Betting on the Dark Horse: Why We Think This Privacy Coin Is Overlooked

Everyone talks about financial freedom in crypto, but what if your transactions are an open book? In a world where governments and corporations track every move, this coin stands as the last bastion of true anonymity. But is it unbreakable, or just another illusion? Let's uncover the alpha...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Introducing: Monero

Let's get one thing straight: Monero isn't trying to be the next Ethereum killer or a memecoin sensation. It's a focused project aimed at one core issue: making digital money truly private and fungible. Born in 2014 from a fork of Bytecoin, Monero drew on the CryptoNote protocol to address Bitcoin's glaring privacy shortcomings. Where Bitcoin's blockchain is like a public ledger, anyone can scrutinise it; Monero obscures the sender, receiver, and amount in every transaction by default. This isn't optional; it's built-in, utilising tools such as ring signatures, stealth addresses, and confidential transactions.Over the years, Monero has evolved through community-driven upgrades, tackling everything from efficiency tweaks to enhanced security. As of August 2025, it sits at around a $4.8 billion market cap, holding steady in the top 25-30 cryptocurrencies and commanding over half the volume in decentralised derivatives for privacy coins.

Its value prop? In a world of increasing financial oversight, Monero provides untraceable utility that goes beyond speculation, think secure donations in restrictive regimes or peer-to-peer payments without a trace.

In this report, we'll unpack Monero's history, dive into its tech stack, examine its economic design, assess its place in the market, explore its ecosystem and adoption. We'll also flag the risks and look at the technical analysis. By the end, we will provide our thesis and you'll have the alpha to decide if Monero fits your portfolio strategy.

The Origins and Core Mission

Monero didn't emerge in a vacuum. Back in 2014, the crypto scene was still reeling from Bitcoin's success, but a growing chorus of developers and privacy advocates pointed out its Achilles' heel: traceability. Bitcoin's blockchain, while revolutionary, acts like a permanent public record. Addresses are pseudonymous, but with enough chain analysis, you can link transactions to real identities. This creates "tainted" coins, where certain BTC might be blacklisted by exchanges or governments. You might think this is good for tracing down hackers and criminals, but the ability to obscure transaction trails isn't inherently about evading the law; many users simply value their right to financial privacy, especially as the crypto market becomes increasingly institutionalised.Enter Monero

It started as a community fork of Bytecoin, which itself was based on the 2013 CryptoNote whitepaper by the pseudonymous Nicolas van Saberhagen. The motivation? Bytecoin had issues like suspected pre-mining (around 80% of its supply), so a group of developers, led initially by figures like "thankful_for_today," re-launched it as Monero, meaning "coin" in Esperanto, to emphasise fairness and transparency in development. The core problem it targeted was simple: create electronic cash that's as private as physical bills, resistant to surveillance, censorship, and coin tainting.This tied directly into cypherpunk ideals, echoing the post-2008 financial crisis push for decentralised money free from institutional oversight. Early versions introduced key breakthroughs:

- Ring signatures to mix real transaction inputs with decoys, hiding the sender.

- Stealth addresses for one-time use, breaking links between transactions and users.

- Later, in 2017, Ring Confidential Transactions (RingCT) to conceal amounts.

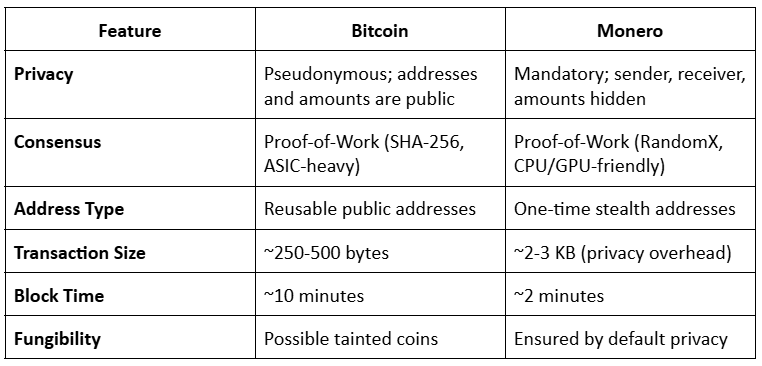

To highlight how Monero stacks up against Bitcoin at the foundational level, here's a quick comparison:

Bitcoin vs Monero comparison table

Inside the Tech: Cryptography, Consensus, and Privacy Engine

Diving deeper, Monero's technical foundation is what sets it apart in a sea of transparent blockchains. At the protocol level, it utilises a Proof-of-Work consensus with the RandomX algorithm, introduced in 2019, to maintain mining accessibility on everyday hardware, such as CPUs and GPUs.This was done to avoid the centralisation seen in the Bitcoin network, where a few mining pools dominate. RandomX demands random code execution and memory-hard operations, making it tough for specialised chips.

The blockchain itself features dynamic block sizing, adjusting based on the median of the last 100 blocks to handle demand without fixed limits like Bitcoin's old 1 MB cap. Blocks come every 2 minutes, with difficulty tweaking per block for quick adaptation.

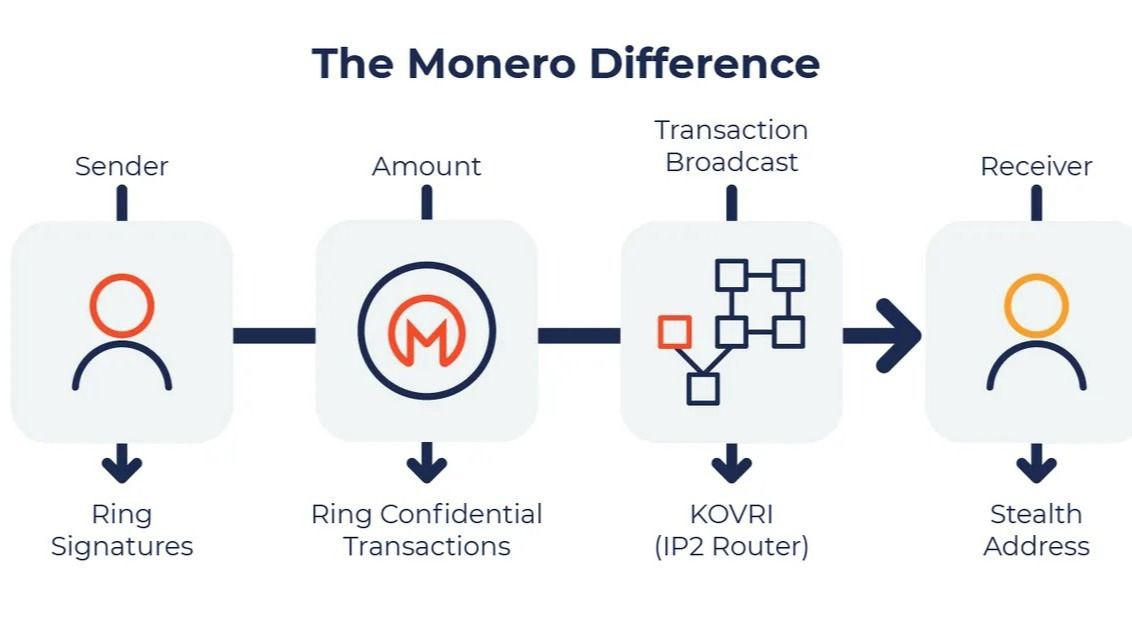

But the real magic is in the privacy stack. Three pillars work in tandem:

- Ring Signatures: These mathematically blend your transaction input with 10 decoys (current ring size is 11), using elliptic curve cryptography (Ed25519) to make it impossible to tell which is real. The anonymity set is 11, so the odds of pinpointing the sender are 1/11 at best. Decoys are selected via a triangular distribution, favouring recent outputs to avoid patterns.

- Stealth Addresses: Recipients get one-time addresses generated via Diffie-Hellman exchange from their public keys and a random scalar. You scan the chain with your private view key to find funds, then spend with your private spend key. This breaks address reuse, a common Bitcoin tracking vector.

- Ring Confidential Transactions (RingCT): Amounts are hidden using something called "Pedersen commitments". Bulletproofs, added in 2018, slashed proof sizes by 80%, from ~13 KB to ~2 KB, improving efficiency without sacrificing security. So overall, this feature hides the amount being transacted which is super cool for privacy.

Monero technical design

These 3 features interact seamlessly: Rings hide senders, stealth hides receivers, RingCT obscures values. But there are trade-offs, transactions are larger (~2-3 KB vs. Bitcoin's 250-500 bytes), verification is slower (~10x), and metadata like timestamps remains visible, opening doors to timing or statistical attacks (though post-2017 fixes like better decoy sampling have reduced this to under 5% success for modern txs).However, in aggregate, Monero's tech delivers practical privacy where others fall short, like Bitcoin mixers that rely on trust or Zcash's optional shields.

Now let's look at its tokenomic and economic models...

Tokenomics and Economic Model: Inflation for Security

Monero's economics flip the script on Bitcoin's scarcity narrative. There's no hard cap; circulating supply is ~18.446 million XMR, with a tail emission of just 0.6 XMR per block after the main emission ended in 2022. This creates a low ~0.3% annual inflation rate, designed to keep miners incentivised forever, avoiding Bitcoin's future reliance on fees alone, which could potentially lead to network abandonment.The emission curve started high and tapered geometrically, ensuring a steady supply without shocks. Miner rewards mix this tail with transaction fees, calculated dynamically (approximately $0.10-$0.50 per tx).

Economically, assumptions hold that growing adoption (more txs) will boost fee revenue, offsetting inflation. During bear markets, tail emission provides baseline security.

When comparing Monero and Bitcoin:

- Bitcoin bets on fixed-supply appeal, but if BTC market cap struggles to keep up with halving of block rewards, fees must cover everything. This is risky if volumes dip, and fees alone aren't sufficient to secure the network.

- By having tail emissions, Monero prioritises sustainability, translating usage into value via incentives.

Market Standing and Competitive Edge

In the broader crypto market, Monero isn't a giant; its $4.8B cap is ~0.12% of the $3.92T total. Hence, we think it is largely overlooked.But in privacy coins, it's king, capturing over 50% of decentralised derivatives volume and leading spot DEX rankings for privacy assets. Position has fluctuated: Peaked top 10 in 2017-18 (~$8B), dipped in bears, but stabilised post-2021.

There are a few rivals to Monero in the market: Zcash uses zk-SNARKs for optional privacy, faster verification, smaller txs, but trusted setup risks and only ~5% shielded txs. Dash's PrivateSend (CoinJoin) is mixing-based, trust-dependent, and less native. Monero is the biggest and most OG coin in the privacy sector that stood the test of time.

Ecosystem and Real-World Utility

Monero's ecosystem thrives on organic growth, not hype. Development is organised via GitHub and the Community Crowdfunding System (CCS). Recent wins include quantum-resistant protocols in 2024, which the Bitcoin community is currently struggling with.Infrastructure: Full nodes need ~100 GB storage, syncing in 1-2 days on standard hardware which is comparable to Bitcoin's average sync time. Wallets range from Cake (mobile, user-friendly) to Ledger (hardware, secure but feature-limited). Dev tools include RPC APIs and solid docs, though no native smart contracts.

- Legitimate uses: P2P payments in capital-controlled countries (e.g., Venezuela, China), donations to activists (post-2017 spikes), merchant acceptance (~1K via processors like NOWPayments).

- Adoption metrics: 50-100K active addresses, ~27K daily txs, $50-100M volume, correlates with privacy demand, not price hype.

- Challenges: UX hurdles like wallet scanning and larger txs make it tougher than Bitcoin for newbies, but tools like mobile apps help.

Security Incidents, Team Updates, and Market Shifts

Monero's history includes a series of security challenges that test its robustness, but the project has consistently bounced back, often emerging stronger. These events highlight the risks of privacy tech while showcasing the community's quick response. From past vulnerabilities to the latest mining drama, here's a rundown of key incidents and what's happening now.Key Security Incidents Over the Years

Monero's privacy focus makes it a target, but exploits have been rare and contained:- 2017 WannaCry Ransomware: North Korean hackers (Lazarus group) laundered funds via Monero, marking early ties to illicit use, botnets have mined XMR illegally since then, but no direct protocol breaches.

- 2019 Vulnerabilities Disclosure: Devs reported nine bugs via HackerOne, including one that could steal XMR from exchanges; no exploits happened, and patches were swift.

- 2023 CCS Wallet Breach: The community crowdfunding system lost 2,675.73 XMR (~$460K at the time) from a compromised hot wallet; partial tracing via chain analysis occurred, but the attacker evaded capture.

- Early 2024 Flooding Attack: Spam transactions overwhelmed the network, spiking fees temporarily, but caused no permanent harm or losses.

The August 2025 Qubic 51% Incident

Fast-forward to early August 2025: The Qubic mining pool allegedly grabbed over 51% of hashrate, performing a 6-block reorganisation as a "demonstration," not a hack. No funds were stolen, but it exposed selfish-mining flaws, dropping XMR ~8% from $170 to $156. Exchanges like Kraken paused deposits briefly.The rebound was quick, the price climbed 14% amid fixes, with volume up 80%. Ex-lead Riccardo "Fluffypony" Spagni proposed "detective mining" to spot threats early, and hashrate rose to 5.4 GH/s post-event.

In our opinion, this incident was a very good stress test and the impact of it was largely overinflated to make headlines. Monero remains secure.

Overall, these tests show Monero's undervalued strength, tech holds firm under pressure, and flush of weak hands due to the recent FUD creates an opportunity for those who truly understand the value proposition. Now, let's look at what price action tells us...

Technical Analysis

On the weekly timeframe using a logarithmic chart, Monero has been in a multi-year accumulation structure since 2018. After first reaching the $470 region in early 2018, price has revisited this zone multiple times, including a peak at $515 in May 2021 and another high near $420 in May 2025. These repeated rejections from similar levels suggest Monero is trading within a long-term range rather than trending freely. Despite this, the asset has maintained a broader uptrend since 2020, forming a series of higher lows and gradually compressing toward resistance.

One of the key structural shifts came between 2022 and 2024, when Monero spent nearly two years trading around its 200-week EMA, forming a base just beneath the $234–$289 range. This zone acted as a key supply area in prior cycles but was decisively broken earlier this year. Price rallied up to $420 following the breakout and is now pulling back toward that same range, which is currently being tested as support. Holding this area would mark a successful flip of long-term resistance into support, a critical confirmation of structural strength.

If this zone breaks down, the next clear support lies between $203 and $220, a weekly demand zone left behind during the breakout. Below that, the 200-week EMA near $189 offers further dynamic support. From a macro perspective, Monero has been forming a base for nearly eight years, absorbing multiple drawdowns without breaking down structurally. This makes it one of the more technically intact accumulation setups in the market, especially for an asset with limited exchange support and ongoing regulatory challenges.

Risks and Challenges Ahead

Monero faces ongoing challenges from regulations and technical limits. These issues explain why it's often overlooked despite its strong privacy features. Below, we break them into three main difficulties, with simple explanations of the problems and how Monero responds.Bans and Delistings from Governments and Exchanges

People in many countries have limited exposure Monero because its privacy makes it hard to track transactions for anti-money laundering (AML) rules. For instance, Japan banned it on exchanges in 2018, South Korea delisted it in 2020, and Australia has pushed similar restrictions, often causing short-term price drops of 20-30%.Exchanges point to know-your-customer (KYC) requirements as the issue, since Monero's hidden details complicate compliance, unlike Zcash, where privacy is optional and easier to handle. This reduces Monero's accessibility but boosts its use in darknets, where ~30% of transactions occur due to its "off-limits" appeal.

Push & Pull with Law Enforcement and Tracking Tools

Law enforcement and firms like Chainalysis try to uncover Monero transactions by spotting patterns, such as timing or stats in the data. While early versions (pre-2017) were more traceable, success rates now sit under 5% for modern ones, mostly relying on user mistakes or external leaks rather than breaking the code.Monero counters with upgrades like better decoy selection in rings and features to hide IP addresses. It's an ongoing battle; Monero improves its defences, while analysts get smarter, but this keeps its privacy edge sharp for users who need it most.

Growing the Network Without Losing Privacy or Speed

Monero's privacy tools slow things down, handling only ~5-10 transactions per second (TPS) due to heavy computations and a growing blockchain (~100 GB). This makes it lag behind faster chains in high-volume scenarios like busy trading.Dynamic fees help manage crowds, and optimisations like Bulletproofs have cut transaction sizes. Layer-2 ideas (like private channels) are in research, but the core trade-off remains: stronger privacy means tougher scaling. The roadmap emphasises careful updates to balance this, though rivals like Grin offer leaner designs.

If you are well informed with the risks and the core idea of this protocol, here is how to buy Monero (XMR coins).

How to Buy

Unlike other cryptocurrencies, Monero can't be on typical DEXes, and the best way to buy it is through centralised exchanges. Here is how to do it:- Step 1: Choose a centralised exchange

- Step 2: Create and verify your account

-

- Sign up for an account on the chosen exchange and go through the verification process.

- Step 3: Deposit funds

-

- Deposit funds into your exchange account. You can typically use bank transfers, credit/debit cards, or cryptocurrency transfers.

- Check the exchange's supported payment methods if you are depositing fiat currency (like USD or EUR).

- Step 4: Buy XMR

-

- Navigate to the trading section of the exchange.

- Search for the XMR trading pair (e.g., XMR/USDT, XMR/BTC)

- Decide on the amount of USDT/BTC you want to purchase and choose between a market or limit order.

- Market order: Buy XMR at the current market price.

- Limit order: Set a specific price at which you want to buy XMR. The order will be fulfilled once the market reaches your specified price.

- Review the order details and confirm the purchase.

- Step 5: Withdraw XMR to your wallet

-

- After purchasing XMR, it's a good practice to withdraw the tokens to a secure wallet like Monero GUI wallet for safekeeping.

- You can download Monero-compatible wallets here

Cryptonary's Take: Our Thesis

Look, Monero won't wow you with flashy DeFi yields or memecoin hype; it's built for the shadows, and that's its strength.As crypto gets absorbed by Wall Street with ETFs, 401(k)s, and Digital Asset Treasuries (DATs), the original ethos of privacy and self-custody is fading. Unlike BTC and the rest, Monero is the escape hatch, and is taking crypto back to its cypherpunk roots. We believe OG Bitcoiners and privacy hardliners will increasingly gravitate toward XMR as institutions, regulators, and politicians flood the space.

Secondly, privacy is actually turning from niche to necessity; Monero has proven resilience through bear markets, exchange delistings, and regulatory storms. With tail and hard-capped emission securing the network indefinitely, it's positioned for steady, utility-driven growth. The tech behind the chain is very cool too and is an undeniable leader in the privacy sector. As the need for privacy and cypherpunk culture increases, we believe XMR will catch a serious bid.

That said, it is not without risks: exchange delistings and regulatory uncertainty can seriously cap upside. But, if you're betting on a world where anonymity matters more than ever, add some XMR as a hedge, especially after the recent FUD where weak hands were flushed but the platform came back stronger. Our invalidation: if the tech breaks and the community folds under pressure from regulators or if the price changes its market structure, that would, in aggregate, invalidate our thesis.

But overall, we think Monero is a great privacy chain, while XMR is a solid asset to hold mid-to-long term and diversify into the OG crypto play.

Peace!

Cryptonary, OUT!