August 2025 Recap: Political Firestorms and Market Whiplash

August brought a collision of geopolitics, inflation shocks, and overt political pressure on the Fed. Despite volatility across equities and crypto, the dovish turn at Jackson Hole set the stage for a September rate cut and hard money assets like gold closed at new highs. Let’s unpack what really shaped the final stretch of summer...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Macro Overview

August opened with renewed geopolitical tension as Russia escalated the war in Ukraine. President Trump met with Vladimir Putin in an attempt to stabilize conditions, but markets read the summit as inconclusive, keeping uncertainty elevated.Labor data released on August 2 showed a sharp slowdown in hiring with Non-Farm Payrolls printing just 73,000 versus 110,000 expected, while unemployment held at 4.2%. Beneath the surface, revisions painted a darker picture: June payrolls were revised from 147,000 down to 14,000, and July from 144,000 to 19,000. This combined adjustment of –258,000 jobs revealed the labor market was far weaker than initially reported. The supply of labor has also been shrinking, likely due to immigration policies, which has kept the unemployment rate from moving higher. These revisions suggest Powell may now be behind the curve and too late in cutting rates. Trump responded by firing Bureau of Labor Statistics Commissioner Erika McEntarfer, raising concerns about political interference in economic stewardship.

August 13 marked the month's turning point when inflation came in hot. Core CPI printed at 3.1% YoY versus 3.0% expected, while PPI a few days later surprised at +0.9% MoM versus +0.2% expected. Bitcoin had just tagged fresh highs above $120,000 earlier in the week, but the hot prints marked the local top. Over the following sessions, Bitcoin drifted steadily lower into the $112,000–$115,000 zone, Ethereum slipped back under $4,300, and nearly $420M in longs were flushed. Trump escalated tensions further by signaling he wanted Fed Governor Lisa Cook removed, marking his second attack on U.S. economic institutions in under a month.

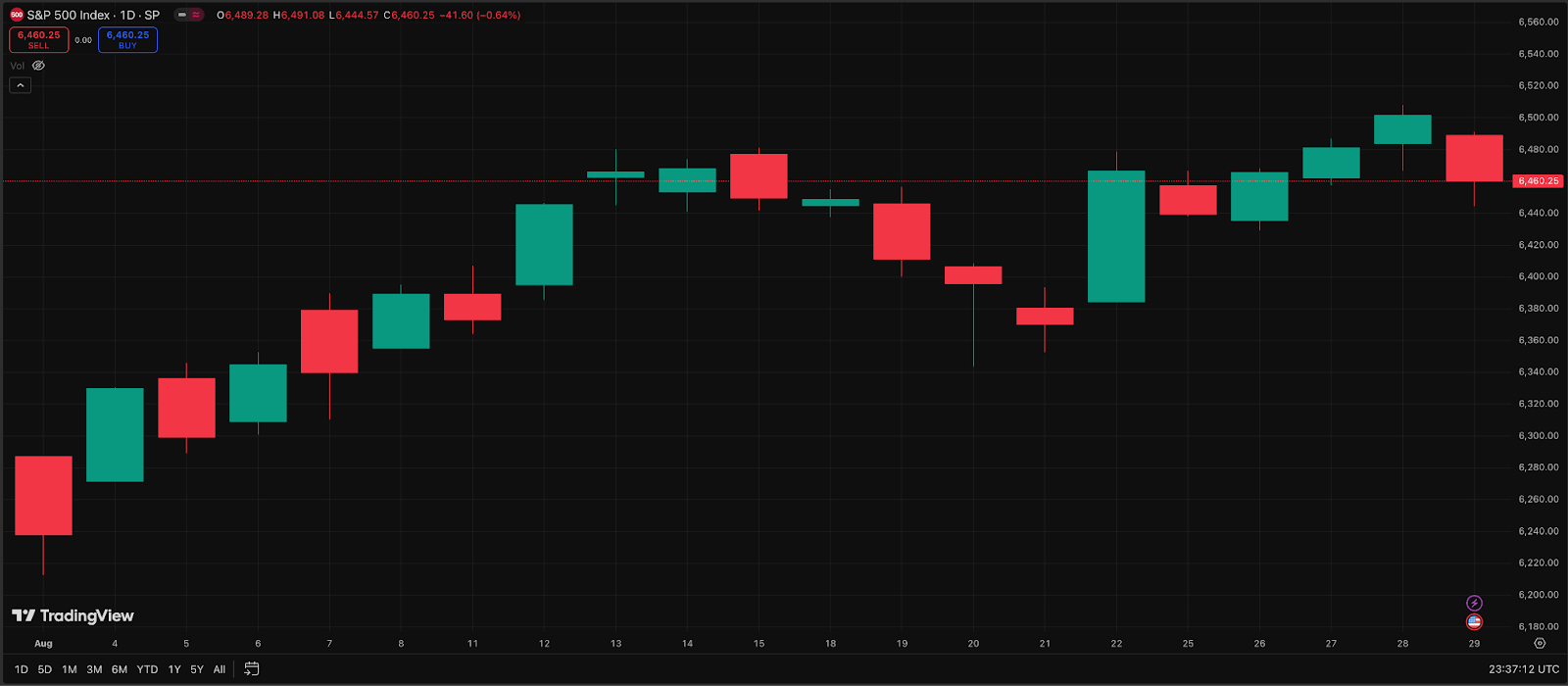

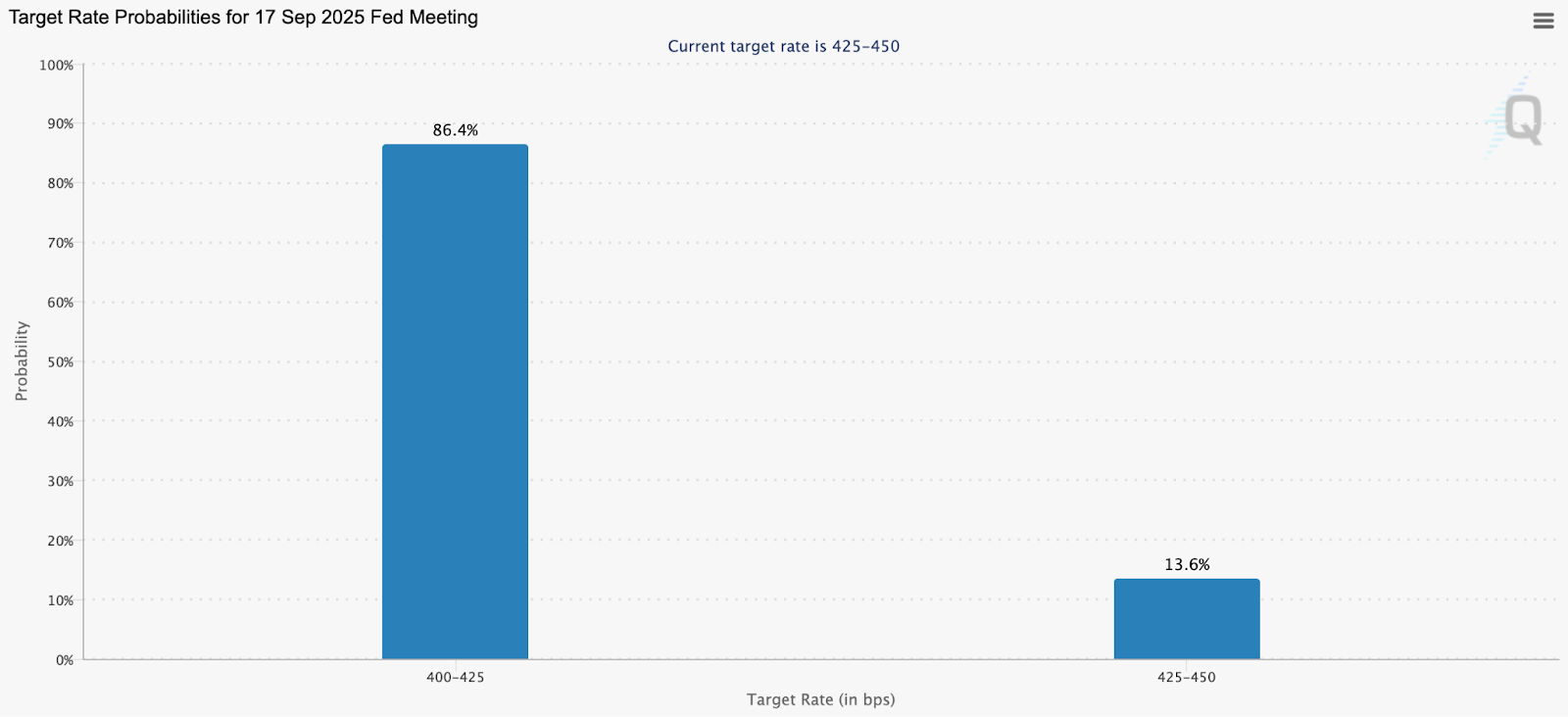

Heading into Jackson Hole on August 23, markets were fearful with Bitcoin pinned near $112,000 and the S&P 500 testing support at 6,400. Somewhat surprisingly, Powell struck a dovish tone, explicitly acknowledging labor market risks and suggesting conditions may warrant cuts. Risk assets rallied on the speech: Bitcoin rebounded toward $116,600 while Ethereum retested $4,800. The dovish pivot re-priced odds of a September cut back above 80%.

However, volatility returned later in the month. Nvidia reported earnings broadly in line but disappointed on data center revenue, sending the stock down 3.3% and weighing on the S&P. On August 27, a dormant whale unloaded 24,000 BTC valued at $2.7B via Hyperliquid. The sale came as Bitcoin was already retracing from its Jackson Hole bounce from the low $110Ks, and the move accelerated a flash sell-off to around $110.6K intraday. From there, price continued to cascade into the $108,000–$110,000 range where it finished the month. Gold closed at $3,448, marking its strongest monthly finish on record and a new all-time high.

The $9 Trillion Retirement On-Ramp

Early in August, the Trump administration signed a sweeping executive order allowing U.S. 401(k) retirement plans to allocate into Bitcoin, stablecoins, gold, private equity, and other alternative assets. This created the first regulated pathway for America's largest pool of household wealth, more than $9T in retirement savings, to directly flow into crypto. Even a modest 1% allocation would represent roughly $100B in potential inflows.For Bitcoin, the optics were historic: the asset now sits alongside S&P index funds in retirement portfolios. Institutional asset managers such as BlackRock and Apollo immediately began preparing products to capture flows, while traditional advisors debated risks and fees. Market reaction was initially muted, but sentiment across crypto Twitter and institutional desks quickly framed it as the biggest structural on-ramp Bitcoin has ever received.

History shows how powerful this shift can be. When ETFs were first integrated into 401(k) plans, assets under management grew 30x, from $500B in the early 2000s to $15T by 2025. REITs followed a similar trajectory, expanding 14x from under $100B in the 1990s to $1.4T today. Crypto now has the same long-duration capital pipeline in place, embedding hard money allocations deeper into the U.S. financial system than ever before.

ETH Shows Structural Outperformance

August saw both Bitcoin and Ethereum notch fresh all-time highs before retracing under macro pressure. Bitcoin briefly pushed into the mid-$120,000s before sliding back into the $108,000–$112,000 zone. Ethereum touched $4,800 mid-month and, unlike Bitcoin, finished August higher than it began, closing around $4,370.

The more important story was relative performance. The ETH/BTC ratio climbed steadily above 0.04 for the first time in nearly a year, peaking at 0.043 on August 24 before settling around 0.0402 by month-end. This confirmed our rotation thesis flagged in July: treasury companies and institutional allocators are increasingly viewing ETH as a high-utility complement to Bitcoin, leveraging its yield-generating capabilities through staking and DeFi protocols.

Institutional demand reinforced this trend. Treasury firms accumulated more than 550,000 ETH in August, pushing total holdings above 2.6 million ETH, equal to roughly $11.5B or 2.1% of supply. Spot ETH ETFs in the United States also absorbed over $9B in inflows since July. Together, these flows now account for close to 5% of circulating supply being held in regulated or institutional channels.

The result was clear in price action. While Bitcoin closed the month down about 3%, Ethereum ended higher on both a relative and absolute basis. ETH's structural bid from balance-sheet demand and ETF inflows provided a firmer floor, highlighting that Ethereum is increasingly positioned as the institutional rotation trade.

But it was not only institutions driving this theme. The most striking confirmation came from a single entity on-chain.

Hyperliquid in Focus: Whale Rotations and Plasma Fallout

The month's rotation story was inseparable from Hyperliquid, which cemented its role as the leading on-chain execution venue. A prominent dormant whale, holding over $5B in Bitcoin, executed a series of BTC-to-ETH rotations through Hyperliquid's Unit settlement layer, moving $3.85B in BTC for 837,429 ETH. Transactions were structured in tranches of 2,000 BTC ($217M) and 1,000 BTC ($109M), executed across multiple sessions, including during thinner weekend liquidity windows that amplified volatility. Much of the ETH was subsequently staked, representing nearly 0.5% of total supply and instantly placing the whale among the largest individual holders.

This scale of flow highlighted Hyperliquid's growing role as the preferred venue for institutional-grade rotations, where censorship resistance and certainty of execution outweigh centralized exchange risks.

Yet August also revealed the risks of Hyperliquid's rapid growth. Pre-listing derivatives for Plasma (XPL) became a flashpoint when presale holders, many sitting on 10x gains, used perps to hedge ahead of the token's listing. On August 27, a whale-led surge drove the mark price from $0.60 to $1.80 within minutes, triggering auto-deleveraging and mass liquidations. Open interest collapsed from $160M to $30M, with reported trader losses ranging from $17M to $160M, while one whale pocketed $47M in profits. The price quickly mean-reverted to around $0.60, but the fallout exposed vulnerabilities in thin pre-markets lacking circuit breakers.

In response, Hyperliquid introduced new safeguards including enhanced mark price indexing and volatility halts. The takeaway is clear: Hyperliquid has become the premier venue for liquid spot, perps, and basis trades where risks are quantifiable, but caution is warranted with illiquid pre-listing markets until protections are battle-tested.

Delta-Neutral Strategies, Liminal, and Passive Yield

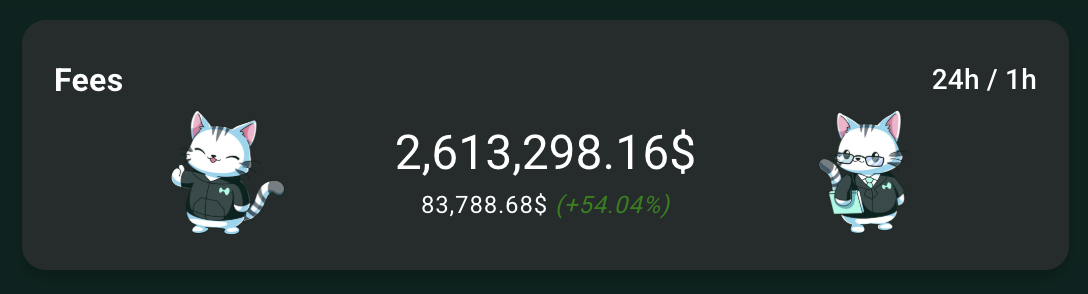

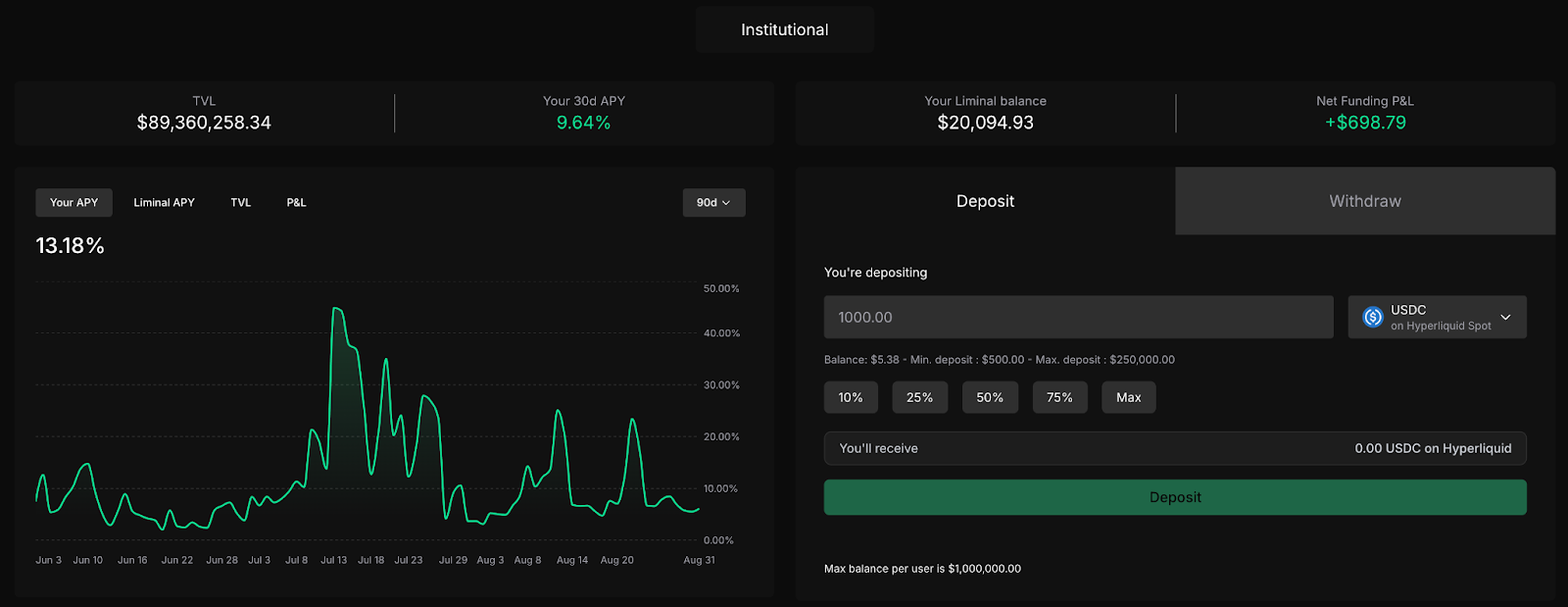

August underscored the importance of strategies that generate consistent returns regardless of market direction. Delta-neutral setups, particularly basis trades, produced 10–30% APYs by harvesting funding, lending spreads, and protocol incentives. The principle is simple: buy spot, short perps, and collect the premium paid by over-leveraged traders. Platforms like Liminal now automate this process directly on Hyperliquid with full self-custody, making it accessible without constant management.

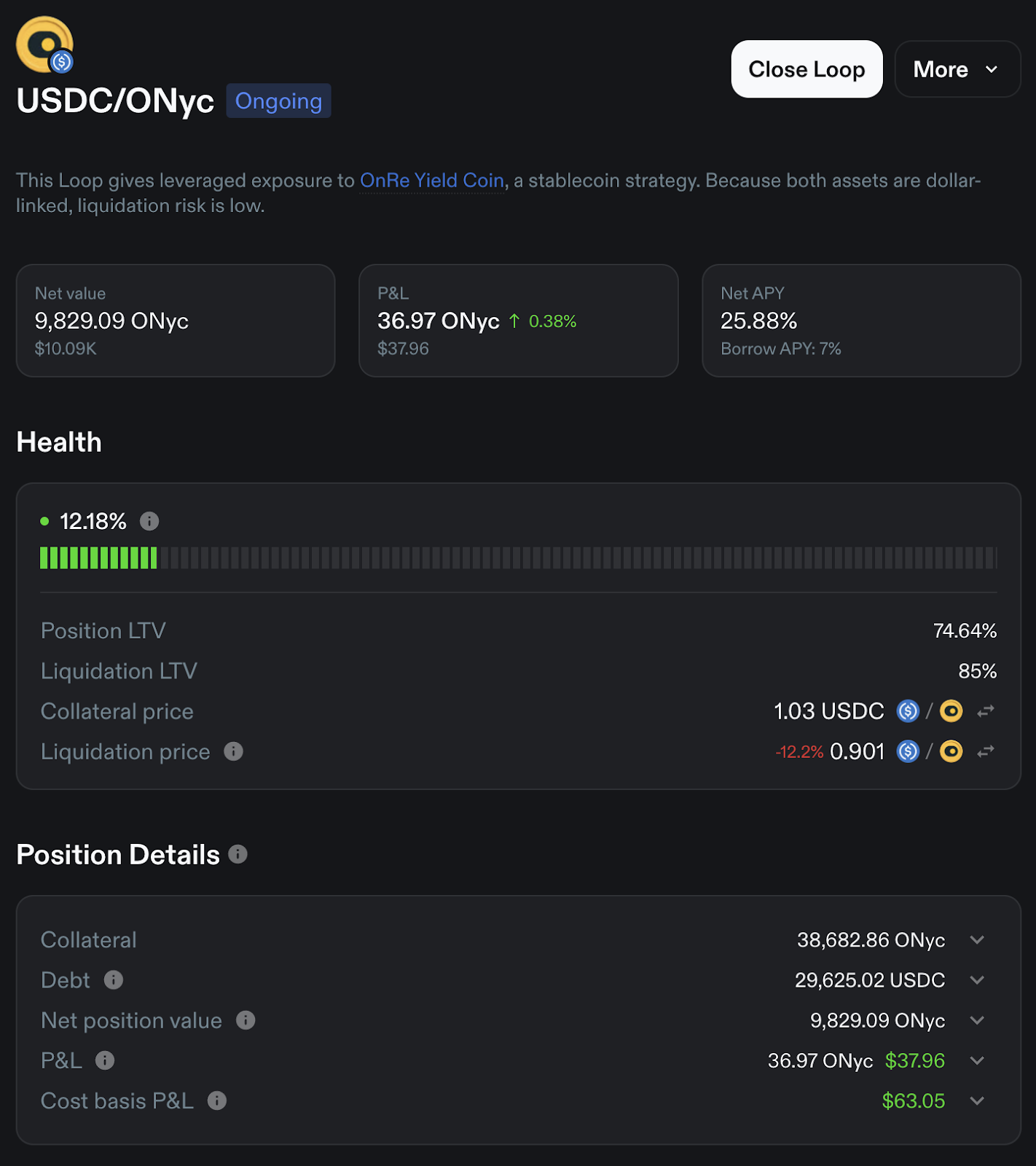

Stablecoin strategies add another layer. Protocols such as Hylo, OnRe, and Jupiter Lend delivered 7–15% base yields, with multipliers pushing effective returns above 20%. These yields are not theoretical. They represent real cash flow that can be counted on in both volatile and quiet markets.

The significance lies in what this cash flow allows. Profits from yield farming and airdrops can be rotated into directional opportunities such as Aura or other conviction assets. Done consistently, this creates what is effectively a zero-cost entry into higher-beta bets. Instead of relying solely on price appreciation to drive portfolio growth, investors build a foundation of income that steadily compounds while funding asymmetric upside.

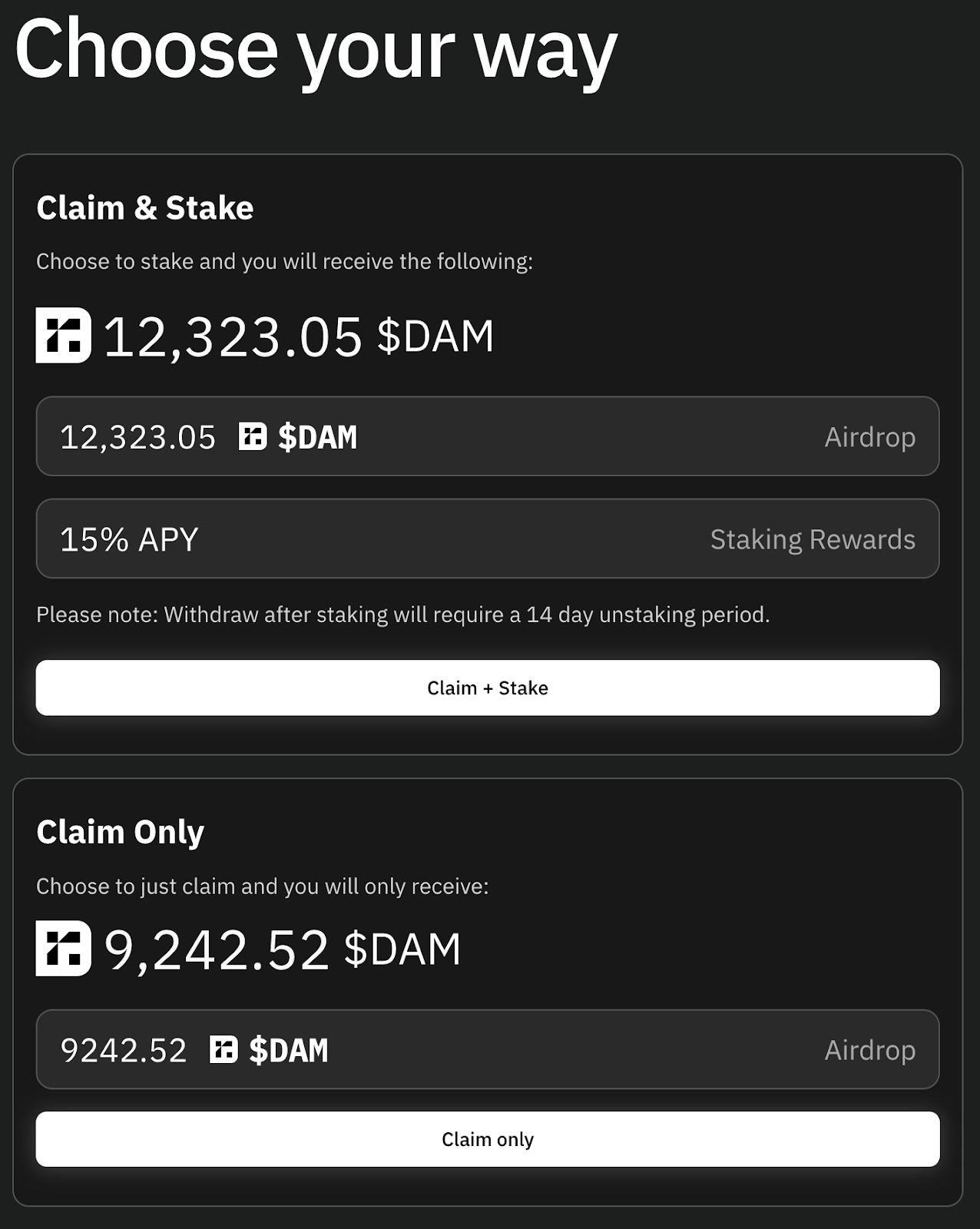

Reservoir's airdrop in August was a clear example of this in practice. We covered Reservoir in detail in our Stablecoin Airdrop Series, noting its srUSD stablecoin as one of the most efficient plays in DeFi. Early participants captured yield while positioning for points, which converted into a meaningful token distribution. Those tokens could be sold into stables or recycled into assets like $BTC, $HYPE, $AURA, turning passive income into free upside.

This is the difference between speculation and strategy. Memes and momentum can deliver short-term wins, but sustainable wealth comes from combining them with structured income streams that recycle into conviction positions. The result is a portfolio that grows not only when prices rise but also when volatility simply persists.

Yeezy Coin and the Meme Market's Extractive Trenches

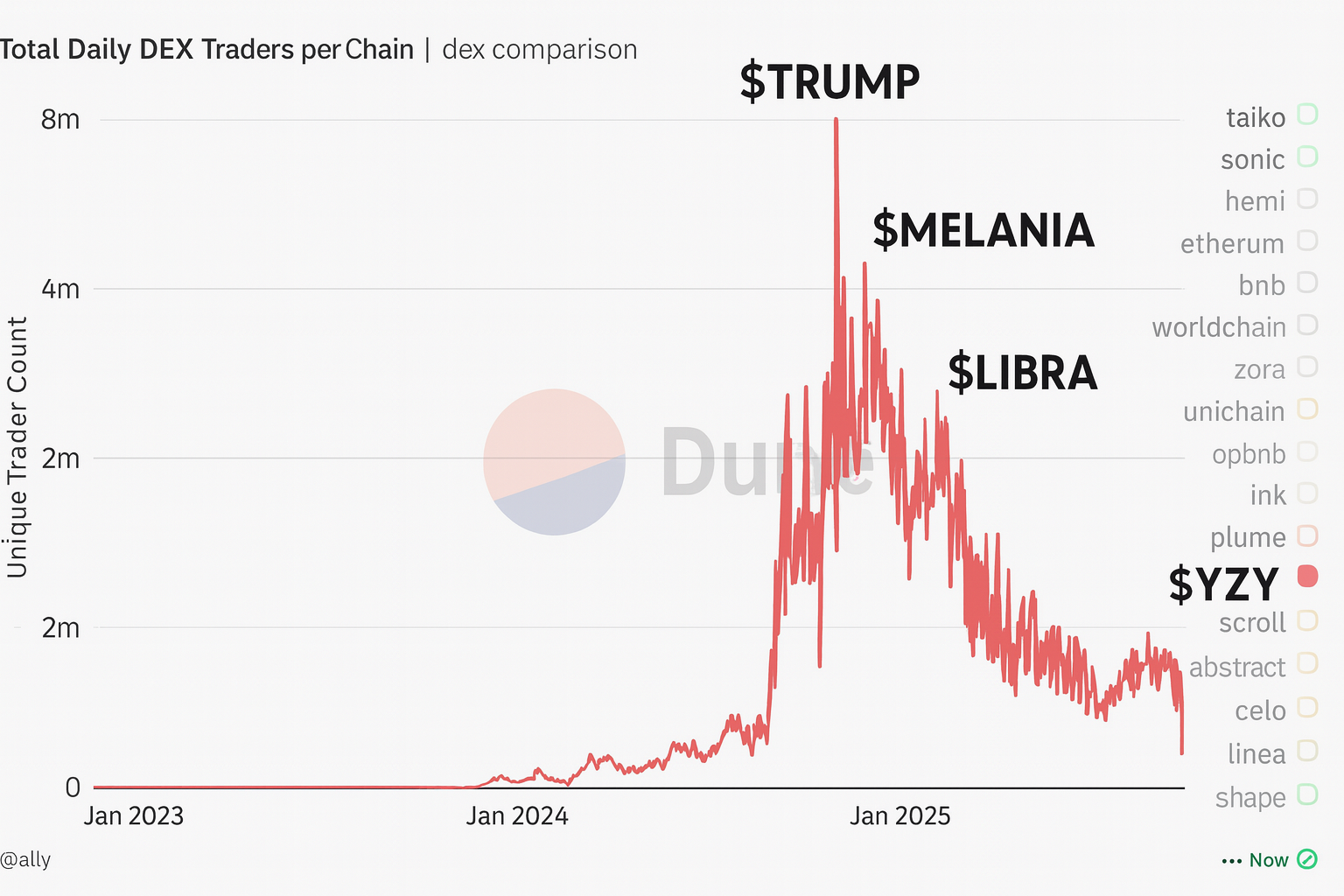

August also featured the much-hyped launch of Yeezy Coin ($YZY), a celebrity-branded meme token that initially drew enormous attention but quickly revealed the extractive nature of these launches. The token opened with heavy volume and a sharp spike, but within days collapsed more than 75%, trading under $0.50 by the end of the month.

The bigger picture is clear when looking at user participation across Solana DEXs. Previous meme cycles like $TRUMP, $MELANIA, and $LIBRA briefly drove trader counts into the millions, but each peak has been followed by a steeper decline. $YZY was no exception: new wallets piled in on launch day only to face aggressive distribution from insiders and early buyers. Instead of onboarding and retaining users, these launches hollow out liquidity and leave participants worse off.

For retail participants, the lesson is straightforward: stay away from celebrity or opportunistic meme launches unless you are prepared to be exit liquidity. Instead, stick with cults and real communities with mission or a movement.

For example, our latest pick, $AURA represents what a real community meme looks like. Its growth has been steady, cultural, and organic, driven not by celebrity branding or opportunistic marketing but by actual grassroots participation. Distribution is healthier, price action more sustainable, and the community continues to expand rather than collapse after a single hype-driven event. Aura may not deliver the instant vertical candle of a $YZY launch, but it builds lasting conviction and avoids the extractive dynamics that define so much of the meme sector today.

Cryptonary's Take

August reinforced a simple truth: crypto is no longer a sideshow to traditional markets but a structural component of them. The dovish pivot at Jackson Hole, Trump's $9T retirement order, and record gold prices underscored how hard money assets now sit at the center of global capital flows. Bitcoin continues to anchor the cycle, but Ethereum is steadily claiming its place as the institutional rotation trade, supported by balance-sheet demand and ETF inflows.Hyperliquid's emergence as the execution venue of choice shows that real liquidity is migrating on-chain. The whale rotations from BTC into ETH were historic, and while the Plasma fallout exposed weaknesses in thin markets, the platform's resilience in handling billions proved why decentralized rails are winning.

The playbook for individuals is clear. Use market-neutral strategies like Liminal and stablecoin loops to build steady income, then rotate those profits into conviction bets. This creates a zero-cost entry into asymmetric upside while insulating portfolios from drawdowns. Reservoir's airdrop illustrated this in action, turning passive yield into free exposure to future growth.

At the same time, August showed the dangers of extractive hype. Yeezy Coin was the latest celebrity meme launch to hollow out liquidity, leaving late entrants with losses and proving once again that opportunistic branding cannot replace sustainable communities. Aura offers a refreshing contrast: organically rooted, culturally vibrant, and powered by genuine conviction, proving that authentic memes succeed by inspiring belief rather than exploiting investors.

Looking ahead

September's expected rate cut could be the next big catalyst. We'll be breaking down every major macro shift in our Market Updates and Market Pulse reports. Beyond the macro, we see few trends emerging around projects with revenue and buybacks while the meme market is forming a bottom. Therefore, September will likely mark the sentiment reset that sets up for outperformance for memes and revenue-generating projects, especially as risk appetite returns with rate cuts. However, asset selection will be crucial and we will be here to guide you.

Stay tuned and subscribe to stay ahead of the curve. We deliver real alpha through in-depth analysis, curated research, high-quality airdrops, and passive income strategies that actually generate returns.

Cryptonary's OUT!