Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

The information made available in this report is NOT for replication. The purpose is to share the thought process behind the DAO’s decision making – additionally, this is a HIGH RISK journey for the DAO which means capital has also been allocated in accordance with this. Once again, DO NOT REPLICATE.Status: Voted & rejected

This proposal has been rejected. As the unlock has already taken place, there is no clear time period or stop-loss for this play. The risk of any stop loss chosen being hit is too high, and price action is too uncertain, especially with Sandbox's recent pump.

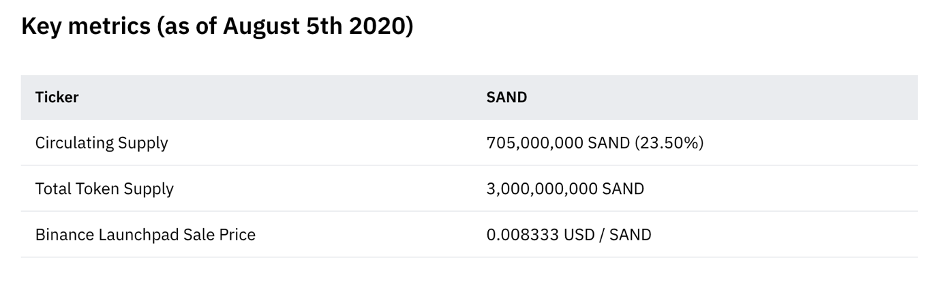

Asset: SAND

Description: 15% of total SAND supply unlocked on 13th June 2022, and I anticipate considerable selling pressure from VCs who are up over 200x.Proposal: Short SAND.

Vital notes - This proposal has not been voted on and requires feedback before considering execution. As the unlock has already happened there is a high level of speculation which must be taken into consideration.

Reason

Very sizable unlock, bullet unlock (in 1 day) of 15% of the total supply (450m tokens) of SAND on 13th June, increasing the circulating supply by 36%. The market hasn’t reacted yet, but this doesn’t mean it won’t.Given current market conditions, investors will likely be looking to sell big, considering they are up over 200x on their investment, and all their other bags are nuking.

As you can see from the screenshot below, one wallet put 5m SAND into Binance only 2 hours ago! (0x5366dC49E76ba0173921C636AA23DcD00E4B296b)

![]()

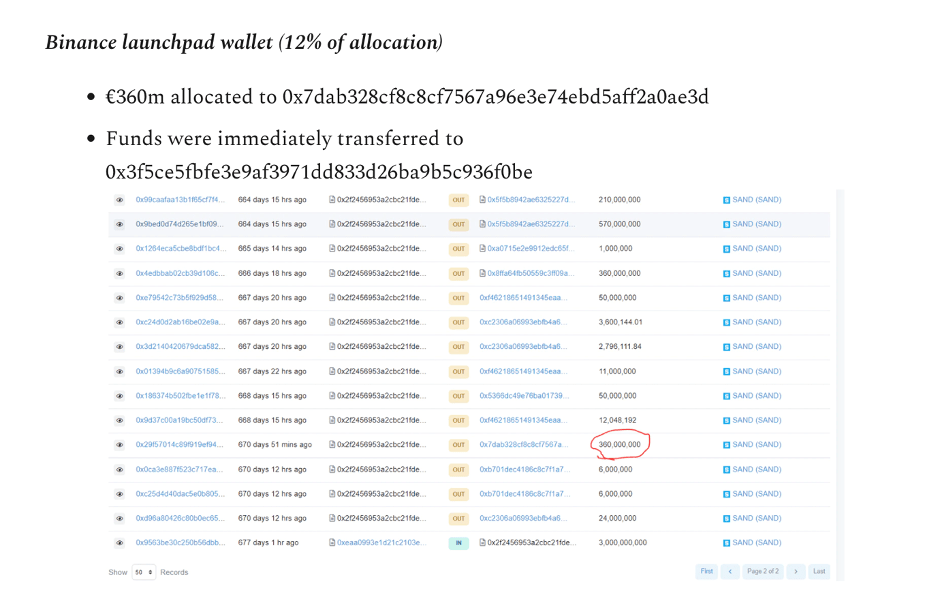

It’s difficult to track down the other tokens, however, we know the launch took place on Binance launchpad, and 360m tokens were sent there straight away, as you can see below:

This person also sent their 2.5m SAND unlock to Binance. From the wallets I can track down, they all seem to be selling or getting ready to sell. The fact I can track these down means they aren’t from the launchpad, so either investors or the team. (0x8c6D2be82c3F511567733E1980a809b15C123Bd5)

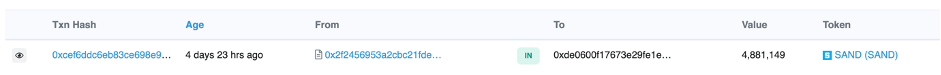

And another 4.8m sat in this wallet (0xdE0600F17673e29Fe1eDa9E80608e3E00DA8d1Ba)

Obviously, this is only the tip of the iceberg, but it does demonstrate that the distribution has happened, and investors are selling.

I believe the selling pressure has been partly avoided so far as people wait to see the market’s next move, and partly just hasn’t been noticed as all things went down. I propose we wait. Only pulling the trigger on this trade when we all agree there is not a rally coming crypto-wide any time soon (likely after the rally we are expecting).

This proposal is more to discuss the logistics, and iron out the details before we put forward the detailed final proposal.

Note, the funding rate is not concerning, only slightly negative on the major exchanges and positive on the minors - https://coinalyze.net/the-sandbox/funding-rate/

Method

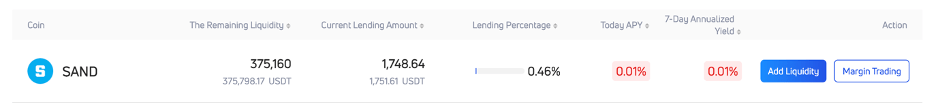

We have 2 options here, perpetual protocol has SAND, so we could short it there, or we could margin borrow sand on Gate.io and sell it, to buy back and pay off the loan at a later date.0.01% APY to borrow on Gate.io if I’m not mistaken - it is difficult to find the details but that’s the rate lenders are paid so I assume it is translated across (at the very least should be very close) - this makes it my preferred method for this trade.

Strategy & Execution

With a potential pump around the corner, I’m looking for more opinions here. My outline idea is as follows:Look to identify the local top of this market move up, using on-chain metrics and technical analysis. When we identify the local top and DAO members agree (using standard vote), we then execute the spot short (using margin borrow against our USD on Gate.io).

Take profits – I propose taking profits as follows, buy back (% of initial amount) 20% at 5% profit, 50% at 10% profit, 30% at 20% profit.

Stop-loss – Stop loss will be placed at 10% loss, subject to DAO members' agreement (would require a conversation and vote). A hard stop will be placed at 20% loss (no vote, instant execution).

Technical Analysis (provided without knowledge of what the TA was for – didn’t know the plan was to short, and unedited)

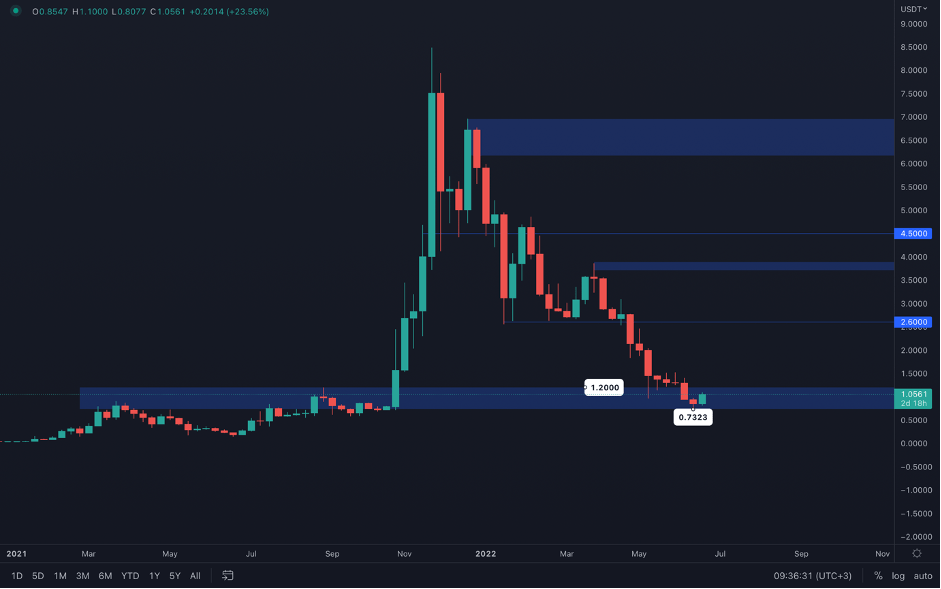

As far as technicals go, we can obviously see that SAND has been in a downtrend for over 200 days. SAND’s bearish market structure is completely intact, and only a weekly break above $2.60 can invalidate this, followed by a higher low and a higher high in order to flip its market structure. The reason why we’re interested in SAND is that price has come down to an extremely important demand area, as price spent multiple weeks ranging between $1.20 - $0.70 last year, before starting to increase exponentially

.Of course, we’re aware of the reason why SAND has had such a crazy run last year, and that’s hype. The Metaverse was a topic of discussion for almost the entire year, and many Metaverse tokens have exploded in value due to the hype created around them. This has to be acknowledged, as the hype has ended and price came back right back to where it started.

Although we should be expecting price to range between $1.20 - $0.70 for multiple weeks, this can change due to a short-term rising BTC. There’s no denying that this range isn’t powerful, as we can prove that by 2021's price action (prior to the hype), a constant range where people accumulated SAND and ultimately received exponential gains in a short amount of time. Although that will not happen again, at least not in such short amount of time, the $1.20 - $0.70 range presents a good opportunity to buy, given how it is the most important demand area for SAND. Current market conditions will most likely have an impact upon SAND and the price will be kept in the range for some time, before showing signs of a break, either under or above it.

Some things I want to hear from other members:

What do we think will happen next in crypto, do we think shorting is appropriate right now? If not, what will change that, when will it be appropriate to short? If we do have a pump, I believe SAND will suffer much worse than others on the way down.