Update: 10/6/2024

The IO.net ecosystem is set for an important week, and the projects’ token generation event, or TGE, is scheduled for June 11th. In the lead-up to the event, IO.net was introduced on Binance Launchpool, where users were able to stake their BNB and FDUUSD to farm $IO tokens for four days.Ahmad Shadid, one of the founders of io.net, announced on X that he is stepping down as the CEO, effective immediately. The founder did not mention a clear reason for his decision.

IO.net hasn’t witnessed the best pathway to its TGE, with recent allegations of possessing fewer GPUs than initially claimed. While the founder did not clarify, he mentioned “allegations regarding my past” in his announcement, and the community speculated that he was possibly talking about the GPU FUD. The company has added another statement noting that "...this leadership change follows multiple months of transition planning with the IO.net leadership team, investors, and strategic advisors with the goal of guiding IO.net in its next phase of growth..."

If we look at IO.net's current explorer page, the total number of GPUs is far lower at 19,578 than in our initial report, which was around 30,885. So, it can be inferred that the team weren’t originally reporting the correct number of GPUs. The number of unverified GPUs listed is 817,992, but the verified GPU numbers are around 117,343.

For context,

- Unverified GPUs: total connected devices in the last 30 days

- Verified GPUs: devices that passed Proof of Work, which runs every 6 hours

- Cluster Ready GPUs: devices that passed Proof of Work and are deployable

What's next?

From an investment perspective, this new development on io.net is worrisome.A CEO exit before the TGE indicates a strong level of uncertainty, which can be very volatile for the token. The team has yet to address its previous GPU-related FUD, and now, a change in leadership raises critical concerns about the project and the team’s stability.

The community believed Shahid was ready to dump his $IO token allocation at TGE, for which he will bear no responsibility after his departure. However, the founder highlighted, "I have 4 years of lockup + vesting.” A majority of the public is not buying his statements right now.

The $IO token will be released amid massive FUD, so the best way forward is to not get immediately involved and analyse the environment after the TGE event. If users have been farming $IO tokens, holding them is fine, but we don’t recommend deploying fresh capital immediately after the token listing on June 11th.

The bottom line is that we need to observe io.net more closely. We will take a deeper look to be sure that the FUD is really FUD and not signs of deeper issues. If it all checks out, we could then go on to revisit our initial investment thesis and present an upside potential for the token.

Editor's note: We have now added another update to this report regarding a materially relevant FUD about this project. 10/06/2024

Update: 29/04/2024

When we published our initial reports on io.net last month, we concluded that “IO.net is poised to become the next big crypto gem, capitalising on the DePin and AI narratives.” While the project didn’t have a token yet, we recommended participating in the airdrop campaign. We also believed that its token launch would provide an opportunity to load up on the coins of a promising project.Two months later, the project is now getting some serious FUD on Twitter, and while this is a developing story, it raises some materially relevant concerns that the IO.net team will need to address.

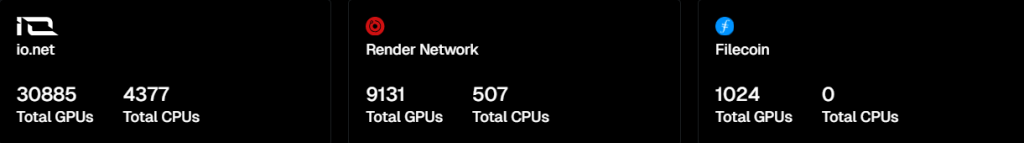

The main bone of contention is that a Twitter user, @MartinShkreli, has alleged that IO.net claims to have different numbers of GPUs—ranging from 7,468 to 564,306 on the platform—and that they have a significantly smaller number of GPUs. In our initial report, we opined that IO.net could be a major contender because the 30,885 GPUs it listed then showed impressive adoption.

IO.net’s business model connects those needing heavy computations to GPU providers, and its revenue comes from the fees it charges as DePIN provide. So, its core proposition leans heavily on outpacing the competition with its GPU numbers.

IO.net has yet to respond to this specific concern or provide any other clarification. We will continue to watch if there’s a public statement and also reach out to IO.net directly for clarification.

IO.net has yet to have its TGE, so we recommend that you exercise caution on everything IO.net-related until the team addresses this concern.

Editor's note: We have now added an update to this report regarding a materially relevant FUD about this project. 29/04/2024

Introduction

AI projects can potentially boost the global economy by more than $10 trillion by 2030. However, there is a massive shortage of computing power to train AI models.Therefore, computing power is becoming increasingly valuable and is being concentrated in the hands of a few centralised players.

Blockchain technology can help decentralise access to computing power for AI projects.

So, today, we introduce a new project offering value at the intersection of DePin and AI.

We've been fans of AI's potential, exploring various AI agents with enthusiasm and a critical eye. See our research here and here.

We understand that the market is a mixed bag, with many AI projects offering more hype than substance.

But if you’ve seen the value in Render, Nosana, and Filecoin—all leading GPU providers in crypto—you’ll be quick to spot the untapped potential in this new project.

Let’s dive in.

TLDR

- This new project aggregates GPU computing power to build the world's largest AI-compute cloud.

- Despite being a young project, the adoption has been impressive, with impressive numbers on its platform's demand and supply sides.

- Has strong backing and a robust business model.

- The best part is that it doesn’t have a token yet; we are still early.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

DePIN meets AI

IO.net is a decentralised computing network that aims to revolutionise the AI-compute sector by building the world's largest AI-compute cloud.

The platform aggregates underutilised GPUs from various sources, such as cryptocurrency mining farms and independent data centres, to provide cost-efficient and customisable access to significant computing power for machine learning and AI development.

IO.net's services address the current limitations in GPU supply. The rapid growth of AI and machine learning has led to a shortage of GPUs, resulting in higher costs, longer wait times, and limited hardware choices for AI developers.

By aggregating and utilising the unused GPU power from various sources, IO.net helps bridge the gap in GPU supply and offers a more affordable, flexible, and accessible solution for AI developers.

At the same time, IO.net leverages distributed computing libraries to orchestrate and batch-train “jobs” across a network of GPUs, ensuring that the AI models are trained and deployed with high precision and accuracy.

At this point, we can confidently predict that the AI sector will continue to grow, and the demand for computing power will only increase.

So, what makes IO.net different?

One key feature of IO.net's services is the ability to create clusters of GPUs.

These clusters can distribute the workload of AI and machine learning tasks, allowing faster and more efficient processing.

The result? 90% cheaper compared to Microsoft’s Azure 140 to train AI models.

If 1inch.com is the aggregator of DEXs, IO.net is the aggregator of GPU platforms such as Render and Filecoin. IO.net is building the internet of GPUs.

Adoption so far has been incredible; over 30k GPUs connected with partnerships with major industry players such as Render and Filecoin.

GPU providers from different parts of the world are currently connected to the platform, and we believe it will only expand in the future.

Platforms are two-sided markets.

To successfully bootstrap the platform, there needs to be both supply-side and demand-side.

So far, we have seen that the supply side of the platform is incredible. Now, let’s look at the demand side.

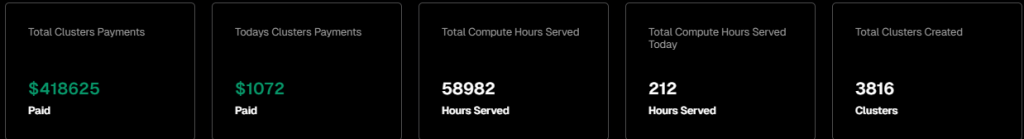

The total fees generated are above 400k, with over 58k compute hours served. This is impressive, given how young this project is.

With the demand for GPUs increasing in the future, we expect demand to accelerate even further.

Almost 400k on-chain transactions with almost 80k verified inferences (Verified inferences refer to the process of validating the accuracy and reliability of AI training).

IO.net’s computational resources are already being used in generative AI. BC8 AI is one of the first partners to directly use IO.net’s resources to deliver AI services to the public.

It is clear that, as far as the platform business model is concerned, IO.net has a decent chance of achieving network effects and getting the flywheel running.

Now, let’s have a look at how IO.net makes money.

Business model

IO.net connects those who need heavy computations to GPU providers.With the wide proliferation of AI, many researchers, universities, and institutions need computational power to train their AI models.

Current centralised alternatives are too expensive and significantly slow down the development of AI.

IO.net provides a cheaper, more efficient, and decentralised alternative. To provide these services, they currently charge a 2.5% fee. They accept USDC payments using Solana Pay and will soon accept debit/credit cards.

We are very excited about it because it’s one of the few practical applications of blockchain outside of the Web 3 ecosystem. We believe it can greatly expand the adoption and understanding of how revolutionary the technology is.

Also, this business model is one of the few in crypto that potentially won’t be significantly affected by crypto cycles because the demand for service comes from outside of crypto.

Naturally, a project of this calibre garnered considerable attention, leading to the acquisition of influential supporters and backers who recognised its potential to significantly accelerate the AI space.

Who are the backers?

IO.net has recently secured $30 million in funding at a $1 billion valuation to tackle the global AI compute shortage. This ambitious venture, backed by prominent industry leaders and venture capital firms, aims to create the largest decentralised GPU network the world has ever seen.Among the notable supporters are Anatoly Yakovenko (founder of Solana) and Mo Shaikh (founder of Aptos), lending their expertise and credibility to the project.

VC firms such as Hack VC, Multicoin Capital, 6th Man Ventures, M13, Delphi Digital, Solana Labs, and Aptos Labs also joined the notable list of backers of IO.net.

Tokenomics (based on exclusive alpha)

The project is still in its early stages, and we are extra early.We are so early that the team hasn’t finalized their tokenomics yet. Public sources provide varying information regarding the use of the native token and are sometimes conflicting.

However, fear not; we have gathered some exclusive alpha information for you.

The Token Generation Event (TGE) will occur in about 6-7 weeks. There will be no presale and no IDO.

Initial supply at TGE: 500mln

Max supply: 750mln (250mln issued over 30 years)

Use case: Still finalising.

One thing is clear, though: The team doesn’t want the token to be a farm-and-dump Ponzi. It will be used in an ecosystem, potentially for governance, incentives, and revenue-sharing.

Despite tokens not being out yet, we found a way to position ourselves for the token launch.

How to position yourself

The launch of a token is in 6-7 weeks. Currently, the only way to exposure ourselves to the project is through airdrop.So here is what to do.

Action plan:

- Join their Discord, go to “wallet-submission”, and submit your wallet.

- Join the Galxe campaign and complete the tasks.

- You will need to have either a Galxe Passport or a Galxe Humanity Score.

- To get the Humanity Score, you will need $5 on Polygon to mint the ID

- To get the Passport, you will need to KYC; however, Galxe claims all the data will be encrypted

- You can choose either of them based on your preferences

- Participate in weekly AMAs and be active on Discord (not guaranteed; the purpose is for the team to notice your contribution)

- Stay tuned; we will try to gather more information on how to increase the chances of the airdrop

Cryptonary’s take

IO.net is poised to become the next big crypto gem, capitalising on the DePin and AI narratives.With strong backing and a top-tier team, the project is addressing a pressing and critical problem.

It is highly recommended that you secure a piece of this promising project through the airdrop or by participating in the token generation event.

We will update our community with the latest developments and insights on io.net.

Cryptonary, OUT!