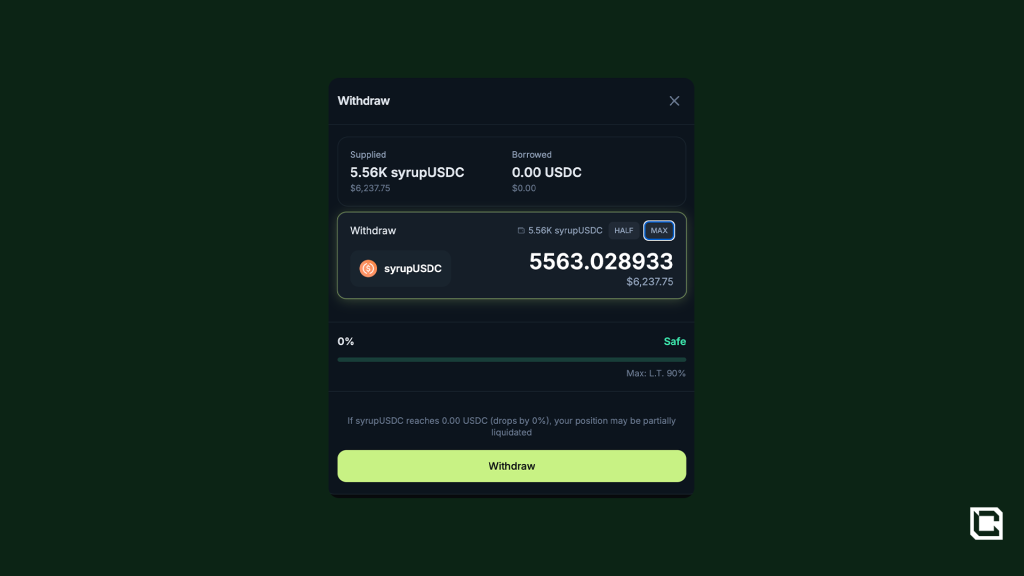

- Unwind (Multiply tab): Partially or fully close the loop. This is the simplest way to exit.

Note: Clicking on your position under Borrow or Multiply shows different interfaces. If you want to fully exit, the Unwind function under Multiply is the easiest.

During unwind, you may see partial USDC returned first — this mechanism is designed to protect against MEV bots before completing the full withdrawal. The system repays your USDC loan before releasing the remaining syrupUSDC collateral.

Risk Management

- Liquidation: Positions liquidate at 90% LTV with a 1% penalty.

- Peg Stability: SyrupUSDC has historically held a steady upward trend vs. USDC, which reduces effective liquidation risk, but sharp deviations are still possible.

- Counterparty Risk: Yield is tied to Maple lending pools, which rely on borrower performance and impairment protections.

Bonus: Airdrop Angle

Syrup currently has its own token. Maple distributes Drips rewards on Ethereum, but there is no guarantee these extend to Solana. The real upside today comes from Jupiter's $2M+ incentives, which reward early users of Lend and Multiply. Future recognition from either Syrup or Jupiter is speculative, but possible.Risk Rating: ★☆☆☆☆ (1/5 — With Low Leverage)

Risk Rating: ★★★☆☆ (3/5 — With Higher Leverage)

- Pros: Transparent UI, strong incentives, sustainable base yield, risk-adjustable leverage.

- Cons: Leverage introduces liquidation exposure, Maple lending carries credit risk, incentives will taper.

Here is a step-by-step tutorial:

Cryptonary's take

Yield farming is a balancing act between risk and reward. Protocol design and incentive structures determine how durable those returns are, while market volatility and protocol risk are unavoidable parts of the game.Think of it this way: your base lending APY or LP yield is the floor, and any airdrop allocation you eventually receive acts as a multiplier on that return. The precise value of an airdrop is never known in advance, but history shows that engaged participants are often rewarded far more than the standard APY would suggest.

Stablecoin vaults, concentrated LP ranges, leveraged asset looping, and lending markets all represent different roads to the same destination. Those who consistently seek out alpha and allocate capital with conviction are the ones who reap the greatest rewards over time. In DeFi, strategy, selectivity, and timing all separate the outperformers from the crowd.

The strongest strategies layer sustainable yield with potential airdrop exposure. Together, they can provide a steady income while positioning for what is often a significant payout in the future.

Happy farming!

Cryptonary, OUT!