Art and money: Are NFTs making a comeback?

With many NFT collections rising by 50% and more in the past couple of months, we have decided it is finally time to talk about what's up in the NFT market. In this piece, we want to give the full top-down on the market from what to trade, where to trade, and what NOT to do.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

NFTs are so back

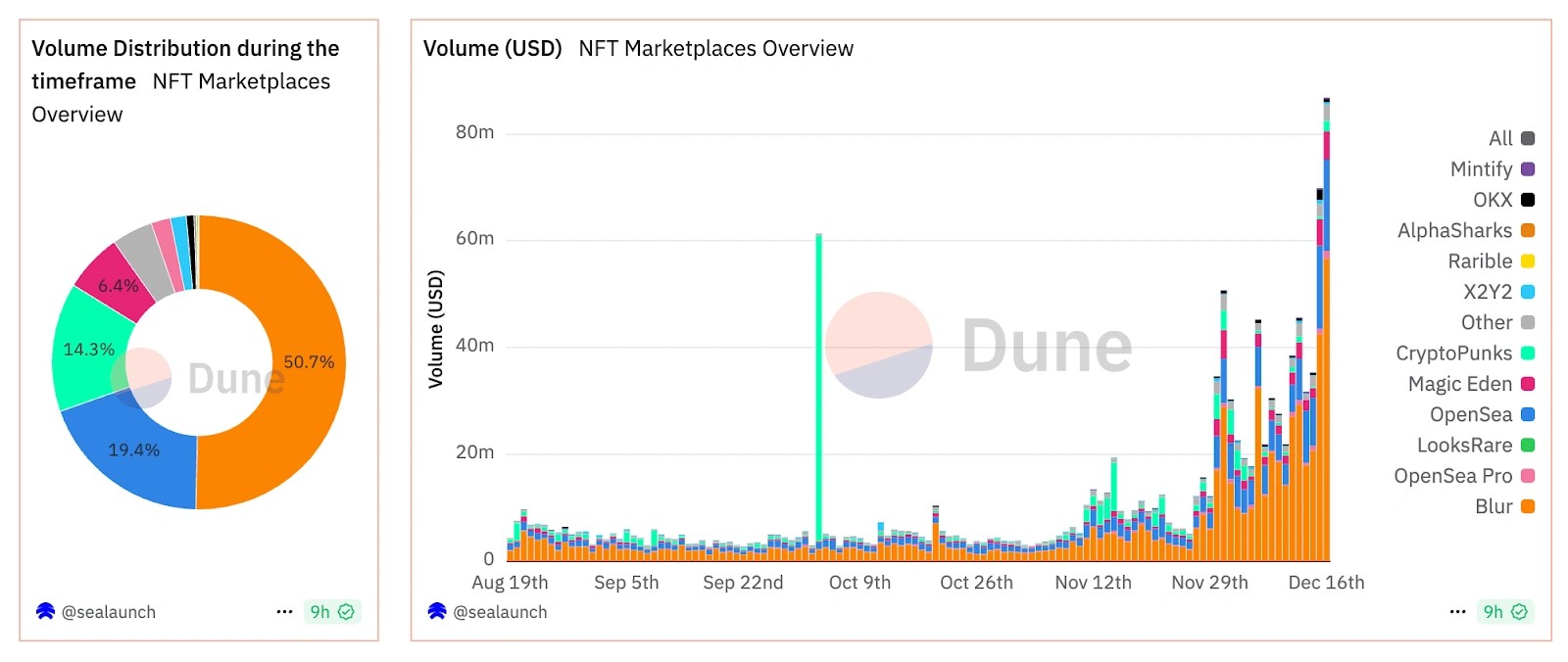

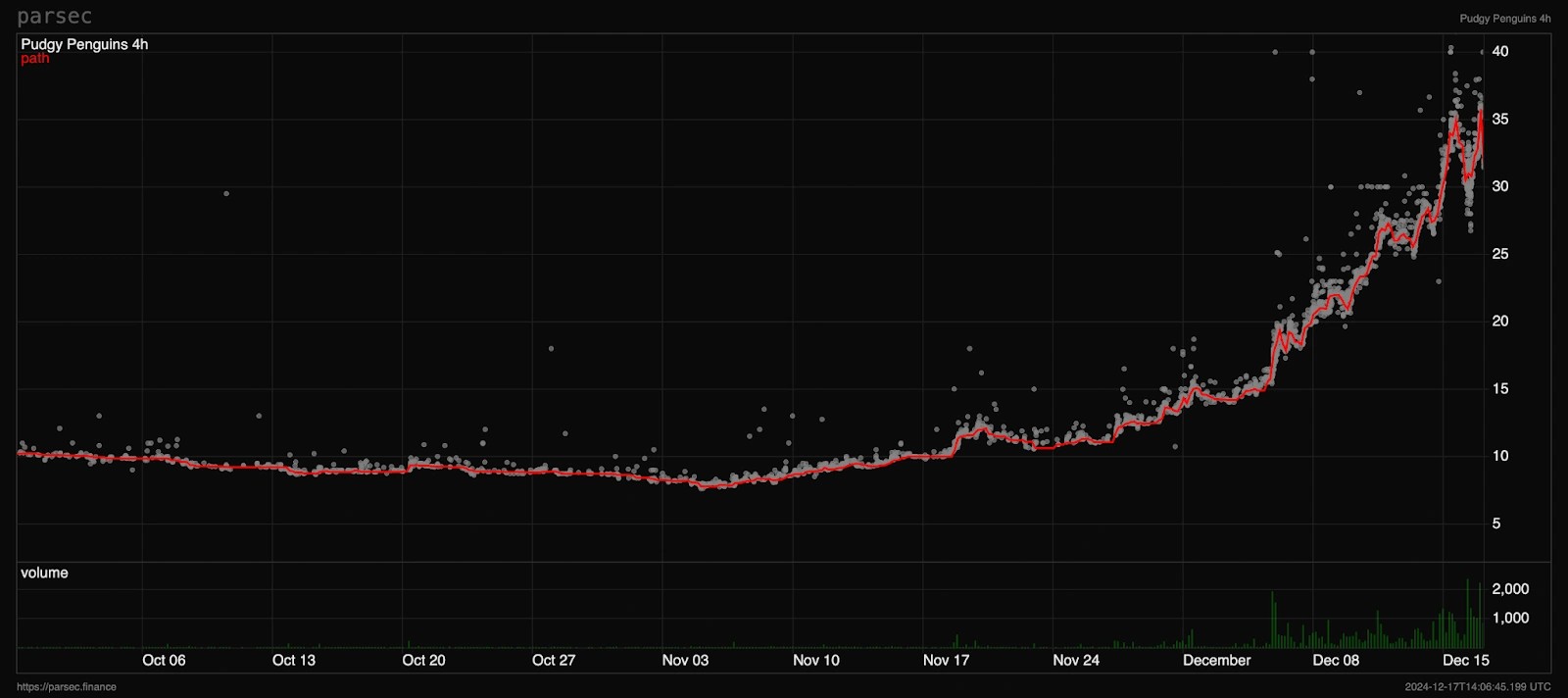

Yes, it is correct to finally say to the NFT bros that we are finally back. As we can see in the chart below, just this month alone, we have 8x the average NFT volume throughout the year, and this uptick began back in November, so it might really be an NFT time again!

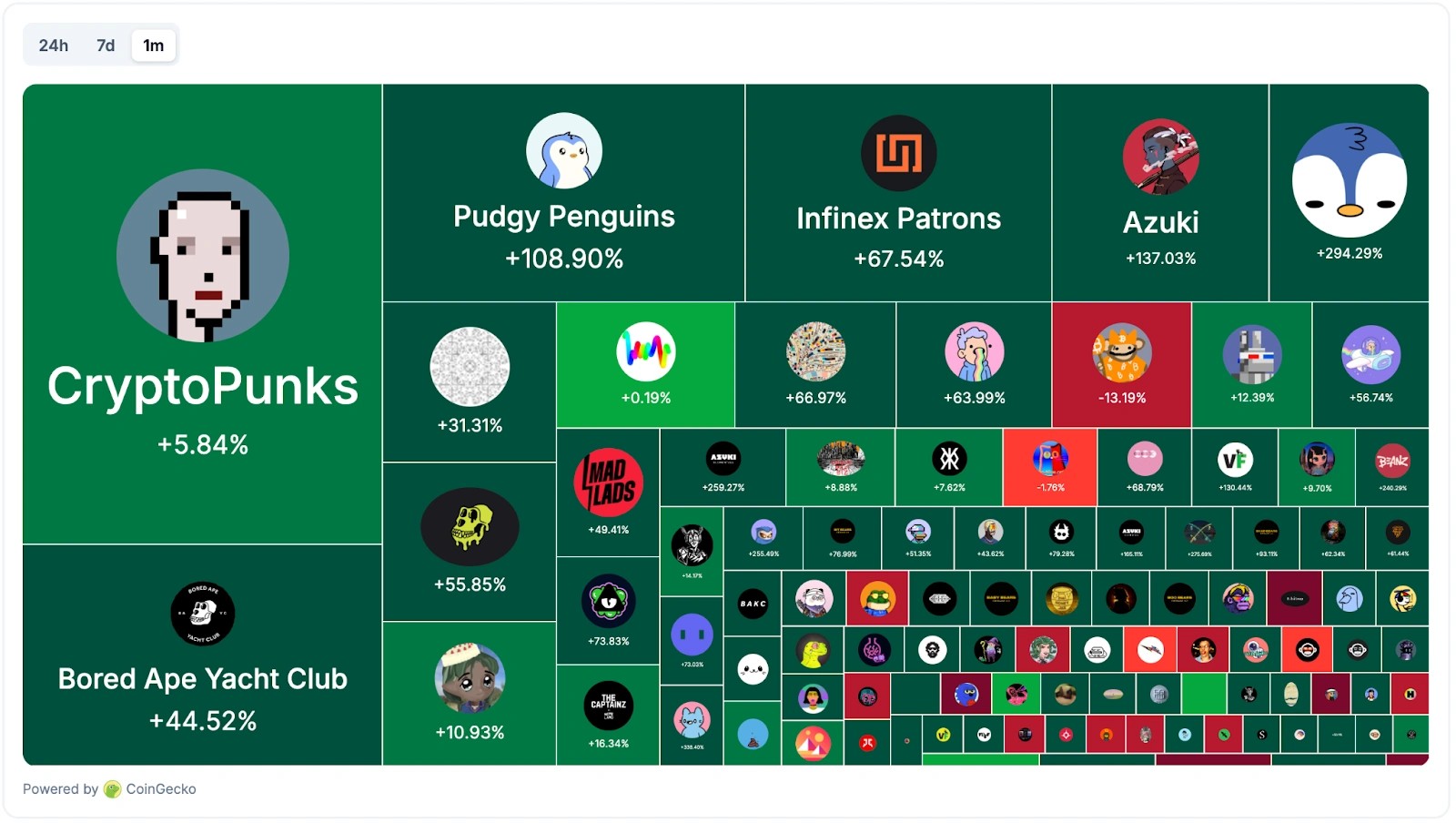

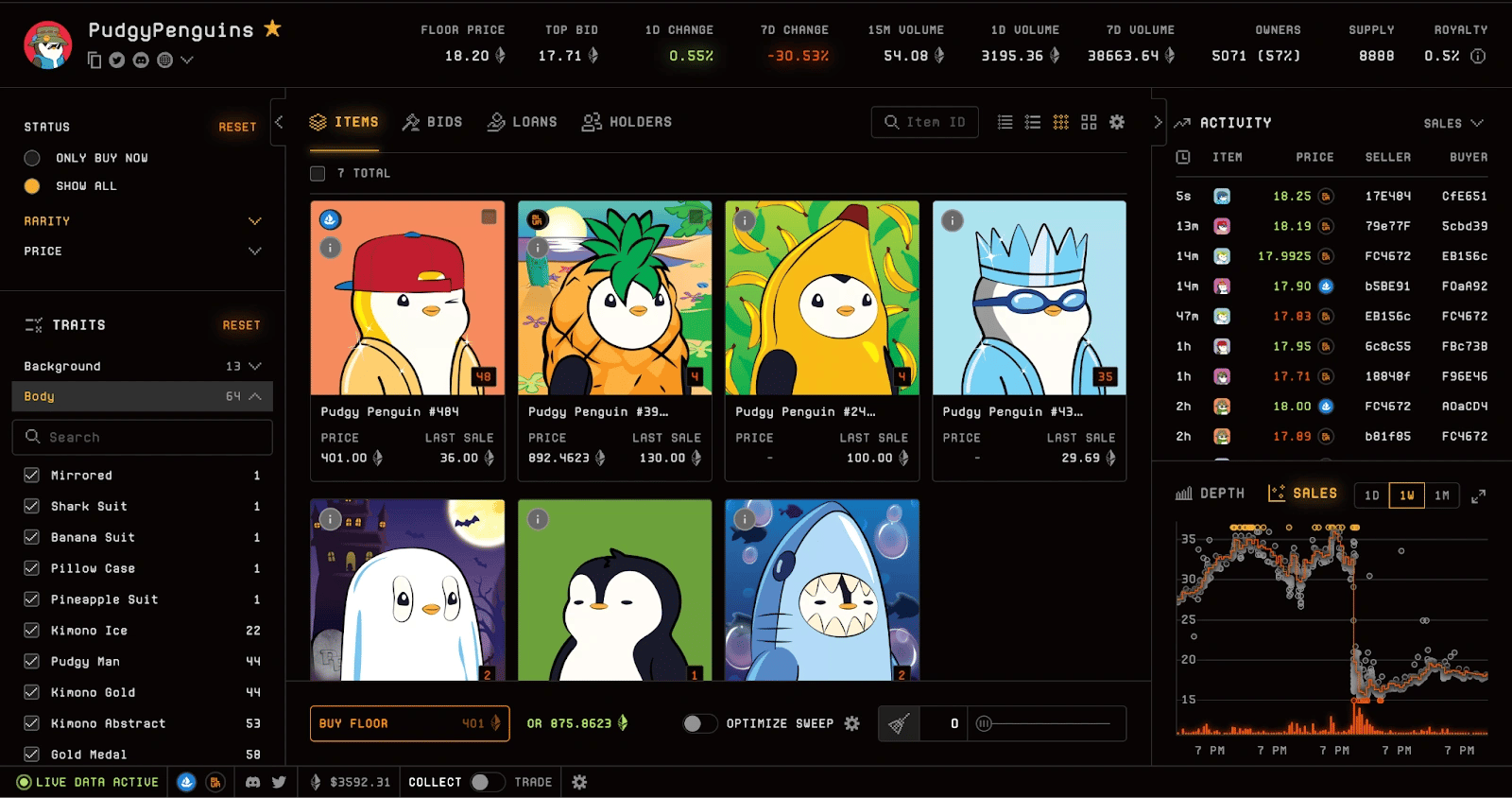

On top of this, you also have a huge upward move in floor prices, with prominent collections such as Azuki and Pudgy Penguins up over 100% just in the past couple of months. Clearly, the winds are changing, right?

With all that being said, if we are really back, there are a few things we need to talk about: how to catch the next big move, our bull case for the NFT space, and finally, the risks. We run deep in the NFT space, so make sure to stick around.|Without further ado, let's dive in…

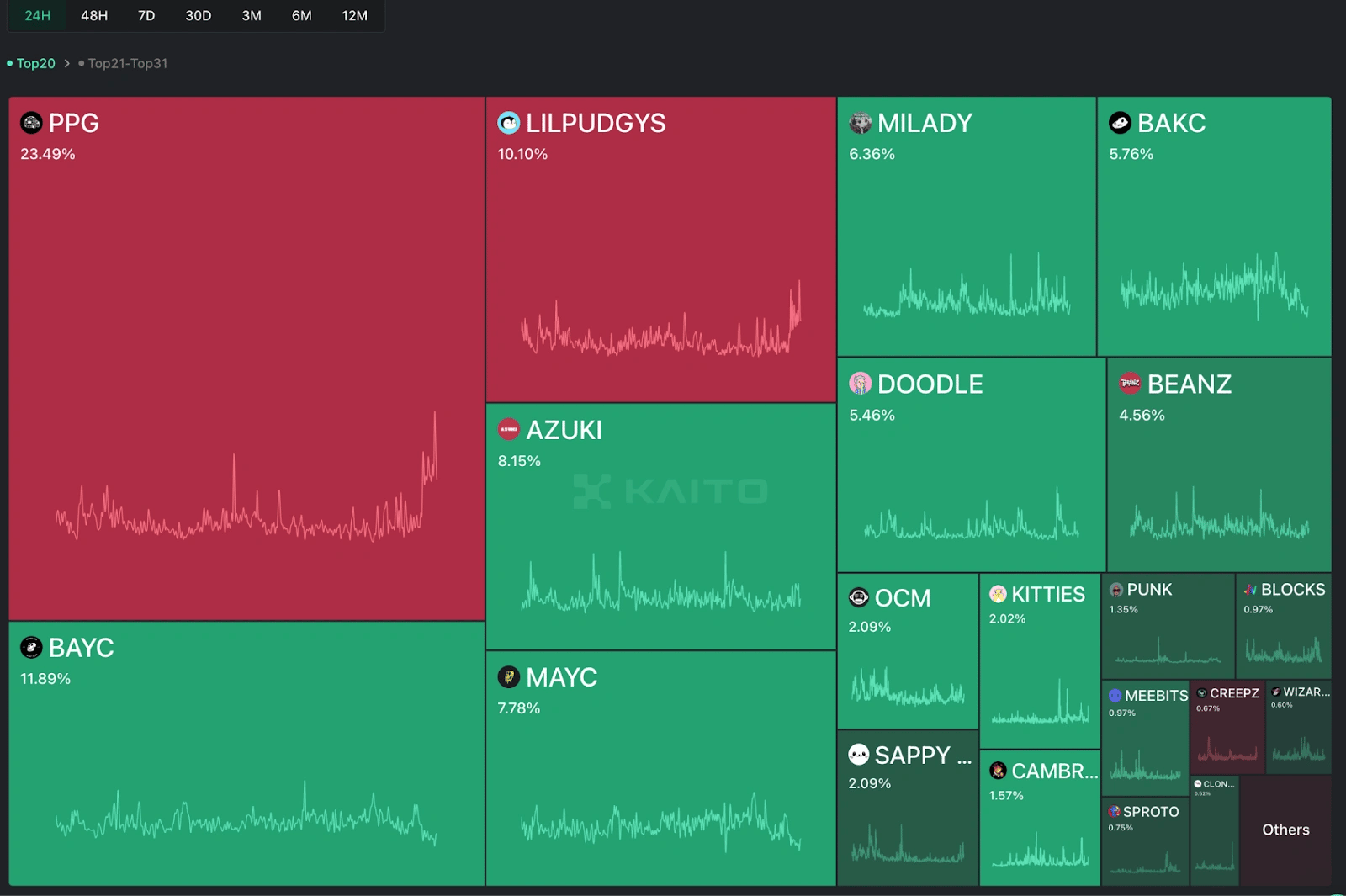

Who is on top?

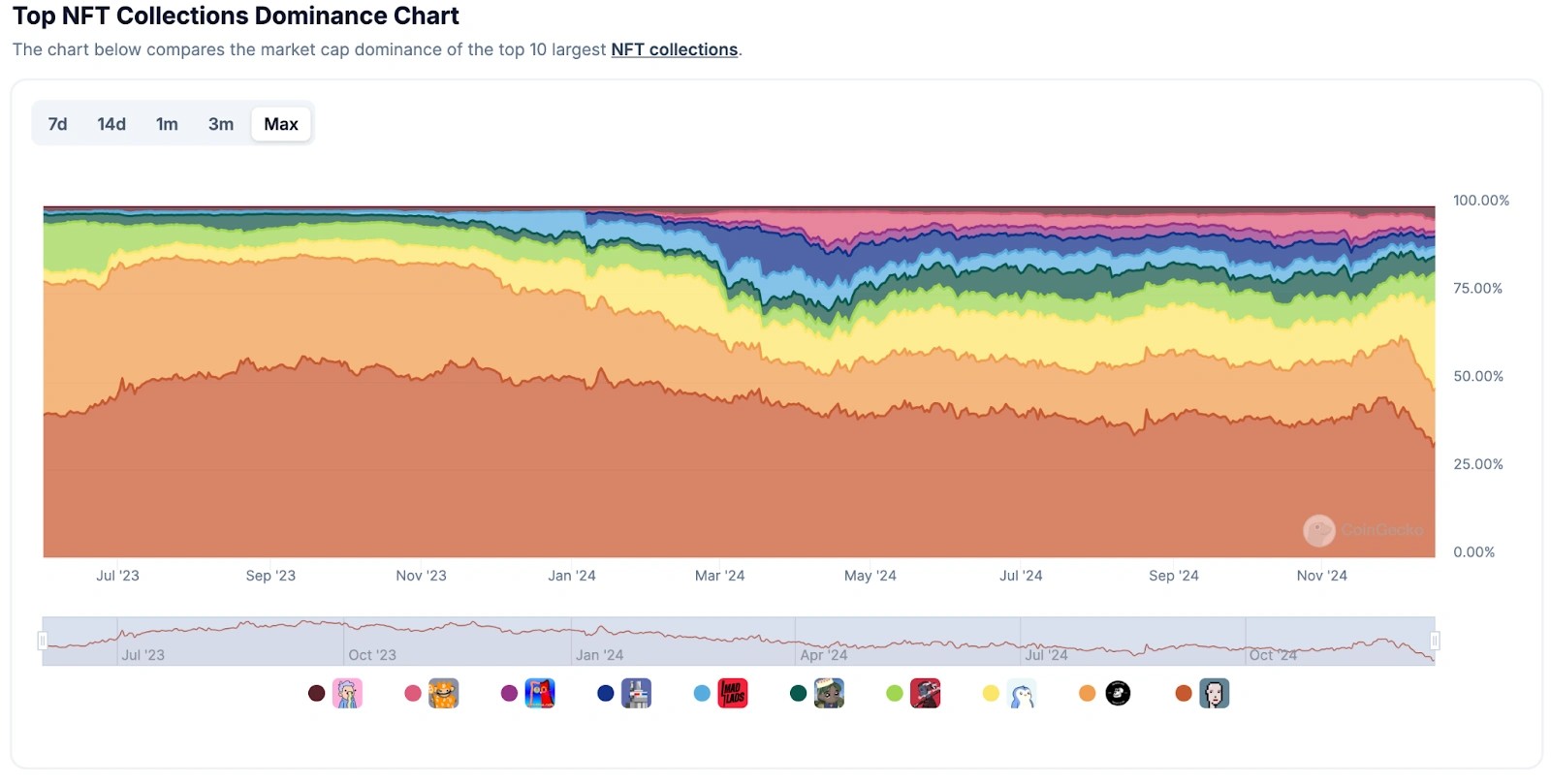

To start, let's get a good grasp on what are the top projects at the moment; from the data below, we can see that the top projects have stayed roughly the same throughout the year with household names like BAYC, Pudgy Penguins, Azuki, Milady, and a guest appearance of the Cool Cats.

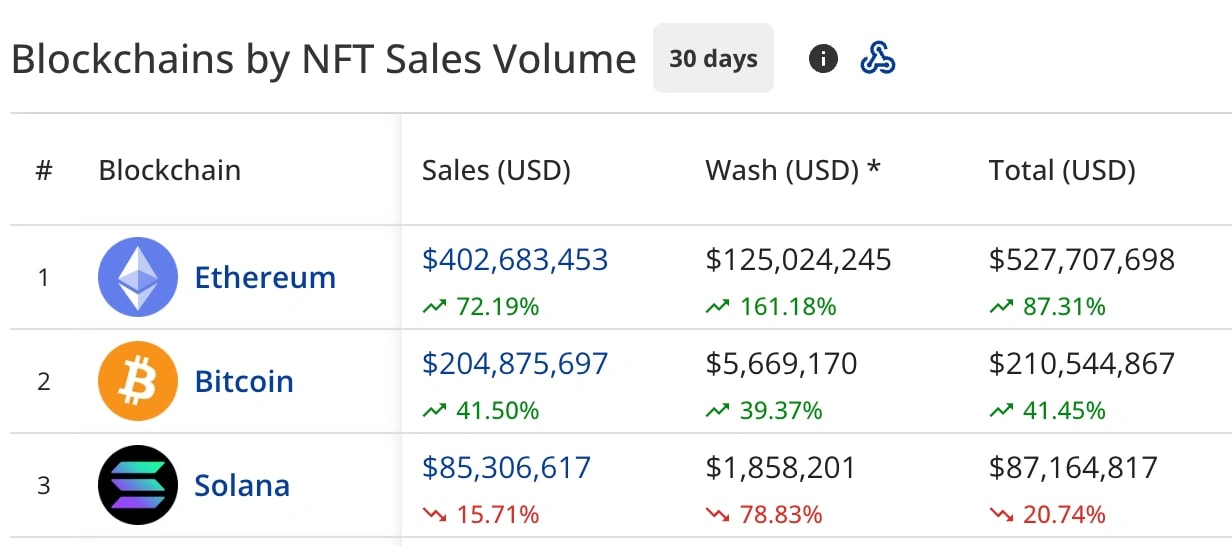

Additionally, all these NFTs reside on Ethereum, which throughout the NFT lull has remained the king above other chains, and we can see this quite clearly below.

If we take a look at collection dominance, we can tell a very similar story: collectors like Ethereum NFTs have an 80% + stake in the total dominance of the top NFT collections.

So, floors are rising, volume is rising, and we know that ETH is the place to be if we are going to trade these assets. The next step is to determine how we will go about catching them before they pump. Well, we have what we like to call our 3 M's to get into NFT collections:

- Momentum

- Management

- Mindshare

For example, let's take a look at the Pudgy Penguin chart from this year. As we can see, it went sideways for the majority of the year, but finally in early November, we saw a substantially higher high getting made, which was then followed by a higher low and so forth. Essentially, the chart shows that people have gone from not really wanting to own more to wanting to aggressively own more of the asset.

We can also see a similar momentum example in the Azuki chart. As we can see here, the big higher high came in around early this month, and since then, it has moved almost 100%!

But this isn't the only thing that we look for; after all, that is ⅓ of our Ms, so let's get into the next one.

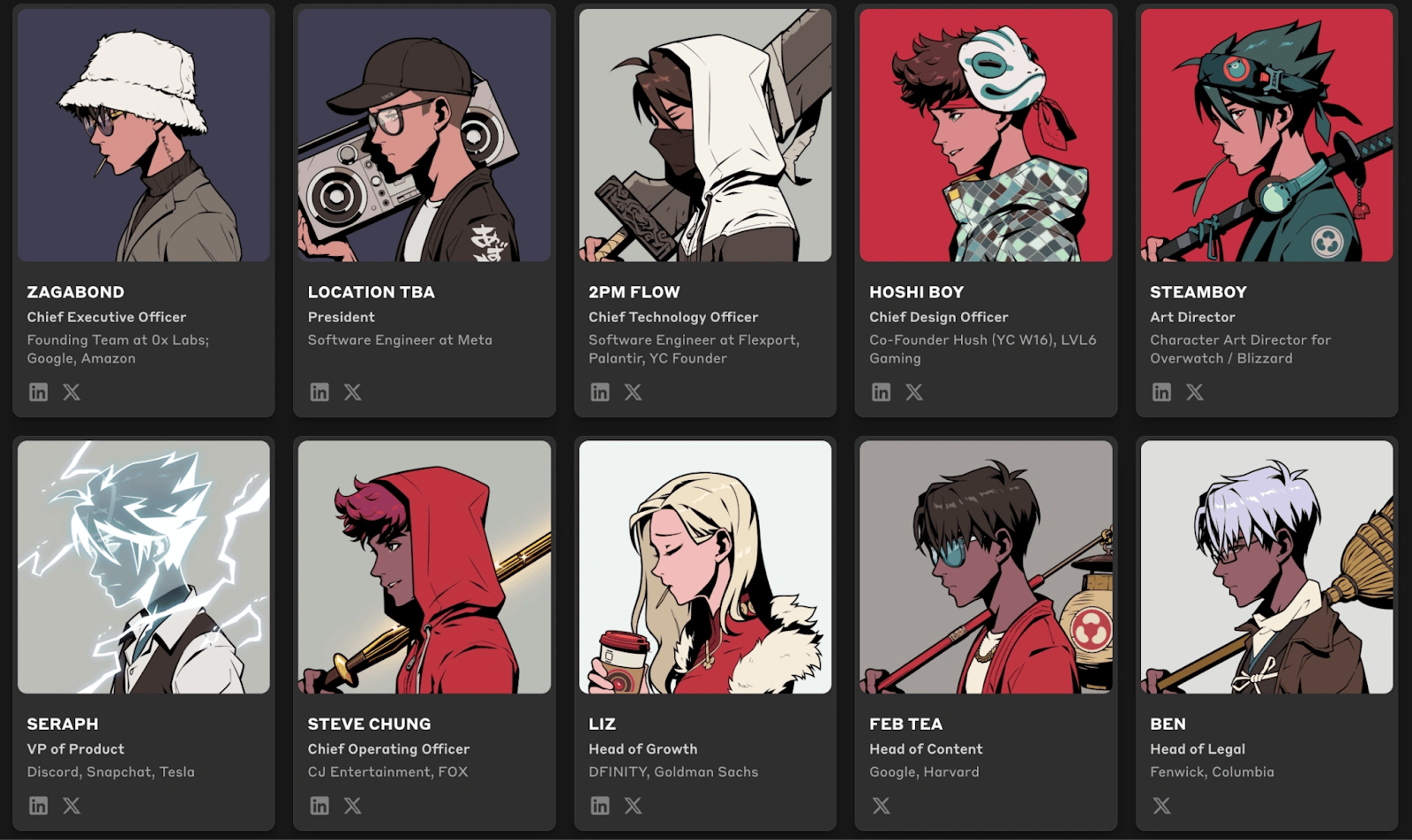

Management: Another thing that makes a successful NFT collection is the management or the team. NFT collections that have longevity typically have teams that not only consistently show up but also consistently ship things out. So what does that look like?

Well, here are some examples. Starting off with Doodles, throughout the whole last year and this year, Doodles has been growing its IP branding like crazy. With team-ups with music giants like Pharrell Williams and with McDonald's just a couple of months ago, it is clear to see the team is making moves.

Another team is the Pudgy Penguin team, who spent the past months absolutely crushing it on social media, amassing billions of impressions along with millions of followers. But that isn't it. They also got their toys into one of the biggest distributors in the world, Walmart. Quite an impressive feat.

Then, we also have the Azuki team, who has made a lot of new hires and even started creating their own anime. Amazingly enough, a lot of teams on top of the ones we have mentioned have been building, shipping, and making moves through the NFT lull, which is quite warming to see. As investors, these are the projects we need to keep tabs on for bullish narratives, a change in momentum or our final M.

Mindshare: In our opinion, this is one of the most important things among the 3 criteria we have. But why, you might ask? Essentially, NFTs have always been about mindshare. Rewinding back to 2022, why did Bored Apes have their tulip moment? Well, because they were a finite asset with millions of people interested in it. The more people who like the asset are bullish on the asset, the more buyers there are, and with NFTs typically having low finite supplies, the key to achieving the pump.

When it comes to seeing mindshare increase, there are some easy ways, like an uptick in social media engagement, prominent people getting involved, or new brand partnerships. But a good rule of thumb is that mindshare will increase the more the team ships things out.

In conclusion to our 3 M's criteria, we think a pretty simple way to think about it is this. The more the team (Management) ships and does things right, the more other people and investors get interested in the product (Mindshare), and with more interest and more buyers, we will see the floor start to move (Momentum) and finally that is were you the retail investor should get involved after all the boxes are checked off.

So we have shared our bull case and how to get involved, so now we will get into our bear case, but don't click off now because at the end, we will share our top pick right now to get involved in the NFT space and a bonus tip.

Bear case: dilution

Dilution is arguably the most important bear case that we have against NFTs, and it is almost similar to our problem with altcoins that have a lot of supply left to unlock. Once a team launches their NFT collection, which is pretty much their biggest liquidity injection for the lifetime of the project, they could also get money from trading fees of NFTs. However, with the addition of new platforms like Blur and others, people can effectively skip out on the fees, leaving these teams with a small amount of cash to work overtime.

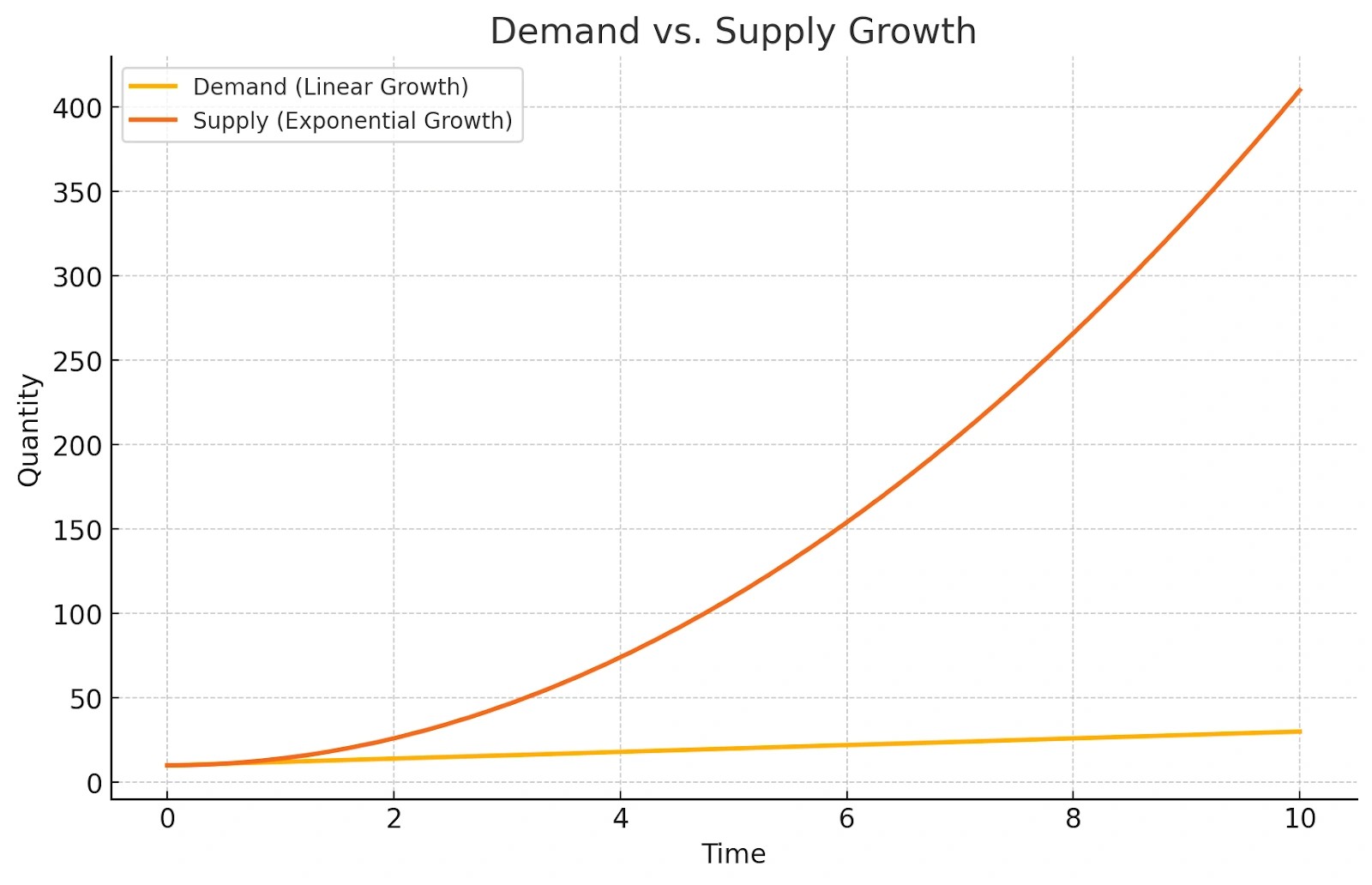

This leaves teams in a rough situation where they have to effectively "increase" the supply of the project to continue using treasury to do more things like partnerships, new hires, and growth initiatives. The issue with this is quite simple: when they do this, more supply comes into a market with a traditionally low number of buyers and collectors, and essentially, the chart looks like this.

This is the biggest bear case because it almost HAS to happen to each collection in order for the team to expand and grow as a company. We think that this might be the biggest reason why NFTs are so slept on since big investors wouldn't want to be consistently devalued as time goes on. Of course, it would be amiss to say that these dilutions can result in a net positive if dilutions are minor relative to the products teams ship. However, long-term and more substantial dilutions lead to a harder time for prices to rise.

The second bear case we have is fees. This is less of a problem, short or long-term, but more so a narrative issue. These creator fees were a big reason why so many people got turned off from NFTs with the classic 7.5% creator fee people used to pay. Traders and investors make markets, and 7.5% of profit is taken away with each transaction, and many people lose interest. Fast forward to now, and this is less of an issue.

Blur typically has the option for only a 0.5% fee for NFTs now; creators can hard set their cut, though, and Opensea has brought theirs down to 2.5% with the ability to adjust how much goes to the original creator of the NFT. While these are steps in the right direction, creators typically put a 3-5% fee on their pieces, meaning that people still get a lot of profit eaten away. This is partly what made meme coins more attractive, as they worked off the same ideas of momentum and mindshare while having nominal fees.

Overall, we feel that between forced dilution and high fees, the bear case against NFTs as long-term investments over other altcoins is pretty strong, as for each side of things, there really isn't room to budge. Teams need money to grow, and the only way for them to have cash flow is by taxing their investors in a big way, which, in our heads, creates a negative flywheel.

But all hope is not lost; let's continue on!

BONUS TIP: Gem hunting

So how do we get the most upside from projects we find that cross off our 3 M's criteria? Well, the best way to do it is to identify pre-dilution projects. But why might you ask? Isn't the dilution bad for the holders? Remember what we said. In the short term, there is money to be made from these projects.For example, even though Bored Apes diluted heavily since their main BAYC collection came out, the original holders got tons of value from being there early. They could sell the new supply and make a profit off the speculative value increasing towards the supply event. This also happened with Doodles leading into duplicators, Azuki leading into beans and elementals, and Pudgy Penguins leading into $PENGU.

There are more examples, but the idea remains the same. If we can find solid teams with growing projects that have momentum and have minimal dilution so far, we should bet on them. Eventually, there should be a new supply event that will bring speculative buyers, increasing the price of the original collection.

So now that we know what to look for in the future, here are some projects we think will be enjoyable or interesting going forward.

Projects we like

Azuki

Azuki is the first project we want to talk about with the potential for investment. Azuki is pretty well known due to its extensive team and its being in the top 5 NFT collections.When talking about our first M, Management, we can see the team behind Azuki is quite well-vetted, with people from Meta, Google, Blizzard, Tesla, and even Harvard. We can instantly tell that the Management is good. On top of this, through the NFT lull, Azuki continued to push out new things, most notably their Web3 anime.

Secondly, as we mentioned above, Azuki also has momentum on their side. From the chart, we can see the volume picking up along with the floor price consistently making higher highs and higher lows, which means it has bullish momentum.

And lastly, Mindshare. When looking at the mindshare of Azuki, we can see the chart looks constructive, with Azuki and Beanz (secondary collection to Azuki) taking up about 12% of the top 20 projects. Furthermore, they continue to be recognised in more places as the best to make if you love anime in Web3.

We would be remiss not to say that Azuki has diluted quite a bit from launch till now, with about 20,000 extra in supply across Beanz and Elementals, which is about a 200% increase. This dilution initially goes against what we want to see in a potential investment; however, it is important to know that there is quite a big catalyst for the future of $ANIME.

With the impending release of a memecoin for Azuki, we can assume that due to this, buyers will continue to pour in due to speculation, and as we saw with Pudgy Penguins, when a token is about to come, the floor price can increase exponentially.

Pudgy Penguins

Yes, Pudgy has diluted a lot, and before we dig into it, we want to say that an investment here would strictly be long-term due to some of the potential airdrop opportunities that come to the Pudgy ecosystem.

When we get to our first criterion, which is management, we know that the Pudgy team has this down pat. Since Luca Netz bought them out, they have risen from one of the most dead NFT projects to arguably the biggest NFT project in the Web3 space to date. As far as momentum goes, with the launch of $PENGU, the floor has spiked downwards quite a bit.

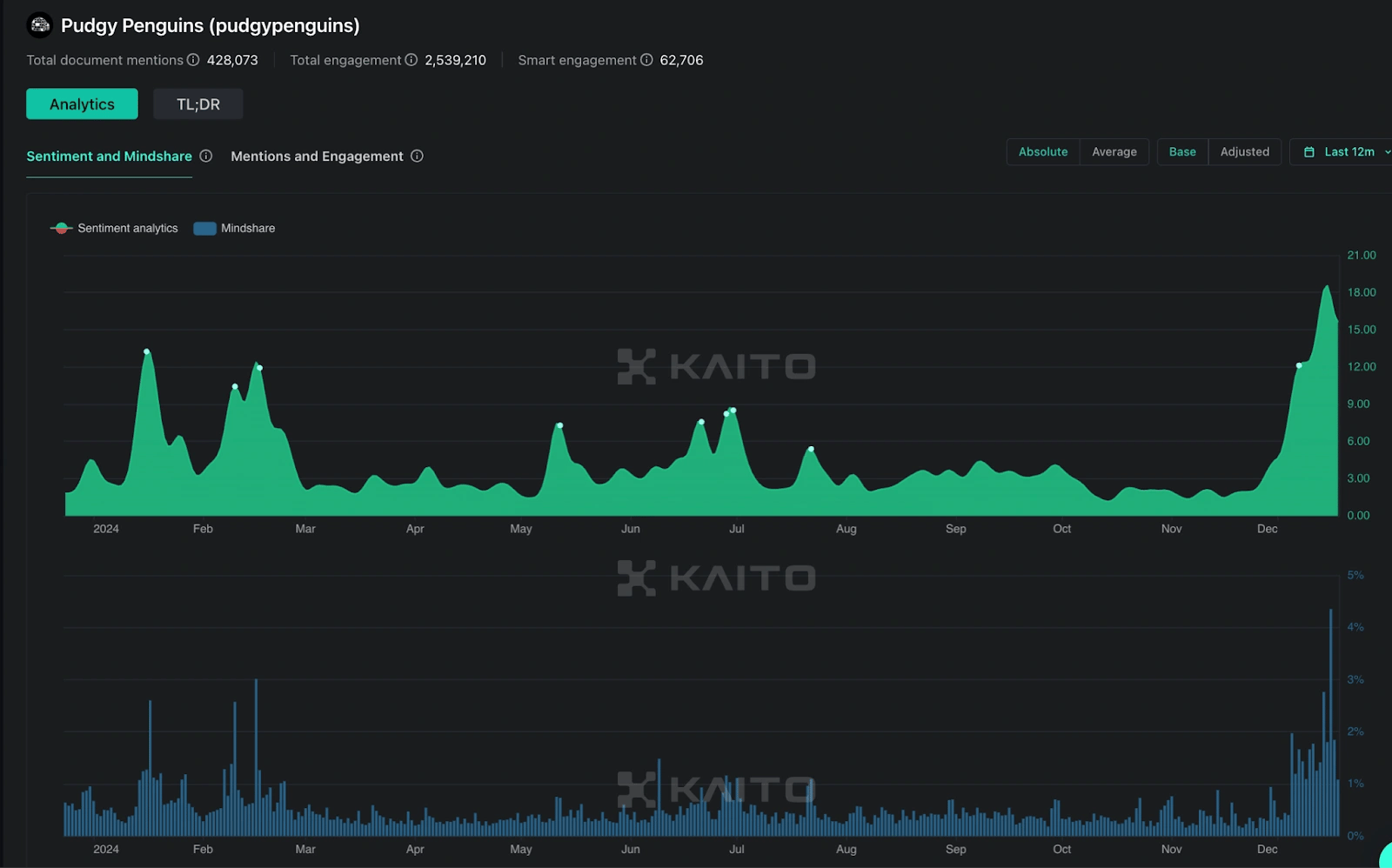

So, for now, and likely for a bit, the floor will bleed or remain sideways, barring any huge moves from the token. However, we think that this would provide a buy-the-dip opportunity as there are a few catalysts still in the pipeline. Lastly, let's talk about Mindshare. Of all web3 projects, we believe that Pudgy Penguins likely has the largest mindshare not only in web3 itself but also in Web2 social media.

We can see that in the image below; with over a million toys sold, millions of followers across social media, and billions of views, we definitely cannot fade what they have done so far.

So, to end things off, what are the bullish catalysts for Pudgy Penguins? Well, we believe they will be the recipients of airdrops for the upcoming Abstract chain. On top of this, many believe Pudgys will also continue to get community allocations for other big drops in the future, such as Monad. Overall, even though the dilution is high, we believe this project is good for dip buying as it continues to have momentum in mindshare and upcoming catalysts.

Project AEON

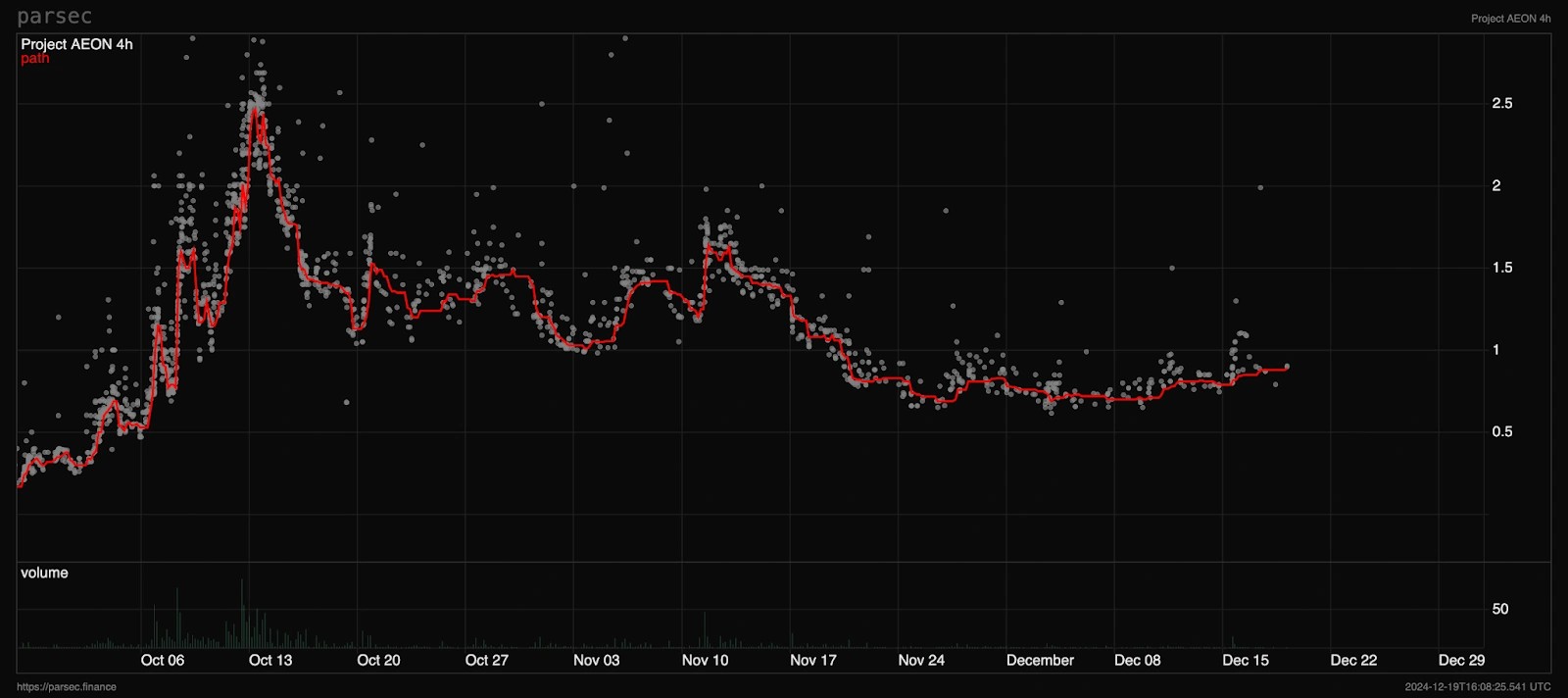

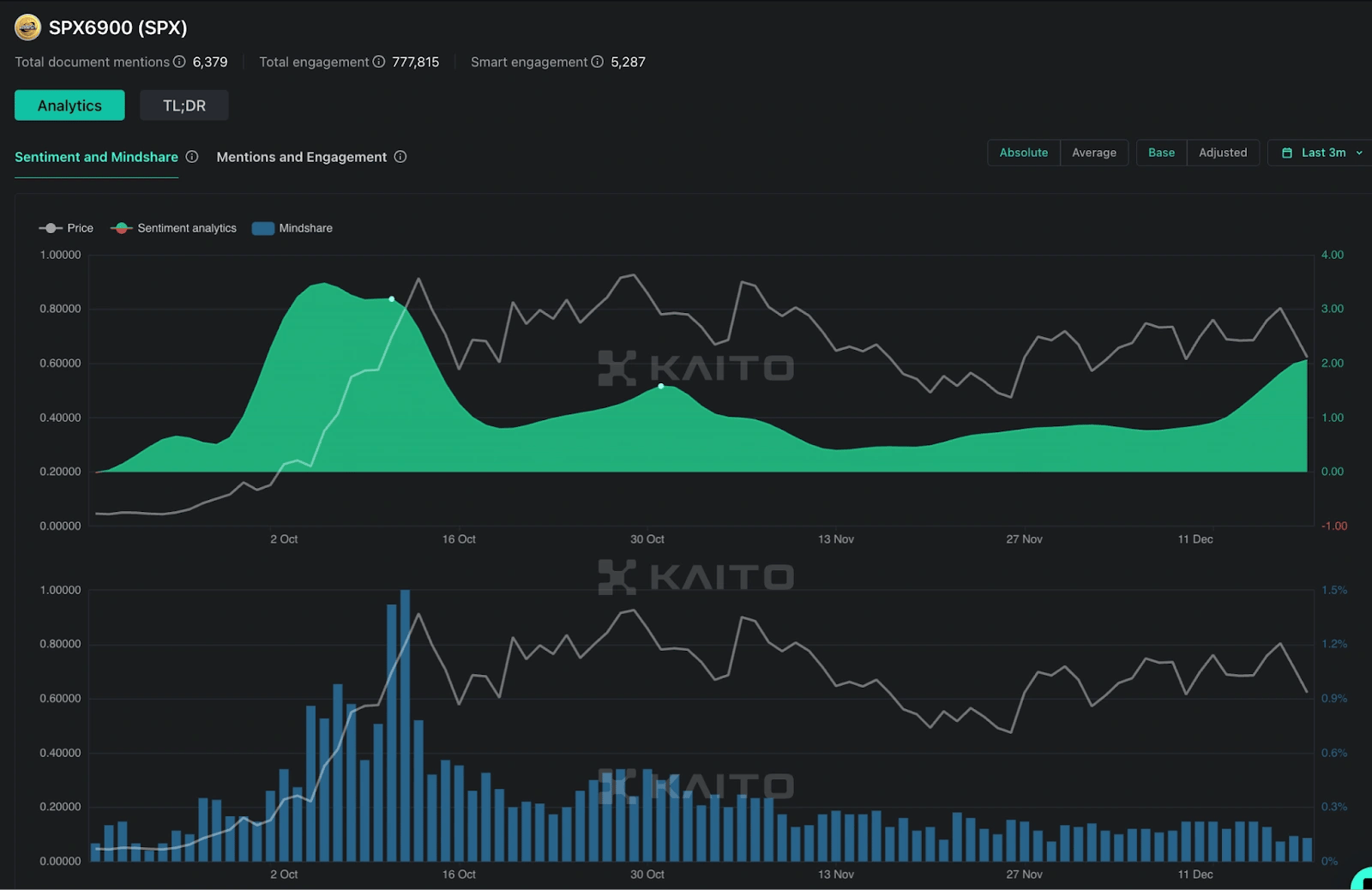

Lastly, we want to highlight the NFT collection Aeons, which is the NFT collection relating to the memecoin SPX6900.![]()

This has potential because of the possible comeback of memes going into 2025. As we can see, the NFTs follow the token's price quite closely, so taking the bet on the NFTs if you are into art and collecting seems like a solid bet.

This project is mostly community-run. That being said, as with SPX6900, the community is very active and widespread across Web3. One of the strongest cults in crypto. For Momentum, it looks like it has found a stable floor after the massive run-up at the start of the year. Since there is no solid momentum at the time, we would recommend waiting for an uptick before potentially looking to get in.

Lastly, as far as mindshare goes, we can also see it has been slowly bleeding along with price, this along with the lack of momentum definitely gives us pause but we can see that although price is suffering sentiment remains high and rising.

Overall, we believe this one will take some time to cook, but with the future bullish headwinds for SPX6900 coming in 2025, we think this is definitely something to keep an eye on for the collectors and art maxis.

Alternative exposure

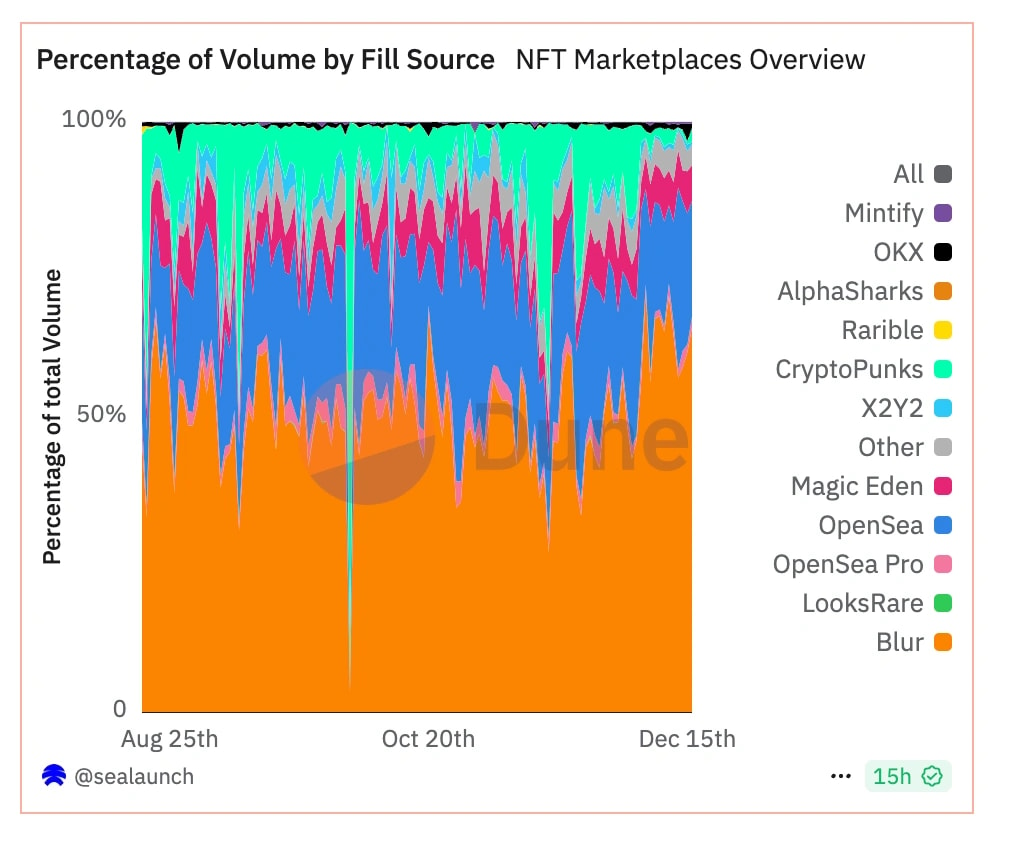

Just before we wrap things up, we think it's prudent to bring up an alternative way to get "exposure" to the NFT space without the typical liquidity constraints and potential dilution. How? Bet on NFT marketplaces!Right now, the most prominent NFT marketplace(liquidity-wise) is Blur. As we can see in the dominance chart below, it is ahead of OpenSea by about.

Everything else has such a low stake in the overall volume that we wouldn't really consider them as contenders. With that being said, we can now take a look at Blurs token - $BLUR.

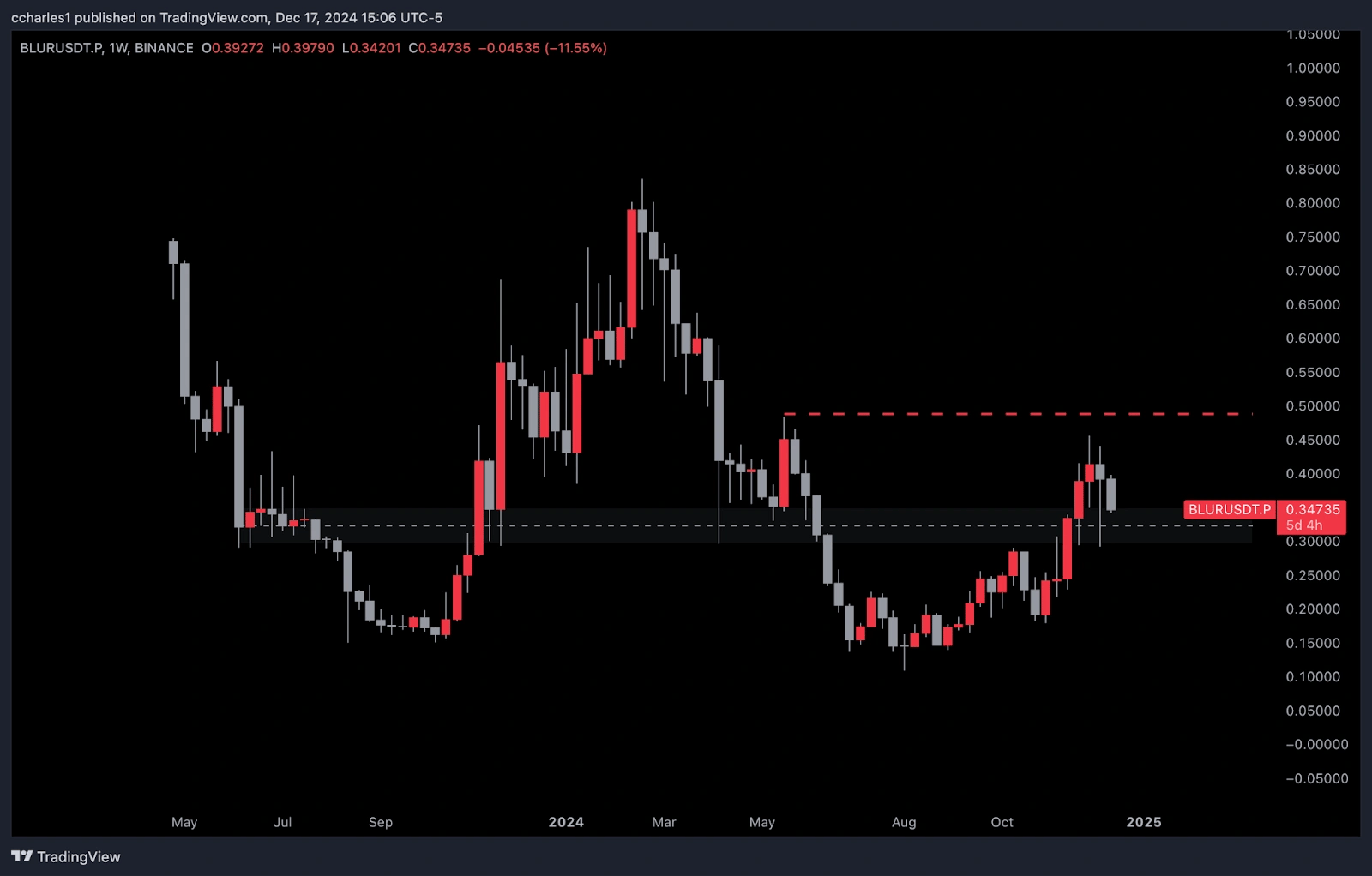

As far as tokenomics go, they are pretty nice relative to most things launched last year, with almost 70% of the supply unlocked. Furthermore, $BLUR's chart is looking like it has the chance to change to a more bullish stance.

When we see it immediately, we can tell that we have put in the first higher high since March in early October, and while the price may be retracing now, we think that this is where it has the chance to put in a higher high. So, with NFTs heating, more attention coming, decent supply metrics, and a now changing constructive chart, we think that $BLUR could be a decent bet for a continued NFT bull run.

Cryptonary's take

Overall, it's clear that with the rising floor prices along with trading volume, the NFT market is back. On top of that, projects that have shown strong momentum, excellent management, and increased mindshare over the lull have also started to see the fruits of their labour. However, the risks of entering projects remain as forced dilution and fees eat into investors' bottom lines, which is challenging for long-term growth.Despite this, opportunities abound. By identifying projects before major supply events, traders can position themselves early for outsized gains, as seen with Doodles, Azuki, and Pudgy Penguins. Alternatively, platforms like Blur offer exposure to the NFT market without liquidity constraints, with its $BLUR token looking increasingly constructive. The NFT space is evolving, and for those who stay sharp, adaptable, and strategic, this could be the beginning of a new wave.

That said, we still believe opportunities abound through identifying quality projects that haven't begun the dilution flywheel. At the end of the day, the NFT market is finally moving again, and we believe that for those who stay sharp and strategic, there are more opportunities just around the corner.

Peace!

Cryptonary, OUT