30X: Alive & Well or...?

The question is no longer which chain will succeed and render the rest of them obsolete. As we have seen with Layer 1 SZN throughout 2021, there is no “one-size-fits-all” solution. Each chain has its own use cases, capabilities, limitations, and offering.

Rather, the question now is very simple – how can we enhance cooperation between these chains and integrate them into a functional economic system that can rival that of the TradFi world?

It is one of the most pressing problems that is stunting the growth of the market, and the adoption of blockchain technology on a global scale. The issue affects everything from user experience, to innovation, and there is no solution that has been universally adopted by the market to date.

However, we do have some solutions that have moved beyond the theoretical stage and are functional – Cross-Chain Liquidity Pools. Let’s dive in!

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

TLDR

- Automated Market Makers have already created many alternatives to centralised exchanges, such as Binance and Kraken.

- The complete decentralisation and automation of swapping and moving wealth have already been achieved.

- THORChain has created a functional solution for cross-chain swaps, meaning wealth can now be moved across chains.

- Scaling the solution and improving user experience is the next phase for the liquidity pool model of cross-chain communications.

Automated Market Makers

Those who have been in the crypto space for a couple of months will no doubt have heard of decentralised exchanges (DEXs) such as Uniswap, SushiSwap, PancakeSwap, Raydium – the list is extensive. Most ecosystems have some form of DEX as part of their core infrastructure. Swapping assets is by far the most common transaction that most people will carry out in their day-to-day business.All these exchanges have a lot in common - they all work using some variant of the Automated Market Maker (AMM) model:

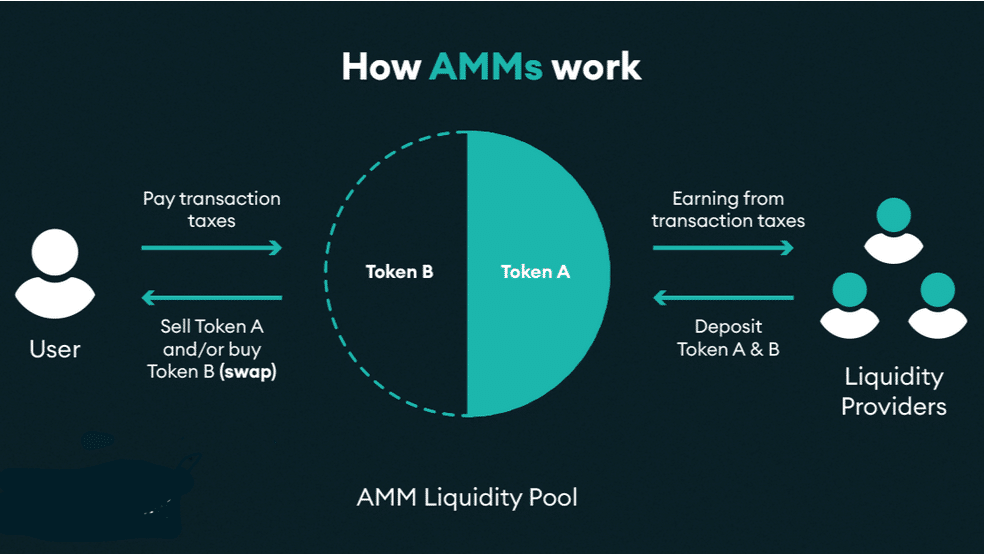

To summarise:

- A pool of assets containing two tokens exists. For the purposes of this example, Token A and Token B.

- This Liquidity Pool is funded by Liquidity Providers who deposit their funds into the pool – half Token A and half Token B.

- A user comes along looking to swap some amount of Token B for an equal value of Token A.

- The user connects their wallet, and a smart contract executes the trade – Token B is deposited, allowing Token A to be withdrawn.

- For the service that has been provided, the user is charged a transaction fee over and above the standard gas fee.

- Liquidity Providers receive this extra fee paid as a reward and incentive to keep their assets in the pool.

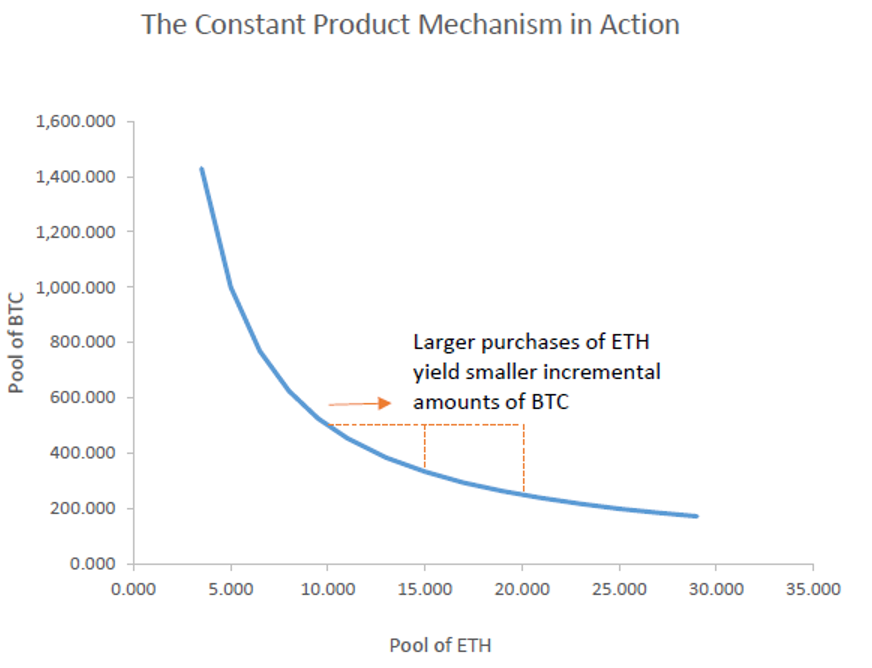

- The ratio of the assets in the pool determines the relative value of the assets – visualised for a BTC-ETH pool below:

Automated Market Makers do not require a centralised entity to facilitate the buying and selling of assets. Looking at the chart above, hopefully, you can see that supply & demand is still a driving factor behind making a market, however it's completely automated. The Liquidity Providers essentially become the exchange and the whole process remains trustless, permissionless, and completely decentralised.

And these DEXs are excellent at what they do! However, for the most part, they only allow users to swap assets that have the same token standards. Want to swap some ERC-20 USDC for ETH? Great! SushiSwap can facilitate that. Want to swap BNB for ETH? Errr – you’ll have to look elsewhere.

Monetary Interoperability

It is impossible to use ETH on the Solana blockchain because the token standards are completely different. ETH cannot exist as an ERC-20 token anywhere other than the Ethereum blockchain. The same is true for any other native asset you can think of – that should be clear at this point.We already have a method for decentralised transactions on a single chain using the AMM model outlined above. However, for security, and for decentralisation when transacting between chains, there must be another layer to the transaction – an intermediary that can communicate with both the initial and destination chains. Recording the transfer of wealth between chains is just as critical as recording any transaction on a single chain.

Luckily, one of the best examples that we currently have for this kind of infrastructure is our very own 30x token….

THORChain

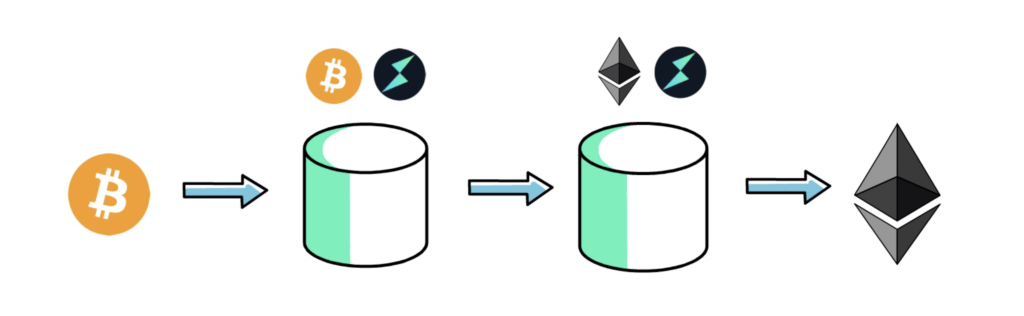

THORChain is a pseudo-DEX that provides a method for users to swap between native assets. Users can swap BTC to ETH, BTC to LTC, BTC to BNB, ETH to BNB, LUNA to BTC…. Any supported asset can be swapped to any OTHER supported asset. Direct swaps - no bridging, no wrapped assets, etc, with the results of any transaction recorded on all relevant chains. Complete continuity from chain to chain.

But how is this possible, you ask? I thought you said there was no way for transactions to be recorded across chains?

Remember the AMM method that we outlined above, where Liquidity Pools are used to facilitate trustless transactions? That’s exactly how THORChain works, but with a couple of extra steps:

- THORChain uses a technology called the Bifrost (Bridge) protocol, which runs a full node for each of the chains that are supported by THORChain. This allows the protocol to record deposits and withdrawals into the respective vaults, on-chain, for each chain.

- The Bifrost can also communicate with the THORChain blockchain, an independent blockchain that essentially acts as a “witness” to transactions that occur on the other chains.

- When a user wants to swap from BTC to ETH, several things happen:

- Their BTC is deposited into the Bitcoin Vault, with the transaction registered on the Bitcoin network.

- The Bifrost confirms that the BTC is in the Bitcoin Vault and registers a “witness” transaction on the THORChain network.

- Once this transaction has been confirmed, THORChain initiates a swap.

- ETH of equal value to the BTC that was deposited into the Bitcoin Vault is released from the Ethereum Vault, and the outbound transaction is registered on the Ethereum blockchain.

- The user is credited with the ETH, and the transaction is complete.

Externally, it appears to the user that they have just swapped BTC to ETH in a single transaction. Internally, however, RUNE has acted as an intermediary asset:

- RUNE is the second asset that must be deposited when a Liquidity Provider adds liquidity to one of the pools.

- The ratio of the RUNE and BTC in the RUNE/BTC Liquidity Pool is compared to the ratio of RUNE and ETH in the RUNE/ETH Liquidity Pool.

- Example: There are 10 BTC and 10,000 RUNE in the RUNE/BTC pool, implying 1 BTC is worth 1,000 RUNE.

- There are 100 ETH and 10,000 RUNE in the RUNE/ETH pool, implying 1 ETH is worth 100 RUNE. This is how the protocol knows how much ETH to send to the user.

- When a swap occurs, the users 1 BTC is deposited into the BTC pool, and 1,000 RUNE is sent from the BTC pool to the ETH pool – remember, the pool must always be balanced.

- Now the RUNE/ETH pool has a surplus of 1000 RUNE – how much ETH does it need to move to get back to equilibrium? If 1 ETH = 100 RUNE, then 10 ETH must be withdrawn from the pool to restore the proper ratio.

The Future

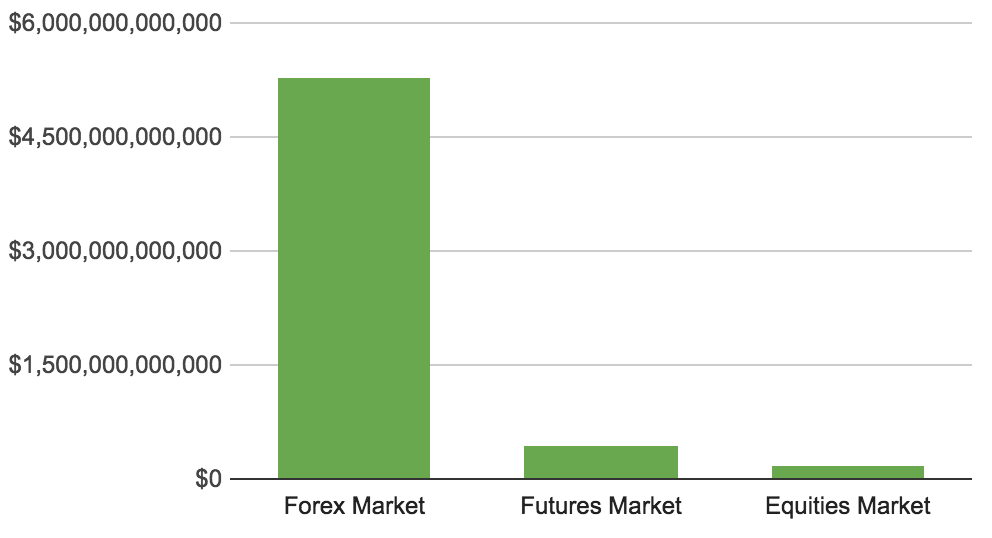

The Liquidity Pool model for cross-chain communications is becoming increasingly popular as a method of moving wealth around between independent chains. Important note: when using a multi-chain DEX such as THORChain you are not moving the assets between chains – you are moving value.The FOREX market(s) allows participants to buy/sell/exchange fiat currencies. There are many reasons an individual or entity would want to change one currency to another – hedging, speculation, etc. The market operates as a global network of computers and brokers around the world, and this network handles TRILLIONS in volume every single day - ranging between $5-6 trillion daily in 2019.

It is the largest and most liquid market on Earth, estimated to be worth $2.4 QUADRILLION.

Now, consider everything that has been written above:

- Instead of a centralised broker handling trades, we have Automated Market Makers.

- Instead of fiat, it is crypto that is being exchanged.

- BTC -> ETH on THORChain (Cross-Chain)

- ETH -> UNI on SushiSwap (ERC-20)

One issue facing this model is that there is currently only enough liquidity to support 6-7 figure transactions at any one time without substantial slippage. For most individuals, this is fine. However, for the likes of Do Kwon trying to move billions of $ of BTC, there is still no good way to do this. The model scales though, with the Liquidity Pools essentially acting as one big bank – the yield/interest being generated by swap fees.

Centralised exchanges still have a monopoly over the point of access for most individuals. However, the growing adoption and acceptance of cryptocurrencies have opened a lot of doors for DeFi protocols that would have been impossible just a year or two ago. The future is bright… The future is multi-chain.