Berachain: New tech or new trap?

As of this week, a project that has been teased for years is finally coming out. It brings the magic of EVM, modularity, and an all-new validator setup all together to make a brand-new L1, and guess what? It's already launched. Let's dive in…

The project in the spotlight today is Berachain. Berachain is an EVM-based L1 that has a lot of hype around it. It had one of the strongest NFT collections over the past couple of years, held a 20 ETH+ floor, and along with that the community is diverse and strong. So, what is it and why should you care? Don't you worry we have got all of that and more coming right up?

In the article, we will cover the following:

- What is Berachain?

- What is the token for Berachain?

- The Tokenomics of the coin

- What opportunity there is to make $$$

- & Things to watch out for

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Berachain?

So, as we said Berachain is an all-new EVM-compatible L1 and before you say it we already know what you are thinking "not another L1!" With things like Avalanche, SuiI, Aptos, and the list goes on, it seems new ones just keep coming out. But what if we told you there was a problem with these L1s? The issue is these L1s, the majority of them, are mostly ghost chains. Money is there but since many run on Proof of Stake, the money sits in validators, and there is a lack of real economic activity and user engagement.This means that while there is a high amount of $ on the chains, few people are using them. This leads to low transaction volume and the majority of the dApps on the chain going unused, essentially making them ghost chains.

That is where Berachain steps in with some differentiations to tackle this problem. In fact, the founder is well known for saying that chains rely on 3 things, developers, users, and liquidity. So, because of this Berachain has introduced an all-new Proof of Liquidity consensus mechanism, a tri token system, and EVM compatibility along with Cosmos Interoperability.

Yes, we know this all sounds new and confusing but bear with us. It will all make sense…

What is POL (proof of liquidity ) & why is it so important?

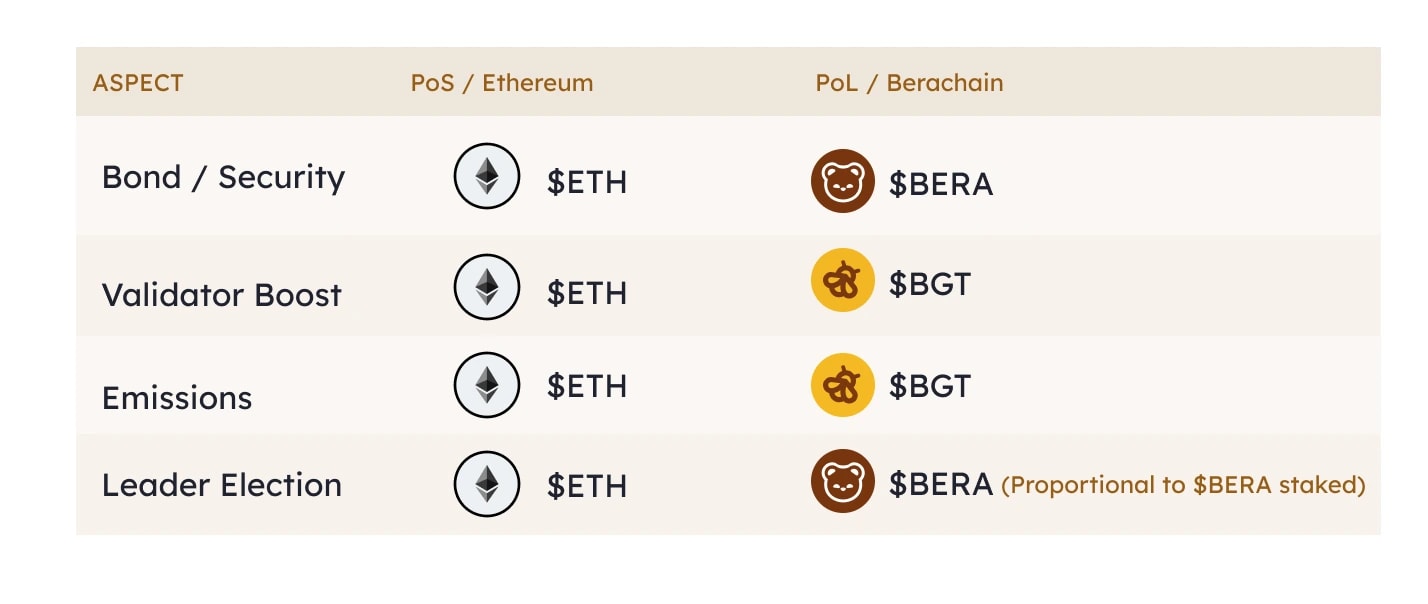

Proof of Liquidity is an all-new consensus mechanism made to rival the old-time Proof-of-Stake or Proof-of-Work mechanisms.

Berachain created this concept after noticing a flaw in the traditional mechanisms like PoS and PoW. These mechanisms typically had DeFi liquidity drained in a big way because the tokens would sit in validators and not provide any inherent value to the ecosystem at large.

PoL on the other hand creates a new relationship with the ecosystem and the validators. It enables a cooperative economy that only rewards LP positions by validators ensuring that the liquidity on-chain gets put to use on-chain.

So how does a PoL mechanism work? Let's get into that now.

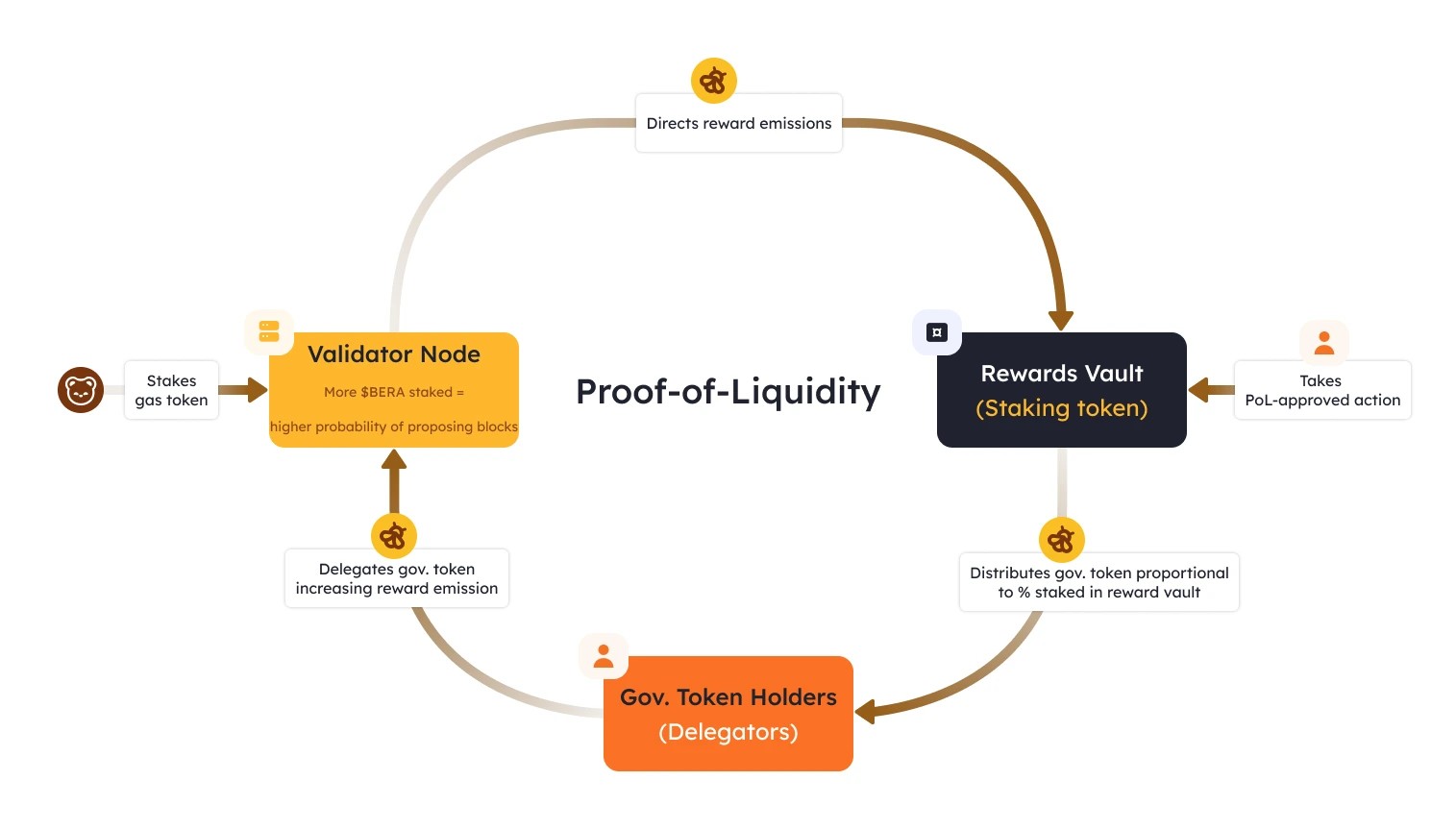

Essentially for it to work, validators have to stake liquidity in ecosystem projects to gain rewards. This reward structure is done through a dual token system using a security layer/gas token $BERA, like $ETH on Ethereum, and a governance token $BGT, more on what exactly each of these tokens does later.

Through staking liquidity in projects, the validators boost the ecosystem by increasing liquidity, they are then rewarded for this with the $BGT token which is soul-bound and used for governance, it cannot be bought nor sold.

Holding the $BGT token is useful as it allows entities to vote on proposals, delegate validators, and additionally influence ecosystem rewards making it very valuable. This also means that only active participants can govern the ecosystem as a whole. It also has a burn mechanism which we will talk about shortly.

In essence, this should fix the ghost chain problem because it means liquidity is always available and deep on-chain as it needs to be provided by validators, this also further secures the network, and it means that users/entities must engage in Defi to gain governance power.

What tokens does it use (3 token model)

Berachain also has a final token $HONEY making it the 3rd native token of the chain. $HONEY is a stablecoin, backed 1:1 by US dollars. It will be used as USDC/USDT is used throughout the rest of DeFi. It can be used for lending, borrowing, payments, and as collateral for leverage purposes.But we aren't done with $BERA and $BGT yet, let's take a quick dive into what each token is used for and end it off with a unique mechanism between the two.

$BERA

This is the gas token and staking token, basically just like $ETH. It is used to pay for transaction fees and through paying and using them for gas the $BERA itself gets burnt. Staking wise validators need to stake it to operate. The more $BERA they have staked and the more they use the liquidity they have the more $BGT they earn.$BGT

This is earned by providing liquidity to whitelisted dApps on Berachain. This means that only people providing economic value to the ecosystem can get it. $BGT is used for governance and generating yield.Additionally, if you hold $BGT you can vote on proposals regarding the future of the chain. You can also generate yield with it by providing liquidity to the ecosystem and securing the network.

There is also another unique mechanism on the Berachain that allows validators and users to burn their $BGT for $BERA. This brings in some interesting game theories where people can decide if they want to hold power/ influence, or "cash" it in by burning it, which also makes the rest of the $BGT holders more powerful. This one-way $BGT action is interesting because it also means that whales and large entities cannot transactionally buy influence. However, it also casts a bearish wave on the tokenomics which we will get to coming up next.

What are tokenomics like?

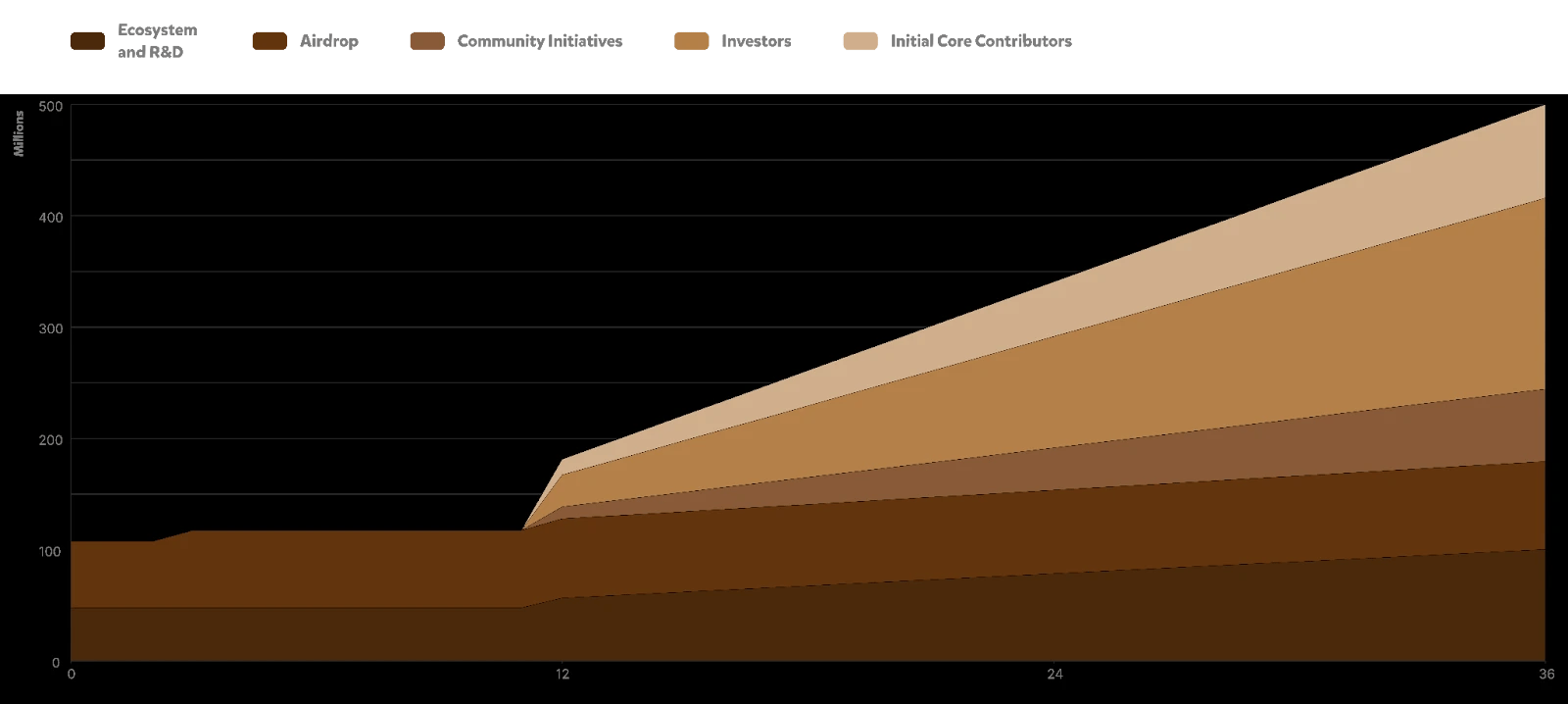

This is where the honey gets sticky, pardon the pun. As we can see from the image below this tokenomics mirrors that of the many tokens that have the majority of the supply gone to insiders and VCs. For those of you who are new, this is a serious issue because it means that over time there will be lots of supply ready to dump on future buyers, limiting the upside potential of the token.

As we continue looking into tokenomics, we come across their vesting schedule. What we can see here is that while supply essentially remains flat for the coming months (up to a year) after that the supply doubles and will continue to scale quickly into the coming years.

This again points out that over the long term, an increase in supply will most definitely cause the price to suffer to the upside as we have seen with many of these heavily VC-backed / insider coins.

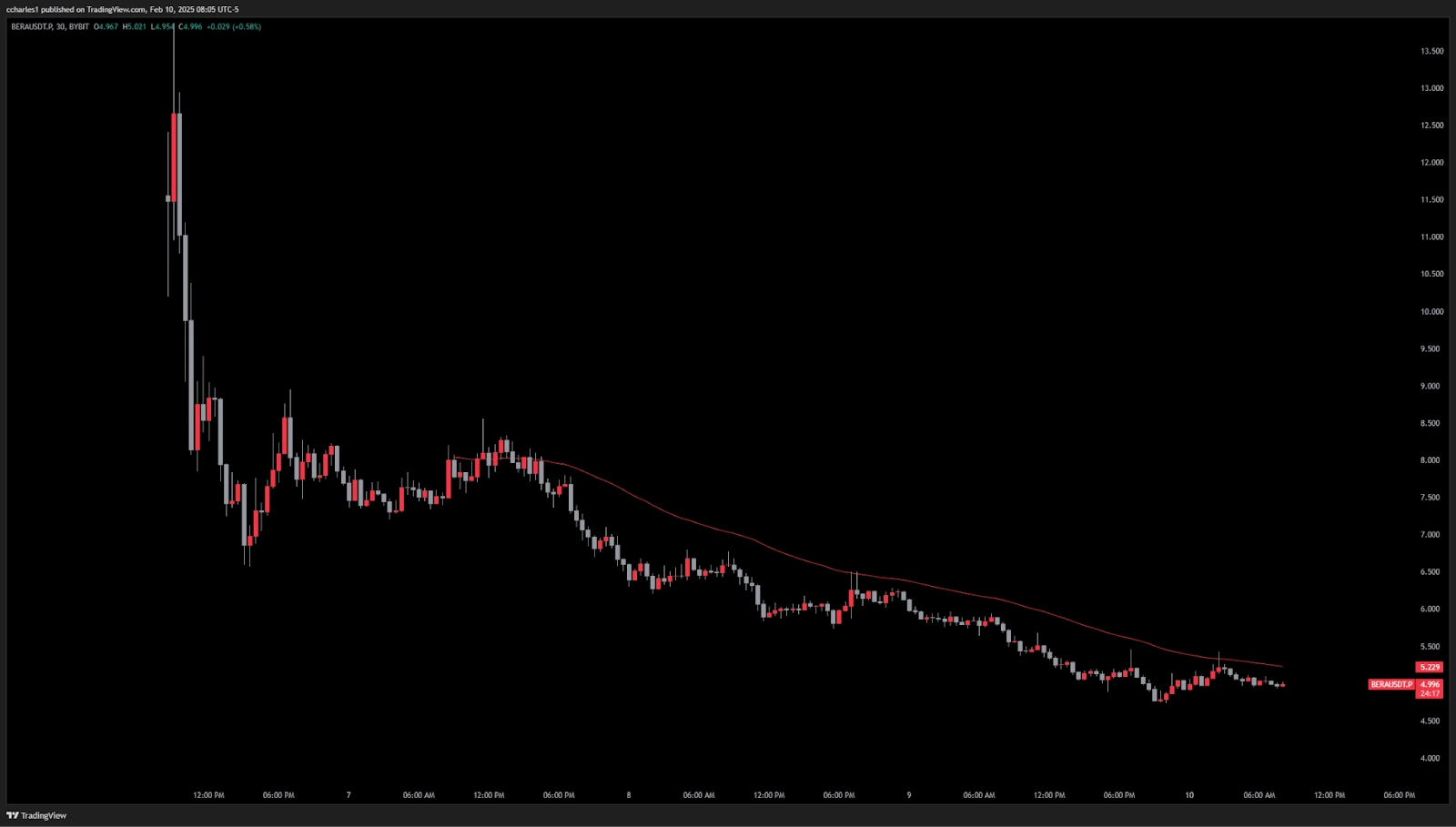

At the current moment, the coin $BERA has freshly launched and while the chart looked promising at the start we can very easily see it has already put in some bearish lower highs on the low time frames. From its looks, the broader crypto community has not welcomed the token with open arms. From the chart below, it's clear that nothing bullish has happened on the chart yet since the launch and has been consistently being sold lower.

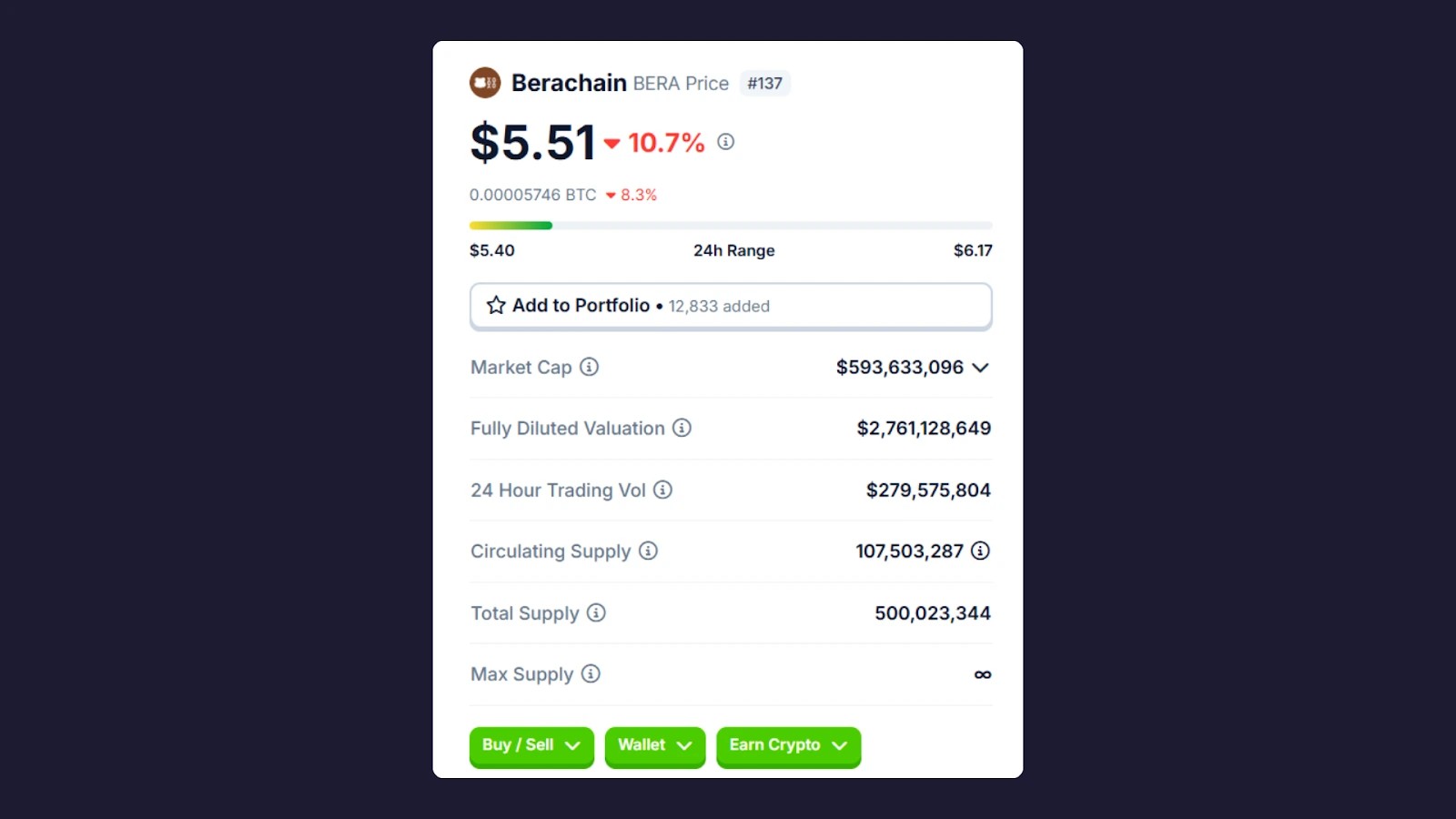

Taking a further look into its tokenomics we start to see more and more red flags here.

We can see that this new launch of the chain, which is supposed to be very innovative and bullish, has failed to even maintain above the $1b market cap level. In fact, it looks weak even at ½ a billion market cap. For reference, tokens like Pepe and Bonk are 4x and 6x higher than this valuation whilst being meme coins.

We can also see that the circulating supply right now is only ⅕ of the total incoming supply which goes hand in hand with what we were saying but what is most interesting is that yes the max supply is infinite. Why is this? Stick around and we will touch on it shortly in our risk section.

Risks

So while the idea is novel and admittedly they sound to be doing some pretty cool things, as we look deeper some potential issues start to poke their head out of the den.

Most of the issues fall in and around PoL, so let's talk about it. PoL is new and as much as it sounds great there could be some serious misalignment of incentives between the team, VCs, large players, and the overall community. Why is that? Well, there are two things that immediately come to mind: Centralization and Inflation.

Centralization

When we talk about centralization we mean that big players can attain and hoard a supply of governance tokens very easily through this. This is because of how PoL works. The largest players get the biggest amount of rewards which in this case are the governance tokens. This means that over time the control of what happens on the chain will easily be able to be cornered by a few players if they see fit leaving what we think as a chink in the armour.Inflation

Inflation is a serious thing long term for any token no matter how novel the tech is. And, unfortunately, the Berachain PoL setup encourages it all too well. This is because of the one-way burn that we talked about regarding $BGT.This burn means that yes, while we are burning the $BGT token we are also minting new $BERA supply, hence why in the photo we see that the supply of $BERA is infinite. This means that even after all the unlocks are done there will consistently be new tokens entering the arena which in a sense will allow the supply to weigh the price down.

Overall, we think that these are both very valid concerns and long term lead us to have a quite bearish stance on the token as it does not seem to fit our standards regarding risk or tokenomics. However, this doesn't mean there isn't an opportunity here so stick around for just a little while longer.

What opportunity is there for us?

While we did lay out a bunch of FUD, we would be remiss to say there was no opportunity here. Two things come to mind when we think about opportunities for us to make money.Farming the APY

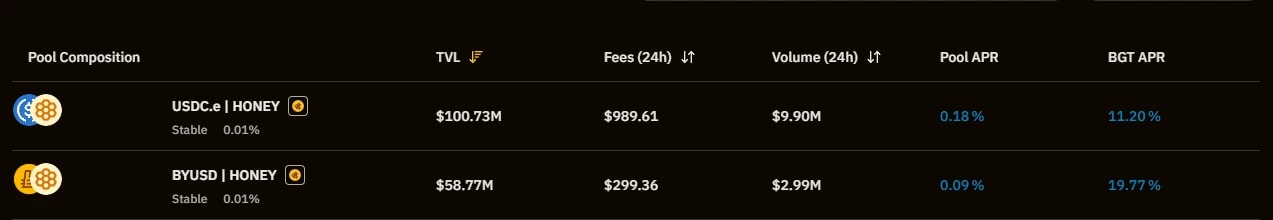

If we look at the pools list below we can see that the APY is quite high.

What this means for us is that through providing our assets for liquidity in these pools we have a chance to make a higher yield. Looking at the USDC.e-HONEY pool, we can see that natively we only get about 0.18% APR but through the PoL rewards ($BGT) we get an additional 11.2% APR through that token. When we get it we can then burn it for $BERA and pocket the profits back into stables.

The same goes for the BYUSD-HONEY pool however we can see that the APR is 8% higher through $BGT rewards. We believe it is wiser to choose the second choice as due to the token price being volatile (to the downside), we should make allowances for a slightly lower "APR" That being said that rate still beats a large majority of stable farms and S&P500.

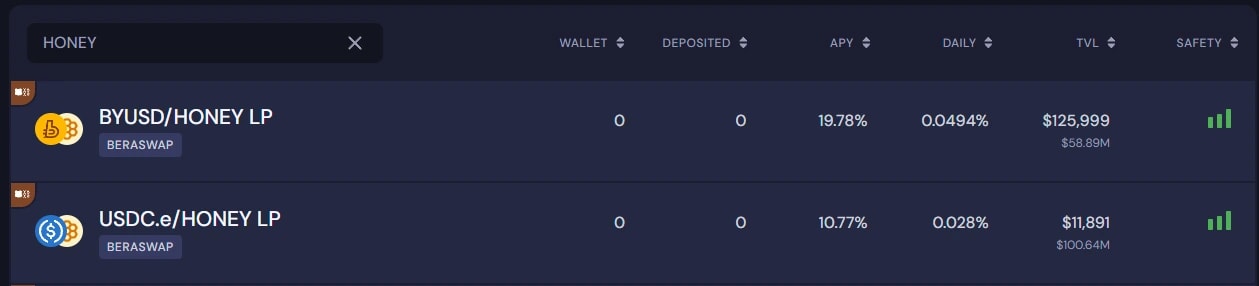

To make things even easier we suggest using Beefy. This allows us to autocompound which when working with APR paid out in tokens is essential. What that means is that when you get the $BGT in rewards Beefy will automatically convert that back into stables for you to continue using in your farm. You, as a user, don't have to go through the hassle of burning the token and then selling the $BERA and then adding it back into your liquidity position, Beefy does it for you!

Secondly, we can see that the rewards for WETH | HONEY are quite high. This most definitely beats all the other ETH yield strategies at the time. With a current pool APR of 26.55%. However, it is important to note that as more liquidity enters the pool the APR will likely go much lower. And, as we can see from the image below the TVL is very low at 97K USD.

Overall, there is an opportunity to get yield here and while rates are high we definitely think it's not a bad idea to look into using Berachain with your stables or spot eth bags for the time being. Going forward we do suggest keeping an eye on APR. If it falls 5-10% lower across pools we suggest using other farms that do not pay in token rewards.

Shorting the token

This is for all our traders out there. We think that with such predatory tokenomics as Berachain has there is ample reason to short the pumps and long-term something that definitely should be on your "short list" in the future.In fact, one of our team members happened to catch a sweet short and alerted our members which ended up netting them about a 40% return in just a couple of hours.

We think that yes even though it is below the $1b market cap it will continue being a good short as the community doesn't seem to like the tech as it is inflationary and a lot of supply will be dumped on users' heads.

Also, we think it is a good idea to short new launches with predatory tokenomics going forward. Data from Messari shows that almost all new launches are down significantly, even considering we had a bull market.

Cryptonary's take

Overall, we do like the new ideas that the Berachain team has brought to the table. PoL is a noble take on how to solve the ghost chain problem. However, many red flags come up with this such as centralization concerns, inflation worries, and predatory tokenomics.Because of these things, we simply must remain bearish on the token. However, this does not mean we cannot still win and we suggest looking into potentially farming some of the yield and following our trade ideas for potentially shorting the coin as we did when the launch occurred.

At the end of the day, they started off with some good ideas but in the end, however, the only opportunity we see here is either earning yield or shorting the token on meaningful pumps. So keep your paws clean, and stay safe out there.

Cryptonary OUT!!