In case you’ve missed our big debut in January, here’s a TLDR on how it works:

- Every month we pick some promising cryptos and buy some.

- We explain our reasoning, set targets and invalidations for every buy.

- And we silence the skeptics with on-chain proof of our investments.

Our objective is simple: OUTPERFORM THE MARKET!We invested $10,000 in January, upped it to $25,000 in February and now we’re raising the stakes once again with $40,000 for this month’s investments! Why so much? The global financial system is failing and we don’t want to end up holding the USD sh*tcoin bag, so we’re slowly getting rid of them.

Disclaimer: This is not financial or investment advice. Any capital-related decisions you make are your full responsibility and yours only. The information made available in this report is NOT for replication. The purpose is to share the thought process behind our decision-making for entertainment purposes only.

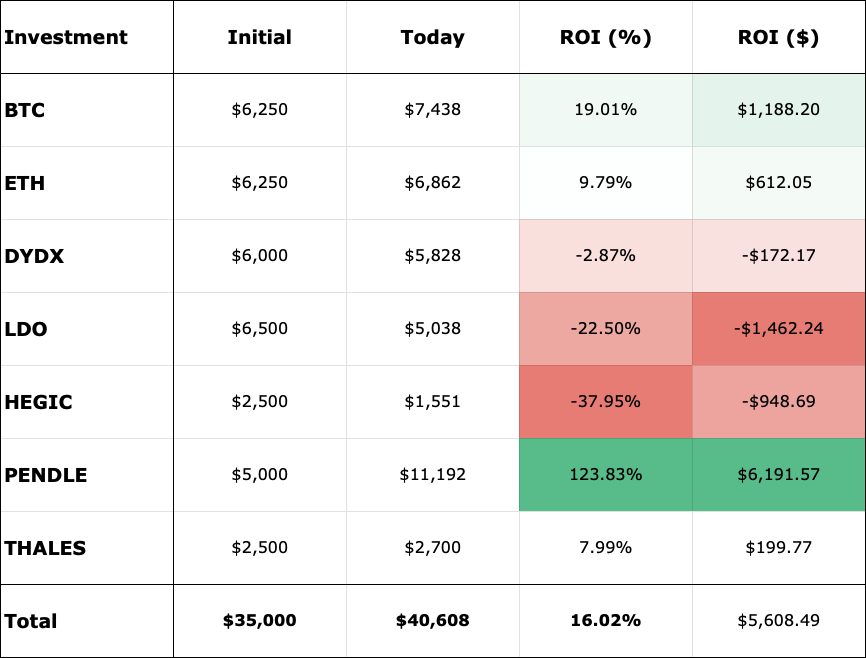

Investment Update

- Market: +12.19%

- Cryptonary: +16.02%

Investment #1 | Bitcoin ($15,000)

Conviction: 60%We're usually all about chasing risks beyond just Bitcoin, but man, the world's screaming for it right now.

The US financial system's about to crash and burn, and the Federal Reserve (Fed) is freaking out. It's looking like they're even trying to shut down the fiat on-ramps into crypto (aka blocking the ways to buy crypto with fiat). The same hour when SVB's bailout was announced, Signature Bank got shut down without a solid reason. We believe they did it because its know to be a crypto-friendly bank.

So, where does Bitcoin fit in all this chaos?

Let’s take a walk down memory lane, all the way back to 3 January 2009.

Read the headline 👇🏼

That day, Bitcoin was born with a hidden message in its first block: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." Satoshi Nakamoto was basically saying the global financial system was rotten and on a crash course. Printing money to fix problems is just kicking the can down the road. Eventually, that system's gonna implode and be replaced. That's why we're going heavy into BTC – the collapse is closer than ever, and Bitcoin will be one of the saviours.

Let's check out what's happening in different countries:

- United States: The Fed's printing cash like crazy to bail out failing banks. Déjà vu 2008, anyone? Will the Fed survive the storm or is it game over? We think the US dollar will stick around, but its value's gonna tank. Plus, the it is losing its global mojo as countries start trading in other currencies. The Chinese Yuan, for instance, is now a candidate in the oil trade game.

- Switzerland: Home to legendary banking services, but one of its largest banks, Credit Suisse, just went belly up. Good thing a competitor snagged it.

- Egypt: Far from the US and Switzerland, Egypt's banks are offering sky-high interest rates on savings accounts to plug the leaks and handle withdrawal requests. This happened in Lebanon in mid-2019, since then depositors had no access to funds and their national currency saw 100x inflation. Egypt's looking like Lebanon 2.0.

Back in January 2023, we presented our Bitcoin Investment Thesis with a USD target of 1 BTC = $650,000. We also gave a gold-based target of 1 BTC = 345 Gold Ounces, considering the dollar's demise. We just didn't think it'd be relevant so soon, lol.

Our targets are long-term, so we keep investing in BTC every month, regardless of short-term price action. Speaking of which, we're expecting a pullback from $30,000 to $25,500 soon, but we're still investing.

Note: The banking system's meltdown will be a huge factor in BTC's parabolic run. But don't expect smooth sailing. If we're right about the collapse, it's gonna get way worse before it gets better.

Investment #2 | Ether ($10,000)

Conviction: 60%Someone said we need a new financial system? Ethereum’s the answer.

You can build banks, lending services, exchanges and any other financial application you want right on Ethereum. This is why we’ll continue to buy ETH every month.

Even though we expect ETH to flip BTC in market cap in the future, today all eyes are on Bitcoin and that is why we have allocated more to it than ETH.

Our Ether thesis remains the same, so we won’t take up word count or more of your time on it - you can read it here.

Investment #3 | ARB ($10,000)

Conviction: 40%Arbitrum's token, $ARB, is here with the year's biggest airdrop (avg. $2,500 per user).

Thesis

Arbitrum's the hot spot for Layer-2s after Terra's fall and Solana's capital fleeing. We've tried the chain, seen the dev interest, innovative projects, and user base. We're confident ARB will join the Top 10 cryptos by market cap in 12-24 months. Picture SOL in 2021.With big airdrops, people usually dump their tokens. We'll be on the other side, buying ARB and DCA-ing into it monthly throughout 2023.

Targets

Medium-Term ($7.5)Comparing market valuations gives us fair value, way better than non-sensical speculation.

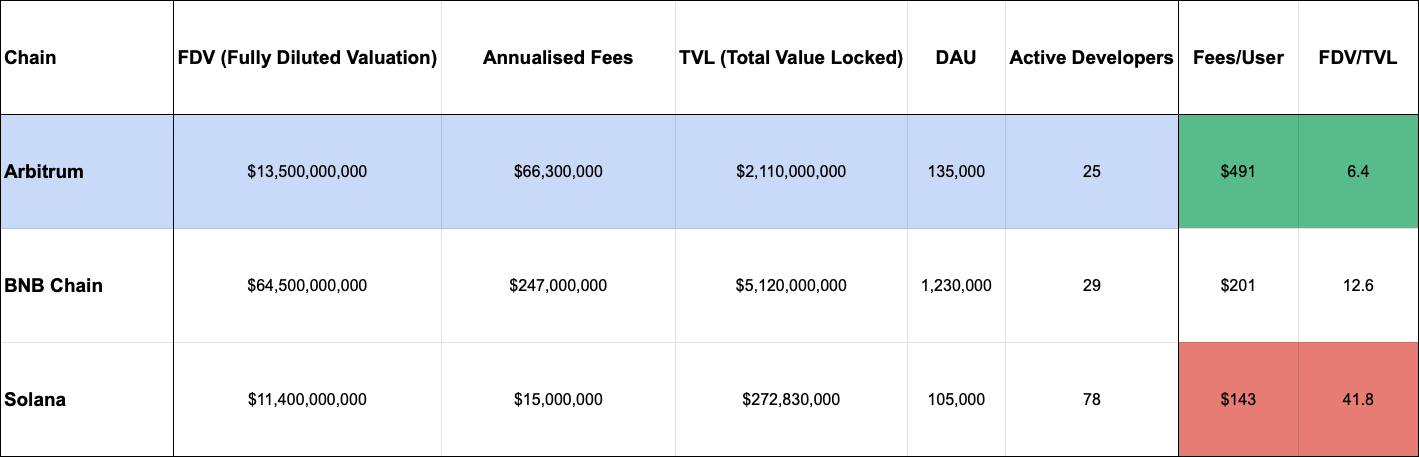

Arbitrum, BNB Chain, and Solana are popular networks with unique opportunities and lower fees (compared to Ethereum). Fair to compare 'em, right?

From the table, we see:

- Arbitrum's FDV/TVL ratio is way lower than BNB Chain's and Solana's.

- Arbitrum users contribute more to the chain's revenue.

$3B x 25 = $75B FDV = $7.5 per ARBLong-Term ($30+)

L2s should have more value and capital than Ethereum's L1. It's possible Arbitrum gets 50% of that capital.

Ignoring future growth and using today's numbers, that'd mean $15B in TVL for Arbitrum. We'll be conservative with the FDV/TVL multiple (20) as the hype fades:

$15B x 20 = $300B FDV = $30+ per ARB

Invalidation

These could make us sell ARB at a loss:- Arbitrum's Layer-2 TVL market share falls below 20% (currently at 66.50%)

- Arbitrum's DAUs (Daily Active Users) drop below 30,000 for 3 months

Investment #4 | Arbitrum Ecosystem ($5,000)

Conviction: 20%Thesis

As we said, Arbitrum printed free money and that money is being used to incentivise new users and capital. What you may not know is that $ARB was also airdropped to Arbitrum projects, and those projects will use that new money to drive new users. This is a positive feedback loop that can lead to exponential gains very quickly.We already have exposure to Arbitrum through HEGIC, LDO, THALES and PENDLE but it does not hurt to bet some more when the opportunity is this good.

Our strategy is to bet on the projects with the biggest airdrop and potential. We will sell half of our position at 2X gain to cover our principal and let the remainder run towards our medium-term targets.

- GMX ($3,000)

GMX is a perpetual futures exchange, just like dYdX and it is by far the largest on Arbitrum. GMX has received the largest airdrop with 8,000,000 ARB ($10M+). They will be using this money to maintain their top spot on Arbitrum. The chart also gives us a good risk:reward ratio for us to utilise. Yes, GMX has already rallied and many people find it problematic to bet on projects that already saw gains - not us, why? Because a winner is more likely to continue winning than a loser is to suddenly turn into a winner.

Target ($220)

Despite being the largest perpetuals exchange on Arbitrum, it is the most undervalued amongst its other two competitors: Gains and Mux.

First, GMX generates the most fees per user. Second, it has the lowest FDV/TVL ratio. If we assume a very conservative ratio of 5 (very very conservative), then GMX is 3X away from its fair value which puts it at $220.

Invalidation

Price breaking down under $56.50 will lead us to sell all our GMX. This limits our possible loss to just $600.

- SPA ($2,000)

Sperax is the project behind the $SPA token. The project has their own stablecoin (USDs) through which yield is automatically distributed to holders. Despite being a small cap project (<$10M market cap), Sperax got a 1,800,000 ARB airdrop - more than 20% of its market cap. Imagine what will happen to its token, $SPA, with these incentives which have already started.

Target ($0.03)

Sperax currently has $3.3M in TVL and is trading at an FDV/TVL ratio of 10. With the added 1.8M ARB in incentives, Sperax should be easily able to attract at least 5X the airdrop amount in capital which would take its TVL to $15M. All things being equal this means SPA’s price should rise from $0.006 to $0.030.

Invalidation

We’re keeping it on the chart. If price breaks down below $0.0035, we’ll close our position in full. This means, the most we can lose is $900 on this trade.

Airdrop Farming

Arbitrum’s airdrop was real and sizable, not as large as dYdX’s (which we also nailed) but still decent.There are four main contenders when it comes to Layer-2s: Arbitrum, Optimism, zkSync and StarkNet. We believe the medium-term (until 2025) winner will be Arbitrum and the long-term winner (2025+) will be zkSync.

Just yesterday, zkSync announced going live to mainnet and guess what, they don’t have a token yet 👀

gm zkEVM! 👋🏻

zkSync Era Mainnet Alpha is now open to all users. Developers, projects, and users can now experience the power of zkEVM.Read more: https://t.co/pL5PuZqanu

1/11 pic.twitter.com/oS6dwmXzeB

— zkSync ∎ (@zksync) March 24, 2023

So we will be farming the zkSync airdrop. Here are the steps we’ve taken:

- Bridged 3 ETH through bridge.zksync.io

- Placed small trades on https://app.mute.io/ as the slippage is very high.

The second airdrop we’ll be farming is Ether.fi’s. This protocol is a Lido competitor with no token, here’s what we’ve done:

- Connected wallet on https://www.mainnet.ether.fi/

- Deposited 3 ETH as early adopters and we’ll keep it there for a month minimum

Bye Bye, Dollars 👋🏼

So, here's the deal. We're kinda worried about what's up with the USD on a global scale (you know, like what we talked about in the Bitcoin section). That's why we're gonna start turning any profits we've got in stablecoins into on-chain gold (XAUT).Why gold, not Bitcoin, you ask? Sure, BTC is Gold 2.0 but it's too volatile to park profits in.

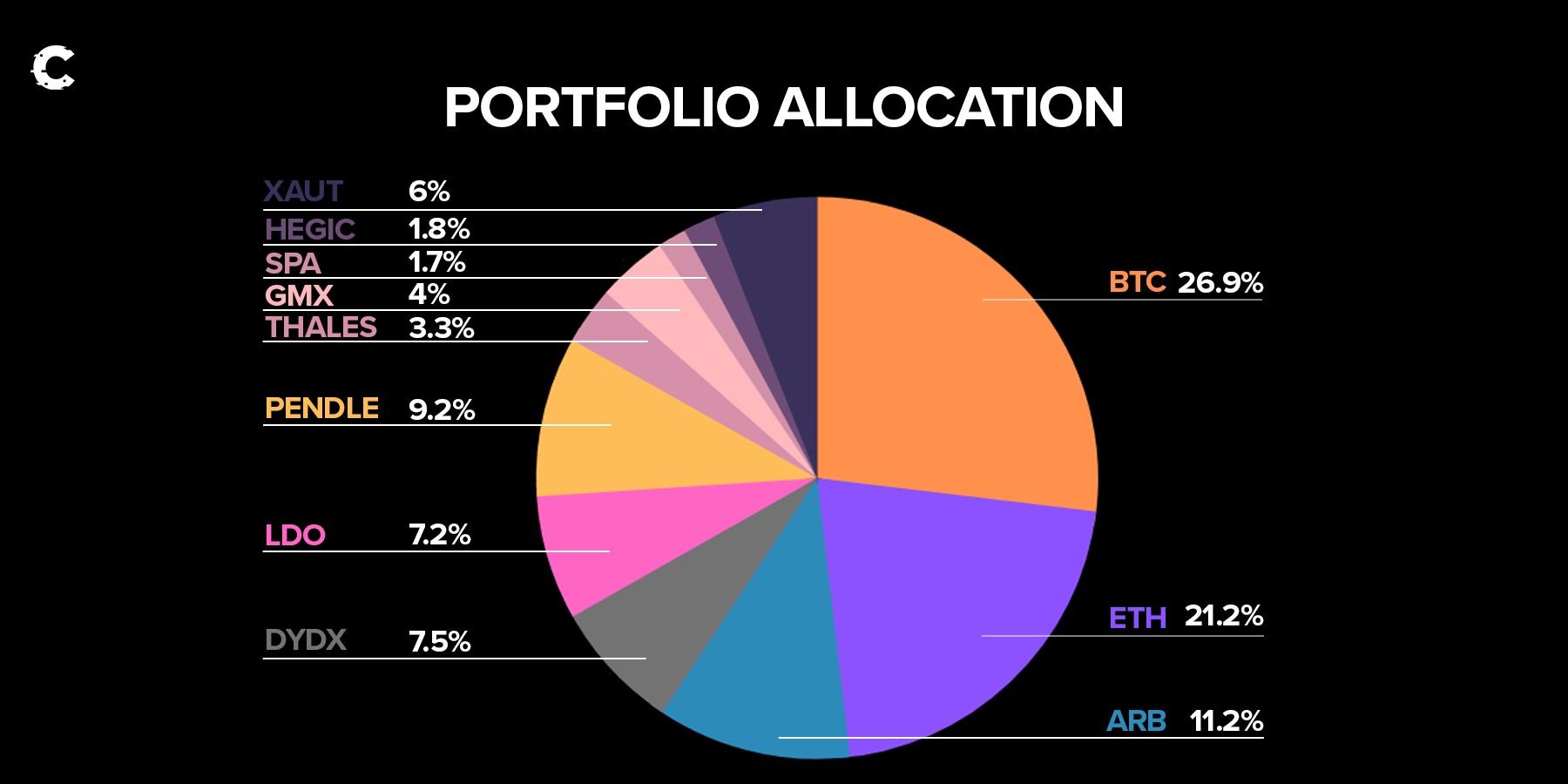

Portfolio Allocation

Next month, we will be re-assessing our portfolio and we will rebalance certain position as a quarter (3-months) would have passed. To clarify, we will never exceed 15 positions at any one time.

Investments Summary

- BTC: Invested $15,000 and awaiting our 2030+ target of $650,000

- Entry Price: $27,510

- Size: 0.5436 BTC

- ETH: Invested $10,000 and awaiting our 2030+ target of $115,000

- Entry Price: $1,750

- Size: 5.7 ETH

- ARB: Invested $10,000, selling 50% at $7.50 and the remainder at $30.

- Entry Price: $1.27

- Size: 7,878 ARB

- GMX: Invested $3,000, selling 50% at $140 and the remainder at $220.

- Entry Price: $70

- Size: 42.85 GMX

- SPA: Invested $2,000, selling 50% at $0.012 and the remainder at $0.030.

- Entry Price: $0.0062

- Size: 320,335 SPA

- Took action to farm two aridrops: zkSync’s and Ether.fi's

- Converted all profits from USD into on-chain gold (XAUT)

Skin in the Game Addresses

Bitcoin: bc1qzpppmek8wh2vqymq06petmfwmhjj9k8vdxl389Ethereum: 0x8Be9987d18a10F770cADC94635CeDB2eF33B0f17

Thank you for reading 🙏🏼

Looking forward to seeing you again next month!