This seasons hottest Arbitrum airdrops and protocols

Ready to ride the next wave of hype in the booming world of crypto? Look no further than the Arbitrum ecosystem one of the most popular Ethereum scaling solutions. Just like our successful early entry into Solana, we did it again with Arbitrum, providing many of our Cryptonary Pro members with the opportunity to participate in the $ARB airdrop.

We've scoured the landscape and found two exciting protocols ready for you to get into on the ground floor. We've also uncovered low-risk, high-reward airdrop opportunities that you won't want to miss. And, we've got an update on our Arbitrum Watchlist holdings.

TLDR

- Sector Finance is holding a public sale and we want to participate!

- ChronosFi is an upcoming Solidly fork launching on Arbitrum, which we will invest in speculatively.

- Dolomite, Rage Trade, and the Vertex Protocol offer low-risk, high-reward opportunities in return for using their products.

- We remain bullish on PlutusDAO and CVI Finance but will continue to avoid Umami Finance.

Disclaimer: This is not financial or investment advice. Any capital-related decisions you make are your full responsibility and yours only.

Sector Finance

Sector Finance offers financial products tailored to match individuals’ risk levels. The platform runs on various ecosystems including Ethereum’s mainnet, Moonriver, and Optimism.The platform offers a comprehensive selection of products and strategies for different risk profiles. The yield earned from depositing these products is paid in $ETH or $USDC.

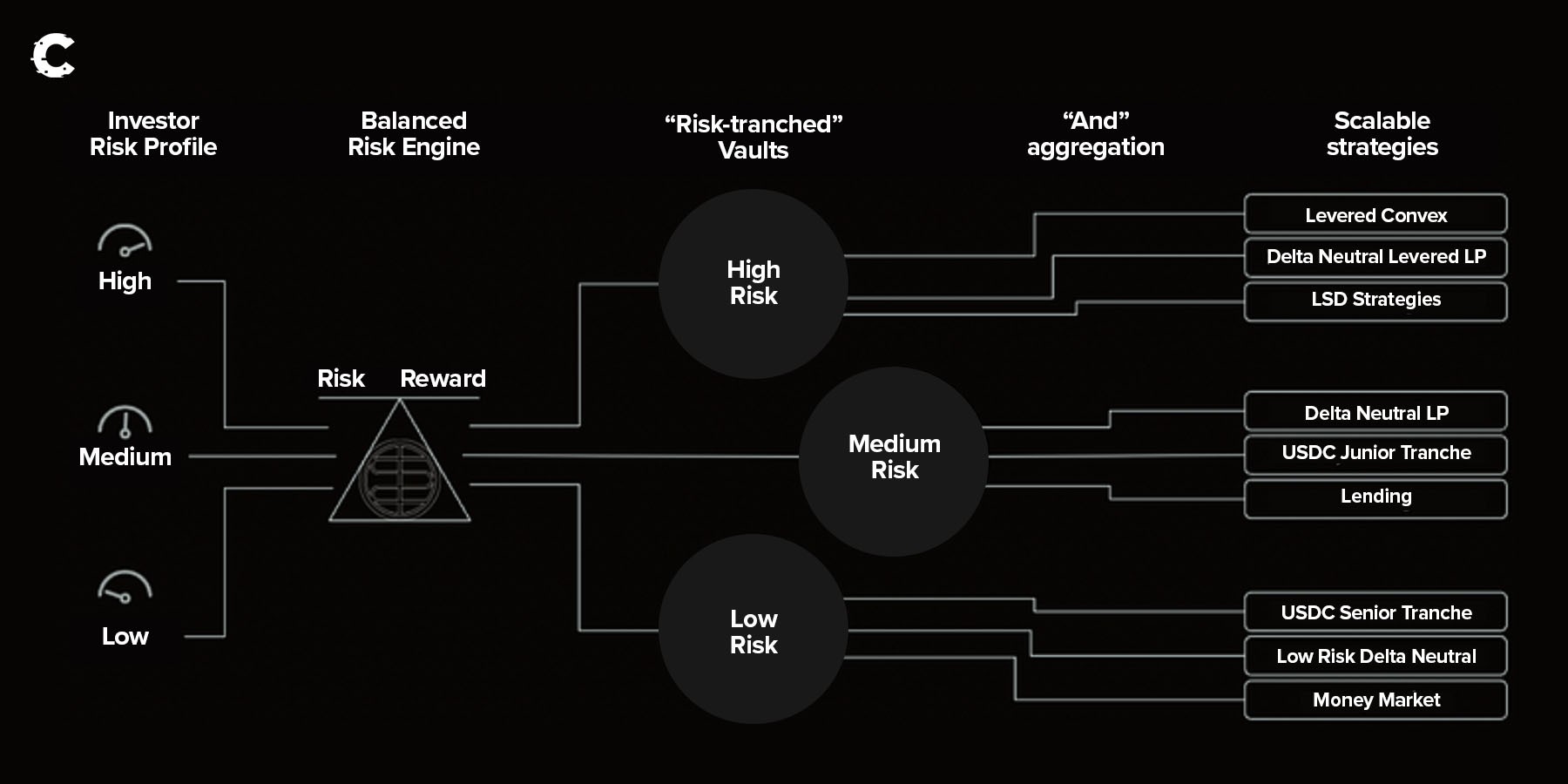

Sector Finance’s three core components:

Risk engine: evaluates and organises the risk of the protocol’s single-strategy investment vaults. This allows an accurate assessment of risk exposure for individual investors.

Single strategy vaults: are delta-neutral (a strategic trading approach that attempts to neutralise "vulnerability" to market movements) and generate earnings irrespective of market conditions. They allow users to directly deposit assets to the strategy of their choice, providing a more personalised investment experience.

Aggregator yield vaults: combine multiple yield-generating strategies based on different risk levels. There are currently six different aggregator vaults with varying risk profiles. They offer users a diverse and flexible approach to earning yield on investments.

Tokenomics

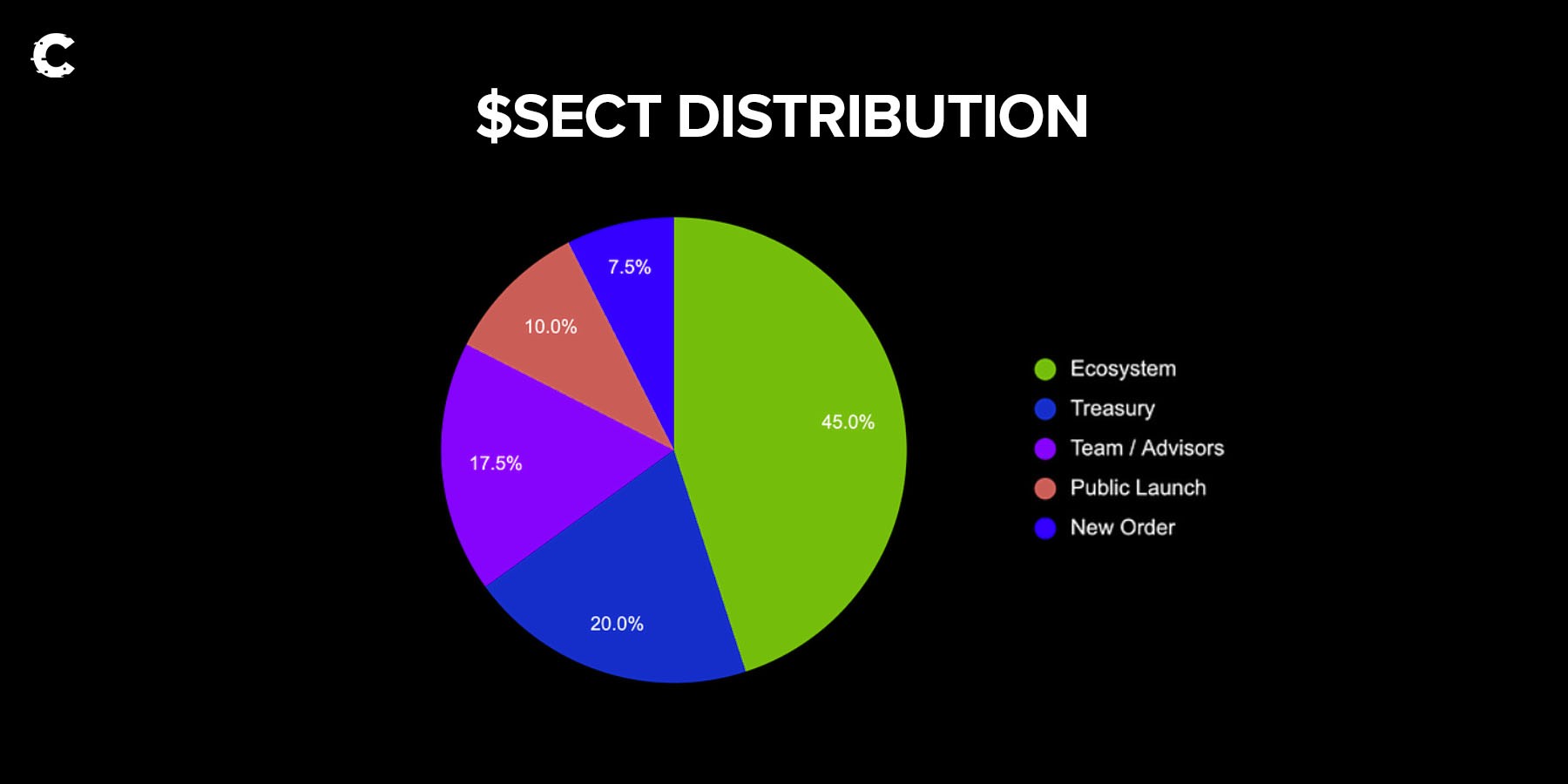

$SECT is Sector Finance’s governance and utility token. It has a total supply of 100,000,000 and is distributed as follows:

$SECT’s supply distribution includes a significant allocation for the team, advisors, and the New Order DAO (decentralised autonomous organisation), which played a role in incubating the project and making a seed investment.

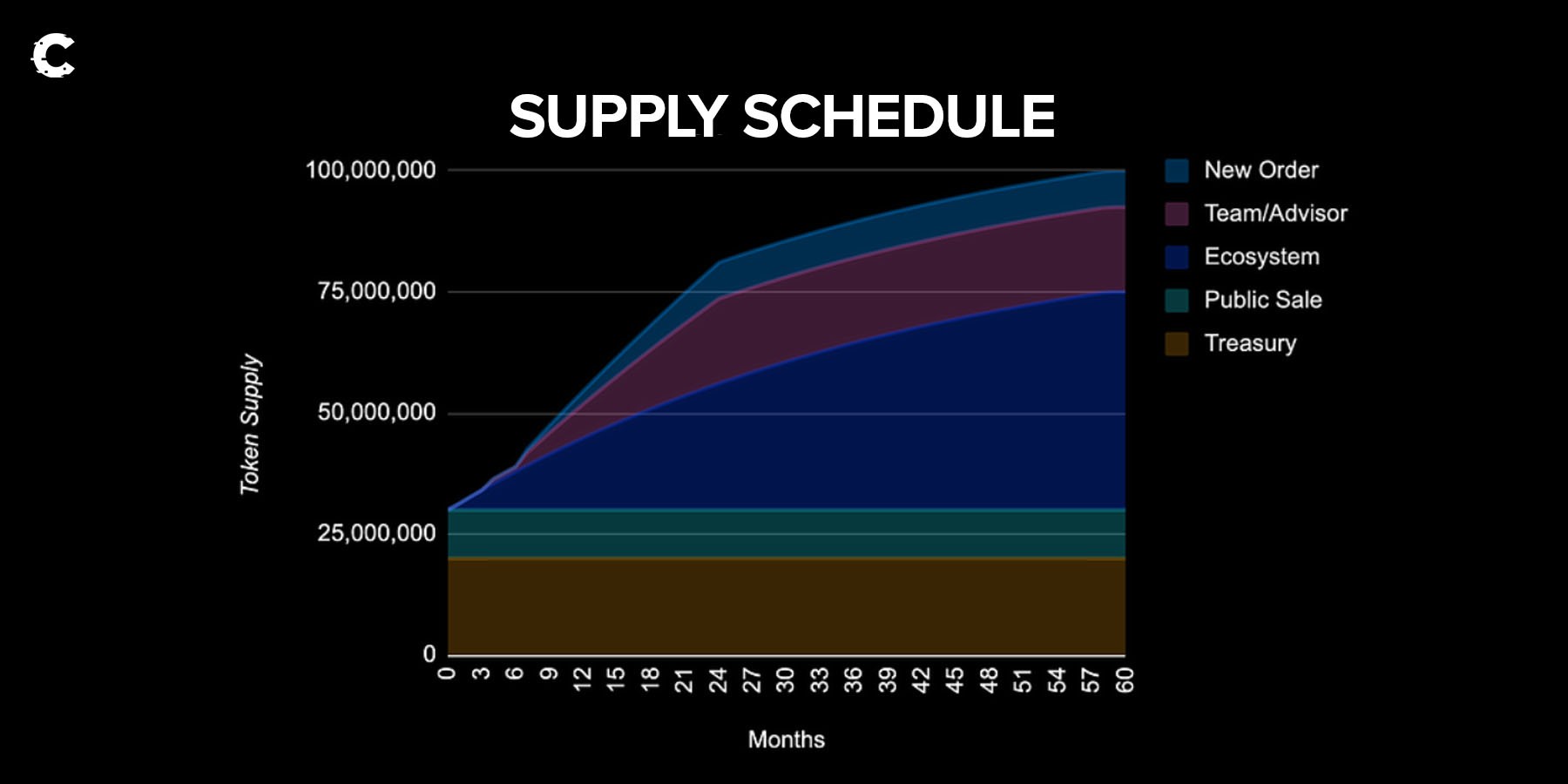

Nevertheless, it is important to note that many of these tokens will not be available on the market immediately, resulting in at least three months of low supply and few token unlocks. As a result, there will be a limited number of tokens available to trade, which may cause the $SECT’s price to be volatile and cause it to trade at a high fully diluted valuation (FDV).

Token holders will be able to lock their $SECT and turn it into $veSECT to gain voting rights to direct the protocol's fees and emissions. The team plans to enable fee-sharing with token holders.

Sector Finance is offering a reward to people who deposit funds into their protocol between March 6 and April 30. They will use 2% of the Treasury allocation (which is 20%) to distribute $bSECT tokens to these individuals. The $bSECT tokens can later be converted to $SECT tokens at their public launch value.

How to get involved

The launch began on Wednesday, March 30, 2023, at 5 PM UTC and will end on Friday, March 31, 2023, at 5 PM UTC. It was scheduled to be hosted on the launchpad of Camelot DEX on Arbitrum.There was also a whitelist launch for early depositors and $xGRAIL (Camelot’s governance token) holders 24 hours before the public phase.

The launch model used a fair price discovery method, requiring a minimum total commitment of $1.5M worth of $USDC and capping total commitments at $4M. This means that the token value will depend on the total amount pledged, with each investor receiving their tokens at the same valuation as everyone else. The final token valuation will be determined by the total number of investors, ranging between $1.5M and the $4M cap.

The allocation for the launch is 10,000,000 $SECT, which is 10% of the total supply. One-third of the allocation received by investing in the public launch will be locked as $veSECT and staked for three months.

The accepted payment for the launch is $USDC and there is no minimum or maximum allocation.

Cryptonary’s take

Sector Finance's straightforward approach to product offerings and user interface sets it apart from others in the market.While being hosted on Arbitrum creates hype, the project is still in its early stages and carries a high degree of risk. However, Sector Finance's emphasis on risk transparency is a key factor often overlooked by other protocols offering similar vault strategies.

After the public sale, $SECT’s fully diluted valuation (FDV: the total value when all tokens are released) could range from $15M to $40M, depending on the amount of money raised. This means that the token will be sold between a price of $0.15 to $0.40 on the market.

Nevertheless, since only 9.7 million of the 100 million tokens will be on the market when the token goes live, the market cap will be significantly smaller than the FDV.

Predicting the potential valuation after the launch of Sector Finance is challenging, given that it's a relatively new protocol that's not widely known. But, based on competitors such as JonesDAO and Umami Finance, we anticipate a market valuation of $10M to $15M following the launch. With just 9.7 million tokens in the initial circulating supply, this could suggest a price range of $1.1 to $1.6 per token. This price will not last long since token inflation will rise over time, but given the limited number of tokens available at launch, it is a reasonable target.

Stan from the research team: Because Sector Finance is still a young project, I will only invest 2.5% of my portfolio in its public sale. After the token launch, I intend to DCA (dollar cost average) out of my position if the project hits a price between $1.1 and $1.6.

ChronosFi

ChronosFi is a new project that's based on the same principles as Solidly, which is an innovative automated market maker that was created by Andre Cronje and introduced on Fantom. ChronosFi will launch on Arbitrum in the next two weeks. It’s inspired by other platforms like Thena on Binance Smart Chain, Equalizer on Fantom, and Velodrome on Optimism.While it may sound like another platform trying to do the same thing, ChronosFi sets itself apart with new features and innovations.

One of the key features of this model is its no-rebasing approach, which promotes long-term sustainability by avoiding the need to adjust token supply algorithmically to control price - a common practice in other cryptocurrency models.

Also, ChronosFi's maturity-adjusted liquidity provider returns align incentives with the long-term viability of the project. The rewards users receive are adjusted depending on the length of time they provide liquidity.

As a result, users who hold their tokens for a longer time get larger returns, incentivising them to contribute to the project's long-term growth rather than simply shifting their liquidity around to chase higher yields.

Tokenomics

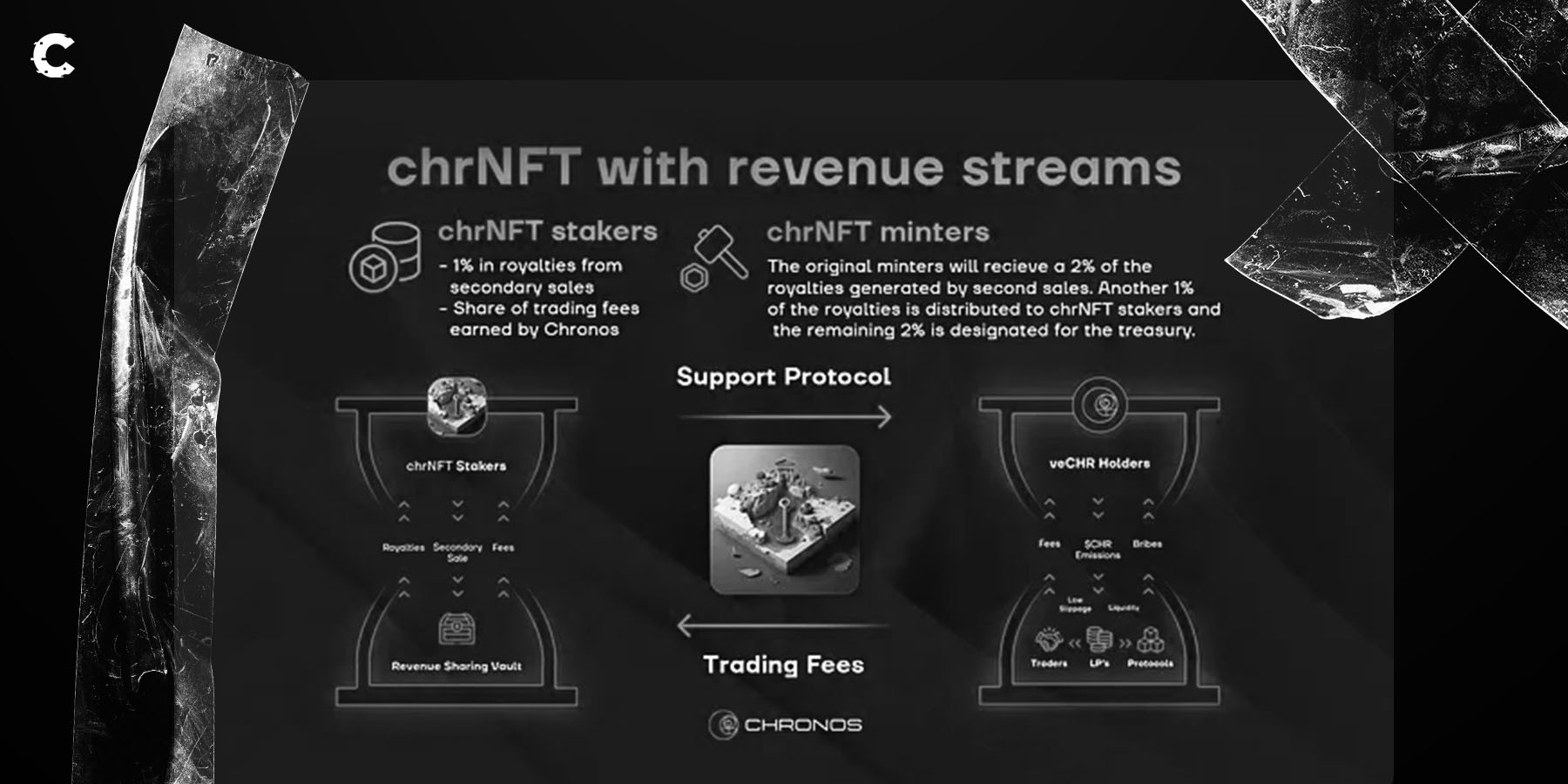

Chronos’ tokenomics has two components, an NFT and a token ($CHR). This is similar to Thena Finance.ChrNFT

The Lost Keys of Chronos (chrNFT) collection, which consists of 5,555 NFTs, has helped fund the protocol. Chronos has set aside 60% of the profits from the NFT sale to provide initial liquidity to $CHR when it launches, and 40% to fund platform development.

In exchange for the capital raised, chrNFT holders will receive a portion of all trading fees generated on Chronos. NFTs must be staked to earn fees. Staked NFTs can earn up to 20% of all swap fees on Chronos. The original minter is also to earn 2% in royalties from secondary NFT sales.

Most notably, chrNFT minters will receive 9% of $CHR's initial supply (4.5M tokens) via an airdrop consisting of 810 tokens split between 405 $CHR and 405 VeCHR, but there will also be a bonus airdrop for anyone who purchases the NFT on the secondary market, which will be approximately 310 veCHR per NFT.

$CHR

$CHR is a utility token that serves as the backbone of the protocol. It will have a supply of 50M tokens and be distributed as follows:

$veCHR

$veCHR is a unique token that holders receive in return for locking their $CHR tokens. The lock-up might last up to two years. Holders of $CHR who lock their tokens will additionally get $VeCHR as a reward for locking.The $veCHR token has several utilities:

Gauge voting: Holders of $veCHR can vote for gauges every week (i.e., determine how much token inflation is distributed to a certain liquidity pool).

Governance rights: $veCHR holders can participate in governance, and cast votes for protocol improvement proposals.

Fee revenue: Voters can earn up to 90% of swap fees generated by the pools they voted for each epoch (7 days).

Bribe revenue: Voters can get 100% of bribes, which are rewards offered by protocols in return for directing emissions to the pools voters voted for each epoch.

How to get involved

Because there is no token sale, the only way to obtain early access to the $CHR token was through the ChrNFT launch, but there will also be opportunities to receive a portion of the 28% of tokens allocated to user airdrops by interacting with the protocol when it launches.The NFT public sale occurred on March 29, 2023, at 8:00 PM UTC and was completely sold out. Nonetheless, the NFTs can still be purchased on the secondary market via Arbitrum's NFT marketplace Wenmoon and multichain NFT marketplace TofuNFT. At the time of writing, the price of NFTs is 0.26 ETH ($465).

If you do not want to be exposed to the NFT, you can test ChronoFi when it launches and potentially get airdropped tokens, or buy the $CHR token when it launches on the open market.

Cryptonary’s take

ChronosFi is an experimental DeFi project with a unique design, presenting an opportunity amid competing Solidity forks on Arbitrum.None of the current Solidly forks on Arbitrum have maintained their TVL, and market share tends to move to new forks. ChronosFi will be the next to go live. The main reason to purchase the NFT is to get fee revenue that is split with NFT holders. The fact that it will receive tokens will likely increase the value of the NFT depending on how successful ChronosFi is.

Stan from the research team: I decided to grab a ChrNFT to jump on the ChronosFi bandwagon early and bought an NFT for the price of 0.30 ETH. If the protocol turns out to be the winning Solidly Fork on Arbitrum, there is the potential for some nice rewards, especially as fees are shared among NFT holders. Given the speculative nature of this venture and the fact that the protocol and $CHR token have not yet launched, my level of exposure is significantly lower than my other investments.

Arbitrum airdrops

If you don't want to take any risks, these potential airdrops may present you with a low-risk opportunity instead:Dolomite

A margin trading and lending protocol on Arbitrum that’s evolved from a dYdX fork into a feature-rich platform. Dolomite doesn't yet have a token, but we anticipate that it will airdrop one to users who use the protocol.You can learn how to use Dolomite by viewing their website's tutorial.

Rage Trade

A yield and perpetual protocol built on Arbitrum using LayerZero. Rage Trade's team has hinted several times that there will be a $RAGE airdrop for users.You can learn how to use Rage Trade by viewing their website's tutorial.

Vertex Protocol

Vertex Protocol is an upcoming decentralised exchange (DEX) on Arbitrum that aims to incentivise platform activity through the Vertex Trading Incentive Program (VTIP).On VTIP, users can earn rewards by completing various tasks on the platform during the initial airdrop phase (within the first six months of launch). Vertex is currently in private beta mainnet, but it's a good idea to start trading on the platform once it goes live to reap the rewards.

The Vertex Protocol mainnet is not yet functional, however, you can use the app on the testnet.

Update on our Arbitrum Watchlist holdings

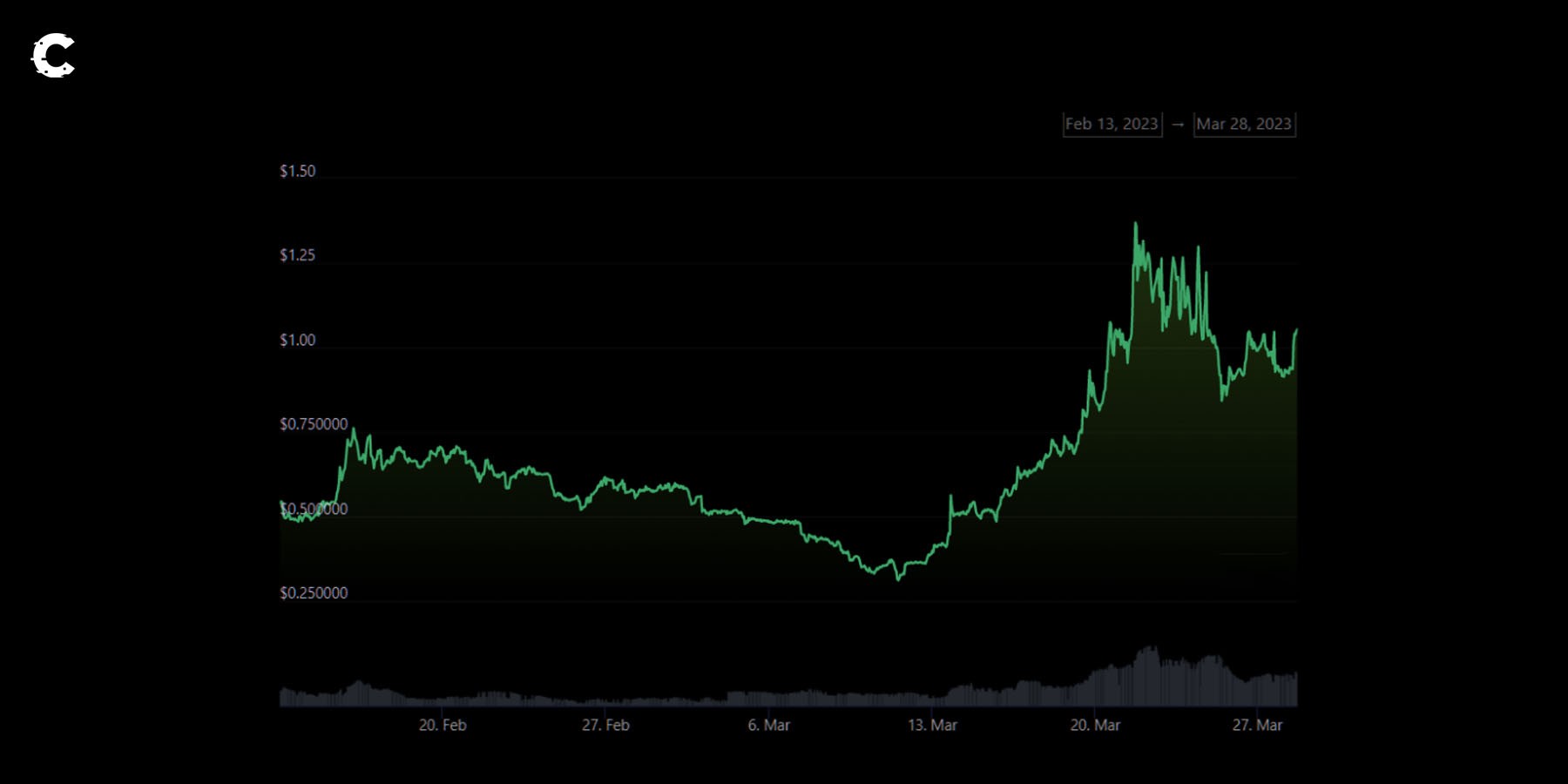

Here's a quick update on the projects we discussed in the first Cryptonary Arbitrum Watchlist to see how they're doing.PlutusDAO ($PLS)

Our first pick was Plutus DAO, a protocol striving to become the central governance hub for various crypto assets in the Arbitrum ecosystem. Since our initial report, $PLS has surged from $0.49 to $1.05, for a remarkable 115% increase.

Currently, PlutusDAO is on track with its plans. It has launched plsARB to gain governance power over the Arbitrum DAO and has successfully launched plsRDNT to accumulate governance power over the lending protocol Radiant Capital.

However, the most significant catalyst for PlutusDAO will come in the form of updated tokenomics, which are expected to launch in April.

CVI Finance ($GOVI)

CVI Finance is a remarkable tool that brings the VIX (a live index that shows what the market thinks about how prices will change in the short term) from traditional markets into crypto. $GOVI was our second pick, and it has gained 32.5% since the report was released.

We had expected better performance but the launch of the new tokenomics (which we discuss in our latest report), was delayed. Finally, on March 27, CVI announced the details of its revamped tokenomics, and we believe that this will be the project’s next catalyst.

Umami Finance ($UMAMI)

We also highlighted Umami Finance as a potential project on Arbitrum, but internal conflict at the protocol kept us away from investing. Unfortunately, the conflict worsened, resulting in a legal battle between the ex-CEO and current employees.So, we will continue to avoid investing in Umami Finance, as we see limited upside potential in the token.

Cryptonary’s take

We’re thrilled about the launch of Sector Finance and ChronosFi, as they offer a chance to be early investors in two highly promising projects on Arbitrum.However, it's crucial to bear in mind that these are speculative investments in recently launched projects. So, we’ve only allocated a small amount of capital to them.

On the other hand, Dolomite, Rage Trade, and the Vertex Protocol offer low-risk opportunities to receive potential airdrops for using the products.

While we remain optimistic about PlutusDAO and CVI Finance, we have not invested in Umami Finance due to the legal issues the team is facing.

Action points

- We’ll invest 2.5% of our portfolio into Sector Finance's public sale, which will begin on Wednesday, March 30, 2023, at 1:00 PM EST and end on Friday, March 31, 2023, at 1:00 PM EST. to enter at a price between $0.15 and $0.40 and exit at a price between $1.1 and $1.6

- We will purchase one ChrNFT on the secondary market to gain early exposure to the protocol. When the protocol is released, we want to use ChronosFi to receive an airdrop.

- We’ll use Dolomite, Rage Trade, and Vertex Protocol (once it’s available on the mainnet) to receive airdrops.

- We remain bullish on PlutusDAO and CVI Finance (mentioned in our previous watchlist) especially as they’re preparing to upgrade their tokenomics. However, we won’t invest in Umami Finance due to ongoing legal issues.