Airdrop alert: Time to get positioned for the HyperEVM ecosystem

When it comes to airdrops, our wins echo loudly - six figures from Hyperliquid and many others. Now, we’ve spotted another potential game-changing opportunity. Ready to uncover it? Let’s dive in…

Hyperliquid’s Season 1 airdrop in November 2024 distributed 31% of the $HYPE token supply — worth over $7 billion at its peak — to nearly 94,000 users. If you followed our previous guide, you were likely among them who received 6 figure rewards. With 38.888% of the 1 billion total supply still reserved for emissions and community incentives, attention has shifted to a potential “Season 2” airdrop tied to the launch of HyperEVM and tokenless protocols built on top of it.

Launched in early 2025, HyperEVM brings Ethereum-compatible smart contracts to Hyperliquid’s high-performance Layer-1 blockchain, expanding its DeFi capabilities. This guide’s your blueprint to lock in eligibility by diving into six tokenless protocols on HyperEVM and Season 2 of Hyperliquid. Let’s roll!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

HyperEVM and Hyperliquid: A unified vision for DeFi

Let’s start from the top. Hyperliquid is a high-performance Layer-1 blockchain optimised for trading, capable of processing up to 200,000 transactions per second using its proprietary HyperBFT consensus mechanism. Its decentralised exchange offers gas-free perpetual and spot trading with up to 50x leverage.In 2025, the launch of HyperEVM introduced Ethereum-compatible smart contracts, enabling developers to build dApps that leverage Hyperliquid’s speed, liquidity, and composability. This expansion supports Hyperliquid’s broader vision of housing all of finance on-chain — from trading and lending to staking and beyond.

Hyperliquid’s Season 1 airdrop rewarded traders based on metrics such as volume, consistency, and leaderboard rankings. With HyperEVM now live, future airdrops are expected to expand eligibility to include broader ecosystem participation, such as staking, liquidity provision, and dApp usage. The Hyper Foundation has maintained a community-first approach, excluding venture capital and allocating a substantial share of tokens to users—making early adopters the most likely to benefit from future rewards and distributions. Now, let’s have a look at how we are going to position ourselves.

Step 1: Account setup and bridging into HyperEVM

To interact with HyperEVM, you'll need a funded wallet and access to the Hyperliquid ecosystem.1. Access the Platform: Visit Hyperliquid and connect an EVM-compatible wallet (E.g Rabby).

2. Bridge Funds: Bridge USDC or USDT from Arbitrum

- Navigate to the Portfolio tab

- Click Deposit, then select USDC or USDT to bridge from Arbitrum

- To use them within the HyperEVM ecosystem:

- Go to the Portfolio tab then click Transfer

- Move your USDC from Perps to Spot

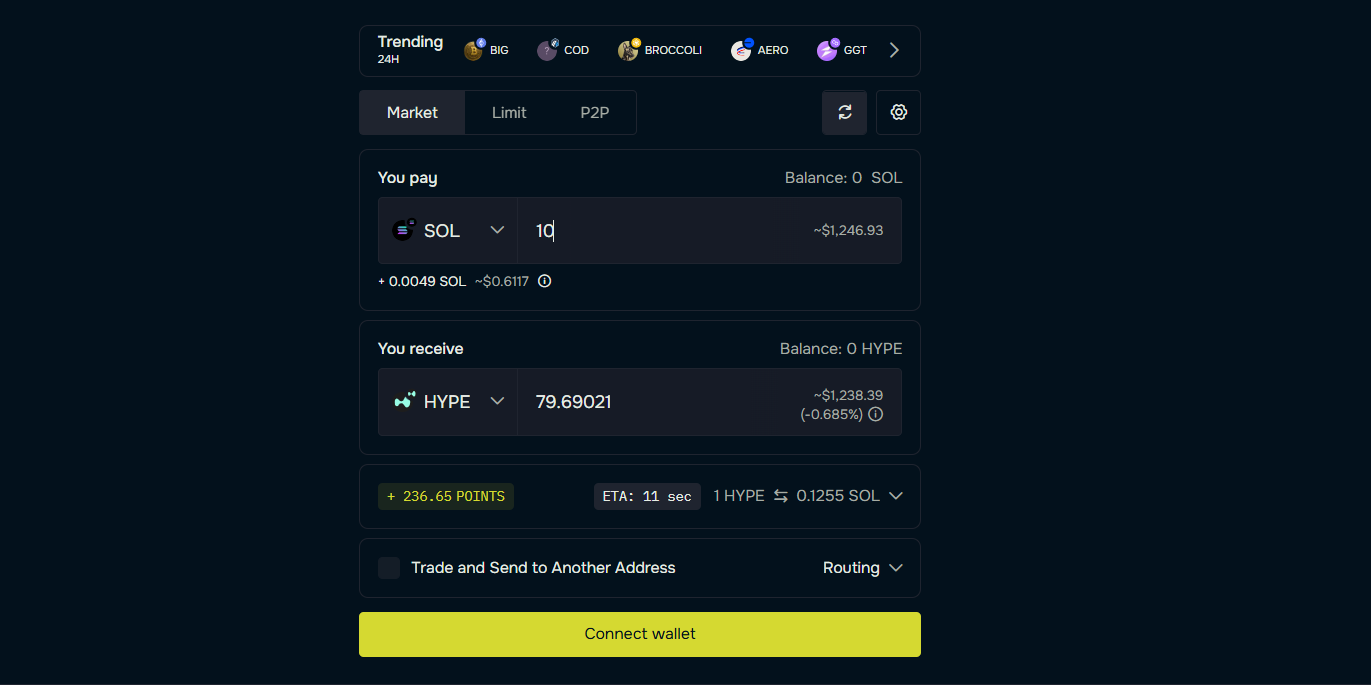

- Use the Spot Market to swap USDC for $HYPE

Option B: Bridge BTC or ETH via Unit Protocol

- Visit app.hyperunit.xyz

- Connect your wallet

- Send BTC or ETH to the provided address

- Receive uBTC or uETH in your Hyperliquid Spot Account after on-chain confirmations

3. Transfer Assets to the EVM Layer

Once your tokens (e.g., $HYPE, uBTC, or uETH) are in your Spot Account, go to:- Trade → Balances → Transfer to EVM

Alternatively, you may use deBridge as an entry point; however, we recommend this option only if you’ve already completed the initial setup and properly configured your Hyperliquid account.

Ultimately, this moves your assets into the EVM layer, enabling access to HyperEVM dApps—essential for ecosystem-level participation and likely airdrop eligibility.

Ultimately, this moves your assets into the EVM layer, enabling access to HyperEVM dApps—essential for ecosystem-level participation and likely airdrop eligibility.

Why this matters for the airdrop

Using Unit Protocol demonstrates cross-chain interaction and DeFi-native behavior, both of which are common airdrop eligibility signals. Avoiding centralised exchanges and interacting with assets like uBTC and uETH on-chain shows the type of real usage the Hyper Foundation is likely to reward. Further engagement—such as using these assets within HyperEVM dApps (e.g., spot trading, liquidity provision, lending) — could significantly boost your chances of qualifying.Step 2: Native Staking

Native staking for $HYPE launched on Hyperliquid’s mainnet on December 30, 2024, enabling users to earn yield, secure the network, and potentially enhance eligibility for HyperEVM-related airdrops and ecosystem rewards.

How to Stake:

- Visit Hyperliquid staking page

- Transfer $HYPE from your Spot Account to the Staking Account (instant deposit).

- Select a validator and confirm your stake.

Validator Recommendation: Nansen x HypurrCollective

Stake through the Nansen x HypurrCollective validator, accessible directly at Nansen. Nansen announced its NSN Points Program on September 9, 2024, set for launch in Q2 2025, rewarding stakers retroactively with points redeemable for exclusive features or potential airdrops. Having raised over $88 million, Nansen’s validator offers dual incentives:

- Native $HYPE staking rewards (2.3% APR).

- NSN Points accrual for future rewards.

Why this matters:

Staking signals commitment to Hyperliquid’s ecosystem, a likely factor in airdrop eligibility as HyperEVM grows. As of April 2025, 36% of $HYPE’s circulating supply—approximately 288 million tokens — is staked, reflecting robust network participation. Staking with Nansen maximizes rewards by combining Hyperliquid’s yield with NSN Points, enhancing your position for both ecosystems’ distributions.Step 3: Engage with HyperEVM protocols

The launch of HyperEVM in 2025 has given rise to a growing number of tokenless decentralised applications (dApps). Active participation in these protocols may be a key criterion for the next phase of airdrop eligibility and you can earn some decent drops from these dapps as well. While many projects are under development, the following are among the most established and reputable — each with live or announced points systems likely tied to their own token launches.

Engaging consistently with these protocols through liquidity provision, lending, borrowing, and trading not only strengthens your presence within the HyperEVM ecosystem but may also increase eligibility for multiple future airdrops. Let’s go through this protocols one-by-one.

Hyperswap

Description:A decentralised automated market maker (AMM) on HyperEVM offering a points-based rewards system for liquidity providers.

Recommended Actions:

- Provide liquidity to the HYPE/stHYPE pool (wrapped HYPE and staked HYPE)

- Provide liquidity to the KEI/USDXL pool (Keiko’s stablecoin and Hypurr.fi’s stablecoin)

Note: If your position moves out of range, withdraw and rebalance accordingly. This same process can be applied to any token pair, and the same methodology also applies on Kittenswap. Additional note: At the moment, major portoflio trackers like DeBank do not support DeFi positions on HyperEVM. Fortunately, community members built a solution: Hyperfolio. It is a dedicated dashboard that helps HyperEVM users to track their positions easier. Useful tool if you farming HyperEVM.

Kittenswap

Description:A decentralised exchange focused on memecoin pairs, with a confirmed points program for liquidity providers. That means the airdrop is guaranteed to happen, which is a great opportunity to farm during turbulent times.

Recommended actions:

- Provide liquidity to the WHYPE/LHYPE pool (wrapped HYPE and leveraged HYPE)

- Provide liquidity to the FEUSD/USDXL pool (Felix USD and Hypurr.fi’s stablecoin)

Keiko Finance

Description:Keiko Finance is a permissionless Collateralized Debt Position (CDP) protocol built on the HyperEVM, enabling users to deposit supported assets as collateral and borrow KEI, a stablecoin designed to maintain a stable value. It offers predictable interest rates, allowing users to leverage their assets for trading, investing, or other financial activities without selling their holdings. The protocol is starting to gain traction, reaching milestones like $3.5 million in Total Value Locked (TVL) and incentivising participation through a points program. It is also a tokenless protocol with a very high chance of an airdrop.

Recommended Actions:

- Open a vault using LHYPE as collateral

- Borrow $KEI and deposit it into the Stability Pool

Note: When participating in lending protocols, always monitor your Health Factor or collateral ratio to avoid liquidation, particularly during periods of high volatility. For liquidity provision, we recommend focusing on correlated asset pairs (e.g., HYPE/stHYPE or stablecoin/stablecoin) to reduce the risk of impermanent loss.

Felix Protocol

Description:Felix Protocol is also a decentralised borrowing protocol on the HyperEVM, allowing users to deposit crypto assets as collateral to mint feUSD, a stablecoin pegged to the US dollar, for trading, saving, or earning yield through Stability Pools. It emphasizes security with a lower 40% Loan-to-Value (LTV) ratio and is built as an authorized fork of Liquity V2, incorporating enhanced risk management.

Unlike Keiko Finance, which supports a higher 90% LTV for borrowing KEI and focuses on predictable interest rates, Felix prioritises conservative lending to minimize liquidation risks and offers unique yield opportunities through its Stability Pools. However, similar to KEI, Felix is also tokenless protocol, with airdrop likely to come in the coming months

Recommended Actions:

- Open a vault using $HYPE (minimum borrow is 2,000 feUSD; requires substantial collateral)

- If vaults are full, acquire feUSD through Hyperswap or Kittenswap

- Deposit feUSD into the earn tab to earn liquidation rewards

Hypurr.fi

Description:A lending market centered around $USDXL, with a rewards model based on lending and borrowing loops. Again also tokenless.

Recommended Actions:

- Lend wstHYPE

- Borrow WHYPE to create a looped position and increase reward potential

- Lend BTC and borrow $USDXL (optional)

Hyperlend

Description:A lending and borrowing protocol on HyperEVM, offering points or and potential rewards for participation. Just like many other protocols built on HyperEVM, it is also tokenless.

Recommended Actions:

- Supply wstHYPE (wrapped staked HYPE)

- Borrow $HYPE using your collateral

Step 4: Continue trading

While we anticipate that the majority of future rewards will be tied to EVM-based activity and staking, maintaining consistent trading activity is likely still beneficial. Trading may continue to play a role in future snapshot criteria or point systems—especially given Hyperliquid’s foundation as a high-performance trading platform. We've outlined how to trade effectively here and here.

Step 5: Bonus/Optional actions

These actions are entirely optional and best suited for users who want to go the extra mile and stay deeply involved in the Hyperliquid ecosystem. While not required for potential airdrop eligibility, they may offer added exposure to community-driven projects and future reward opportunities.

- Claim a Hyperliquid Domain Personalize your identity within the ecosystem by securing a Hyperliquid domain name here.

- Collect Hyperliquid’s Meme Token: Alright Buddy The leading meme token in the ecosystem. Contract address: 0x056f0975f104cb5318ecc55f0c82b33a756d29c6

- Explore the Hypio NFT Collection Hypio is the primary NFT collection on Hyperliquid and has received airdrops and collab whitelist access from several partner projects.

Cryptonary’s take

Hyperliquid is redefining what it means to be a community-first, high-performance DeFi protocol. Season 1 distributed over $7 billion in rewards—surpassing all expectations—and the protocol is now generating more weekly revenue than Ethereum. All of this has been achieved without a token sale or VC involvement, with 38.888% of $HYPE still allocated for future distribution.With HyperEVM now live, we’ve entered a new chapter. This time, it’s not just about trading. Staking, liquidity provision, and dApp usage are all in play.

Season 2 may not come with a formal announcement. No countdown. No warning. Just a snapshot. Why? Because they likely want to reward natural, consistent users—not opportunistic participants farming a deadline.

We’re all-in on HyperEVM, hammering six tokenless gems: Hyperswap, Kittenswap, Keiko Finance, Felix Protocol, Hypurr.fi, and Hyperlend. Provide liquidity, stake $HYPE, borrow, lend — every move counts. These protocols’ points program scream future airdrops. We’re farming hard, early, and smart.

Cryptonary, OUT!