Addressing the Binance FUD

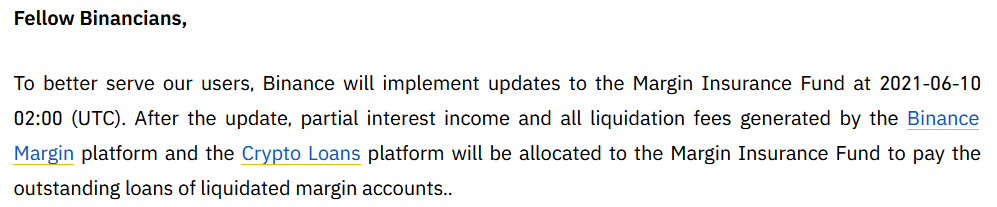

The Twitter user also stated that Binance was using their own profits to subsidise the Fund – this is pure fiction and we found zero evidence of this anywhere. Additionally, there is no evidence of Binance subsidising losses using BNB, or any source for this being the case. The following is a screenshot of the announcement that Binance released:

Introduction

A piece of FUD came to our attention very recently regarding Binance and the potential fallout from the mass liquidation event in May. The premise of this FUD was that Binance was allegedly trying to raise funds to fill up their Margin Risk/Insurance Fund in the aftermath of the market crash of the 19th May, in order to “pay the outstanding loans of liquidated margin accounts”.The FUD

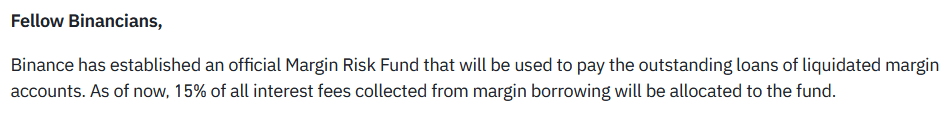

Now, we agree that the wording of this announcement is not great, and we can see where the confusion comes from. However, upon further research we cross-referenced previous announcements and found a similar statement released by Binance on the 27th of April 2020:

We can see from both statements that they use the same wording – and as far as we are aware, at no point last year did Binance have to pay out for liquidated margin positions. Therefore, we believe we can conclude beyond reasonable doubt that Binance is not in any sort of trouble or debt, and there are not any outstanding accounts that need covered.

Here is the April 2020 announcement:

https://www.binance.com/en-IN/support/announcement/360042799851

And the June 2021 announcement:

https://www.binance.com/en/support/articles/907318ffc70546feb9d61199302e4a70

Margin Risk Fund

We believe that similar to the April 2020 Margin Risk Fund announcement, this move is a pre-emptive measure to protect themselves against mass liquidations. However, this doesn’t take away from the fact that they have implemented liquidation fees for Isolated Margin, Cross Margin and Crypto Loans.Binance stated that the purpose of the fees is to secure more funding for the Margin Insurance Fund – on a side note the name of this fund isn’t consistent across both announcements (Risk Fund/Insurance Fund). We were unable to find any data on how much capital is actually allocated for this fund (not even a ballpark figure). It doesn’t appear to be as transparent as the USDT-M and COIN-M futures Insurance Funds.

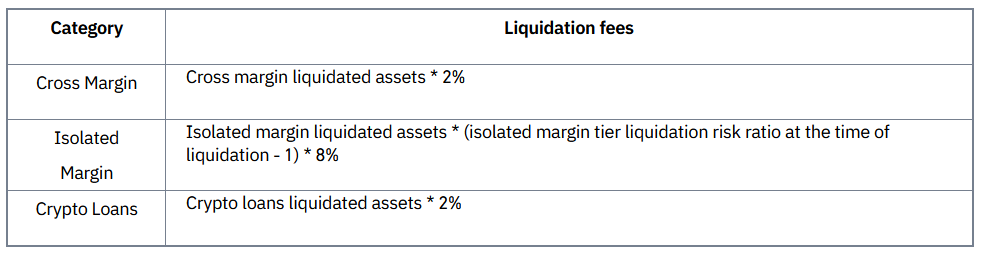

The fees will be structured as follows:

As can be seen from the table above there will be a 2% liquidation fee for both Cross Margin and Crypto Loan positions, and a whopping 8% for Isolated Margin accounts. This means that Margin traders using Isolated positions will be liquidated earlier than they would have been before in order to meet the new fees.

Our Opinion

We believe that these new fees show that Binance does not have their customers best interests in mind and would rather protect themselves. Yes, this will improve the safety of the lenders funds by ensuring more funds are available to make up for shortfall. However, the majority are borrowers and these fees will be detrimental to their trading.One could argue that Binance doesn’t have any obligation to prevent apes from YOLO-ing their lifesavings on a 20x margin position and getting liquidated. This is true on a certain level since only the individual is responsible for how their capital is managed.

However, as traders ourselves, we feel that there’s an ethical reason to minimise the fees that traders pay in general - especially if the difference is between liquidation and preservation of capital. Aggressively milking traders for every cent they have is not a an ethical business model; however profitable it may be. Nothing generates customer loyalty than a consistently positive user experience, and we believe Binance has fallen short here.

That doesn’t take away from the fact that no-one should be leveraging in this market unless they have a proven track record. How many times must retail traders get liquidated before they realise that this is, in fact, not the way?