Are you down significantly? Best practices andrecovery strategies

When a crypto asset crashes, it's a harsh reality check-just because it's down doesn't mean it can't go lower. There is no such thing as a guaranteed bottom in this market, and holding out hope for a recovery is not an option. Not only is it helpful to know how to navigate a downturn, it's the difference between surviving and getting wiped out. Let's talk more about this…

Double-edged sword

Crypto's volatility is both a challenge and an opportunity, but when a portfolio is deep in the red, blind hope is a losing strategy. Assuming there is a natural floor is a gamble because a coin that is down 70% can still plummet another 70%. Making wise, calculated decisions is more important for survival during a slump than waiting.Knowing when to de-risk, rebalance, and capitalise on the market are all elements of a strategic strategy. The goal of risk management is to preserve capital and set up for the next leg, not to get involved in panic selling. This could mean shifting into stable assets like USDC, adjusting allocations to reduce exposure to extreme volatility, or even capitalising on market inefficiencies through range trading and short positions.

At Cryptonary, we've executed this playbook in real-time, making well-timed entries and exits across key assets, securing gains before the markets tuned. Many who followed our strategy are now in profit and sitting in stables, ready for the next move. If you weren't able to act, what matters now is focusing on recovery and making the best use of your capital, time, and energy. The market will present fresh opportunities, and our job is to guide you through them.

Downturns don't just expose weak assets-they expose weak strategies. Disciplined investors are separated from others who lose everything during these times.

In this guide, we'll break down how to assess your holdings, strategically shift capital, and use range trading or short positions to stay profitable in a declining market. Adapting to market realities is what keeps you in the game; investing passively doesn't work in brutal conditions.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Assessment of the current portfolio

Assessing your portfolio critically and objectively is the first step in weathering a downturn. This isn't just about tracking how much you're down- it's about understanding why. Are certain assets dragging you down, or are your losses a result of a larger market correction? Knowing the difference between asset-specific vulnerabilities and systemic downturns is crucial since it determines your next course of action.Each asset in your portfolio has to be reevaluated in light of current market circumstances and fundamentals. Has the project's technology, leadership, or competitive positioning changed? Does the price decline indicate more serious structural problems or is it an industry-wide cycle? Knowing which is which makes all the difference. Some assets rebound with the market, while others never do.

Beyond individual assets, portfolio allocation needs a reality check. If high-volatility plays are causing outsized damage, it might be time to rebalance. Rebalancing involves more than just cutting losses; it involves aligning your long-term plan and true risk tolerance.

That could mean shifting into more stable assets, diversifying into sectors with stronger resilience, or increasing cash positions to wait for better re-entry points. A downturn is an opportunity to adapt and prepare for the next leg, not merely something to suffer.

Rebalancing and de-risking strategies

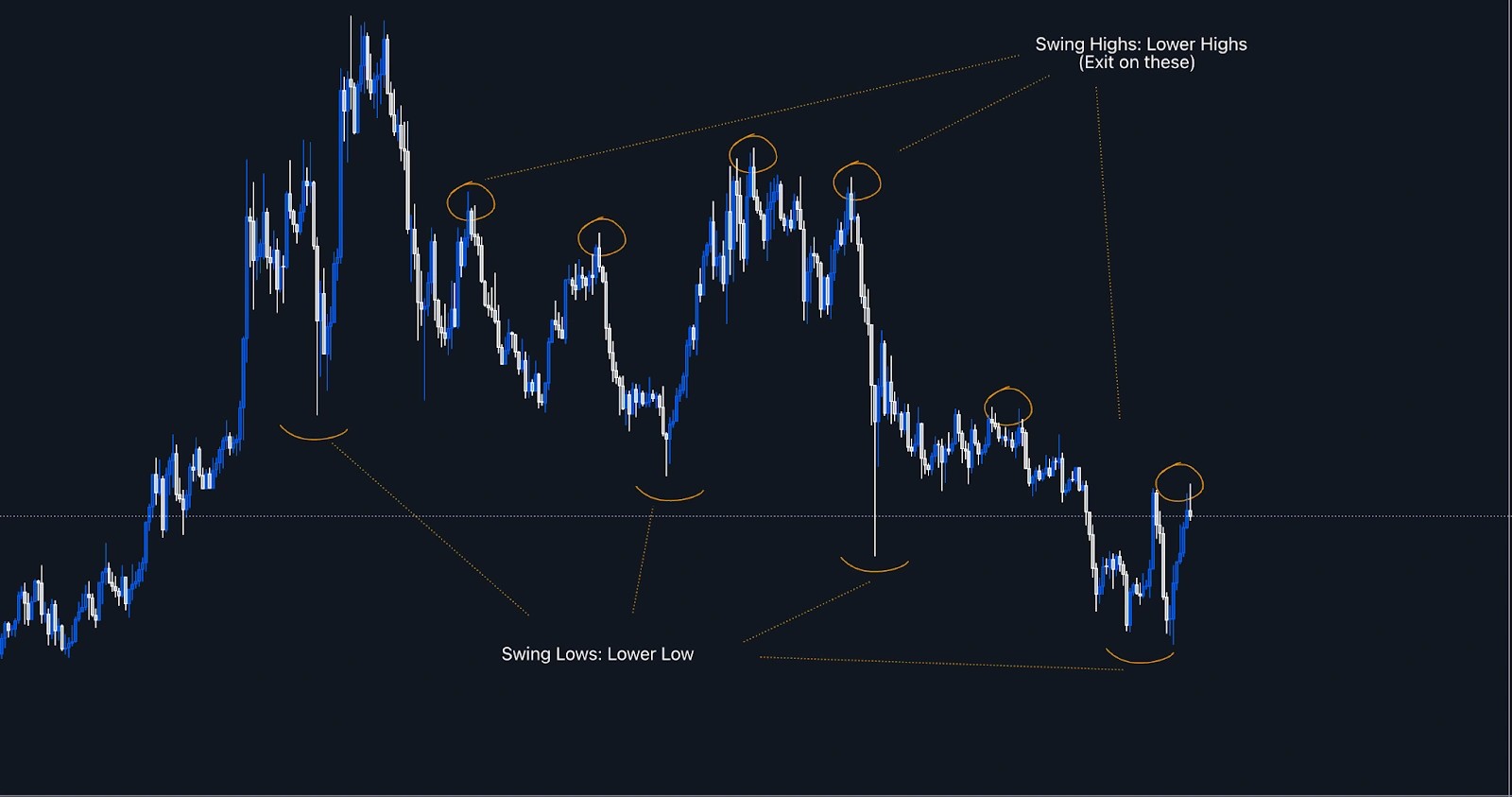

Blindly holding and hoping is not a strategy when markets turn red. Rebalancing entails taking charge, minimising unnecessary exposure, and setting yourself up for survival and profit in the remaining cycle. Knowing what to keep, what to reduce, and where to put money while you wait for better circumstances are crucial.Reducing exposure to high-volatility assets that still represent a sizable negative risk is the first step in a downturn. If a position is bleeding and lacks strong recovery potential, cutting it on every potential lower-high swing before it does further damage is the smart move.

At the same time, adding to stable, undervalued assets can provide long-term upside when the market turns. However, even supposedly "safer" assets in the cryptocurrency space might get wrecked under extreme circumstances. This is why moving into stablecoins is often the most effective way to preserve capital.

Stablecoins offer a real hedge against market turmoil, as opposed to switching between unpredictable assets. Moving into stables isn't about giving up. It's about staying in the game. When you're down 70% or more, every decision feels like a battle between cutting losses and hoping for a rebound. But sitting in positions that keep bleeding isn't a strategy- it's a slow exit from the market. Moving into stables doesn't mean you're out-it means you're giving yourself a chance to fight another day.

Downturns offer chances to actively trade volatility in addition to simply holding stablecoins. When markets are moving sideways, range trading-buying support, and selling resistance can be quite successful.

You may transform market volatility into profit by using a disciplined method to earn profits even in rough situations. For those who are at ease with advanced strategies, shorting weak assets can be an additional strategy to profit from downturns or hedge against them.

We have rolled out a new series on Journalling and will share exciting opportunities in Cryptonary’s trades. It is time to pay attention to how to capitalise on range-bound volatility…

Making stablecoins work

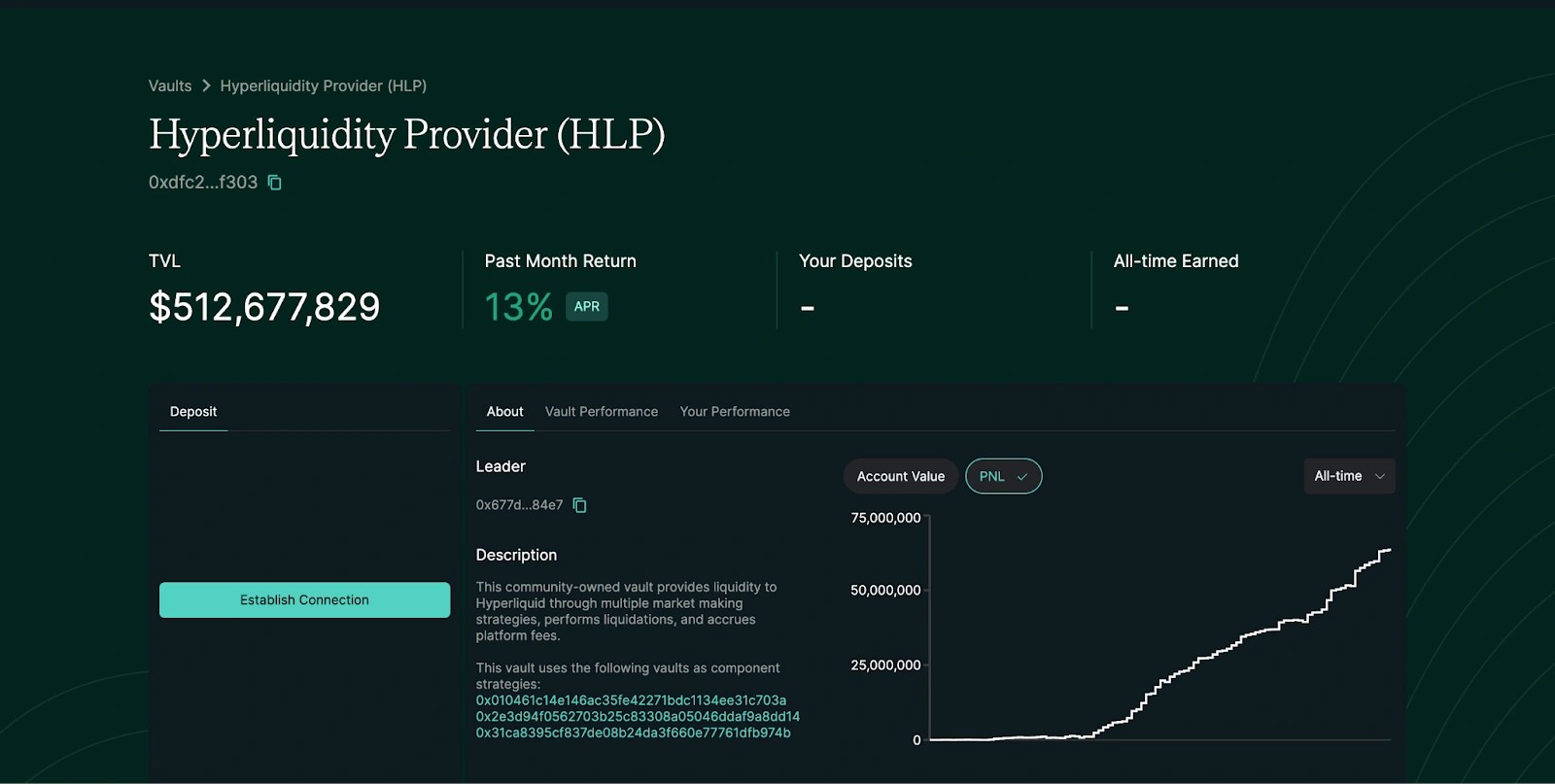

Another option is to earn a yield on stablecoins. Holding stablecoins doesn't mean sitting idle. DeFi makes it possible to make money even when the market is down. While you wait for improved market circumstances, you may generate passive income through yield farming, lending, and liquidity provision.This is further enhanced by platforms like Hyperliquid, where you can bag anywhere from 12%-16% APR, and HL Vault allows traders to switch between actively trading and generating income with ease, maintaining capital growths without needless risk.

We recently went into great detail on yield farming, explaining how it operates, the risks involved, and the best ways to maximise returns. If you're considering putting your stablecoins to work, that guide is a must-read to help you determine the best approach for your portfolio.

Playing defence during a downturn puts you in the greatest possible position to play offence when the time comes. It's not just about surviving. You're not simply watching a bleed happen; you're getting ready to take control of the next run-up by protecting your cash, trading wisely, and making your stablecoin holdings work for you.

Emotional discipline and long-term focus

Surviving a crypto downturn isn't just about strategy- it's about emotional control. The worst decisions are made under pressure when markets fall because fear takes over.Emotion, not logic, is the reason for errors like panic selling at the bottom, refusing to reduce losses, or mindlessly holding onto assets with little chance of return. Investors who maintain discipline, eliminate emotional bias, and act on strategy rather than fear are the ones who survive these cycles.

A long-term mindset is essential. Crypto markets move in cycles, and while short-term price action can be brutal, history shows that strong assets recover. Recognising which assets will truly survive and which won't is crucial.

Those who survive and those who are wiped out are distinguished by sticking to a well-planned investment strategy, refraining from rash decisions, and seeing downturns as opportunities rather than failures.

One of the best ways to take emotion out of investing is to set predefined rules for buying and selling. Depending on your approach, you either cut it loose or double down if an asset falls to a specific level.

A structured approach to risk management includes predefined stop-losses (SL), take-profits (TP), and partial profit-taking strategies. Here's a simple breakdown:

- Set Stop-Losses (SL) to Protect Capital- Before entering a trade, define at what price level you're out, with no second-guessing. Depending on volatility, a common approach is:

- Swing trades: 10-20% SL below entry (adjust based on volatility and price levels).

- High-conviction plays: Wider SL, but only if fundamentals remain intact.

- Short-term trades: Tighter SLs (3-5%%) to limit downside risk.

- Use Multiple Take-Profit (TP) Levels Instead of Waiting for One Final Target - Taking profits in steps prevents round-tripping gains. Instead of a single TP, structure it like this:

- TP1 (25-30% of position) - At first major resistance level.

- TP2 (40-50% of position) - At next key resistance or structural highs.

- TP3 (Final exit or moonbag) - Leave a small portion running in case momentum continues.

- Secure Profits Along the Way with Partial Exits - When the price moves in your favour, don't just hold for the "perfect" exit-lock in profits step by step. Market conditions change fast, and waiting for a final TP can often result in watching gains disappear as trends reverse.

- Re-entering the Market with a Bias - Trading isn't just about exits- it's about getting back in at the right time. If your analysis is correct, the goal isn't just to make one good trade but to ride the momentum while reducing risk along the way.

We've developed a trading journal template and a full video tutorial to help you structure this process effectively. This approach ensures that your judgements are backed by reason rather than emotion, whether you're restoring your strategy or recovering from losses.

This is the action plan you need to maintain discipline and get back on track if you're serious about improving your execution.

![]()

At the end of the day, investing isn't just about picking the right assets-it's about managing yourself. You are less likely to get shaken out at the worst possible moment if you have a deeper understanding of risk management, market dynamics, and historical trends. Those who remain focused, patient, and disciplined will win this game, not those who chase hype or panic under pressure.

Cryptonary's take

Surviving is about making the right moves while others panic. Rebalancing into stable assets, using yield farming to keep capital working, and employing long and short-term trading strategies aren't just defensive tactics. They help you maintain control and set yourself up for the next run.Moving into stablecoins, leveraging platforms for yield, and executing disciplined trades all contribute to a strategy that works in any market condition. What differentiates individuals who stay in the game from those who lose is control of their emotions.

Downturns don't last, but the lessons and strategies built in tough markets define long-term success. Stay informed, stay sharp, and most importantly-stay ready to strike when the next opportunity comes.

Cryptonary, OUT!