All research completed by Alpha-DAO to build out a thesis behind the following investment or any other market movements are explained below.

The report also includes the execution strategy, alongside the capital allocated and the fees paid to the blockchain once a proposal is passed.

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

The information made available in this report is NOT for replication. The purpose is to share the thought process behind the DAO’s decision making – additionally this is HIGH RISK journey for the DAO which means capital has also been allocated in accordance with this. Once again, DO NOT REPLICATE.

One short week and we are back with another proposal. Sold in P.25 and buying in P.26, getting confusing huh? Well the reality is, the market has been confusing and we must adapt.

Description

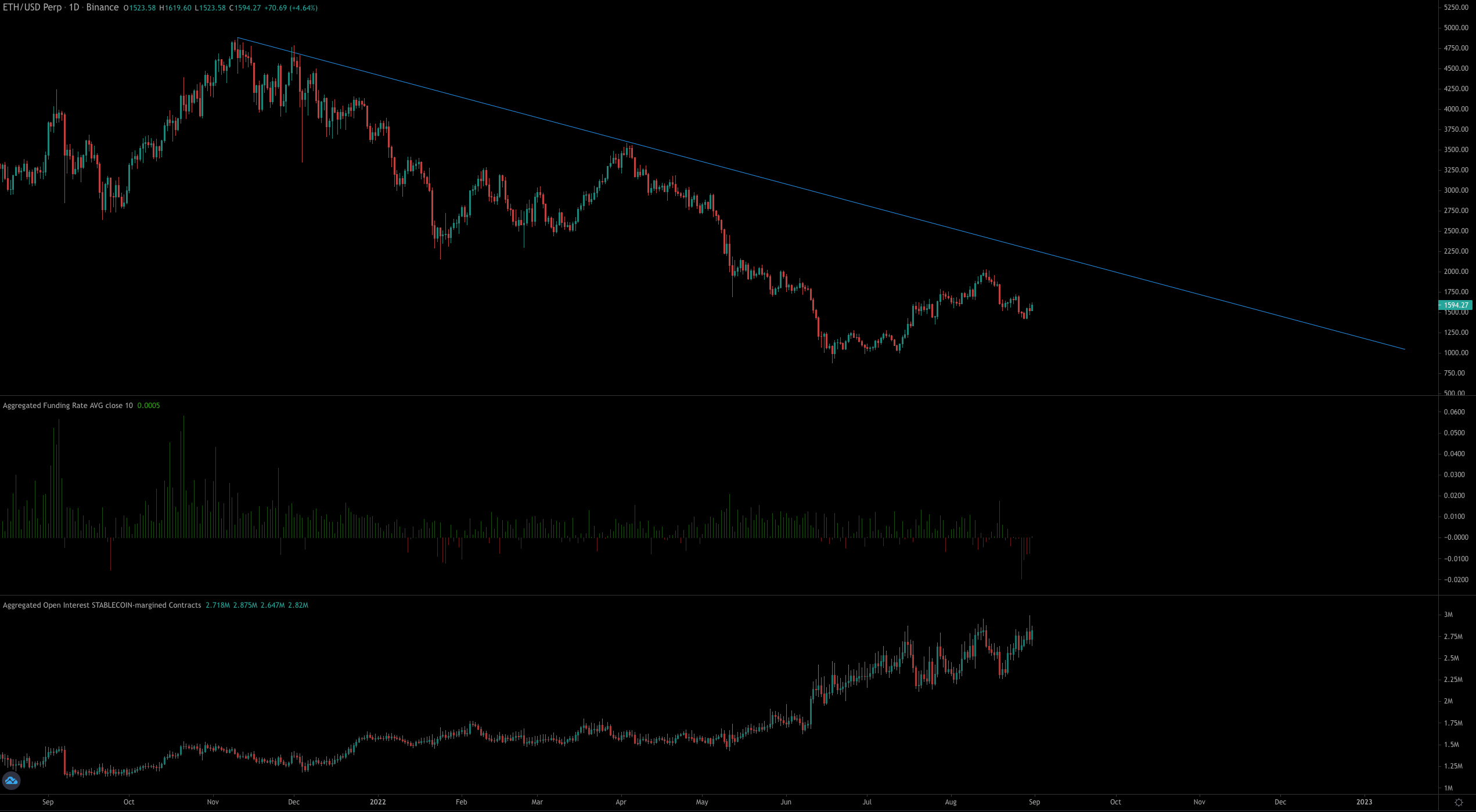

ETH traded in a falling wedge formation which is a bullish pattern. The breakout has occurred and the technical target is $1,935.The risk:reward is a decent 3:1.

Thesis

The macro side still looks horrendous with further tightening on the way, the technicals however are looking surprisingly good. Let's take a chance.

The other side is that longs aren't exactly "popular" at the moment so the market is not overweight on the long side which can be seen by the flat/negative funding rate on ETH-PERP below.

Implementation Plan

Moved 10,000 USDC from Alpha-DAO.ETH to dYdX.- Entry: ~$1,600

- Take Profit: $1,935

- Invalidation: 4H closure inside the wedge or $1,490

Executed

Position was exited after a higher than anticipated CPI print.Exit price ~$1,670

Final result: +$2,420

$220 in funding the rest from profits