What do we mean by re-rated? A large number of useless and scam assets are occupying the Top 10 and Top 20 largest by Market Capitalisation list. Two examples of low intrinsic value assets in those lists are BCH and BSV (even EOS).

What does re-rating look like? The useless assets dropping down the list and being replaced by brand new assets with higher value, as well as hype around them due to the novelty.

This type of hype, within the world of Decentralised Finance (DeFi) is not retail-based per se. It is based on products filling gaps in the market. The best part? These are products we can interact with and use rather than read about in Whitepapers and have an imaginative idea of what it would look like down the road, which is what ICOs have done (promises and mostly no deliveries).

The 20x token we invested in back in late October has already delivered a superb return and is on track to our target which is ending up being conservative too. We fully expect it to cement a place for itself within at least the Top 15 assets by Market Cap. We picked it up when it was still not even in the Top 40.

The asset we are investing in now has the strongest economic model (tokenomics) we have seen to date and it is not even in the Top 50. This one, our projection is quite high on. We believe it to be a token that can make its way to the Top 10 by 2022.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

DeFi’s Problem

Decentralised Finance is “Wall Street on-chain” without the corruption; the efficiency is superbly high. Most of DeFi today lives on Ethereum but there are so many blockchains out there and each one of those blockchains has its own native asset which does not necessarily live on Ethereum

There are solutions, bridges to transfer value from one chain to another and providers like BitGo (centralised) and Ren (decentralised) whom wrap BTC as an ERC-20 token. This makes it live within the Ethereum ecosystem and hence makes it tradable within Ethereum DeFi.

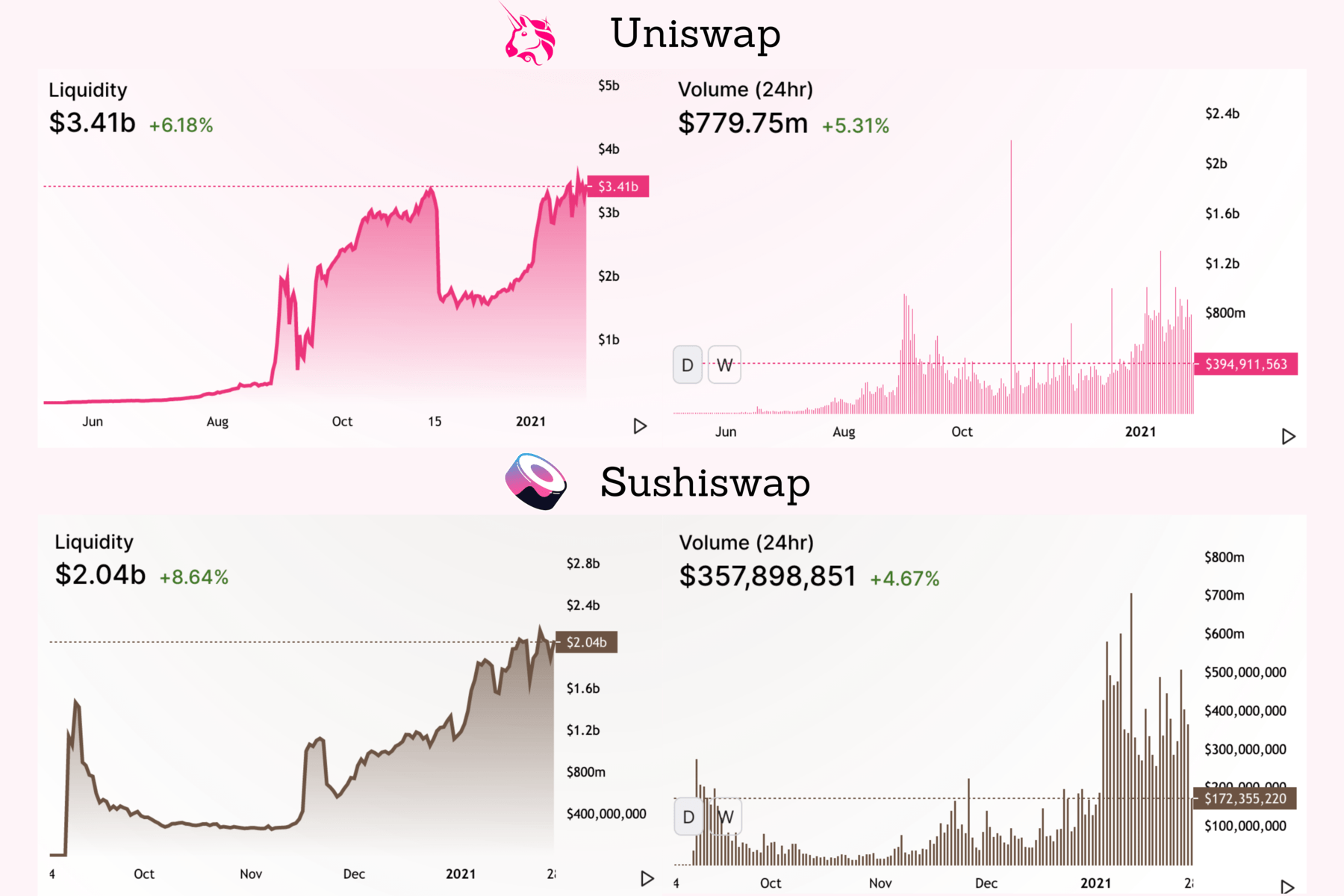

These allow for an entire ecosystem of on-chain trading through DEXes (Decentralised Exchanges) like Uniswap or Sushiswap. To understand how big those protocols are, let’s go through some numbers.

UNI (Uniswap’s Governance Token) has a Market Cap of $4.2 Billion and ranks 13th

SUSHI (Sushiswap’s Governance Token) has a Market Cap of $900M and ranks 41st

There is obvious demand and liquidity bootstrapped in those protocols. Given their parabolic growth and demand, can they overrule centralised exchanges? Not quite.

The reason is a two-part answer:

- UI/UX (however this can and will be simplified overtime by third party applications)

- Centralised Exchanges (CEX) are chain-agnostic

The latter means no matter the blockchain, the assets are interchangeable. For example, on a CEX you can exchange ETH for XRP. On a DEX like Uniswap, you can’t. The only way you could do it (which does not exist today) is with wrapped XRP presented as an ERC-20 token which you can unwrap through the provider and then get your XRP on the XRP Ledger. Tedious process right? Also too much friction.

The next innovation is Cross-Chain Swaps; which is yet to catch fire.

For the longest time we have been looking for a good market-fit, a good product that achieves this with their approach. The great part is we found one that both has a good product design that will fit the market, but mostly (for us investors) a hardened steel strong economic model.

Introducing THORChain

THORChain is a cross-chain swapping protocol. Simply put, it means you can have BTC and swap it for ETH if you wanted to through THORChain without having to deal with any centralised entity. This is a game-changer because up until this point, it did not exist.

This section will be dedicated to explain how this protocol functions. Our aim is to keep it as simple as possible but it may still get a little technical.

From a developer perspective, maintaining transaction security with no errors when dealing with cross-chain swaps is no simple task, which is why the devs have decided to combine multiple proven technologies to create the desired outcome rather than innovating from the ground up which may result in a longer trial/error process.

Here are the technologies they combined together (it’s technical):

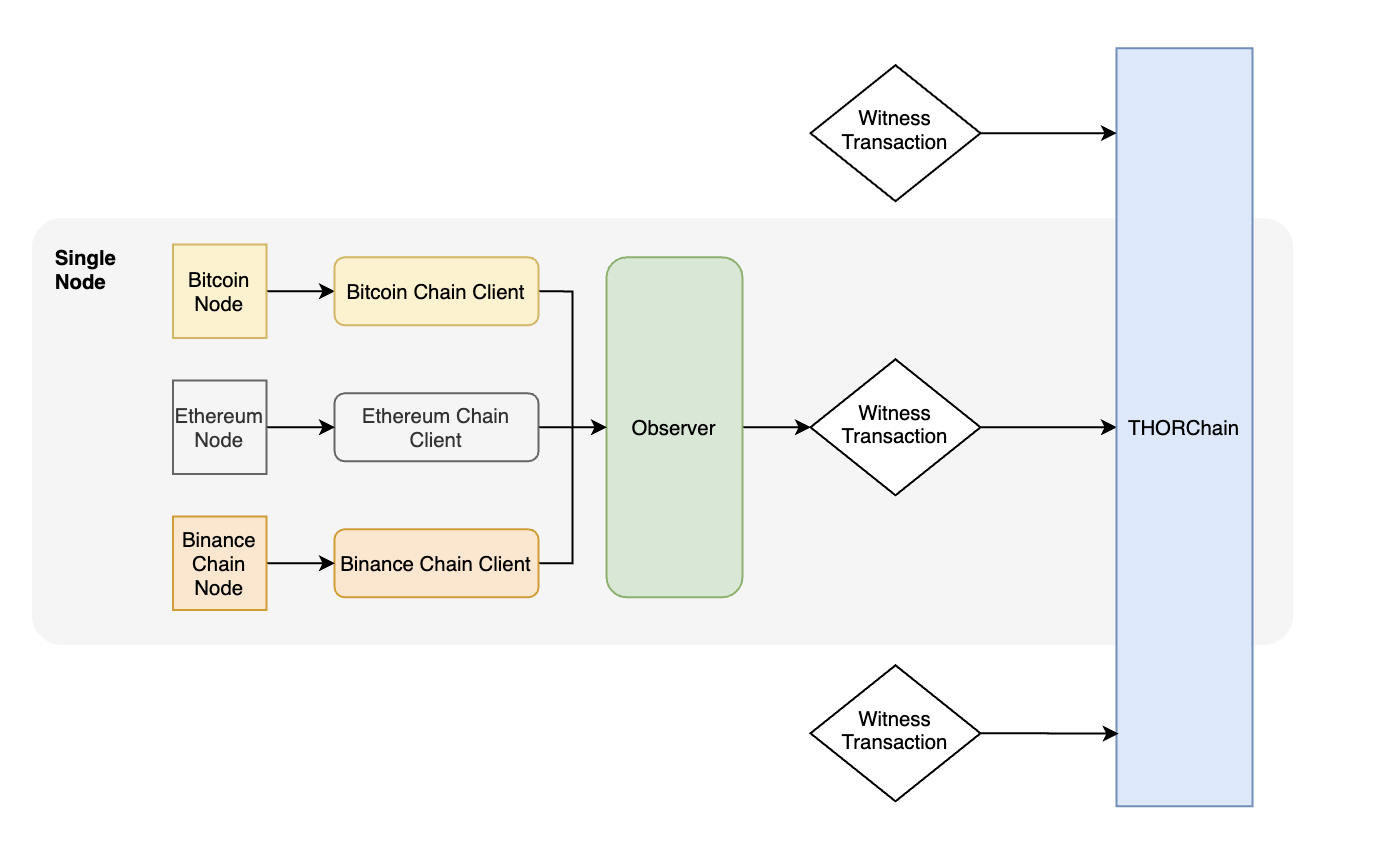

1. 1-way State Pegs (Bifröst Protocol)

In simple terms, the “Bifröst” modules deal with the differences in connection requirements needed by different chains (configurations/transaction details). Nodes keep watching Vault addresses on the integrated chains and whenever an inbound transaction is seen, a new THORChain witness transaction is created which registers the Tx details. Once majority of nodes agree on the transaction, it changes from a pending transaction to a finalised transaction.

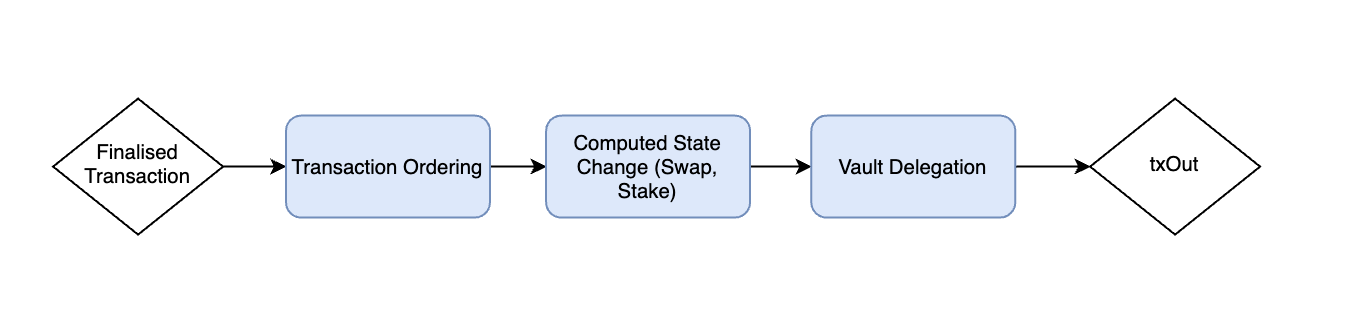

2. State Machine (dubbed THORChain State Machine)

Once the transaction is finalised, the state machine takes care of computing state changes, transaction ordering and delegates it to the outbound vault which finishes with the Tx out; it includes the outgoing chain in question.

3. Signer Module & TSS Protocol

As the final transaction is created, it is sent to the signer to serialise and send it to the required chain. The TSS (threshold signature scheme) protocol coordinates key-signing. Then the transaction is broadcasted.

Market Participant Roles

Participants in the THORChain ecosystem are split into four categories:

- Liquidity Providers: Providing assets to the pools to be traded against, they are paid a reward in exchange for that service.

- Node Operators: Process transactions and secure the vaults/assets.

- Traders: Use the protocol to swap one asset to another.

- Arbitrageurs: Capitalise from any price discrepancies which maintains an overall efficient pricing system.

In DeFi, most protocols employ oracles for price feeds such as Chainlink. However, these pose a threat: price manipulation of the indices to trigger unwanted events such as liquidations on protocols (called Oracle attacks, real example here). With arbitrage, any price discrepancy is always taken advantage of by traders/bots which maintains an efficient market, just like the price of Bitcoin or Ether is normalised between different exchanges (this is done through arbitrage).

Interfaces

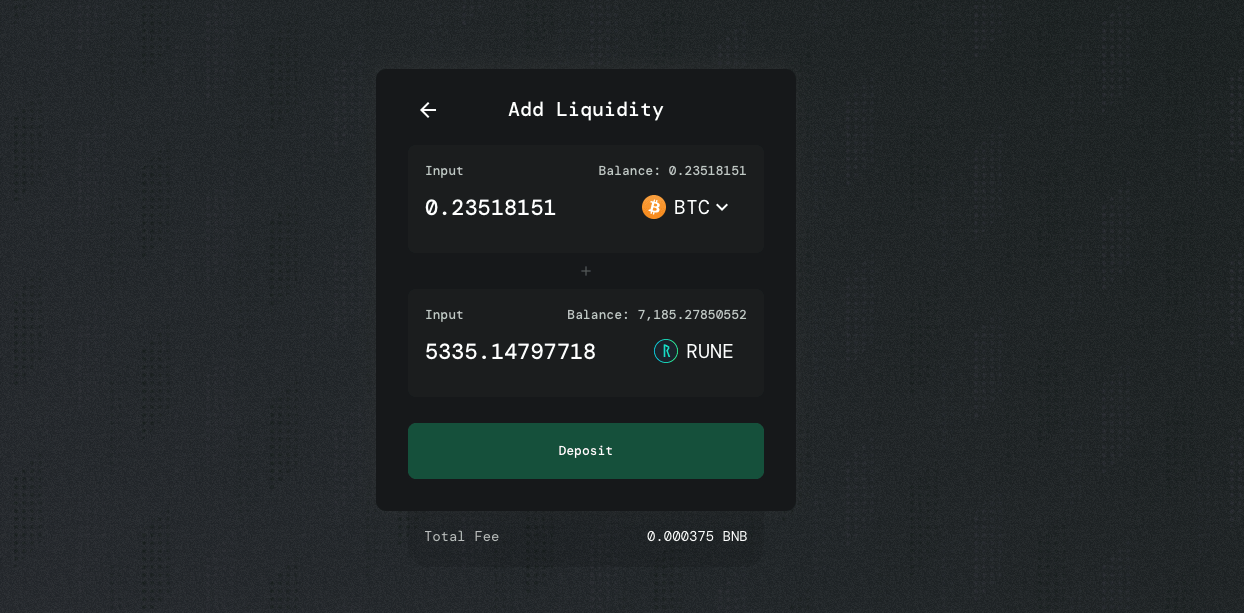

As of now, THORChain operates on BEPSwap. A DEX powered by THORChain validators who maintain the integrity and security of the pooled assets. This is limited to assets that live on the Binance Chain. The total notional amount of assets locked in Binance Chain DeFi is under $900 Million (remember this as it’ll come in handy later with the valuation maths).

The next interface that is currently in testnet is ASGARDEX, a DEX powered by THORChain which will power cross-chain swaps. The first chain being tested now to add after Binance Chain is the Bitcoin network. Once implemented (now in testnet) it will allow anyone to swap between BTC, BNB and any BEP2 asset. When Ethereum is added, the world of cross-chain swaps would expand massively given the $25 Billion locked in Ethereum DeFi.

The Token: RUNE

This is where things go up a notch. RUNE, by far, has one of the strongest economic models we have seen to date. As you know, one of the most appealing aspects of DeFi protocols is revenue which can is palpable by token holders/stakers. This gives intrinsic value to the assets. RUNE benefits from this revenue, but RUNE must also be kept 1:1 proportion in pools with other assets and its supply is limited (500,000,000 RUNE).

1. RevenueThe revenue is earned by liquidity providers and node operators. This comes from two sources: emissions (inflation) and protocol fees.

Inflation begins at 30% APR and drops to a smaller 2% by the end of the decade. Two-thirds of the emissions are sent to node operators whom process the blocks and the remaining third is shared between liquidity providers.

Fees are more sustainable source of income which has a very high ceiling with protocol adoption and use. The team also innovated a lot in this area.

The first type of fee paid is the Network Fee which both pays for network resources and external gas costs.

The second fee is the Slip-Based Fee. A protocol like Uniswap, charges 0.3% per transaction, regardless of the size of the pool being traded against. This poses a problem, if the BTC/USDT pool is attracting the most volume then naturally liquidity providers will gravitate towards it to capture the fees. This decreases the depth of other pools. By charging a slip-based fee, meaning a fee proportional to the order size/liquidity available, pool depths converge to the size of transactions passed through them.

Overall, this generates revenue for RUNE holders whom are active on the network. This gives the token intrinsic value. For example, RuneRanger whom has the minimum requirement for node operators (1,000,000 RUNE) earns a very handsome sum as detailed below.

My $RUNE node is currently printing me 860 $RUNE per day, roughly $1,550/day

That’s $565,000/yearHaters mad pic.twitter.com/F2RwLiET8W

— $RUNE Ranger 🔨 (@TheRuneRanger) January 13, 2021

2. Base Currency

Pools are one of the most impressive innovations in decentralised finance. Here is a brief explanation of liquidity pools in DeFi:

Collective assets/funds locked in a smart contract with which other traders can trade against. A liquidity provider provides both BTC and ETH to the BTC/ETH pool, a trader comes whom owns ETH and sells it to the pool in exchange for getting BTC. This liquidity that the trader requires is available for use at any time thanks to the pool. rather than orderbooks in CEX.

Why would anyone provide assets as a liquidity provider you ask? In exchange for earning trading fees.

THORChain operates in a similar fashion, pools to be traded against. However, if they are to offer BTC, ETH, BNB, XMR and XRP as assets and create every single combination possible, this would require 9 different pools for 5 assets and this number only grows (499,500 pools for 1,000 assets). Which makes having deep liquidity on each and every one of these pools an impossible task. Instead, THORChain uses a simpler approach: RUNE as the base currency.

In the example above, there would only be 5 pools needed: RUNE-BTC/RUNE-ETH/RUNE-BNB/RUNE-XMR/RUNE-XRP. Pools also must be 1:1 balanced. Meaning if there’s $1,000,000 worth of BTC in the RUNE-BTC pool, it must be balanced with $1,000,000 worth of RUNE. The more assets that make it onto the pools, the more RUNE captures in value. Given that there can only be 500M RUNE, this means the only way for any of this to be possible if THORChain is to be used and have deep liquidity, would be a ridiculously high price per RUNE.

The other aspect to factor in is, in a bull-market the value of the pooled assets increases which means the value of pooled RUNE must also increase. Additionally, due to the mechanism called the “Incentive Pendulum”, for each 1 RUNE pooled 2 RUNE are incentivised to be bonded by node operators.

TLDR: $1M in pooled assets (such as BTC, ETH etc) will cause the total value of RUNE to be $3M to reach equilibrium. (Keep this in mind as well as it will come in handy in the valuation maths section).

Incentive Pendulum

To maintain the 67/33 (~2:1) equilibrium in the network for optimal functionality between bonded RUNE and pooled RUNE, incentives are dynamically changed.

At any point in time, THORChain can be in one of five states:

- Unsafe

- Under-bonded

- Optimal

- Over-bonded

- Inefficient

Optimal State (67/33)

This maintains the reward distribution as is since the network is at an optimal ratio.

Unsafe State

In order to incentivise an increase in bonded RUNE, the rewards are skewed towards node operators until the Optimal State is again reached.

Inefficient State

The polar opposite of the Unsafe State, where pooled RUNE need to be increased and hence LP rewards are boosted to return the Optimal State.

Valuation

You read 2,000 words which helped you gain an understanding of THORChain and the economic model of its native token RUNE. Now we reach the bread and butter of this fundamental analysis report: Valuation.

As we stated at the start of this report, this token (RUNE) is one we expect to reach the Top 10 MCap list in 2022 due to an incredibly strong economic model.

Our crypto-market theory states the Total Market Cap reaches $3 Trillion in 2022 (this is conservative; ~3x from here). Given THORChain integrating both Bitcoin and Ethereum chains next, we’d likely see a very significant jump in pooled assets.

*With Binance Chain, the TVL is about $850 Million, Ethereum’s DeFi TVL is $25 Billion (30 times larger).

With cross-chain swaps going live, the volumes will ramp up as well which only generates more fees and encourages further liquidity to be provided, increasing the value of the RUNE pooled. (Positive feedback loop).

With a $3 Trillion in Total MCap, it is reasonable to project that THORChain (with first movers advantage) gains access to 0.5% of those assets. This is the equivalent of $15 Billion in liquidity is provided on the protocol. Due to protocol design, this means RUNE should have an MCap of $45 Billion, translating to $90 per token (500,000,000 tokens in total supply).

Our Price Entry

Our price entry objective is allocating capital to run at/under $3. Yes, RUNE has already began rallying but this does not mean we will be sidelined on its way to high 2 digits when it's at low 1 digit. We'll be buying over the next 48 hours to achieve a reasonable average price.Moreover, momentum in an asset shows market conviction. THORChain's product is not fully out yet, we may have come after the developers but we are certainly amongst the early investors in RUNE.

It is not always only about buying blood. Imagine if someone saw Bitcoin jump from $1,000 to $2,000 and decided to stay sidelined on a fundamentally sound asset because of what he "could" have done. It would be a tragedy.

Note: The short-term price action (positive or negative) does not interest us personally as this is a long-term investment for us. Had it been a swing trade, our entry and approach would have been different.

RUNE is in a bullish market structure of higher highs and higher lows all denominated in the chart above.

Looking at our $90 target, all of the current price action is dwarfed.

This is the bet that we are taking.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

RUNE Update | 23 November 2021

Despite being long-term bullish on RUNE, we cannot ignore the fact that it has entered a bearish territory after breaking the $11.50 line in the sand. Unless that level is reclaimed, we expect RUNE to chop and drop (per the Discord message above). The good thing is that $11.50 is about a 4X from our entry.