3 key factors you should consider since Cryptocurrencies markets crashed over 50%

The COVID-19 pandemic caused markets from around the world to crash. The S&P500 is down 30%, the FTSE100 is down 35% and Bitcoin was no exception as it crashed by over 40% in 24 hours. During the crash, markets became highly correlated, even ones that tend to show inverse correlation such as equities and gold, because investors needed to get their hands on cash in whichever way they could.

Pandemic hits the markets

[caption id="attachment_15023" align="aligncenter" width="2880"]![Bitcoin dives from $8,000 down to $3,900 overnight [13th March 2020]](https://cryptonary.com/cdn-cgi/image/width=3840,quality=90/https://cryptonary.s3.eu-west-2.amazonaws.com/wp-content/uploads/2020/03/Screen-Shot-2020-03-16-at-12.59.56-PM.png) Bitcoin dives from $8,000 down to $3,900 overnight [13th March 2020][/caption]

Bitcoin dives from $8,000 down to $3,900 overnight [13th March 2020][/caption]

March 12th 2020 will go down in the history books for Bitcoin as price opened near $8,000 and closed under $5,000, doubling the asset’s weekly volatility. It marked the largest daily drop in Bitcoin's history, and the largest notional value of liquidations in a 24 hour period with over $1 billion longs liquidated.

[caption id="attachment_15022" align="aligncenter" width="2880"]![Bitcoin Volatility chart spikes to highs [BVOL]](https://cryptonary.com/cdn-cgi/image/width=3840,quality=90/https://cryptonary.s3.eu-west-2.amazonaws.com/wp-content/uploads/2020/03/Screen-Shot-2020-03-16-at-12.58.33-PM.png) Bitcoin Volatility chart spikes to highs [BVOL][/caption]

Bitcoin Volatility chart spikes to highs [BVOL][/caption]

Sooner or later, we’ll hopefully have some positive news regarding the pandemic and that is our bet on humanity. When that occurs, legacy markets will need time to recover because of the economic consequences. Assets like Gold on the other hand, will act as a safe haven once the panic is over with and we enter a more sustainable economic slowdown.

Bitcoin has had instances where it acted as a safe haven similar to Gold, the latest of which was the mimicked reaction to the FED rate cuts. Additionally, citizens have already used Bitcoin as a safe haven against hyperinflation in countries like Venezuela. We believe there is a high probability this continues.

Investors that thrived by buying crashes

Market crashes, survived, can bring forward financial freedom to many as it has before.

Warren Buffett made a killing by buying undervalued shares and so did Jamie Dimon when JPMorgan acquired Bear Stearns for $10 a share. Since the 2009 lows, JPMorgan’s shares more than tripled from the strategic moves made.

Legendary investor Carl Icahn bought the bankrupt Fontainebleau property in Vegas for approximately $150 million and later sold it in 2017 for $600 million, a quadruple profit.

1. Bitcoin: overvalued or undervalued?

Before investing in anything we must ask ourselves, is this asset over or undervalued? To do so we must have a precise technique for valuing the asset in the first place. Given that Bitcoin has no revenue or customers, valuing it is not done using the usual route.

Many valuation methods have been offered over the years, such as the stock-to-flow model. While the latter may bring some insight it offers a very wide range of possible prices which does not give us a precise floor under which the asset becomes undervalued.

The Bitcoin network is maintained by miners, if these miners are not profitable they would simply shut down their machines and consequently bring down the network.

Hence the floor against which we value Bitcoin is the point of profitability for miners. Any price below it is considered an exceptional catch.

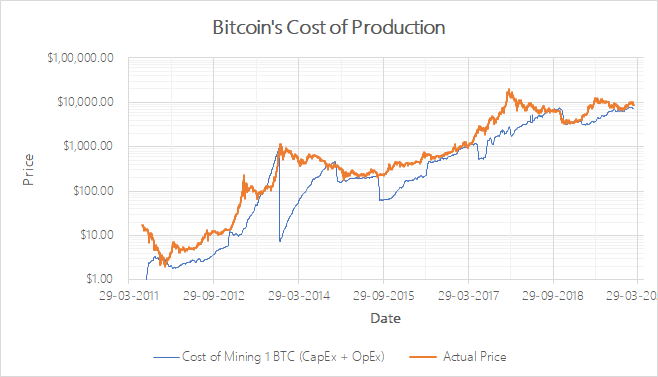

[caption id="attachment_15019" align="aligncenter" width="658"] A chart showing the cost to produce 1 Bitcoin[/caption]

A chart showing the cost to produce 1 Bitcoin[/caption]

Miners’ profitability depends on many different factors which practically boil down to set-up and running costs. Analyst DataDater offered a new valuation model named: “Bitcoin’s Cost of Production (CoP) model”. That model has accurately depicted Bitcoin’s floor over the years and it set miners profitability at $7,577.51 as of last week.

As stated by Satoshi Nakamoto in the whitepaper: “The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation. In our case, it is CPU time and electricity that is expended.” If these costs are not covered for miners they have no incentive to keep the network running which becomes a “do or die” situation.

The spikes seen in the cost of mining occur either when more efficient mining equipment is offered, such as the switch from FPAGs to ASICs in 2013 which caused the production price to momentarily go down before the increase in difficulty as more mining power entered. The other factor to take into consideration is the halving which increases the cost of production as the rewards decrease, the model estimates the CoP to be nearly $14,000 post-halving (2020).

When prices crash, like November 2018, some miners shut down temporarily to avoid running their business at a loss. Which slows down production and decreases the hash rate, hence decreasing the electricity costs until mining is sustainable and the entire cycle is started over again.

2. Buying blood on the streets

The market is offering us an exceptional chance today, to buy Bitcoin and sound crypto-assets at a huge discount during this fire sale. The valuation model is not the only thing to take into consideration. From a logical perspective, Bitcoin’s price is not directly affected by the COVID-19 pandemic like legacy markets are. The crash, and especially its magnitude, is rather uncalled for.

Now the magnitude itself is another topic that must be covered. The steepness of the crash was accentuated by the liquidations on futures platforms, especially BitMEX. As price went down, people’s stop losses or liquidation levels were hit, which became extra sell orders that the market must absorb. The latter situation pushed the price down further than it would have if there were only spot exchanges.

Under normal conditions, futures trade at a premium to spot rates mainly because there is a high demand to buy Bitcoin at high leverage. While dividend payouts and storing costs tend to be part of the equation, they aren’t here. That characteristic has sustained over time and very rarely do futures trade at a negative basis (spot price>futures price).

[caption id="attachment_15024" align="aligncenter" width="1200"] Basis [spot futures] source: skew.com[/caption]

Basis [spot futures] source: skew.com[/caption]

As can be seen on the this chart, futures prices tend to mimic that of the underlying with a very small premium. On June 27, the premium momentarily reached +6.15% which was a good indication for a decline (which occurred right after).

Before price “stabilised” after this recent crash, the basis breached -20% which is an extreme situation that didn’t last for long. While the discount is small, currently prices have a negative basis which for us is a longer-term bullish indication.

3. Risk management

No matter how much conviction one may have, their risk has to be managed and nothing should be risked if it cannot be lost. The crash hopefully awakened many people to the importance of risk management, but there was one event that could have absolutely obliterated the entire cryptocurrency market, and that is Bitcoin going to zero.

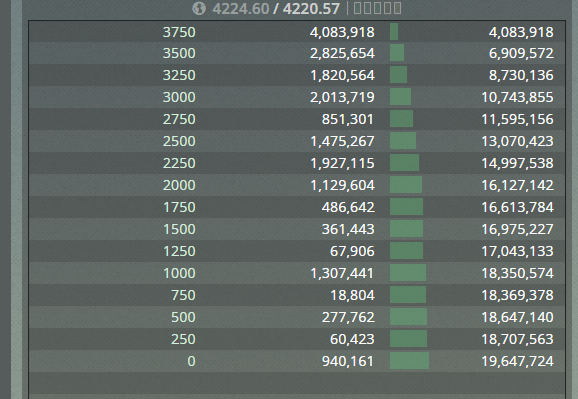

On the day of the crash, BitMEX’s orderbook had less than $20 million left on the bids before the price reaches absolute 0.

[caption id="attachment_15020" align="aligncenter" width="578"] BitMEX’s order book showing less than $20 million in bids[/caption]

BitMEX’s order book showing less than $20 million in bids[/caption]

While unfathomable to many, this was closer than most people would have ever thought. Had it happened, price recovery would have been a very long and arduous (if not impossible) process. Luckily BitMEX had “hardware problems” at that exact moment which released that risk into oblivion.

Stepping outside the block (pardon the pun)

The uncalled for panic, the fire sale and miners profitability model are all screaming to us a major buying opportunity. With that being said, while positioning ourselves in the market long-term, we are managing our risk as we are well aware of the “doom” possibility that nearly occurred.

Luckily, price recovery will theoretically be of high magnitude where excessive risk or even margin are not required to create great returns.