What's not to like? So far, for the past 3-4 months, there hasn't been anything big pop-off. As you all know, prior to that, we had tons of opportunities and much more, and now things seem to be quite quiet.

But the sea of red has started turning a bit more green recently. The double-digit red days were briefly replaced with double-digit green days, and now one question hangs in the air that we will be aiming to answer in this article. Are memes coming back, or are they still dead in the foreseeable future?

In this article, we want to cover four main things:

- The meme pulse is still beating

- What is the general market like?

- Unsustainable rallies by prominent figures

- What are we looking for going forward?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The meme pulse is still beating

It has been a couple of months since the memecoin sector took a hit, and the broader market has struggled to gain traction. However, even though the memecoin sector has fallen out of the spotlight recently, there is still a lot to get excited about. In fact, we would say that there are a lot of reasons for the long-term bullishness of the sector. Starting with…Degens will always be degens

One thing that has stayed in the meme lull of the past few months has been the fact that degens will be degens. This means that no matter the market conditions, rain or shine, degens are always looking for ways to get outsized returns, and memes are the perfect category for that. This isn't a one-way street, either. With every pop in internet/meme culture, there also seems to be a similar coin that launches beside it.Nowadays, these pumps last a couple of days due to low liquidity, but think back to things like Chillguy and Moodeng. This love by Degens for memes still hasn't gone away. The data backs this up: in 2024, dog-themed memecoins alone accounted for over half the sector's market cap at one point, reaching $36 billion by March, with returns 2.5 times higher than other categories.

As long as degens remain degens, the memecoin market will be poised for its next big moment. So far, the market has been telling us that our thesis is valid. Therefore, we expect that when the right environment returns-be it a broader crypto bull run or a viral narrative, we'll be able to look for actionable meme plays with confidence.

Memecoins and internet culture

Let's face it, internet culture runs this world, and a key to Internet culture is memes. As we alluded to before, internet culture and memes are still working in tandem, even in low-liquidity environments. Memes are essentially the language of the internet, they are funny, easy to understand and almost instantly recognisable. They are key to things going viral.Memecoins are also so powerful in this age because they aren't bound by any utility or even fundamentals. Their power lies in a single, potent ingredient: attention. We see this dynamic unfold daily as viral trends sweep through the market. At the start of the run, we had things like Moodeng, WIF, Chillguy, etc.

More recently, a coin inspired by Studio Ghibli artwork launched, weaving a narrative that propelled it to a $20 million market cap in mere days. This phenomenon underscores a key truth - memes remain the magnetic force drawing people to wager on emerging trends.

The pattern keeps on getting clearer when we consider:

- Memes run the internet, which is a bull case for memecoins forever

- Memes are viral by nature, they HAVE to be liked by many

- They don't require logic, they run off vibes

- They evolve with trends; whatever is popular, there will be a way to bet on it through memecoins.

NFTs stayed dead

A while back, we spoke about how NFTs might make a return at some point and then take away from the shine that meme coins have. However, fast forward to now, and that thesis hasn't played out.NFT platform volumes per month have not been able to maintain over $500m a month, while yesterday alone $DOGE did over $1b in volume.

The market has shown its hand; it is clear that meme coins are the preferred degen tool for investing in internet culture and trends. There were also attempts to align NFTs along with meme coins like Pudgy Penguins $PENGU coin. But it's safe to say meme coins will remain king in the crypto space.

Here's why memes make better gambling tickets than NFTs:

- More liquid - easier to enter and exit positions

- Easier to understand - you're betting on a coin, not an image with complex traits

- Instant price exposure - you get exposure to hype quickly, without needing to find a seller

- Memes are scalable - one meme coin can go viral globally, while NFTs often require community-building around individual collections

- Fewer barriers to entry - no need to understand minting, wallets, or rarity tools, all you need to do is buy

Memes listed everywhere

Another bull case for memes is that now memes as a legitimate asset class are more accessible than ever. All major exchanges like Coinbase, Binance, Bybit, Hyperliquid, and more have all gone ahead and listed a majority of the big memes out there, even beginning to list ones with lower and lower market caps.While this isn't immediately clear on why it's a bull case, we think that it is because it lets bigger players bypass the on-chain friction and join the fun. Popular TradFi platforms are growing their memes listed on them. For example, Robinhood has PEPE, BONK, WIF, and SHIB all listed. Across these exchanges, there is an excess of billions of dollars, and as we said, degens will be degens. So when that new hot runner eventually comes, liquidity from exchanges might flow quicker, driving faster acceptance compared to past cycles.

Memecoins in the broader market

Next, let's talk about the overall market, since for any asset to perform/outperform long-term, we need the broader market to be in a bullish stance.Market overview & risk-on conditions

Memes pump when markets turn "risk-on." That means traders want gains, not safety. In past bull runs, memecoins led the charge. DOGE pumped before alt season. SHIB signaled euphoria. PEPE came during a brief market thaw. Memes often mark the emotional turning point. A few days back, risk was creeping back. Bitcoin was higher, and meme volumes were rising again.However, right now, things don't look especially bright. BTC has had a daily downtrend for a while. ETH lost its weekly structure, and SOL is the same price it was last year and this month. It is safe to say that from a major viewpoint, we are in a low liquidity bearish market.

That being said, though, recently, we got a bounce on BTC from 76k to 88k (15% move), we did see memes outperform, like Fartcoin pulling a 200% move, for example, and many others doing 50% to 100% moves. This shows that the appetite is there for memes when the time is right, but as we just mentioned, for larger moves to happen, we need better liquidity .

Why do we keep harping on the word low liquidity? It's because meme coins only tend to do explosively well when we are in higher liquidity times, AKA risk-on conditions. Despite what many will say these types of conditions only happen when the majors are bullishly skewed, and money is pouring into the overall economy.

Essentially, we need risk on the season to hit before we can get any huge runners, for the most part. While we are not a risk on condition, it is the market showing us that while we can still be bullish memes as a whole, it is most likely best not to get too antsy in taking positions in them as the overall market is skewed down, which directly affects our chances.

Investor sentiment

Even while the overall market does seem dead, that doesn't exactly mean that nothing bullish can happen in fact, we are inclined to say that investors' sentiment towards memes has never been better. Why? Memes have ingrained themselves as a key part of the culture, and as we have seen recently, when a big one runs, everyone gets involved.For example, with Fartcoin, we saw so many people in the TradFi world get involved with SNL. We've even seen Trump talk about his meme coin and altcoins. This is all to say that memes are no longer cliche. They are a real option people can use to bet on trends, and as time goes on, more and more people realise this.

This all wraps together with culture, exchange listings, degens, and TradFi investors all interested in meme coins; it's safe to say sentiment towards them has largely warmed up over the past year.

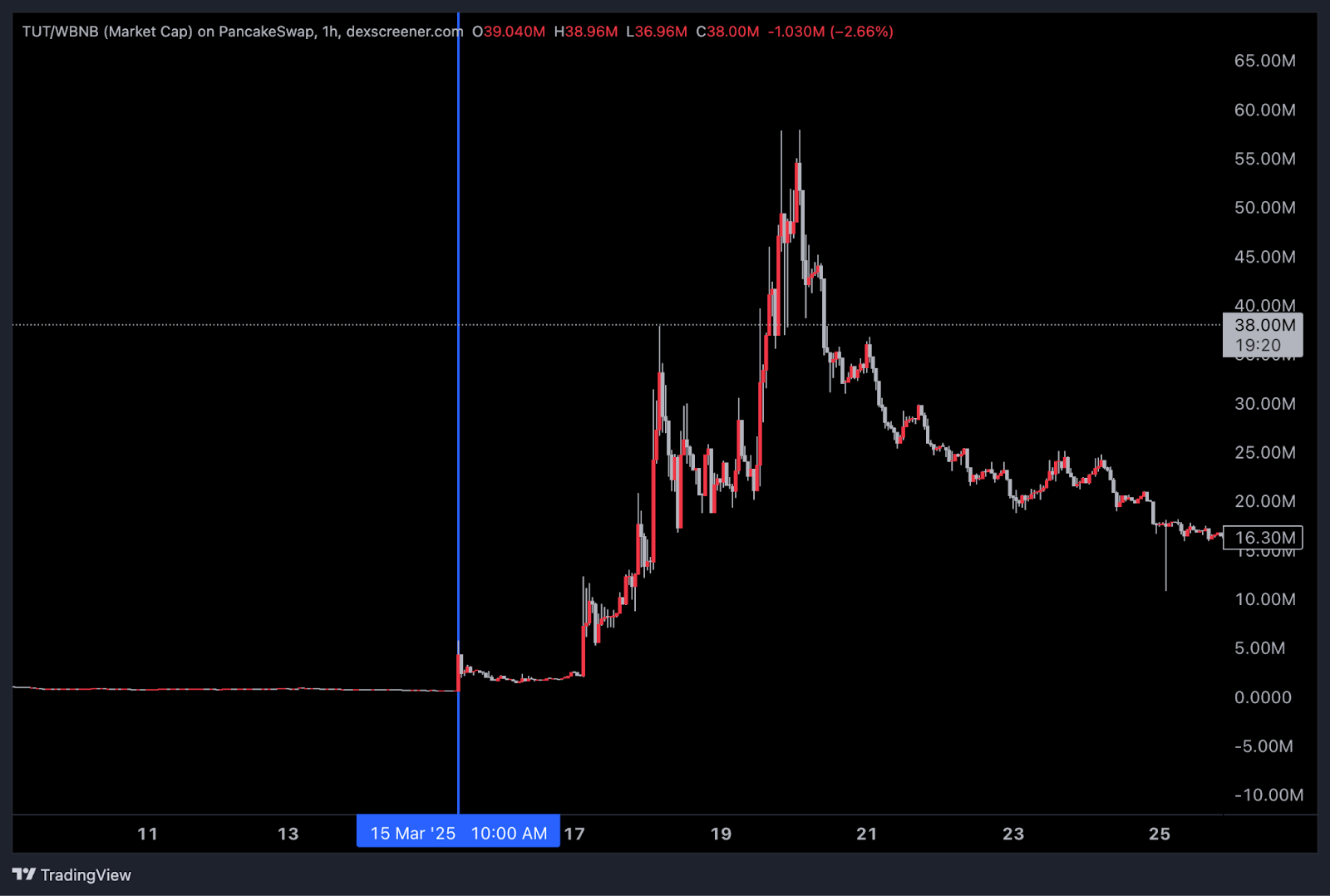

The Pitfalls of forced memes

However, one thing we are noticing at the moment is that there are more and more forced meme plays. To us, this all started when key figures in the industry began heading memecoins instead of the community/narrative leading them. Now, we have L1 chains being pushed by these people, such as ones on Binance Smart Chain and Tron.There has been some action on both of these chains, but nothing has come out of the memes on these recently pushed chains. No sustained runners just flash in the pan, allowing a small few to get out in profit while most are left holding the bag. Let's look at a few examples of this happening so far on BSC.

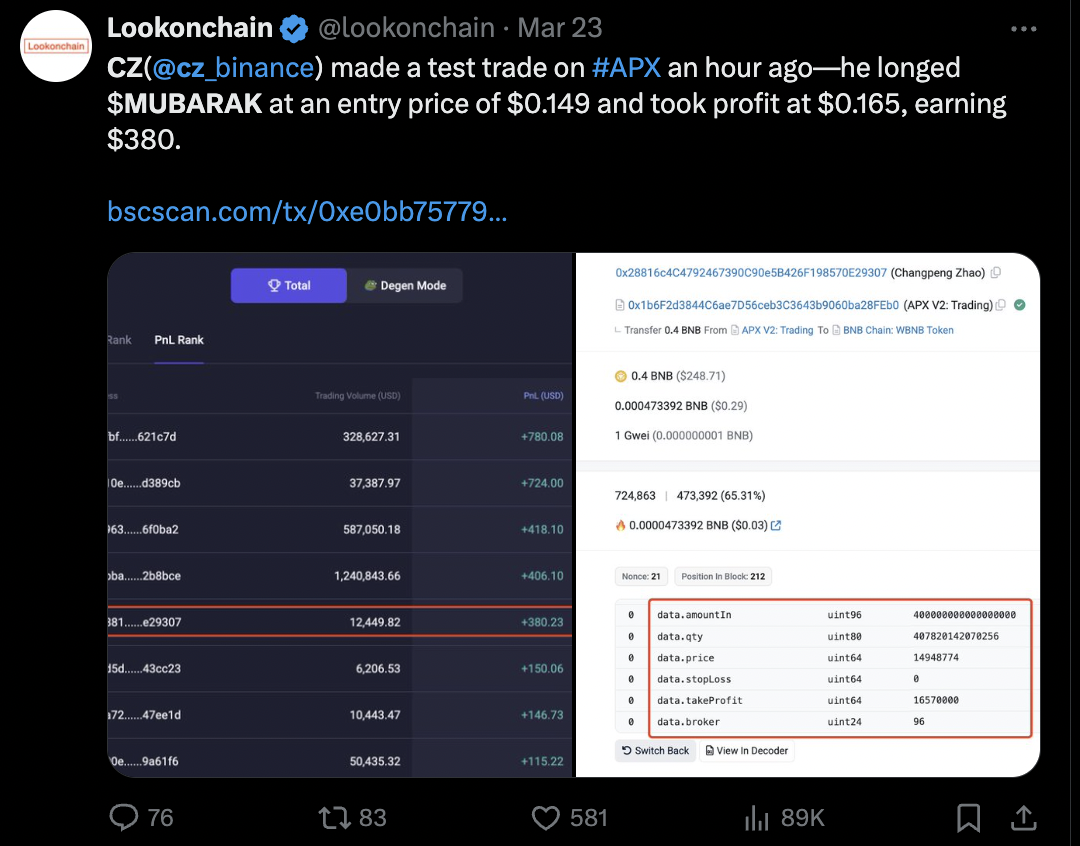

The first coin we want to look at is Mumbarak. While CZ, Binance's ex-CEO, hasn't directly tweeted about it, he's been spotted buying random meme coins on BSC, which naturally drew attention to it. On top of this, he changed his PFP for Ramadan too, which also drove more attention to a coin.

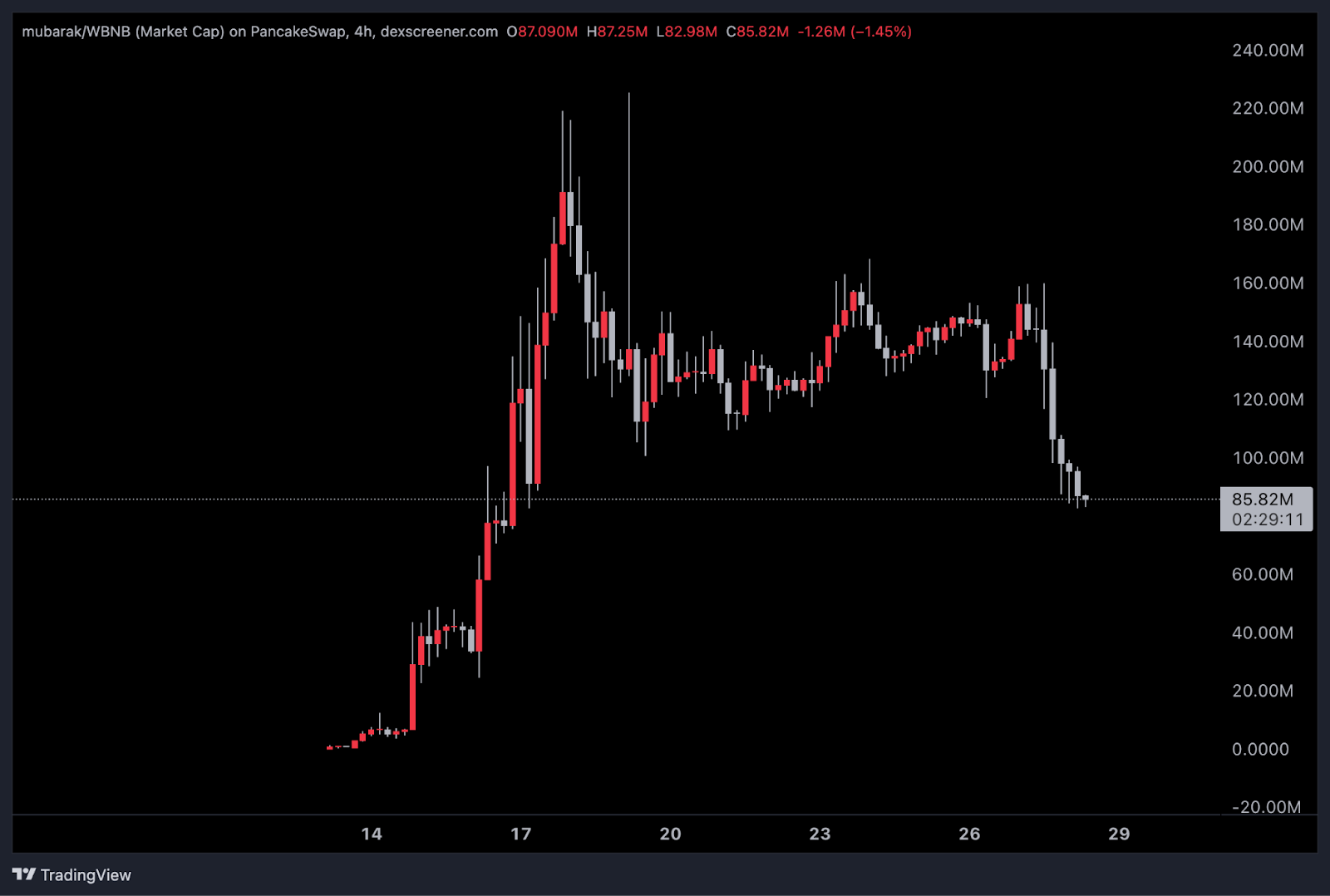

Looking at the chart, it has pretty much gone straight upwards since, but after peaking has started forming bearish price action already after about 10 days.

We can see the power of his dwindling when recently, on the 23rd, he longed Mubarak at a $140m market cap, yet the price only went up 10% before he closed, and since then the price has gone down a staggering 50% in just a short time.

This is what happens when memes are being pushed by people and not pushed by strong communities: they end up lacking soul, which in turn leads to no longevity, which means that once the tweets stop, the price stops moving positively.

As we can see from these examples, the forced meme narratives (top-down approach) simply do not work long-term. Yes, there is money to be made, but the door to exit once the music stops is very small.

Additionally, we can see examples of this also failing back in the Solana meme bull market, where it seemed like every other day, influencers would pump coins, but since it was them bringing the attention, once it stopped, the coins dropped. We have also seen attempts of this by Tron & Avalanche as well; the founders/teams would tweet or even allocate funding for a specific set of memecoins built on the network, and within a week, these coins would be down staggering amounts and eventually die.

This is all to say that the forced top-down narrative just doesn't work; longevity comes from good roots. That being said, this leads us to what we look for when it comes to these things.

The future of memecoins: What really matters

So now, let's do some future prepping. Let's look at what specifically we want to see in the future to help us identify the good from the bad. Organic vs. Forced memes. At the start of this article, we quickly brought up how, recently, some memes have been purely pushed by single actors, and some are even being pushed on random L1s in an effort to be unique. From what we can see, forcing narratives gets coins nowhere.Almost all the hundreds of millions plus market cap runners have one thing in common, and usually, that is that not one person or group forced the coin to do well; rather, the runners tend to be liked and, in a sense, "bootstrapped" by the community. We saw this in memes like PEPE, DOGE, WIF, POPCAT, and the early days of SPX6900. Usually, when a coin has healthy roots, it tends to bloom.

Coins with VC backing, presales, insiders getting to buy first, or influencers shilling from the get-go tend to have weak roots and live very short lives. In this game, we will always look for authenticity. We, along with the market, value fun, community, and vibes.

Virality factors & Long-term sustainability

Another factor we look for is virality. What makes a meme viral? Well, it typically lands somewhere with a mix of simplicity, humor, and branding. This was readily seen with memes that are simple to understand and that have good and memorable branding. We also put a large emphasis on community. Typically, when we look for memes that can stick around, we want to see a good "fanbase" around the meme. Lastly, we also think that whatever it is, it cannot be too serious; there should always be a fun vibe around it.Here are some of the things we look for:

- Catchy one-liners - something that sticks in your head instantly

- Good art - simple, clean, and recognizable visuals

- Cult-like community - a fanbase that's loyal and proud

- Non-rug narrative - projects that don't raise immediate red flags or look like cash grabs

- Wide distribution - accessible across wallets, exchanges, and social circles

Cryptonary's take

So, are memes back? Not quite - the sector's pulse is beating, but it's not a full-on rave yet. But the market is already dropping hints. Internet culture remains meme-obsessed as they are fun and the best speculative tool to get outsized returns.Therefore, even in the low liquidity environment we are in now, degens continue wanting to degen. But beware the fakes: top-down memecoins are the crypto equivalent of a forced laugh. CZ tweets, pumps Mubarak, and- poof- 50% down in days. No community, no staying power- just a quick cash grab for the connected. Good memes are built on strong cults, funny ideas, art, one-liners, and fair distribution.

We are still very bullish on memes since the desire to get rich quickly is likely to always be there. Therefore, we remain optimistic on the future of memes and the wealth they will create, however, we need to wait until the stars align to place high-conviction bets.

Until then, just stay alert, keep up with the developments, and preserve capital until better liquidity and a macro environment.

That's it for us!

Cryptonary OUT!!