Although we get our DOT returned to us at the end of the lease it is still important to have a plan for extracting as much value from each auction as is possible. It is not as easy as just calculating a potential 3X, 5X, or 10X gain – these are all Layer 1 protocols in their own right and as such will have their own ecosystems developing on them too.

Polkadot is the ecosystem of ecosystems, after all.

The purpose of this journal is to outline the key fundamental points and outline the tokenomic model for the Acala Network.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

TLDR

- Acala is the DeFi Hub for Polkadot.

- If 1 ACA token reaches a valuation between 0.16-0.24 DOT, we will begin taking some profit on our unlocked ACA allocation.

- Calculations can be found at the end.

Fundamentals

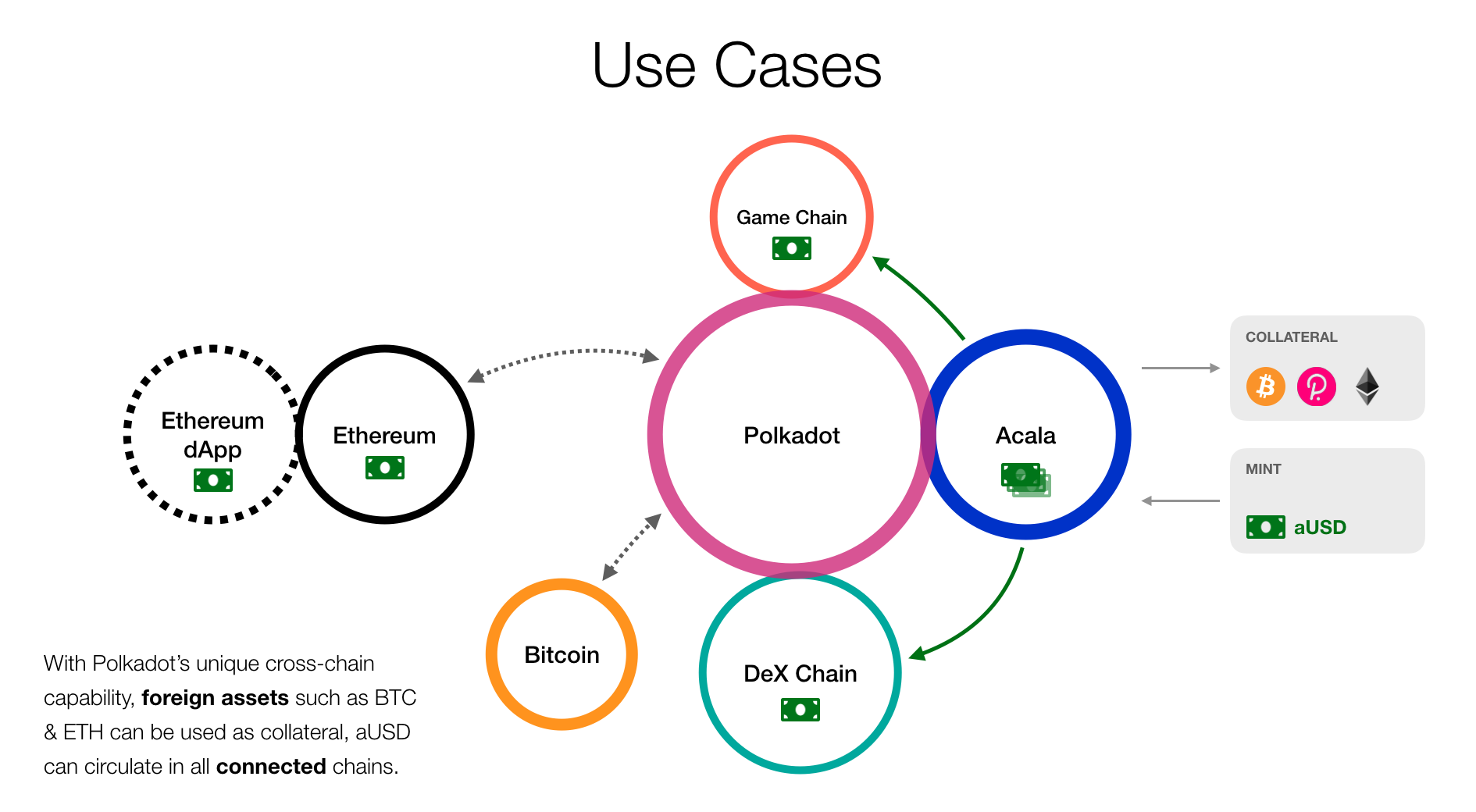

The problem with DeFi in its current state is that it is segregated by chain. For example, it’s impossible to use Solana based assets as collateral for taking out a loan on Ethereum based lending protocol Aave. This is where the chain-agnostic properties of Polkadot come in to play. Acala is a multi-chain DeFi hub for the Polkadot ecosystem where liquidity from many chains and token standards can be used for a variety of DeFi activities.

What are the key components?

Honzon Protocol

Acala has a built in stablecoin platform and their own stablecoin called the Acala Dollar (aUSD). aUSD is an algorithmic, decentralised stablecoin, pegged 1:1 to the United States Dollar through an over-collateralisation mechanism. The technology behind this utility is called the Honzon Protocol. Here’s a brief rundown of how it works:

- Users will be able to deposit BTC, ETH, DOT, or L-DOT as collateral which allows them to mint aUSD. (More collateral options will be available after launch).

- This opens a Collateralised Debt Position (CDP) which is a fancy way of saying that the user now owes aUSD, with the other assets held as collateral.

- The user can then go and utilise the aUSD for a variety of functions on any chain connected to Polkadot. For instance, lending or purchasing other assets – everything that can be done with all stablecoins like USDC, for example.

- The peg to USD is maintained because all aUSD that is minted is backed by collateral of more value than the aUSD is worth – ie. over-collateralisation.

- This can lead to liquidation if the value of the deposited assets reaches a certain collateral-to-debt threshold. This is called the Liquidation Ratio.

The Honzon Protocol is the key to stablecoin liquidity on Acala. Having access to stablecoin liquidity is central to decentralised finance activity on any network and having that kind of utility across all chains connected to Polkadot is a game-changer in terms of user experience, cross-chain liquidity, interoperability, and DeFi integration.

HOMA Protocol

Generally, on most Proof-of-Stake secured networks there is only a finite number of tokens available at any one time. By design, networks that use a Proof-of-Stake consensus to secure the network require tokens to be staked.This gives rise to a dilemma – there must be enough tokens staked that the network is secure, whilst also having enough tokens for a large number of users to use for other activities like bonding, paying transaction fees, lending, etc.

This is where the HOMA Protocol comes in – users can stake their DOT through Acala and receive the derivative token L-DOT (Liquid-DOT). Here’s how it works:

- Users deposit DOT into the HOMA Staking Pool.

- In return, users receive L-DOT tokens at a 1:1 ratio for their deposited DOT.

- Staking rewards are paid in L-DOT tokens.

- L-DOT is a fungible derivative token which means it can be traded, used as collateral to mint aUSD, swapped for other tokens, etc.

- Currently there is a 28-day unbonding period for staked DOT. The HOMA Protocol removes this impediment by providing some options for early unstaking (with some additional fees).

- This is possible because all staking rewards are held in a reserve pool until a user decides to unbond (swap their L-DOT back to DOT) meaning that there is float that early unbonders can dip into for a fee.

ACA Tokenomics

Since we have already covered what ACA is used for in previous journals, here’s a TLDR:- ACA is the governance and utility token for Acala network.

- Used for voting rights in the DAO, paying fees, and as a contingency for recapitalising the collateral pool for the aUSD stablecoin in the event of insolvency.

There are a few aspects that we need to look at to deduce a fair valuation for Acala, and we have a number of parameters we can use to do this:

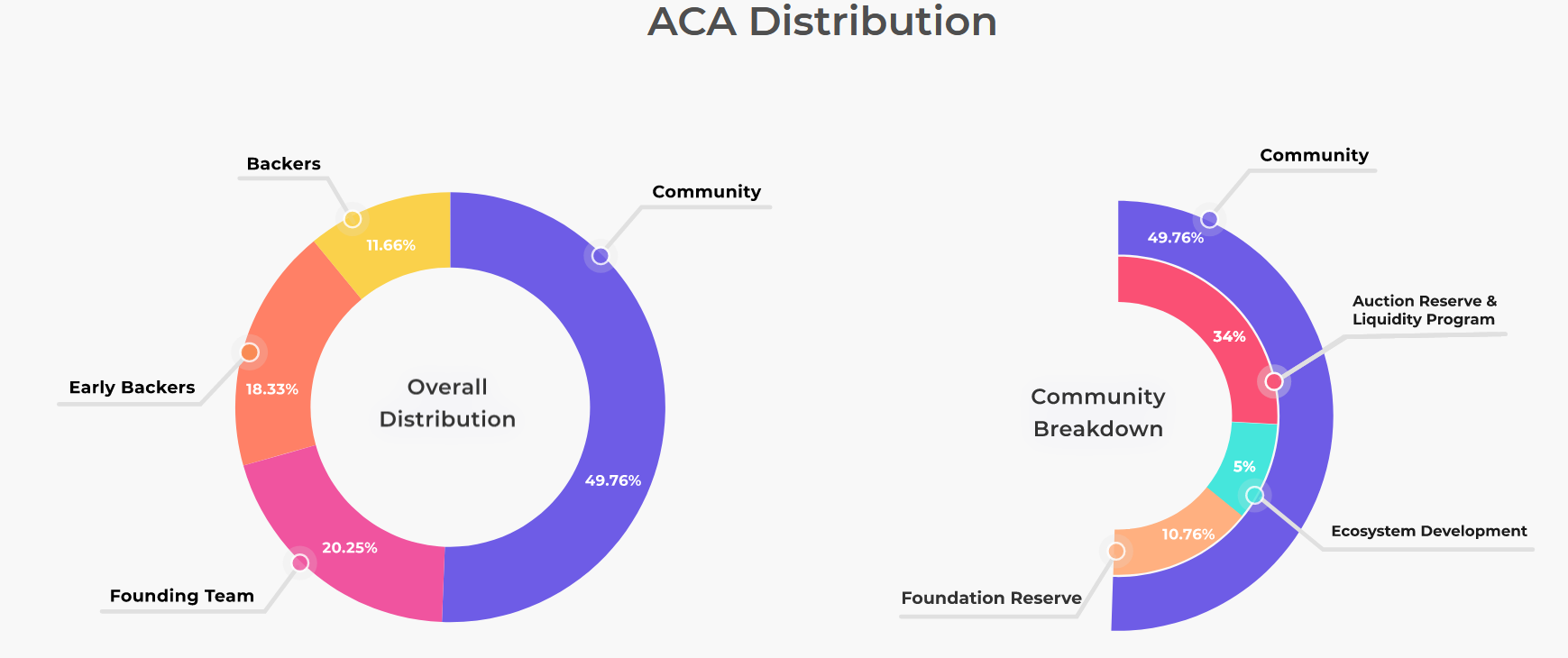

- The number of tokens allocated to rewards (15% of supply, 150 million tokens).

- The vesting schedule (20% unlocked at launch, 30 million tokens). The remaining 80% vested linearly over 96 weeks.

- Estimated total tokens available at launch - 30 million immediately unlocked from rewards + another 130-170 million tokens available as exchange liquidity/incentives etc. A conservative estimate would be the higher end, so 200 million tokens available at launch.

We can use this estimate to carry out an arbitrary calculation of market cap based on the total DOT raised for the project, which is 32.515 million DOT (rounded).

- $40 * 32.515 million = $1.3 billion (rounded). This is the implied Acala market cap.

- $1.3 billion/200 million ACA = ~$6.50 per ACA.

We can use this to estimate what the overall ACA price would have to be for us to sell the 20% unlocked at launch to breakeven on our DOT investment at $40 per DOT:

- $40/0.92 = $43.35 per ACA.

- $43.35 * 200 million ACA tokens = $8.67 billion market cap for Acala.

- $40 * 1.059 billion DOT tokens = $42.36 billion.

- ($8.67 billion/$42.36 billion) * 100% = 20%.

Now, the price of DOT is going to be variable and so are both the DOT and ACA supply so the calculations will vary depending on the exact moment the data is taken. Due to this, we’ll call it anywhere between 16-24%. This is a reasonable area for us to start selling some ACA tokens to recoup some of our capital.

- Ratio for profit taking: 1 ACA = 0.16-0.24 DOT.