Beat the crypto market: This asset has a triple-digit upside

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

Imagine discovering a promising crypto asset with enormous growth potential - we are talking of a triple-digit upside potential.

But there's a catch – it keeps issuing more tokens, diluting existing investors.

But is there a way to enjoy the upside while minimising the risks?

Today, we unveil the playbook institutional players use to lock down massive gains while minimising their downside.

Now, this is a report you can’t afford to miss. It is backed by hardcore technical and fundamental analysis.

You can't Google this. Even cutting-edge AI solutions aren’t capable of synthesising this level of insight. And don't bother asking analysts in your favourite signal groups- they're just as in the dark as the rest.

Are you ready for a triple-digit upside with limited downside?

Let’s go!

TLDR 📃

- We expect Liquid Staking Tokens/Derivatives (LSTs/LSDs) and stablecoins to grow the crypto market, offering safety and benefits over traditional staking.

- Curve’s crvUSD stablecoin offers a unique liquidation mechanism for smoother DeFi experiences.

- However, the CRV token has an aggressive inflation schedule, making the token less attractive.

- Owning Convex, the token of a project with a controlling stake in Curve, gives you exposure to CRV without the attendant risks.

- The recent Vyper exploit looks bearish to many retail investors, but we see the beaten down token prices as an opportunity to accumulate at lower prices

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

[embeddoc url="https://cryptonary.s3.eu-west-2.amazonaws.com/wp-content/uploads/2023/09/Alpha_Report-Long_Form-Sept-1-1-1.pdf" viewer="browser"]The longer institutional version of this alpha report is available here👆.

https://youtu.be/9q3eXN9JIXc

Part 1: A bird’s eye view of crypto

Let’s start by taking a step back to view the markets from the fundamentals.First, what use cases exist in DeFi, and which will stand the test of time?

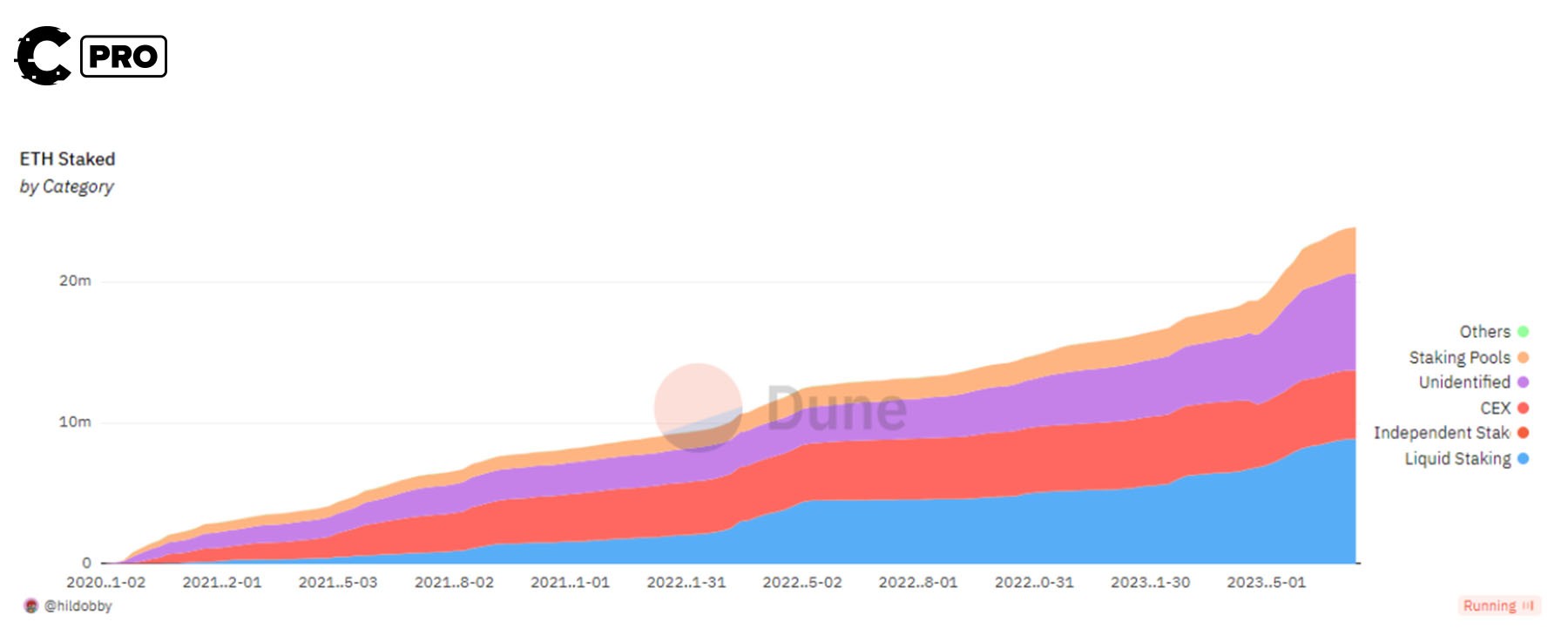

In our opinion, we see both Liquid Staking Tokens/Derivatives (LSTs/LSDs) and stablecoins growing in popularity and profitability over the coming months and years.

Let’s dive in!

Playing it safe with stablecoins

Stablecoins provide a safe haven for investors hoping to protect themselves from downside volatility while maintaining their on-chain buying power.

[Stablecoin Supply Ratio and Stablecoin Market Cap over time]

Stablecoin supply (in blue above) breached $100B in June 2022 and has hardly looked back.

For context on the permanence of Stablecoins, DeFi Llama lists 90 projects with a supply of more than $1 million.

Switching things up with Liquid Staking

Stablecoins are safe, but for the thrill-seeking investor, you’ll need to enter the world of Liquid Staking.If you don’t know much about Liquid Staking, here’s a crash course (we’ll use Lido as an example since it is the largest):

- You come to Lido with 1 ETH in your wallet.

- You deposit your ETH with Lido, receiving stETH (a Liquid Staking Token) in return.

- Lido then takes your ETH and stakes it to receive rewards.

- After Lido subtracts its fees, the rewards are passed along to you.

- Run your validator hardware.

- Have a minimum stake of 32 ETH.

- Lock up your ETH in the validator.

- Run the risk of being slashed and potentially losing some of your stake if you make a mistake.

We also see massive room for growth because only about 20% of ETH is currently staked.

But not so fast…

There are lots of stablecoins and LSTs in the market.So, Cryptonary, which stablecoin or LST should I pick?

Our strategy is simple- invest in the infrastructure – it’s like owning a casino vs. gambling in one. The house always wins!

And luckily for us, there’s a key player infrastructure player who stands to benefit from the rising tides of stablecoins and LSTs – enter Curve Finance.

Part 2: Curve Finance is the smart play for stablecoins and LSTs

Curve is the second largest Decentralised Exchange (DEX) by TVL (Total Value Locked). It rose to prominence by pioneering StableSwap - a novel method for efficiently swapping like-kind assets.For example, suppose a whale ever wants to swap one million dollars worth of one stablecoin for another. In that case, they’ll get a better execution for large trades with minimal slippage on Curve than on another DEX like Uniswap.

But whales are not the only reason Curve is a hot pick. Let’s go back to the infrastructure thesis.

When new stablecoin or LST projects launch, they often look to deploy their pools on Curve - because that’s where all the action takes place.

Don’t just take our word for it. Run a simple Google search and check where projects like Lido, Rocket Pool, Frax, Liquity, and countless others deploy their main liquidity pools. We’ll save you the stress – the answer is Curve.

Deeper liquidity pools inevitability means more trading volume, which, in turn, births more fees. And where do these fees flow? Hint: to Curve (CRV) token holders.

However, the CRV token is not without its drawbacks

The pros and cons of Curve’s CRV token

By locking CRV tokens (up to 4 years, receiving veCRV), users can unlock the three main use cases of the governance token:- Earn trading fees: 50% of all trading fees flow to veCRV holders

- Boosting: holding veCRV allows you to boost rewards (up to 2.5x) on the pools you are LPing in

- Voting: being able to choose which pools will earn future CRV rewards

Now, the cons!

There’s no such thing as a free lunch, and the CRV token isn’t perfect.

The main issue lies in its inflation schedule.

The CRV token has an aggressive inflation schedule, so many investors (including us) tend to shy away from it as an investment vehicle.

Now, we’re left with a dilemma! We want exposure to Curve’s outperformance but don’t like its token.

Part 3: Convex - the smarter way to get exposure to Curve

After much research into the pros and cons of projects in the Curve ecosystem, we have arrived at our favourite balance of tokenomics, value accrual, and risk profile.The answer is Convex. This is “the Hedge Fund” with a majority stake in Curve.

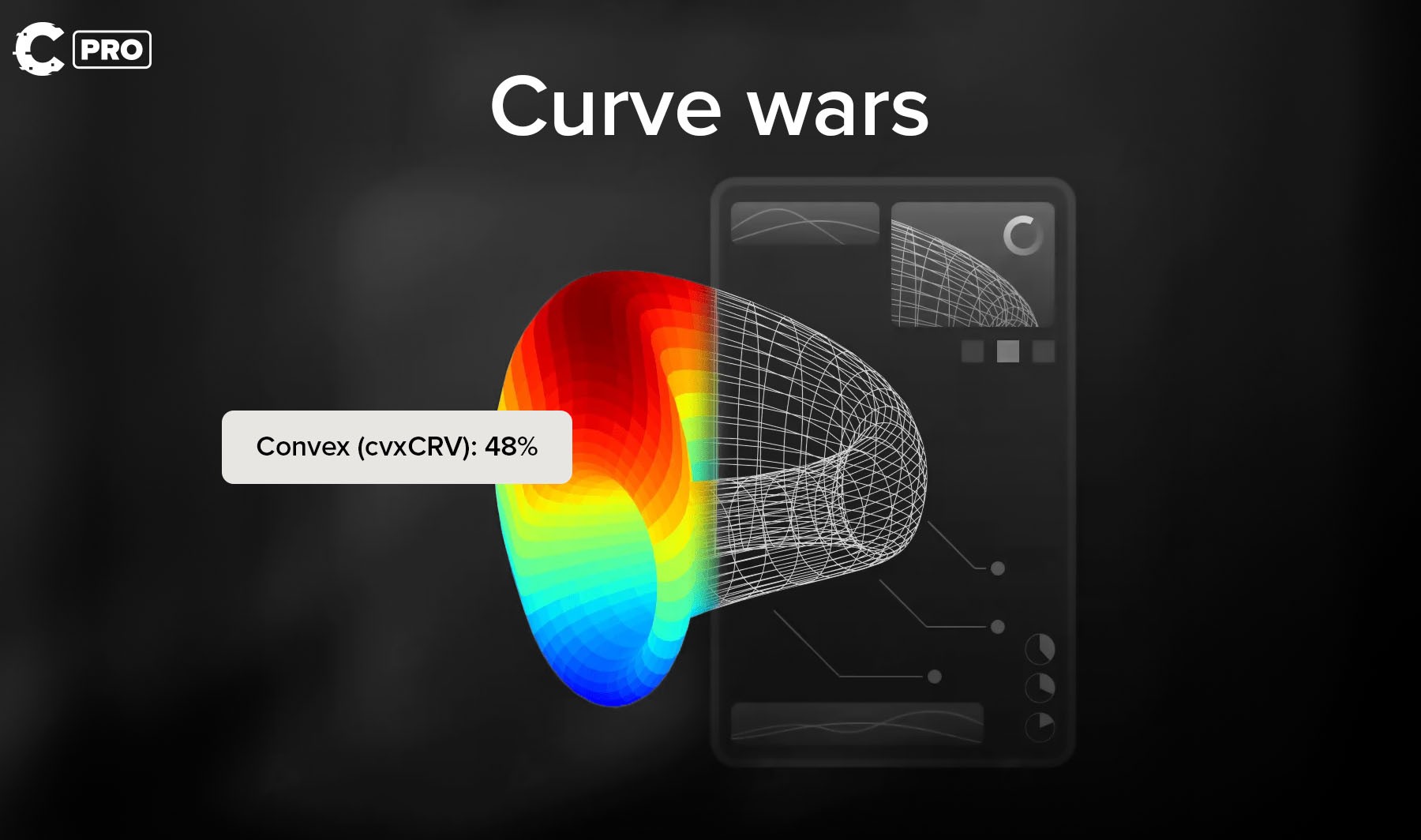

Convex now controls roughly half of all veCRV in existence and thus has the power to decide which Curve pools receive future rewards.

The best part is that Convex enables you to receive all the benefits of owning CRV without locking up your CRV for veCRV for up to 4 years like other retail investors.

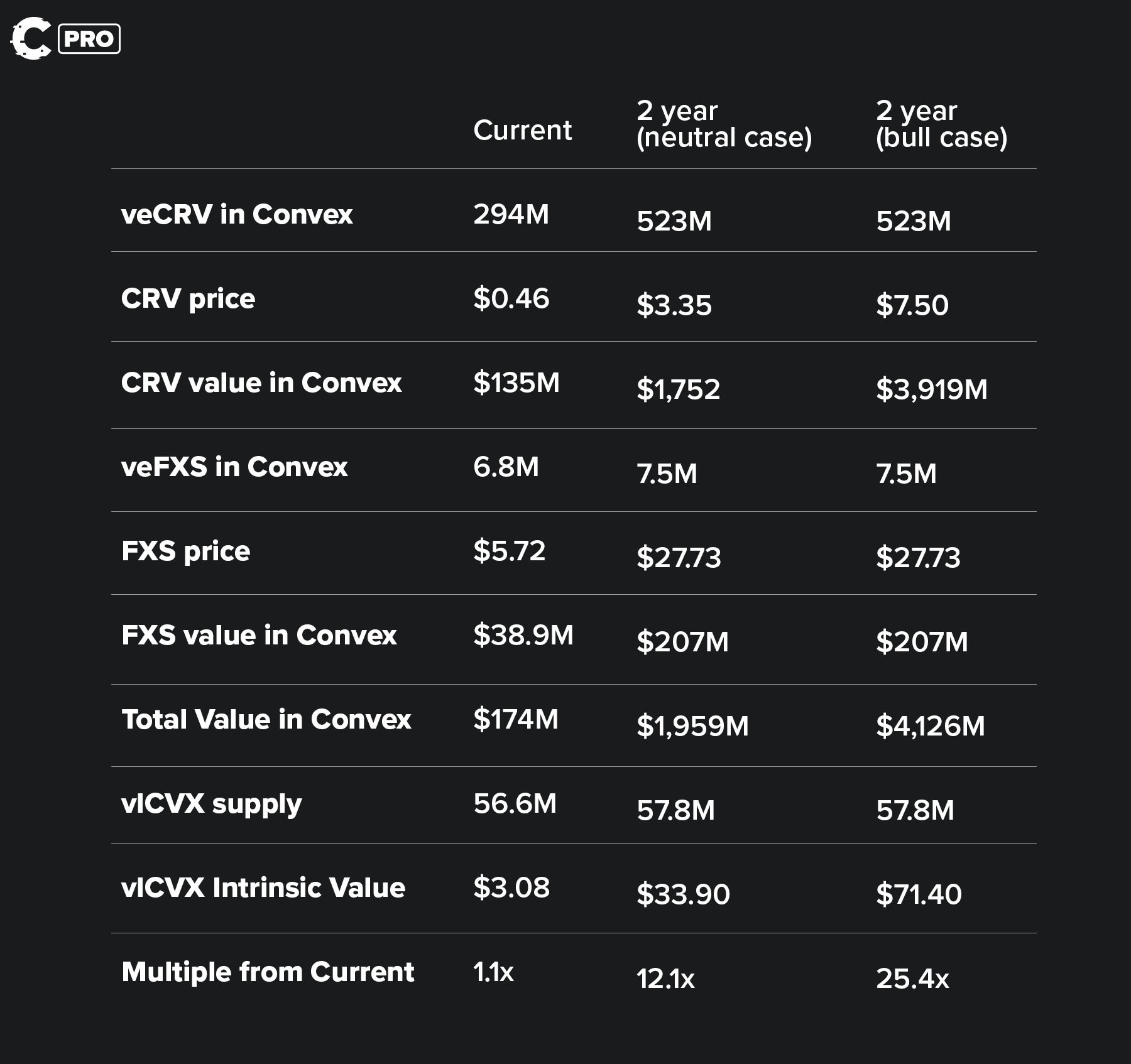

Convex’s token, CVX, derives its value from the quantity of veCRV it controls once it is locked (into vlCVX, vote-locked CVX). Let’s look at an example:

- Say that 700,000 CRV are locked in Convex.

- And there are a total of 100,000 vlCVX.

- This means that each vlCVX has the voting power of 7 veCRV.

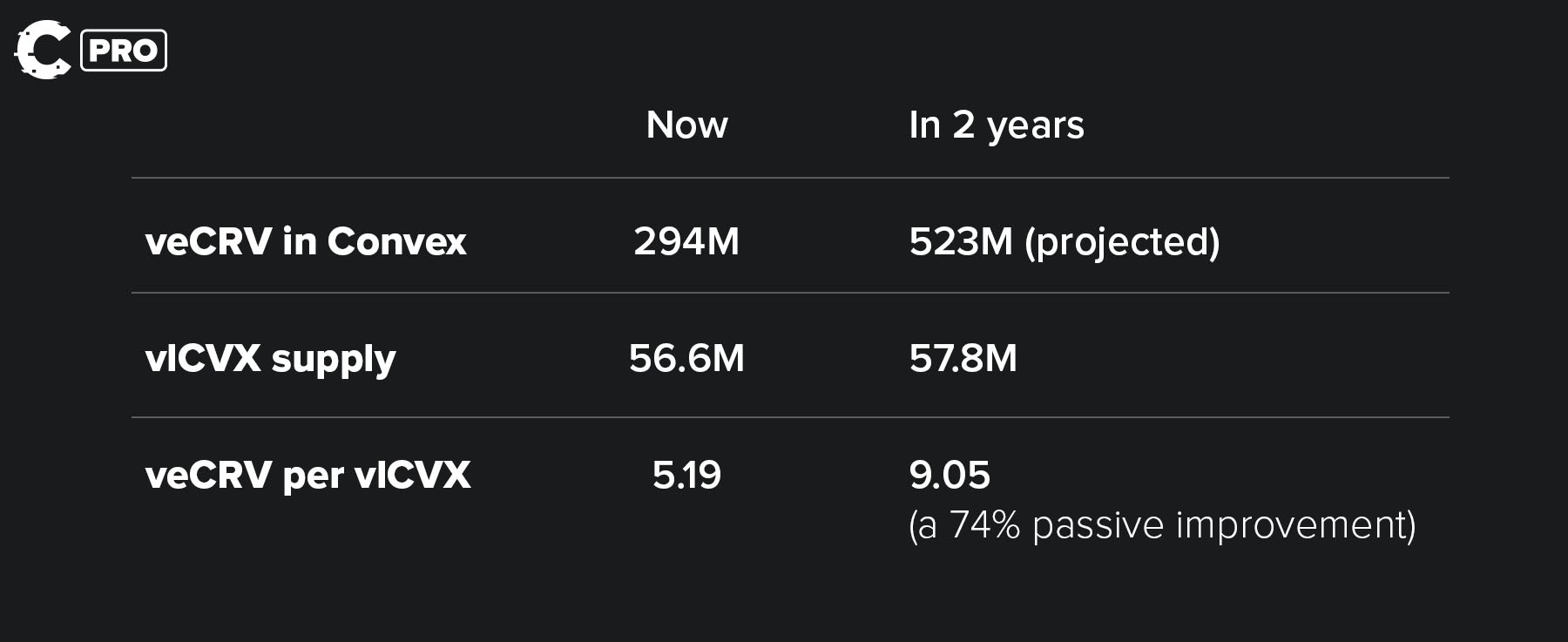

And while CRV supply is highly inflationary, CVX emissions are tiny. This slight but significant difference means that, over time, the amount of CRV controlled by every piece of CVX increases.

Let’s crunch the numbers and see where the price of CVX could be in a couple of years.

CVX valuation exercise and price targets

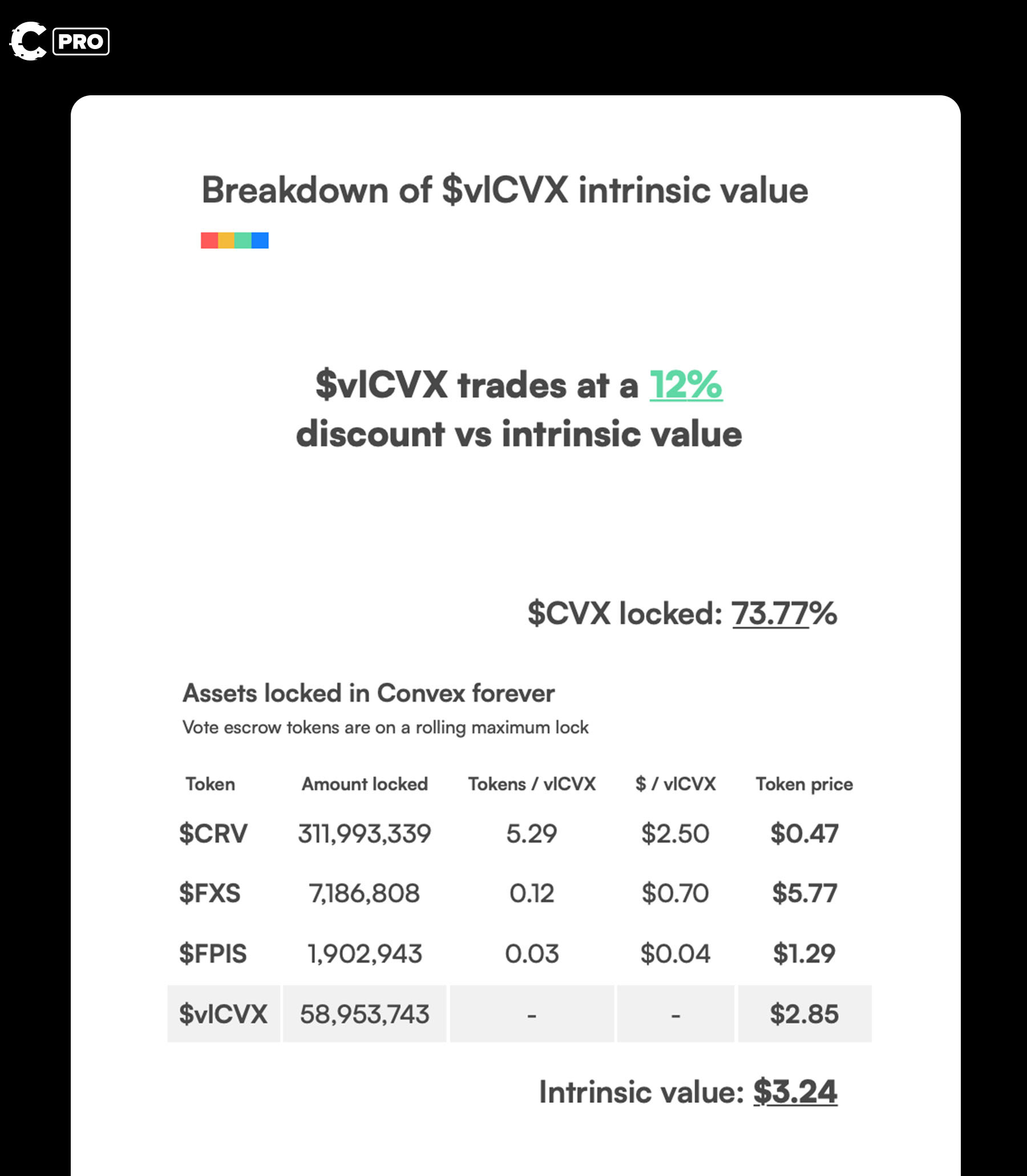

CVX’s intrinsic value is tied to each CVX token's voting power, which is proportional to the locked governance tokens in Convex.In addition to the CRV mentioned above, Convex also allows you to lock CVX for Frax’s FXS and FPIS tokens, both of which share CRV’s tokenomics architecture.

The amount of CRV, FXS, and FPIS that “back” each CVX give us an idea of CVX’s intrinsic value. A nifty web app is available here to check CVX’s intrinsic value in real time.

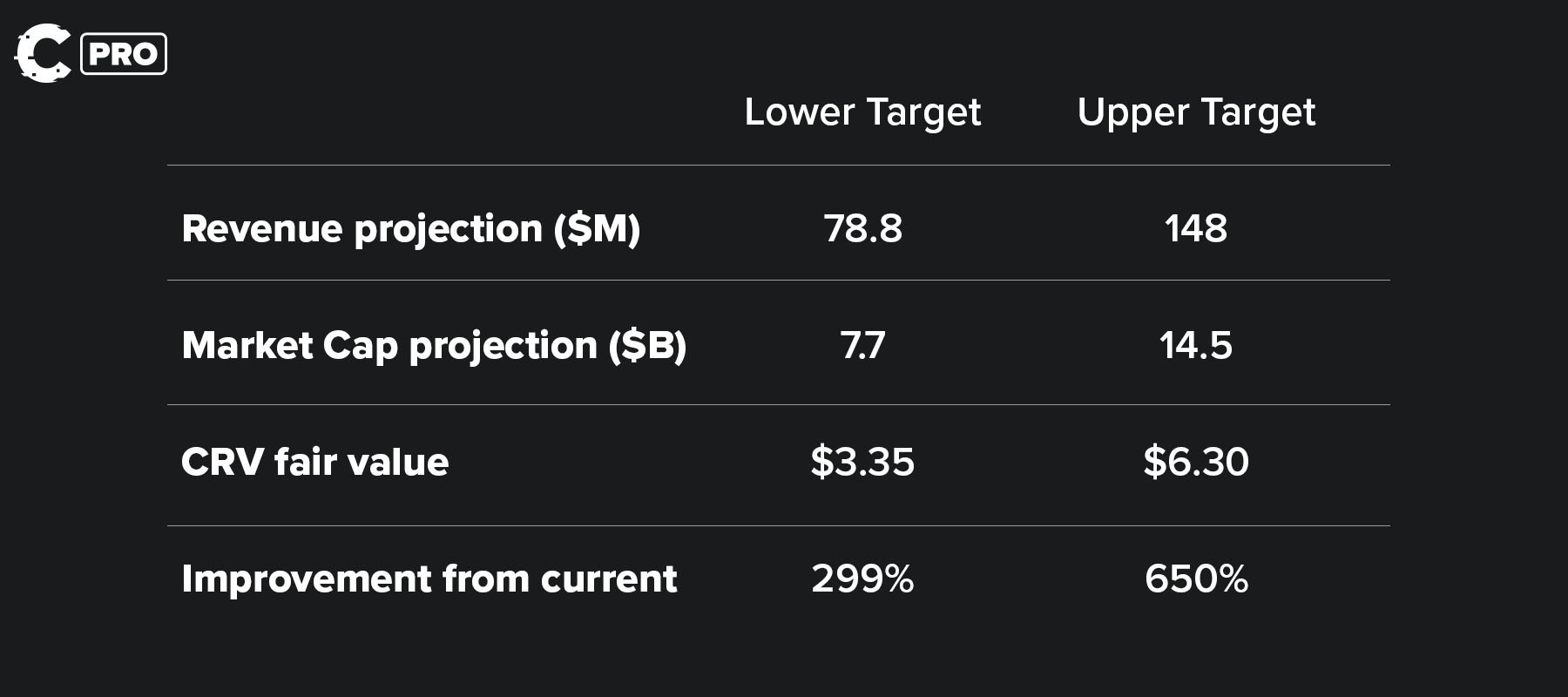

Here’s our CRV’s valuation projection

Curve generates most of its revenue from trading fees. Since these fees roughly scale with volume, we will construct a couple of conservative targets for future volume and use this to estimate revenue accrual to veCRV.Hence, our volume targets will be:

- Lower target: Curve’s previous monthly all-time-high of $29.7B

- Upper target: Uniswap’s previous monthly all-time-high of $90.8B

- Lower target = $43.7M

- Upper target = $113M

And while founder Michael Egorov believes the market cap of crvUSD will hit $1B by the end of 2023, we will stay conservative and project that it will take two full years to reach this goal.

- 2-year crvUSD market cap goal = $1B

- Average borrow rate = 3.5%

- Annualised revenue generation = $35M

Now check out CVX valuation

Now, because you can lock CVX for FXS and FPIS, we will include them in the factors driving our CVX valuations.Therefore, we will include the more conservative price target from FXS, as delivered in our previous report.

However, FPIS is negligible to the calculations (<1%) and thus will be omitted.

Based on the above, we arrive at our lower and upper price targets of $33.90 and $71.40 for CVX.

Note that the previous all-time high for CVX falls between these values at just under $50. This past performance gives us confidence that our price targets are within the realm of possibility.

Invalidation criteria ❌

As always, here are a few criteria that might cause us to revisit our thesis and reduce our CVX exposure.- Fallout from Vyper Exploit. A bug in the firmware used in a small subsection of Curve pools led to the loss of funds totalling around $62M. The resulting decline in CRV price led to the Curve founder selling some of his tokens over the counter to secure outstanding loans. We see the resulting price action as an opportunity to buy in at lower prices, but will continue to monitor this risk.

- Disruption from Uniswap v4 hooks - Uniswap’s recently announced hooks. Granted, we don’t fully understand the capabilities of the hooks yet, but it would be foolish to ignore the volume king.

- Disruption from Maverick – Maverick is making headlines with its hefty valuation. We think the volumes will taper after incentives dry up; however, we will monitor this situation.

- ETH staking participation is lower than expected - if ETH’s staking participation does not rise above 20-25%, we may see a drop in LST expansion. While this may impact the growth trajectory of Curve, we don’t see it as very likely.

Cryptonary’s take 🧠

Convex’s role in the DeFi ecosystem is vital.Convex is the hedge fund pulling the strings on Curve behind the scenes, not just holding all of the power but also getting paid for the power it wields.

We are making the CVX trade because it is a bet on continued innovation in the crypto space.

It is a bet that new projects will continue to launch, and these projects will need a rallying point for their capital.

And right now, CVX remains the most prominent rallying point of the bunch.

As in any market, liquidity is king.

And in DeFi, if Curve is the king, Convex is the kingmaker.

Action points 📝

Here is how we are taking action with our Convex thesis:- Over the next several months, we will slowly accumulate CVX, ceasing purchases once it breaks above its long-term consolidation high of $7.

- We will take profits on half of our CVX at our lower price target of $33.90.

- We will exit our position entirely at our upper price target of $71.40.