It’s been a while since our last update, and much has happened. Let’s dive into some developments, stats and facts to see where we’re at.

For existing holders, let’s see where things are going, and for those not yet in the know, it’s time to check out these two massive opportunities!

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility and yours only.

TLDR:

- Our conviction in the 30X ecosystem has continued to grow. Both THORChain and THORSwap have seen relentless development.

- THORChain ($RUNE) is a Layer 1 chain built to facilitate cross-chain swaps. THORSwap ($THOR) is the main user interface for THORChain.

- With BlockFi and other centralised finance (CeFi) markets defunct, much of the centralised competition in lending/borrowing has disappeared.

- THORChain is well-placed to sweep up this newly available market share.

- New products (e.g. THORChain Savers) and integrations (e.g. TrustWallet) continue to add value to both $RUNE and $THOR.

- THORSwap emissions have significantly decreased (by over 70%). Plus, an additional proposal to burn significant amounts of $THOR is also promising for its future price.

- $RUNE and $THOR remain attractive investments.

- Dollar-cost averaging is the best approach for investing in these assets.

THORChain ($RUNE) – The On-Chain BlockFi?

THORChain is a cross-chain decentralised exchange (DEX) that facilitates direct swaps between L1 tokens. It’s a Layer-1 blockchain built using the Cosmos SDK. The developers have been busy this past year. Each developmental stage has added value, which is priming the ecosystem for astronomical growth in 2023.Synthetic assets and mainnet went live with more chains added (Doge, Cosmos, Avalanche). We also saw the launch of one of the most significant features to date: THORChain Savers Vaults.

Introducing ThorChain Savers

THORChain Savers Vaults allow users to deposit assets to THORChain and earn yield. To say Savers launched at an opportune time is an understatement - 2022 was a horrendous year for CeFi, and THORChain is now well-positioned to scoop up the spoils.BlockFi, Voyager, Celsius… all were centralised lending platforms that offered great yield on $BTC, all mismanaged customer funds, and as a result, all of them are now bankrupt.

There are very few places (centralised or not) that still offer yield on Bitcoin. THORChain Savers Vaults is one of them. Users can simply deposit $BTC into a vault and earn yield. Previously, users could only earn yield by depositing to a liquidity pool. This comes with several risks though, like impermanent loss. (Impermanent loss is a phenomenon unique to liquidity pools whereby liquidity providers may end up with less value than if they had simply HODL’d the staked assets. Learn more here.)

The best part about Savers? It’s completely decentralised, with simple yield and no impermanent loss.

Let’s look at how the Vaults have been performing…

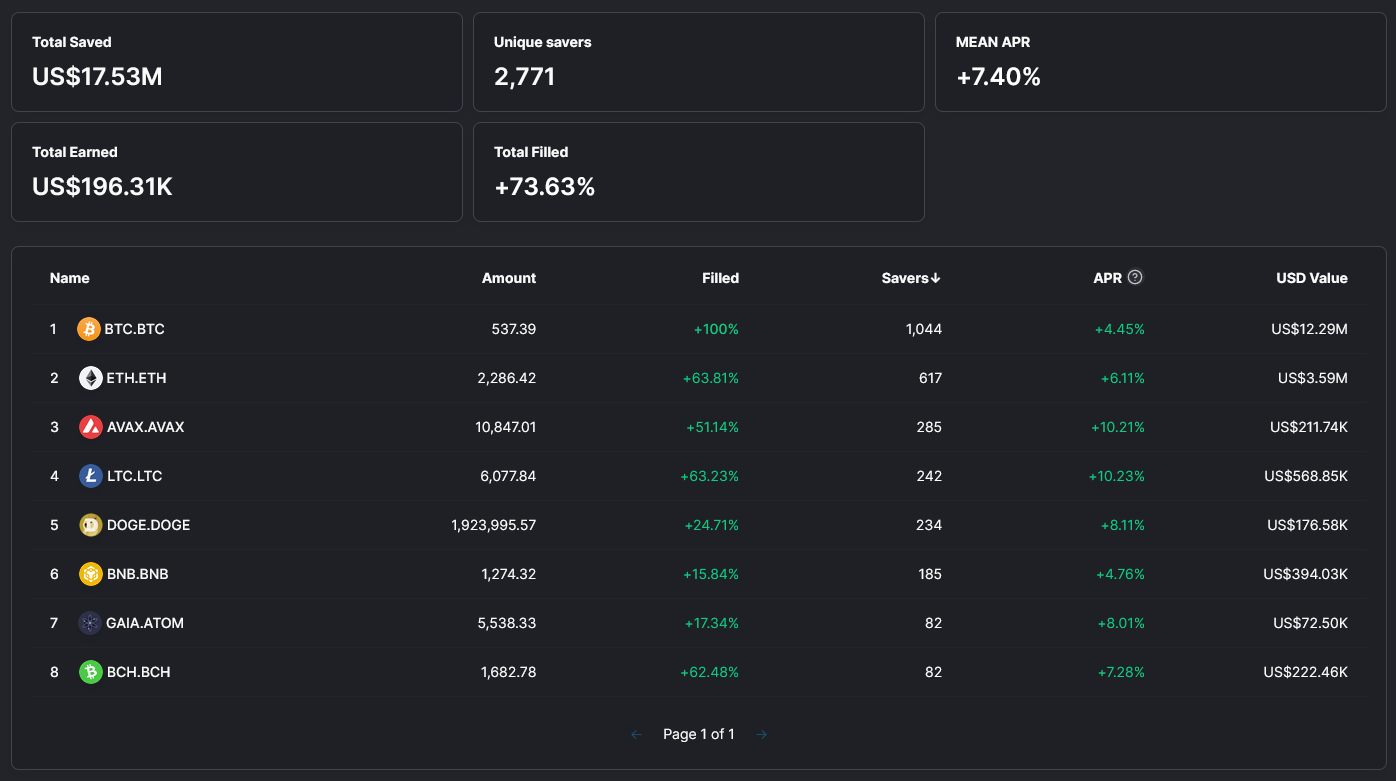

THORChain Vaults have a self-imposed cap on the total quantity of assets that can be deposited. The cap is suggested by the devs, and voted on by node operators. Caps are raised as confidence increases in the product over time. As we can see, the $BTC pool is completely full, with over $12 million in $BTC deposited and $17.5 million savers total value locked (TVL: a measure of all assets staked/bonded/deposited with a protocol).

In layman’s terms, the product is attracting users, and as expected, the main asset deposited is $BTC.

So, to summarise

- THORChain doesn’t lend out funds. Instead, assets are deposited into a liquidity pool and used by traders to swap. This is where the yield comes from (trading/swap fees).

- This differs from providing liquidity, as there’s only single-sided risk – no impermanent loss.

- THORChain Savers adds buy pressure to RUNE with each deposit.

- $RUNE benefits from this, and price increases

Ever-Growing Infrastructure

THORChain’s developers have been busy integrating it with back-end infrastructure. The most prominent example is its integration with TrustWallet. TrustWallet users can now swap cross-chain within the user interface.The key here is that users won’t even know they’re utilising THORChain. Yet the $RUNE token still benefits. It’s all about generating swap volume. The higher the volume, the more fees generated, and the more $RUNE supply locked up by liquidity providers.

All of this equals: $RUNE up.

THORSwap (THOR) – The Spiderweb DEX

Let's dive into our second asset, $THOR.THORSwap is the primary front-end for THORChain. Just like THORChain, THORSwap has been booming - 400%+ from its December low!

How does it work?

- When a user requests a swap, the DEX aggregator scans other DEXs and liquidity pools. The goal is to find the best possible deal for the user. Once this is found, the aggregator places the swap.

- THORSwap is a cross-chain DEX aggregator. It does the same thing as a regular DEX aggregator but across many blockchains and ecosystems.

- For instance, a user could swap from native $BTC to UNI (an ERC-20 token). The route would be $BTC -> ETH -> UNI. However, there’s no DEX that offers direct $BTC -> UNI swaps. THORChain offers $BTC -> ETH, and Uniswap offers ETH -> UNI.

- THORSwap combines the two into a single swap.

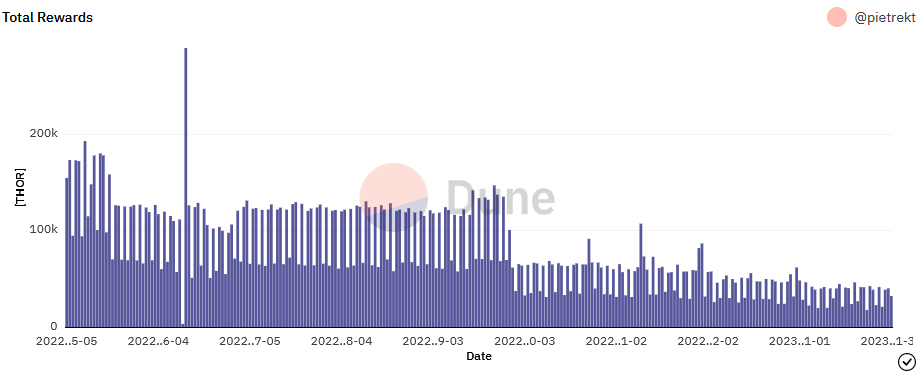

Yet, the key development that has flown under the radar is the THOR inflation cut. The $THOR token launched in November 2021, but high inflation and the bear market drove its price way down.

The fact that devs have cut emissions, has raised another question, though. What should be done with the large community allocation?

THORSwap’s fully diluted valuation (FDV: the theoretical market cap of the crypto if all tokens were in circulation) is now quite high (5:1 ratio with market cap). This means that $THOR must inflate +400% before the max supply is reached.

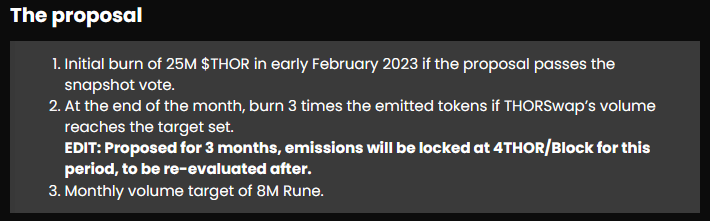

The solution? There’s a proposal to change this:

Here’s the plan. Basically, 25 million $THOR will burn straight away. And, a large proportion of THOR emissions (an estimated 2.5 million) will burn each month.

Now, $THOR stakers already enjoy revenue sharing by staking. A reduction in $THOR (whether circulating or not) is a direct benefit for $THOR holders and stakers. Taking THOR out of circulation reduces supply. Lower supply, with the same level of demand = higher token price. Coupled with the drop in inflation, we would expect the price to reflect these changes.

2023 Expectations

Other than executed developments, here’s what we can expect in 2023:- Lending, the final piece of THORFi. By adding lending, THORChain will be able to compete with other DeFi and CeFi markets. We will cover this when more details become available.

- Saver’s cap raised and expansion of the product – more vaults, more assets, more yield.

- Wallet integrations – there are early-stage plans to integrate with MetaMask. This would be huge for obvious reasons.

- More exchanges and integrations with the THORSwap aggregator.

- THORChain order-books (limit buy/sell orders etc) – one step closer to a full centralised exchange experience, on-chain.

Cryptonary’s Take

Let's summarise…- $RUNE has more products and has started locking up circulating tokens. This equals positive price appreciation.

- $THOR has reduced emissions, potential burning, and revenue sharing is on the table. Its already low market cap sets it up for easy growth.

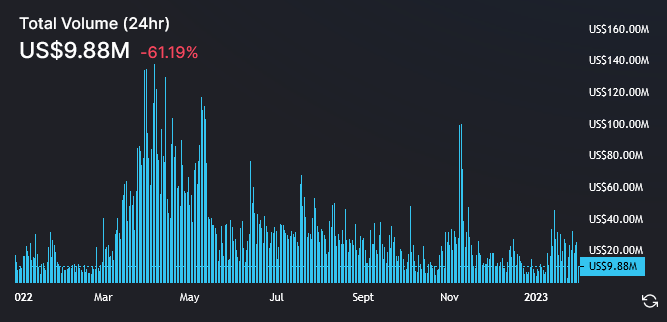

The bear market indisputably affected all corners of the crypto market, cross-chain swaps especially. When participants exit the market, they take their assets with them, severely affecting liquidity and activity-based protocols like THORChain.

However, when volumes increase, it becomes more attractive to deposit to a liquidity pool. When that activity returns, we expect significant movement.

And indeed, volumes are already starting to return on both THORChain and THORSwap.

Let’s take a look at some targets…

$RUNE:

With $RUNE back above $1.66, there’s no reason that $3 can’t be reached in the near term

Longer-term targets are $6, and $13. Our ultimate target remains $90.

$THOR:

$0.45 is a resistance level, and $BTC is nearing $25,000. This means there will likely be a more certain time to get in on THOR. Once it’s above $0.45, we should expect a clear road to $0.70.

Longer term, we’re still looking for a target market cap comparable to 1inch (check here).

For those wondering about our initial entries, here are the reports: THORChain & THORSwap. Stay up to date with our weekly technical analysis here.

Action Points

At this stage of development, here are the actionable items:- The long-term prospects for the THORChain ecosystem are excellent.

- We believe a dollar-cost averaging strategy is the best way to approach investment in this ecosystem.

- Alternatively, waiting for key support and/or a break of resistance (outlined above) would be a high R:R (risk: reward) move.