In this edition of Skin in the Game, we’re not only showing you not how we’re holding on but how we’re taking more for ourselves while we can.

News Flash: we’re crossing the “$100,000 invested” milestone today ⚡🎉

In case you’re new here, every month, we put our money where our mouth is, diving into the crypto market with full transparency. We give you a front-row seat into Cryptonary's brain, showing why, where, and how we're making our moves 🧠

Sit tight because we're ramping things up again! We've got a cool $15,000 ready to roll this month.

Disclaimer: This is not financial or investment advice. Any capital-related decisions you make are your full responsibility and yours only. The information made available in this report is NOT for replication. The purpose is to share the thought process behind our decision-making for entertainment purposes only.

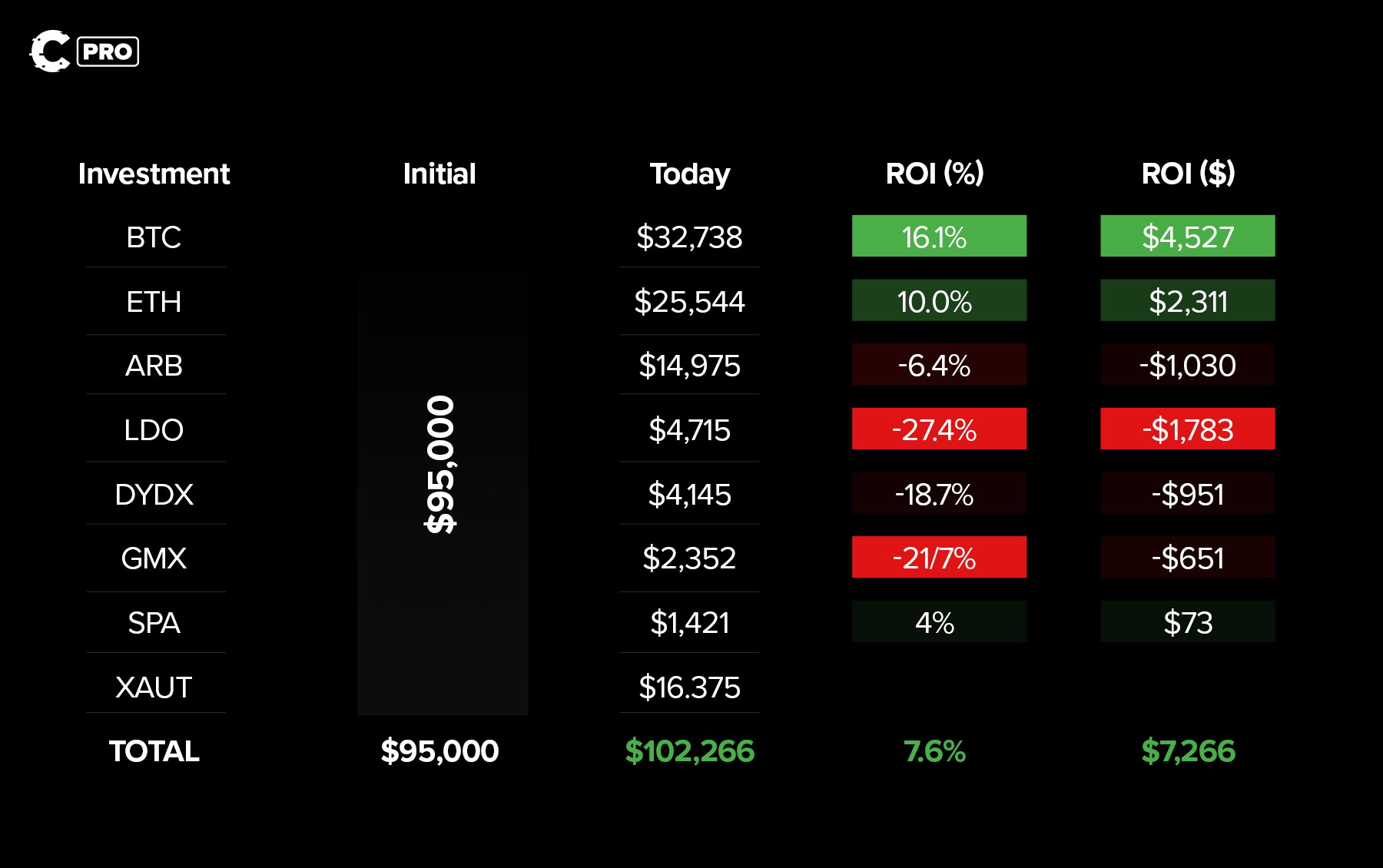

Portfolio snapshot 📒

Up to now, we've successfully invested $95,000. Here’s the breakdown ⤵️

Next up: We're pushing an additional $15,000. Wondering where, why, and how much? Let's get right to it!

Where? 🪙

While the market's surging, we're not about to risk it all on dicey altcoins. We're playing it cool, waiting for stronger signs of upward momentum. Our strategy? Grab the best part (middle) of the ride - trying to nail the highs and lows is a wild goose chase.

So, where are we investing?

BTC, ETH, ARB, FXS, LBR.

Why, and how much? 🧠

The usuals

- Bitcoin (BTC - $3,000) is bagging most of our attention due to its recent institutional popularity. We're talking about industry giants like BlackRock with a staggering $10T under management.

- Ethereum (ETH - $3,000) always deserves a portion of our investment cake, particularly as its market share expands with the L2 surge. For more on our reasoning, check out our full thesis here.

- Arbitrum (ARB - $3,000), the rising star akin to Solana, is a no-brainer. Our sights are still set on a medium-term target of $7.50 and a whopping $30+ in the long run.

As for small-cap alts, we're specifically keen on those that serve BTC and ETH.

With Bitcoin, mining stocks usually take center stage. However, since we're crypto-focused, they're off our table. Ethereum brings a different flavor to the mix. If ETH keeps growing and more ETH gets staked (thanks to liquid staking platforms like Lido), then liquid staking derivatives (LSDs) will likely outpace ETH. It's a higher risk, higher reward scenario— but if LSDs take off, LSD-Fi apps will fly even higher.

Think of it as a thrilling, escalating ripple effect that we're excited to ride!

Frax Finance | FXS ($3,000)

Thesis

FXS has been pulling off some truly audacious moves.

You may have come across our research report on FXS (here). But two major announcements in recent weeks are giving us the buy itch.

First off, they're launching the new Frax Chain, which translates to higher yields on their liquid staking token, sfrxETH—more capital and fees, baby!

Second, their founder is strongly endorsing some hefty FXS buybacks—great news for the price!

Target

Our research report sets a clear target of $76.70, but we're strategizing to sell at three distinct price points:

- We'll sell 50% at $12 to regain our principal

- 25% sale at $27.50

- The remaining 25% at $76.70

Invalidation

- De-peg event: We'll unload all of our FXS if FRAX (the stablecoin) de-pegs below $0.90 for more than a day.

- Drop below $2.90: Our charts signal it's time to sell if the price slips below $2.90 (currently hovering around ~$6).

Lybra Finance | LBR ($2,000)

Thesis

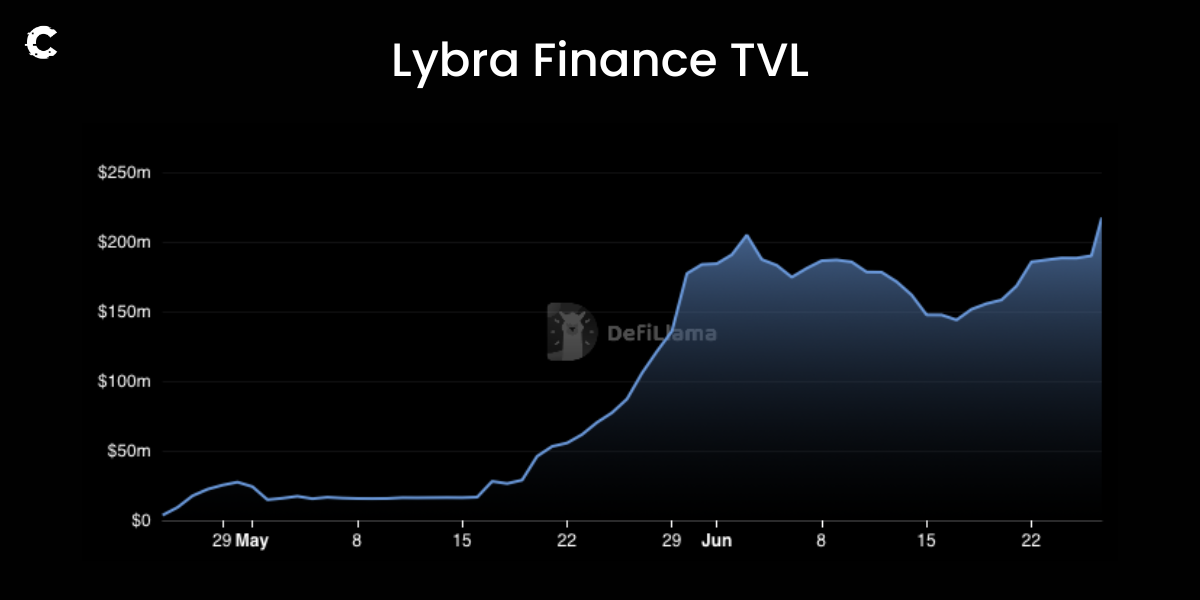

Alright CPro, we've nailed it before with LSD-Fi (PENDLE, anyone?), and we're at it again—this time, with Lybra. We had our eyes set on Raft, but since they lack a token, Lybra's intriguing stablecoin model, coupled with yield offering, won us over.

Lybra's leveraging LSD protocol (Liquid Staking Derivatives) to roll out a stablecoin that fetches yield using Lido’s stETH. They do this by empowering users to mint eUSD against their ETH and stETH stash.

Why should you care? Well, this over-collateralised eUSD is relatively safe’r’ as a brand new project. Plus, it serves up a sustainable interest, backed by ETH staking yield (unlike UST).

This magic blend catapulted Lybra’s TVL (Total Value Locked) from a modest $77M to a whopping $217M in just a month!

Targets

When we invest in new projects, our safety net is to recoup our principal at a 100% price increase ($2.60) - our cue to offload half of our holdings. We'll part with another 25% at $5, and cling to the rest until we get a clearer picture of LSD-Fi's market standing.

And if the growth curve flatlines or TVL turns stagnant, we might think about backing out.

Invalidation

We're all about smart risks. So, if the price nosedives under $0.94, we're out—limiting our loss to a maximum of 27.7% (or $554).

Hold up, we’re not done yet 🖐🏼

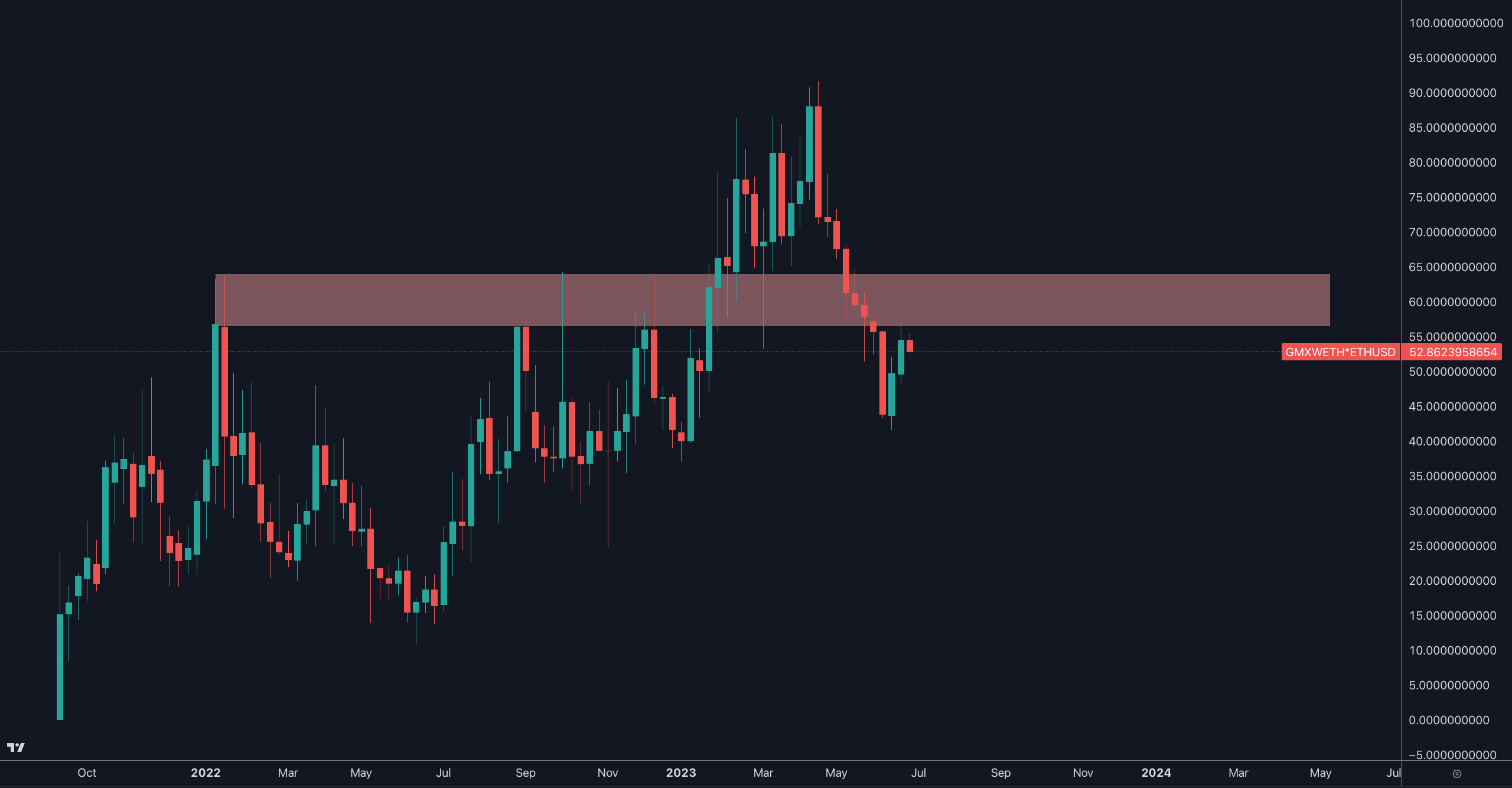

We're selling a particular token because, well, our safety threshold's been triggered. Even though the sight of BTC soaring past $30,000 is pretty awesome, we've got to stick to our game plan.

Sadly, GMX slipped below our $56.50 mark. So, we're parting ways. The proceeds from this sale will be smoothly transitioned into XAUT, as per our usual practice.

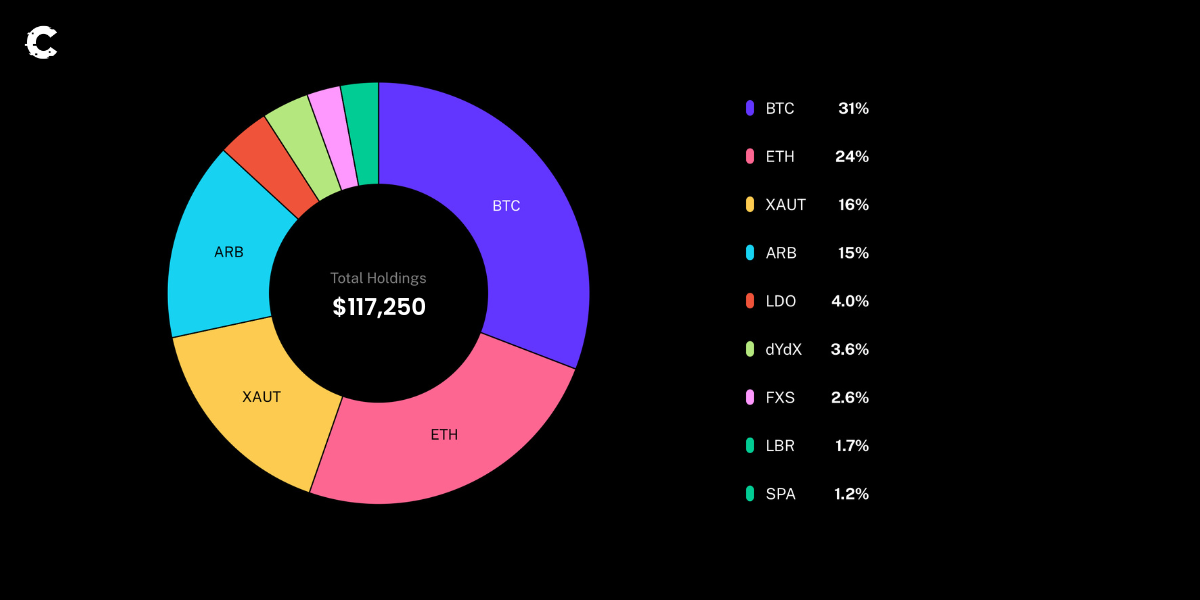

Portfolio allocation 📊

SITG summary 📝

- BTC: Invested $3,000 and awaiting our 2030+ target of $650,000.

- Entry Price: $30,300

- Size: 0.099 BTC

- ETH: Invested $3,000 and awaiting our 2030+ target of $115,000.

- Entry Price: $1,850

- Size: 1.62 ETH

- ARB: Invested $3,000, selling 50% at $7.50 and the remainder at $30.

- Entry Price: $1.13

- Size: 2,655 ARB

- FXS: Invested $3,000, selling 50% at $12, 25% at $27.50, and the remainder at $76.70.

- Entry Price: $5.94

- Size: 506 FXS

- LBR: Invested $2,000, selling 50% at 2.60, 25% at $5 and holding the rest.

- Entry Price: $1.34

- Size: 1,487 LBR

- GMX: Sold 42.3 GMX for 2,250 USDT.

- Bought 1.15 XAUT with the above 2,560 USDT.

SITG addresses ⛓️

Bitcoin: bc1qzpppmek8wh2vqymq06petmfwmhjj9k8vdxl389

Ethereum: 0x8Be9987d18a10F770cADC94635CeDB2eF33B0f17

Thank you for reading! 🙏🏼