And that’s why the best crypto investment advice remains the simple “buy low - sell high” mantra.

When you buy low, your profit is “guaranteed” on the upside; when you buy a top, your losses are “guaranteed” on the downside.

But how often do you get a chance to buy low? It depends.

But one of the easiest times to buy assets at a discount is smack dab in the bear market.

And that’s why we are BUYING THE DIP on today’s edition of Skin in the Game.

Disclaimer: This is not financial or investment advice. Any capital-related decisions you make are your full responsibility and yours only. The information made available in this report is NOT for replication. The purpose is to share the thought process behind our decision-making for entertainment purposes only.

Quick update on the market 📰

This was our master plan from last month.- Figure out when we’ve hit the bottom

- Determine where we are in the cycle.

- Start stocking up during the “depression/disbelief” stage.

- Go full throttle in the “hope” phase once we’ve confirmed our position.

We’re still in the depression/disbelief stage, and the stars haven’t aligned to lead us back into bull territory. At least, not yet.

But, on the plus side, low exposure to alts has protected us from even more downside…

Losing, but still winning? 🤯

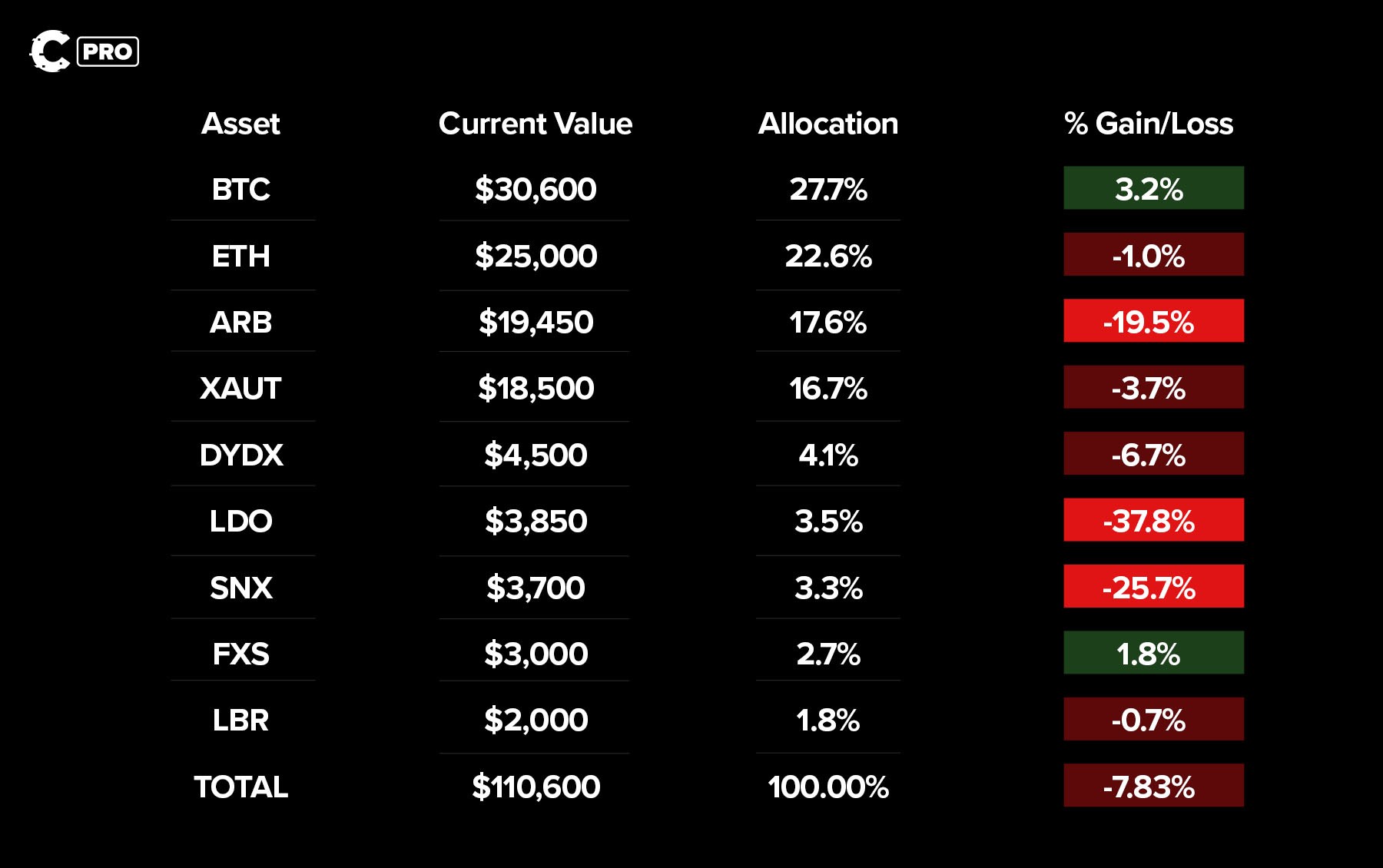

Here’s how the portfolio currently shapes up after this month's drama:

To date, we’ve invested $120,000 into the market.

Since the last Skin in the Game, we’re down around -4.4%.

But against the wider market, we’re winning:

Chart showing Bitcoin's % decline from last Skin in the Game (25/7) to today (25/8)

The goal is to outperform BTC.

And that’s exactly what we’re doing - BTC is down 11.58% in the last four weeks.

And THAT is a lesson in risk management.

Capital preservation is key…

So, what’s the plan going forward?

The Gold standard 🪙

Gold's overall trend has been bearish since peaking in May, but here's the kicker - it surged continuously throughout the past year.

We expect the zig-zags to continue as we experience potential turbulences in the short term. Put simply, the lower picture might be bearish, but the overall trend for Gold has actually been UP.

And peep this - gold has been our safe haven during the SITG journey, and we're surely not backing down now. Want some advice that can clear that up for you?

Follow Gold.

That’s the cue for spotting whether we have a correlation, causation, or connection.

The crypto market has been correlated closely to Gold’s movements.

What do we do if the bottom is in and BTC is at support?

Simple – we buy the dip.

So, what’s on Cryptonary’s shopping list? 📜

With prices down across the board, we’re using the opportunity to make some moves on choice altcoins.And, of course, our DCA into the big boys continues after last month's postponement.

Here’s the scoop👇

We are investing $15,000 💵

This month, we are putting $15K in the market. Last month, we bought $10K - we’re upping the stakes slightly to reflect the opportunity the market has presented.Let’s get the DCA out of the way so we can move on to the juicy stuff:

- Bitcoin (BTC - $5,000) gets a large allocation to anchor our portfolio as part of our risk-management strategy. You can’t buy the dip without buying the King.

- Ethereum (ETH - $2,500) is still an altcoin with much higher volatility. However, we’re still showing it some love with a lower allocation in line with our strategy of remaining cautious with alts.

THOR | $4,500

Thesis

It’s simple - THORChain volumes are up big. Where do people go to use THORChain? That's THORSwap.Revenue sharing with stakers means that this volume directly impacts the price of THOR. And that’s what we’re betting on with this investment.

Exit plan to take profits

We originally wanted to make this a trade, but THOR dipped under $0.20, so we are taking a longer timeframe instead. As a mid-term investment, our upside target is modest:- 40% of the position will be sold at $0.45

- 25% of the position will be sold at $1.70

- 20% will be sold at $5

- 15% will be left to accumulate staking rewards.

Escape plan to minimise losses

The invalidation is based on technicals - let’s keep it simple:- A weekly closure under $0.13 would turn this into a bad investment.

SYN | $3,000

Thesis

Synapse has just completed an audit for the Synapse Chain code. We wager that Synapse Chain can’t be far away. We’ve seen previous announcements cause large SYN upside moves, and there’s no reason to believe this time will be different.Essentially, we’re betting on the possibility that Synapse will announce a date for the launch of Synapse Chain.

As a bonus, SYN is currently at all-time lows, whilst BTC is at support. We predicted this could happen as a worst-case scenario in our 50x report.

If this is the worst-case, we’re betting things get better from here.

We’ll be looking to secure our initial investment and walk away from this position with a bag for the long term.

Exit plan to take profits

- 50% of the position will be sold at $0.90

- 25% will be sold at $5.30

- 25% will be sold at $32

Escape plan to minimise losses

There are a couple of invalidations for this position. If either of the following scenarios happens, that will trigger an exit while looking for new opportunities to reenter the market.- No sign of Synapse Chain news before the end of Q4 (December 2023)

- A weekly closure under $0.425 - the current all-time low

Investment summary ✍️

- We invested $5,000 into BTC.

- Entry price: $25,971.70USD

- Size: 0.18924

- We invested $2,500 into ETH.

- Entry price: $1,640.54

- Size: 1.524 ETH

- We invested $4,500 into THOR, selling 40% at $0.45, 25% at $1.70, and 20% at $5.

- Entry price:$0.17

- Size: 26,679.971 THOR

- We invested $3,000 into SYN, selling 50% at $0.90, 25% at $5.30, and 25% at $32.

- Entry price: $0.43

- Size: 7,095.072 SYN

SITG addresses ⛓️

- Bitcoin: bc1q04yt39u4rzryz539jtd7nkkk7qy2tkscxyad9j

- Ethereum: 0x938A75511F44325b9a5EB75eBe445BBaeb29F305

- Arbitrum: 0xD1693AEAd7545470A1e3ED30600Dc18c0E3Bf01d

- zkSync: 0x603F02750e21cEFB1E30D6bE27EdCCcBFe1d9455