Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

The information made available in this report is NOT for replication. The purpose is to share the thought process behind the DAO’s decision making – additionally, this is a HIGH RISK journey for the DAO which means capital has also been allocated in accordance with this. Once again, DO NOT REPLICATE.

Asset: Astar Network (ASTR)

Description: Polkadot Infrastructure Play

Thesis:

- The Polkadot ecosystem has been on our radar now for over a year.

- Up till very recently most of the projects have still effectively been in their “baby-steps” launch phase.

- What I am seeing is a lot more activity recently, especially around Acala and Astar.

- Acala recently (5 days ago, 24/03) launched a $250 million ecosystem fund to jump-start the Polkadot DeFi economy through their stablecoin and incentives for builders that have viable use cases for aUSD.

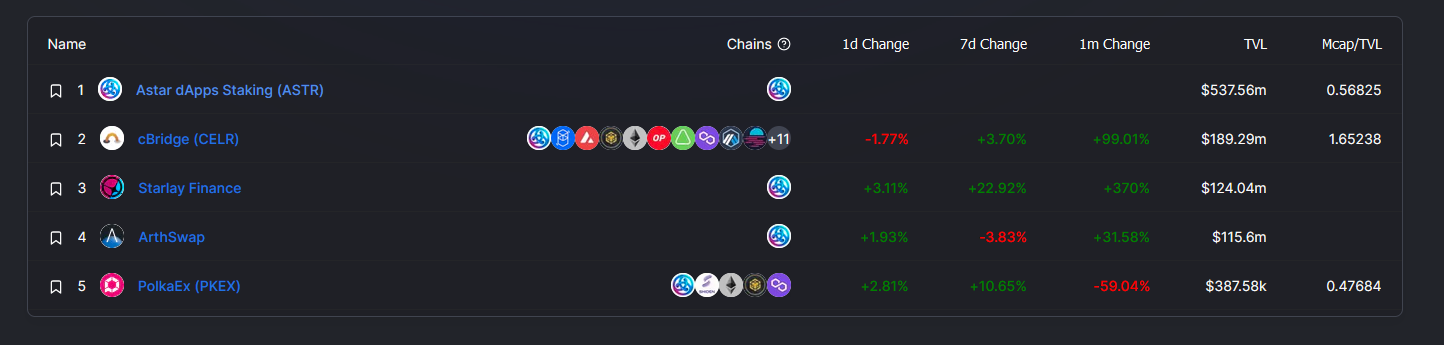

- Starlay Finance, the first lending protocol (think Aave) built native to Polkadot, is soon to launch on

- Additionally, (and I know we’re not fans of TradFi but in this case it’s relevant), Coinbase recently invested in Astar Network in a follow-up round of funding, and Microsoft (and Alameda, and other VCs) will support Astar’s incubation program whereby funding will be provided to developers looking to build on Astar and Polkadot in general.

- We already know that if developers be developin’ on Astar, significant quantities of ASTR tokens will be locked in DApp Staking. (see report)

- According to CoinGecko, Astar sits at an MCap of around $300 million – with a TVL of $540 million. Inefficiency?

- The market appears to be swinging bullish Q2, with volumes on Astar and other Parachains picking up.

Valuation & Risk Management:

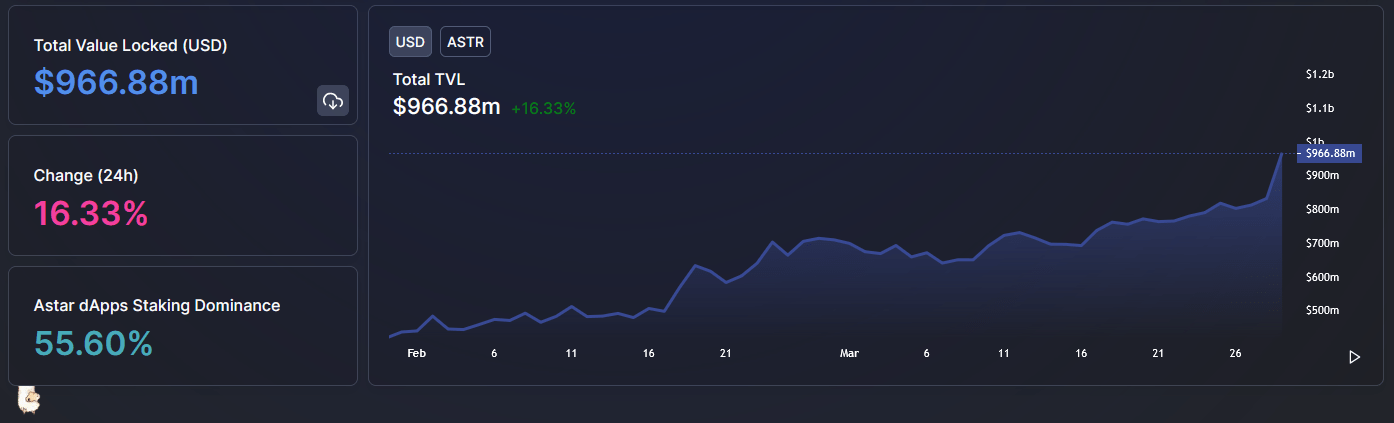

(The DeFiLlama figures include validator staking as well as DApp staking, which is around 56% of the total as shown)

Total TVL has grown significantly in the last month. If we look at the table below, we can see why:

I believe that this growth will continue and will drive price appreciation of ASTR; both directly through DApp staking, and indirectly through use and hype around the protocols launching on it. We are still early in the Polkadot ecosystem’s journey, but I believe now is the time to capitalise on the “bud” before it flowers. The basic infrastructure is basically all there, including a bridge.

My intention is for this to be a Q2 play, however, given the likelihood of Astar Network being around for a while, I don’t think it would be a bad idea to hang on to at least some of the tokens longer term.

So, my proposal is this:

- TWAP $10,000 into ASTR anywhere around $0.10-0.20 everyday over a period of 4 days. (25% each day).

- The reason for this is because I don’t personally believe $50k BTC will be taken first time around and we may end up getting a better price – after voting is completed this should be a full week (3 days voting, 4 days buying).

- For the exit strategy, I propose selling 25% every 100% from our entry up to 3x. The rest will be held till a later date as a longer-term investment.

- This takes ASTR from a $300m MCap to a $900m MCap, well within what I consider to be reasonable for one of the first Parachains on Polkadot in a heated market.

- The aggressive exit strategy compared to some of the other proposals put forward is because I would like to still have some liquidity for future Polkadot plays – especially some of the Polkadot native protocols that don’t have tokens yet.

- In my opinion, invalidation would be a sustained drop in TVL in Astar Network over a period of a week or a daily closure under $0.07.

https://cryptonary.com/research/astar-network/

https://defillama.com/chain/Astar

Implementation Plan:

ASTR is widely available so I will leave the best course of action up to Karim, who will be executing the above plan in the event of a pass.

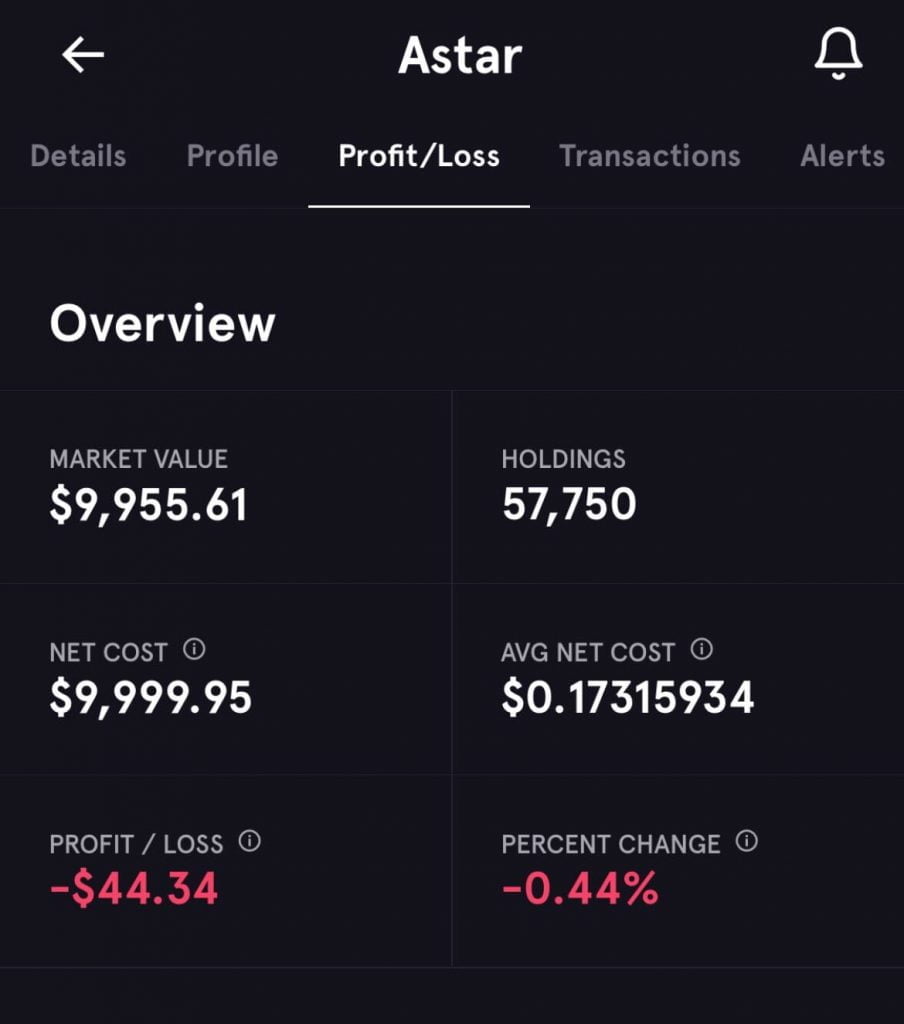

STATUS: PASSED

Proposal 17 Executed

- 10,000UST withdrawn from Anchor

- 10,000UST sent to KuCoin

- 10,000UST sold for 9,990USDT

- 9,990USDT sold for 57,750ASTR

- Average Entry: $0.1732