The L2 scaling protocol is bracing its community for a massive token unlock on March 16. 1.1 billion ARB tokens will be distributed to the project’s team, advisors and investors, raising the circulating supply by 87%.

1.1 billion ARB tokens are currently valued at over $2.4 billion. The common consensus in the market is that the unlock event will cascade selling pressure on ARB’s price. Yet, nothing is certain at the moment.

In this market update, we will examine a few scenarios and identify whether ARB is actually going to face a potential sell-off period after the unlock event.

TDLR

- ARB circulating supply will increase to 2.56 billion on March 16

- Private investor unlocks have historically been positive for tokens

- ARB’s 40% price rise is lagging behind other L2s in 2024

- Unlock event has a high probability of being ‘priced in'

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

What do we know about ARB's unlock event?

Before discussing speculations and reasoning, let's summarise the facts about the ARB unlock event.

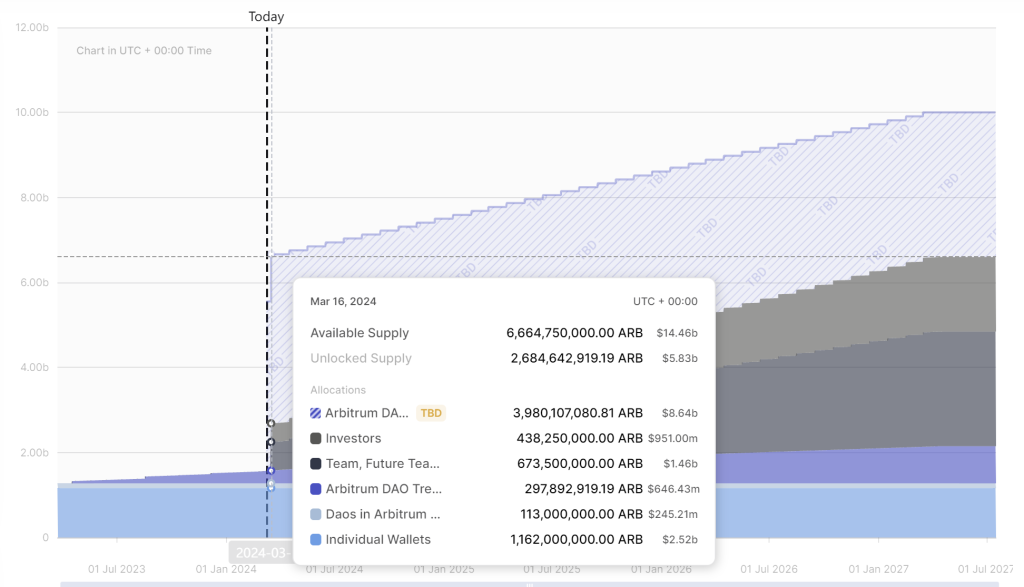

ARB’s cliff unlock will increase the circulation supply from 1.45B to 2.56B, an 87% increase.

The token unlocks will be distributed between the investors and the team.

- Team: 673,500,000 tokens

- Investors: 438,250,000 tokens

Estimated new market cap based on current price: $5.55 billion

What does data tell us about token unlocks?

Now, based on these facts, the wider community is expecting a period of volatility. A part of crypto Twitter is turning bearish, which is logically understandable. A rapid increase in supply is fundamentally never good for an asset’s price, a basic demand-supply law.Yet, a recent market report indicates that the narrative can be extremely different for digital assets. The report studied 600 token unlock events and analysed how cliff events impact prices. The unlocks were classified into founder/team, private and public investors, community, development, and others.

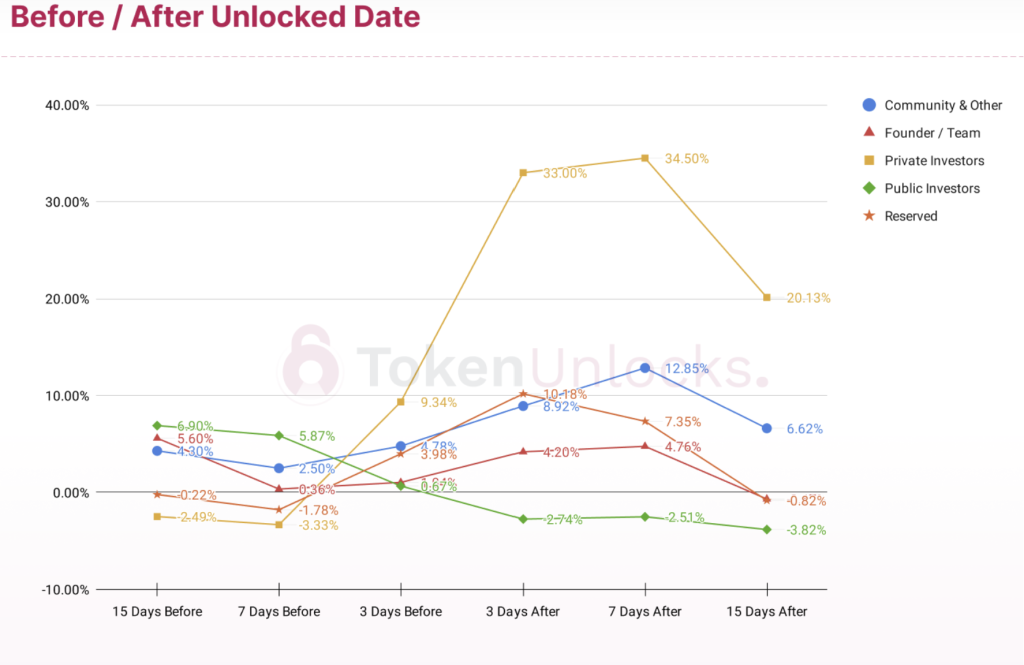

The research categorised events based on predefined criteria and analysed price movements before and after unlock dates relative to the released token amount and its proportion of the total supply.

Surprisingly, the data revealed that unlocks by founders/teams don't typically result in price declines. In fact, prices tend to be higher before and after the unlock than on the unlock date itself.

In the private investor’s category, prices often drop 15 and 7 days before the unlock, possibly due to concerns among non-private investors about potential sell-offs by private investors, triggering a “sell the news” kinda event.

However, post-unlock, token prices in the private unlock category tend to increase significantly, as high as 34.5%, seven days after the unlock event.

Now, let us take this information and analyse ARB’s price action leading up to the event.

Technical analysis

Arbitrum’s token unlock event has been in active conversation for a while now. It is beginning to pick up steam, but crypto Twitter has been aware of it for a long time.

Based on that fact, it is important to note that ARB rallied to its yearly high back in January. Since then, the asset has consolidated sideways and bounced from an incline trendline (orange).

In comparison, all the other L2s have recently registered their yearly highs. When the L2 networks are evaluated side by side in terms of their yearly ROIs, it looks something like this:

- ARB: +40%

- MATIC: +47%

- OP: +58%

- MNT: +67%

- IMX: +75%

Now, based on the study, ARB is on a minor incline 30 days and 15 days before the unlock event. With another week to go, it will be interesting if ARB’s decline before the event mirrors the historical price action of other unlock events.

Cryptonary’s take

Now that we have a fair idea of how ARB’s price action is shaping up with respect to speculation and historical analysis let us incorporate the current market dynamics and catalysts as well.The landscape is fairly bullish at the moment, with Bitcoin consolidating near its new all-time high. For the L2 landscape, the Dencun upgrade is another positive event that is taking place days prior to the unlock.

With ARB maintaining stability and undergoing somewhat of a correction since January, we believe that the unlock price is possibly priced in.

From an investors’ and team’s perspective, it makes less sense to sell your allocation when the market is showing strength. It is not like we are at the end of a cycle where we have been on a rally for months. Therefore, while volatility should be expected, the probability of ARB rallying after the event is fairly decent.

Emphasis on ‘decent’ - we are not suggesting that the price will undergo a mega pump, but we don’t think there’ll be a nasty dump either.

Until then,

Cryptonary Out!