All research completed by Alpha-DAO to build out a thesis behind the following investment or any other market movements are explained below.

The report also includes the execution strategy, alongside the capital allocated and the fees paid to the blockchain once a proposal is passed.

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

The information made available in this report is NOT for replication. The purpose is to share the thought process behind the DAO's decision making - additionally this is HIGH RISK journey for the DAO which means capital has also been allocated in accordance with this. Once again, DO NOT REPLICATE.

Description

Sell ETH/LDO & Buy LowerThesis

Technical

Both ETH & LDO set bearish engulfing candles on the weekly timeframe.[caption id="attachment_229781" align="aligncenter" width="2560"] ETH/USD 1W[/caption]

ETH/USD 1W[/caption]

[caption id="attachment_229779" align="aligncenter" width="2560"] LDO/USD 1W[/caption]

LDO/USD 1W[/caption]

Fundamental

- The macro landscape remains unchanged with an upcoming energy crisis in Europe going into the winter, of which we’re already seeing price increases. CBs are likely to enter with liquidity at some point to save the day and avoid societal collapses, however the time period leading into it would be dreadful for asset prices; including crypto.

- The second point is the unwinding of “The Merge Trade”. Given that an ETHPoW fork is planned, many purchased spot ETH, sent it to self-custodied wallets and hedged by selling an equal amount of ETH0930 futures. When the merge occurs alongside the fork, these bettors will have gained their “airdrop” of ETHPoW tokens and will dump the excess ETH they purchased for this specific purpose. I speculate this creates the last push down of this upcoming downside leg

Implementation Plan

Sell 3.95ETH at a price > $1,500.Sell 4,350 LDO at a price > $1.80.

Netting us >$13,755

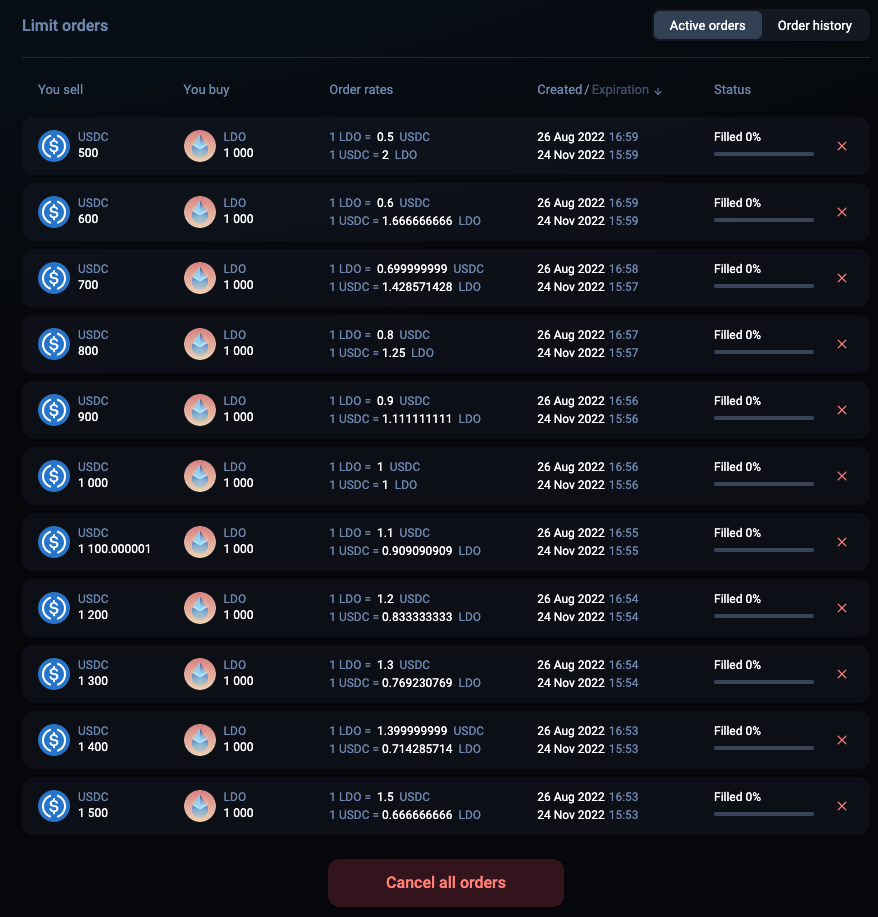

Rebuy 11,000 LDO in increments of 1,000 at prices of: ($1.50/$1.40/$1.30/$1.20/$1.10/$1.00/$0.90/$0.80/$0.70/$0.60/$0.50) for an average entry price of $1.

Then, once filled, the take profits will be as follows:

- 2,200 LDO at $3.50

- 2,200 LDO at $4.50

- 1,600 LDO at $8.00

Execution

- 3.95ETH sold for 6,304 USDC ($4.19 network fee)

- 4,350 LDO sold for 8,220 USDC ($11.39 network fee)