Time Sensitive: The 4x Market-Neutral Trade Everyone’s Missing

Opportunities like this are rare in crypto. Most launches are driven by hype or speculation with no way to manage risk. This one is different. This ICO has a hard-capped valuation, visible pre-market pricing, and a structure that allows traders to lock in a 4× spread with near-zero directional exposure. Curious to know more? Let’s dive in…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The ICO Resurfaces

Initial Coin Offerings (ICOs) were once the defining force of crypto’s early expansion. Between 2013 and 2018, hundreds of projects raised capital directly from the public through token sales, offering unprecedented access to early-stage innovation. While many devolved into speculative chaos or outright scams, the model itself was revolutionary because it removed intermediaries and gave retail investors direct exposure to protocol ownership.

Ethereum ICO info

Ethereum’s 2014 ICO remains the landmark success story. Tokens sold for roughly $0.31, raising about $18.6 million. At peak valuation, that early purchase translated to more than 12,000× returns, establishing ETH as the ultimate example of community-funded innovation.Now, a decade later, MegaETH is reviving the ICO concept, but under a framework that blends onchain fairness, transparent governance, and institutional credibility.

The MegaETH Sale: Structure and Timeline

The MegaETH public sale opens at 1 PM UTC on October 27, 2025, and runs for 72 hours. It is hosted on Sonar, a capital-raising platform integrated with Echo, which was acquired by Coinbase earlier this month for approximately $375 million. That acquisition gives the event a unique layer of legitimacy, positioning it within a regulated and scalable infrastructure for onchain capital formation.Echo was founded by Cobie, one of the crypto industry’s earliest advocates for community-led investing. The platform has helped projects raise over $200 million across 300+ deals and recently powered the XPL token sale.

Key Data about the ICO:

- Total token supply: 10,000,000,000

- Supply reserved for public sale: 500,000,000 (5% of the total supply)

- Network: Ethereum Mainnet

- Payment method: USDT

- Starting price: $0.0001 ($1 million mcap)

- Ceiling price: $0.0999 ($999 million mcap)

- U.S. accredited investors have a mandatory 1-year lock-up with a 10% discount

Sale Timeline and Process

- Registration (Oct 15–27): Participants must complete KYC, wallet verification, and (for U.S. investors) accreditation through Sonar before bidding opens. Registration does not guarantee allocation but is required for eligibility.

- Open Bidding (Oct 27–30): The English auction begins at 1 PM UTC on October 27 and runs for 72 hours. Participants commit USDT on Ethereum mainnet to reserve $MEGA tokens. The bidding system automatically moves toward the clearing price within the $0.0001–$0.0999 range.

- Allocation Calculation (Oct 30–Nov 5): Following the sale, bids and participant profiles (social, onchain, GitHub, and additional wallet data) are analyzed to determine allocations. Oversubscription triggers the U-shaped distribution system, where contribution history and lock-up choices can increase allocation priority. Refunds for non-winners begin after this phase.

- Withdrawal Period (Nov 5–19): Allocation winners may choose to withdraw entirely during this window, receiving a full USDT refund. This mechanism adds flexibility and transparency for participants who change their mind post-sale.

- Final Allocation (Nov 19–21): Any forfeited or unclaimed tokens are reallocated to partially filled bids. Participants who selected the 1-year lock-up receive a 10% rebate on their purchase.

Token Distribution: Tokens are automatically distributed to verified wallets after final allocation. Lock-up participants will receive their tokens one year later.

Fairness by Design

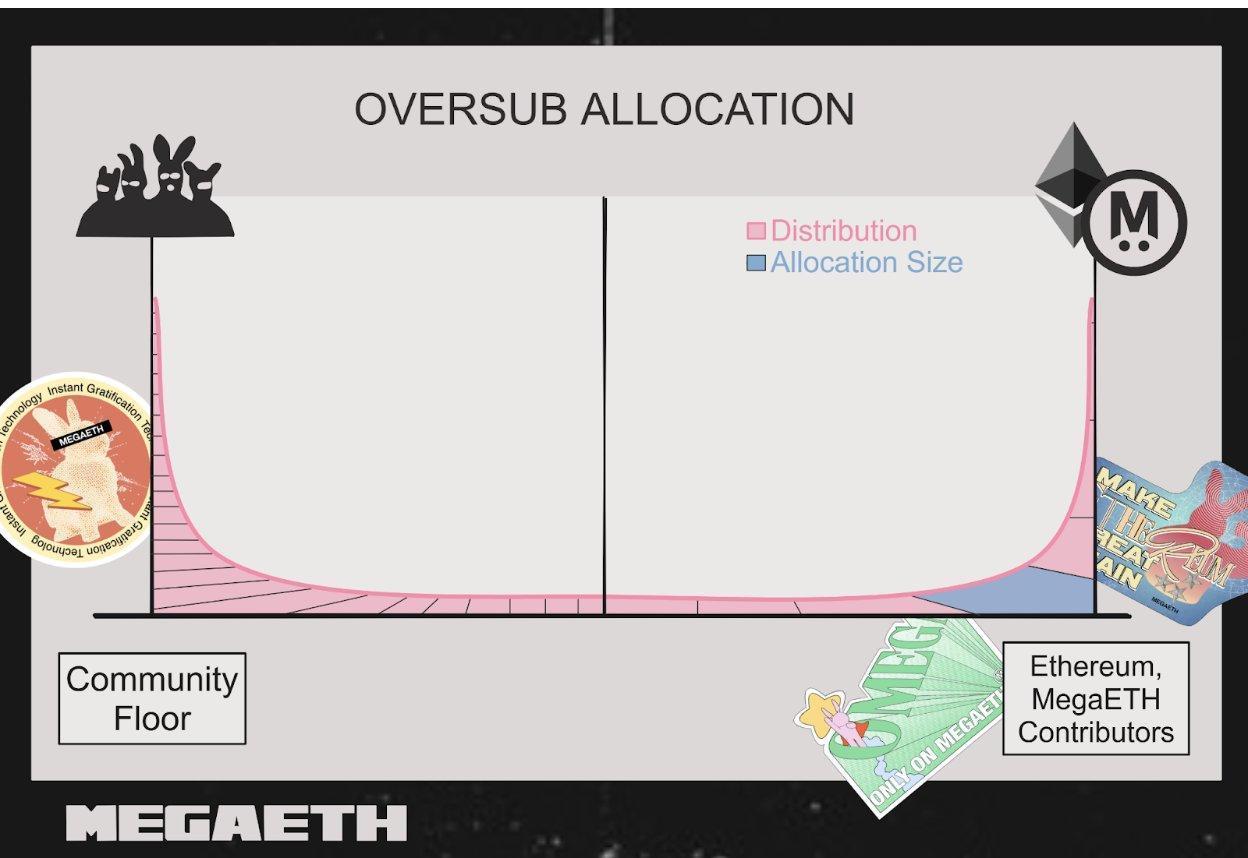

Unlike the gas wars and insider-dominated token launches of the past, MegaETH’s sale introduces a carefully engineered U-shaped allocation model. The system aims to achieve two simultaneous goals: broad token distribution and merit-based prioritization.

MegaETH allocation model

If the sale is oversubscribed, allocations are divided bimodally:- Contributor Priority (Depth): Larger allocations go to participants who have demonstrably contributed to MegaETH or Ethereum through activity, development, or ecosystem support.

- Community Floor (Breadth): At least 5,000 participants will receive smaller baseline allocations (starting at $2,650) to ensure inclusion and wide ownership.

How Contribution Is Measured

Contributor verification draws from both onchain activity and social signals, measured through a hybrid scoring system developed in collaboration with KaitoAI. Factors include:- MegaETH Culture: Ownership of ecosystem-native NFTs such as Fluffles, Lemonheads, or works from key community figures.

- Vocal Supporters: Wallets linked to active Twitter or Discord accounts that advocate for Ethereum and MegaETH’s long-term mission.

- Onchain Exploration: Consistent usage of major Ethereum protocols — examples include early interaction with Aave, Uniswap, Pendle, Curve, Stargate, EigenLayer, and Ethena.

- Ethereum DeFi Involvement: Meaningful participation in DeFi ecosystems, with CapMoney stablecoin deposits explicitly highlighted as a key signal of engagement.

- Dope NFT Ownership: Proven holders of iconic collections like CryptoPunks, Fidenza, Milady, and Pudgy Penguins.

Hedging Playbook (Optional)

Goal: Capture the spread between the MegaETH ICO clearing price and the current pre-market price on Lighter/Hyperliquid while staying market-neutral. To mitigate venue risk and manage liquidity constraints, execution is split 50/50 between Lighter and Hyperliquid. This ensures balanced exposure, smoother fills, and protection in the event one venue experiences volatility or dislocation.Keep total position sizing conservative, ideally between $5,000 and $10,000 per venue, given limited open interest and depth ahead of TGE.

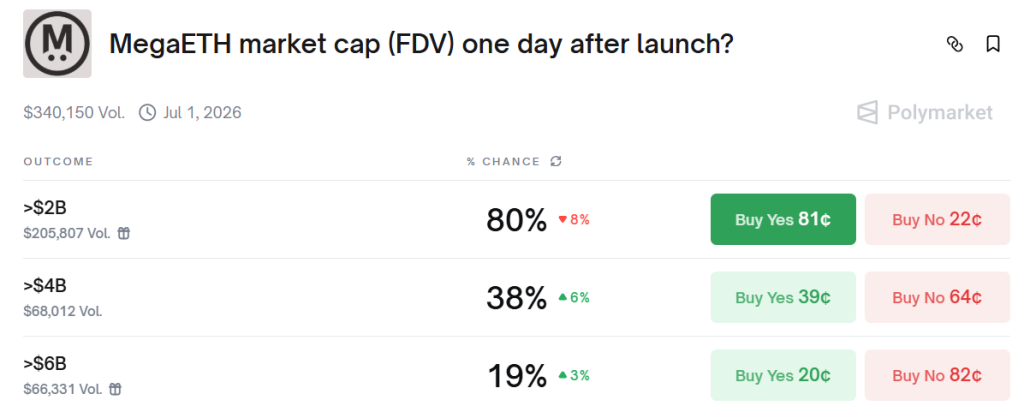

At the ceiling price of $0.0999 (999M FDV), the pre-market on Lighter is currently around $0.44–$0.46 ($4.5B FDV). That represents roughly a 4.5× valuation spread, which can be locked in through a properly collateralized 1× short.

MEGA/USD Pre-Market on Lighter

Why Split Between Lighter and Hyperliquid

- Diversified execution: During the XPL incident on Hyperliquid, a whale identified as Techo Renovant opened an oversized long that wiped the order book and triggered widespread liquidations. The token briefly spiked over 200% in minutes before collapsing.

XPL/USD on Hyperliquid

By contrast, prices on Lighter remained stable during comparable pre-market conditions.

XPL/USD on Lighter

- Points upside: Lighter’s TGE is expected before year-end, meaning all trading activity earns points that could later convert into an airdrop reward.

- Better Risk Management: Each venue has unique liquidation and funding behavior. Splitting exposure minimizes venue-specific risk.

Execution Steps

1) Go to the official portals:- MegaETH Sale Page: token.megaeth.com

- Echo Main Dashboard: app.echo.xyz

- Sonar Sale Interface: app.echo.xyz/sonar/

2) Connect your EVM wallet on the Ethereum Mainnet.

- Use the address with your strongest on-chain history. Wallets that have interacted with top DeFi protocols or NFT collections often receive higher allocation priority.

- Ensure the same wallet is connected across both Echo and Sonar. This wallet will be used for KYC and for placing the bid.

5) Refunds: Any portion of your USDT that does not receive an allocation will be refunded in full once the sale concludes. There is no risk of losing unallocated funds.

6) Wait for allocation confirmation: Once your final token amount (A) is known, prepare to hedge that exact number of tokens on Lighter.

7) Do not select the 1-year lock-up option: The 10% discount does not justify locking capital for a year. This trade is designed to close shortly after token distribution.

8) Open a short position on Lighter and/or Hyperliquid for the same number of tokens (A) at the current pre-market price ($0.44–$0.46).

9) Set leverage to 1× and margin to Isolated.

- Post a large margin buffer: Minimum 20–30% works, but for pre-TGE tokens we prefer 50–100% extra so the liquidation price sits far above any realistic move.

- Watch the Est. Liq. Price field in the order ticket and add collateral until it is at a level you consider unreachable. You can always top up the margin later if needed.

Execution quality

- Use limit orders for precise entries.

- For larger positions, use small TWAP clips to reduce slippage.

- If you are new to Lighter, start with a small trade to understand fills, funding timing, and interface behavior.

- Monitor your position until token distribution. Stay 1× at all times. Funding rates are typically minor but should be checked daily. Add more margin if necessary to maintain your buffer.

- Unwind after TGE or token listing. Once $MEGA becomes tradable, sell your ICO allocation and buy back your short in the same window to lock in the spread.

Illustrative Example

This trade setup effectively locks in your entry price for the MegaETH ICO.- When you receive your allocation, short the same amount on Lighter and Hyperliquid.

- If the price moves lower, the short position gains value and offsets the decline in your spot allocation.

- If the price moves higher, your ICO tokens increase in value, compensating for the short position’s loss.

- In both cases, the total position remains balanced, creating a market-neutral structure that fixes your effective entry price.

- Short entry: $0.46527

- Position notional: $13,958.10

- Available margin: $15,211.57 (round up to $17,000 for extra safety)

- Estimated liquidation price: $0.77545 (from the order ticket)

- Fees: maker 0.002%, taker 0.02%

- Leverage setting: 1x Isolated

- Per-token spread: $0.46527 − $0.0999 = $0.36537

- Gross spread on 30,000 tokens: $10,961 before fees and funding

This configuration is fully delta-neutral once your ICO allocation is confirmed. The only variables affecting returns are execution precision and funding, both minimal under 1× leverage.

Expected Outcome

- Locks in a 4–4.5× valuation gap between the ICO and pre-market prices.

- Earns Lighter points while the hedge runs.

- Maintains risk-defined exposure through over-collateralization and 1× leverage.

Additional Considerations

- Refunds: All unallocated USDT is refunded automatically after the sale.

- Partial fills: Only short your confirmed allocation.

- Funding: Small at 1× but worth monitoring.

- Timing: Execute immediately after allocation results to avoid losing the spread.

- Counterparty risk: Pre-markets carry exchange exposure. Keep it 50/50 between Lighter and Hyperliquid

- Testing: Run a small test order first if you have never used Lighter or Hyperliquid.

This structured hedge converts MegaETH’s public sale from a speculative play into a defined-reward, low-risk trade while stacking additional upside through Lighter’s points system.

Cryptonary’s Take

With Coinbase’s acquisition of Echo, the infrastructure behind MegaETH’s sale carries a level of institutional credibility that few public offerings in crypto can match. The structure itself is what makes this sale special. The capped valuation and transparent auction design create a measurable spread between the $999M ICO ceiling and the $4.5B pre-market price.By pairing your ICO allocation with a 1× short split evenly across Lighter and Hyperliquid, you are not speculating on direction. You are locking in value. At current prices, that spread translates to roughly a 4–4.5× return on capital deployed before fees and funding.

For those who prepare correctly, the opportunity is both rare and time-sensitive. The spread is real, the risk is controllable, and the execution path is straightforward. Few setups in crypto offer this level of clarity and asymmetry.

Executing this strategy not only locks in the valuation gap but also earns Lighter points toward its confirmed airdrop, creating an additional layer of upside while maintaining a delta-neutral position.

At Cryptonary, we focus on opportunities where structure meets strategy. MegaETH is a clear example of how informed execution can turn defined spreads into predictable outcomes while managing exposure across multiple venues.

MegaETH valuation according to PolyMarket

Cryptonary, OUT!