Airdrop report: 3 fresh opportunities you can't ignore

September was a strong month for airdrop farmers, with rewards from Linea, Aster, Avantis, and even a surprise NFT from Hyperliquid. With sentiment turning and protocols eager to launch into favorable conditions, this month's playbook highlights the next opportunities across prediction markets and stablecoins. Let's dive in...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

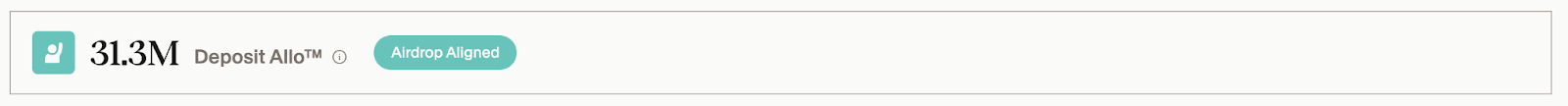

USD.AI

USD.ai (USDAI) is a synthetic, yield-bearing stablecoin protocol on Arbitrum and Plasma that uses GPU hardware from AI firms as collateral. Built by Permian Labs, it connects DeFi and AI by issuing loans to emerging AI startups, effectively turning compute rigs into on-chain assets while maintaining a dollar peg.

How to Farm the USD.ai Airdrop

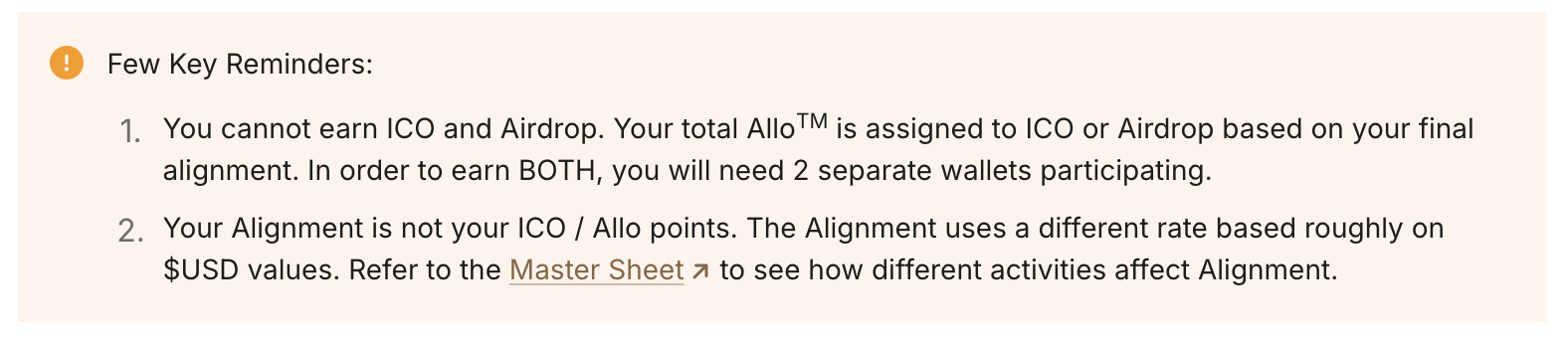

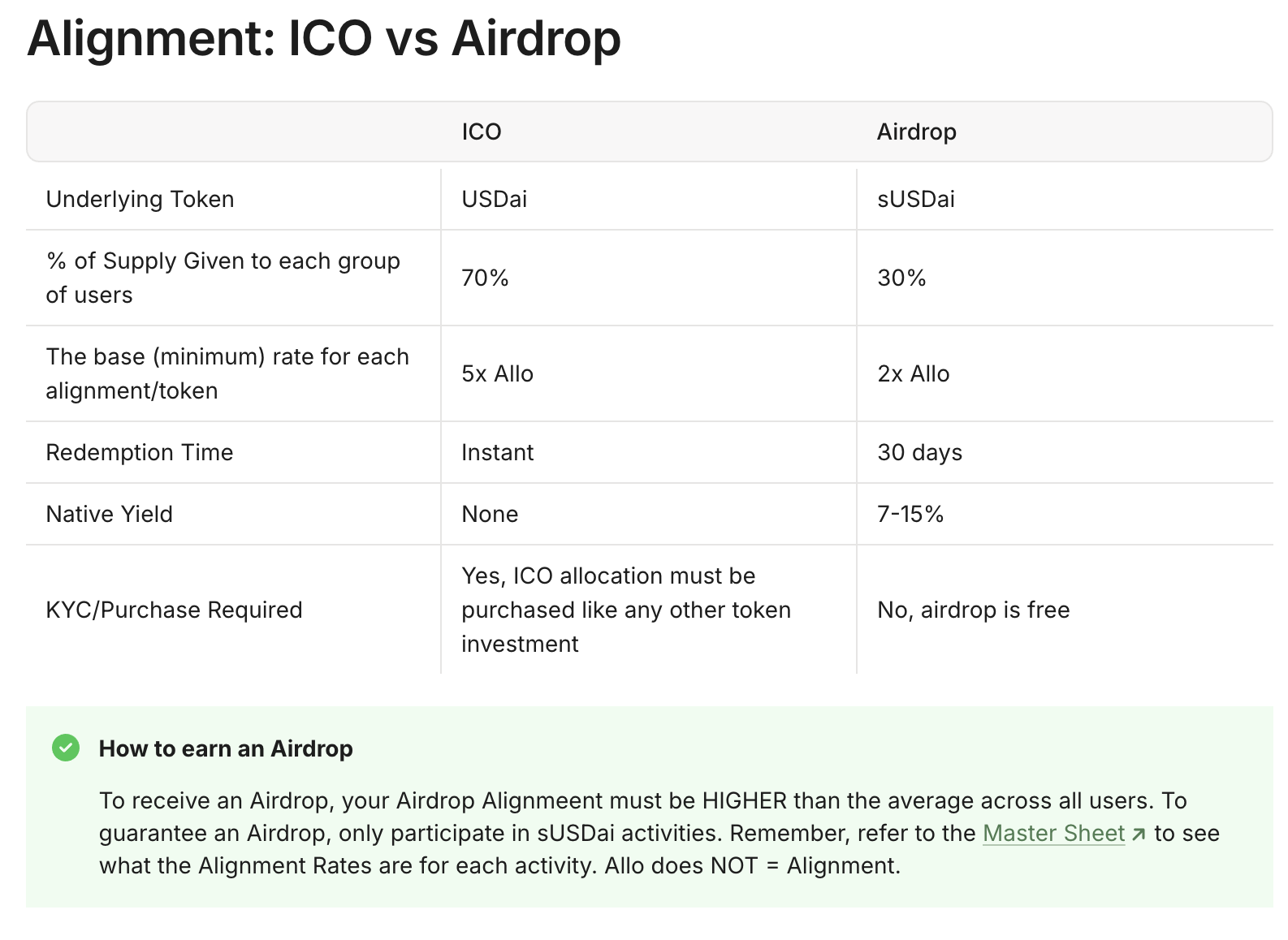

USD.ai (USDAI) is introducing Allo Points (ALLO™) as the rewards system for both its ICO and airdrop. You can only pursue one option per wallet, and we recommend focusing on the airdrop path rather than the ICO. The reason is simple: ICO participation requires KYC and direct purchase, while the airdrop route is free to farm and does not require identity verification.

Why Choose the Airdrop Route?

- No KYC requirement – The ICO allocation must be purchased and verified like a traditional token sale. For privacy and accessibility, the airdrop is the cleaner option.

- Free upside – The airdrop is based on activity and alignment, not direct purchases.

- Yield-bearing exposure – By choosing the airdrop route, you also earn yield depending on where you deploy your assets.

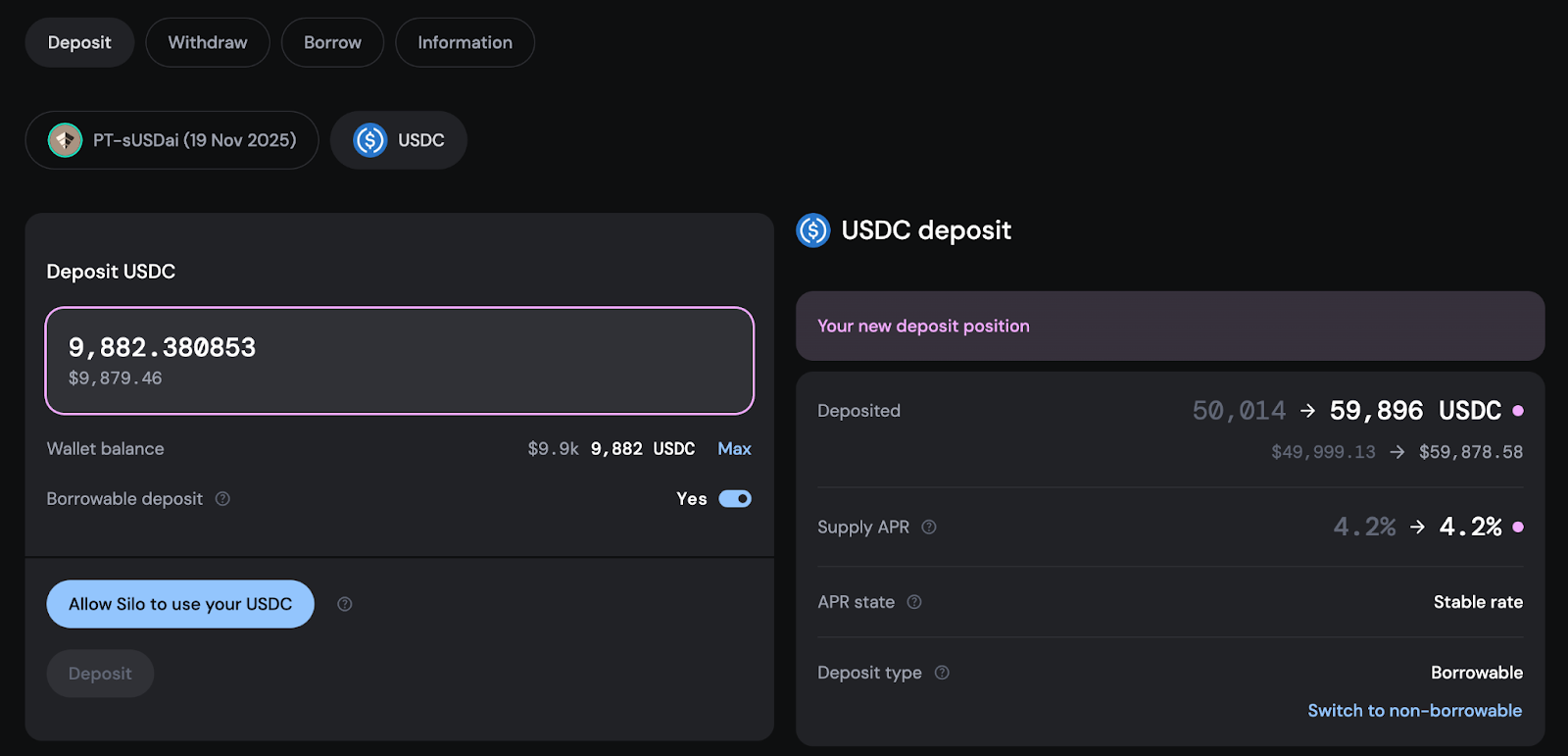

Where to Deposit: USDC in Silo

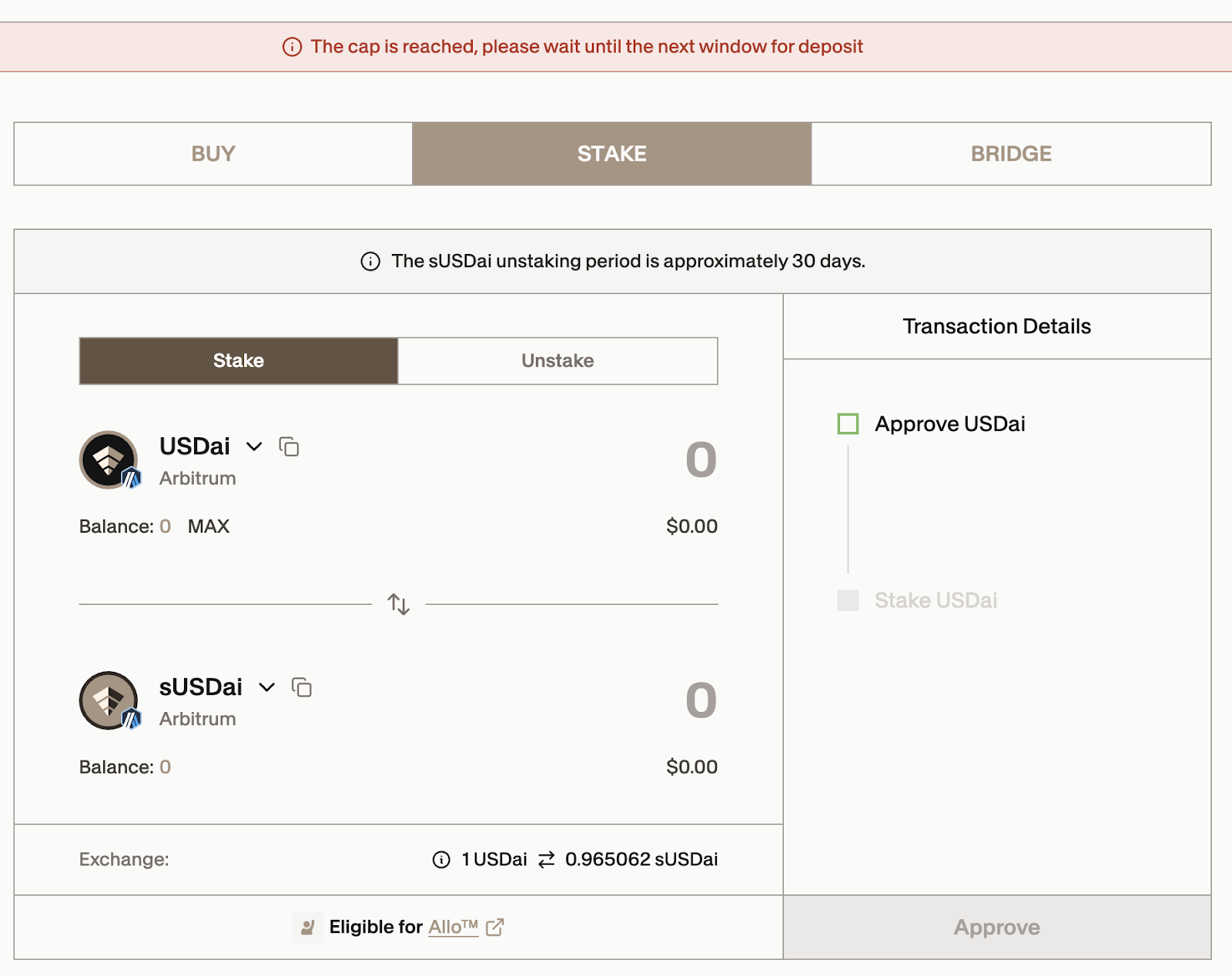

While there are multiple ways to earn Allo points through sUSDAI strategies, the best option right now is depositing USDC into Silo. Here's why:1. sUSDAI deposits are capped

- Direct staking of sUSDAI has already hit its cap. The only way to acquire it now is on the open market, where sUSDAI is trading at a premium above its peg. That means you'd be paying more USDC than it's actually worth, which is inefficient.

2. Unstaking lockup is too long

- Staking sUSDAI directly has a 30-day unstaking period. This lack of flexibility makes it less attractive compared to other options.

- USDC in Silo is flexible, liquid, and earns yield

- Depositing USDC into Silo currently yields 4.2% APR, and there is no lock-up period—you can withdraw anytime.

- On top of that, you earn Allo points, which are the real upside. Depending on final alignment and point multipliers, these points could be worth significantly more than the base yield.

Step-by-Step Guide

- Go to the USD.AI website and join a team.

- Bridge USDC to Arbitrum.

- Go to Silo Finance and click the USDC tab.

- Deposit USDC into the designated pool.

- Track your Allo points through the dashboard. Your points will contribute toward your airdrop allocation.

Here's our video covering USD.AI.

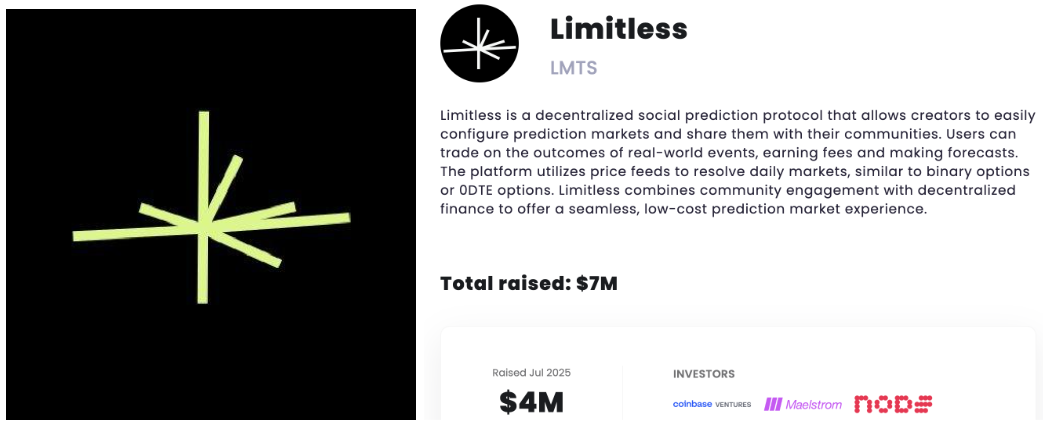

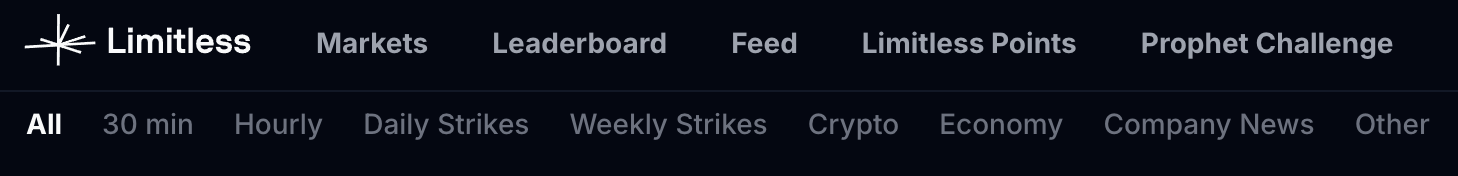

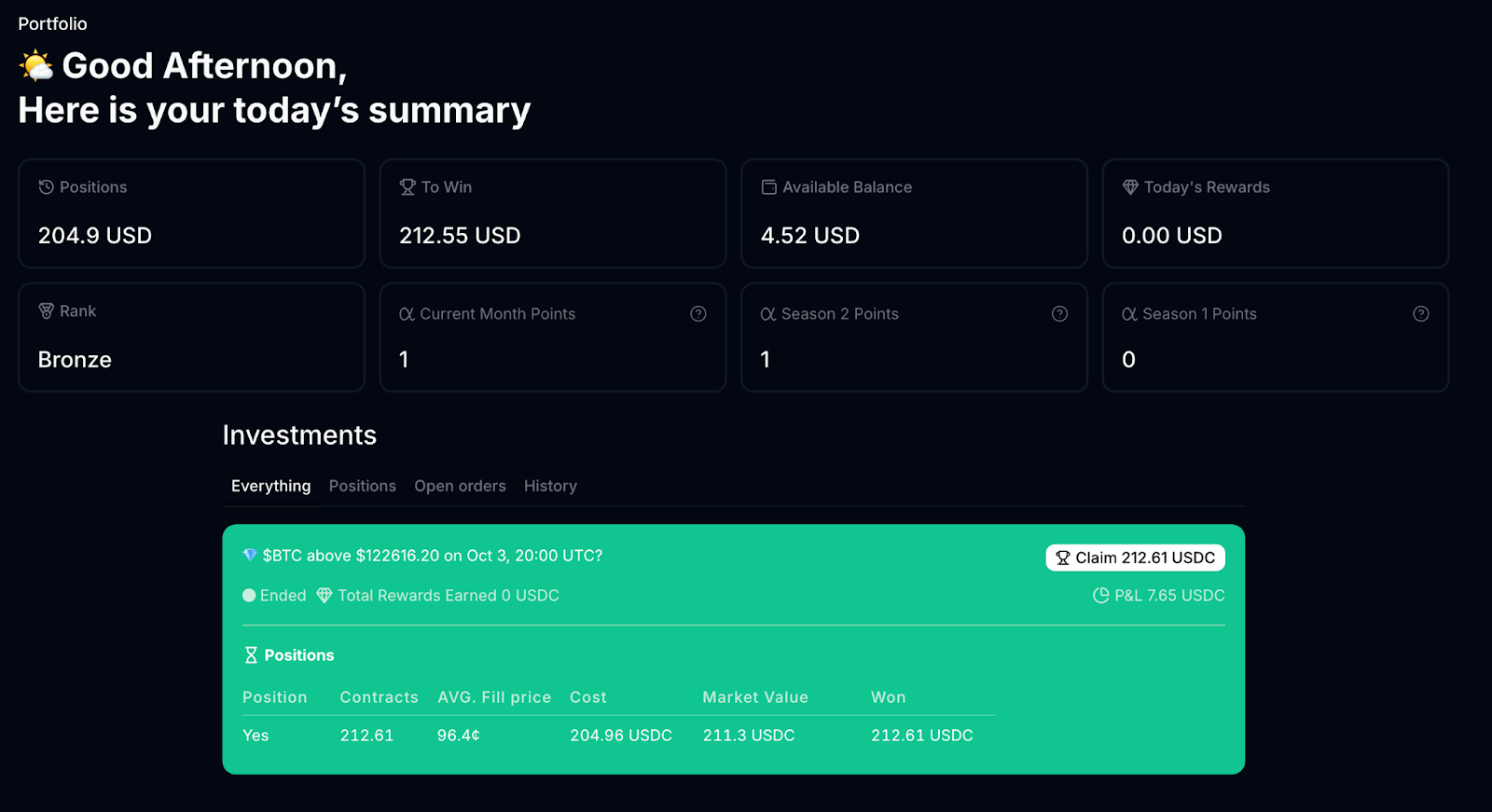

Limitless

Limitless is a prediction market protocol on Base that rewards traders, liquidity providers, and active participants with ownership through its Points Program. In a sector where platforms like Polymarket and Kalshi have reached multi-billion-dollar valuations, Limitless is positioning itself as the next major player by putting activity-driven incentives directly into users' hands.

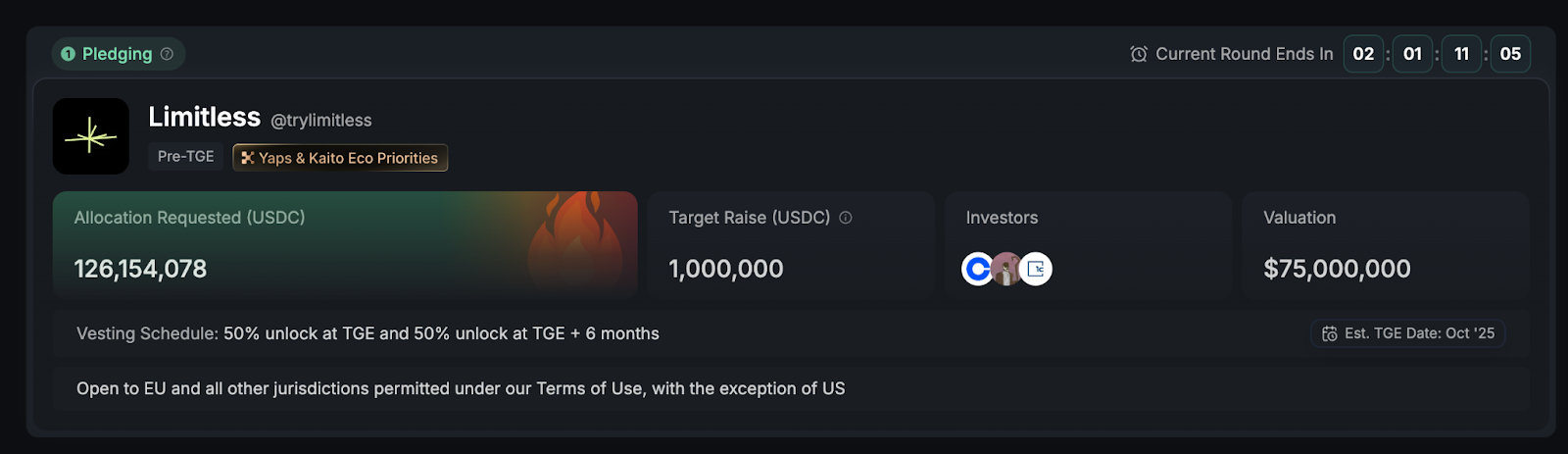

The protocol lets users bet on real-world events such as crypto prices, elections, and economic data, while earning points that convert into ownership through an upcoming airdrop. Despite being new, Limitless has already processed over $420 million in trading volume, highlighting strong user adoption and momentum. Adding to this, the protocol is debuting on the Kaito launchpad, where its pre-TGE pledging round drew over $126 million in requests against a $1 million target. This combination of investor demand and on-chain traction signals major upside for early participants.

With Season 2 live until January 26, 2026, and TGE rumored for late October, timing is critical. This guide breaks down a simple farming strategy designed for beginners and airdrop hunters.

How to Farm the Limitless Airdrop

Step 1: Get USDC on Base- Use Jumper to bridge USDC directly to the Base Network. You'll need ETH to pay for transaction fees. We recommend using a Rabby wallet.

- You'll need at least $200 volume per wallet to qualify.

- Register with this invite link (it may give bonus points via referrals).

- In the top right, toggle Advanced Mode to access full features.

- Click "Hourly" in the top left to find short-term markets (e.g., "Will BTC price be above $X in the next hour?").

- Wait until the final 5–10 minutes before the market closes — this maximizes accuracy on short-term predictions.

- Place one Yes/No bet of at least $200 to hit the volume threshold in a single go (reduces steps and friction).

- You'll need to sign two separate transactions in order to execute the trade.

- Go to Portfolio to view active positions.

- Once the market settles, claim your USDC winnings (or remaining funds).

- Rinse and repeat across multiple wallets to maximize chances of a base reward if the team rewards minimum qualifiers.

Key Notes

Points Distribution: Points update every Monday based on the prior week's volume. Rewards may factor in not just raw trading size but also frequency and market variety, so consistent activity is key.Time Sensitive: Season 2 runs until January 26, 2026. Early activity can boost multipliers, and with TGE rumored for late October, getting started now is the best way to maximize your rewards.

Beginner Tips: Focus on hourly markets for simplicity. They are fast, low stakes, and make it easier to generate steady qualifying volume. Track your points through the app under the portfolio tab. You do not need advanced strategies; consistent trading is enough to build a strong position for the airdrop.

The goal here is not to maximize profit but to generate volume while minimizing unnecessary losses. Even if whales dominate the leaderboard, a base reward system could make multiple wallets highly profitable. Given the massive demand on Kaito and the short runway to TGE, timing is critical.

And in a perfect scenario, interacting with Base-native protocols like Limitless could also contribute to eligibility for a future Base (Coinbase) airdrop. While there are no guarantees, it adds another reason to stay active in this ecosystem.

To go deeper, check out our full video guide [link here] and read the official Limitless documentation for a complete breakdown of rules and reward mechanics.

Finally, make sure to join the Limitless Discord and follow their Twitter to stay on top of announcements, leaderboard updates, and any last-minute changes.

Here is a step-by-step tutorial on how to farm this airdrop:

CapMoney

Cap Money is a stablecoin protocol on Ethereum (built on the MegaETH layer) that lets users mint cUSD, a yield-bearing stablecoin backed 1:1 by USDC or USDT. With the passage of the Genius Act and the success of protocols like Ethena, stablecoins have proven to be one of the few areas in crypto with real product-market fit. Cap Money extends that trend by offering a simple way to hold a pegged asset while earning yield and farming points for a potential airdrop.

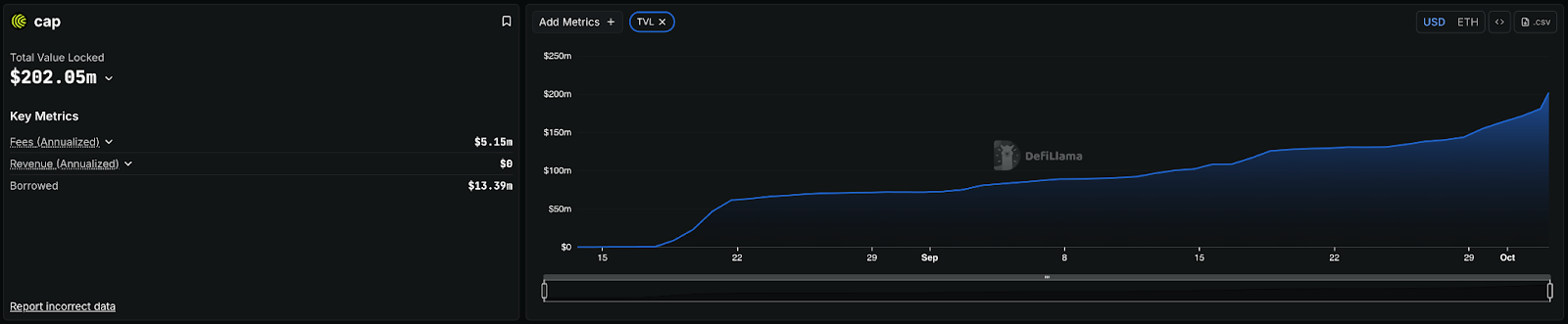

With more than $200M in TVL, it is already gaining strong traction and stands out as one of the most beginner-friendly ways to position for rewards in DeFi.

Why Farm Cap Money?

- Passive and Beginner-Friendly: No trading required. Just mint, hold, and accumulate.

- Low Risk: Always redeemable 1:1 back into USDC or USDT, minimizing downside.

- Proven Meta: Stablecoins remain one of the strongest narratives, with protocols like Ethena rewarding early adopters heavily.

- Early Advantage: The program started on August 18, 2025, so consistent farmers are already stacking points.

Step 1: Get USDC on Ethereum

- Use Jumper to bridge USDC directly to Ethereum Mainnet. You'll need ETH to pay for transaction fees. We recommend using a Rabby wallet.

- Go to the website and connect your wallet.

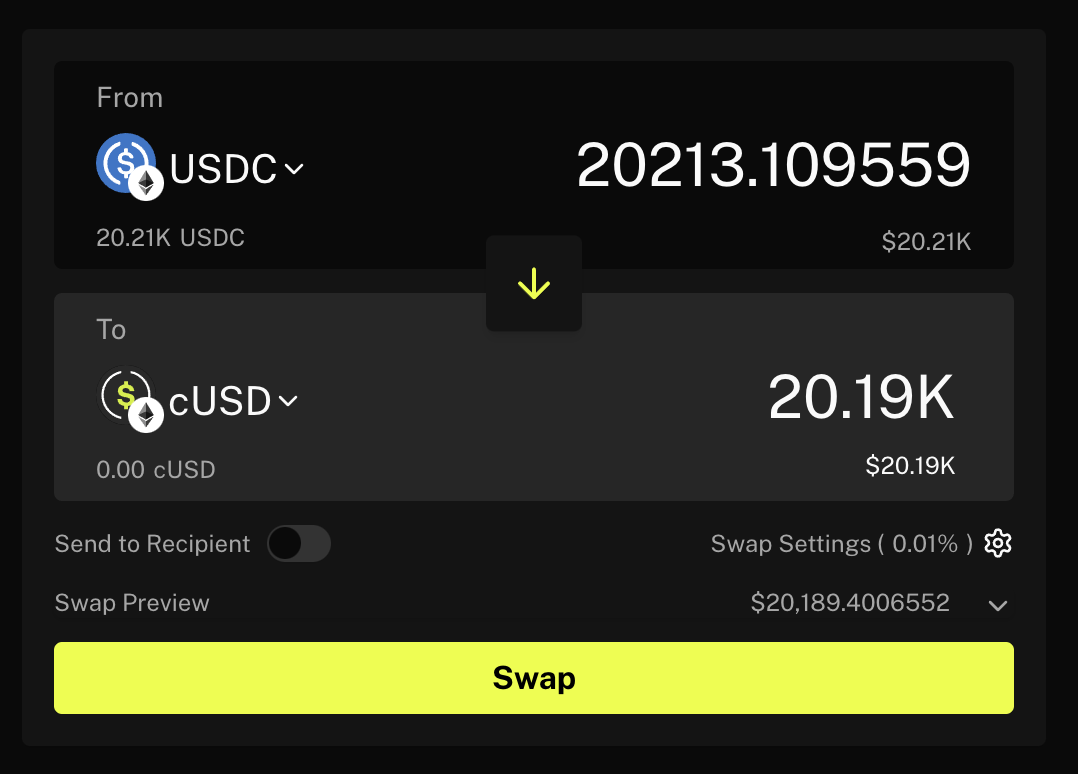

- Swap USDC for cUSD at a 1:1 ratio with low fees.

Important: Both plain cUSD and YT versions count for Caps points, but the staked version only earns yield.

Step 3: Hold and Earn

- Once minted, just hold cUSD in your wallet. That's it!

- Points update daily and are tracked under the "Caps" tab.

Click the "Caps" tab to view your total, rank, and leaderboard.

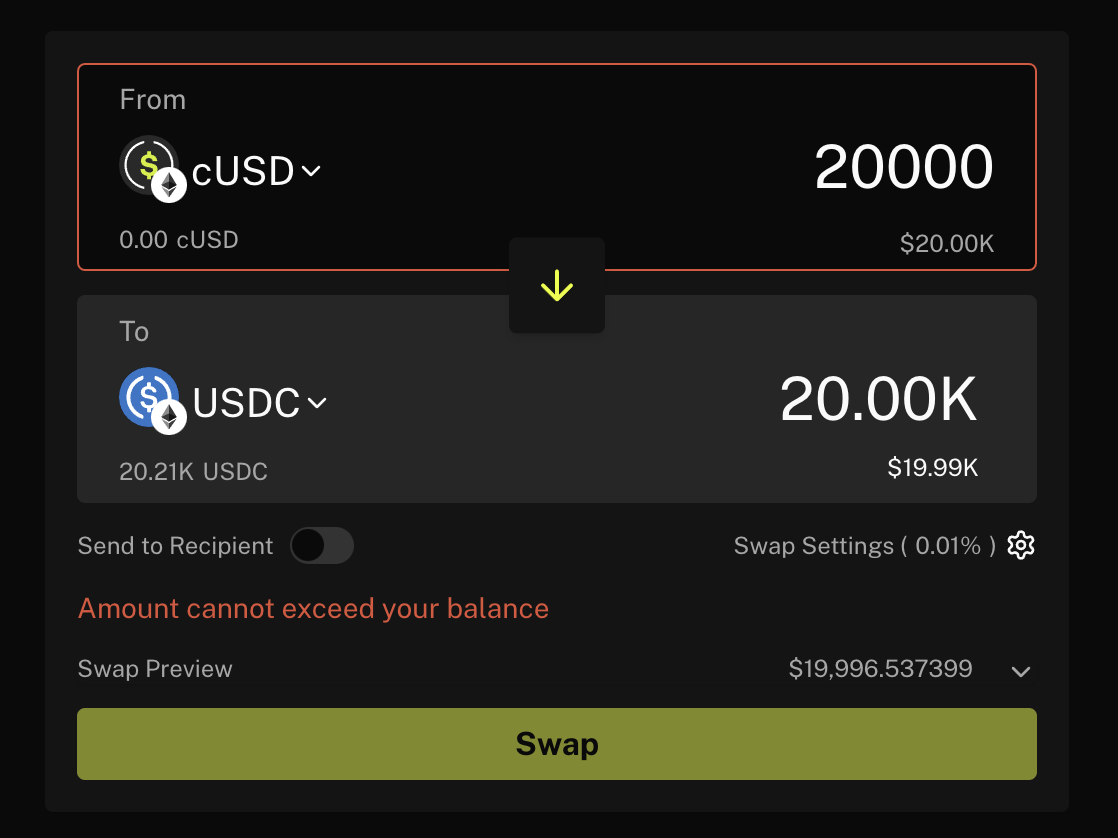

Redeem back to USDC anytime via swap tab.

Cap Money is one of the easiest passive farms live right now. You simply mint cUSD, hold it, and watch Caps points accumulate. With rising demand, strong TVL growth, and stablecoins proving to be one of the most resilient narratives in DeFi, this is a low-effort way to position for upcoming rewards.

Click here for our video guide.

Cryptonary's Take

Airdrop farming continues to evolve, but the common thread is clear: protocols that solve real problems are the ones worth focusing on. Prediction markets are gaining cultural and financial traction, with Limitless showing strong early adoption on Base. Stablecoins remain one of the few areas in crypto with proven product-market fit, as Cap Money demonstrates with simple mechanics and fast-growing TVL. Meanwhile, experiments like USD.ai point to the merging of DeFi with broader industries like AI.For farmers, the key is consistency. Stick to simple strategies, spread activity across credible protocols, and stay aligned with ecosystems that are showing momentum. Timing also matters: with several TGEs on the horizon and a broader market backdrop that is turning favorable, the opportunity set looks better than it has in over a year.

The window to build exposure before these tokens go live is open, but it will not last forever.

Cryptonary, OUT!