Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

The information made available in this report is NOT for replication. The purpose is to share the thought process behind the DAO’s decision making – additionally, this is a HIGH RISK journey for the DAO which means capital has also been allocated in accordance with this. Once again, DO NOT REPLICATE.This report outlines new information that has come to light. This proposal looks to take advantage of this knowledge before it becomes widely known and subsequently take advantage of the market momentum coming from it.

Asset: Shadow (SHDW)

Description: Solana and data storage Infrastructure Play

Valuation & Risk Management:

I propose an allocation of 5% of the AlphaDAO funds (5,000 USDC) to spot purchase SHDW at the current price of around 0.85 USDC. The take profit point for this would be at a price points of 1.2 and 1.5 USDC, with 50% of the position closed when those targets are hit. The stop loss here would also be tight, at the 0.7 USDC level, as either the mechanism and SHDW drive work as anticipated which should be reflected in the price. Any other outcome should trigger the Stop Loss. The timeline for this development in price is the next 4-8 weeks and if that is not met the position should be exited to ensure capital efficiency, especially as there is an existing hefty allocation via previous proposals.

Implementation Plan:

The purchase can be made across Raydium, Orca and Aldrin Exchange, all of which are DEXs on Solana.

Proposal 18 | Status | Executed

- 5,000UST withdrawn from Anchor

- 5,000UST sent to Alpha-DAO.SOL via Wormhole/Portal

- 5,000UST exchanged for 5,000USDC via Jupiter

- 5,000USDC exchanged for 5,312 SHDW via Jupiter

- Average entry: 0.94$ per SHDW

- Take profit @ 1.2 and 1.5 USDC, with 50% of the position closed on each target achieved.

- Stop Loss at the 0.7 USDC (33% daily sells if 0.70 is hit). The full position is exited if the price is below 0.70 USDC over 3 days.

Thesis:

The below report is collated from a Q&A session from the GenesysGo discord, hours of reading discussions between Frank (co founder of GenGo), the dev team and questions from external developers and SHDW holders. It condenses the key issues and questions which currently exist around the SHDW drive and allows us to better predict what the project is aiming to do. We will cover core investment updates and the direction of the projects before presenting my interpretation of the discussions regarding the tokenomics and what they mean for holders of SHDW.

The SHDW drive looks to be a comprehensive storage solution. The goal is to initially manage to index and store all of the solana blockchain data, a significantly better solution than the current Google Big Table solution Solana implements. To explain it in simpler terms - Solana data will be easily and quickly accessible to anyone - via SHDW drive. Once native Solana storage is taken care of the team will look to expand to as many blockchains as they can. In general the approach being taken is to build the SHDW drive with future scalability in mind. The answer to most common questions such as, will it support different data types?, will it host multiple chains’ data? will there be a UI ? is YES. The team has realised that for their product to perform they will have to match at least the current solutions usability and feature space. Basically SHDW drive will have to be as good as existing solutions to have a chance at being successful so most accepted features are planned to be included. You can see some more in-depth questions and Franks’ responses at the end of this report - which should give you a good sense of the direction that the project is taking and their approach.

Now let’s dive into the juicy alpha - the hints and what my intuition is saying regarding the tokenomics.

This concept is key for someone to understand the innovation that GenGo is planning. SHDW drive aims to offer two different types of storage - this is the feature that will differentiate them from the competitors. The two types of storage are mutable and immutable storage. Simply put - when mutable you can delete or update something - whilst when immutable you can’t edit anything, it’s meant to stay there forever unaltered.So far we have not seen a robust solution to this problem by any competitors (Filecoin, Arweave etc..). Competitors and their current offerings and shortcomings have been covered in previous reports, and if you’re reading this, i expect you to already understand the general thesis behind SHDW.

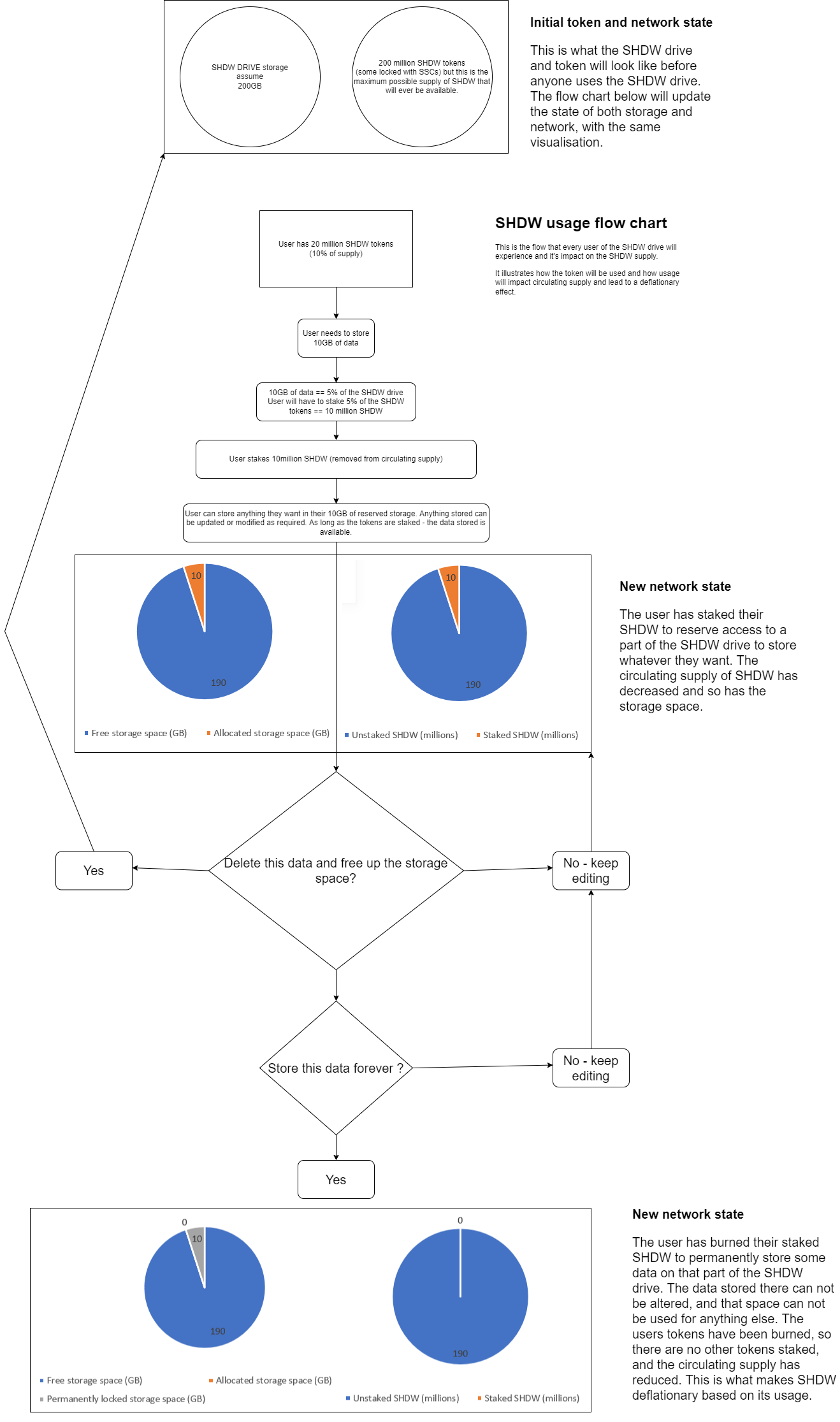

Anyways - why is this important Bill ? Well, SHDW is what enables GenGo to solve the above problem of both permanent and non-permanent storage. As far as i understand SHDW holders will be able to stake/lock up their SHDW tokens to gain access to storage on the SHDW drive. The amount of SHDW will determine how much storage space the user will be able to use. As long as the SHDW is staked/locked the user will have their data stored. If they wish to unlock their SHDW they will also relinquish their storage space on the SHDW drive. This takes care of the ‘mutable’ storage part.

But what about the ‘immutable’ storage ? Well those staked/locked tokens can burned in order to make the files stored permanent. Yes that is burnt which means SHDW will effectively be deflationary as it’s usage and the amount of files stored immutably on the SHDW drive grows.

To quote word for word from Frank himself:

The whole point is that when you stake SHDW into the SHDW Drive users are staking their claim for ownership of piece of the storage map. We make sure it’s all on-chain and always available. If you don’t need the data stored forever you unstake, give up your piece of storage real estate, but still have your SHDW tokens. We’re building a flag so you can forfeit your staked SHDW in exchange for permanent immutable storage

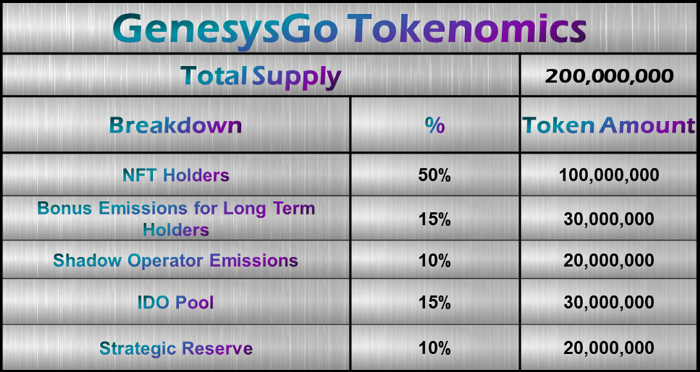

From the above diagram you can see how the SHDW token has deflationary potential. But let’s explore some more factors. Firstly it is important to remember that a large % of tokens is still locked up with SSC staking. Indeed 65% of all SHDW tokens are locked to the SSC NFTs. The SHDW drive should launch approximately halfway through the year. A rough estimate the SSCs will have 25% of the circulating supply unlocked by then. An another 15% from the IDO pool bring us to roughly 40% of the tokens being available on the circulating market when the SHDW drive goes live. This is around 80,000,000 SHDW tokens.

Some of these tokens will have to be staked by SHDW drive operators (the people who will run the computers to store the data), and they will receive emissions as shown above. We still do not know the exact details regarding how operating a SHDW node will work.

Aside from the tokens being staked by the operators, users will have to stake tokens in order to access the storage. In turn many users will also have to burn their SHDW in order to make their data permanent. This should lead to a sudden supply shock to the available SHDW once the drive goes live - with the combination of staking from operators and users looking to reserve storage along with the burning of SHDW from users looking to have permanent storage. In contrast to all this usage - the only new supply of SHDW tokens on the market will be from SSC emissions and the SHDW operator emissions.

Simply put - if the usage of SHDW drive is enough SHDW will become a deflationary token. What makes this particularly interesting is that although the full supply of SHDW is fixed and can only decline via burning - the amount of storage can increase as more operators join the network and as more resources are allocated. We currently don’t have any details about how this could operate but a logical assumption is that the inflation of the storage space available reflects back to the staked/burned SHDW. Regardless having the token be deflationary and the utility inflationary is an extremely novel combination which I expect to perform admirably.

To put the above in simpler terms, the number of available SHDW tokens will decrease as the value offered by them also increases.

One last thing i will add here which is rampant speculation by myself - but it truly is something i believe we might see. Solana is currently storing their historical data with Google Big Table. This is an extremely expensive method and i currently costing the Solana Foundation around 50K USD a month just for the server costs. Additionally due to the throughput of Solana - Google Big Table struggles to keep up with writing the data - as a result sections of the Solana blockchain are not recorded correctly. To combat this, Solana have two engineers whose main role is to ensure that the history is being written correctly. As you can clearly see this is a massive waste of resources? Why? Well the problem is not being solved - it is simply being dealt with as it appears and is not scalable.As the SHDW drive is purpose built to keep up with the throughput off Solana - it will not require the same expenditure of resources and babysitting that their current solution with Google Big Table does. The Solana ledger sits at above 50TB of data - which is a hefty amount of data to store - and this will need to be permanently stored. I expect at some point either the Solana Foundation of Anatoly to announce mass purchase of SHDW tokens in order to initially store the Solana ledger and also to be able to store the new data which is generated as Solana runs.

Lastly let’s look at a key checklist to make sure only high quality opportunities are being pursued. The checklist is made up of three key elements:

- Current market sentiment - the market is generally bullish and in an upswing. SHDW is also seeing some momentum. Overall market conditions are favourable.

- Strong fundamentals - The reason SHDW is even being discussed is due to its fundamentals, use case and team.

- Technical Analysis - does the chart coincide with the above outlook and is it primed for entry? The information divulged above from the GenGo channels is not common knowledge, and in general should not be reflected in the current price action. The TA will also offer us a take profit target, looking to take advantage of momentum in the market as the above knowledge regarding staking and burning of SHDW becomes public knowledge along with the SHDW drive becoming operational.

The TA above comes from Eugene.

The blue level is the area to watch, due to the low liquidity/MCap big buys/sells cause those wicks but overall it's been trading around there for like 2 months. Any moves above have been on pretty low volume (on Raydium at least). It has been setting higher lows over the last week or so, would be looking for volume to step in here and if there's a catalyst for that (which we know there is) then the probability of further upside is high IMO. Near-term upside target would most likely be $1.50 for SHDW.

Core investment update:

Are there any limitations on the type of data the SHDW drive will be capable of storing? (file size, type, formats etc.)Frank | GenesysGo — Nope! We're building the drive to be able to store data of any type. Low key, we are planning to come after Filecoin and their goal to "store the internet". (edited)

Do you have a feel for required system specs for SHDW drive node operators? Will they be similar to RPC server/validator specs at first (i.e. preeeetty pretty beefy)? Or will a less kickass system be sufficient as long as it has a fat pipe and a boatload of drive space?

Frank | GenesysGo — Starting off, we'll stick with beefy systems. However, I may or may not (but definitely did) drop a version of storage onto my laptop and watched as our system pushed data to it for storage.

Is there any reason why SHDW Drive can't also provide storage services to other chains (like ETH), such that limiting $SHDW price estimates to solana-only models is an incorrect approach ?

Frank | GenesysGo — Shadow Drive will definitely end up providing storage to any and all chains. Solana is just the beginning...

There's a trend in software development of having the Cloud dev environments where the codebase lives on a server. The devs connect with whatever hardware they have and the code runs on the beefy server. Like JetBrains Space or Fleet. Would it be possible to host such a thing on Shadow Drive?

Frank | GenesysGo — I don't see why not? Metadata can be stored in multiple places. The NFT projects would simply need to change a few lines of code to point requests at SHDW Drive instead of Arweave

What would be the shape of the shadow drive? at least initially, a cli program to upload files or a UI or both?

Frank | GenesysGo — CLI uploads and commands will be the start. UI will come later. Both will run together

Hey guys, for work I am asked by the task force for municipalities of the Netherlands to explore blockchain solutions. Most of it is cringe stuff (guys don't even know why they should/should not opt for a chain), but here to ask how easy will it be to port data over to the future Shadow drive? Data that needs to be stored is basically a JSON object per registration. Naturally, an indication, if it could be done this year or help with a PoC, will be much appreciated.

Frank | GenesysGo — If it's not easy to upload a file and store data with us then we're not doing a very good job imo. I see you being able to test and use our storage solution in the next few weeks

Will it be possible to only provide resources for Shadow Drive and not RPC resources? So that a desktop computer could be used for Shadow Drive instead of the beefy servers needed to provide Solana RPC services.

Frank | GenesysGo — Yes

You've said operating a shadow node will involve operators staking SHDW tokens. Do you have any indication of how many SHDW tokens will be needed to operate a node, or a target number of third party nodes?

Frank | GenesysGo — $10k worth is the current amount we're targeting. We're tracking a USD amount of $SHDW bc we really like thinking ahead about scale and don't want to price out operators in the future as $SHDW grows in value. One thing I do disagree with Solana on is their "1 SOL = 1 SOL" approach. The reality is that running nodes (whether it's Solana or Shadow) has real world USD costs. A "1 SHDW = 1 SHDW" approach would impact our ability to onboard new Shadow Operators and stay true to our belief that being a Shadow Operator

Are there plans for Shadow Drive to support video storage and streaming?

Frank | GenesysGo — Definitely.

I'm not sure what the storage risks would be or how the storage quite works, but will you do tiered storage safety? Like, more copies of your data are distributed/stored with "Shadow Storage Gold" vs "Shadow Storage Silver"? I think it would also be cool if there's a streamlined way to store certain blockchain data locally as well (i.e. nft/transaction data from Phantom). I need to read more about what proper cataloging of blockchain history/storage actually consists of though... with merkle trees, accounts, etc..

Frank | GenesysGo — I think there is a risky tendency by blockchain devs to rly overcomplicate things due to a very loose definition of what constitutes "web3". There's an infinite number of rabbit holes blockchain builders rush down in order to reinvent the wheel and slap a "web3" label on it. I've found it helpful to think about "web3" not from a tech lens but more from a philosophical one.

Without entering into too technical aspects, is there a mechanism in shadow drive guaranteeing no data loss ? If data is replicated in several shadow drive operators but they suddenly stop their servers, how can you guarantee that the data will not be lost ? Is there a sort of nakamoto coefficient that would ensure that no data would be loss above this threshold ?

Frank | GenesysGo — Yes

Project direction

Why don't we utilize SHDW token utility for the shadow network (RPC servers)? I understand why you decided to offer the RPC services for free but I would think overtime, that value gets diminished quite substantially. Why not implement at least a "mini-utility" with SHDW for RPC servers?Frank | GenesysGo — There are additional RPC elements and improvements we have planned (which are only possible bc of Shadow Drive storing all on-chain data directly) that we're discussing as additional use cases for $SHDW, however... I would strongly caution against underestimating just how big data storage actually is. We also strongly believe in upholding the commitment we made to the ecosystem around the free RPC network. We raised a ton of money during the IDO... that is years and years of RPC support for the entire ecosystem. Why is that important? Because, like it or not... if Solana doesn't grow then SHDW doesn't grow and vice versa.

If the storage will be on the chain, does Solana Labs / Foundation / Anatoly, validators have to buy in to the architecture before it becomes part of Solana? I wonder how the approval process works in the decentralized world.

If the storage becomes part of the chain and storage is provided by all the validators as part of them maintaining the chain, can ShadowDrive ask the users to pay for what's already part of the chain? What will be a good example for a service charging for what's on chain?

Frank | GenesysGo — We're in conversations with Solana about this. They understand that we're not doing this purely bc we're nice guys. They also get that there's a full community of supporters behind us (and them) on this and so I have zero worries around this. That said, this is probably the one area where we're going to be continually opaque. That's bc releasing details of those convos/answering this question right now would be me speaking on behalf of both Solana and GenGo. I can speak on behalf of GenGo but these convos aren't GenGo only

Can solana validators / foundation keep up with SHDW drive development? As in, can they scale to accommodate you, given problems with slowdowns over the past few months? I know long term plans are for SHDW to offer services to ETH and EVM chains, but obviously that will place a huge load on the solana network.

Frank | GenesysGo — Assume the best, plan for the worst. We're building with the thought in mind that the problems with slowdown/scale will continue. This isn't bc we think Solana will continue to have problems (quite the opposite)... it's bc if we build thinking the problems will continue then our ability to scale won't be affected. If the problems disappear then our ability to scale also isn't affected.

Technical Details

What's the most challenging thing you're working on right now?Frank | GenesysGo — The most challenging thing is creating trustlessness. There are plenty of storage solutions out there as data storage is by no means a new thing and we have no intention of reinventing the wheel here. Trustlessness though... that's what matters. How do you verify someone is storing your data and being a "good actor" about it? To accomplish this we're building a series of smart contracts that pass hashed (encrypted) keys between those who provide storage to the network. These keys are generated via $SHDW and are passed via a standard Solana transaction. So, the txn of payment takes place on chain, the creation of the hashed public/private key pairs take place and are visible on chain (not the keys themselves, just the fact that the keys were created and the parties involved were in good standing). This is the very high level TL;DR version and it's the part of SHDW drive that we think is the most important to get right. Fortunately, we're feeling very very good about this and are very excited

Can we build a distributed Postgres DB on SHDW drive?

Frank | GenesysGo — This question was rly interesting to the team. The short answer is, yes... absolutely. There are many many things which could be built on top of Shadow Drive. We've got a list and this got added.

What architecture choices will be made to speed up the storage and storage retrieval processes? Are there aspects of Solana's general design principles -- parallelism, etc that will be incorporated as well? Also, will th dev side be complimentary to the current Solana dev environment? I.e. usage of Rust and what not? Or be pretty different?

Frank | GenesysGo — We're huge fans of Rust since it's programming language which is very close to the machine level. If we wanted to get closer we'd need to start looking into C. So, the environment should be very complimentary to the current Solana dev environment.

Are there any security concerns? Is there a possibility of virus being stored and replicated? Is there a need to scan for virus?

Frank | GenesysGo — Existing storage solutions have been tackling this for years. I would say that our security concerns are no more than that of any storage provider (which is to say that they are many). The good news is there are many many battle tested ways to protect users and address security concerns.

If Shadow Drive is used to replace Google Bigtable as the primary method for long-term storage of the full solana historical record, is there a single canonical history stored on shadow drive that all validators will reference or is each validator required to separately store and pay for their own version? If there's a single canonical version, who pays for that to be stored?

Frank | GenesysGo — Validators don't reference the history ever. Proof of History is purely a point in time consensus mechanism. Validators reaching consensus on current blocks aren't affected at all by the entire validator network instantly forgetting that block. It's everyone else that cares. So, the single canonical history is what matters and it matters for builders, users, auditors, etc and it is served by RPC servers to those users.

Can the digital ledger for solana since genesis block be stored in a decentralised way without compromising security? (ie. breaking a map into parts would ease storage but bad actors could forge a fake) And what's the bare minimum of mirrors for these ledgers to be secured, and fidelity increases with every mirror but will it be capped to keep the economic model profitable?

Frank | GenesysGo —Sure it can. The concept of a network having to reach consensus in order to allow for an action to happen (data to be stored or a request to be served) is nothing new.