Why you should read this report

- BTC's open interest and funding rates hint at trader sentiment—find out what this could mean for price action.

- ETH's technical analysis reveals a critical range to watch - learn the key levels that could trigger a breakout.

- SOL's price is approaching a pivotal juncture - discover why the next move could be significant.

- WIF retested an important level - see our analysis on whether this resistance will hold or break.

- POPCAT narrowly avoided a bearish pattern - read about the crucial support and resistance zones ahead.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC

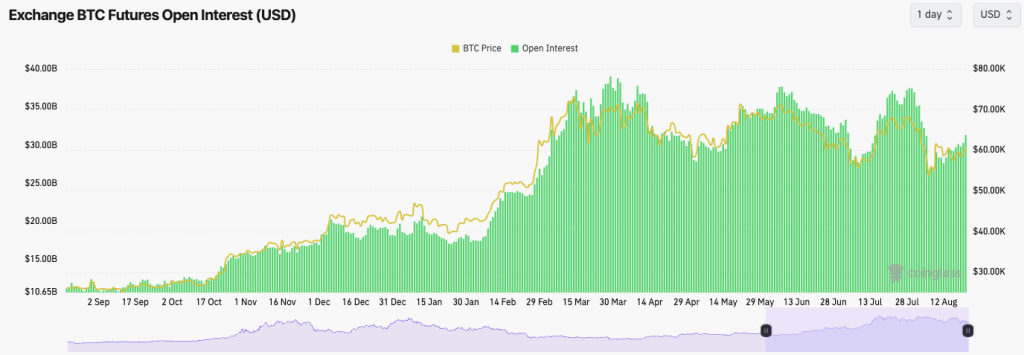

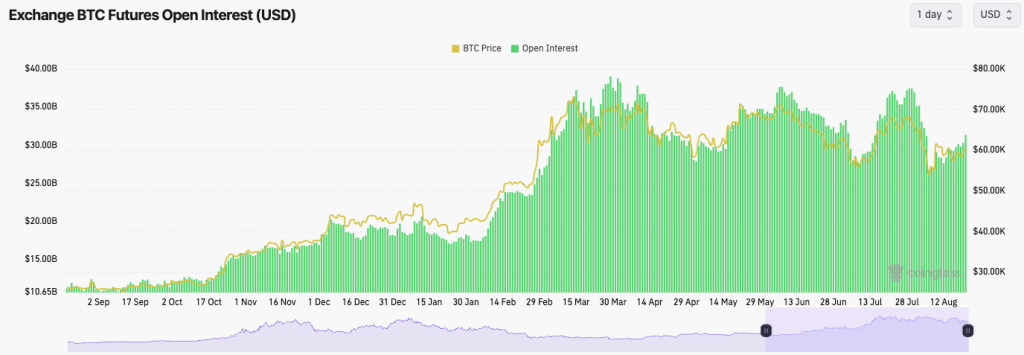

From a mechanics perspective, Bitcoin's Funding Rate has continued to move back and forth between slightly positive and slightly negative over the past week. This shows indecision among traders.In the last 24 hours, Bitcoin's Open Interest has kicked up slightly but remains well below the highs, suggesting that traders are unwilling to pile leverage back on following the flush out from a fortnight ago.

BTC Open Interest:

Technical analysis

- Price has perfectly followed the arrowed direction we placed ten days ago.

- Price is currently still beneath the horizontal resistance of $63,400, which is a key level for price to reclaim for price to then see a bullish reversal.

- Price is well above the main horizontal support of $52,800, and it has also recently bounced off of the local support of $56,000.

- The RSI is in middle territory here, so that's not providing a headwind for the price to move in either direction.

Cryptonary's take

What could be described as boring price action, we could argue we called perfectly last week. Of course, we want to call for crazy price targets, but our job is to do our best to predict/estimate what's going to happen, and over the last week, we've done that.August is always a quieter month, with lighter volumes; therefore, big volatility bouts are possible. However, in the immediate term (between now and Powell speaking on Friday), we're expecting price to remain between $56k and $63k. We're not expecting any fireworks in the immediate term.

But over the medium term, we are becoming increasingly bullish. We see the last six months of range-bound price action as hugely positive for Bitcoin once it decides to break out, which we believe we will see in the coming months. Q4 2024, we're expecting fireworks, with 2025 to be even better. Patience for now and that's reflected in our conservative and more subdued price targets for the immediate term.