Unsurprisingly, the market is filled with hundreds of decentralised exchanges (DEXs), all vying to be the preferred platform for trading these assets.

However, one stands out from the pack out of these hundreds of exchanges!

What sets it apart, you ask?

Well, it is tackling a problem almost everyone in the market finds annoying.

Many of our users were curious about our stance on this innovative protocol.

Therefore, by community request, we present our deep dive into…drumroll... the CoW Protocol.

TLDR

- CoW Protocol is an “intent” based DEX aggregator that protects its users from MEV attacks.

- Despite a solid user base, its tokenomics is weak.

- It faces strong competition, and its USP can be eroded with a feature update from competitors.

- Our ARIMA analysis shows a strategy to improve your chances of making profits, even though the token doesn't offer a compelling long-term investment opportunity.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

CoW Protocol

CoW Protocol is a fully permissionless platform that provides the best secure and efficient trading tools. The project has two products:- MEV blocker

- CoW Swap

MEV blocker

Let’s start with the basics. The MEV or “Maximal Extractable Value” MEV refers to the maximum value that can be extracted from blockchain transactions by having the ability to include, exclude, or re-order transactions within a block. MEV attacks exploit the blockchain's transparency to manipulate the sequence of inclusion for pending transactions.When executed, it functions as a sort of hidden tax where MEV “searchers” can manipulate your trades, causing unfavourable prices or failed transactions. As of 2021, It is estimated that Ethereum users have lost over $1B of value due to MEV.

Generally, there are three types of MEV attacks.

- Frontrunning

- Backrunning

- Sandwich attacks

Here's how it works:

- The attacker monitors the blockchain network for pending transactions.

- When the attacker spots a large trade, they quickly place a buy order for the same asset, causing the price to increase.

- The attacker then places a second sell order at the higher price, which is executed immediately after the victim's trade.

- The victim's trade is now executed at an inflated price, resulting in a loss for the victim and a profit for the attacker.

Therefore, the CoW Protocol team created an MEV blocker that can be freely integrated into any wallet or dApp.

CoW Swap

CoW Swap is the 1st Automated Market Maker (AMM) designed to provide a more efficient and user-friendly trading experience while protecting users from the risks associated with front-running and other forms of value extraction.One of the key features of CoW Swap is its intent-based trading. Unlike traditional AMMs, in intent-based trading, users don’t submit transactions on-chain but rely on “solvers” who find the best prices. This architecture is similar to DEX aggregation; however, it has some key differences: Coincidence of Wants (CoW) - unlike DEX aggregators, CoW Swap optimises direct P2P trading. If two orders have opposite buy/sell intents, users can bypass liquidity provider fees and pay fewer gas fees because they don’t interact with contracts.

This results in lower fees compared to traditional aggregators.

Another feature of CoW Swap is its use of batch auctions to execute trades to prevent MEV attacks. This means that trades are executed in batches, with uniform clearing prices for all trades in the same batch.

Because the price is the same for trades in the same batch, there is no need to order transactions within the same batch.

This approach helps to ensure that users get a fair price for their trades and prevent MEV attacks.

Vitalik Buterin highlighted the unique value proposition of the CoW Protocol to prevent MEV attacks.

Since we now understand the deal with the CoW Protocol, let’s dive into the numbers.

Fundamentals

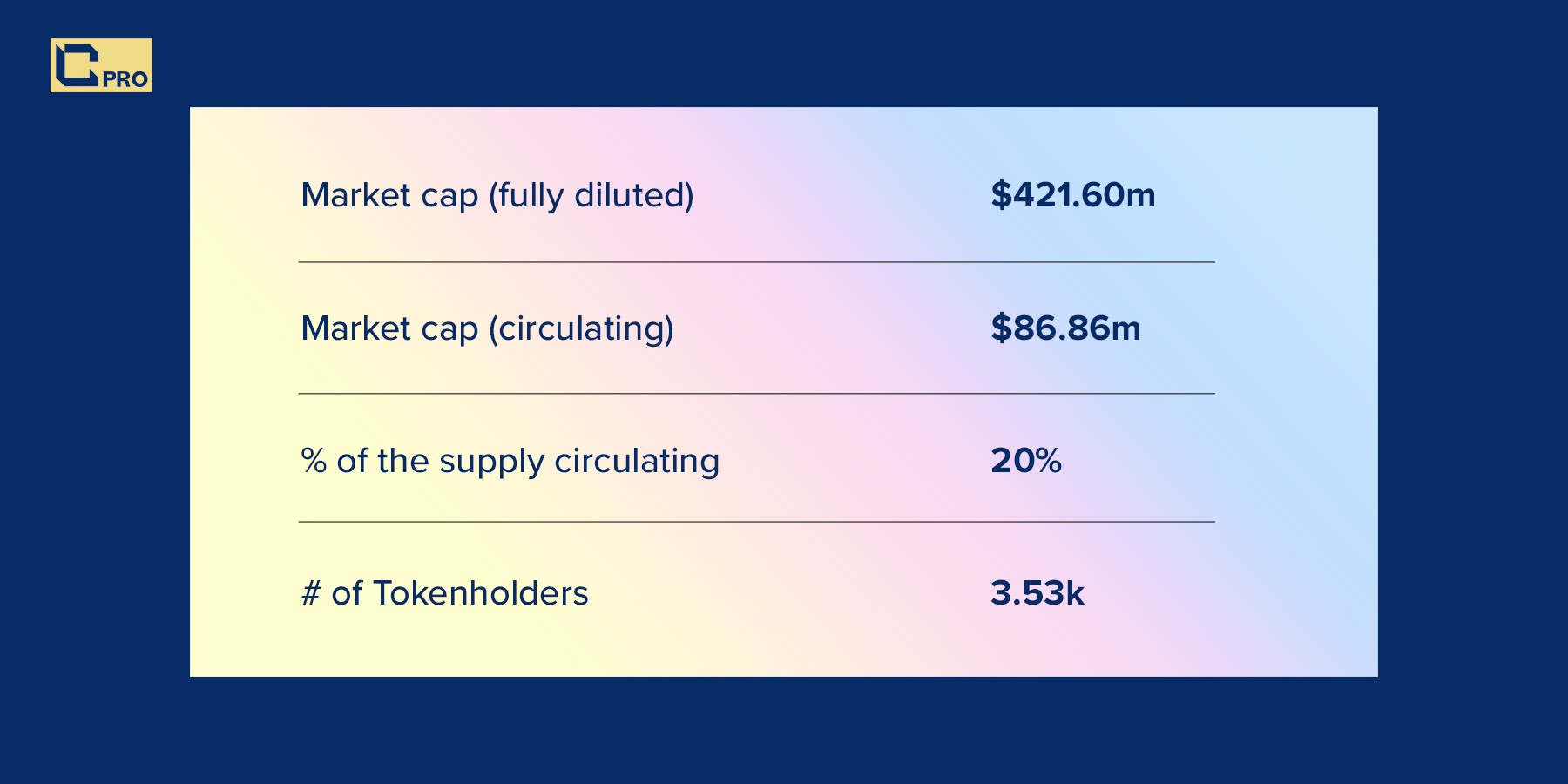

CoW Protocol is governed by the DAO, and it has a $COW token.

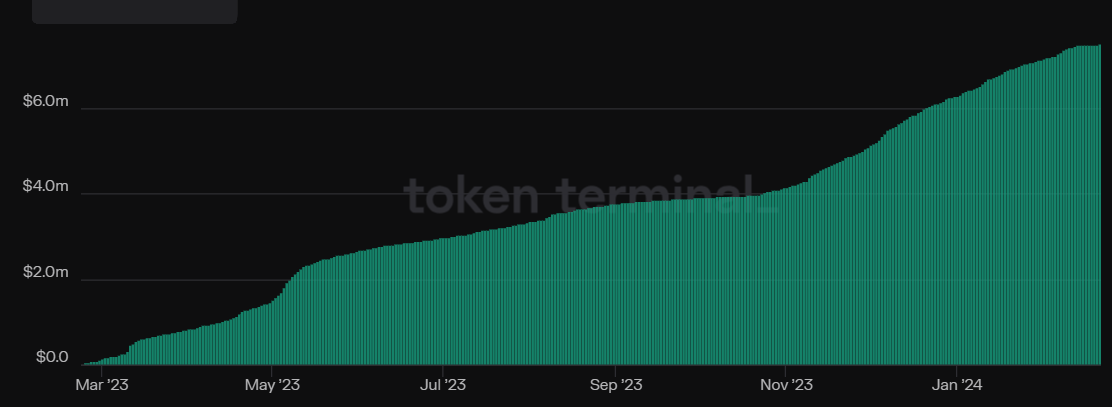

Trading volume

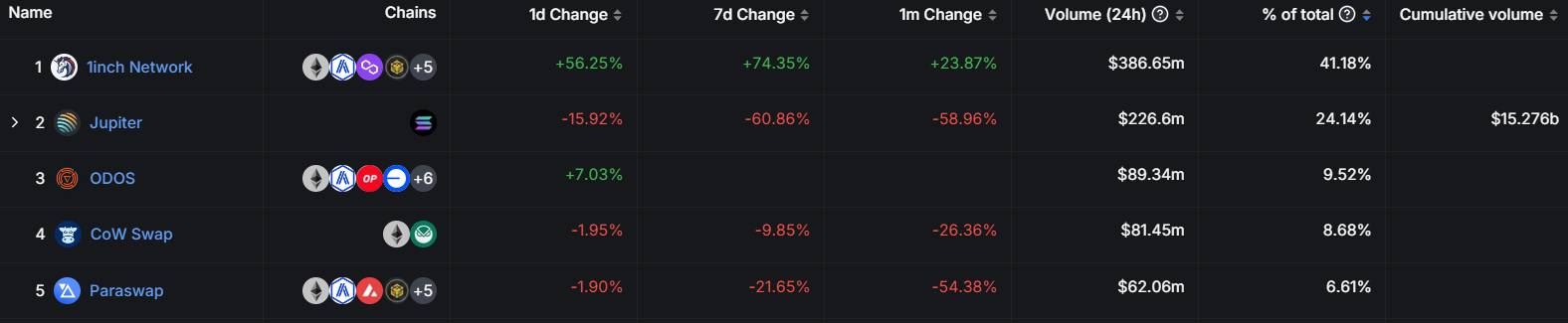

For any DEX, trading volume (even though sometimes it can be manipulated) is usually a main indicator of how much the DEX is used and where it stands regarding market share.In the last 365 days, the CoW Protocol has facilitated $14.7 billion in trading volume. For comparison, 1inch (DEX aggregator) has generated over $117 billion in trading volume in the same period.

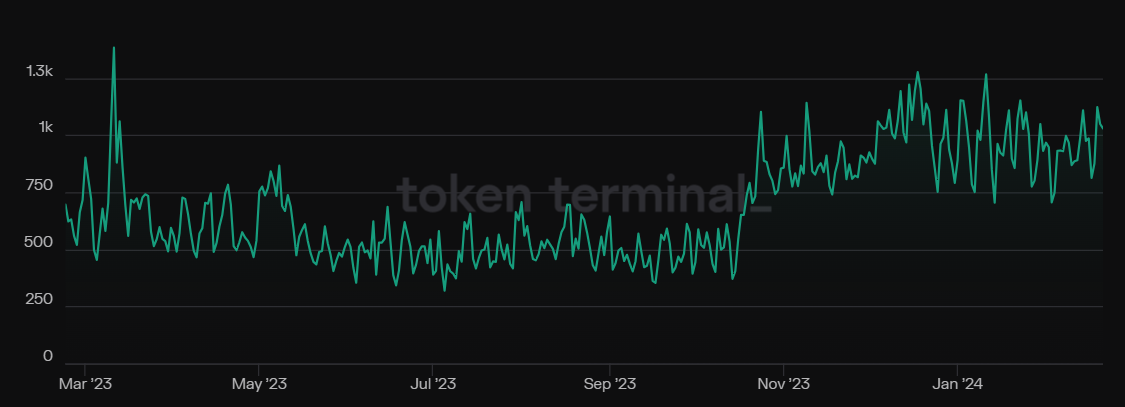

Active users

CoW Swap has been attracting an average of 500 users each day until October 2023. However, the market has started to recognize the advantages of CoW Swap over its competitors, leading to an increase in its user base. As a result, the number of active users has risen to an average of 800 daily.

Tokenomics

The $COW token is technically inflationary, as per documentation. However, inflation can occur only with the approval of the DAO if doing so is necessary for the long-term sustainability of the protocol. The inflation act is only possible once every 365 days and capped at 3% annually.To date, no inflationary measures have been needed, so the supply of the $COW token remains at an initial 1 billion tokens.

The token is used mainly for governance, but on January 16 2024, the DAO started testing a fee model.

Based on a model proposed, the CoW Protocol will charge fees whenever a user receives more than they ask during the swap (CoW Swap’s architecture is uniquely positioned to offer this). The collected fees are stored in a multi-sig wallet operated by the team. TLDR: the CoW Protocol is just starting to experiment with revenue-sharing models. However, investors can’t yet get a share from the fees generated by the protocol.

Strong competition

But beyond the fact that investors can’t yet benefit from the fees generated, one other major concern about the CoW Protocol is the competitive landscape.The DEX sector is overcrowded.

In addition, the DEX aggregation sector is also crowded.

So, while CoW Swap does have a competitive advantage in its MEV-protecting feature, the feature is compelling but doesn’t have a moat that could help CoW Protocoal gain meaningful market share.

So, while CoW Swap does have a competitive advantage in its MEV-protecting feature, the feature is compelling but doesn’t have a moat that could help CoW Protocoal gain meaningful market share.

Let’s assume the demand for MEV protection surges, and it becomes obvious that a DEX must take measures to protect against MEV attacks. In that case, there is not much stopping Uniswap and 1inch from devising similar solutions to protect users.

Also, bigger DEXs like Uniswap and 1inch have the resources to ship new solutions and network effects to retain users. In essence, CoW Protocol’s competitive advantage can be eroded in a single move with a product update from its competitors.

Unless CoW Swap has something under the sleeves, we don’t see it gaining meaningful market from industry leaders.

Furthermore, some industry participants believe MEV is a natural consequence of open and transparent markets and should be left as a factor for efficient markets to manage.

So, while CoW Swap is a good project with a good team and community, beyond the possibility that the “Intents” narrative gains ground, we don’t see a compelling enough long-term opportunity here.

That said, we found a way to get an upside from the CoW token.

Quantitative analysis

The COW token is up more than 400% in the last year and over 50% in the past 30 days.

We are in a bull market, and during bull markets, projects that have shown an uptrend tend to continue showing strength as their uptrend triggers a virtuous cycle.

Therefore, we wanted to figure out a way to take profitable positions in CoW Swap without much reliance on the fundamentals of its revenue or competitive advantage.

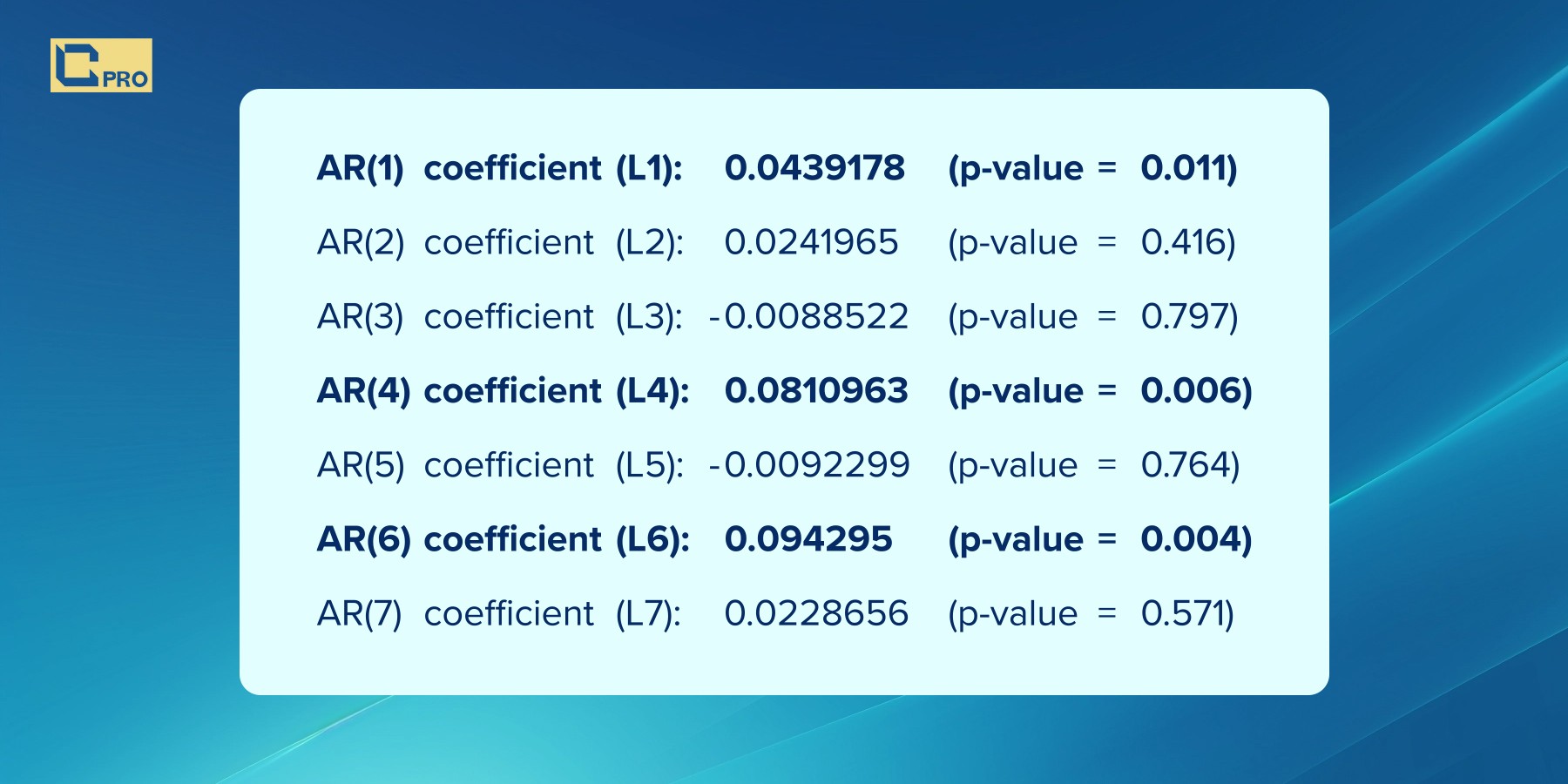

To achieve this aim, we performed AutoRegressive modelling (ARIMA) based on the entire past price action of $COW and found interesting relationships.

ARIMA is a statistical analysis model that leverages time series data to forecast future trends.

Based on 695 daily price changes (difference between opening price and closing price), we got the following results:

A p-value less than 0.05 typically suggests that there is sufficient evidence to conclude that there is a relationship between A and B. In our case, A and B are price changes on different days.

These results suggest that $COW price change is influenced by how prices changed 1, 4 and 6 days ago (lags).

In other words, if the price closed positively 1, 4, and/or 6 days ago, there is a higher chance that today's price will also close positively.

6th day (lag) is the most significant both in terms of effect size and evidence.

Note: the sample includes the entire historical price action, so the insights are not specifically tailored to a bear or bull market environment. We posit that the results explain how the asset behaves in general.

If you decide to trade or invest in COW in the short term, make sure to combine these data with other backing, such as technical analysis.

Technical analysis

Looking at the asset from a technical point of view, you can see we are in two nice, relatively strong bullish trends: one longer-term and the other shorter-term.

Always be mindful of the shorter-term, steeper trends, as they are more likely to snap due to the psychological factors that the market experiences with quick accelerations in price.

Regardless, it is a very nice positive price action with some key levels to look at to accumulate COW:

- $0.46

- $0.39

- $0.329

Cryptonary’s take

We believe that the CoW Protocol brings value to the DeFi space. It has a solid team and a mission to protect users from profit-hungry MEV bots.However, the competition is fierce in the DEX space. We currently don’t have enough confidence to say that the CoW Protocol can compete with sector giants. In addition, tokenomics doesn’t excite us, and it is still unclear whether there will be revenue share in the future.

However, we are not necessarily saying that $COW is a bad asset for the bull market; we've shared a quantitative strategy that can improve your odds of profit on the token.

However, unless “Intents” based trading comes back as a narrative, you are better off getting exposure to COW via trades backed by our ARIMA analysis than an investment.

We will be watching how things develop, and we are happy to revise our thesis if there's a material change to the fundamentals of the CoW Protocol.

Cryptonary, OUT!