It is a liquidity infrastructure aggregating multiple decentralised exchanges (DEXs) to provide users with the best prices, token selection, and user experience.

As many of you might know and expect, Jupiter will launch its $JUP token today.

While we have shared our initial thoughts regarding Jupiter here, we thought providing some context to this anticipated event would be great.

A quick review of the tokenomics

JUP’s utility: GovernanceJUP has a max supply of 10b tokens.

- 1b (10%) of that will be airdropped to users who interacted with Jupiter before Oct 2023

- 250m (2.5%) will be used for launchpool

- 50m (0.5%) will be lent for CEXs for market-making purposes

- 50m (0.5%) will be used for LP

It is neither good nor bad in the short term; in the long term, it will depend on how the rest of the supply is utilised.

What about the price?

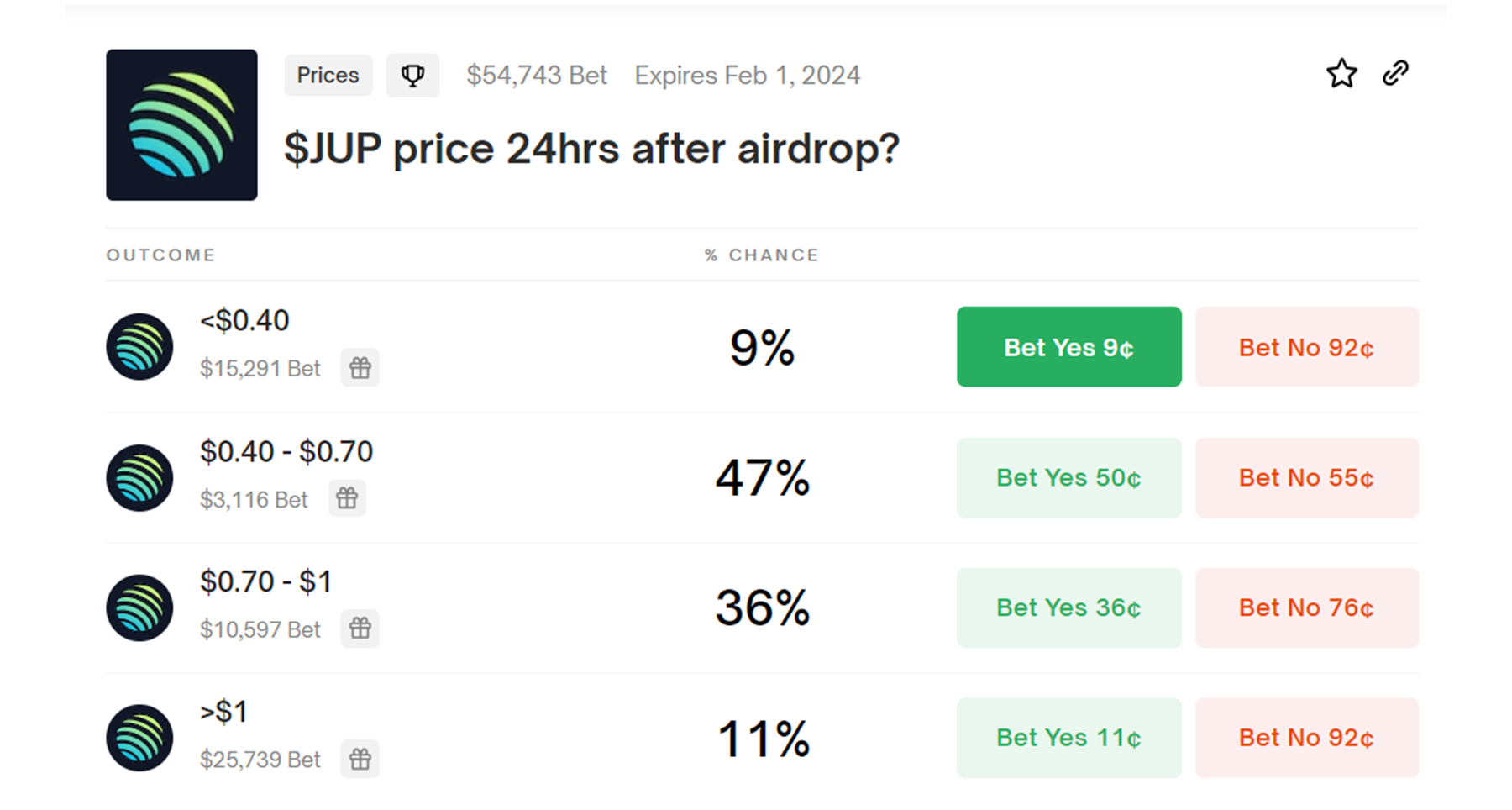

Currently, the market is pricing $JUP in the $0.4 - $1 range in the first 24 hours, according to Polymarket.

On Aevo, the price has ranged between $0.4 - $0.8

These markets give us initial thoughts on how the market is pricing the $JUP token and potentially can guide us on how to play the airdrop event.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

So what is the game plan?

If you have read our report, you know how crucial Jupiter is for the Solana ecosystem.Therefore, regardless of whether you got an airdrop or not, buying below $0.5 (lower range of what the market is expecting) can be a great long-term opportunity if you are bullish on Solana and Jupiter.

If you got an airdrop, taking some profits above $1 (above the range of what the market is expecting) is worth considering.

$1 would assume a fully diluted mcap (FDV) of $10b. For comparison, Ethereum’s #1 DEX, Uniswap, has an FDV of $6b. We all love Jupiter; however, it is a slight stretch for $JUP

Of course, it can cross the $1 mark because not all the supply is entering the market.

However, there's little downside to you securing some profits at that price.

Cryptonary’s take

Jupiter’s token debut is a crucial event for the whole Solana ecosystem. The $JUP token can generate momentum for more new ecosystem tokens.If you have read our airdrop reports here and here, you know that there are many tokenless protocols on Solana, and this airdrop can be the precedent for other ecosystem protocols to launch their own tokens.

Jupiter’s airdrop can result in a trickling-down wealth effect for the broader ecosystem. That means when a new token is introduced to an ecosystem and generates wealth for its holders, this wealth will eventually spread to other parts of the ecosystem, resulting in new capital inflow, new users and further growth.

Have a great day, everyone.

Cryptonary, OUT!