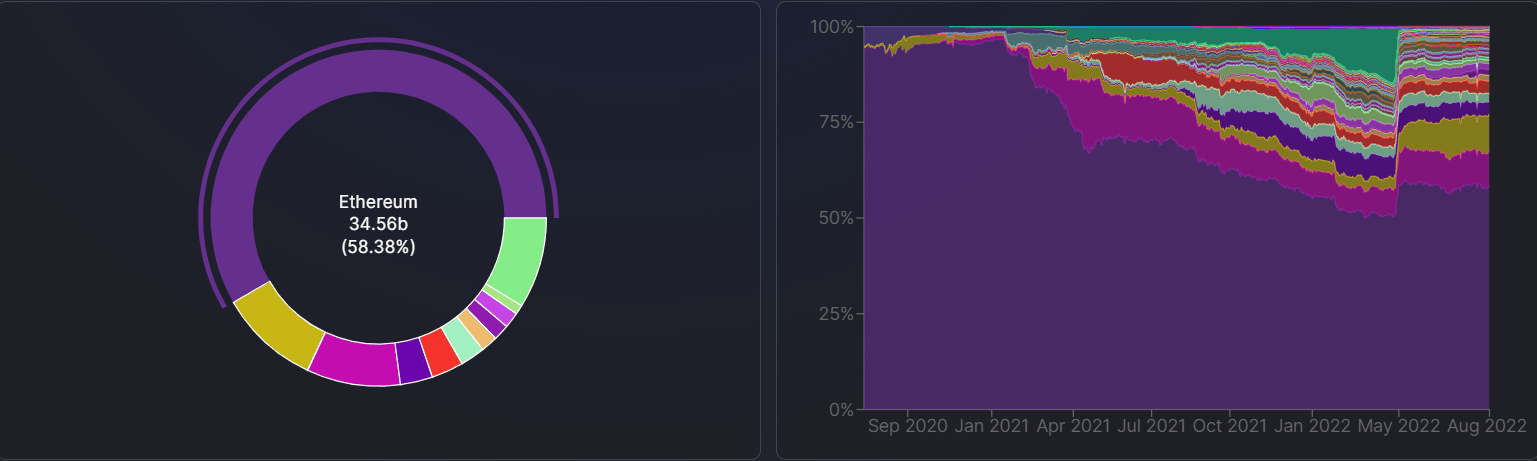

When DeFi flourished in 2020, Ethereum was practically the only prominent L1 out there. In 2021, things changed. Many L1s developed to address the challenges associated with the Ethereum network and have caught significant traction. And in 2022, we’re continuing to see a lot of new L1s on the rise that can compete in this sector.

In 2020, Ethereum accounted for 95% of all DeFi liquidity. Today, Ethereum accounts for almost half of all DeFi liquidity - other L1s have captured liquidity from Ethereum.

With various chains, we believe that the future of DeFi will include multiple L1s, not just one, each with its niche.

This report acts as a culmination of facts after deep research into each and every L1 that has tried to exist since 2018, and why only a few were home runs. This will act as a base for the decision-making process going forward for the CPro Research team when it comes to choosing amongst the sea of L1s.

From there, we will collectively decide on a few chains we hone in on and create research reports about.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility and only you are accountable for the results.

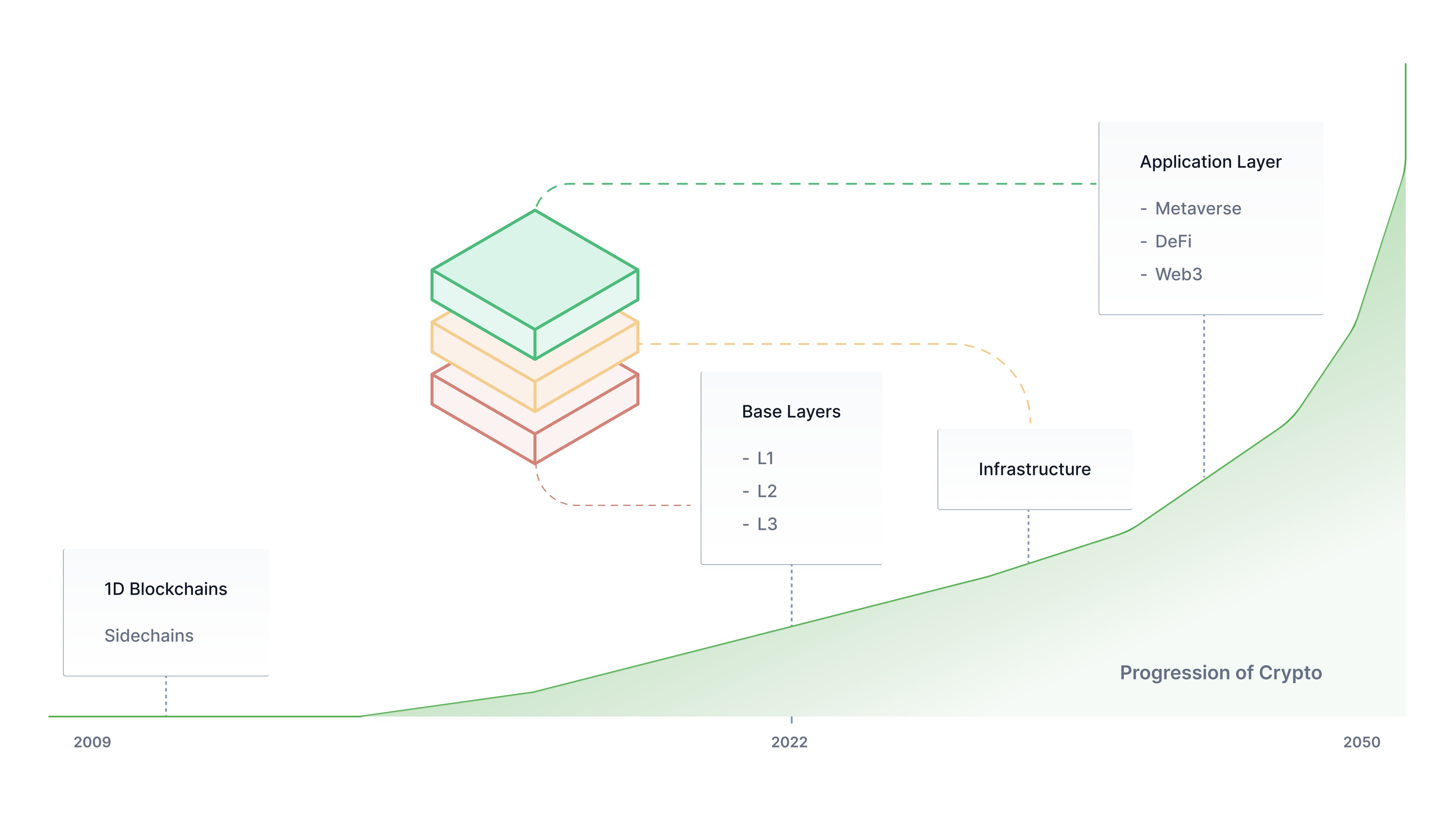

A Layer 1 (L1) or a smart contract platform is the underlying core architecture of blockchain technology. Developers build decentralised apps on top of Layer 1. Think of the Internet as an L1 and Instagram as one of the apps built on the internet.

An L1 processes and finalises transactions on its blockchain. L1s have their own native tokens, usually used to pay transaction fees.

L1s are the Base Layers within their ecosystems. The Application Layer is built on the L1 - think Synthetix (app) built on Ethereum (L1).

Ethereum was the first Layer 1 to implement smart contracts. Many other L1s have followed suit since. Some have been successful long-term, some were successful temporarily, and some failed.

Back in 2018, EOS a smart contract Layer 1 raised over $4bn in the largest Initial Coin Offering ever, but it couldn't compete with Ethereum. Cardano was vastly overhyped with little to no DeFi activity. Elrond allows developers to build a smart contract with the potential to earn 30% of the smart contract fees as royalties, yet there is only one protocol in its ecosystem. And Terra had the largest decentralized stablecoin ever (UST), and yet the entire chain eventually collapsed.

But what did the home runners have in common? What are the crucial elements needed for the success of a new L1?

After extensive deep research, we determined that an ideal Layer 1 should include the following features.

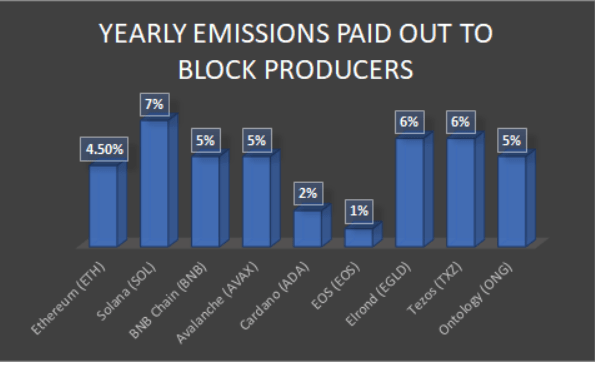

Security

Security is the top priority when evaluating any L1. No one wants to use an L1 that is not secure. Blockchain security is the ability for transactions to be finalised and not reverted.Security is assessed by :

- The number of rewards given to block producers for submitting honest blocks.

- Resistance of the network to a 51% attack. In essence, the larger the network and the more nodes there are participating in it, the more hash power is needed to control over 50% of it. For PoS networks, the higher % of the stake securing the network, the harder it becomes to own half of it.

- A strong security model consists of block producers who are always incentivized to secure the network.

- Transaction fee revenue. The network that pays out the higher fee revenue to block producers is more secure and can offer higher settlement assurances. Block producers are heavily incentivised to secure the network with a higher fee revenue - e.g. the Ethereum network when gas fees rise ridiculously.

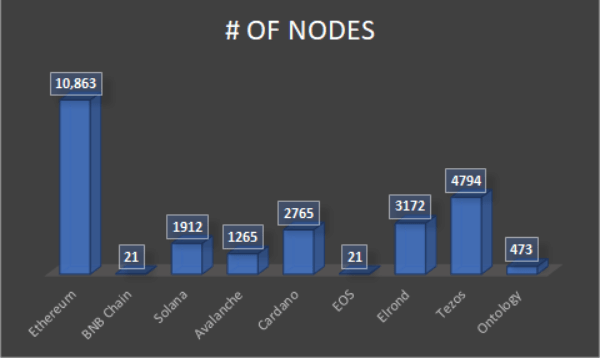

Decentralisation

Decentralisation is at the heart of blockchain technology. When security and decentralisation are combined, you have the two most important aspects of a Layer 1 network.Decentralisation is assessed by:

- The ability for all individuals to participate in validating (mining/staking) or maintaining the ledger (running a node) - a decentralised blockchain should be public and permissionless.

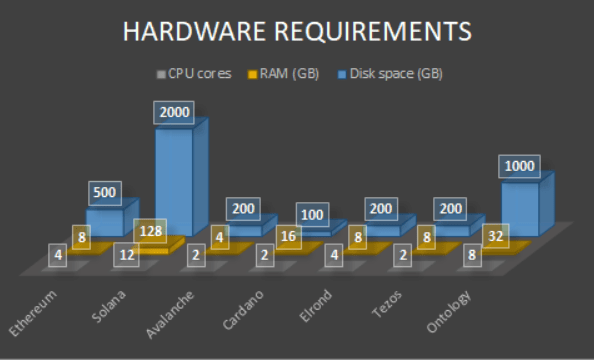

- The cost of hardware components required to become a block producer.

- The number of nodes operating the network to prevent a single point of failure and malicious transactions.

- Is there a limited number of nodes that can participate in securing the network - a fixed cap on the number of nodes?

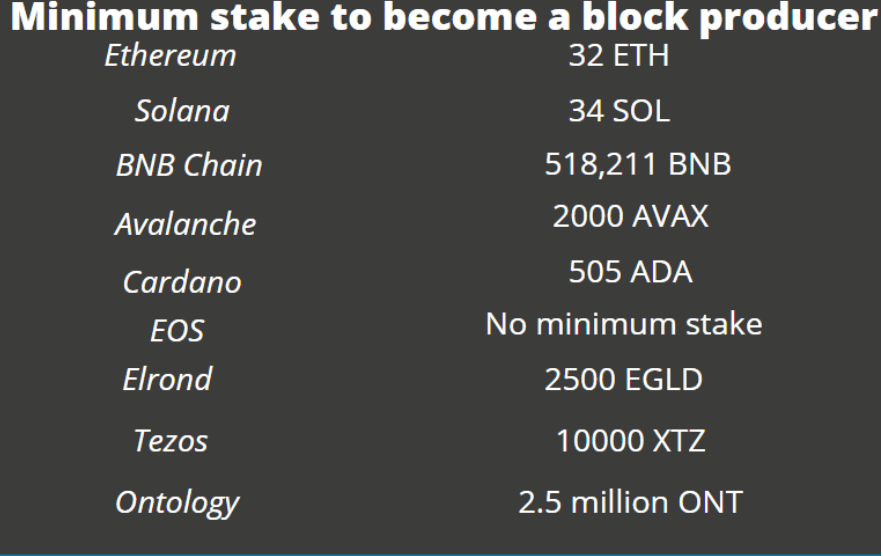

- What is the minimum amount of stake to become a block producer?

BNB Chain & EOS have a cap on the number of nodes - 21.[/caption]

BNB Chain & EOS have a cap on the number of nodes - 21.[/caption]

Developers

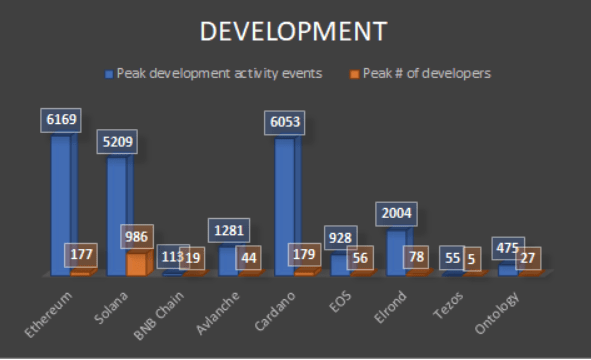

Now that we've determined that an L1 is safe and reliable for developers to build on, we must consider whether or not developers are building. Are developers continuously incentivized to build by receiving a consistent income from the use of deployed apps? Or is there a lack of building?

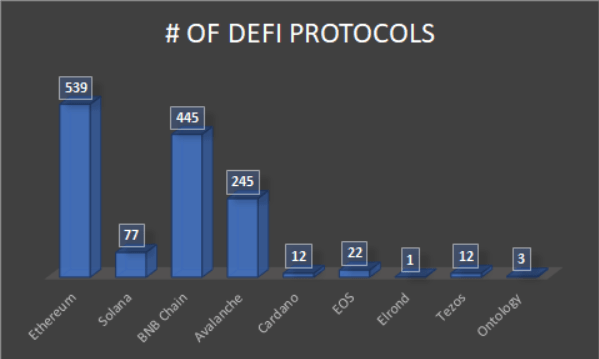

Applications

Without developers, there are no applications. Without applications, there are no users - no users = no value. How many apps are there in the ecosystem, and are they used extensively to generate enough revenue?

Network Activity

Blockchains make money by selling blocks. They offer an unstoppable, decentralized value transfer service over the internet.Network activity is assessed by:

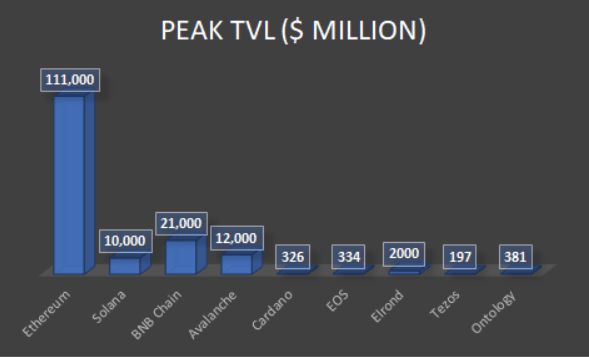

- Total Value Locked (TVL): the amount of money locked in DeFi protocols such as staking, lending, etc.

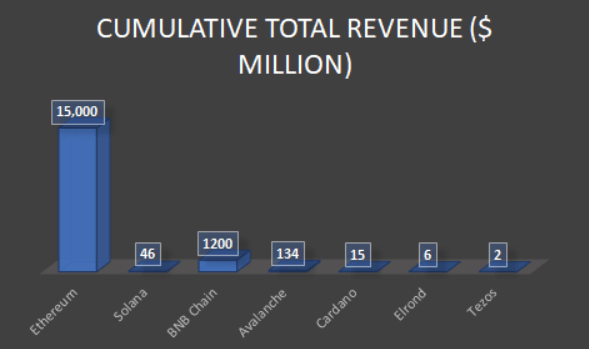

- Total revenue: the amount of money generated from transaction fees.

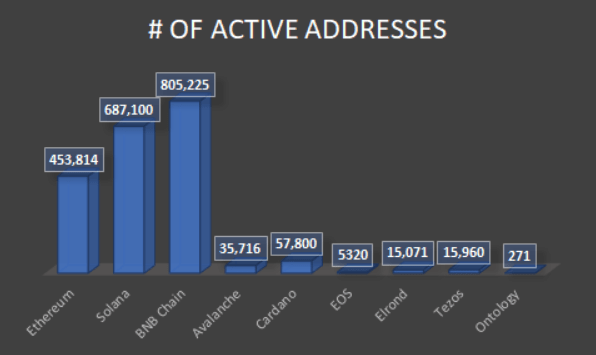

- Active Addresses: users who are sending transactions daily. Is this number going up gradually over time?

[caption id="attachment_231722" align="aligncenter" width="596"] Gradually increasing over time: Ethereum, Solana, BNB Chain, Avalanche, Cardano, Elrond and Tezos. Gradually decreasing over time: EOS & Ontology.[/caption]

Gradually increasing over time: Ethereum, Solana, BNB Chain, Avalanche, Cardano, Elrond and Tezos. Gradually decreasing over time: EOS & Ontology.[/caption]

Vision & Value

How does the chain benefit the crypto industry, what new features does it introduce, and does it solve a problem?Or is the project attempting to become the next Ethereum? Is it claiming to solve issues that do not exist?

Ethereum pioneered smart contracts, Solana was the first blockchain with 400ms block time, Avalanche is highly scalable with near-instant finality, and BNB Chain, with BNB being the chain’s token backed by the world's largest exchange - Binance. Cardano, EOS, Elrond, Tezos, and Ontology tried but failed to solve Ethereum's scalability problem because their focus was on replicating Ethereum rather than bringing a new and valuable product.

Tokenomics - The Economic Model of a Token

Investors should be incentivised to hold the native L1 token. This can be done either from a speculative value (exciting upcoming news) or intrinsic value (fundamentals). An ideal native token should have the following mechanics:- Paying transaction fees for payments - such as ETH on the Ethereum network or SOL on the Solana network.

- Governance - achieving a decentralised governance system where all token holders can impose and vote on proposals for the sake of the network.

- Securing the network through staking - validators and users can earn rewards by participating in the network.

Note:

Team, backers, investors and community are also important factors to tie in with the above, however, we chose to leave them out, and include them when covering assets in separate reports.

Results

Our findings are contradictory, but they help us understand the main point. A winning Layer 1 must be sufficiently secure & decentralised.In terms of developer interest, Cardano is one of the top three L1s. Solana and Avalanche have fewer nodes than Tezos and Elrond. However, what distinguishes an L1 are its protocols. Users are constantly using these protocols in winning L1s - high revenue. The most important lesson we learned today is that if an L1 does not have widely used applications, it will have low revenue, which equals poor L1, regardless of how strong it is in other areas.

According to our framework, an ideal homerun Layer 1 would have high-security incentives derived from the model and rewards. Decentralised by having low barriers to participation in the network - neither too low nor too high. Massive developer interest, widely used applications, and high TVL and revenue.

Final Words

So far, we've gone over everything there is to know about L1s and how important they are to DeFi.Evaluating any Layer 1 is difficult, especially given the hundreds of smart contract platforms available today. However, we were able to develop our model to determine whether an L1 has a chance of making it or not. Smart contract platforms are now available for the Web3 generation of internet applications. But the question remains which L1s will have a chance of succeeding?

This infrastructure will support trillion-dollar companies, similar to Web2.

In the following report, we will go over CPro's top contenders in the L1 sector!