As part of our ongoing strategy to maximise returns in this sideways market, we've consistently positioned ourselves early in some of the most rewarding DeFi opportunities. Our track record includes airdrops from ANZ, HYPE, EIGEN, DRV, ZK, ZRO and countless more, all of which delivered 4, 5 and even 6-figure rewards. With new projects emerging, we're once again focused on identifying and farming high-potential airdrops before the market catches on.

In times of uncertainty, we've advised our members to take profits and prioritise stablecoins as a safe haven. The challenge now is finding ways to generate yield while waiting for a clearer market direction before re-entering riskier positions. We've previously covered several yield-generating strategies, which you can find here.

Building on that foundation, we're now shifting our focus toward asymmetrical opportunities through strategic airdrop farming, aiming to maximise rewards with minimal downside risk. Let's go!

Disclaimer: This is not financial or investment advice. You are responsible for your own capital decisions.

Ethereal

The first in line is Ethereal. To dive into this airdrop, first, we need to do a quick primer on Ethena. For those unfamiliar, Ethena is a decentralised finance protocol designed to transform digital dollars through USDe, a yield-bearing stable asset supported by a delta-neutral strategy. We previously covered Ethena extensively here.In just one year, it has become the third-largest USD asset, with billions in supply and rapid revenue growth. USDe is widely integrated across both centralised and decentralised finance, serving as collateral on major exchanges like Bybit, OKX, and Bitget.

It is also available on Aave, where users can earn interest or borrow against it, making it an important liquidity source across platforms like Pendle, Morpho, and Sky Finance.

Bybit has been a crucial venue for USDe's adoption, as it allows traders to use USDe as margin collateral for futures trading, further solidifying its utility in the derivatives market.

The protocol's resilience was tested during the Bybit hack on February 21, when USDe briefly depegged-reportedly to $0.9945-before quickly recovering.

This demonstrated the effectiveness of Ethena's delta-neutral strategy, which hedges exposure and ensures price stability even during volatile events.

Looking beyond crypto, Ethena is launching Converge, a new institutional-grade blockchain designed to bridge DeFi and traditional finance.

Built in partnership with Securitize, Converge will serve as the settlement layer for tokenised assets, stablecoins, and on-chain financial products. Initial institutional demand for iUSDe is projected to exceed $10 billion as investors seek high-yield digital dollar solutions.

Key protocols like Aave, Pendle, Morpho, Maple, and Ethereal have already committed to building on Converge.

The opportunity

Ethereal is an upcoming decentralised spot and perpetuals exchange on the Ethena Network, leveraging native USDe collateral. Designed for institutional-grade performance - featuring sub-20ms latency and over 1 million orders per second - it combines high-speed execution with DeFi-enabled self-custody from day one.Ethereal aims to be the leading trading hub for the expanding Ethena ecosystem and beyond. Ethereal currently has over $450 million in deposits, and according to Debank, only around 16,000 users have deposited into the protocol so far. And most importantly, Ethereal is tokenless, which is a very attractive opportunity for us. Here is how to farm this airdrop:

Action plan:

- Step 1: To get started, you'll need USDe on Ethereum L1. You can swap for it using Jumper or DeFi Llama, with the contract address: 0x4c9EDD5852cd905f086C759E8383e09bff1E68B3

- Step 2: Once you have USDe, the next step is to deposit it into Ethereal to start earning rewards.

By completing these steps, you've set yourself up for at least two potential airdrops, earning both Ethereal rewards and 30x Ethena points, which contribute to their Season 3 and 4 airdrops. You can track your progress here. One key benefit is that USDe has no lockup period, meaning you can withdraw at any time.

Ethena's Season 1 lasted only six weeks and was highly rewarding for early adopters. Ethereal's Season 0 runs until May 2025, which could align with a potential token launch.

However, there's a chance that active trading on the platform (once live) may be required to maximise rewards. Either way, we expect this to be a solid opportunity.

Bonus: Pendle Pools (for degens; high-risk)

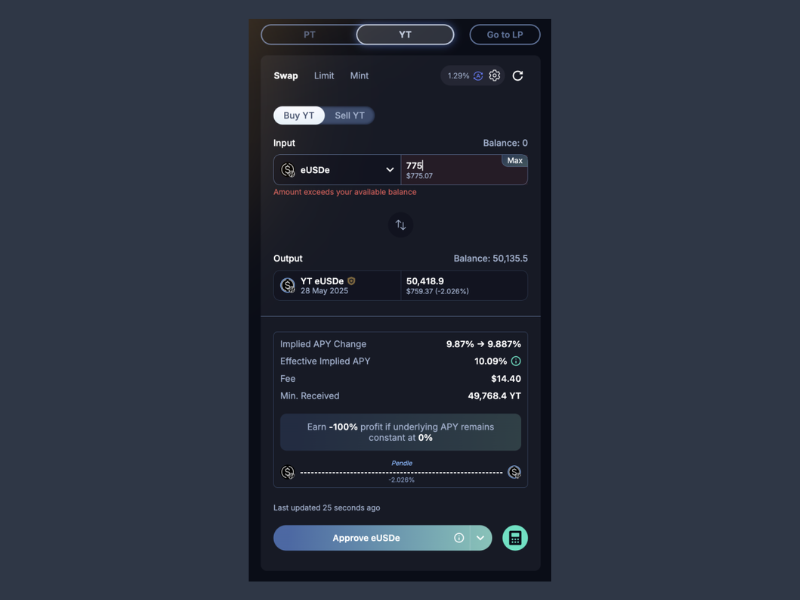

If you are a risk-savvy and experienced airdrop farmer, here is how you can boost your potential rewards. The YT eUSDe pool on Pendle, expiring May 28th, offers 60% more Ethereal points and an automatic 50x Ethena multiplier.

To simplify: $1,250 in USDC will earn points at the same rate as depositing $50,000 USDe into Ethereal. The catch is that the $1,250 will be worth $0 at maturity (May 28th).

Therefore, the key question is whether the Ethereal and Ethena rewards on a $50,000 deposit will be worth more or less than $1,250. Keep in mind, you can exit the position at any time and still keep all your earned points.

Please note: We're not particularly bullish on governance tokens and will likely sell any rewards in favor of stablecoins for future farming opportunities or redeploy them into other assets when the timing is right.

Level protocol

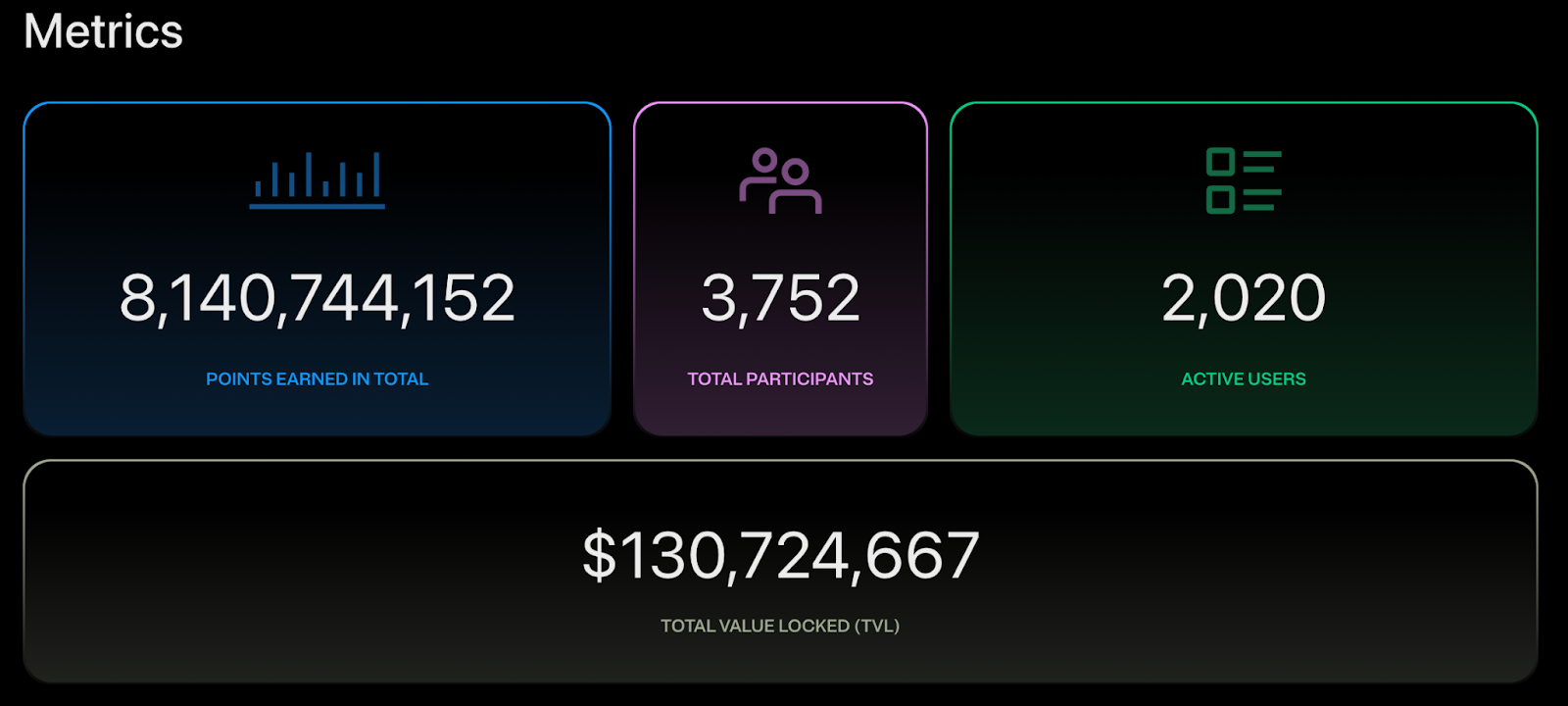

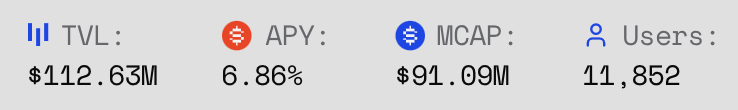

Level is a decentralised stablecoin protocol backed by $6.2M in funding from Dragonfly and Polychain Capital. With $91.1M in TVL but only 12,000 users, participating in Level's XP program could offer significant returns.

Level enhances economic security in decentralised networks by integrating USDC & USDT into network defense mechanisms, turning idle assets into productive instruments.

It issues lvlUSD, a fully collateralised, yield-generating stablecoin, which can be staked for slvlUSD to earn sustainable, transparent, and risk-adjusted yields through DeFi lending and restaking protocols.

Given the wide range of assets and DeFi integrations, covering every strategy in detail isn't practical. Instead, we'll focus on a beginner-friendly approach that also captures the upside in a second application.

For our readers who are more comfortable navigating between different protocols, we would also recommend considering the YT lvlUSD 29May20025 pool offered by Pendle.

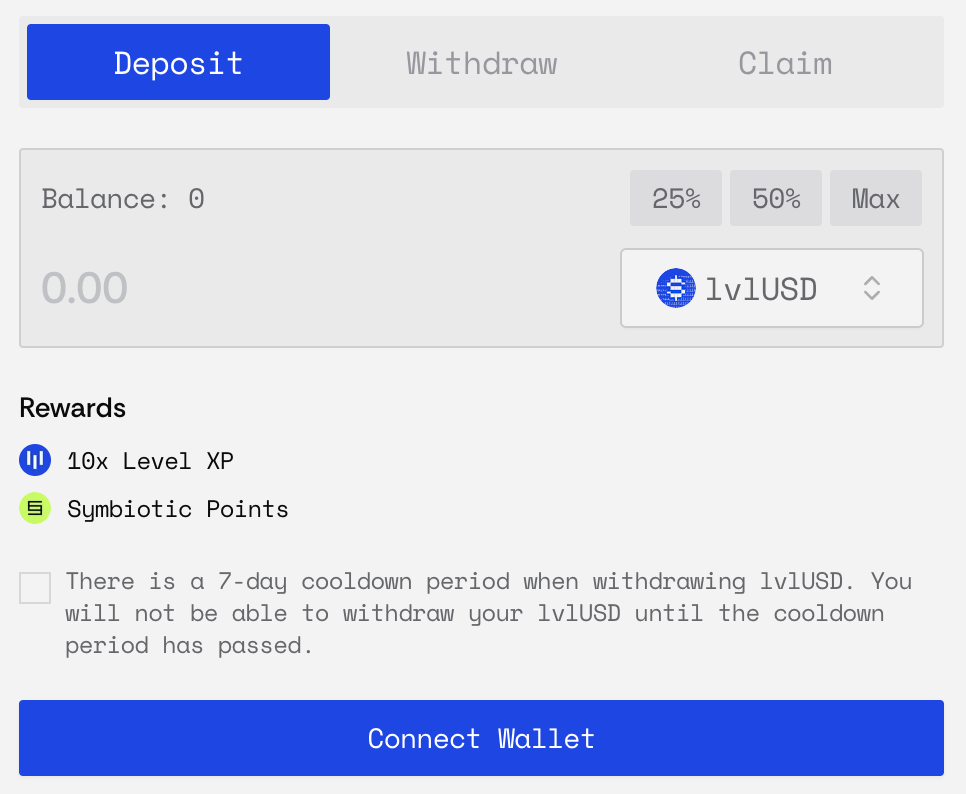

The simplest method is to simply deposit lvlUSD into the XP farm. This will earn you 10x Level XP and Symbiotic points as a bonus.

Here is how to farm this airdrop: To get started, you'll need funds on Ethereum L1

- Step 1. Visit the Level app

- Step 2. Click the top-right "Connect Wallet" button on the app to connect your wallet.

- Step 3. Review Level's Terms of Service and Privacy Policy. Click "Agree" to confirm your acceptance of both.

- Step 4. Click on "Buy" on the left-side menu (highlighted in red below).

- Step 5. Select the asset you want to use to buy lvlUSD, enter the amount, and click "Increase Allowance", then confirm the transaction in your wallet.

- Step 6. Once the allowance transaction is confirmed, click "Buy lvlUSD" and approve the transaction in your wallet.

- Step 7. Wait for the purchase transaction to confirm. Congratulations! You now own lvlUSD. A popup will appear, highlighting different ways to use your lvlUSD.

Farming lvlUSD

- Step 1. Visit https://app.level.money/farm

- Step 2. On the right-side panel, ensure the "Deposit" tab is selected. Next, click on the asset list and choose lvlUSD or your preferred asset for farming. Rewards and the 7-day cooldown period will vary based on the asset you deposit. In the case of lvlUSD, deposits earn 20x Level XP + Symbiotic points as rewards. Additionally, withdrawing lvlUSD from the farm incurs a 7-day cooldown period.

- Step 3. After selecting the asset you'd like to deposit in the farm, enter the desired amount, then check the box acknowledging the 7-day cooldown period for withdrawing lvlUSD from the farm. Finally, click "Increase Allowance" to proceed and confirm the transaction in your wallet.

- Step 4. After the allowance increase transaction is confirmed, click the "Deposit lvlUSD" button and approve the transaction in your wallet.

- Step 5. Wait for the purchase transaction to confirm. Congratulations! You are now earning Level XP. The "Farm" dashboard will update to reflect your current position(s), and your account status will change to "Earning XP".

Reservoir

Here is the last one for today. Reservoir is a next-generation stablecoin protocol developed by Fortunafi, a leading real-world asset (RWA) tokenization platform with a $48 million valuation and $9.51 million in total funding from investors like Shima Capital, Manifold, and industry leaders from LayerZero Labs and Llama.

Here is the last one for today. Reservoir is a next-generation stablecoin protocol developed by Fortunafi, a leading real-world asset (RWA) tokenization platform with a $48 million valuation and $9.51 million in total funding from investors like Shima Capital, Manifold, and industry leaders from LayerZero Labs and Llama.

Built on Ethereum with native cross-chain integration, Reservoir is designed to offer users high-yield stablecoin solutions backed by both digital and real-world assets.

You can view their proof of reserves here. Its native stablecoin, rUSD, will provide secure and transparent yield-generating opportunities across DeFi, requiring nothing more than a wallet and an internet connection.

Given the raised amount, the low number of current participants (under 4,000), and a TVL of $130 million, we believe Reservoir is another underfarmed airdrop opportunity. Similar to Level Protocol, there are a variety of DeFi integrations to choose from.

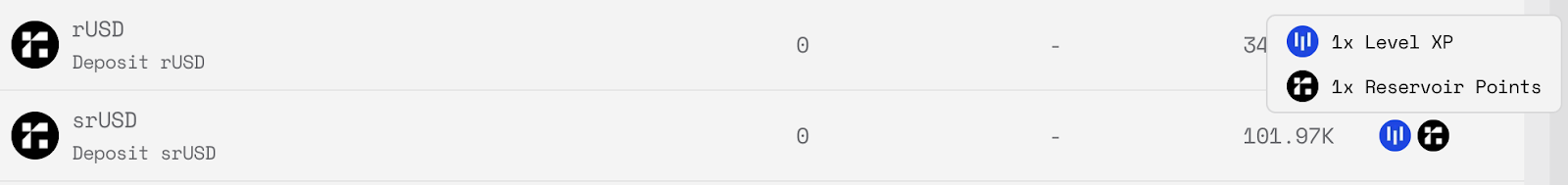

We believe the most capital-efficient strategy is swapping into the staked Reservoir stablecoin (srUSD) and then re-depositing that asset into Level. This approach earns 8% APY, a 1x multiplier on Level XP, and a 1x multiplier on Reservoir points.

Here is an action plan: How to buy srUSD

- Step 1. First, you'll need USDC on the Ethereum L1.

- Step 2. Head to the Reservoir app and navigate to the "MINT" tab at the top of the page.

- Step 3. Swap USDC for rUSD

- Step 4. Swap rUSD for srUSD.

- Step 5. Deposit srUSD into Level.

To deposit srUSD into Level, simply follow the same instructions from the previous section and substitute srUSD in place of lvlUSD.

Cryptonary's take

Stablecoins are more than just a safe haven in uncertain markets- they're the backbone of DeFi, facilitating liquidity, leverage, and yield across an evolving ecosystem. While the market remains choppy and directionless, there's no reason to let idle assets sit. With the right positioning, stablecoins can generate low-risk yield and unlock high-reward airdrops at the same time.That's exactly what we're focused on. Ethereal, Level, and Reservoir are three of the most underfarmed stablecoin protocols, each offering stacked incentives for early adopters.

This is Part 1 of our stablecoin airdrop series-with more opportunities to come. Stay early. Stay efficient.

Peace

Cryptonary, OUT!