While most DeFi protocols have kept their distance from regulators, Hyperliquid took a proactive approach-becoming one of the few to formally engage with the U.S. CFTC. By responding to requests on perpetual derivatives and 24/7 trading, it demonstrated a serious commitment to transparency, resilience, and the future of on-chain finance.

Filtering the noise: What actually still matters

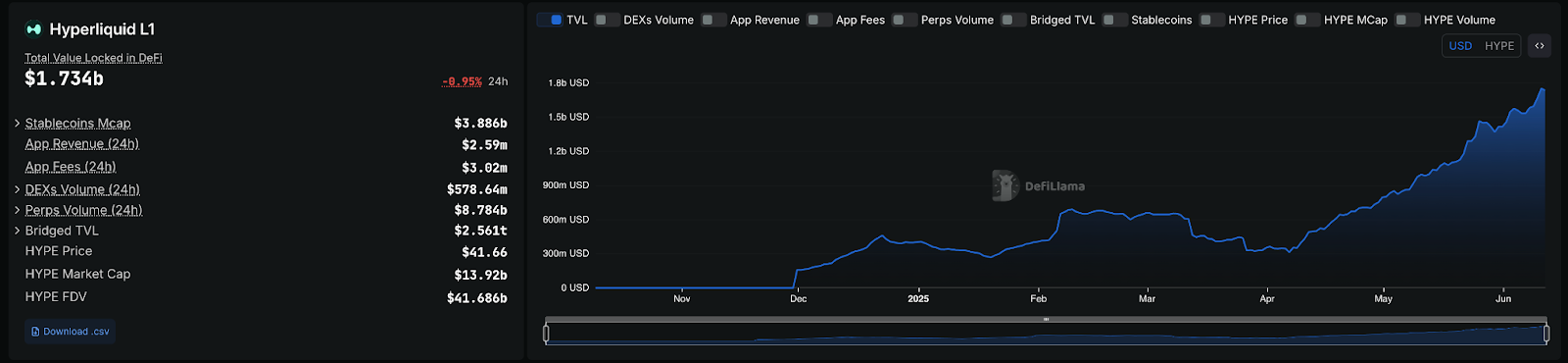

Since our original airdrop guide dropped on April 12, 2025, the Hyperliquid ecosystem has exploded in terms of TVL, price action, and adoption. Even if you only bought the $HYPE needed to farm most protocols, you should already be up-just on that alone.Like clockwork, every so-called expert is now pushing out guides claiming to know the best strategy. Let's be clear: they're spreading bad information. Half the projects they cover have already sunset their point systems, and they're completely missing the new opportunities that have emerged since our last breakdown.

This walkthrough builds on our original guide. If you're new to the ecosystem, we suggest starting there first.

Now that the ecosystem has had time to mature, we can clearly see which protocols have traction and which are fading out. This update focuses on where to allocate capital to stay eligible for future $HYPE allocations and to target protocol-specific rewards.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Bridging into HypeEVM: The biggest barrier

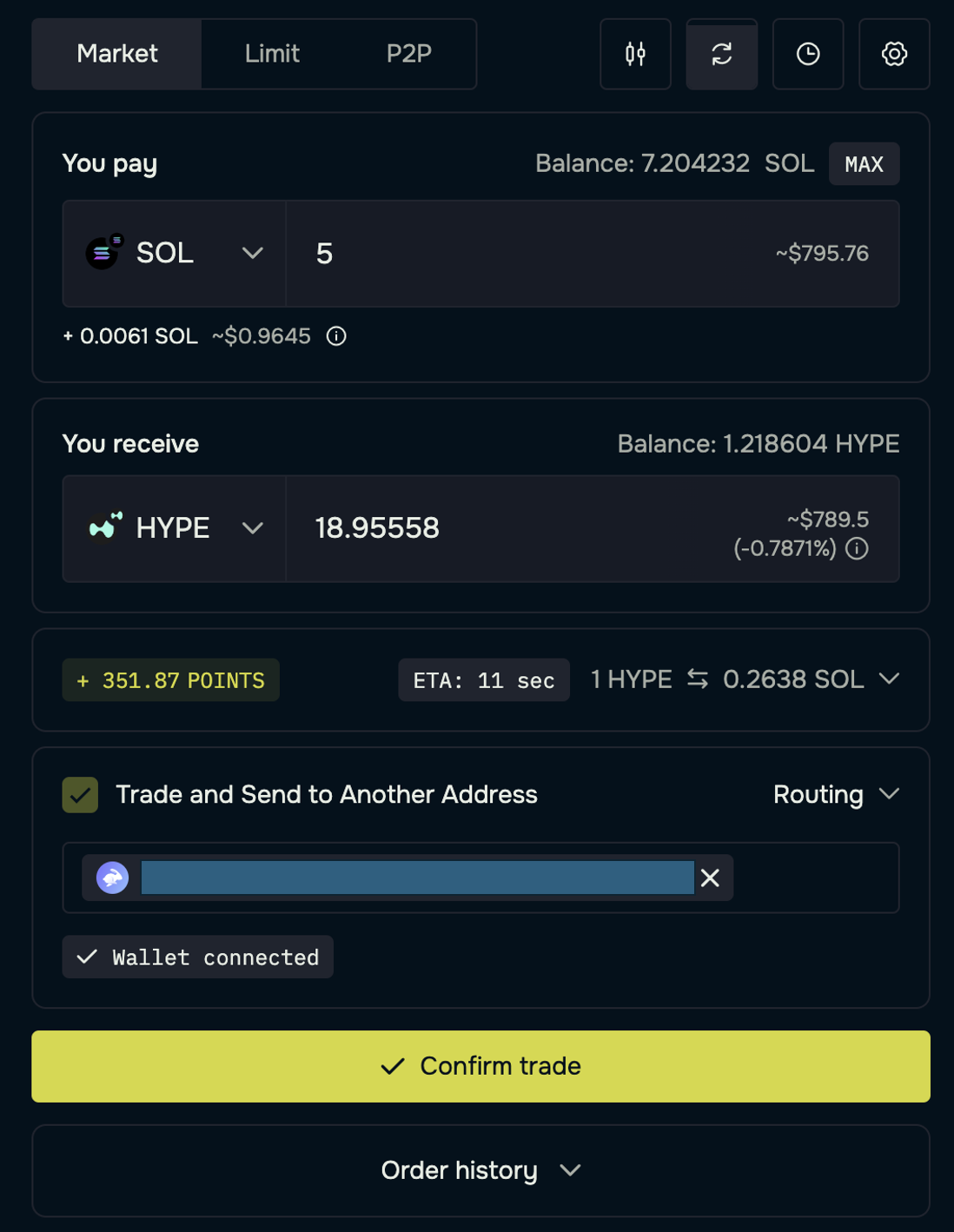

One of the biggest complaints we've consistently heard from users is the friction involved in bridging into the HypeEVM ecosystem. For many, the process feels fragmented and unintuitive-especially for users coming from Solana who are used to more streamlined, native integrations. There's no official bridge endorsed by Hyperliquid, and current options vary in reliability, fees, and UX.deBridge is one viable option, but users should be aware that fees and slippage can eat into your capital-especially when routing through volatile pairs. It works, but it's not always optimal.

The most cost-effective method right now goes like this:

Bridge USDC to Arbitrum → deposit into Hyperliquid → transfer from perps to spot → buy $HYPE spot → send to HypeEVM using the native interface.

It's not the most beginner-friendly route, but it consistently avoids slippage, minimizes fees, and prevents issues with unsupported token formats.

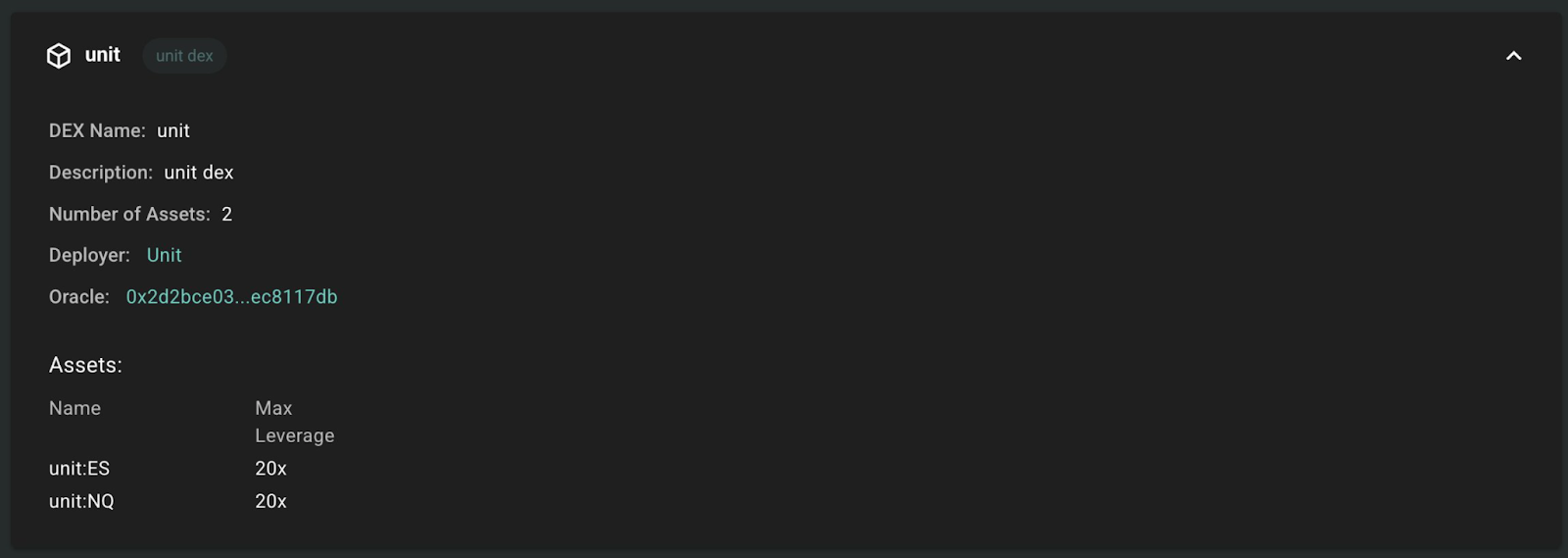

If you're serious about maximizing your shot at future HYPE rewards, Unit isn't optional-it's the alpha.

Unit is rapidly becoming a core pillar of the Hyperliquid ecosystem. With $SPX and $NQ now live on testnet under HIP-3 with 20x leverage, this is the clearest signal yet that Hyperliquid is evolving beyond crypto-native assets.

Even better, Unit now supports deposits in Solana and Fartcoin (yes, really). Once these assets land in your Hyperliquid spot account, start generating as much volume as possible-volume remains one of the strongest on-chain signals for future rewards.

Need the full setup? Here's the step-by-step video walkthrough:https://www.youtube.com/watch?v=X2M13JCqHD0

Native Staking: Still One of the Smartest Moves

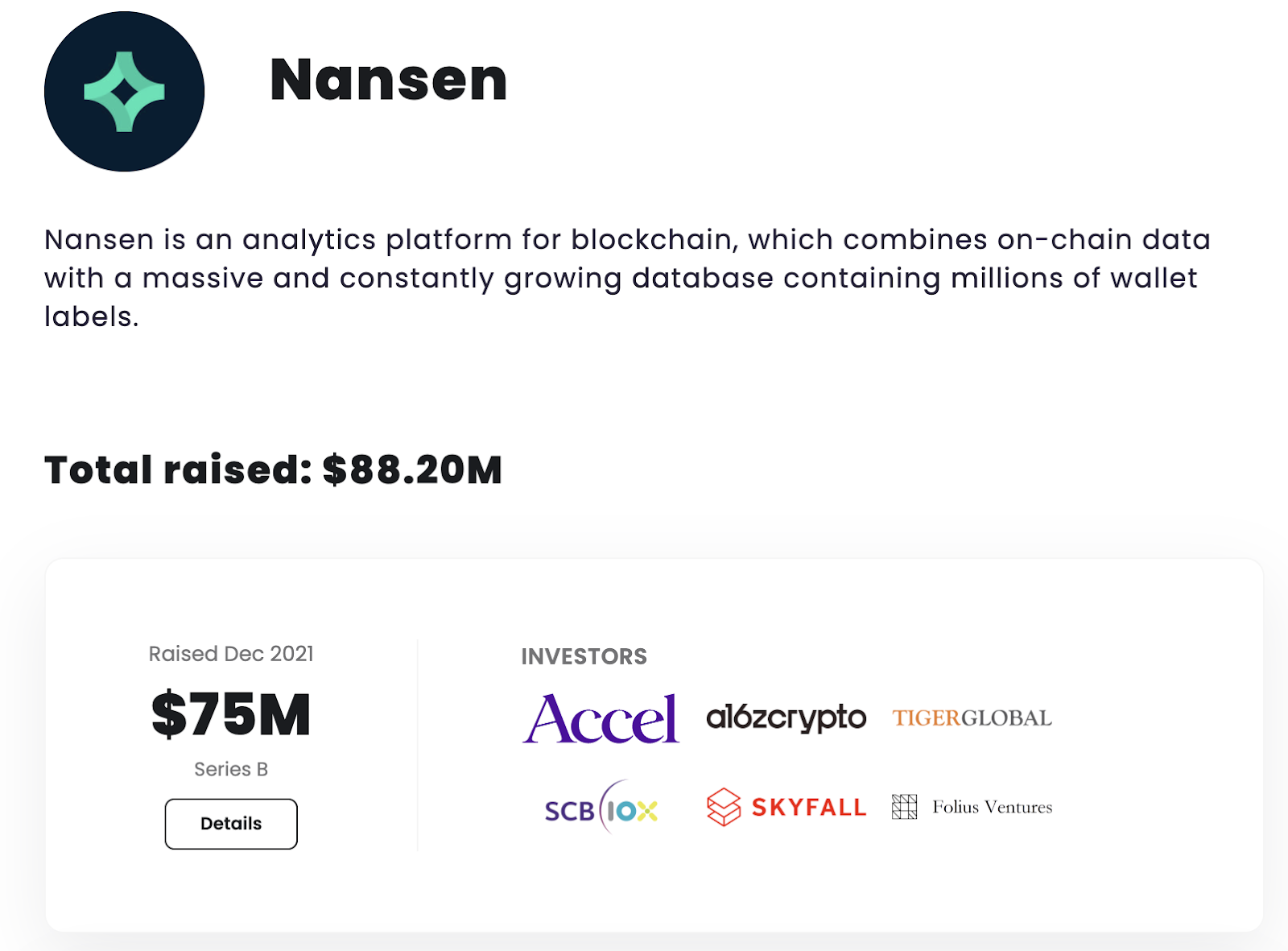

We covered this in our last guide, but with Nansen's NSN Points program going live on June 17, 2025, it's worth spotlighting again. Official Announcement

Native staking lets users earn yield, support the network, and position for future HyperEVM-related rewards and airdrops.

How to stake:

- Go to the Hyperliquid staking page

- Click "Spot → Staking Balance Transfer" to move your $HYPE

- Click "Stake Tokens", then select a validator

- We recommend Nansen x HypurrCollective for dual rewards

- Confirm your stake

https://www.youtube.com/watch?v=RAtTmEn2cvM

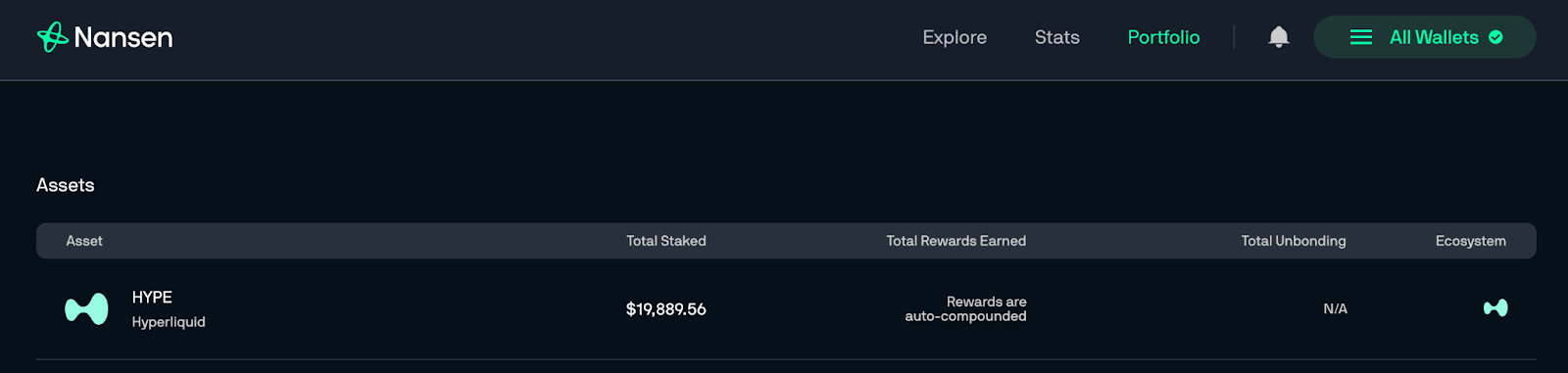

Once staked, you can also track your staking balance on Nansen's dashboard:

Why Nansen?

Staking through Nansen x HypurrCollective qualifies you for NSN Points, rewarding early participants with future perks, features, or potential airdrops. As one of the most trusted names in on-chain analytics, Nansen brings added credibility to the staking process, and it's also one of the clearest signals of long-term commitment to the Hyperliquid network-something that's likely to be rewarded.

So Which Protocols Still Matter?

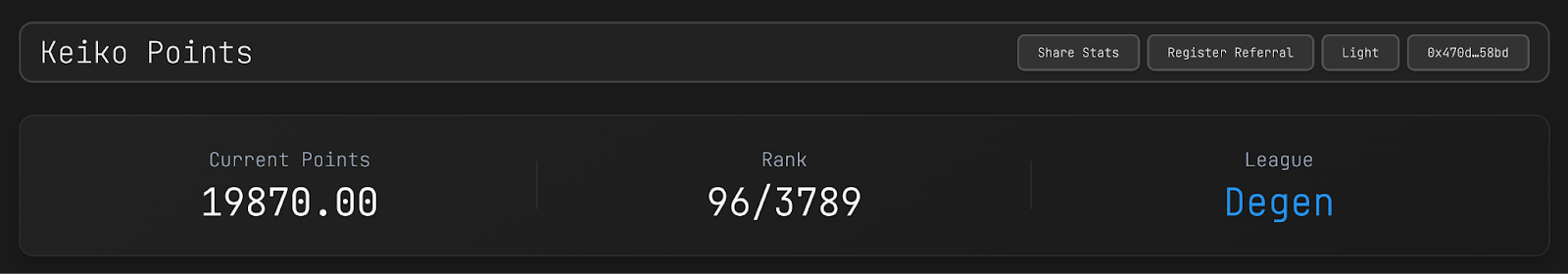

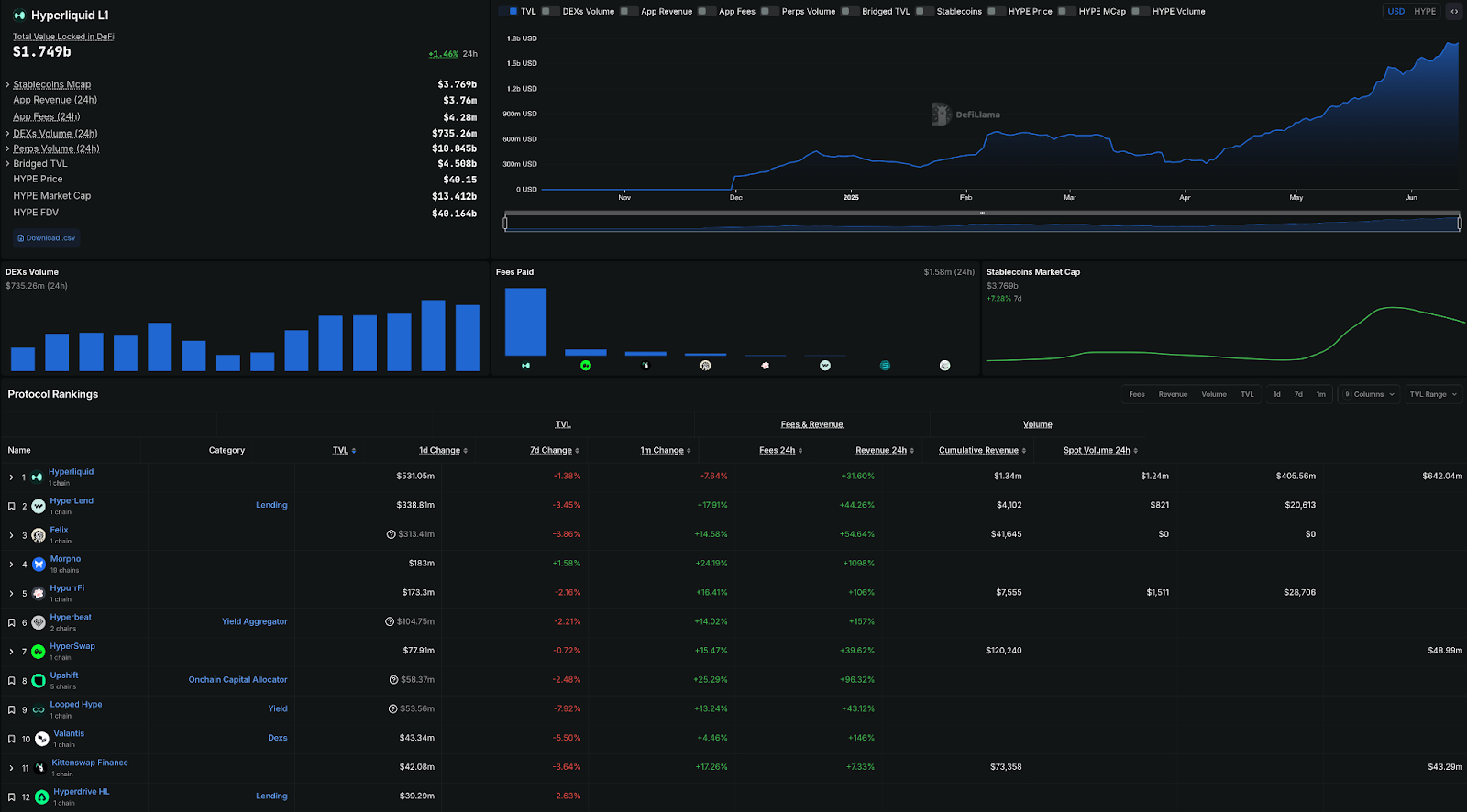

Most of the core protocols we initially highlighted remain valid, but our focus has evolved. We've discontinued using Keiko for now due to relatively low adoption, and we've also removed capital from Kittenswap, as their token launch appears imminent and the opportunity cost of staying deployed there is no longer justified.

That said, we remain well-positioned for both protocols, having participated meaningfully in their respective campaigns. If or when they launch tokens, we expect to be in a strong spot to benefit.

Hyperswap, which was also expected to launch by now, has instead extended its points campaign through August 1. While this was initially frustrating, we've chosen to continue using it due to its overlap with several other protocols (Felix), making it a practical and still-rewarding place to stay active.

Aside from Unit and Nansen, which we've already covered, our current focus is on protocols with live campaigns, strategic alignment with HyperEVM, and high airdrop potential. These include:

The objective now is to optimize capital allocation across these protocols-deploying assets where they're most productive and best positioned for future upside.Hyperbeat

Description:

Hyperbeat is a self-funded, community-aligned initiative focused on building high-performance validator infrastructure and DeFi tooling for Hyperliquid and HyperEVM.

Recommended actions:

- Swap your $HYPE to $WHYPE using a supported DEX like Hyperswap

- Go to the Earn tab on Hyperbeat

- Select the Hyperbeat Ultra HYPE vault

- Click Deposit and confirm the transaction

Hyperlend

Description:

Hyperlend is a lending and borrowing protocol built on HyperEVM, offering incentives for supplying and borrowing assets in a tokenless ecosystem. It currently holds the highest Total Value Locked (TVL) of any protocol on HyperEVM, reflecting strong user adoption and capital efficiency.

Recommended actions:

- Supply $wstHYPE (wrapped staked HYPE) to start earning points

- Borrow $HYPE or other supported assets against your collateral

- Maintain a health factor above 1.5 to avoid liquidation risks

Note: Using correlated pairs like $wstHYPE → $HYPE helps reduce volatility exposure. Always monitor your health factors and avoid aggressive leverage unless you're managing it actively.

Hyperswap

Description:

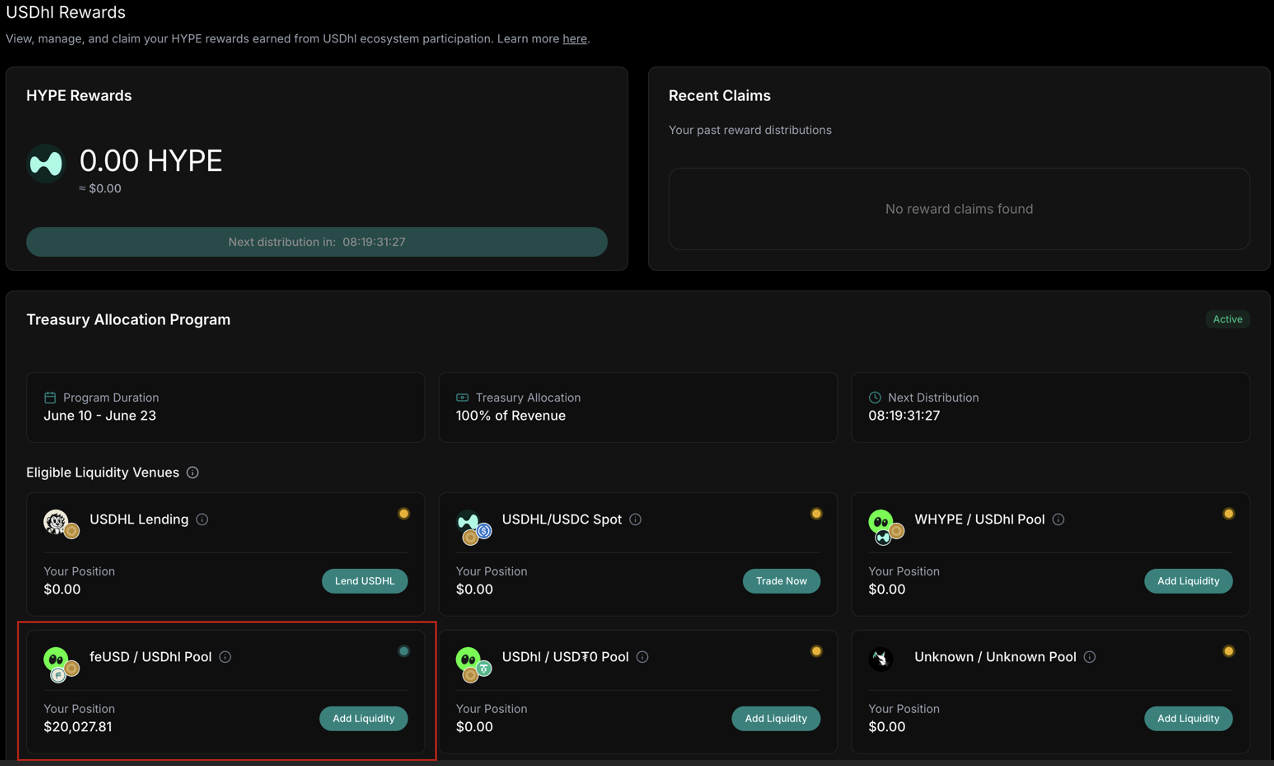

A decentralized automated market maker (AMM) on HyperEVM offering a points-based rewards system for liquidity providers. Hyperswap has extended its campaign through August 1, with pool multipliers and stacked incentives making it a key component of HyperEVM DeFi.

Recommended Actions:

- Provide liquidity to the feUSD/USDHL pool (Felix stablecoin and USDHL)

- Use the 0.01% fee tier to maximize points and fee efficiency

- Set a price range between 0.98 (min) and 1.02 (max) for optimal coverage

- Rebalance if your position moves out of range

Here's our previous video showing you how to add liquidity and use Hyperswap properly.

Note: USDHL is backed by M^0, a well-funded money middleware protocol ($57.5M raised from Bain Capital, Galaxy, GSR, and others). While it's unclear whether M^0 will launch its own token, the backing adds significant credibility to USDHL's stability. More on M^0

Hypurrfi

Description:

Hypurr.fi has emerged as one of the leading powerhouses in the HyperEVM ecosystem. What sets it apart is its use of isolated lending markets and deep integration with the Unit Protocol, one of the foundational components behind the Hyperliquid vision of bringing all of finance on-chain.

Recommended actions:

- Supply idle assets like SOL, BTC, ETH, or USDe via the Isolated Markets or Pooled Markets tab

- Borrow stablecoins like USDT0 against blue-chip collateral

- Target markets with current incentives like Looped HYPE, Hyperpie HYPE, or cmETH

- Explore unique pools like XAUt0 (tokenized gold) for alternative collateral opportunities

Here's our previous video showing you how to use Hypurr.fi properly

Note:

- If you still have stables, supplying USDe may qualify you for future Ethena rewards

- Incentivized markets change often, so check the app regularly for updates

Hyperdrive

Description:

Hyperdrive is a multi-functional DeFi protocol built on Hyperliquid's HyperEVM. Its core product is a stablecoin money market that supports lending, borrowing, one-click yield vaults, and liquid staking. Notably, Hyperdrive is one of the few HyperEVM protocols to have attracted institutional investment, raising $6M in May 2025 from top-tier firms including Hack VC, Arrington Capital, Delphi Digital, and SIG.

The team has also confirmed that a native points system is live in the background, with a full public rollout expected soon-making early usage potentially very rewarding.

Recommended actions:

- Deposit USDe into the Primary USDe Market under the Earn tab. This provides a stable yield and may also count toward future Ethena airdrop seasons.

- Borrow USDe or USD₮₀ from the Borrow tab against your BTC, ETH, or HYPE collateral.

- Borrow HYPE from the LST Market using liquid staked $HYPE (e.g., $wstHYPE) as collateral.

- Keep an eye on structured vaults like Hyperdrive Liquidator Vaults or the Hyperliquidity Vault once live.

Felix

Description:

This is a pretty interesting one. Felix is one of the TVL giants of HyperEVM-initially launched as an authorized fork of Liquity V2, but now far beyond that. The protocol has expanded significantly with the rollout of Vanilla Markets, which provide a simpler, more accessible borrowing experience for stablecoins like USDe, USDT₀, and USDHL. Currently, only HYPE and uBTC are supported as collateral, but the range of borrowing options is diverse. Felix remains a core destination for stablecoin leverage on Hyperliquid, with deep liquidity and a live points system that heavily rewards borrowing activity.

In the CDP section, you'll borrow feUSD against HYPE or uBTC. Felix shows your liquidation price clearly so you can monitor risk. However, feUSD is redeemable, and borrowers are placed into a redemption queue based on interest rate. Vaults with lower interest rates are more likely to be redeemed against, meaning your collateral can be partially liquidated even if healthy. To mitigate this, it's often better to select a slightly higher interest rate, which pushes your vault further back in the queue and reduces redemption risk.

In Vanilla Markets, you can borrow USDe, USDT₀, or USDHL directly, without any redemption mechanics. These markets are ideal for smaller positions or those who want a simpler borrowing experience. You'll also enjoy higher max LTVs (up to 77%) compared to the CDP system.

Recommended actions:

- CDP Borrowing: Deposit HYPE or uBTC as collateral to borrow feUSD

- Deposit feUSD into Stability Pools to earn liquidation rewards and protocol fees

- Vanilla Borrowing: Use HYPE or uBTC to borrow USDe, USDT₀, or USDHL with higher LTV and no redemption mechanics

- Deposit into the feUSD/USDHL pool on Hyperswap, which qualifies for both Hyperswap and the Felix USDHL program rewards

- Supply USDe in Vanilla Markets to earn passive yield and potentially qualify for additional Ethena rewards

Liminal (The Basis Trade)

Description:

Liminal is a delta-neutral basis trading protocol built on Hyperliquid that automates long spot and short perp strategies to capture funding yield. It's one of the most efficient ways to generate stablecoin-denominated yield using volatile assets like $HYPE-offering optimized execution and seamless staking integrations.

Caps are currently limited to $20M TVL, but users withdraw periodically, so timing your entry can help you secure a spot. An access code is required to join-ask in our Discord if you need one.

Recommended actions:

- Enable Institutional Mode (requires $100K+ trading volume and withdrawal of all assets from your Hyperliquid account)

- Authorize Liminal's API, create a sub-account, and deposit USDC to start (minimum $500)

- Use $HYPE to maximize funding yield; Liminal auto-executes a 1x short + spot buy for delta-neutral exposure

- (Optional, for advanced users): Stake your spot HYPE via the native Hyperliquid staking flow (e.g., with Nansen) for additional rewards

- Monitor your vault or revoke API access anytime via Hyperliquid → More → API tab

Of course, all of this can be done manually, but Liminal executes it with near-perfect precision and zero friction. Furthermore, if you were to replicate this yourself, you could technically send the spot HYPE from the long side of the trade to HyperEVM and use that to farm all the protocols we just mentioned.

That would essentially allow you to farm HyperEVM for "free" — but doing so now would lock you into the current price of HYPE. Instead of capturing any upside from price appreciation, your yield would come from a potential airdrop. On the flip side, you'd be protected from downside risk if HYPE were to fall.

Cryptonary's take

Hyperfolio was the only reliable tracker when we published our first guide-and it's still solid. But now with Debank integrating HyperEVM, the ecosystem has crossed the threshold from niche to necessary.If you followed both guides, you've done more than just "get in early"-you've positioned yourself ahead of the curve. The points we've earned since April don't just validate our strategy-they prove that consistency is king.

There is still time if you haven't positioned yourself yet. The snapshots are coming. Get positioned now.

Cryptonary, OUT!

+1,000