Alpha-DAO: Proposal #10

Alpha-DAO is a new Decentralised Autonomous Organisation created by the research team behind the CPRO reports. There have been 8 structural proposals passed; however, the second investment that the Alpha-DAO will embark on has been passed after a 72-hour voting period.

Based on an ecosystem that the Alpha-DAO research team is familiar with and well-versed in, it was a no-brainer for most of the team to pass this vote.

All research completed by Alpha-DAO to build out a thesis behind the following investment is explained below.

The report also includes the execution strategy, alongside the capital allocated and the fees paid to the blockchain.

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

The information made available in this report is NOT for replication. The purpose is to share the thought process behind the DAO’s decision making – additionally this is HIGH RISK journey for the DAO which means capital has also been allocated in accordance with this. Once again, DO NOT REPLICATE.

Background

If you've ever interacted with any of the applications built on the Solana blockchain, you have probably also interacted indirectly with GenesysGo (GG). GG initially started as a service for people to stake their SOL and help secure the network. In turn they then expanded to also offer RPC services. RPC services are required by anyone, as it's how transactions are sent from individual computers to the blockchain. A generalised overview of your transaction is:1- Use your computer with Phantom (wallet) to send a transaction

2- Transaction instructions processed to the RPC server

3- RPC server feeds your transaction to the validators (the Solana blockchain) to validate

4- When your transaction is validated the RPC server relays this back to you and updates your wallet on screen.

As you can see from the above, RPC servers are integral to a blockchains success, as without them there wouldn't be any transactions. Indeed earlier this year, due to the speed of Solana and the lack of correctly configured RPC servers, Solana ran into multiple technical issues. GG systems did not contribute to this outage due to the specifications of their hardware. Their business model combined with the best possible hardware has made them the market leader for anyone looking for RPC calls (all developers and protocols looking to use the blockchain). GG owns upwards of 50% of the market share in the Solana RPC server provider market.

Now that you've understood how infrastructure plays a critical role in any blockchain application, let's look at another critical sector of infrastructure: Storage.

Storage is critical for all blockchains, especially for Proof-of-Stake networks to store their history (all the blocks in existence since the first one) in an immutable manner. Additionally, all peripheral data (e.g. images for NFTs) have to be stored securely as well. To put the scale of data in perspective the full Solana ledger is currently 50TB and is growing by 6TB a week.

Well that doesn't seem to be such a big problem does it? Surely it's stored safely? Pls Anatoly...

The current solutions are:

- One week of history is stored locally on all validators

- Parts of the history are stored on IPFS and ARweave

- Full history also stored on a Google big data database

Enter Shadow Protocol - the next piece of the puzzle being built by the Genesys team. The goal is provide a decentralised storage solution for Solana and that network consisted of three key parts:

1 - Operators (People providing storage and compute power to the SHDW protocol)

2 - Network (RPC network)

3- Drive (Decentralised storage)

Shadow Protocol will be governed by a DAO, with $SHDW being the governance token. Operators provide storage and compute resources in return for receiving rewards in the form of SHDW tokens. Users will be able to choose between either a one time payment for permanent storage (the ARweave model) or a monthly rent payment to continue hosting their data (IPFS model). Storage payments will be taken in the SHDW token creating both a use case and demand for it.The most important and interesting part though is the fact that operators will be required to stake their tokens to participate in the network using a Proof of Stake model, with emissions stemming from the fees collected (i.e. Revenue). This further increases demand, and removes tokens from the circulating supply, with a clearly understandable use case. Its applications expand outside of blockchain to general data storage applications. Shadow Protocol is designed to be able to handle the throughput that Solana requires, and to be built to work in synergy with Solana. In turn this should ensure that it can handle the demands of other 'slower chains'. Running a SHDW node and participating in the network remains within Alpha-DAO plans, to extract maximum value from its purchases.

Question: What did we purchase?

Answer: Two NFTs

Question: Why?

Let us explain.

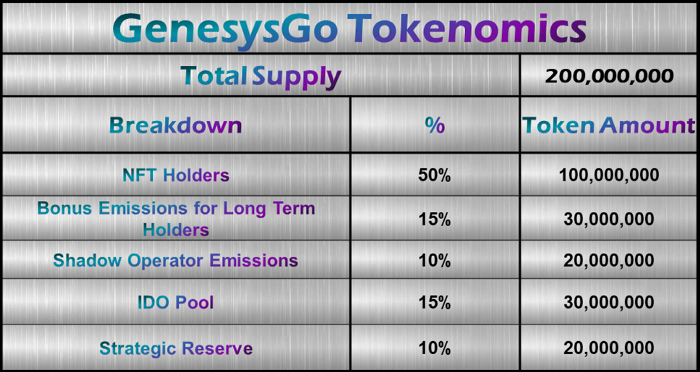

There are 200,000,000 (200 million) SHDW tokens in total supply at the start. The team wanted to raise funds but they wanted to avoid the typical VC route to mitigate risk of big concentration of the supply in a few hands. So, they decided to perform the "seed" phase funding via an NFT called "Shadowy Super Coders" (SSC). At the start, it wasn't known what purpose the NFT would serve but the mint price was 2.5SOL with a collection of 10,000 NFTs.

As you can see above, 50% of the supply is reserved for the "seeders" or NFT holders which means (after doing the maths) that each NFT will own 10,000 SHDW tokens. Now, we also know that these tokens will be vested and unlocked linearly over one year; meaning daily unlocks for 365 days as an NFT is staked - there will be contract for that.

The Strategic Reserve (10%) tokens are unlikely to be available on the market. The IDO Pool tokens will be available on the 3rd of Jan 2022. The IDO will follow the Mango model, and thus those tokens will be exchanged for the total USDC which is present in the pool. For more details on what the Mango IDO model is please review the mechanism here. At the moment the details regarding the upcoming IDO are not clear, aside from the date (03/01/22 2pm UTC), the token starting price (0.5$) and the amount of tokens that will be available (30 million tokens). As more details become clear there will be a follow up report outlining how to participate in the IDO. Additionally, Frank the founder of GG will be attending our discord AMAs to answer any questions that you might have about the project directly!

From both the Mango and Aurory raises, these pools are massively oversubscribed, and thus the token price is always higher than the stated token price. In this case the token price is 0.50$, so it is reasonable to see a price of 1.5$ per token when the pool closes. These tokens however will be the only ones available on the open market. As can be seen NFT holders will be receiving 65% of the token supply. However all of these tokens are locked up. They can only be accessed if a holder stakes their NFT and then claims their tokens which are unlocked daily. Each NFT comes with 10,000 tokens that are locked away. It is up to owner to stake the NFT and then recover the tokens attached to it. If the tokens are not redeemed and the NFT is sold, the new owner can then redeem the remaining tokens. Additionally once an NFT has been staked for a year and all the 10,000 tokens have been redeemed, and additional bonus of more tokens are unlocked. This vesting schedule ensures that there will not be many tokens available throughout the upcoming year. Additionally there is no 'dumping by VC' scenarios present, and the distribution of unique owners is diverse. The additional bonus of 3,000 tokens for having continually staked your SSC is another important upside factor to include.

To understand why the choice to purchase the SSC NFTs was made, it is important to look at the projects Market Cap (MCap) using two methods. Firstly let's use the 0.50$ token from the IDO. With that valuation per token the MCap implied is 200million * 0.5 = 100million $. A more accurate approach would be to use the price of the NFTs to project the market cap. With the current floor price of 70SOL, it implies a MCap of 700,000SOL or 126million $ for 65% of all the tokens. Extrapolated this gives a MCap of approximately 200million $ for the SHDW project. The clearest comparison for SHDW is ARweave, which raised a 2.2million $ funding round, and is now has a MCap of 2 billion $. Bear in mind it has achieved this valuation with a current storage capacity which is smaller than the size of the whole Solana blockchain.

It has to be mentioned here that the NFT mint occurred on the 3rd of November with a price of 2.5SOL per NFT. Using that valuation the company raised funds valued at 4.5million $. Of course at that time there was very little clarity on what exactly the SHDW tokens associated with the NFTs would be used for. As the information became publicly available, the market has started to reflect this. The best indicator of this is the movement of the price floor from 40 SOL at the time the proposal was made, to the current price of 70SOL as of the time of the proposal voting window closing. Regardless we believe that the current state and MCap of ARweave is a logical comparison/expectation for the SHDWY network by the end of 2022. Conveniently this lines up with when the staking bonus will be available for the SSCs which the DAO will have staked. In turn such a comparison leads to a projection of 10$ per token, well grounded in reality. The choice to purchase an NFT over participating in the IDO with the capital was made as it would allow for a locked in purchase price for a sizable amount of tokens.

For proof of concept see ARweave trading at sub dollar prices in August and its sustained increase in price stemming from demand since September. With the expected growth of Solana, the SHDW network is expected to grow in parallel. One year of patience could lead to significant rewards with the possibility of sustained upside, as infrastructure is always in demand.

Peak inside Alpha-DAO

This is the exact process the proposal went through inside of the DAO.Proposal

Acquisition of Super Shadowy Coders (SSC) to lock in exposure and allocation to the SHDW token. Each SSC NFT receives 10K SHDW tokens with daily vesting over the course of a year.

If voting to approve the allocation please indicate the level of allocation we should look for - 1/2/3 (corresponding to A/B/C) NFTs. I am voting for option C personally.

Timeline: 12months

Objective/Projection: 25K $ to 300k $ (12x)

Preferred allocation: 30K SHDWY tokens (one year vesting) - 3 SSC = 3*45SOL = 135SOL = 25K USDC = 25% of treasury

[audio m4a="https://cryptonary.s3.eu-west-2.amazonaws.com/wp-content/uploads/2021/12/downside_2.m4a"][/audio]

[audio m4a="https://cryptonary.s3.eu-west-2.amazonaws.com/wp-content/uploads/2021/12/downside_1.m4a"][/audio]

Funds Update

- Test TX for 10UST

- 23,990UST (Terra TX) which was then redeemed to our Alpha-DAO.sol address (GxYgGVBkDz6hQqMYGrpFTue5JZZg9GPeatTgjKx2n7TU)

- #1445

- #1563