A deeper dive into our bet AI, memecoins, and Telegram bots

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

What if we told you some young hardcore researchers found a way to blend those narratives and are building a very intriguing product

Are you excited?

Even though we have covered multiple AI projects, Telegram bots and memecoins, we haven't seen anything like before.

Want to know more?

Let's get straight into our deep dive into…

TLDR

- Solana is a great market for launching TG bots. The Solana ecosystem loves Telegram bots; most TG bot activity happens there.

- This Telegram-based project built on the Solana blockchain aims to create powerful AI time-series models for getting powerful insights into crypto assets.

- Adoption is still in the early stages. However, partnerships and integrations are heating up, with some big market participants paying attention to the project.

- We believe it has a 10x potential in the base case scenario and 15x if it exceeds our expectations.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Solana x Telegram bots

Solana is known for its high speed and low transaction fees, making it an attractive platform for developers and users. Its unique applications, such as Nosana, IO.net, and Parcl (we may have a report coming soon), showcase the versatility and potential of the Solana ecosystem.Due to its unique monolithic scaling approach, which can handle high transaction volumes, Solana is popular among developers and hosts many innovative projects.

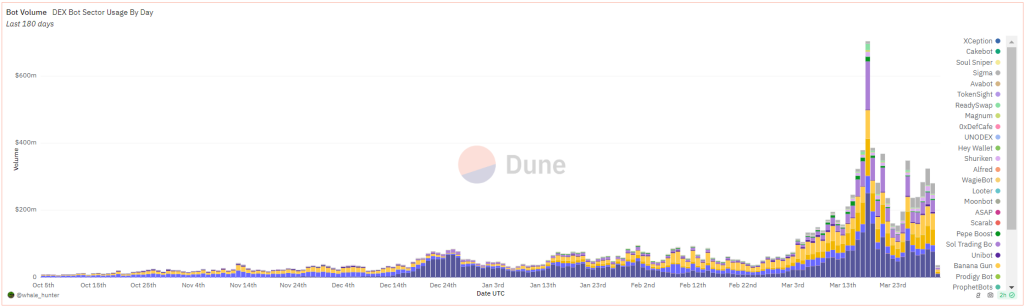

One innovation that became very popular during this cycle is Telegram bots (TG bots), which can be used for various purposes, including trading and airdrop farming.

We have previously covered TG Bots and expressed the view that TG bots are here to stay.

They are convenient, fast and easy-to-use tools that drastically improve UX when interacting with blockchains.

Not surprisingly, the adoption of TG bots has been trending up. More and more users prefer using TG bots instead of Web interfaces.

To date, almost 87 million users have at least once tried TG bots, and the adoption rate doesn't seem to be slowing down.

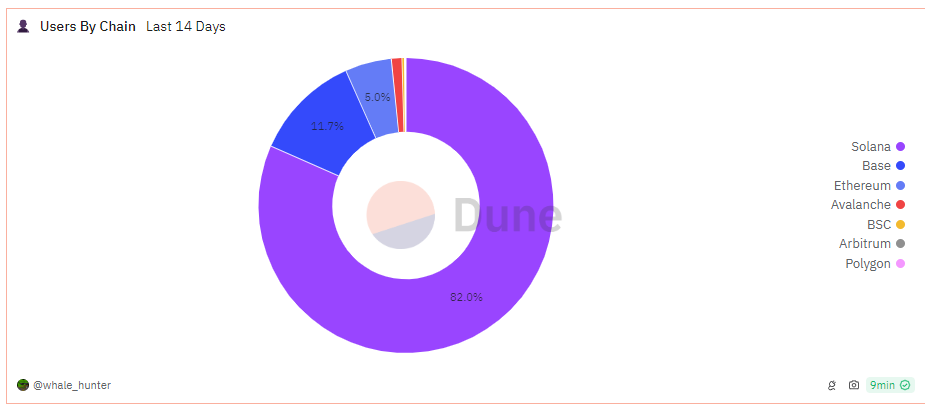

We can also see that Solana dominates the TG bots sector. More than 80% of TG bots users are on Solana.

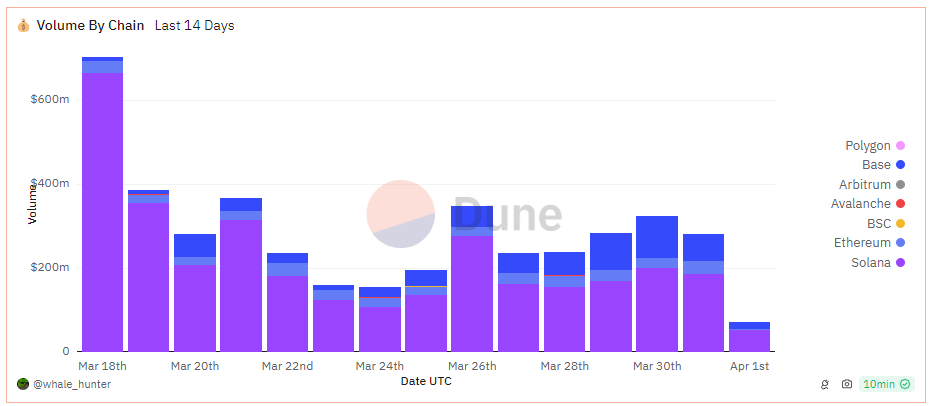

Looking at the volumes, Solana also dominates in terms of TG bots usage.

It is obvious that the Solana ecosystem is the place for TG bots. Recently, we spotted a new innovative bot that combines research based on AI and crypto investing—this is the first of its kind.

Introducing Deep Dive into…

Dither AI

Dither AI is a Telegram-based project built on the Solana blockchain that aims to create powerful AI time-series models for getting powerful insights into crypto assets. It was trained on open-source data from the Solana blockchain.Last week, we covered Dither and discussed how it currently has two products: DitherBot and SeerBot. Catch up on that introduction to Dither if you missed it.

While DitherBot aims to improve the efficiency of price discovery for financial assets, SeerBot intends to be an all-in-one trading product.

On the surface, if you think about Dither, you may be tempted to mistake it for a project using AI for trading signals; however, that is not the case. Trading signals is just one application of the foundational model they are building.

By the way, most AI applications are built on finetuned versions of the foundational models. For example, ChatGPT's GPT-3.5 and 4 are revolutionary chat applications. But before we got 3.5 and 4, there were GPTs 1, 2, and 3 that the public didn't experience. GPT 3.5 and 4 were only possible because of the finetuning that went into the foundational AI models.

Dither AI is currently at GPT-1 as it is building the foundational layer, which can later be finetuned to provide various applications such as smart money, semantic sniper, forecasting, sports betting, etc.

It is hard to tell what it will grow into, but our spider senses tell us it can develop into something amazing.

Adoption

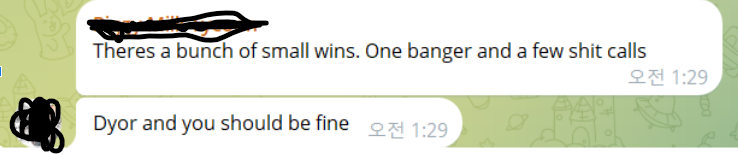

Currently, it has two private TG groups where it delivers its services: Standard and Premium. To gain access, a user must hold 2k DITH tokens for Standard and 50k for Premium.Standard is mostly used for memecoin trading, where there are many signals and quick insights into the tokens. Currently, it has around 900 users (members)

Premium is intended mainly for institutions. It launched just today, so there is not much information, except it is designed to offer much broader and deeper insights into the markets.

Currently, it has around 100 users (members).

The numbers show that we are in the early stages of the platform. However, we found that some big industry players are following the project closely, including the Co-founder of Delphi Digital.

We can see that the project has caught the attention of some big players.

Additionally, the team is making great efforts to onboard other Telegram bots and engage in partnerships with them, which leads to the next section.

Partnerships

Despite being in the early stages, it already has some notable partnerships and integrations. The integrators will pay referral fees, 50% of which will improve the liquidity of the $DITH token on the Solana blockchain.BonkBot, one of the popular TG trading bots, is one of the integrators of Dither's SeerBot. BonkBot has started with a small team and could build a product loved by Solana users.

Similarly, Dither is a small team of hardcore AI researchers trying to build innovative products.

Another integrator is the Trojan bot. Trojan bot, similar to BonkBot, is a sophisticated Telegram trading bot designed to enhance the cryptocurrency trading experience by merging the convenience of the Telegram platform with the capabilities of DeFi on the Solana blockchain. It offers a range of features that cater to beginners and experienced traders, making trading on Solana-based DEXes more efficient and user-friendly.

We believe that if successful, every trading bot will eventually integrate the SeerBot, which means $DITH will have very deep liquidity, which will open the door for bigger players to enter $DITH.

Tokenomics

Basic information

- Market cap (fully diluted): $23.5m

- Number of holders: 7k

- Top 10 holders: 21%

To gain access to the Standard group, a user must hold 2500 $DITH. For the Premium group launched just today, a user must hold 50k $DITH in their wallet.

Additionally, we could find alpha information for our community.

It is very likely that on April 13, Dither will launch a "3-day pass". Users will be able to access all Dither services for three days if they pay 300 $DITH. 80% of the proceeds will be burnt forever.

As more tokens are bought from the market to pay for the pass and later burnt, it will put deflationary pressure on the price of $DITH, which is positive for investors and the overall liquidity of the token.

Of course, the magnitude of the effect will depend on the demand for 3-day passes. Currently, Dither is flying under the radar, so we don't expect this development to impact the price greatly.

However, we believe the team is on the right track, even if there might not be an immediate demand for passes.

The most important thing for us is the team's intention to build sustainable tokenomics that benefits the whole ecosystem.

Therefore, we believe the team will eventually find good tokenomics through 3-day passes or something else.

Price targets

It is still in its early days, but we believe the project has tremendous potential if it can deliver what it is trying to build.Additionally, we are at the market stage when narrative rather than fundamentals drive the price.

Fortunately, Dither fits many narratives simultaneously: AI, Prediction Markets, Memecoin, and Telegram bots.

Based on the information above, we have the following price targets.

Conservative target

in the conservative case, we believe the overall market will keep going up, and narratives will drive the price.In this scenario, we expect a $100m mcap (roughly 5x from here)

Currently, the market price is $0.2263; our 5x target would imply a price of $1.

Base case

In the base case, we believe there is a substance beyond just narratives, and Dither AI will get meaningful adoption from other telegram bots.In this scenario, we expect a $250m mcap (roughly 10x from here)

The $250m target mcap would imply a price of $2.5.

Best case

In the best case, we expect Dither to deliver some groundbreaking applications that will drive both hype and incredible adoption.Over the past year, we've seen some incredible AI applications, and we might see some from Dither AI as well.

Therefore, in this scenario, we expect $375m mcap (roughly 15x from here)

The $375m target mcap would imply a price of $3.75.

Technical analysis

DITH token has been on a decline since March 7, after the asset reached its peak of $0.64.

However, on March 28, it breached positively above a descending channel pattern, but on March 29, there was another bearish confirmation. After that, a shooting star candlestick was formed, and DITH struggled to close above $0.30 on the daily chart.

The asset is looking to bounce from the ascending trendline (yellow) in the chart, but with collective bearishness in the market, DITH may close a value under the ascending line.

Since DITH is a fairly new token, it is advisable to identify a bullish reversal before taking a position, as the drawdown may continue without rhyme or reason. The range between $0.06 and $0.175 is the desired re-test region.

If you decide to invest, here is how to do it:

Action plan: 1. Go to Jupiter

- Insert the contract address (E1kvzJNxShvvWTrudokpzuc789vRiDXfXG3duCuY6ooE) of DITH in the "To receive" field.

- Execute the swap

Cryptonary's take

We have seen many AI tokens perform extremely well this cycle; we believe the trend will also hold for the rest of the cycle.That means we need to position ourselves for the upcoming waves of AI narrative when compelling opportunities arise.

We believe Dither is one of those opportunities that presents an asymmetric upside for the risks involved.

Of course, we are in the early stages of DITH; therefore, there are potential risks. However, we believe it is worth taking a shot.

Cryptonary Out!