Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

The information made available in this report is NOT for replication. The purpose is to share the thought process behind the DAO’s decision making – additionally this is HIGH RISK journey for the DAO which means capital has also been allocated in accordance with this. Once again, DO NOT REPLICATE.Hello Frens. Maven Here. This piece will share my most recent Alpha-DAO proposal word for word and explain why it got rejected. Enjoy.

Proposal:

Deposit 50K UST into Solend in $UST lending pool to receive 29.23% APY rewards (13.63% in LUNA)

Tricky thing is is that the deposit limit on this pool has been reached … twice. It was been since been raised to 7 million which I witnessed 2M deposited in there in a second. The large trading firms are onto this. Makes sense, rewards are crazy. We’ll be earning in LUNA which is an asset I am very long on and should be a part of the AlphaDAO Portfolio. This would be an improvement on the current APY we're earning on Anchor, as we'll be earning largely in LUNA.In order for this trade to execute, we need rapid deployment of funds. Due to this, I have tweet notifications on for both Rooter (founder of Solend), Solend, and possibly Terra Daily.

I will be withdrawing my personal stack of UST from Anchor and keeping it in my Phantom ready to go so I waste no time bridging. In order for this trade to be successful, we need to get the timing perfect. Due to the current time it takes us to move funds, this trade is infeasible unless whoever is in direct control of the money also has notifications turned on for these accounts and will be ready to deploy in an instant with UST already bridged to Phantom beforehand. It’ll be tough, but we have a chance if we’re ready.

Risks

- Solend smart contract risk

- Price action of assets assets we earn APY in (SLND, LUNA)

- Earning rewards partially in Solend’s native token (SLND) - a token we aren’t necessarily bullish on

- Possible rapid decrease of APY in stablecoin pool compared to the current stable 19.5% APY from Anchor

- The need to actively manage the funds

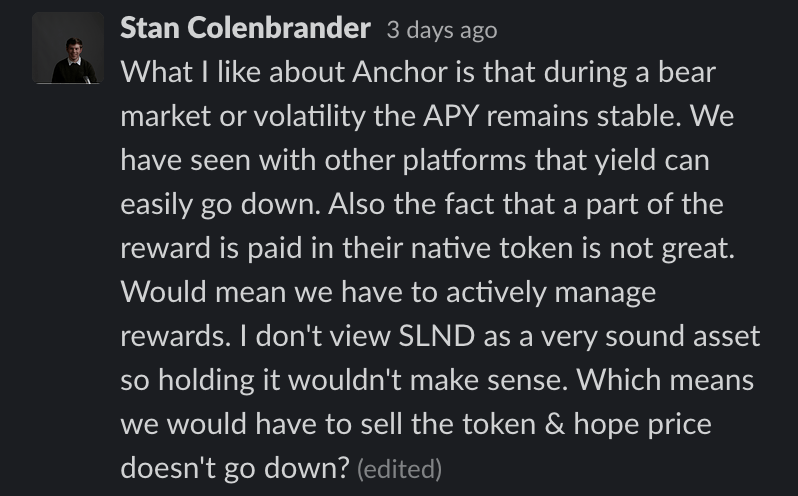

Stan posed the question “would we have to sell the token (SLND)?” This a great question. When conducting a short term trade (as opposed to a long term investment) it’s important to know what your exit is. My plan for this was to hodl the $LUNA earned, and sell off the $SLND. This was not properly communicated by me in the proposal, which led to Stan being unsure of what the full spectrum of the trade is. Thanks Stan for adding this perspective.

When trading, you need to actively manage funds. It is time sensitive (as explained in the proposal), time consuming, and can be stressful. Investing in assets you have long term conviction in and hodling them for the long term is a safer and perhaps superior strategy. At the very least, you will be able to sleep better at night

Let’s address the decreasing APY. As we’ve learned with liquidity mining, most of the time ridiculous APYs simply cannot last. As the pool fills up with more capital, more rewards need to be paid out to all the new users who have joined. This decreases the rewards eventually until they are dried up. Solend has placed caps on this pool to sustain rewards, however there is no way to know what the next cap would be, and how long these rewards would last. The pool has since increased from 7M to 10M in deposits and the APY has decreased from 29% to 18%.

Conclusion

I proposed what I deemed to be a viable short term trade to increase our $LUNA position. The team however thought the opportunity cost of this trade was too great. They preferred to keep the stablecoins in Anchor. After voting, the proposal was rejected. This is what a decentralized democracy looks like!

That’s all for today. Thanks for reading!