30x Token: Ecosystem Development

In early 2021, we released a report on a protocol that we believe will have a central role to play in the future DeFi economy. To say it has been a bumpy road to get to where they are now is an understatement - the past few months have been eventful to say the least.

However, the one thing that has remained constant is the development and expansion of the ecosystem built on this protocol. Several projects are now at the stage of fruition and will be launching tokens of their own over the next few weeks.

One project in particular has caught our attention, with solid value accrual and community incentive – something that we feel is extremely important for any protocol, especially one as young as this.

In this journal we will be covering the fundamentals of this project, what the revenue generation looks like, and how we believe this protocol can propel the entire ecosystem going forward into the final quarter of 2021 and beyond.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

TLDR

- Built on THORChain, THORSwap is the world’s first multichain decentralised exchange (DEX).

- THORSwap aims to become the leading cross-chain DEX aggregator.

- THOR is the utility and governance token of THORSwap, offering a robust revenue capture/value accrual model.

- There will be a THOR IDO towards the end of October on THORStarter, capped at $300 per wallet and limited to 2,500 wallets.

- The IDO will be followed by a RUNE-THOR liquidity pool.

- Further details are not available at the moment.

What is THORSwap?

Most decentralised exchanges are currently built on a single chain – for example, SUSHISwap on Ethereum and Serum on Solana. Additionally, these exchanges use bridging and wrapped tokens to facilitate the trading of tokens that are not native to the chain the DEX is built on. Wrapping tokens adds another layer of complexity, and risk, to the already complex DeFi user experience.

Powered by THORChain, THORSwap is a multichain DEX providing direct Layer-1 to Layer-1 swaps – no wrapped tokens, no pegged assets, it does exactly what it says on the tin. THORSwap was developed by the same developers behind BEPSwap, the original THORChain DEX from the single-chain chaosnet (SCCN) period earlier this year. BEPSwap was a massive success with over $5 billion in lifetime trade volume across 70 liquidity pools and was one of the key reasons the THORChain developers used to justify the rollout of multi-chain chaosnet (MCCN).

Currently, THORSwap only supports the assets and chains that are available through THORChain, which is around 20 different assets across 5 Blockchains - Bitcoin, Binance Chain, Ethereum, Bitcoin Cash, and Litecoin. Due to exclusively using liquidity from THORChain, THORSwap is limited to offering only short tail crypto assets. A short tail crypto asset is a high volume/high demand asset like Bitcoin, or Ether, also known as an “economically significant” asset.

A long tail crypto asset is a low volume/low market cap/lower demand asset, which is basically any asset outside of the main Layer 1 tokens and coins – think UNI, SUSHI, RAY, etc. Currently, these assets must be approved by THORChain before a liquidity pool can be created for them. The next phase of their roadmap, THORSwap will look to provide long tail asset trading pairs across multiple chains. This will pave the way for thousands of supported assets and set the stage for THORSwap to become the go-to multichain DEX aggregator.

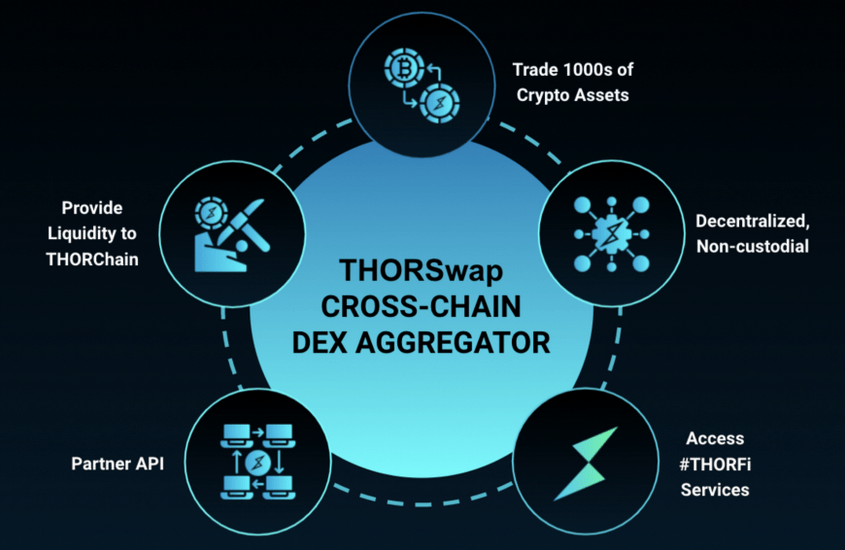

To achieve the vision of a trustless, decentralised, non-custodial multichain DEX, THORSwap has highlighted four key products that will be key:

- Interface - THORSwap will be the on-ramp to the wider THORChain ecosystem, with a slick GUI and comprehensive access point to other THORChain based products and services.

- DEX Aggregator – Leveraging and building upon THORChain’s technology, THORSwap will offer multichain swapping for thousands of assets across multiple blockchains at attractive rates.

- API – Provide partner protocols with the means to leverage THORSwap functionality/liquidity pools, indirectly expanding the user base.

- THORChad Rewards Platform – We covered THORChads briefly in this journal, however providing community incentive is paramount to building and expanding the user base of the protocol.

The Trading Blackhole

Central to the products outlined above is the “trading blackhole”. This is a perpetual positive feedback loop that provides incentive for the growth and adoption of THORSwap as the leading multichain DEX:

- Discounted trading fees provides incentive for using THORSwap over other DEXs.

- This leads to increased trading volume on the platform.

- Increased trading volume leads to more revenue from trading fees.

- More revenue leads to more value for the THORSwap community.

- Adding value for the community ultimately provides incentive to use the platform, bringing us full circle.

Central to THORSwap is cross-chain DEX aggregation. An aggregator in this context is essentially a price comparator – a DEX aggregator scans for the best prices for whatever asset the user is trying to swap and routes the trade to that liquidity source. THORSwap is in a particularly attractive position to take advantage of this utility due to the cross-chain nature of THORChain and the THORSwap DEX.

Of course, the success of THORSwap is dependent on the success of THORChain, which has been hindered by the exploits earlier this year. However, having followed developments closely over the past few months we are confident that the worst of the fallout is behind THORChain.

This brings us on to the next point – how does the community benefit from fee revenue and liquidity pools?

Liquidity Providers

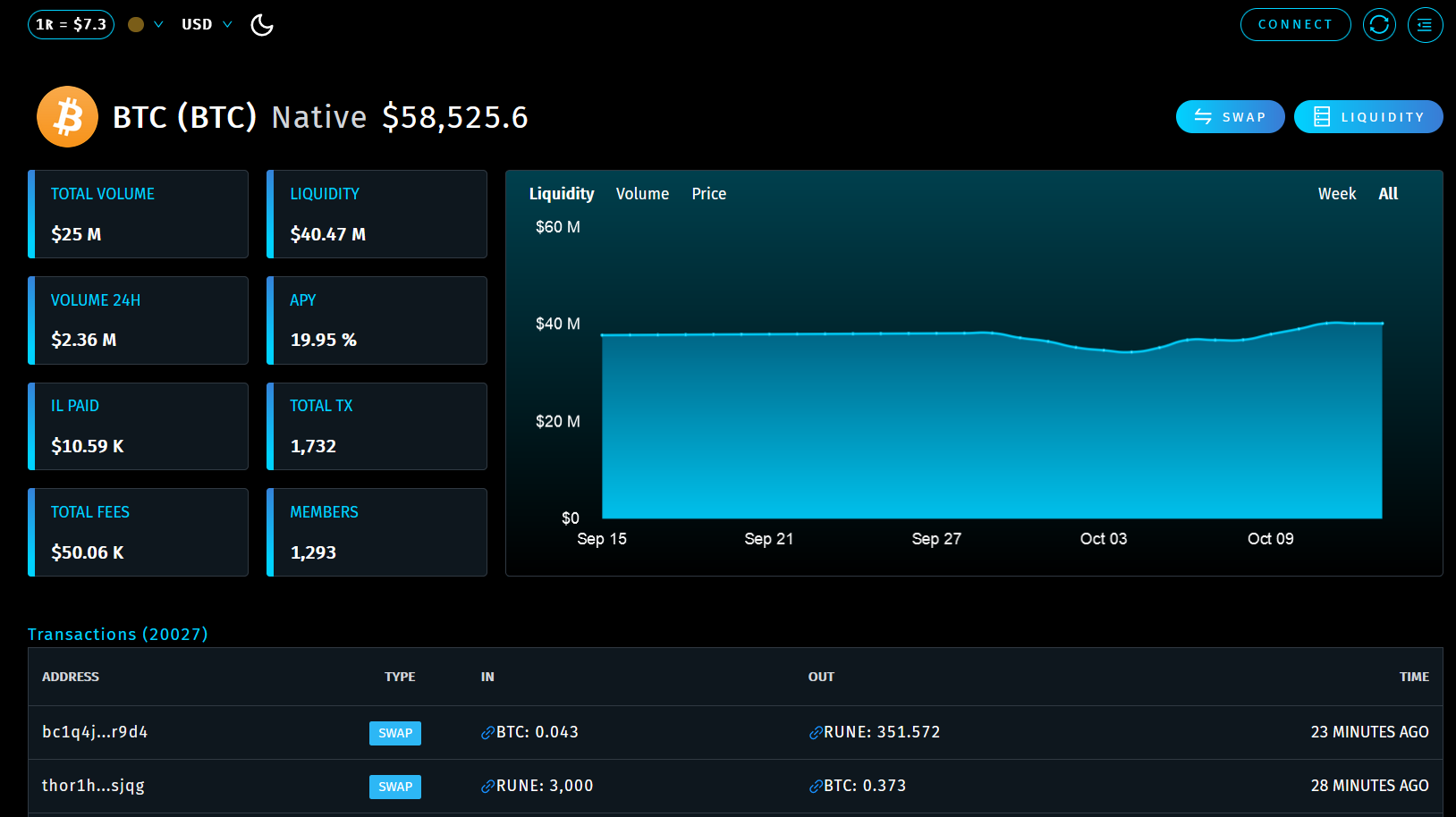

Users can add liquidity to the various liquidity pools for each asset available through THORChain/THORSwap to earn a share of the fees generated from trading and slippage. We have covered how it all works and the risk involved in this journal. Native RUNE is required, as well as the native version of the second asset – in the above example, Bitcoin.

As stated in the 30x interest journal, impermanent loss and other risks are involved when providing liquidity in any liquidity pool (LP). There is impermanent loss (IL) protection paid out by the THORChain treasury to incentivise risk-free liquidity providing, but this is only for the early stages of development to attract liquidity. There is currently no option for single-sided staking of RUNE, or any other asset traded on THORSwap.

For some, this is a problem. Although there will likely be options in the future for pooling RUNE into delegated nodes, this currently isn’t the case. Is there another way to gain exposure to fees and revenue without the risk of IL or an exploit draining a pool? We think there will be soon!

THOR Token

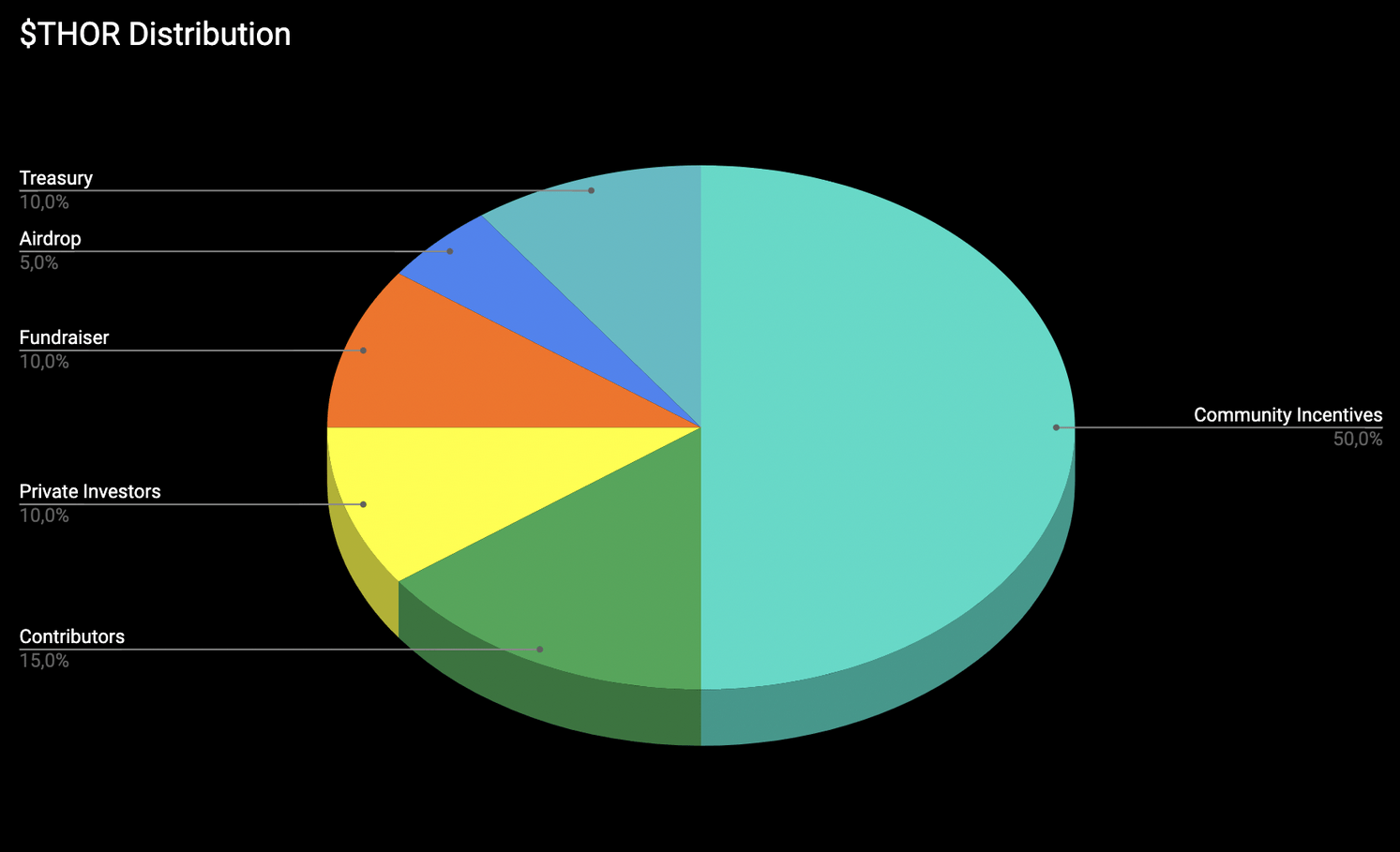

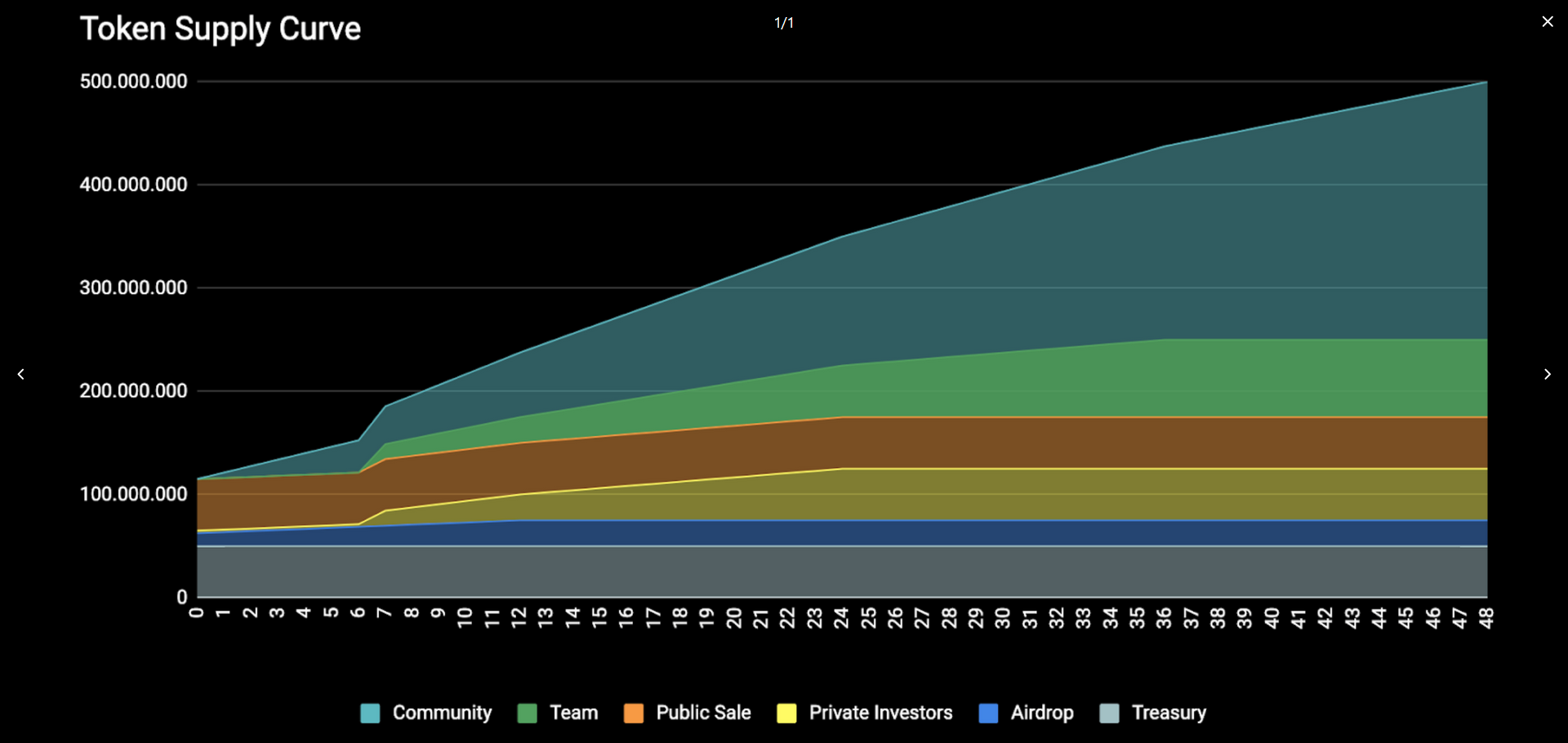

THOR is an ERC-20 (Ethereum chain) asset and is the utility and governance token for THORSwap. Whilst the main purpose of RUNE is to incentivise liquidity, the main purpose of THOR will be to incentivise trading activity on the THORSwap platform (remember the black hole?). In this respect, RUNE and THOR will have a cooperative relationship, with RUNE attracting the liquidity necessary to support high volume trading activity incentivised by THOR.The maximum supply will be 500 million tokens, with an initial circulating supply of 115 million THOR. The token allocation and emissions schedule is as follows:

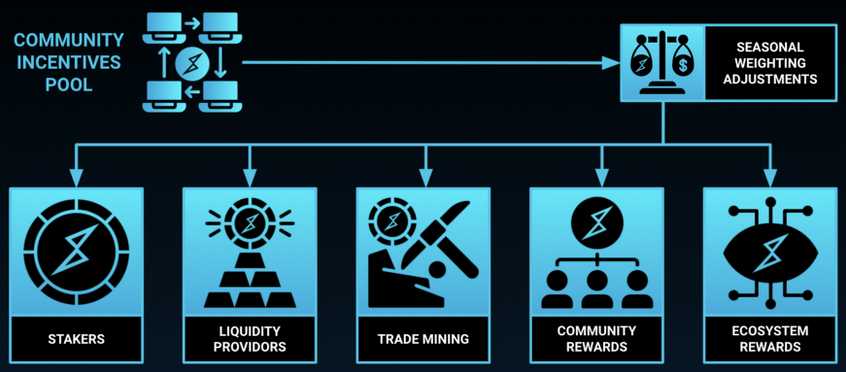

- 50% for Community Incentives – mining, LP rewards etc.

- 20% for Private/Public Sale (fundraiser), divided 10% public sale and 10% private – early investors do not receive a discount so there will not be a supply spike when the token launches.

- 15% for the THORSwap Team/Contributors, with a heavy vesting schedule laid out over a 36-month period.

- 10% for the THORSwap Treasury.

- 5% will be Airdropped.

The THOR token supply will be emitted over a period of 4 years, after which the entire supply will be in circulation. Most of those emissions dedicated to community incentives, and THORSwap has stated that there will be sufficient utility in holding and using THOR to counteract the inflation stemming from rewards.

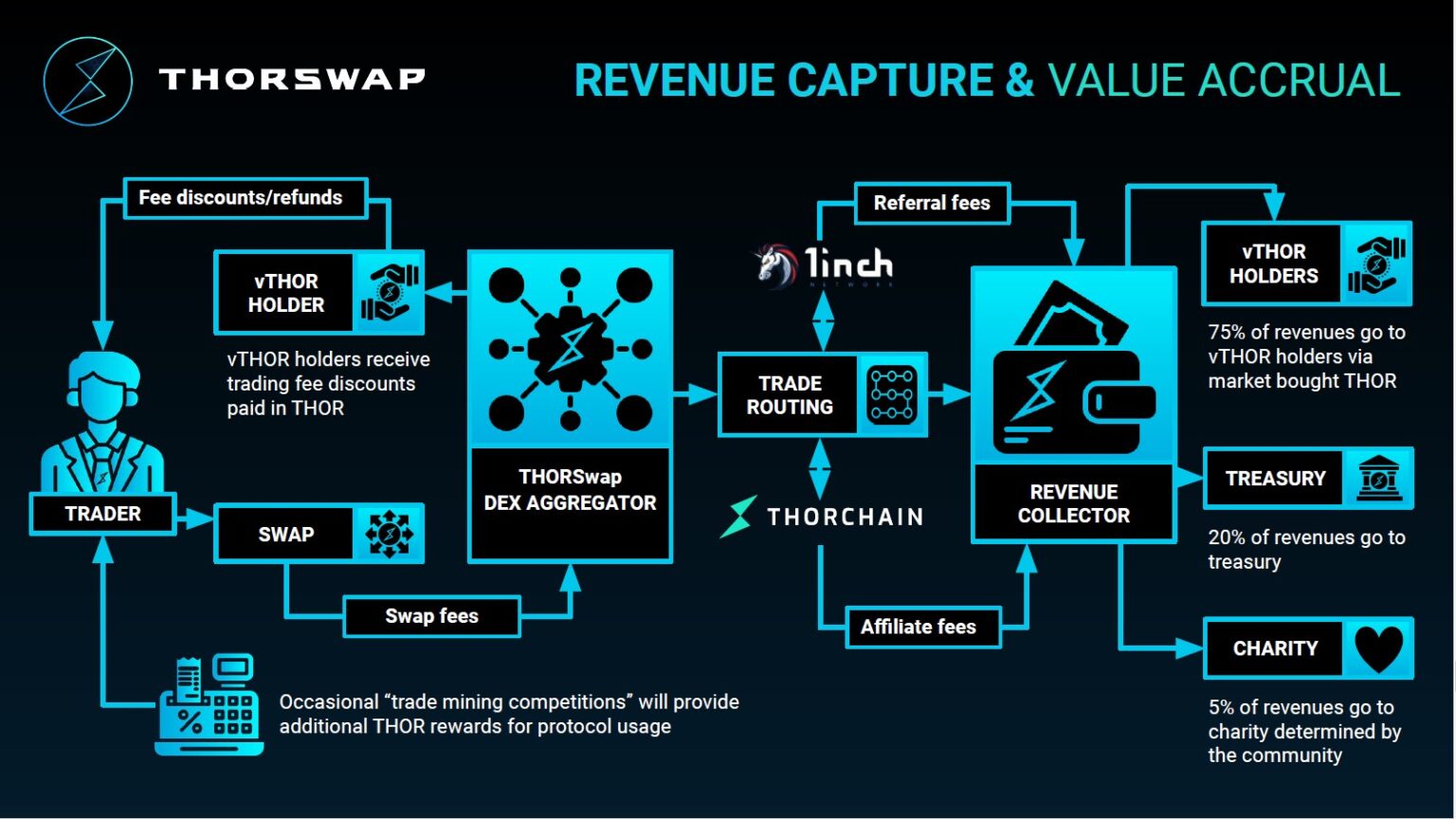

The THOR token will also act as a “proof of membership” token - THOR holders will be able to stake their THOR and receive vTHOR tokens which entitles them to a share in THORSwap revenue, voting rights in the DAO, THORSwap trading fee discounts, and a THORSwap membership that will likely entitle them to future airdrops and other perks.

We believe that the single-sided staking will be attractive to those who are put off by the prospect of LPing through THORChain. In this respect, THOR would act as an indirect way of gaining exposure to THORChain revenue and activity with marginally less risk involved. There is a relatively extensive revenue generation and value accrual model, outlined below:

- Affiliate fees from THORChain-routed trades.

- Referral fees from aggregators depending on the route of the swap - 1INCH is used as the example in the above flowchart.

- Value accrual from THORChain related projects like THORNames, THORChads DAO etc.

- Most of the trading fees will be distributed to vTHOR token holders (75%).

- 20% of all fees generated by the protocol will be allocated to the Treasury to fund operations and development.

- 5% will go to charity.

- Treasury funds will also be used to purchase THOR on the open market for weekly proportional redistribution to vTHOR holders.

THOR IDO

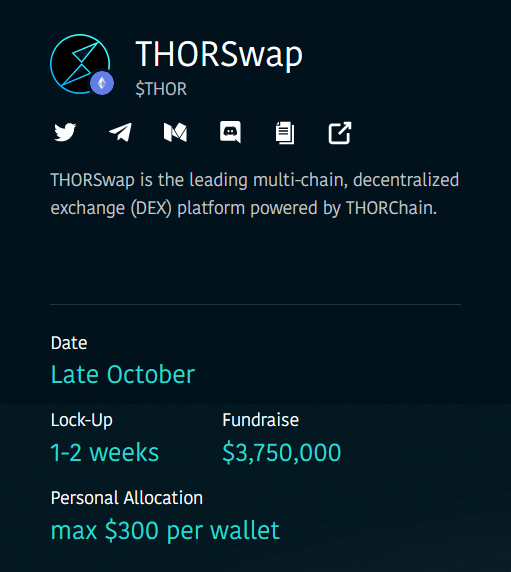

The date for the THOR IDO hasn’t been confirmed, however we do know some details of the mechanism:

- The IDO will be hosted on THORStarter towards the end of October.

- There will be a maximum allocation of $300 per wallet– this is not a guaranteed purchase as we expect the pool to be oversubscribed.

- There will be a THOR-RUNE liquidity pool launched soon after the THORStarter IDO which will be uncapped, and users will be able to swap RUNE for THOR with no imposed limits.